Professional Documents

Culture Documents

Beta An Indispensable Measure of Security Analysis

Uploaded by

Pulakesh TahbildarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Beta An Indispensable Measure of Security Analysis

Uploaded by

Pulakesh TahbildarCopyright:

Available Formats

BETA: AN INDISPENSABLE MEASURE OF

SECURITY ANALYSIS

NOVEMBER 2020 Rajesh Khairajani

Partner

Valuation Services

This thought leadership paper provides insights on the concept of beta in valuation.

INTRODUCTION

In the world of finance, the capital asset pricing model (“CAPM”) is the most widely used method for

computation of cost of equity (“Ke”). The formula for Ke based on pure CAPM is:

As can be observed from the above formula, the factor beta is used as a modifier to the equity risk premium

(“ERP”). It is the sole risk factor of the pure CAPM, the form most often shown in textbooks.

A pre-requisite for understanding beta is to understand the difference between systematic and unsystematic

risk.

Systematic risk Unsystematic risk

Inherent to the entire market or market segment Specific to a company

Diversification cannot eliminate these risks Diversification can greatly reduce unsystematic risk

Examples: inflation, war, fluctuating interest rates Examples: fire, slumping sales

WHAT IS BETA? A beta estimate for a public company comes by

regressing excess returns of the public

Beta is a measure of the systematic risk of a stock, company's stock on the excess returns of a

the tendency of a stock's price to correlate with market portfolio over a look back period. (Top-

changes in the market. The "market" is typically

down beta estimate)

represented by a broad-based equity index that

includes a wide range of industries and arguably

behaves like the market as a whole. A question often faced by valuation

practitioners is that how is a beta estimate

ESTIMATION OF BETA arrived at for a non-

public company?

The formula for computation of beta is:

A proxy beta is estimated by identifying

Beta = Covariance (stock, market) guideline public companies and estimating their

Variance of market betas. A proxy beta needs to be used when the

subject business is a division, reporting unit, or

Where:

a closely held business. (Bottom-up beta

estimate)

Covariance = Correlation (stock, market) * Standard

deviation (stock) * Standard deviation (market))

INTERPRETATION OF BETA

The market's beta is 1.0 by definition. A company with a beta equal to 1 has the same risk as the market.

(Theoretically it moves up and down with the market in tandem), a company with a beta greater than 1 is

riskier than the market and a company with a beta less than 1 is less risky than the market.

For example, if a stock's beta value is 1.3, it means, theoretically this stock is 30% more volatile than the

market.

What does beta tell you about the movement of security prices?

Value of beta Interpretation

β=0 Movement of security is uncorrelated with the movement of market

β=1 Security moves proportionately with the market (same direction and equal magnitude)

β>1 Security moves in the same direction with the market but with higher magnitude

0<β<1 Security moves in the same direction with the market but with lower magnitude

IMPACT OF BETA ON SHARE VALUATION b. Blume adjustment: Based on the assumption

that betas tend to move toward the market's beta

Beta Discount rate Share valuation (1.00) over time, a weighted average beta may be

computed by weighing the historical betas by 2/3rd

and the market beta by 1/3rd.

c. Operating leverage: The unlevered beta may

also be adjusted for operating leverage as the

ADJUSTMENTS TO BETA operating leverage of the guideline public

companies may differ from that of the subject

Following are some of the adjustments that financial company. The unlevered beta is adjusted for

analysts make to the beta based on subject operating leverage by applying the following

company/industry characteristics: formula:

a. Unlevering and relevering beta: Betas published for βO = FC /(1 + FC/VC)

public stocks reflect the capital structure of the

companies and are known as levered betas. They Where:

incorporate two risk factors: business (or operating) risk

and financial (or capital structure) risk. Removing the βO: Beta adjusted for operating leverage

effect of financial leverage i.e. unlevering the betas is FC: Weight of fixed cost in operating expense

desirable to eliminate the impact of the varying capital structure

structures of the comparable companies on the beta. VC: Weight of variable cost in operating expense

The formula for unlevering beta is as follows: structure

d. Excess cash and investments: The unlevered

betas of the guideline public companies may be

Where: adjusted for excess cash and marketable securities

held by the companies. Non-inclusion of the

βU: unlevered beta surplus assets (assets that can be sold or

βL: levered beta distributed without impairing company operations)

t: tax rate for the company leads to an incorrect estimate of the beta. The

D: Debt in the capital structure adjustment is based on the principle that the beta

E: Equity the capital structure. of the overall company is the market-value

weighted average of the business or assets

The unlevered beta is then relevered based on an (including excess cash comprising the overall firm).

appropriate capital structure applicable to the subject The formula is as follows:

company

βU = [Asset beta for operations*(operating

assets/total assets)]+[asset beta for surplus

assets*(surplus assets/total assets)]

LIMITATIONS CAN BETAS BE NEGATIVE?

• Beta is an indicator of short term risk and fails to The concept of negative beta goes against the intuition

capture longer term fundamental risk, where big- that if a beta of 1 represents average risk and a beta of

picture risk factors are more indicative. High betas zero represents no risk, then how can an investment

may mean price volatility over the near term, but have negative risk? However the answer to this question

they don't always rule out long-term opportunities; is in the affirmative. Beta should be viewed as the risk

added by an investment to a well-diversified portfolio.

• Computation of beta involves a great deal of Accordingly, any investment when added to a portfolio

estimation regarding the period, the periodicity of which makes the overall risk of the portfolio go down, is

the return interval (i.e. daily, weekly, monthly, and said to have a negative beta. A standard example that is

annual), the appropriate market index, the use of a offered for a negative investment is gold which acts as a

smoothing technique, and adjustments for small hedge against higher inflation.

company stocks; and

By the definition of beta, the prices of security with a

• Beta on its own is somewhat deceptive. It is an negative beta move in the opposite direction of the

historical statistic, and a stock, bond or fund is not market.

always going to behave like its beta predicts. It is

useful to pair it with R2 i.e. the coefficient of

determination, which indicates the proportion of a

security's total variance related to the market, and

which illustrates the reliability of the beta. This is

computed by comparing the market's variance with

the security's variance. A higher R2 represents a

greater confidence in the beta's information. A low

R2 may mean that the instrument's return is more

affected by events other than market-related risk.

Disclaimer: This publication contains general information only, and none of KNAV International Limited, its member firms, or

their related entities (collectively, the 'KNAV Association') is, by means of this publication, rendering professional advice or

services. Before making any decision or taking any action that may affect your finances or your business, you should consult a

qualified professional adviser. No entity in the KNAV Association shall be responsible for any loss whatsoever sustained by any

person who relies on this publication.

KNAV was founded in 1999 and is a full-service firm providing Accounting, Taxation and Advisory. The

firm is headquartered in Atlanta and has a remote delivery center in Mumbai, India. In addition, the

firm has offices in Canada, United Kingdom, Netherlands, India & Singapore through its network of

member firms in these locations.

All member firms of KNAV in India, North America, Singapore are a part of the US$ 4.11 billion, US

headquartered Allinial Global; which is an accounting firm association, that provides a broad array of

resources and support for its member firms, across the globe. The International Accounting Bulletin

has released the result of its 2020 world survey and has ranked Allinial Global as the world’s second

largest accounting association.

For any queries, please contact Punit Khemani at punit.khemani@knavcpa.com / +44 7931 685 237

or Rajesh Khairajani at rajesh.khairajani@knavcpa.com / +91 9820 3182 65

Visit us at www.knavcpa.com

3

UK office: Ground floor, Hygeia3 3 College Road, Harrow, Middlesex HA1 1BE

Building, 66-68

Other offices: Canada | India | Netherlands | Singapore | USA

You might also like

- Measuring Market Risk with BetaDocument10 pagesMeasuring Market Risk with Betakapil gargNo ratings yet

- Differences in Estimation of Equity BetasDocument5 pagesDifferences in Estimation of Equity Betasxxx85828No ratings yet

- Concept and Classification of BetaDocument16 pagesConcept and Classification of BetamonuNo ratings yet

- Beta CoefficientDocument2 pagesBeta CoefficientNahidul Islam IU100% (1)

- Equity BetasDocument5 pagesEquity Betasxxx85828No ratings yet

- CH 6-Beta Estimation and Cost of EquityDocument26 pagesCH 6-Beta Estimation and Cost of EquityJyoti Bansal100% (1)

- Sec B - Group 5 - Project ReportDocument9 pagesSec B - Group 5 - Project ReportSuraj DongareNo ratings yet

- FM CH 06 PDFDocument26 pagesFM CH 06 PDFLayatmika SahooNo ratings yet

- Unit 8 Capital Budgeting Decisions and The Capital Asset Pricing ModelDocument16 pagesUnit 8 Capital Budgeting Decisions and The Capital Asset Pricing ModelAarav AroraNo ratings yet

- 09 Capital Budgeting and RiskDocument12 pages09 Capital Budgeting and Riskddrechsler9No ratings yet

- Risk, NPV and IrrDocument22 pagesRisk, NPV and IrrLinda Chow100% (1)

- BetaDocument16 pagesBetaAkshita Saxena100% (2)

- Beta - A Measure of Risk in FinanceDocument20 pagesBeta - A Measure of Risk in FinanceSakshi SharmaNo ratings yet

- Jackson Banking Supplement II - As Sent - 2Document7 pagesJackson Banking Supplement II - As Sent - 2AlejandroCervantesNo ratings yet

- Chapt ER: Beta Estimation and The Cost of EquityDocument26 pagesChapt ER: Beta Estimation and The Cost of Equitymds89No ratings yet

- Beta Value - Levered & UnleveredDocument2 pagesBeta Value - Levered & UnleveredVijayBhasker VeluryNo ratings yet

- BetaDocument9 pagesBetaRavi RaiNo ratings yet

- Beta CoefficientDocument3 pagesBeta CoefficientNahidul Islam IU100% (1)

- Assess stock risk with betaDocument4 pagesAssess stock risk with betaDebashish SarangiNo ratings yet

- Beta in StocksDocument7 pagesBeta in Stocks22MBAB14 Cruz Slith Victor CNo ratings yet

- Inside The Black Box - Revealing The Alternative Beta in Hedge Fund Returns - (J.P. Morgan Asset Management)Document10 pagesInside The Black Box - Revealing The Alternative Beta in Hedge Fund Returns - (J.P. Morgan Asset Management)QuantDev-MNo ratings yet

- Discount Rates: III: Relative Risk MeasuresDocument20 pagesDiscount Rates: III: Relative Risk MeasuresElliNo ratings yet

- EDUCATIONDocument7 pagesEDUCATIONAP STATUS STUDIONo ratings yet

- StatsDocument10 pagesStatsKabir AliNo ratings yet

- Chapter - 6: Beta Estimation and The Cost of EquityDocument14 pagesChapter - 6: Beta Estimation and The Cost of EquityAkash saxenaNo ratings yet

- Wall Street Mastermind S Investment Banking Technical Interview Cheat SheetDocument2 pagesWall Street Mastermind S Investment Banking Technical Interview Cheat Sheetxandar198No ratings yet

- BOBJ SuperUser Guide - Ad Hoc WEBI ReportingDocument31 pagesBOBJ SuperUser Guide - Ad Hoc WEBI Reportingnewscop1No ratings yet

- Betas Business TutorialDocument16 pagesBetas Business TutorialRaul Diaz SanhuezaNo ratings yet

- Risk ReturnDocument17 pagesRisk ReturnNikhil TurkarNo ratings yet

- Corporate Finance-Lecture 6Document6 pagesCorporate Finance-Lecture 6Sadia AbidNo ratings yet

- Beta Leverage and The Cost of CapitalDocument3 pagesBeta Leverage and The Cost of CapitalpumaguaNo ratings yet

- Beta in FinanceDocument47 pagesBeta in FinanceRitika IsraneyNo ratings yet

- Compare BetaDocument9 pagesCompare BetaPatcharanan SattayapongNo ratings yet

- HTTP Viking - Som.yale - Edu Will Finman540 Classnotes Class7Document7 pagesHTTP Viking - Som.yale - Edu Will Finman540 Classnotes Class7corporateboy36596No ratings yet

- Session 5: Post Class TestsDocument3 pagesSession 5: Post Class TestsSai KiranNo ratings yet

- Assessing Risk in Stocks Beyond BetaDocument4 pagesAssessing Risk in Stocks Beyond BetaBhramar KocheNo ratings yet

- What Is BetaDocument4 pagesWhat Is BetaAjay MuraliNo ratings yet

- Additional Material - Bottom Up BetaDocument17 pagesAdditional Material - Bottom Up BetaJason Paul BoneteNo ratings yet

- Driving Innovation at A Mature FirmDocument17 pagesDriving Innovation at A Mature FirmSaniyaMirzaNo ratings yet

- BITA StudiesDocument7 pagesBITA StudieschetanpatelhNo ratings yet

- Session 7 Cost of CapitalDocument22 pagesSession 7 Cost of CapitalVishwa Deepak BauriNo ratings yet

- The WACC User's Guide: SSRN Electronic Journal April 2005Document25 pagesThe WACC User's Guide: SSRN Electronic Journal April 2005Sumantha SahaNo ratings yet

- Session 3: Project Unlevered Cost of Capital: N. K. Chidambaran Corporate FinanceDocument25 pagesSession 3: Project Unlevered Cost of Capital: N. K. Chidambaran Corporate FinanceSaurabh GuptaNo ratings yet

- Operating and Financial LeverageDocument20 pagesOperating and Financial LeverageEmilio Joshua PaduaNo ratings yet

- S6 Cost of Capital Online VersionDocument28 pagesS6 Cost of Capital Online Versionconstruction omanNo ratings yet

- Valuation For Investment BankingDocument27 pagesValuation For Investment BankingK RameshNo ratings yet

- Beta finance measure stock market riskDocument11 pagesBeta finance measure stock market riskshruthid894No ratings yet

- Beta CalculationDocument30 pagesBeta Calculationrksp99999No ratings yet

- Interviews Financial ModelingDocument7 pagesInterviews Financial ModelingsavuthuNo ratings yet

- Acova Radiateurs (v7)Document4 pagesAcova Radiateurs (v7)Sarvagya JhaNo ratings yet

- Q32Document1 pageQ32Adarsh RaiNo ratings yet

- Capm Ta 2Document6 pagesCapm Ta 2Olivier MNo ratings yet

- Assignment: Submitted Towards The Partial Fulfillment ofDocument16 pagesAssignment: Submitted Towards The Partial Fulfillment ofHarsh Agarwal100% (2)

- MathProject 001Document5 pagesMathProject 001Kabir AliNo ratings yet

- BetaDocument27 pagesBetasridhar4u18No ratings yet

- TTS - DCF PrimerDocument2 pagesTTS - DCF PrimerKrystleNo ratings yet

- The BCG Growth-Share Matrix: Theory and Applications: The key to portfolio managementFrom EverandThe BCG Growth-Share Matrix: Theory and Applications: The key to portfolio managementRating: 2 out of 5 stars2/5 (1)

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

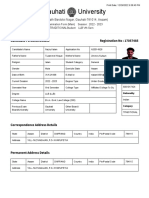

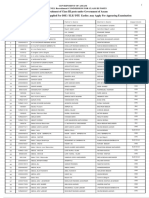

- Jonaki 5th Gauhati University Exam Form Payment Receipt - 100652Document2 pagesJonaki 5th Gauhati University Exam Form Payment Receipt - 100652Pulakesh TahbildarNo ratings yet

- 3RD SRKGauhati University Exam Form Download - 102405Document2 pages3RD SRKGauhati University Exam Form Download - 102405Pulakesh TahbildarNo ratings yet

- NAZ 3RD Exam Form Payment Receipt - 100317Document2 pagesNAZ 3RD Exam Form Payment Receipt - 100317Pulakesh TahbildarNo ratings yet

- Nazrul Islam submits LLB exam formDocument2 pagesNazrul Islam submits LLB exam formPulakesh TahbildarNo ratings yet

- Jonaki 5th Gauhati University Exam Form Download - 100703Document2 pagesJonaki 5th Gauhati University Exam Form Download - 100703Pulakesh TahbildarNo ratings yet

- UntitledDocument717 pagesUntitledPulakesh TahbildarNo ratings yet

- RM - JDDocument4 pagesRM - JDPulakesh TahbildarNo ratings yet

- MyjournalDocument8 pagesMyjournalPulakesh TahbildarNo ratings yet

- UntitledDocument688 pagesUntitledPulakesh TahbildarNo ratings yet

- 4068-Article Text-11665-1-10-20210125Document8 pages4068-Article Text-11665-1-10-20210125Pulakesh TahbildarNo ratings yet

- Amul Case Study PDFDocument12 pagesAmul Case Study PDFPulakesh TahbildarNo ratings yet

- Intro What Is Strategic Group Mapping - 111659Document3 pagesIntro What Is Strategic Group Mapping - 111659Pulakesh TahbildarNo ratings yet

- Public Domain Cafe Menu-Compressed 1 1Document8 pagesPublic Domain Cafe Menu-Compressed 1 1Pulakesh TahbildarNo ratings yet

- IJRMP 2014 Vol03 Issue 04 06Document9 pagesIJRMP 2014 Vol03 Issue 04 06Pulakesh TahbildarNo ratings yet

- A Study On Working Capital Management On Ultratech Cement, HyderabadDocument8 pagesA Study On Working Capital Management On Ultratech Cement, HyderabadPulakesh TahbildarNo ratings yet

- Working Capital Management Manikgarh Cement LTD PARMESHWARDESHMUKH3 LA15 MBA17Document50 pagesWorking Capital Management Manikgarh Cement LTD PARMESHWARDESHMUKH3 LA15 MBA17Pulakesh TahbildarNo ratings yet

- Foreign Exchange MarketDocument4 pagesForeign Exchange Marketsamradhi vermaNo ratings yet

- The Inflation Rate in PakistanDocument1 pageThe Inflation Rate in PakistanSaqib MunawarNo ratings yet

- Cambridge International AS & A Level: BUSINESS 9609/21Document4 pagesCambridge International AS & A Level: BUSINESS 9609/21VinjeroNo ratings yet

- Derivatives and Risk ManagementDocument4 pagesDerivatives and Risk ManagementXxx vidios Hot videos Xnxx videos Sexy videosNo ratings yet

- Rock Corp.'s Accumulated Other Comprehensive IncomeDocument4 pagesRock Corp.'s Accumulated Other Comprehensive IncomeEngel QuimsonNo ratings yet

- Topic 1 Q & ADocument2 pagesTopic 1 Q & APeter MastersNo ratings yet

- Assignment On Marketing Planning ProcessDocument5 pagesAssignment On Marketing Planning ProcessEshan GargNo ratings yet

- EserciziDocument6 pagesEserciziAlessandro d'IserniaNo ratings yet

- RIngkasan Teori Perdagangan InternasionalDocument5 pagesRIngkasan Teori Perdagangan Internasionall a t h i f a hNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Deepjyoti DasNo ratings yet

- Assignment No. 2: Course: Advanced Microeconomics Code: 805 Semester: Spring, 2020 Level: M.Sc. EconomicsDocument14 pagesAssignment No. 2: Course: Advanced Microeconomics Code: 805 Semester: Spring, 2020 Level: M.Sc. EconomicsAmmara RukhsarNo ratings yet

- Absorption Costing (Or Full Costing) and Marginal CostingDocument11 pagesAbsorption Costing (Or Full Costing) and Marginal CostingCharsi Unprofessional BhaiNo ratings yet

- Tutorial 4: Simple Problems: Following Program Segment?Document5 pagesTutorial 4: Simple Problems: Following Program Segment?x1No ratings yet

- ME Final Assignment 1Document21 pagesME Final Assignment 1shaikh shahrukh100% (1)

- Econ 100A Final Exam Study GuideDocument3 pagesEcon 100A Final Exam Study GuideNikhilNo ratings yet

- 8-4 Trends in Stock Closing PricesDocument8 pages8-4 Trends in Stock Closing PricesFausto SosaNo ratings yet

- Managing & Measuring Economic ExposureDocument20 pagesManaging & Measuring Economic ExposureMalkeet SinghNo ratings yet

- He Defines Economics As The Science of Choice. It Studies How People Choose To Use Scarce Resources orDocument5 pagesHe Defines Economics As The Science of Choice. It Studies How People Choose To Use Scarce Resources orMarilyn GarciaNo ratings yet

- Valuation of Rotable Spare PartsDocument25 pagesValuation of Rotable Spare PartskeiichimNo ratings yet

- Answers: L1CF-TBB207-1412 - Medium Lesson 2: Costs of The Different Sources of CapitalDocument220 pagesAnswers: L1CF-TBB207-1412 - Medium Lesson 2: Costs of The Different Sources of CapitalJoel Christian MascariñaNo ratings yet

- Price Elasticity and Revenue Relations: A Numerical ExampleDocument9 pagesPrice Elasticity and Revenue Relations: A Numerical ExampleteshomeNo ratings yet

- Chapter: Firms in Competitive MarketsDocument42 pagesChapter: Firms in Competitive MarketsSazzad Hossain SakibNo ratings yet

- Chapter 13Document20 pagesChapter 13Busiswa MsiphanyanaNo ratings yet

- Bennett Builders Builds 1 500 Square Foot Starter Tract Homes inDocument1 pageBennett Builders Builds 1 500 Square Foot Starter Tract Homes inAmit PandeyNo ratings yet

- FM212 2018 PaperDocument5 pagesFM212 2018 PaperSam HanNo ratings yet

- LG Flyer PDFDocument2 pagesLG Flyer PDFAtif MehfoozNo ratings yet

- Distribution StrategyDocument28 pagesDistribution StrategyNix Roberts100% (1)

- Elasticity of DemandDocument7 pagesElasticity of DemandLakshmiRengarajan100% (2)

- Math Works 10Document369 pagesMath Works 10Syed Saad Hussain100% (11)

- Efficiency, Markets and GovernmentDocument27 pagesEfficiency, Markets and GovernmentMuliana SamsiNo ratings yet