Professional Documents

Culture Documents

Highlights:: Economic Indicators Period Status Current Year Last Year

Uploaded by

BakhtawarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Highlights:: Economic Indicators Period Status Current Year Last Year

Uploaded by

BakhtawarCopyright:

Available Formats

HIGHLIGHTS:

● The State Bank of Pakistan (“SBP”) decided to raise the benchmark policy rate by 100 bps to 17% in their Monetary

Policy Committee meeting earlier this month. The SBP stated the reason for such hike is due to high inflation expectations,

“The MPC stressed that it is critical to anchor inflation expectations and achieve the objective of price stability to support

sustainable growth in the future”.

● In the Inter-bank market, the National currency value stood at a level of PKR 262.60USD as of 27th of January 2023. The

Pakistani rupee decline by 2.73%, previously on 26th January 2023 it went down by 9.61% in only span of one day. As a

result of this, Pakistan is most likely heading towards the 9th review of the ongoing IMF programme.

● Pakistan’s Large-Scale Manufacturing (“LSM”) growth contracted by 5.49% during November 2022 vs. the last year.

Likewise, on a Month-on-Month comparison (“M-o-M”), the LSM growth increased by 3.55% compared to the previous

month of November 2022 (Base Year 2015-16).

● The cumulative inflows of deposits in the Roshan Digital Accounts (“RDA”) reached $5.58 billion at the end of December

2022.

● As per the SBP, the remittances sent by Overseas Pakistani workers decreased by 3.17% to $2.04 billion in December

2022 vs. $2.11 billion in November 2022 on a M-o-M basis.

● According to the official statistics of the Federal Board of Revenue (“FBR”), the FBR has collected tax revenue worth

PKR 740 billion in December 2022, although it has missed the target for the month by PKR 212 billion.

● The net foreign currency reserves held by the SBP stood at $3.68 billion as of 20th January 2023.

● The Broad Money (M2) stock from 1st of July 2022 to 7th January 2022 has contracted to PKR 408 billion, as compared

to a contraction of PKR 547 billion last year in the same period.

● According to the Pakistan Bureau of Statistics (“PBS”), the Consumer Price Index (“CPI”) inflation surged by 24.5% on

a year-on-year (“Y-o-Y”) basis in December 2022 vs. 12.30% last year.

● As per the PBS, Pakistan’s Exports decreased by 3.26% to $2.31 billion in December 2022 vs. $2.39 billion in November

2022 on a M-o-M basis.

● Pakistan’s net FDI has depreciated by 58.7% or $654 million to $461 million provisionally during Jul-Dec FY23, as

compared to $1,115 million during Jul-Dec FY22.

● The total net Foreign Investment declined by almost 181 times or $1,281 million to negative $(397) million on a Y-o-Y

basis in Jul-Dec FY23 as against the amount of $709 million in Jul-Dec FY22

● The country has posted a Current account deficit (“CAD”) of $3.67 billion in FY23’s Jul-Dec period.

The outlook of the economy of Pakistan is as follows;

[

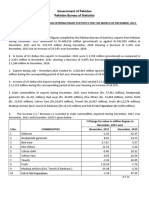

ECONOMY AT A GLANCE

Economic Indicators Period Status Current Year Last Year

LSM (Base Year 2015-16) November (5.49)% 5.96%

Central Government Debt November PKR 50.90Trillion PKR 40.97 Trillion

th

Credit to Private Sector Jul – 7 Jan PKR 421 Billion PKR 773 Billion

Roshan Digital Account December US$ 140 Million US$ 244 Million

Worker’s Remittances December US $2,042 Million US $2,520 Million

Currency in Circulation Jul – 7th Jan PKR 257 Billion PKR 210 Billion

th

Net Government Sector borrowing Jul – 7 Jan PKR 1,321 Billion PKR 31 Billion

National CPI (Base Year 2015-16) December 24.5% 12.3%

FBR Tax Collection Jul-Dec PKR 3,428 Billion PKR 2,929 Billion

Foreign Exchange Reserves with SBP As of 20th Jan $3.68 Billion $16.19 Billion

Foreign Direct Investments Jul-Dec $462 Million $1,115 Million

Trade Deficit in Goods Jul-Dec US$ (17.00) Billion US$ (25.44) Billion

Current Account Deficit Jul-Dec $(3,667)Million $(9,091)Million

Page 1 of 6 January 28, 2023

1. LARGE SCALE MANUFACTURING:

According to the PBS, Pakistan’s LSM sector showed a contraction of 5.49% in November 2022 on a Y-o-Y basis vs.

November 2021. Similarly, on a M-o-M basis, the overall output growth increased by 3.55%, compared to the month of

October 2022. After a decline for three consecutive months, the LSM sector finally recorded a growth on a month on month

basis. Moreover, during the Jul-Dec period of the Fiscal year 2022-23, the growth rate of large industries contracted by 3.58%.

Out of 22 major industries, only 5 industries posted a surge in production during the first five months of FY23 as compared

to last FY22’s same period. These include wearing apparel, leather products, furniture, other manufacturing section and other

transport equipment. However, the output in Food, beverages, tobacco, textile, coke and petroleum, pharmaceutical, Rubber,

wood products, Non-Metallic Mineral Products, Fabricated Metal, Computer, electronics and Optical products, Electrical

Equipment, Machinery and Equipment, Automobiles, Chemical, iron and steel products, and Paper and board has decreased

during Jul-Dec period of FY23 months under review, compared to the preceding year FY22 same period, data from the PBS

has revealed. Sector-wise, important groups such as cotton yarn, and cotton cloth contracted by 11.0% and 5.10%, while

garment showed growth of 51.48% in the period of Jul-Dec 2022. Whereas, the cement industry declined by rate of 16.45%.

Jul-Dec

LSM (%) Weight Nov-22 Oct-22 Nov-21

2022-23

Textile 18.2 (22.04) (24.62) (1.99) (11.45)

Food 10.7 (13.61) (4.88) (4.68) (7.78)

Coke & Petroleum Products 6.7 5.26 (15.04) (4.35) (13.63)

Chemicals 6.5 (7.06) (7.68) 6.49 (0.73)

Wearing Apparel 6.1 49.70 34.14 24.27 51.48

Pharmaceuticals 5.2 (8.34) (18.56) (18.07) (23.22)

Non-Metallic Minerals Products 5.0 (13.07) (10.06) 14.33 (12.35)

Beverages 3.8 9.97 (1.17) (1.77) (5.42)

Iron and Steel Products 3.4 (8.71) (8.45) 20.90 (0.87)

Automobiles 3.1 (18.97) (30.56) 52.83 (28.73)

Tobacco 2.1 (20.25) 5.42 29.16 (22.32)

Electrical Equipment 2.0 (3.28) 7.75 (0.67) 1.06

Paper & Board 1.6 (1.32) (8.07) 11.29 (2.84)

Leather Products 1.2 9.84 2.82 (1.87) 8.18

Other Transport Equipment 0.7 (41.01) (41.82) (12.64) (41.76)

LSM Growth for Nov 2022 (Y/Y) (5.49)%

LSM Growth of Nov 2022 vs. Oct 2022 (M/M) 3.55%

LSM Growth for July-Nov 2022-23 (Y/Y) (3.58)%

(Source: PBS)

2. Roshan Digital Account (“RDA”):

The cumulative inflows of deposits under the RDA reached $5.58 billion since its announcement in September 2020. Out of

the $5.58 billion, approximately two-thirds, $3.50 billion or 63% have been invested in the Naya Pakistan Certificates

(“NPCs”). Some 511,159 accounts have been opened from 175 countries during the span of over two years.

Cummulative Position Monthly RDA Funds

SInce September 2020 (USD millions)

Conventional 350

Stock Exchange 1% Naya

Pakistan 300

Others Certificate

36% 250

32%

200

310

307

297

150

290

266

250

250

249

245

245

244

239

226

222

197

100

189

188

187

169

168

161

146

141

140

50

0

Dec-21

Dec-22

Jul-21

Jul-22

Apr-21

Aug-21

Nov-21

Apr-22

Aug-22

Nov-22

Mar-21

May-21

Mar-22

May-22

Jan-21

Feb-21

Jun-21

Sep-21

Oct-21

Jan-22

Feb-22

Jun-22

Sep-22

Oct-22

Islamic Naya Pakistan Certificate 31%

(Source: SBP)

Page 2 of 6 January 28, 2023

3. WORKER’S REMITTANCES:

According to the SBP, the remittances sent by Overseas Pakistani workers decreased by 3.17% to $2.04 billion in December

2022 vs. $2.11 billion in November 2022 on a M-o-M basis. Similarly, on a y-o-y comparison, the inflows went down by

19.0% when compared to $2.52 billion received a year ago in the same month. In addition to that, in Jul-Dec period of FY23,

inflows declined by 11.1% to $14.05 billion compared to $15.81 billion received a year ago in the same period. Notably, on

a cumulative basis, the pace of growth in FY23 is in negative as compared to the last FY22’s Jul-Dec period, where it grew

by almost 11.40%. A descriptive analysis has revealed that remittances inflows during the Jul-Dec period of FY23 were

coming mainly from four major territories: Saudi Arabia, UAE, UK, and the USA. With a 24.70% share in overall home

remittances flows, Saudi Arabia remained a significant contributor. However, inflows from Saudi Arabia have a negative

growth of 14.0% to $3.47 billion in Jul-Dec period of FY23 vs. $4.03 billion during same period of FY22. An amount to the

tune of $1.53 billion, or a 10.86% share, was received from the US, showing increase of 2.20% in Jul-Dec of FY23 vs. Jul-

Dec period of FY22. Worker remittances from the UK decreased by 7.90% and although it’s contributed almost 14.07% or

almost $2.0 billion in half of FY23 over same period of FY22. On the other hand, remittance growth from UAE declined at a

rate of 13.50%, while its share is $2.60 billion or 18.52% in the total remittances.

Remittances Trend Comparison

(USD in million) Cumulative Flow FY23 vs. FY22

3,500 (USD in millions)

3,000

4,034

3,470

3,008

2,500

2,602

2,147

4,200 1,977

1,807

1,750

1,632

1,568

1,544

1,526

1,494

1,300

2,000 3,200

3,125

2,810

2,778

2,761

2,725

2,724

2,200

2,707

2,688

2,670

2,658

1,500

2,524

2,518

2,520

2,490

2,437

2,460

2,273

2,266

2,333

2,216

2,190

2,144

2,108

1,200

2,042

1,000 200

USA UK Saudia UAE Other EU Others

500 Arabia GCC Countries

0 Countries

Mar-21

Jun-21

Sep-21

Dec-21

Mar-22

Jun-22

Sep-22

Dec-22

Jan-21

Feb-21

Apr-21

May-21

Jul-21

Aug-21

Oct-21

Nov-21

Jan-22

Feb-22

Apr-22

May-22

Jul-22

Aug-22

Oct-22

Nov-22

Jul-Dec FY23 Jul-Dec FY22

(Source: SBP) (Source: SBP)

4. CONSUMER PRICE INDEX INFLATION:

The monthly rate of inflation has risen to 24.5% in December 2022 on a Y-o-Y basis. In the previous month, the CPI was

recorded at 23.8%. On an average, during the Jul-Dec period of the FY23, Pakistan’s inflation rate recorded around 25.2

percent. Food inflation in Urban and rural areas also increased to 32.7% and 37.9%, respectively in December 2022. In

addition to that, the wholesale price index (“WPI”) stood at 27.1% on a Y-o-Y basis. In previous month WPI has been recorded

around 27.7% in November. Whereas, on a monthly basis, the National CPI has recorded a rise of 0.5%. Similarly, the food

inflation in rural areas increased by 0.1 percent, while no food inflation has been witnessed in urban areas, compared to

November 2022. In December 2022, the Core inflation, which is calculated on the basis of excluding energy and food items,

rose by 14.7% and 19.0% in urban and rural areas on a Y-o-Y basis, respectively.

CPI INFLATION (Y/Y)

30% (Base Year 2015-16)

27.10% 34.00%

25% 26.20%

29.00%

20% 24.00%

37.90%

32.70% 19.00%

15%

24.50% 14.00%

10%

12.30% 9.00%

5% 11.70%

9.00% 4.00%

0% -1.00%

Dec-21 Dec-22

National CPI Food (Urban) Food (Rural) WPI

(Source:SBP)

Page 3 of 6 January 28, 2023

5. FBR TAX REVENUE COLLECTION:

FBR's TAX COLLECTION According to official data published by the FBR, the FBR

(PKR in Billion) has collected tax revenue worth PKR 740 billion in Dec

2022 and failed to achieve both, its monthly target of PKR

4,000

965 billion and Jul-Dec target of PKR 3.65tr. Targets have

3,500

3,000

not been achieved amidst the pursuance of contractionary

2,500 policies. When compared with previous year tax collection

2,000 in Jul-Dec period, taxes grew by 17.0% or PKR 500 billion.

3,428 As per Mr. Shahbaz Rana’s article titled “Rs220 billion hole

1,500 2,929

1,000

surfaces against FBR’s target” published on 31sr Dec 2022

500

in the Express Tribune, of the PKR 3.428r, FBR collected

0

PKR 1.5tr in income tax, while share of taxes at import

Jul-Dec F23 Jul-Dec F22 stage dropped to 43% amidst rise in income tax and

contraction of imports. Whereas, share of Sales tax is PKR

1.27tr.”

FOREIGN EXCHANGE RESERVES: FOREIGN EXHANGE RESERVES

The net reserves of the SBP stood at $3.68 billion as of 20th (USD in million)

11,707

January 2023, decreasing by 20% or $923 million compared with

9,453

15,000

last week’s $4.60 billion on 13th Jan 2023. Moreover, when

5,885

5,822

5,775

10,000

3,678

compared to last month reserves which was then $5.8 billion,

5,000

went down 36.8%.

0

Since reaching the $17.34 billion mark in the first week of Feb Net Reserves with Private Banking Total Forex Liquid

-5,000 SBP Reserves Reserves

2022 (on the back of the receipt of $1.05 billion under the

Extended Fund Facility programme of the IMF and Pakistan 20-Jan-22 23-Dec-22

International Sukuk Bond issuance of $1 Billion), the Net (Source: SBP)

foreign exchange reserves are on the verge of declining.

FDI SECTOR WISE Electricity, gas,

(% SHARE)

6. FOREIGN DIRECT INVESTMENT: steam and air

Others, - conditioning

Pakistan’s net FDI has depreciated by 58.7% or $654 million to Mining , -… supply, 52.69

$461 million provisionally during Jul-Dec FY23, as compared to Manufacturi

$1,115 million during Jul-Dec FY22. Whereas, the total net ng, 26.29

Foreign Investment declined by almost 181 times or $1,281

million to negative $(397) million on a Y-o-Y basis in Jul-Dec Wholesale

and retail

FY23 as against the amount of $709 million in Jul-Dec FY22. trade, 9.07

This Pie chart shows the percentage share of flows in different

sectors of the Economy in the period of Jul-Dec FY23. Transport &

Storage,

Agriculture, Financial and insurance

2.00

2.04 activities, 40.70

7. BALANCE OF TRADE IN GOODS:

As per the PBS, Pakistan’s trade deficit shrunk by a good

Balance of Trade in Goods

margin of 33% to almost $17.0 billion during the period of

(USD in million)

Jul-Dec of FY23 vs. same period of FY22 amidst a steep

25,000 deduction in import bills. As far as Exports are concerned,

40,563 it went down by 5.73% to USD 14.26 billion in FY23’s

15,000 31,245

period of Jul-Dec compared to USD 15.12 billion in same

14,258 15,125

5,000 period of FY22. Whereas, on a monthly basis, the exports

-5,000 decreased by 3.26% to $2.31 in December 2022 from $2.39

-16,987

-25,438 billion in November 2022. Addionally, the country's trade

-15,000

deficit rose by a slight margin of 1.79% to $2.84 in

Exports Imports Trade Deficit December 2022 from $2.79 in November 2022 on a month

Jul-Dec F23 Jul-Dec F22 on month basis.

(Source: PBS)

Page 4 of 6 January 28, 2023

8. BALANCE OF PAYMENT:

Pakistan’s CAD has slightly increased to $400 million, which (USD in millions) FY23 P FY22

(Jul-Dec) (Jul-Dec)

is still a sustainable level, when compared to a deficit of $1.86

billion in the last FY22’s December month. Latest data Current account Balance (3,667) (9,091)

released by the State Bank of Pakistan (“SBP”) showed. This Capital Account Balance 285 119

is the fifth consecutive month where CAD has below the $1 Financial Account Balance 1,204 (10,105)

billion mark amidst a notable decline in the import bills. On a Net FDI in Pakistan 668 (1,070)

Net Portfolio investment 1,031 374

cumulative basis from July to December in the ongoing FY23,

Net incurrence of Liabilities (868) 9,823

the CAD declined by $5.42 billion to $3.67 billion, compared

to a relatively large deficit of $9.09 billion in the same period Overall Balance 4,284 (788)

last year. If the Government is successful in keeping the CAD SBP Gross Reserve 5,702 17,837

bill below USD 1 billion mark monthly, then overall CAD (Source: SBP)

position could decrease to approx. USD 10-12 billion in FY23.

External Sector Postion

(Monthly)

Exports of Goods & Services Imports of Goods & Services Remiitances CAD

8,000 0

6,000

-500

4,000

2,000 -1,000

0

-1,500

-2,000

-4,000 -2,000

-6,000

-2,500

-8,000

-10,000 -3,000

Feb-21

Jun-21

Feb-22

Jun-22

Jul-21

Aug-21

Jul-22

Aug-22

Apr-21

Sep-21

Nov-21

Apr-22

Sep-22

Nov-22

Dec-21

Dec-22

Jan-21

Mar-21

May-21

Oct-21

Jan-22

Mar-22

May-22

Oct-22

9. Regional Analysis:

On a Y-o-Y basis, double digit inflation was observed only in Pakistan and Srilanka. Whereas, the Bangladesh and Indian

economy are gradually stimulating and inflation is declining over there. However, the Pakistani economy has faced a fragile

situation that is why CPI is on the rise. Simultaneously, exchange volatility has hit the Pakistani economy very badly. On the

other hand, the Srilankan rupee is relatively stable against the greenback in last six months, therefore, a decline in CPI has

been reported in Srilanka. While, India also had a stable currency, and hence, the impact of rising inflation didn’t haunt their

economy too much. Similarly, China has lower CPI and the impact of volatility in prices is not quite visible in their country

due to their stable currency parity.

Local Consumer Price Index

Currency

Currency

Country CPI Appreciation Regional Comparision

(%) Units per

(Depreciation)

USD % Change Y-o-Y 60

(As of 27th Jan)

Pakistan 24.5 262.6 (48.4) 40

India 5.72 81.51 (8.63) 20

Bangladesh 8.71 105.5 (22.9) 0

Jul-21

Jan-22

Jul-22

Apr-22

Sep-21

Oct-21

Nov-21

Feb-22

Mar-22

Jun-22

Sep-22

Dec-21

Oct-22

Nov-22

Dec-22

May-22

Aug-21

Aug-22

China 1.80 6.76 (6.04)

Pakistan India Sri Lanka

Sri Lanka 57.2 362.0 (80.1) Bangladesh China

(Source: Trading Economics)

Page 5 of 6 January 28, 2023

OUTLOOK:

● In the last quarter, the economy of Pakistan, realized a few economic challenges. Despite, decline of inflation rate in

previous month, inflation remains elevated. Particularly, core inflation is on a rising trend. It is very likely amidst uncertain

situation of the economy that the inflation expectations are going to go up for consumers and business owners in the

coming month.

● Secondly, despite the policy-induced decline in the CAD, numerous challenges for the external sector have risen such the

case observed with the Pakistan’s domestic currency. Furthermore, lack of recent financial inflows and current debt

repayments have led to a depletion in official reserves.

● Thirdly, the global economic activity has slowed down and with that, a decline has been observed in the global commodity

demand which has had an adverse impact on the outlook of National exports, and a decline has also been witnessed in

worker’s remittances which is ultimately offsetting the gains from the contraction of imports. On the other hand, if the

international financial condition stabilizes and there is an improvement in the worldwide commodity market in the future,

then it might provide some relief to Pakistan’s economic position.

● The IMF on last Thursday announced to sending its team to Pakistan in next week for the 9th review of the $7 billion loan

tranche which has been much waited. However, the Resident Representative of the IMF stated that, “At the request of

the Pakistan’s officials, an in-person fund mission is scheduled to visit Islamabad from January 31 to February 9 to

continue discussions under the 9th Extended Fund Facility (“EFF”) review”. This seems to be a positive development

for the economy of Pakistan.

● In this havoc like situation, Pakistan badly needs to streamline its taxation system to attain a likely tax target worth of

7.47 trillion rupee for the next fiscal year and to meet other financing need for the rest of the FY23. The Government

needs to correct the fractured system of taxation and should remedy the inequity of taxes in Pakistan. Otherwise, it may

be difficult for Pakistan to meet its tax target by June 2023.

● Among very few options in this difficult time, the practical way forward in the recession period will be to cut down on

non-essential imports, which the current regime has done brilliantly. Furthermore, the government needs to raise the

incentives for the production of essential food items and productivity in the manufacturing industries. Moreover, the

Government should consider shifting their policy focus to targeted subsidies and for the implementation of crucial reforms

to diversify the structure of the Pakistan’s economy in order to build a resilient economy.

● In addition to that, Pakistan has to remain engaged with IMF to complete ongoing programme, which is the best possible

way out for Pakistan’s economy. Subsequent to that, SBP need to impose strict regulations to curb dollar hoarding, as it

has an adverse effect on foreign remittance of Pakistan due to numerous artificial rate prevailing in exchange markets.

● The Government should take measures to help the economy to stabilize and recover, and announce a strategic plan for

sustainable economic growth and building foreign reserves instead of looking at friendly countries for bailout packages.

Effective policy measures should be such as, inter-alia: (a) Limit the size of primary deficit in the budget; (b) Effective

Tax reforms to broaden the tax base; (c) Structural reforms in the commodity producing sectors; (d) Need to work on

comparative trade polices to enhance National Export; (e) Reduce interest rate to boost Economic activity and limit the

debt servicing.

DISCLAIMER

The views expressed in our report are based on our judgment of the present economic scenario. This report is not a Solicitation and we

disclaim the accuracy of the outcome scribed in the report; hence, we extend no implied or express warranties and/or guarantees, financial

or otherwise.

The redistribution of this report, without express permission, is strictly prohibited.

Page 6 of 6 January 28, 2023

You might also like

- Teach Yourself EmbryologyDocument15 pagesTeach Yourself EmbryologySambili Tonny100% (2)

- Root Cause Analysis ToolsDocument22 pagesRoot Cause Analysis Toolsjmpbarros100% (4)

- 2nd Quarter Exam Empowerment - TechnologiesDocument3 pages2nd Quarter Exam Empowerment - Technologieskathryn soriano100% (11)

- The Titans and The Twelve OlympiansDocument35 pagesThe Titans and The Twelve OlympiansJariejoy Biore67% (3)

- Alteryx - Tool - Flashcards - 201910Document16 pagesAlteryx - Tool - Flashcards - 201910simha1177No ratings yet

- Value for Money in Public–Private Partnerships: An Infrastructure Governance ApproachFrom EverandValue for Money in Public–Private Partnerships: An Infrastructure Governance ApproachNo ratings yet

- Learn To Create A Basic Calculator in Java Using NetbeansDocument9 pagesLearn To Create A Basic Calculator in Java Using NetbeansRicardo B. ViganNo ratings yet

- Pakonomics - March 2023Document6 pagesPakonomics - March 2023Tahir QayyumNo ratings yet

- Fund Managers' Report - Conventional - Nov 2022Document15 pagesFund Managers' Report - Conventional - Nov 2022Aniqa AsgharNo ratings yet

- Government of Pakistan Pakistan Bureau of StatisticsDocument2 pagesGovernment of Pakistan Pakistan Bureau of Statisticsimran fayyazNo ratings yet

- Fund Managers Report - Conventional - Oct 2022Document15 pagesFund Managers Report - Conventional - Oct 2022Aniqa AsgharNo ratings yet

- Release Statement January 2022Document2 pagesRelease Statement January 2022Syed Zarak AbbasNo ratings yet

- Fund Manager Report - Conventional - Sept 2022Document14 pagesFund Manager Report - Conventional - Sept 2022Aniqa AsgharNo ratings yet

- Fund Managers - Shariah Compliant - Oct 2022Document14 pagesFund Managers - Shariah Compliant - Oct 2022Aniqa AsgharNo ratings yet

- Fund Managers Report Dec 2022 ConventionalDocument14 pagesFund Managers Report Dec 2022 ConventionalAniqa AsgharNo ratings yet

- FMDQ Markets Monthly ReportDocument9 pagesFMDQ Markets Monthly ReportJohnNo ratings yet

- Fund Manager Report - Shariah Compliant - Sept 2022Document13 pagesFund Manager Report - Shariah Compliant - Sept 2022Aniqa AsgharNo ratings yet

- Release Statement January 2023Document2 pagesRelease Statement January 2023muhammad ahsanNo ratings yet

- Release Statement June 2022Document2 pagesRelease Statement June 2022MalikNisarAwanNo ratings yet

- Pakistan Economic Survey FY23: Key HighlightsDocument11 pagesPakistan Economic Survey FY23: Key HighlightsVijayNo ratings yet

- ABL Funds Manager Report - Conventional - August 2022Document14 pagesABL Funds Manager Report - Conventional - August 2022Aniqa AsgharNo ratings yet

- Press 20220515 External Sector Performance March 2022 eDocument14 pagesPress 20220515 External Sector Performance March 2022 eRio FernandoNo ratings yet

- mbs304 Pop 2022 m10Document10 pagesmbs304 Pop 2022 m10stounbadiNo ratings yet

- ABL FMR Jan 2023 ConvetionalDocument14 pagesABL FMR Jan 2023 ConvetionalAniqa AsgharNo ratings yet

- 05january2024 India DailyDocument155 pages05january2024 India Dailypradeep kumarNo ratings yet

- This Press Release Is Embargoed Against Publication, Telecast or Circulation On Internet Till 5.30 PM On 31 May 2022Document56 pagesThis Press Release Is Embargoed Against Publication, Telecast or Circulation On Internet Till 5.30 PM On 31 May 2022Parth BhatiaNo ratings yet

- Government Domestic Borrowing: Monthly Report OnDocument8 pagesGovernment Domestic Borrowing: Monthly Report Onrashedul islamNo ratings yet

- EconomyDocument2 pagesEconomyAnand DhakadNo ratings yet

- Release Statement Feb 2023Document2 pagesRelease Statement Feb 2023sajjad aliNo ratings yet

- NQS - August - 2022 Issue As of 09august - RevDocument5 pagesNQS - August - 2022 Issue As of 09august - RevSon DevNo ratings yet

- CmonthlyDocument5 pagesCmonthlyVST SiteNo ratings yet

- OGDCL Full Year (FY 2021) Results Presentation - 0Document11 pagesOGDCL Full Year (FY 2021) Results Presentation - 0Elishba MustafaNo ratings yet

- Q2 2022-23 GDP EstimatesDocument8 pagesQ2 2022-23 GDP EstimatesRepublic WorldNo ratings yet

- Ienergy Coal Petcoke Import DataDocument18 pagesIenergy Coal Petcoke Import DataSaurabh DugarNo ratings yet

- ABL Fund Manager's Report - Shariah Complaint - August 2022Document13 pagesABL Fund Manager's Report - Shariah Complaint - August 2022Aniqa AsgharNo ratings yet

- Analysis of The Economic Survey 2022-23Document39 pagesAnalysis of The Economic Survey 2022-23Umair NeoronNo ratings yet

- NQS - January - 2023-Issue-06 January - FinalDocument8 pagesNQS - January - 2023-Issue-06 January - FinalTrio RamosNo ratings yet

- Spanish Treasury Chart Pack: April 2022Document81 pagesSpanish Treasury Chart Pack: April 2022andres rebosoNo ratings yet

- F. No. K-12011/3/2020-EPL-1 Government of India Ministry of Commerce & Industry Department of Commerce Economic DivisionDocument6 pagesF. No. K-12011/3/2020-EPL-1 Government of India Ministry of Commerce & Industry Department of Commerce Economic DivisionSumanta DeNo ratings yet

- Enhancing India-Indonesia Trade Relations - Amids Pandemic Covid-19 - 28 April 21Document28 pagesEnhancing India-Indonesia Trade Relations - Amids Pandemic Covid-19 - 28 April 21Hendra NusantaraNo ratings yet

- Ar Webcast Q2 2022 Final PDFDocument19 pagesAr Webcast Q2 2022 Final PDFJuan GurrolaNo ratings yet

- 2023 Nqs Final 10 AugustDocument6 pages2023 Nqs Final 10 AugustMissy MiroxNo ratings yet

- 5 6154586374507856628 PDFDocument1 page5 6154586374507856628 PDFArka MitraNo ratings yet

- External Sector Performance - July 2022Document13 pagesExternal Sector Performance - July 2022Ada DeranaNo ratings yet

- External Sector Performance 2022 OctoberDocument13 pagesExternal Sector Performance 2022 OctoberAdaderana OnlineNo ratings yet

- 2021 Statistical Analysis of U.S. Trade With Japan Public Version OTEDocument11 pages2021 Statistical Analysis of U.S. Trade With Japan Public Version OTECerio DuroNo ratings yet

- BudgetExecution Report July-June 2022 V 15082022 Final 2Document51 pagesBudgetExecution Report July-June 2022 V 15082022 Final 2Ishimwe oliveNo ratings yet

- Unit-4-BBA 3 YR - INTERNATIONAL TRADEDocument19 pagesUnit-4-BBA 3 YR - INTERNATIONAL TRADEguptadisha241No ratings yet

- Quarterly Report On Public Debt Management For The Quarter October - December 2022Document32 pagesQuarterly Report On Public Debt Management For The Quarter October - December 2022Chhandama ChhangteNo ratings yet

- Economy of SerbiaDocument27 pagesEconomy of SerbiaAman DecoraterNo ratings yet

- Bulleting - CPI December 2022Document12 pagesBulleting - CPI December 2022kingsleyNo ratings yet

- Export Performance 2023Document7 pagesExport Performance 2023Adaderana OnlineNo ratings yet

- EC 052 Dt. 14.06.2022 Import of Veg. Oils Nov.21 May 22 - CompressedDocument7 pagesEC 052 Dt. 14.06.2022 Import of Veg. Oils Nov.21 May 22 - CompressedSAMYAK PANDEYNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Five Months Data of 2021.22Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Five Months Data of 2021.22Mohan PudasainiNo ratings yet

- External Debt Quarterly Report Dec 2023Document7 pagesExternal Debt Quarterly Report Dec 2023ashokvardhan781No ratings yet

- Sukuk Snapshot 1Q 2021 - RAMDocument12 pagesSukuk Snapshot 1Q 2021 - RAMMoutaz BadawiNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Two Months Data of 2021.22 2Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Two Months Data of 2021.22 2shyam karkiNo ratings yet

- Current Macroeconomic and Financial SItuation. Tables Based On Annual Data of 2019.20. 1Document89 pagesCurrent Macroeconomic and Financial SItuation. Tables Based On Annual Data of 2019.20. 1hello worldNo ratings yet

- Annual Data of 2020.21 5Document97 pagesAnnual Data of 2020.21 5Aakriti AdhikariNo ratings yet

- Data On Fiscal Situation of KeralaDocument23 pagesData On Fiscal Situation of KeralaM CharlesNo ratings yet

- Economy of CroatiaDocument38 pagesEconomy of CroatiaAman DecoraterNo ratings yet

- News Highlights & Investor Watch 21-Sep-2023Document2 pagesNews Highlights & Investor Watch 21-Sep-2023WJAHAT HASSANNo ratings yet

- General Profile ArubaDocument3 pagesGeneral Profile ArubacayspepeNo ratings yet

- Contents - English - 2020Document12 pagesContents - English - 2020M Tariqul Islam MishuNo ratings yet

- BCA Material Price Updated On Jun 2022Document2 pagesBCA Material Price Updated On Jun 2022tan ptNo ratings yet

- Export Efforts of Manufactured Goods: Recent Trends in ExportsDocument8 pagesExport Efforts of Manufactured Goods: Recent Trends in ExportsprathlakshmiNo ratings yet

- Generating EquipmentDocument15 pagesGenerating EquipmentRajendra Lal ShresthaNo ratings yet

- Chapter 11 - Gene ExpressionDocument2 pagesChapter 11 - Gene Expressionapi-272677238No ratings yet

- Ronkonkoma Train ScheduleDocument1 pageRonkonkoma Train Scheduleanthonybottan0% (1)

- Material Safety Data Sheet: L IdentificationDocument4 pagesMaterial Safety Data Sheet: L Identificationkesling rsiNo ratings yet

- Analytical Model For Predicting Shear Strengths of Exterior Reinforced Concrete Beam-Column Joints For Seismic ResistanceDocument14 pagesAnalytical Model For Predicting Shear Strengths of Exterior Reinforced Concrete Beam-Column Joints For Seismic ResistanceAndres NaranjoNo ratings yet

- Black - Skin - and - Blood DocUmeNtary PhotograPhy PDFDocument7 pagesBlack - Skin - and - Blood DocUmeNtary PhotograPhy PDFVinit GuptaNo ratings yet

- Disaster Readiness and Risk ReductionDocument239 pagesDisaster Readiness and Risk ReductionGemma Rose LaquioNo ratings yet

- Tuto 4 CPCDocument2 pagesTuto 4 CPCPrabakaran LinggamNo ratings yet

- Answer The Following Questions in Not Less Than 5 SentencesDocument2 pagesAnswer The Following Questions in Not Less Than 5 SentencesAlfred OcampoNo ratings yet

- L&T - PBQ - 8 L Bengaluru Ring Road Project - HighwaysDocument12 pagesL&T - PBQ - 8 L Bengaluru Ring Road Project - HighwayskanagarajodishaNo ratings yet

- BSCRIM Program Specification AY 2018 2019Document9 pagesBSCRIM Program Specification AY 2018 2019Jezibel MendozaNo ratings yet

- Kinematics 2D (Projectile Motion) - NEET Previous Year Question With Complete SolutionDocument4 pagesKinematics 2D (Projectile Motion) - NEET Previous Year Question With Complete SolutionrevathyNo ratings yet

- Training MatrixDocument2 pagesTraining MatrixNazareth ES (Region IX - Pagadian City)No ratings yet

- Escala TimpDocument8 pagesEscala TimpLucy GonzalesNo ratings yet

- Sundaram Questions Assorted From GroupDocument23 pagesSundaram Questions Assorted From GroupAbu Syeed Md. Aurangzeb Al MasumNo ratings yet

- BQ 2954Document22 pagesBQ 2954Yunpu ChangNo ratings yet

- Installation & Maintenance Instructions: Description / IdentificationDocument6 pagesInstallation & Maintenance Instructions: Description / IdentificationPrimadani KurniawanNo ratings yet

- DSD DM BrochureDocument38 pagesDSD DM BrochureMonu SinghNo ratings yet

- The List, Stack, and Queue Adts Abstract Data Type (Adt)Document17 pagesThe List, Stack, and Queue Adts Abstract Data Type (Adt)Jennelyn SusonNo ratings yet

- Multi Channel AV Receiver: Operating Instructions STR-DH510Document80 pagesMulti Channel AV Receiver: Operating Instructions STR-DH510Angus WongNo ratings yet

- Key Players in The Indian Industry TodayDocument46 pagesKey Players in The Indian Industry TodaydakshjainNo ratings yet

- Pr1 CP Mathandscigr11Document65 pagesPr1 CP Mathandscigr11AllyNo ratings yet

- DIGITAL INPUT DIJB-01 (First Floor)Document12 pagesDIGITAL INPUT DIJB-01 (First Floor)Kandi ChandramouliNo ratings yet

- US20140245523-Helmet Mountuing Systems - Kopia PDFDocument22 pagesUS20140245523-Helmet Mountuing Systems - Kopia PDFja2ja1No ratings yet