Professional Documents

Culture Documents

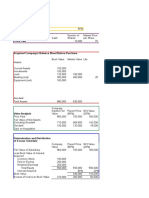

Components of Cost of Capital

Uploaded by

Chakshika AgarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Components of Cost of Capital

Uploaded by

Chakshika AgarwalCopyright:

Available Formats

The following are the components of the cost of capital:

1. The Cost of Debt:

Debt financing is one of the more frequently sought forms because it is one

of the least costly. In terms of the cost of capital definition, the firm must

make sure that when it borrows funds, the rate earned through use of the

debt-invested funds is equal to or greater than the cost of this debt.

Thus, the cost of debt must be equal to the rate of return earned on debt-

invested funds, so that the earnings available to the common shareholder

remain unchanged. This means that the explicit component cost of debt is

equal to the rate of return earned by investors, or the interest rate on debt.

Thus the cost of capital is really a minimization concept in the sense that a

minimum rate of return that must be earned on invested rupees is specified.

Of course, a higher rate of return, above the cost factor to the firm, is much

more desirable. Initially we may define the cost of debt as the interest rate

the firm has to pay to the lending source, whether it be to a bank or for a

new debt issue the firm has placed with the public market.

This will be referred to as the cost of debt because this is what the firm has

to pay annually to its debt investors for borrowing the sum. The firm must

earn such a rate of return on its debt-financed investments that the earnings

available to the common shareholders remain unchanged.

If less than an estimated per cent return were received on the investment,

the earnings available to the shareholders (earnings per share) would

decline, and this could have an adverse effect on the price of the stock.

2. The Cost of Preferred Stock:

Preferred stock (or preference shares) is frequently referred to as a hybrid

security which is somewhere between debt and common equity. It is similar

to debt in that it pays a fixed commitment or annual dividend, and, in case

of liquidation, the claim to the assets of the corporation by preferred holders

has priority over the claims of the common shareholders.

It is similar to equity, or common stock, in that if the dividends are not paid,

the result is not corporate bankruptcy. To the investor, an investment in

preferred stock is less risky than one in the common stock of the

corporation, but more risky than an investment in its debt securities.

3. The Cost of Using Retained Earnings:

Equity capital usually consists of two components. The first is the amount

of funds available in the form of net income that may be used to pay

dividends or may be retained in the business for asset purchases. The second

source of equity capital is the amount of funds raised by a new common

stock issue.

The definition of the cost of retained earnings is the rate of return that must

be earned on equity-invested capital so that the total yield available to the

common shareholders remains unchanged. The cost of retained earnings

simplifies to the rate of return that stockholders expect to earn on the

common stock of the firm. This expected or required rate of return can be

determined from the valuation formula for common stock.

4. The Cost of Issuing New Equity Stock:

It will be found that the cost of issuing new common stock or external equity

is slightly higher than the cost of internal equity or retained earnings. This

is because the price that the stock is sold for in the market is not the price

the firm receives.

As with preferred stock, when new common stock is issued, firms utilize

the services of investment bankers to help place it; for their services, the

bankers are paid a commission, which is referred to as the flotation costs of

underwriting a new equity issue.

The price the firm is interested in to determine its cost of equity for a new

issue is the net price, which is the market price of the stock less the’ flotation

costs.

You might also like

- Chapter 4 Financing Decisions PDFDocument72 pagesChapter 4 Financing Decisions PDFChandra Bhatta100% (1)

- Gann Wheel Calculator Excel - Google AramaDocument1 pageGann Wheel Calculator Excel - Google AramaSmith DURMAZNo ratings yet

- Finance Management Notes MbaDocument12 pagesFinance Management Notes MbaSandeep Kumar SahaNo ratings yet

- Private Equity and Venture Capital in The European Economy An Industry Response To The European Parliament and The European CommissionDocument302 pagesPrivate Equity and Venture Capital in The European Economy An Industry Response To The European Parliament and The European Commissionjuranyt2No ratings yet

- Gitman 12e 525314 IM ch11r 2Document25 pagesGitman 12e 525314 IM ch11r 2jasminroxas86% (14)

- Financial Management Unit 2Document10 pagesFinancial Management Unit 2Janardhan VNo ratings yet

- Definition of Cost of CapitalDocument2 pagesDefinition of Cost of Capitalmd nahidNo ratings yet

- CF 3rd AssignmentDocument6 pagesCF 3rd AssignmentAnjum SamiraNo ratings yet

- FM Unit4 NewDocument6 pagesFM Unit4 NewHariom lohiaNo ratings yet

- Cost of Capital TheoryDocument6 pagesCost of Capital Theoryjerin joshyNo ratings yet

- FM 1 - CH 5 NoteDocument12 pagesFM 1 - CH 5 NoteEtsub SamuelNo ratings yet

- 21MGH202T FM Unit IV Study MaterialsDocument19 pages21MGH202T FM Unit IV Study Materialslogashree175No ratings yet

- Cost of Capital: Vivek College of CommerceDocument31 pagesCost of Capital: Vivek College of Commercekarthika kounderNo ratings yet

- Financial Decision PDFDocument72 pagesFinancial Decision PDFDimple Pankaj Desai100% (1)

- Sources of Long Term FinanceDocument30 pagesSources of Long Term FinanceManu Mallikarjun NelagaliNo ratings yet

- Report in Financial MagtDocument12 pagesReport in Financial MagtSonny Fred MasilangNo ratings yet

- MB20202 Corporate Finance Unit III Study MaterialsDocument24 pagesMB20202 Corporate Finance Unit III Study MaterialsSarath kumar CNo ratings yet

- Cost of CapitalDocument18 pagesCost of CapitalAishvarya PujarNo ratings yet

- CH 4 Financing DecisionsDocument72 pagesCH 4 Financing DecisionsAnkur AggarwalNo ratings yet

- Cost of CapitalDocument2 pagesCost of CapitalAnanthakrishnan KNo ratings yet

- Cost of Capital of A Firm Is The Minimum Rate of Return Expected by Its InvestorsDocument10 pagesCost of Capital of A Firm Is The Minimum Rate of Return Expected by Its InvestorsPreeti SharmaNo ratings yet

- Wa0030.Document56 pagesWa0030.SXCEcon PostGrad 2021-23No ratings yet

- Cost of Capital Vs Required Rate of Return Whats The DifferenceDocument2 pagesCost of Capital Vs Required Rate of Return Whats The DifferenceImran AnsariNo ratings yet

- Final Report C.PDocument14 pagesFinal Report C.PRozminSamnaniNo ratings yet

- The Cost of Capital: ResourcesDocument20 pagesThe Cost of Capital: ResourcesAbegail Song BaliloNo ratings yet

- Chapter Four: The Cost of Capital 4.1. The Concept of Cost of CapitalDocument9 pagesChapter Four: The Cost of Capital 4.1. The Concept of Cost of Capitalmelat felekeNo ratings yet

- Dividend Discount ModelDocument9 pagesDividend Discount ModelVatsal SinghNo ratings yet

- Cost of Capital 1Document7 pagesCost of Capital 1Tinatini BakashviliNo ratings yet

- F.M AssignmentDocument7 pagesF.M AssignmentHashmi SutariyaNo ratings yet

- Gitman 12e 525314 IM ch11rDocument22 pagesGitman 12e 525314 IM ch11rAnn!3100% (1)

- Mba Corporate FinanceDocument13 pagesMba Corporate FinanceAbhishek chandegraNo ratings yet

- Chapter - Iv Theoretical FrameworkDocument10 pagesChapter - Iv Theoretical FrameworkNahidul Islam IUNo ratings yet

- BITTTTDocument12 pagesBITTTTMohamed RaaziqNo ratings yet

- Cost of Capital-OverviewDocument8 pagesCost of Capital-OverviewEkta Saraswat VigNo ratings yet

- Cost of CapitalDocument12 pagesCost of CapitalMohamed RaaziqNo ratings yet

- Cost of Capital and Capital Structure TheriesDocument4 pagesCost of Capital and Capital Structure Theriessarath cmNo ratings yet

- FMF T8 DoneDocument10 pagesFMF T8 DoneThongkit ThoNo ratings yet

- Present Value: Rate Return Investment Percentage AmountDocument6 pagesPresent Value: Rate Return Investment Percentage AmountArs KhanNo ratings yet

- Cost of Capital: F.M Isb & MDocument2 pagesCost of Capital: F.M Isb & MAkshay ShettyNo ratings yet

- Intro To Finance NotesDocument9 pagesIntro To Finance NotesAzeemAhmedNo ratings yet

- Financing DecisionsDocument10 pagesFinancing DecisionsAahana GuptaNo ratings yet

- Module 4-CoC-1Document13 pagesModule 4-CoC-1Abida RiazNo ratings yet

- Lecture - Sources of FinanceDocument27 pagesLecture - Sources of FinanceNelson MapaloNo ratings yet

- Cost of CapitalDocument15 pagesCost of CapitalRonmaty VixNo ratings yet

- Fin Cost of CapitalDocument3 pagesFin Cost of CapitalMochiminNo ratings yet

- VentureFinance Chapter5 PDFDocument20 pagesVentureFinance Chapter5 PDFMara Ysabelle VillenaNo ratings yet

- Cost of CapitalDocument43 pagesCost of CapitalAnup MishraNo ratings yet

- Cost of Capital Unit IIIDocument2 pagesCost of Capital Unit IIISiva SankariNo ratings yet

- CH 07Document23 pagesCH 07mehdiNo ratings yet

- Chapter Five Cost of Capital 5.1. The Concept of Cost of CapitalDocument16 pagesChapter Five Cost of Capital 5.1. The Concept of Cost of Capitalsamuel kebedeNo ratings yet

- Topic: Cost of Capital ReportersDocument6 pagesTopic: Cost of Capital ReportersAlexandra Denise PeraltaNo ratings yet

- Overview of Financial ManagementDocument187 pagesOverview of Financial ManagementashrawNo ratings yet

- Financial ManagementDocument7 pagesFinancial Managementanusmayavbs1No ratings yet

- Financial ManagementDocument8 pagesFinancial ManagementAayush JainNo ratings yet

- Chapter 3Document16 pagesChapter 3ezanaNo ratings yet

- CH 5 Cost of Capital Theory (510139)Document10 pagesCH 5 Cost of Capital Theory (510139)Syeda AtikNo ratings yet

- Unit 4 FMDocument7 pagesUnit 4 FMSHIVANSH ARORANo ratings yet

- Viva Ruchi MamDocument9 pagesViva Ruchi Mam21358 NDIMNo ratings yet

- Cost of CapitalDocument6 pagesCost of CapitalhiyajNo ratings yet

- FM Lesson45Document10 pagesFM Lesson45kimaniNo ratings yet

- Cost of Capital Meaning, Concept, DefinitionDocument16 pagesCost of Capital Meaning, Concept, DefinitionSahil KapoorNo ratings yet

- ACT112 Final Exam Set 1 QuestionnaireDocument10 pagesACT112 Final Exam Set 1 QuestionnaireBashayer M. Sultan100% (1)

- Study On Equity Diversified Mutual Fund Schemes in IndiaDocument18 pagesStudy On Equity Diversified Mutual Fund Schemes in IndiaShashwat ShrivastavaNo ratings yet

- Palantir - Stock-Based Compensation Update (NYSE - PLTR) - Seeking AlphaDocument18 pagesPalantir - Stock-Based Compensation Update (NYSE - PLTR) - Seeking AlphaRyan LamNo ratings yet

- Idx Annual Statistics 2018 PDFDocument210 pagesIdx Annual Statistics 2018 PDFAndrew WijayaNo ratings yet

- What Is Property, Plant, and Equipment - PP&E?: EquityDocument2 pagesWhat Is Property, Plant, and Equipment - PP&E?: EquityDarlene SarcinoNo ratings yet

- IPM - Valuation of BondDocument21 pagesIPM - Valuation of BondjamesNo ratings yet

- F. No. 117ADocument6 pagesF. No. 117ADipak Prasad100% (1)

- Investors Perception Indian Stock Market 120102040143 Phpapp01Document95 pagesInvestors Perception Indian Stock Market 120102040143 Phpapp01Priya Ramanathan67% (3)

- Share RegistarDocument4 pagesShare RegistarBishwa ShikharNo ratings yet

- Assignment 2Document43 pagesAssignment 2Judy ZhangNo ratings yet

- GAP Takaful 1 PDFDocument4 pagesGAP Takaful 1 PDFAbdul Nafay SiddiquiNo ratings yet

- Livevol Database StructureDocument15 pagesLivevol Database StructureJuan LamadridNo ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalJohn Marthin ReformaNo ratings yet

- CH 14Document20 pagesCH 14M Rafi PriyambudiNo ratings yet

- Cost of CapitalDocument23 pagesCost of CapitalnigemahamatiNo ratings yet

- WN 1: Computation of FRA RateDocument5 pagesWN 1: Computation of FRA RateBharat GudlaNo ratings yet

- Weather Derivative ValuationDocument392 pagesWeather Derivative ValuationDr. Mahuya BasuNo ratings yet

- Esigned Kyc Stock PDFDocument27 pagesEsigned Kyc Stock PDFsantanu chowdhuryNo ratings yet

- Morning CoDocument3 pagesMorning CoKeahlyn BoticarioNo ratings yet

- Far 5Document9 pagesFar 5Sonu NayakNo ratings yet

- Essentials of Corporate Finance 9Th Edition Ross Solutions Manual Full Chapter PDFDocument36 pagesEssentials of Corporate Finance 9Th Edition Ross Solutions Manual Full Chapter PDFroberto.mcdaniel967100% (10)

- Sioux City Proposed Capital Improvement Budget 2014-2018Document551 pagesSioux City Proposed Capital Improvement Budget 2014-2018Sioux City JournalNo ratings yet

- Class 2-1 - Capital Structure 1Document2 pagesClass 2-1 - Capital Structure 1Anna KucherukNo ratings yet

- Acc Group WorkDocument3 pagesAcc Group WorkALEXANDER SWANZY MARTEYNo ratings yet

- Cafta: Online Learning SeriesDocument13 pagesCafta: Online Learning SeriesSourish Re-visitedNo ratings yet

- Nestle & Alcon - The Value of A ListingDocument9 pagesNestle & Alcon - The Value of A ListingSreya DeNo ratings yet

- Equities and Tobin's QDocument18 pagesEquities and Tobin's Qapi-26324170No ratings yet

- 20181122Document1 page20181122Brian HuangNo ratings yet