Professional Documents

Culture Documents

EO (GO) 07-2023 - Instructions For Pay Fixation

Uploaded by

nageswara reddy0 ratings0% found this document useful (0 votes)

75 views3 pagesFixation of pay

Original Title

EO(GO)07-2023 - Instructions for pay fixation

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFixation of pay

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

75 views3 pagesEO (GO) 07-2023 - Instructions For Pay Fixation

Uploaded by

nageswara reddyFixation of pay

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

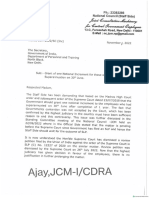

Sia rare age arate =

OFFICE OF THE PRINCIPAL COMMISSIONER OF CENTRAL TAX

gece ote A, TERT A

HYDERABAD GST COMMISSIONERATE =

(CADRE CONTROLLING AUTHORITY)

thee At, ware at, Para ae, aeltcar, Gears - 600 004

GST BHAVAN, LB STADIUMROAD, BASHEERBAGH, HYDERABAD

Phone No.040-23241117 / 23240725 Fax No. 040-23299204

e-mail:ogst hydcomm@gov.in

C.No.II/3/189/2021-Estt.(CCA) Date: 25-01-2023

ESTABLISHMENT ORDER (G.0) No.07/2023

Sub: Estt - Instructions regarding fixation of pay and drawal/recovery of

arrears consequent on issuance of notional promotion orders in

compliance to the orders of Hon'ble Supreme Court in CA No.

3968/2009 filed by B. S. Murthy and others and Hon'ble Supreme

Court orders in CA no. 1970-1975/2009 filed by Shri D Raghu and

others - Reg.

Ref: Establishment Orders EO (GO): 90/2022 dated 11.11.2022, 126/2022

dated 30.11.2022, and 132/2022 dated 19.12.2022

Consequent on issuance of notional promotion orders in compliance to the

orders of Hon'ble Supreme Court in CA No. 3968/2009 filed by Shri B. S. Murthy and

others and Hon'ble Supreme Court orders in CA No. 1970-1975/2009 filed by Shri D.

Raghu and others following instructions are issued for taking necessary action.

2. All the officers who were given notional promotion vide above orders are

directed to exercise their option for fixation of pay within one month from the date of issue

of this order under FR 22 and other instructions/guidelines in vogue. However, the officer

is entitled to arrears of pay, if any, only from their actual date of promotion on regular

basis. However, no interest on payment of arrears will be admissible.

3. The above guidelines are also applicable to officers retired/expired or those

proceeded on VRS.

4. All the DOs of Hyderabad/Visakhapatnam Zone are directed to take necessary

action to communicate the orders of notional promotion to the Zones to which the

Superintendents who were transferred on promotion as Assistant Commissioner (on

‘Adhoc basis) from their formations (basing on the LPC issued). All the officers may be

directed to submit an undertaking in the prescribed proforma enclosed herewith.

5. With regard to recovery of excess payment made if any, due to revision of pay

fixation made to Government servant, consequent on change in date of promotion, the

same may be examined in terms of the guidelines issued by DoPT under letter F.No. 18/

26/2011-Estt(Pay-I) dated 06.02.2014, F.No. 18/03/2015-Estt(Pay-I) dated 02.03.2016

Page 1 of

read with CBIC guidelines issued by CBIC vide F.No. A-26017/149/2016-Ad.IIA dated

31.08.2016 and DoPT instructions issued by letter vide F.No. 18/03/2015-Estt(Pay-I)

dated 03.10.2022 and take necessary action.

6. Further, with regard to the changes if any in pay fixations done earlier on account

of anomalies/ACP/MACP/stepping up of pay/NFSG may be examined and take necessary

action.

7. This issues with the approval of the Principal Chief Commissioner.

LEE cies

(B. RAGHU KIRAN)

ae aT (tA)

ADDITIONAL COMMISSIONER (CCA)

aff To

‘dafaa aah a The Individuals

(aafPere stferaret % area F Through the officer concerned)

ufafery Copy submitted to:

1) ware yer oTUNTET oT, ete oer eek Ares, erewararay Srcte/ sn raae

Saree ehh are Ear TITAS TTT ASAT TTT

freataqcnadien avant STI

The Principal Chief Commissioner/Chief Commissioner, Customs & Central GST,

Ahmedabad /Bangalore/Bhopal/Bhubaneshwar /Chandigarh/Chennai/Delhi/Guwahati/

Hyderabad Jaipur/Kolkata/Lucknow/Meerut/Mumbai/Nagpur/Panchkula/Pune/Ranch

i/Tiruvananthapuram /Vadodara/Visakhapatnam Zones.

2) wet wart arg arate, aha aes & te ae, gacare & PTeIETA aa

All the Principal Commissioners/ Commissioners of Customs & Central Tax, Hyderabad

Zone and Visakhapatnam Zone.

3) ome weritees, oft terdarcargeist (a) taht farce Sita,

‘gece Srftrwarg, geez

The Additional Director General, DGGI/DRI/DG (V)/DG (Audit)/DGPM, Hyderabad Zonal

Unit, Hyderabad.

4) arcane atari.cn, decare afta arate, Berar

The Additional Director General, NACIN, Hyderabad Zonal ‘Training Institute,Hyderabad.

5) aa (Ta), AA, secrara)

‘The Commissioner (AR), CESTAT, Hyderabad.

6) sree) ger ae (area) ercrare sire eer Be athena ate een she Ht

Rl agar] ame after aa & ata dafot aahige afete ax

ratafayafaratevae aft 1 amr stat # earatafer strata atee at after hat a

orear oPoarferd mer ashe a are

The Additional/Joint Commissioners (P&V) of all Customs & Central Tax

Commissionerates under Hyderabad & Visakhapatnam Zone with a request to circulate

the order to all the officers including concerned retired officers under your jurisdiction

and officers transferred to other Zones on promotion/deputation/ loan, etc.

Page 2 of 3

‘afafert Copy to:

1) wt CAOIPAO, Arar gra & Fett ae, GerraTe & PraTETs aA

All the CAO/PAO, Customs & Central Tax, Hyderabad & Visakhapatnam Zone.

2) erate, ater gem, ata sere aoa a Far ae, aE ee croraPa (@rEaTA) afirara-

The General Secretary, Customs, Central Excise & Service Tax, Group ‘B’ Gazetted

(Executive) Officers’ Association, Hyderabad Zone.

3) aerate, dtr gem, Feta sore aes a aT a, aE ew cra (@rfarA) afirare-

are, Saas a,

The General Secretary, Customs, Central Excise & Service Tax, Group

(Executive) Officers’ Association, Hyderabad Zone.

4) weraiea, afar eqee, Soekte Serre qe & Bar a, ag. aT. Ig, a. aataet aaTORToR,

geuare oF

The General Secretary, Customs, Central Excise & Service Tax, SC/ST Employees Welfare

Association, Hyderabad Zone.

Non-Gazetted

5) adie, aeqee aqarn, Ate, gecrare sre at afta Faaree H arveits Her fer

‘The Superintendent, Computer Section, CCO, Hyderabad Zone for uploading in the Zonal

Website.

2B 1,23

PGE!

6) Tats /retaHTEA Notice Board / Stock File.

(ft. 2 Fee

(B. RAGHU KIRAN)

are args (FA)

ADDITIONAL COMMISSIONER (CCA)

UNDERTAKING

Establis! No. 07/2023 dated 2:

Re!

Thereby undertake that any excess payment that may be found to have been

made as a result of incorrect fixation of pay or any excess payment detected in the light

of discrepancies noticed subsequently will be refunded by me to the Government either

by adjustment against future salary/payments due to me or otherwise, without r:

any objection to it.

I will not claim any interest on account of drawl of arrears, if eligible.

Signature :

Name:

Designation :

Date:

Page 3 0f 3

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- 4 Hike SalariesDocument1 page4 Hike Salariesnageswara reddyNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 1 Precaution 8a50d-A817-4e38-B3d6-Ec44bc1951a2Document1 page1 Precaution 8a50d-A817-4e38-B3d6-Ec44bc1951a2nageswara reddyNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- SB DigitizationDocument1 pageSB Digitizationnageswara reddyNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- EO GO 90 of 2022 Notional PromotionDocument22 pagesEO GO 90 of 2022 Notional Promotionnageswara reddyNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Notional IncrementDocument4 pagesNotional Incrementnageswara reddyNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- UNDERTAKING - DocumentDocument1 pageUNDERTAKING - Documentnageswara reddyNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Statement of Axis Account No:244010100125703 For The Period (From: 01-01-2021 To: 31-12-2021)Document2 pagesStatement of Axis Account No:244010100125703 For The Period (From: 01-01-2021 To: 31-12-2021)nageswara reddyNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Manual Smartwatch U8Document19 pagesManual Smartwatch U8nageswara reddyNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)