Professional Documents

Culture Documents

Dangote Cement PLC Financial Analysis Ratios

Uploaded by

ajao oyindamola0 ratings0% found this document useful (0 votes)

3 views1 pageOriginal Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageDangote Cement PLC Financial Analysis Ratios

Uploaded by

ajao oyindamolaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Dangote Cement PLC Financial Analysis

FINANCIAL RATIO

1. PROFITABILITY RATIOS

Return on capital employed =(Profit before interest and taxation)/(capital employed)×100%

Capital employed= Total assets-current liabilities (₦’million)

=293899/(1823984-410575)×100 =293899/1413409×100=20.79%

2. Return on Equity =(profit after tax and preference dividend)/(capital employed)×100%

=261349/1413409×100%=18.49%

1. ACTIVITY/EFFICIENCY RATIOS

Inventory turnover =(cost of goods sold)/inventory

=181009/67736=2.67 times

2. Inventory days =inventory/(cost of goods sold)×365 days

=67736/181009×365 days =136.58≈137 days

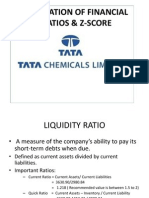

1. LIQUIDITY RATIOS

Current ratio =(current assets)/(current liabilities)

=418990/410575=1.02:1

2. Quick ratio =(current assets-inventories)/(current liabilities)

=(418990-67736)/410575=0.85:1

You might also like

- Cpa Review School of The Philippines: Management Advisory Services AGE OFDocument9 pagesCpa Review School of The Philippines: Management Advisory Services AGE OFJohn Carlo CruzNo ratings yet

- 601 13,14 SolutionsDocument37 pages601 13,14 SolutionsRudi SyafputraNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Notice - Final ExamDocument13 pagesNotice - Final ExamNicoleNo ratings yet

- Fsa - Assignment Completed)Document26 pagesFsa - Assignment Completed)Jlins WgNo ratings yet

- Assignment OF Accounting Principles IN Ratio Analysis & Fund Flow StatementDocument10 pagesAssignment OF Accounting Principles IN Ratio Analysis & Fund Flow StatementIshu AroraNo ratings yet

- Nama: Faradilla Donggio Nim: 2009-30-036 Tugas: Analisis Laporan KeuanganDocument3 pagesNama: Faradilla Donggio Nim: 2009-30-036 Tugas: Analisis Laporan KeuanganZainal Arifin BGNo ratings yet

- Solutions To November 2011 Cost Accounting and Financail Mangement PaperDocument16 pagesSolutions To November 2011 Cost Accounting and Financail Mangement Paperrk_rkaushikNo ratings yet

- Financial Analysis of Berjaya Corporation Berhad 2009-2010Document5 pagesFinancial Analysis of Berjaya Corporation Berhad 2009-2010Yako WenWenNo ratings yet

- Company Ratios.Document3 pagesCompany Ratios.Joshua Marissah NaftaliNo ratings yet

- TapiFruit Valuation - AATIFDocument15 pagesTapiFruit Valuation - AATIFAatif AhmadNo ratings yet

- Chapter 3 Problems AnswersDocument11 pagesChapter 3 Problems AnswersOyunboldEnkhzayaNo ratings yet

- Suggested SolutionsDocument7 pagesSuggested SolutionsSunder ChaudharyNo ratings yet

- Corporate Finance Chapter 4Document15 pagesCorporate Finance Chapter 4Razan EidNo ratings yet

- FM Solved PapersDocument83 pagesFM Solved PapersAjabba87% (15)

- Ratio Analysis of URC-FS & ISDocument2 pagesRatio Analysis of URC-FS & ISMalou De MesaNo ratings yet

- Chartered Financial Management Analyst: (Module 3)Document43 pagesChartered Financial Management Analyst: (Module 3)k 3117No ratings yet

- Toyota Motor Corporation TMC 1Document32 pagesToyota Motor Corporation TMC 1Sigit MaulanaNo ratings yet

- Problem2 Financial ManagementDocument4 pagesProblem2 Financial ManagementCamille MenesesNo ratings yet

- Financial Ratios of Tata Chemicals and Z Score CalculationDocument10 pagesFinancial Ratios of Tata Chemicals and Z Score CalculationRaaj BajajNo ratings yet

- Profitability, Liquidity, Efficiency & Solvency Ratios AnalysisDocument6 pagesProfitability, Liquidity, Efficiency & Solvency Ratios AnalysisNoorAzreen AyienNo ratings yet

- Financial Reporting Week 1 Class 1 Important!Document18 pagesFinancial Reporting Week 1 Class 1 Important!Lin SongNo ratings yet

- I. Ratio Analysis Calculations (2010-11) Liquidity Position: A) Current RatioDocument6 pagesI. Ratio Analysis Calculations (2010-11) Liquidity Position: A) Current RatioManuj KapoorNo ratings yet

- MFRS 116 - PpeDocument26 pagesMFRS 116 - Ppeizzati zafirahNo ratings yet

- Abm FormulasDocument39 pagesAbm FormulasYogambica Pilladi0% (1)

- Maxis Berhad 2013 financial ratios analysisDocument6 pagesMaxis Berhad 2013 financial ratios analysisNicholas LimNo ratings yet

- Fin 1Document4 pagesFin 1tranminhkthNo ratings yet

- Unit 10: CVP Analysis I Essay: AnswerDocument2 pagesUnit 10: CVP Analysis I Essay: AnswerBui QuynhNo ratings yet

- Company Profile Ratio Analysis 2019 I. Liquidity RatiosDocument9 pagesCompany Profile Ratio Analysis 2019 I. Liquidity RatiosVishnu AryanNo ratings yet

- HW 02 SolutionDocument2 pagesHW 02 Solutionchauanh29424No ratings yet

- Corporate Finance Workshop 1Document24 pagesCorporate Finance Workshop 1coffeedanceNo ratings yet

- Cost Incurred Cost Incurred Estimated Cost of Completion Date Date Complete) Revenue Date Contract of CompletionDocument2 pagesCost Incurred Cost Incurred Estimated Cost of Completion Date Date Complete) Revenue Date Contract of CompletionArmin NiebresNo ratings yet

- Answers To The Overall Questions of Chapter SevenDocument3 pagesAnswers To The Overall Questions of Chapter SevenHamza MahmoudNo ratings yet

- Practice Numericals Solutions-1Document7 pagesPractice Numericals Solutions-1Daniyal ZafarNo ratings yet

- UNIT 3 Tutorial Q & ADocument14 pagesUNIT 3 Tutorial Q & AAlicia AbsolamNo ratings yet

- FIN630 Assignment#01 Solution Spring 2019Document3 pagesFIN630 Assignment#01 Solution Spring 2019Shah567No ratings yet

- Calculation and Interpretation of Financial RatiosDocument4 pagesCalculation and Interpretation of Financial Ratiosfatimahsalleh96No ratings yet

- SBL PBA4807 Assignment 1Document11 pagesSBL PBA4807 Assignment 1Charmaine Tshamaano MasuvheNo ratings yet

- Financial Economic1Document7 pagesFinancial Economic1biancaftw90No ratings yet

- BAV Case Assignment On: Midland Energy Case AnalysisDocument7 pagesBAV Case Assignment On: Midland Energy Case AnalysisMANJEERA ANANDNo ratings yet

- Problem BankDocument10 pagesProblem BankSimona NistorNo ratings yet

- Ratio of Price To Book 2.22Document14 pagesRatio of Price To Book 2.22Lê Hữu LựcNo ratings yet

- Ma IiDocument2 pagesMa IiPryaNo ratings yet

- Assessing A FirmDocument4 pagesAssessing A Firm蔡朝泉No ratings yet

- Chapter 7Document16 pagesChapter 7hadassahhadidNo ratings yet

- 9706 Y16 SM 2Document12 pages9706 Y16 SM 2Wi Mae RiNo ratings yet

- Individual Assignment - Financial and Management AccountingDocument28 pagesIndividual Assignment - Financial and Management AccountingJonathan PohlNo ratings yet

- My Mortgage Journal SampleDocument7 pagesMy Mortgage Journal Samplemichylima28No ratings yet

- MIDocument18 pagesMImy tràNo ratings yet

- 1.1 11 (D), 11 (E), 11 (O0,12 (C) 2022Document15 pages1.1 11 (D), 11 (E), 11 (O0,12 (C) 2022AmogelangNo ratings yet

- Analisis Laporan KeuanganDocument6 pagesAnalisis Laporan KeuanganYukito ChamaNo ratings yet

- Course Title: Macroeconomics: Course Code: ECO201 DR - Muhmmad Imtaiz SubhaniDocument34 pagesCourse Title: Macroeconomics: Course Code: ECO201 DR - Muhmmad Imtaiz SubhaniMuhammad RafayNo ratings yet

- Module 3Document13 pagesModule 3Ghillian Mae GuiangNo ratings yet

- Horngrens Accounting 10Th Edition Nobles Solutions Manual Full Chapter PDFDocument36 pagesHorngrens Accounting 10Th Edition Nobles Solutions Manual Full Chapter PDFelizabeth.hayes136100% (10)

- DG Khan Cement Ratio Analysis, Data As at June 30,2017 LiquidityDocument2 pagesDG Khan Cement Ratio Analysis, Data As at June 30,2017 LiquidityQuran Recitation channel Alasad of QuranNo ratings yet

- Blackberry Financial StatementsDocument12 pagesBlackberry Financial StatementsSelmir V KlicicNo ratings yet

- Budgeting, Capital Structure, and Working Capital ManagementDocument11 pagesBudgeting, Capital Structure, and Working Capital Managementritu paudelNo ratings yet

- Answer To MTP - Intermediate - Syllabus 2012 - Dec2014 - Set 1Document16 pagesAnswer To MTP - Intermediate - Syllabus 2012 - Dec2014 - Set 1Crizhae OconNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)