Professional Documents

Culture Documents

Trading Accounts Income Statement

Uploaded by

Kc SevillaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trading Accounts Income Statement

Uploaded by

Kc SevillaCopyright:

Available Formats

NAME: ___________________________ C/Y/S: ______________ DATE: ________________

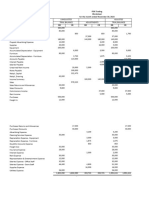

Trading Accounts Allowance for Allowance for Accumulated Accounts Notes Bank Utilities Interest Bonds Premium Share Share Retained Appropriated Revenues

Cash securities receivable bad debts InventoryInventory W-down Land Equipment depreciation payable payable Loan payable payable payable payable on bonds capital premium earnings RE (Expenses)

125,000 250,000 40,000 (2,500) 80,000 (5,000) 500,000 300,000 (60,000) 120,000 40,000 23,000 30,000 500,000 10,000 300,000 50,000 154,500

4,500,000 4,500,000 Sales

(2,500) (2,500) Sales allowances

(3,000) (3,000) Sales discount

4,000,000 3,900,000 100,000

Suppliers (3,800,000) (3,800,000)

(78,000) (78,000) Purchase returns and allowances

(3,900,000) (3,900,000) COGS

Freight in (40,000) 40,000

(2,000) (2,000) COGS: Loss on inventory writedown

Customers 4,300,000 (4,300,000)

(20,000) 20,000

Equipment (80,000) 80,000

Suppliers (70,000) (70,000)

(20,000) 20,000

Customers 15,000 (15,000)

Trading securities 150,000 (100,000) 50,000 Gain on sale of TS

5,000 5,000 Unrealized gain on FV change

Utilities (22,000) 35,000 (57,000) Utilities expense

Interest (20,000) 40,000 (60,000) Interest expense

(2,000) 2,000 Interest expense

Bonds (100,000) (100,000)

Shares 110,000 100,000 10,000

Cash dividends paid (90,000) (90,000)

(200,000) 200,000

Loan 700,000 700,000

Land (500,000) 500,000

Loan (140,000) (140,000)

(34,000) (34,000) Depreciation expense

(70,000) (70,000) Rent expense

(100,000) (100,000) Salaries expense

(12,000) (12,000) Bad debt expense

316,500 Net income

316,500 (316,500)

368,000 155,000 214,500 (9,500) 142,000 (7,000) 1,000,000 380,000 (94,000) 122,000 90,000 560,000 58,000 70,000 400,000 8,000 400,000 60,000 181,000 200,000 -

2,149,000 2,149,000

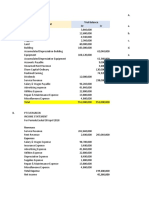

Net income 316,500

Adjustments: Depreciation expense 34,000

Amortization of premium on bodns payable (2,000)

Net income before working capital changes 348,500 Payments to suppliers (3,870,000)

Changes in working capital Collections from customers 4,315,000

Trading securities 95,000 Payments of freight (40,000)

Accounts receivable (167,500) Payment of utilities (22,000)

Inventory (60,000) Payment of interest (20,000)

Accounts payable 2,000 Payment of salaries (100,000)

Trade notes payable 50,000 Payment of rent (70,000)

Utilities payable 35,000 Proceeds from sale of trading securities 150,000

Interest payable 40,000 343,000

Cash flows from operating activities 343,000 Purchase of equipment (80,000)

Purchase of land (500,000)

(580,000)

Proceeds from bank loan 700,000

Issuance of share capital 110,000

Payment of bonds (100,000)

Payment of bank loan (140,000)

Payment of cash dividends (90,000)

480,000

Net increase in cash 243,000

Beginning cash balance 125,000

Ending cash balance 368,000

You might also like

- Database Management Systems: Understanding and Applying Database TechnologyFrom EverandDatabase Management Systems: Understanding and Applying Database TechnologyRating: 4 out of 5 stars4/5 (8)

- Electrical, Optical and Magnetic Properties of Nucleic acid and ComponentsFrom EverandElectrical, Optical and Magnetic Properties of Nucleic acid and ComponentsJ DuchesneNo ratings yet

- HELMI Laundry Basic Accounting March 2006Document3 pagesHELMI Laundry Basic Accounting March 2006Melia SariNo ratings yet

- BCOM AdvDocument14 pagesBCOM AdvGel Bert Jalando-onNo ratings yet

- SBR1 Dummy With Cash FlowDocument15 pagesSBR1 Dummy With Cash Flowakansha.associate.workNo ratings yet

- Tutorial 2 (Suggested Solution)Document2 pagesTutorial 2 (Suggested Solution)DyksterNo ratings yet

- Chapter 13 Corporations CACP - XLSX - Sheet1Document1 pageChapter 13 Corporations CACP - XLSX - Sheet1mhrzyn27No ratings yet

- ARA Galleries Financial ReportsDocument4 pagesARA Galleries Financial ReportsBáchHợpNo ratings yet

- Maria Hernandez case study operations analysisDocument11 pagesMaria Hernandez case study operations analysisYa Ua100% (2)

- Indirect MethodDocument4 pagesIndirect MethodjustinreyNo ratings yet

- Kid's Clothing - GPV Improvement PlanDocument2 pagesKid's Clothing - GPV Improvement PlanSagar BhattNo ratings yet

- Activities and Assesment 2Document4 pagesActivities and Assesment 2Mante, Josh Adrian Greg S.No ratings yet

- Indian MaintenenceDocument1 pageIndian MaintenenceRodrigo YaltoneNo ratings yet

- Kertas Kerja Zamla (2) - 2Document1 pageKertas Kerja Zamla (2) - 2Zamla RiniNo ratings yet

- Example Weibull Probability Plots Using The Weibull Excel ModelDocument2 pagesExample Weibull Probability Plots Using The Weibull Excel ModelAlexander Arenas JimenezNo ratings yet

- rgDocument1 pagergkhgngy5bbkNo ratings yet

- Item Amount Notes: de Mo CompanyDocument2 pagesItem Amount Notes: de Mo Companysyed ahmedNo ratings yet

- FdnacctDocument20 pagesFdnacctvitobautistaNo ratings yet

- Partnership Liquidation StatementDocument5 pagesPartnership Liquidation StatementdewiNo ratings yet

- 2021 SM2 Tutorial 02 InClass SolutionDocument3 pages2021 SM2 Tutorial 02 InClass SolutionZhu ZiRuiNo ratings yet

- MTP 12 25 Answers 1697029886Document13 pagesMTP 12 25 Answers 1697029886harshallahotNo ratings yet

- Kinglong Employees Cooperative 3-Month Income ProjectionDocument1 pageKinglong Employees Cooperative 3-Month Income ProjectionJf LarongNo ratings yet

- klDocument1 pageklkhgngy5bbkNo ratings yet

- T1 - ABFA1153 (Extra)Document1 pageT1 - ABFA1153 (Extra)LOO YU HUANGNo ratings yet

- Fabm OutputsDocument3 pagesFabm OutputsElaine Joyce GarciaNo ratings yet

- Inventario PiendamoDocument1 pageInventario Piendamoalexpiam99No ratings yet

- Cycle Meeting Format .Ppt. Zonal & RegionalDocument19 pagesCycle Meeting Format .Ppt. Zonal & RegionalGul MirajNo ratings yet

- Cash Flow Ore Nickel MiningDocument1 pageCash Flow Ore Nickel MiningISTAMBUL GOWANo ratings yet

- JPP Computer Clinic December 2020 Trial BalanceDocument2 pagesJPP Computer Clinic December 2020 Trial BalanceMinjin lesner ManalansanNo ratings yet

- Accounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 34Document6 pagesAccounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 34Malar SrirengarajahNo ratings yet

- Quiz 1 SFM AnswerDocument4 pagesQuiz 1 SFM Answerangelicacas063No ratings yet

- Exercise 8-7 Page 319Document3 pagesExercise 8-7 Page 319Dianne Jane LirayNo ratings yet

- Zabala Auto Supply Worksheet JANUARY 31, 2021 Unadjusted Trial Balance DebitDocument24 pagesZabala Auto Supply Worksheet JANUARY 31, 2021 Unadjusted Trial Balance DebitIphegenia DipoNo ratings yet

- Accounting - Trial BalanceDocument1 pageAccounting - Trial Balancefranchesca.dejesus.educNo ratings yet

- Tutorial 6 - Solutions Consolidated Statement of Financial Position (Csofp) - Part 2 SolutionsDocument8 pagesTutorial 6 - Solutions Consolidated Statement of Financial Position (Csofp) - Part 2 Solutionscynthiama7777No ratings yet

- Final Accounts (2)Document39 pagesFinal Accounts (2)aayushsurana1204No ratings yet

- ARL Sustainability Report 2021Document121 pagesARL Sustainability Report 2021IMRAN MUSHTAQ AUTOSNo ratings yet

- Problem 2: Income StatementDocument1 pageProblem 2: Income StatementazisridwansyahNo ratings yet

- Empowerment Technologies - G12 MEEDocument11 pagesEmpowerment Technologies - G12 MEEMac Reniel EdoraNo ratings yet

- Previous Year SlidesDocument276 pagesPrevious Year Slidessalman siddiquiNo ratings yet

- 01 Steop enDocument28 pages01 Steop enMutesa ChrisNo ratings yet

- FADM Assignment SolvedDocument12 pagesFADM Assignment SolvedAnujain JainNo ratings yet

- Revenue History ChartDocument2 pagesRevenue History ChartjsweigartNo ratings yet

- SMP 1 Weekly Overall Progress 20240113Document262 pagesSMP 1 Weekly Overall Progress 20240113upickrahmanNo ratings yet

- Anabo, Ivan G. (2550m Vat)Document3 pagesAnabo, Ivan G. (2550m Vat)Ivan AnaboNo ratings yet

- PLAXIS 3D Foundation Analysis Software TutorialDocument1 pagePLAXIS 3D Foundation Analysis Software TutorialJuan Guillermo Quitora RojasNo ratings yet

- Start Professional Practice FinancialsDocument4 pagesStart Professional Practice FinancialsMark CalimlimNo ratings yet

- Tally AssignmentDocument3 pagesTally AssignmentSoumya LatheyNo ratings yet

- 6 Month Debtors and Creditors ReportsDocument3 pages6 Month Debtors and Creditors ReportskarenNo ratings yet

- Worksheet - Ch. 9 Prob. 2Document1 pageWorksheet - Ch. 9 Prob. 2katheenanoNo ratings yet

- Tutorial4 - Sol - New UpdateDocument13 pagesTutorial4 - Sol - New UpdateHa NguyenNo ratings yet

- Lou Bernardo Company 2016 Financial StatementsDocument3 pagesLou Bernardo Company 2016 Financial Statementsangel cao100% (2)

- Finacc 8-3Document5 pagesFinacc 8-3FakerPlaymakerNo ratings yet

- Swinburne University ACC10007 Discussion QuestionsDocument5 pagesSwinburne University ACC10007 Discussion QuestionsRenee WongNo ratings yet

- Exam 2 Review SolutionDocument6 pagesExam 2 Review Solutionsimonedana97No ratings yet

- Production quantity and profit analysis chartDocument11 pagesProduction quantity and profit analysis chartNguyen Khoa DangNo ratings yet

- ABC Company Worksheet Year-End Financials 2021Document1 pageABC Company Worksheet Year-End Financials 2021por wansNo ratings yet

- Solution DDL Partnership Practice Problem Cash Priority Program v2Document1 pageSolution DDL Partnership Practice Problem Cash Priority Program v2Josephine YenNo ratings yet

- Cristobal Store Problem 8-4 Accounts Adjusted Trial BalanceDocument3 pagesCristobal Store Problem 8-4 Accounts Adjusted Trial BalanceFakerPlaymakerNo ratings yet

- Biogas FinanceDocument9 pagesBiogas FinanceEngr Peter Iyke EboghaNo ratings yet

- Ea - TaxDocument8 pagesEa - TaxKc SevillaNo ratings yet

- Quiz On Economic and Political GlobalizationDocument4 pagesQuiz On Economic and Political GlobalizationKc SevillaNo ratings yet

- Quiz On Economic GlobalizationDocument2 pagesQuiz On Economic GlobalizationKc SevillaNo ratings yet

- Ea EconDocument2 pagesEa EconKc SevillaNo ratings yet

- Tax Sa1Document15 pagesTax Sa1Kc SevillaNo ratings yet

- Accounting For Special TransactionsDocument1 pageAccounting For Special TransactionsKc SevillaNo ratings yet

- Review Quiz on Classic Literature and Colonial AmericaDocument2 pagesReview Quiz on Classic Literature and Colonial AmericaKc SevillaNo ratings yet

- 25 Over 30 Partnership LiquidationDocument17 pages25 Over 30 Partnership LiquidationKc SevillaNo ratings yet

- ENSCI Long QuizDocument11 pagesENSCI Long QuizKc SevillaNo ratings yet

- Chapter 3 Answer KeyDocument4 pagesChapter 3 Answer KeyKc SevillaNo ratings yet

- Kwatro Art AppDocument3 pagesKwatro Art AppKc SevillaNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPalex v.m.No ratings yet

- Bab 4 Soal 4Document4 pagesBab 4 Soal 4Abel AbdallahNo ratings yet

- Working Capital Tulasi SeedsDocument22 pagesWorking Capital Tulasi SeedsVamsi SakhamuriNo ratings yet

- Ia1 GG 2020Document27 pagesIa1 GG 2020Jm SevallaNo ratings yet

- Course Outline For Fundamentals of Accounting IIDocument2 pagesCourse Outline For Fundamentals of Accounting IIbekele kefyalewNo ratings yet

- University of Luzon College of Accountancy Adjusting EntriesDocument91 pagesUniversity of Luzon College of Accountancy Adjusting EntriestaurusNo ratings yet

- Application Format Claiming Reimbursement of Certification ChargesDocument10 pagesApplication Format Claiming Reimbursement of Certification ChargesSrk SrkNo ratings yet

- P 2Document444 pagesP 2Denis FernandesNo ratings yet

- R17 Understanding Income Statements IFT NotesDocument21 pagesR17 Understanding Income Statements IFT Notessubhashini sureshNo ratings yet

- SAPayslipDocument1 pageSAPayslipmomen rababahNo ratings yet

- Exclusive Commercial Property Management AuthorityDocument11 pagesExclusive Commercial Property Management AuthorityKatharina Sumantri0% (2)

- 4.-Financial-Statement-Analysis-1 in FabmDocument46 pages4.-Financial-Statement-Analysis-1 in FabmJodalyn CasibangNo ratings yet

- Salaries and Wages: Definitions, Calculations, BenefitsDocument47 pagesSalaries and Wages: Definitions, Calculations, BenefitsJenny Stypay100% (1)

- Fpo TranslationDocument28 pagesFpo TranslationprasunaNo ratings yet

- Chapter 08 DayagDocument25 pagesChapter 08 DayagAljenika Moncada GupiteoNo ratings yet

- Bank Procedure and FormalitiesDocument59 pagesBank Procedure and Formalitiesrakesh19865No ratings yet

- CMA MCQ Self Entrance-1Document2 pagesCMA MCQ Self Entrance-1Ava DasNo ratings yet

- Nguyễn Minh Nhật KNC03 31221024307 P1.2LO 45Document4 pagesNguyễn Minh Nhật KNC03 31221024307 P1.2LO 45Bảo KhangNo ratings yet

- Organizational Capacity AssessmentDocument4 pagesOrganizational Capacity AssessmentValerie F. LeonardNo ratings yet

- Identify and Analyze IT System Components To Be MaintainedDocument12 pagesIdentify and Analyze IT System Components To Be MaintainedAbraha GebrekidanNo ratings yet

- ACC111 Activity 22Document8 pagesACC111 Activity 22Triquesha Marriette Romero Rabi100% (1)

- Unadjusted Trial Balance Adjusting Entries Adjusted Trial BalanceDocument3 pagesUnadjusted Trial Balance Adjusting Entries Adjusted Trial BalanceCj BarrettoNo ratings yet

- 05aug2014 India DailyDocument73 pages05aug2014 India DailyChaitanya JagarlapudiNo ratings yet

- BUSINESS PLAN of DAREMA PLCDocument20 pagesBUSINESS PLAN of DAREMA PLCMelat Makonnen67% (3)

- Finance Interview Prep: Key Accounting QuestionsDocument14 pagesFinance Interview Prep: Key Accounting Questionsmanish mishraNo ratings yet

- BP Op Entpr S4hana2021 08 Co Master Data en XXDocument159 pagesBP Op Entpr S4hana2021 08 Co Master Data en XXVinay Borbachhi (IN)No ratings yet

- Balancesheet - Tata Motors LTDDocument9 pagesBalancesheet - Tata Motors LTDNaveen KumarNo ratings yet

- Tutorial 3Document14 pagesTutorial 3NURSUHAILI IZZATI ABU BAKARNo ratings yet

- Free Cash Flow ValuationDocument14 pagesFree Cash Flow ValuationabcNo ratings yet

- Mission 200 Economics 100 FINALDocument67 pagesMission 200 Economics 100 FINALHari prakarsh NimiNo ratings yet