Professional Documents

Culture Documents

Chapter 28

Chapter 28

Uploaded by

Gellie Real0 ratings0% found this document useful (0 votes)

4 views1 pageThe document lists expenses and losses for several companies, including a $700,000 loss from a typhoon for Farr Company, $840,000 in inventory losses for Harper Company, and $1,400,000 in net losses from disposal of a business segment and property taxes for Mill Company. It also provides income and expense details for other companies such as Pauline Company paying 2 million in staff bonuses at 5% of its 40 million income for the first half of the year, and Davao Company's 2 million total warranty expenses for the first two quarters.

Original Description:

Original Title

CHAPTER 28

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document lists expenses and losses for several companies, including a $700,000 loss from a typhoon for Farr Company, $840,000 in inventory losses for Harper Company, and $1,400,000 in net losses from disposal of a business segment and property taxes for Mill Company. It also provides income and expense details for other companies such as Pauline Company paying 2 million in staff bonuses at 5% of its 40 million income for the first half of the year, and Davao Company's 2 million total warranty expenses for the first two quarters.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageChapter 28

Chapter 28

Uploaded by

Gellie RealThe document lists expenses and losses for several companies, including a $700,000 loss from a typhoon for Farr Company, $840,000 in inventory losses for Harper Company, and $1,400,000 in net losses from disposal of a business segment and property taxes for Mill Company. It also provides income and expense details for other companies such as Pauline Company paying 2 million in staff bonuses at 5% of its 40 million income for the first half of the year, and Davao Company's 2 million total warranty expenses for the first two quarters.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

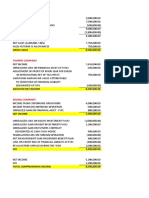

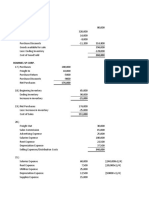

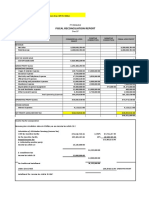

PROBLEM 28-1 FARR COMPANY

LOSS FROM TYPHOON 700,000.00

PAYMENT OF FIRE INSURANCE PREMIUM 100,000.00

PROBLEM 28-7 PAULINE COMPANY

TOTAL EXPENSES 800,000.00

INCOME FOR HALF YEAR 40,000,000.00

STAFF BONUSES 5%

PROBLEM 28-2 HARPER COMPANY

STAFF BONUSES FOR THE FIRST HALF YEAR 2,000,000.00

INVENTORY LOSS 840,000.00

TOTAL INVENTORY LOSS 840,000.00

PROBLEM 28-8 REX COMPANY

PROBLEM 28-3 MILL COMPANY PROPERTY TAXES 600,000.00

NET LOSS FROM DISPOSAL OF A BUSINESS SEGMENT 1,000,000.00 REPAIRS OF EQUPIMENT 900,000.00

PROPERTY TAXES 400,000.00 TOTAL EXPENSES 1,500,000.00

NET LOSS 1,400,000.00

PROBLEM 28-9 DAVAO COMPANY

PROBLEM 28-4 VIM COMPANY

1ST QUARTER WARRANTY EXPENSE 500,000.00

DEPRECIATION EXPENSE 250,000.00

2ND QUARTER WARRANTY EXPENSE 1,500,000.00

EMPLOYEE BONUSES 600,000.00

TOTAL WARRANTY EXPENSE 2,000,000.00

TOTAL EXPENSES 850,000.00

PROBLEM 28-5 MOUNT COMPANY

ADVERTISING COSTS 2,000,000.00

STAFF BONUSES 3,000,000.00

TOTAL EXPENSES 5,000,000.00

PROBLEM 28-6 BAILAR COMPANY

FIRST QUARTER ( 30% X 6,000,000 ) 1,800,000.00

SECOND QUARTER ( 30% X 7,000,000 ) 2,100,000.00

TOTAL INCOME TAX FOR FIRST TWO QUARTER 3,900,000.00

CUMULATIVE INCOME TAX FOR

THREE QUARTERS ( 25% X 21,000,000 ) 5,250,000.00

INCOME TAX FOR FIRST TWO QUARTERS (3,900,000.00)

THIRD QUARTER-INCOME TAX EXPENSE 1,350,000.00

You might also like

- Chapter 18 Govt GrantsDocument6 pagesChapter 18 Govt Grantsrobinady dollaga100% (2)

- Assignment Module 1Document4 pagesAssignment Module 1Geo NacionNo ratings yet

- Chapter 35Document1 pageChapter 35Gellie RealNo ratings yet

- Intermediate Accounting 3Document18 pagesIntermediate Accounting 3Cristine MayNo ratings yet

- Pg-11-7 Book Valuve: Assignment Capital BudgetingDocument9 pagesPg-11-7 Book Valuve: Assignment Capital BudgetingIffi RaniNo ratings yet

- Quali Review Interim Reporting Complete SolutionDocument7 pagesQuali Review Interim Reporting Complete SolutionPaul Ivan CabanatanNo ratings yet

- FS - LandscapeDocument9 pagesFS - LandscapeMekay OcasionesNo ratings yet

- Ferlin Acol Quiz 2 Intact 3Document1 pageFerlin Acol Quiz 2 Intact 3Julienne UntalascoNo ratings yet

- Intermediate Accounting Chapter 9-14Document10 pagesIntermediate Accounting Chapter 9-14thea tangalinNo ratings yet

- Review Session 2024 SolutionsDocument3 pagesReview Session 2024 SolutionsHitesh MehtaNo ratings yet

- Assignment No. 1Document2 pagesAssignment No. 1Sharmaine JoyceNo ratings yet

- Key To Correction - Intermediate Accounting - Midterm - 2019-2020Document10 pagesKey To Correction - Intermediate Accounting - Midterm - 2019-2020Renalyn ParasNo ratings yet

- OverheadsDocument48 pagesOverheadsDhiraj JaiswalNo ratings yet

- Chapter 14 Exercise 12Document7 pagesChapter 14 Exercise 12freaann03No ratings yet

- Laporan Arus KasDocument1 pageLaporan Arus Kasyolla maysantiNo ratings yet

- Project Cost SharingDocument2 pagesProject Cost SharingReintegration CagayanNo ratings yet

- 9 Job Costing & Batch Costing PDFDocument7 pages9 Job Costing & Batch Costing PDFgracel angela tolejano100% (1)

- Assignment 1556954208 SmsDocument59 pagesAssignment 1556954208 SmsentertainmentqurryNo ratings yet

- INTACC2 - Chapter 29Document4 pagesINTACC2 - Chapter 29Shane TabunggaoNo ratings yet

- Chapter 13-14Document6 pagesChapter 13-14Gellie RealNo ratings yet

- Geraldine E. Martinez, Bsa-Iii Chapter 8 - Problem 7Document6 pagesGeraldine E. Martinez, Bsa-Iii Chapter 8 - Problem 7Geraldine Martinez DonaireNo ratings yet

- A2 AppeDocument16 pagesA2 AppeAlarich CatayocNo ratings yet

- W14 - As8 Maranan, A2aDocument3 pagesW14 - As8 Maranan, A2aJere Mae MarananNo ratings yet

- Insurance Co.Document28 pagesInsurance Co.sejal ambetkarNo ratings yet

- Weekly Output Answer Other Comprehensive IncomeDocument1 pageWeekly Output Answer Other Comprehensive IncomeHannah KatNo ratings yet

- TYBCOM - Cost - OverheadsDocument8 pagesTYBCOM - Cost - Overheadsmkbooks4uNo ratings yet

- Life Cycle Q&aDocument48 pagesLife Cycle Q&aanjNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument9 pagesInterim Financial Reporting: Problem 45-1: True or FalseAudrey AganNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument9 pagesInterim Financial Reporting: Problem 45-1: True or FalseAudrey AganNo ratings yet

- 2017 Vol 3 CH 9 AnsDocument3 pages2017 Vol 3 CH 9 AnsDiola QuilingNo ratings yet

- SOL MANUAL TAX SHORT QUIZ XXXXXDocument1 pageSOL MANUAL TAX SHORT QUIZ XXXXXJohn Alpon CatudayNo ratings yet

- Bio Coal EstimateDocument1 pageBio Coal EstimateDhananjay KulkarniNo ratings yet

- Flare GasificationDocument25 pagesFlare Gasificationtimir ghoseNo ratings yet

- Revaluation and ImpairmentDocument14 pagesRevaluation and ImpairmentKyle PereiraNo ratings yet

- Batch 93 FAR First Preboard February 2023 - SolutionDocument5 pagesBatch 93 FAR First Preboard February 2023 - SolutionlorenzNo ratings yet

- AP-5906Q ReceivablesDocument3 pagesAP-5906Q Receivablesjhouvan100% (1)

- p11 29Document5 pagesp11 29Saeful AzizNo ratings yet

- Answer-Key-Chapter-5-BC DeJesusDocument15 pagesAnswer-Key-Chapter-5-BC DeJesusMerel Rose FloresNo ratings yet

- Tutorial 1 - Topic 4 - OAR - QDocument6 pagesTutorial 1 - Topic 4 - OAR - QJong HannahNo ratings yet

- Chapter 08Document10 pagesChapter 08julie anne mae mendozaNo ratings yet

- Same Questions - F303 - 1st MidDocument5 pagesSame Questions - F303 - 1st MidRafid Al Abid SpondonNo ratings yet

- Untitled SpreadsheetDocument9 pagesUntitled SpreadsheetMiguel BautistaNo ratings yet

- PDF DocumentDocument2 pagesPDF DocumentJustine gaile UgaddanNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseMarjorieNo ratings yet

- Interim Financial ReportingDocument7 pagesInterim Financial ReportingRey Joyce AbuelNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseXyverbel Ocampo RegNo ratings yet

- Yearly Sales ProjectionDocument2 pagesYearly Sales ProjectionRomyNo ratings yet

- Taxation Solution To Final PB Oct 2021Document6 pagesTaxation Solution To Final PB Oct 2021keishanget60No ratings yet

- LEVERAGESDocument4 pagesLEVERAGESdonadisamanta9No ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- 02c Analysis of FADocument12 pages02c Analysis of FASaad ZamanNo ratings yet

- Overheads Part 1 SolutionsDocument25 pagesOverheads Part 1 Solutionsdoshiviraj77No ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- Acct6005 Company Accounting: Assessment 2 Case StudyDocument8 pagesAcct6005 Company Accounting: Assessment 2 Case StudyRuhan SinghNo ratings yet

- Application of Economic Concepts-Activity 1Document3 pagesApplication of Economic Concepts-Activity 1Katrina Amore VinaraoNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Solutions - Chapter 7 Non-Current Operating Assets Solutions - Chapter 7 Non-Current Operating AssetsDocument9 pagesSolutions - Chapter 7 Non-Current Operating Assets Solutions - Chapter 7 Non-Current Operating AssetsJohanna VidadNo ratings yet

- Sol. Man. Chapter 18 Govt Grants Ia Part 1BDocument6 pagesSol. Man. Chapter 18 Govt Grants Ia Part 1BChrismae Monteverde Santos100% (1)

- Intellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementFrom EverandIntellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementNo ratings yet

- Article 1156-1162Document6 pagesArticle 1156-1162Gellie RealNo ratings yet

- Problem 12-1 Anne Company: Doubtful Accounts 900,000.00 Loss On Claim Receivable 400,000.00Document1 pageProblem 12-1 Anne Company: Doubtful Accounts 900,000.00 Loss On Claim Receivable 400,000.00Gellie RealNo ratings yet

- Chapter 13-14Document6 pagesChapter 13-14Gellie RealNo ratings yet

- Chapter 11Document4 pagesChapter 11Gellie RealNo ratings yet