Professional Documents

Culture Documents

Essay Questions

Uploaded by

Harry SaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Essay Questions

Uploaded by

Harry SaiCopyright:

Available Formats

Short Answer Questions

1. Define Person

2. Non-Resident

3. Casual Income

4. Annual Value

5 Set off of Loses

Essay Questions

6. State the provisions prescribed for the determination of Residential Status of a

company.

7. State the provisions prescribed for the incomes exempted from tax applicable to

Company.

8 .Explain the provisions relating to set –off and carry forward of losses.

9. Explain briefly the provisions of the Income Tax Act regarding deductions to be made in

Computing the total income of an assessee in respect of certain payments.

10. Compute the Gross Total Income after set off and carry Forward of Losses for the

Assessment year 2022-2023.

1. Loss from Income from House Property Rs.10, 00,000

2. Income from Business Rs.25, 00,000

3. Income from Long term capital gain Rs4, 00,000

You might also like

- Income Tax Brief NotesDocument184 pagesIncome Tax Brief NotesCreanativeNo ratings yet

- Buckwold 21e - CH 7 Selected SolutionsDocument41 pagesBuckwold 21e - CH 7 Selected SolutionsLucy100% (1)

- 012-Practice Questions - Income TaxDocument106 pages012-Practice Questions - Income Taxalizaidkhan29% (7)

- Icwa Inter FoundationDocument760 pagesIcwa Inter FoundationSunil Babu100% (1)

- Direct Taxation PDFDocument396 pagesDirect Taxation PDFmalti j100% (1)

- Direct TaxationDocument760 pagesDirect TaxationCalmguy Chaitu75% (4)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Cma Tax PaperDocument760 pagesCma Tax Paperritesh shrinewarNo ratings yet

- Practice Questions - Income Tax PDFDocument114 pagesPractice Questions - Income Tax PDFEmran100% (4)

- Chart Saransh Final 23-24Document70 pagesChart Saransh Final 23-24PRATHAM AGGARWALNo ratings yet

- Practice Questions Income Tax Bba-Vi Sem Short & Long Practice QuestionsDocument15 pagesPractice Questions Income Tax Bba-Vi Sem Short & Long Practice QuestionsRahulNo ratings yet

- Bcoc 136Document2 pagesBcoc 136Suraj JaiswalNo ratings yet

- Income Tax Brief DemoDocument20 pagesIncome Tax Brief DemoZam HiaNo ratings yet

- Taxation Theory QuestionsDocument7 pagesTaxation Theory QuestionsAtiaTahiraNo ratings yet

- DT Q&A Book May 2023Document432 pagesDT Q&A Book May 2023Shubham TiwariNo ratings yet

- Exam Module3 PDFDocument11 pagesExam Module3 PDFKen ChiaNo ratings yet

- TAXATION - Various ConceptsDocument19 pagesTAXATION - Various Conceptslc17358No ratings yet

- Bcoc 136Document4 pagesBcoc 136Pranav KarwaNo ratings yet

- 18608cp6 PCC Compsuggans TaxationDocument10 pages18608cp6 PCC Compsuggans TaxationPrashant RaiNo ratings yet

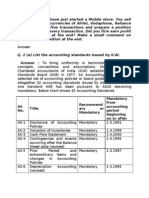

- Recommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterDocument7 pagesRecommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterdnbiswasNo ratings yet

- Question Bank Tax Planning Unit - I: I Test Your Skills: (A) State Whether The Following Statements Are True or FalseDocument69 pagesQuestion Bank Tax Planning Unit - I: I Test Your Skills: (A) State Whether The Following Statements Are True or Falselakshit_gupta100% (1)

- Income Tax&GSTDocument7 pagesIncome Tax&GSTTania SharmaNo ratings yet

- Income Tax MCQ by CA Kishan KumarDocument170 pagesIncome Tax MCQ by CA Kishan KumarDurgadevi BaskaranNo ratings yet

- Saaransh Income Tax Chart Book For AY 22-23Document70 pagesSaaransh Income Tax Chart Book For AY 22-23JobhaNo ratings yet

- Accounting Principles and StandardsDocument6 pagesAccounting Principles and StandardswondmagegnNo ratings yet

- MD CLP 2015-12 C-Chp05 - Salaries TaxDocument74 pagesMD CLP 2015-12 C-Chp05 - Salaries TaxChen ManNo ratings yet

- AE211 Final ExamDocument10 pagesAE211 Final ExamMariette Alex AgbanlogNo ratings yet

- Tax ReviewDocument6 pagesTax ReviewAlbert Delos SantosNo ratings yet

- Income Tax Charts by CA Pooja Kamdar DateDocument67 pagesIncome Tax Charts by CA Pooja Kamdar Datejjhjjgg hfhgf100% (1)

- Bus 103 AccountingDocument3 pagesBus 103 AccountingDyne Morte0% (1)

- Avoidance & EvasionDocument34 pagesAvoidance & EvasionHarshita RanjanNo ratings yet

- Income Tax Important Questions 4Document4 pagesIncome Tax Important Questions 4Chembula JahnaviNo ratings yet

- Topic 9 Employment Income (Derivation & Exemption)Document42 pagesTopic 9 Employment Income (Derivation & Exemption)Rico YongNo ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- Accounting For Income Taxes: Learning ObjectivesDocument21 pagesAccounting For Income Taxes: Learning ObjectivesAnggrainni RahayuNo ratings yet

- Chap 7 - Statement of Cash FlowDocument38 pagesChap 7 - Statement of Cash FlowStevania Berlinda RahardjoNo ratings yet

- Corporate Tax Planning PDFDocument130 pagesCorporate Tax Planning PDFRahul SharmaNo ratings yet

- Lecture 6 Accruals and PrepaymentsDocument21 pagesLecture 6 Accruals and PrepaymentsazizbektokhirbekovNo ratings yet

- Zeal Notice, Auditors & Directors Report AY 12-13Document10 pagesZeal Notice, Auditors & Directors Report AY 12-13Kamalalakshmi NarayananNo ratings yet

- Aggregation, Set Off and Carry Forward of IncomeDocument27 pagesAggregation, Set Off and Carry Forward of IncomeTomy MathewNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set ADocument5 pagesFDNACCT - Quiz #1 - Answer Key - Set AleshamunsayNo ratings yet

- Canadian Taxation Notes 3Document23 pagesCanadian Taxation Notes 3spiotrowskiNo ratings yet

- TIF Problems 07-10 (2014)Document141 pagesTIF Problems 07-10 (2014)Mariella NiyoyunguruzaNo ratings yet

- Chapter 3Document4 pagesChapter 3Quyền Nguyễn Khánh HàNo ratings yet

- Income Tax - I Previous Years Question Papers: Short Answer Questions (2marks Each)Document17 pagesIncome Tax - I Previous Years Question Papers: Short Answer Questions (2marks Each)Prabhakar BhattacharyaNo ratings yet

- Tax Planning CasesDocument68 pagesTax Planning CasesHomework PingNo ratings yet

- XI ACC ASM 2023-24 April-JuneDocument3 pagesXI ACC ASM 2023-24 April-JuneAarush GuptaNo ratings yet

- Comprehensiveexam eDocument10 pagesComprehensiveexam eNghiaBuiQuangNo ratings yet

- Question BankDocument2 pagesQuestion BankSandeep YadavNo ratings yet

- Test Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument9 pagesTest Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- Chap 12Document44 pagesChap 12Jehad Selawe100% (1)

- Bcoc 136Document4 pagesBcoc 136piyushsinha9829No ratings yet

- ADV2Document3 pagesADV2Rommel RoyceNo ratings yet

- Chapter 6Document13 pagesChapter 6vitbau98100% (1)

- FDNACCT - Quiz #1 - Answer Key - Set CDocument4 pagesFDNACCT - Quiz #1 - Answer Key - Set CleshamunsayNo ratings yet

- Basics (DT) Revision P Ques Jan 23Document10 pagesBasics (DT) Revision P Ques Jan 23Grave diggerNo ratings yet

- @CAhelp23 - Inter IncomeTax Must Do List Dec2021Document100 pages@CAhelp23 - Inter IncomeTax Must Do List Dec2021rajuNo ratings yet

- Employment Income - Derivation, Exemptions, Types and DeductionsDocument57 pagesEmployment Income - Derivation, Exemptions, Types and DeductionsTeh Chu Leong100% (1)

- FMGT 1321 Midterm 1 Review Questions: InstructionsDocument7 pagesFMGT 1321 Midterm 1 Review Questions: InstructionsAnnabelle Wu0% (1)

- 74847bos60515 IntermediateDocument21 pages74847bos60515 IntermediateShubhamNo ratings yet

- Financial Statement Analysis at Sangam Dairy: by TurnitinDocument116 pagesFinancial Statement Analysis at Sangam Dairy: by TurnitinHarry SaiNo ratings yet

- What Does ERP Do?Document3 pagesWhat Does ERP Do?Harry SaiNo ratings yet

- KMDocument12 pagesKMHarry SaiNo ratings yet

- KM ToolsDocument2 pagesKM ToolsHarry SaiNo ratings yet

- Pgrevisedacademicyear 2022231 and 2 Sem 01022023Document2 pagesPgrevisedacademicyear 2022231 and 2 Sem 01022023Harry SaiNo ratings yet