Professional Documents

Culture Documents

Some Thoughts On The Failure of Silicon Valley Bank 3-12-2023

Uploaded by

Subash NehruOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Some Thoughts On The Failure of Silicon Valley Bank 3-12-2023

Uploaded by

Subash NehruCopyright:

Available Formats

Some thoughts on the failure of Silicon Valley Bank 3/12/2023

The tech and finance worlds have been consumed for the last four days by the collapse and closure of

Silicon Valley Bank (SVB), a bank serving… Silicon Valley. I’ve been following the developments closely

and wanted to organize some my thoughts into a short commentary piece.

What is/was SVB?

SVB is pretty much a normal bank. The only real difference between them and any other bank is the

nature of their customers—they mostly serve tech startups, the venture capital community, and their

employees. So not only are they geographically concentrated with a high number of clients in California,

but they also have a big industry concentration. So they are sensitive to shocks in the technology

industry in a way that a regular bank that serves a bunch of different industries and types of people is

not.

What happened to them?

SVB’s banking relationships were strongly concentrated in the tech and crypto industries, both of which

experienced big bubbles leading up to 2021. As firms in these spaces raised tons of cash towards the tail

end of the bubble, they turned around and deposited it at SVB (SVB claimed to serve 44% of U.S.

venture-backed startups in one way or another). According to the WSJ, SVB’s deposits climbed 86% in

2021 to $189 billion and capped out at $198 billion in 2022.

When a bank has deposits (liabilities), it has to hold assets against those liabilities. A bank paying you 2%

in your savings account can only afford that if it holds some asset that pays it more than 2%.

Traditionally, the main asset for banks was making loans—they borrow from you at 2% through your

savings account, for example, and turn around and lend the same amount to someone else for their

mortgage at 5%. That 3% difference is the bank’s “net interest margin,” which is the main way that

banks make money.

Silicon Valley Bank’s deposits grew so fast that they basically couldn’t find enough productive loans to

make to keep up with their deposit growth. Instead, they took that money and bought various types of

bonds, such as U.S. government debt and mortgage-backed securities. It’s normal (actually it’s required)

for banks to hold at least some of their assets in these types of high-quality securities, but what was

unusual about SVB was that they held nearly 50% of their assets in this form. That’s a really high

number—for most banks this number will be less than 20%.

Bond prices are sensitive to changes in interest rates. When interest rates go up, bond prices go down—

it’s a mathematical relationship. The Fed started raising interest rates in March of 2022. Based on how

much interest rates have gone up since then, I would expect a typical 10-year Treasury bond that was

issued in February 2022 to be down 15-20% in value today. This is a gross oversimplification of the math,

but to just explain the concept, if SVB bought $100 billion of 10-year U.S. Treasuries in February of 2022

when their deposit base hit its all-time peak, I would expect those Treasuries to be down $15-20 billion

in value today.

Since banks are required to publish information about their holdings every quarter, analysts who were

paying attention to SVB knew full well that they had significant losses on the asset side of their balance

sheet due to rising rates. (When a bank’s liabilities are greater than its assets, it is insolvent.) There were

©2023 Blue Sky Advisors, LLC. All rights reserved.

people tweeting in November 2022 about risks in SVB’s portfolio. Those concerns came to a head this

past week when Peter Thiel advised his portfolio companies to withdraw funds from SVB, precipitating a

bank run.

The fastest bank run in human history

Overall, what happened at SVB was a classic, textbook bank run. But what struck me the most about this

whole episode was the speed at which it happened.

A typical bank has lots of retail depositors that keep relatively small amounts of money in their bank

accounts—certainly less than the $250,000 FDIC insurance limit for the vast majority of accounts. SVB

was different, in that it had a relatively small number of accounts for the size of its deposits. This was

because many of its customers were startups, who might have $80 million sitting in a single account.

Retail depositors have little to fear from a bank run if their deposits are under the FDIC limit. But startup

founders have a lot to lose—I’ve seen numbers saying that 93% of SVB’s deposits were uninsured. And

startup founders are all connected to each other over Slack/Whatsapp/Telegram/Signal—after Peter

Thiel warned his portfolio companies about SVB, all of those startup founders probably texted their

friends, and that was a straight up bank run. Apparently $42 billion of deposits were withdrawn from

SVB in two days—almost a billion dollars an hour. Compare that to me warning my family about risks at

Bank of America over our family Whatsapp group. Rather than opening new accounts at Mercury within

two hours, my relatives might ask me about that message two weeks later, if they even noticed it in

between the deluge of Internet forwards spam and videos of six-year-olds at karate competitions.

Said another way, having $1 million of deposits scattered over 1000 accounts with $1000 each is much

less risky to the bank than having that same $1 million in a single person or company’s account.

And I don’t think this is the last lightning-speed bank run we’ll see. If startups can create new accounts

at Mercury in two hours and deposit $100 million, they can also remove that $100 million in even less

time. I’ll even extrapolate this trend of high-connectivity, rapid information spread, and perhaps even

automated decision-making… right now you still need a human to withdraw funds from a bank, or press

the red button that launches the nukes. But what does a world where ChatGPT makes these decisions

look like?

Shouldn’t experienced bankers have known about the risk of rising rates to a long-term bond

portfolio?

Yes. This part is really baffling to me. I can’t think of a good reason why a bank would have so much of

its asset portfolio dedicated to long-duration securities after the Fed signaled an aggressive rate hiking

path starting in March 2022. Well, other than incompetence, of course.

Would SVB have been in trouble even if they managed their bond portfolio correctly?

I think so. Nobody is really talking about the other half of SVB’s asset portfolio—their loan book. This

part of the portfolio consists of consumer loans, like mortgages, to people who work in the startup

community, and corporate lending, also to startups. Given that the tech sector was already in the

process of blowing up, I have to think that all of these more traditional loans would also be at risk. If

startups close down because they can’t reach breakeven or get enough traction, they obviously won’t be

able to pay back their loans. And if they lay people off, some of those people may not be able to pay

©2023 Blue Sky Advisors, LLC. All rights reserved.

their mortgages. (Not only that, but I read that some of their personal loans were collateralized by stock

options. Obviously, if a startup folds, stock options in it are worth nothing…) It’s the same as if a regional

bank in Houston had heavy exposure to the oil & gas sector—if oil prices crash, I would expect much

higher than normal loan losses in the Houston bank’s portfolio.

Reflexivity in SVB’s lending portfolio

A related point—SVB’s failure itself makes the non-bond portion of its asset portfolio worse. If a large

number of startups have to furlough workers because their funds are frozen at SVB, or if they lose part of

the funds entirely, that means they are more likely to shut down, and any loans SVB made to them

obviously won’t pay out, employees can’t pay their mortgages, etc.

What will happen now?

The Fed and FDIC have been working this weekend to find a buyer to take over the remains of SVB’s

business. I saw rumors on Twitter this morning that uninsured depositors will have access to 50% of heir

funds by Tuesday and hopefully the rest of their funds over the next 3-6 months as the asset portfolio is

gradually wound down.

I’m not so optimistic. I do think depositors will ultimately recover most of their funds, but I don’t think

it’ll be 95%+ recovery like some commentators are saying. I think people aren’t recognizing how weak

recovery in the venture debt portion of SVB’s portfolio is likely to be. SVB had $74 billion of loans

outstanding in Q4 2022, with only $636 million of loan losses booked against them. That number is way

too low. Debt isn’t a great way to fund startups, given how uncertain their cash flows and performance

are. I think the next 18 months will show why debt is used so infrequently to finance startups.

Who is likely to be a buyer?

I’ve seen people suggesting that Goldman Sachs1 or Morgan Stanley might be good potential buyers, as

the franchise value of the SVB customer base might be attractive to their investment banking business.

Maybe. If I was a consultant advising them, I would want them to think very carefully about whether or

not they actually want to assume $74 billion of deposit liabilities in exchange for that $74 billion of loan

assets (I don’t think those loans are worth $74 billion.)

What about contagion to other regional and community banks?

I think this concern is overblown. I’d imagine that very few banks have the kind of depositor base and

distribution that SVB did. Regional and community banks tend to serve small businesses and retail

depositors in their area. These types of deposits tend to be very sticky and the vast majority of them will

be fully protected by the FDIC insurance limit.

There might be some small banks that mismanaged interest rate risk and as a result could be close to

insolvency, but I don’t think their depositors will face anywhere close to the level of the prisoner’s

dilemma that SVB’s customers had. They’re just too small.

What does all this mean for the tech sector?

1

Goldman has already made a small foray into retail banking through their Marcus savings product. Both firms do

wealth management already.

©2023 Blue Sky Advisors, LLC. All rights reserved.

My sense is that we are still in the middle innings of the tech collapse. These doomsday scenarios about

how no startups will be able to make payroll next week because their funds are frozen at SVB are indeed

scary, but I think the bigger effects are still to be felt. VC firms have yet to write down the book values of

their investments in startups that will never reach profitability and SVB’s successor will ultimately have to

recognize much more than $636 million of losses in its venture debt book.

I remember when I first moved to Austin and learned that there were something like 30 startup

incubator/accelerator programs at UT, I was shocked and felt that 28 of them would be gone in five

years. I think the same will be true of a bunch of weak venture capital firms.

Which other sectors are at risk?

I think this is just one example of how a rising rate environment affects industries that relied on money

being free! We are going to see more. Startups with bad business models were able to gobble up huge

amounts of money when interest rates were at 0%. Commercial real estate is another sector that is

sensitive to interest rates and traditionally tends to be pro-cyclical. Some subsectors in CRE are enjoying

strong tailwinds (industrial, healthcare, data) but office CRE is facing an extremely strong headwind due

to work-from-home. I also wonder what kind of financing cliffs private equity firms will be facing in the

next two or three years. Large firms with very large debt loads, like AT&T, have also been struggling.

As always, please feel free to forward this to anyone in your network that might be interested. I’d also

love to hear any comments or questions you have at akash.m.kanojia@gmail.com

©2023 Blue Sky Advisors, LLC. All rights reserved.

You might also like

- FinTech Rising: Navigating the maze of US & EU regulationsFrom EverandFinTech Rising: Navigating the maze of US & EU regulationsRating: 5 out of 5 stars5/5 (1)

- Startup Bank Had A Startup Bank Run - BloombergDocument9 pagesStartup Bank Had A Startup Bank Run - BloombergR LNo ratings yet

- Commercial Banking - SVBDocument6 pagesCommercial Banking - SVBAgnes JosephNo ratings yet

- Silicon Valley BankDocument2 pagesSilicon Valley BankHazem MuhamadNo ratings yet

- TTTCQTDocument35 pagesTTTCQTQUỲNH PHẠM THỊ NHƯNo ratings yet

- Disturbing Thoughts: by John MauldinDocument10 pagesDisturbing Thoughts: by John Mauldinantics20No ratings yet

- Fed and Gov Reaction To The Collapse of SVBDocument2 pagesFed and Gov Reaction To The Collapse of SVBKhanh LeNo ratings yet

- Practical Exercise - Analysis of The Collapse of Silicon Valley BankDocument2 pagesPractical Exercise - Analysis of The Collapse of Silicon Valley Bankhanna.ericssonkleinNo ratings yet

- Bank Bail-Ins? - Learn How To Protect YourselfDocument4 pagesBank Bail-Ins? - Learn How To Protect YourselfjavalassieNo ratings yet

- The Demise of Silicon Valley Bank - by Marc RubinsteinDocument10 pagesThe Demise of Silicon Valley Bank - by Marc Rubinsteinkaala_yuvrajNo ratings yet

- Ellen Brown 24032023Document7 pagesEllen Brown 24032023Thuan TrinhNo ratings yet

- The Fall of USA Silicon Valley Bank and Credit Suisse BankDocument8 pagesThe Fall of USA Silicon Valley Bank and Credit Suisse Bankannettechristie30No ratings yet

- Written Assignment Unit4: XYZ Bank Balance SheetDocument4 pagesWritten Assignment Unit4: XYZ Bank Balance SheetMarcusNo ratings yet

- A Systematic Proposal For The U.S. Banking System A Public/PrivateDocument5 pagesA Systematic Proposal For The U.S. Banking System A Public/Privateapi-25896854No ratings yet

- The Makng of A Bank FailureDocument5 pagesThe Makng of A Bank FailureFayçal SinaceurNo ratings yet

- Karan Desai - GB512X - Assessment 1 Feedback (80%)Document5 pagesKaran Desai - GB512X - Assessment 1 Feedback (80%)Karan DesaiNo ratings yet

- Ellen Brown 19052023Document5 pagesEllen Brown 19052023Thuan TrinhNo ratings yet

- Commercial Real Estate Exposure at US Banks 1707339030Document7 pagesCommercial Real Estate Exposure at US Banks 1707339030Jazlee JlNo ratings yet

- First Citizens Buys Silicon Valley Bank AssetsDocument4 pagesFirst Citizens Buys Silicon Valley Bank AssetsMaula Nurul Subekti SubektiNo ratings yet

- Banking Sector Impact On CoronaDocument4 pagesBanking Sector Impact On CoronaMuyeedulIslamNo ratings yet

- How Silicon Valley Turned On Its Financier: Bank Run Doomed FinancierDocument5 pagesHow Silicon Valley Turned On Its Financier: Bank Run Doomed FinancierVictor Huaranga CoronadoNo ratings yet

- Money Creation and The Banking SystemDocument14 pagesMoney Creation and The Banking SystemminichelNo ratings yet

- FINM3006 Notes On Past Exams: 2016 Test 1Document77 pagesFINM3006 Notes On Past Exams: 2016 Test 1Navya VinnyNo ratings yet

- Ellen Brown 25022023Document6 pagesEllen Brown 25022023Thuan TrinhNo ratings yet

- Chap 012Document15 pagesChap 012van tinh khuc100% (2)

- Metrick 2024 The Failure of Silicon Valley Bank and The Panic of 2023Document20 pagesMetrick 2024 The Failure of Silicon Valley Bank and The Panic of 2023Haiping ZhangNo ratings yet

- Are Bank Runs ContagiousDocument12 pagesAre Bank Runs ContagiousVarun DoegarNo ratings yet

- Silicon Valley Bank AssignmentDocument2 pagesSilicon Valley Bank AssignmentMaazNo ratings yet

- Money and Banking Chapter 12Document8 pagesMoney and Banking Chapter 12分享区No ratings yet

- BANCO BUENO BANCO MALO - The Right Way To Create A Good Bank and A BadDocument7 pagesBANCO BUENO BANCO MALO - The Right Way To Create A Good Bank and A BadFrancisco Cruzado CocaNo ratings yet

- SSRN Id4387676Document21 pagesSSRN Id4387676Mari Giler VillalbaNo ratings yet

- Test Your Understanding of Material For The FinalDocument10 pagesTest Your Understanding of Material For The FinalDegoNo ratings yet

- Grants Interest Rate Observer Summer E IssueDocument24 pagesGrants Interest Rate Observer Summer E IssueCanadianValueNo ratings yet

- FHA Loans, Worth It?Document4 pagesFHA Loans, Worth It?Philip LaTessaNo ratings yet

- Dinheiro FísicoDocument27 pagesDinheiro FísicoWanderson MonteiroNo ratings yet

- Bank Management and Electronic Banking (FIN-441) Assignment 1Document6 pagesBank Management and Electronic Banking (FIN-441) Assignment 1MD. WASIB ISLAMNo ratings yet

- Thewire in Banking Us Regional Banking Crisis Far From OverDocument6 pagesThewire in Banking Us Regional Banking Crisis Far From Overkaala_yuvrajNo ratings yet

- Silicon Valley Bank Is in Trouble But The System Isn't BrokenDocument5 pagesSilicon Valley Bank Is in Trouble But The System Isn't BrokenMaula Nurul Subekti SubektiNo ratings yet

- How To Understand The Problems at Silicon Valley BankDocument3 pagesHow To Understand The Problems at Silicon Valley BankFayçal SinaceurNo ratings yet

- Sub Prime Overview For Samir 1 Final 97-2003 FormatDocument10 pagesSub Prime Overview For Samir 1 Final 97-2003 FormatAliasgar SuratwalaNo ratings yet

- ABA - DODD Frank Community BankingDocument32 pagesABA - DODD Frank Community Banking4DrejtcNo ratings yet

- Bank of AmericaDocument11 pagesBank of AmericaFrederic BoucherNo ratings yet

- 1st Essay Corporate Banking - Caitlynn Hans SetiabudiDocument10 pages1st Essay Corporate Banking - Caitlynn Hans SetiabudicaitlynnsetiabudiNo ratings yet

- China Exchange PolicyDocument1 pageChina Exchange PolicycrosstheevilNo ratings yet

- Do Banks Need To Advertise?Document19 pagesDo Banks Need To Advertise?Rahul GargNo ratings yet

- Silicon Valley Bank Fiasco Simply ExplainedDocument21 pagesSilicon Valley Bank Fiasco Simply ExplainedGoMarkhaArjNo ratings yet

- Proposals For The Treasury, The Federal Reserve, The FDIC, andDocument6 pagesProposals For The Treasury, The Federal Reserve, The FDIC, andapi-25896854No ratings yet

- Hungry Jack's Vouchers: Your Ticket To Delicious and Affordable Fast FoodDocument13 pagesHungry Jack's Vouchers: Your Ticket To Delicious and Affordable Fast FoodMonibulNo ratings yet

- IPP Investment Commentary 'Silicon Valley Bank Collapse'Document2 pagesIPP Investment Commentary 'Silicon Valley Bank Collapse'stevencheangNo ratings yet

- Rajans Take On NPA CrisisDocument9 pagesRajans Take On NPA CrisisAkashNo ratings yet

- "Case Study Part-1": World University of BangladeshDocument6 pages"Case Study Part-1": World University of BangladeshKhalid HasanNo ratings yet

- Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?Document31 pagesMonetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?Putin V.VNo ratings yet

- Managing The Liquidity CrisisDocument8 pagesManaging The Liquidity CrisisRusdi RuslyNo ratings yet

- CH 9 Part 2 Notes EC 113Document6 pagesCH 9 Part 2 Notes EC 113RoselleFayeGarciaTupaNo ratings yet

- Research Paper On Bank FailuresDocument7 pagesResearch Paper On Bank Failuresafeasdvym100% (1)

- Search For White CochroachDocument6 pagesSearch For White CochroachamitfinanceNo ratings yet

- Details of The Authors: Title: Capital Punishment - Looking For Solutions Beyond Basel IIIDocument32 pagesDetails of The Authors: Title: Capital Punishment - Looking For Solutions Beyond Basel IIIGirish VsNo ratings yet

- ProjectDocument7 pagesProjectmalik waseemNo ratings yet

- Liquidity Crises: Understanding Sources and Limiting Consequences: A Theoretical FrameworkDocument10 pagesLiquidity Crises: Understanding Sources and Limiting Consequences: A Theoretical FrameworkAnonymous i8ErYPNo ratings yet

- Bear's Failure CaseDocument2 pagesBear's Failure CaseSaurav Kumar100% (1)

- Warn Act Listings 2023 TWCDocument9 pagesWarn Act Listings 2023 TWCSubash NehruNo ratings yet

- UntitledDocument2 pagesUntitledSubash NehruNo ratings yet

- PWWAOA SGBM 2023 MoM FDocument3 pagesPWWAOA SGBM 2023 MoM FSubash NehruNo ratings yet

- Feb2023 Air TrafficDocument20 pagesFeb2023 Air TrafficSubash NehruNo ratings yet

- Access To Audit Working Papers of A Predecessor Auditor: Guidance NoteDocument22 pagesAccess To Audit Working Papers of A Predecessor Auditor: Guidance NoteHadi ShahruddinNo ratings yet

- Build UnderstandingDocument3 pagesBuild Understandingoy dyNo ratings yet

- Internal Audit Checklist For An Construction Industry 1684113597Document19 pagesInternal Audit Checklist For An Construction Industry 1684113597CA Shuaib AnsariNo ratings yet

- Assignment 1 GGSR Pasuquin Rhia Shin F.Document2 pagesAssignment 1 GGSR Pasuquin Rhia Shin F.Rhia shin Pasuquin100% (4)

- Pgdibo Ibo 01 2019 20Document17 pagesPgdibo Ibo 01 2019 20waliapiyush1993No ratings yet

- 2 Rekrutmen Dan Seleksi PT Chandra Asri PetrochemicalDocument37 pages2 Rekrutmen Dan Seleksi PT Chandra Asri PetrochemicalAlsabaravi Ghiffari100% (1)

- Unit Two: Branch AccountingDocument17 pagesUnit Two: Branch Accountingtemedebere100% (2)

- Module 1 - Introduction To Facilities ManagementDocument10 pagesModule 1 - Introduction To Facilities ManagementAidenSkylerRiveraNo ratings yet

- Procurement Management: Semester Project Develop A Request For Proposal (RFP)Document2 pagesProcurement Management: Semester Project Develop A Request For Proposal (RFP)Linh LilinNo ratings yet

- Tax Avoidance and Firm Risk in China: A Pitch: Yuqiang CaoDocument6 pagesTax Avoidance and Firm Risk in China: A Pitch: Yuqiang CaoMiftahul FitriNo ratings yet

- SMUDocument8 pagesSMUYong RenNo ratings yet

- Pakistan - United States Income Tax TreatiesDocument12 pagesPakistan - United States Income Tax TreatiesMoazzamDarNo ratings yet

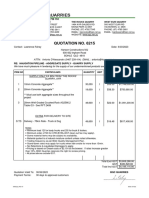

- 6215 Hansen Constructions NQ - Haughton Pipeline - Aggregate Supply - Quarry Supply 06-03-2023 PDFDocument1 page6215 Hansen Constructions NQ - Haughton Pipeline - Aggregate Supply - Quarry Supply 06-03-2023 PDFAntonio DlaessandroNo ratings yet

- Leave MatrixDocument3 pagesLeave MatrixTeoxNo ratings yet

- A Project Report HDFC Standard Life InsuDocument68 pagesA Project Report HDFC Standard Life InsuSneha PandeyNo ratings yet

- Free Sample - Study - Id112211 - Hobby and Stationery Ecommerce Analyzing Global Top BrandsDocument1 pageFree Sample - Study - Id112211 - Hobby and Stationery Ecommerce Analyzing Global Top BrandsHuyền LêNo ratings yet

- Human Resource Information System With Machine Learning IntegrationDocument8 pagesHuman Resource Information System With Machine Learning IntegrationMark Allen C. MargalloNo ratings yet

- Commerce McqsDocument10 pagesCommerce McqsAb GondalNo ratings yet

- Book Your Branch Visit BDO Unibank, IncDocument1 pageBook Your Branch Visit BDO Unibank, IncMiggy AlicobenNo ratings yet

- Young vs. Dallas ISD and Zachary Hall: Demand For SettlementDocument6 pagesYoung vs. Dallas ISD and Zachary Hall: Demand For SettlementRichard YoungNo ratings yet

- Power of Print and The Winner IS: WYP Takes Home The Trophy at The Fourth Edition of The Times Power of Print CompetitionDocument6 pagesPower of Print and The Winner IS: WYP Takes Home The Trophy at The Fourth Edition of The Times Power of Print CompetitionAniruddha_basakNo ratings yet

- Unit 12 Organising For New Product DevelopmentDocument10 pagesUnit 12 Organising For New Product DevelopmentSyrill CayetanoNo ratings yet

- Wuyc2tfz Rkyr Y6zl 6lqr Jgc5v4zqy652 - Electronic Document Management System ProposalDocument19 pagesWuyc2tfz Rkyr Y6zl 6lqr Jgc5v4zqy652 - Electronic Document Management System ProposaltadesseNo ratings yet

- FM6 Final ExamsDocument6 pagesFM6 Final Examsmartinelli ladoresNo ratings yet

- Case Application - Ch18Document2 pagesCase Application - Ch18Thu Hằng TrầnNo ratings yet

- Templates For Canada ImmigrationDocument6 pagesTemplates For Canada ImmigrationChialuNo ratings yet

- Initial Entry Adjusting Entry: Cash Unearned Consulting Revenue Unearned Consulting Rev Consulting RevenueDocument8 pagesInitial Entry Adjusting Entry: Cash Unearned Consulting Revenue Unearned Consulting Rev Consulting Revenuemohitgaba19No ratings yet

- Medicard Phil Inc. vs. CIRDocument2 pagesMedicard Phil Inc. vs. CIRhigoremso giensdks100% (1)

- S E Intimation Earnings Call Q4 2022 23 1Document2 pagesS E Intimation Earnings Call Q4 2022 23 1dinesh suresh KadamNo ratings yet

- Curriculum VitaeDocument4 pagesCurriculum VitaeDAB BREAKERSNo ratings yet

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- The Value of a Whale: On the Illusions of Green CapitalismFrom EverandThe Value of a Whale: On the Illusions of Green CapitalismRating: 5 out of 5 stars5/5 (2)

- Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursFrom EverandBuilt, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursRating: 5 out of 5 stars5/5 (13)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistFrom EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistRating: 4 out of 5 stars4/5 (32)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceFrom EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceRating: 4 out of 5 stars4/5 (1)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (19)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (8)

- Summary of Scott Kupor's Secrets of Sand Hill RoadFrom EverandSummary of Scott Kupor's Secrets of Sand Hill RoadRating: 5 out of 5 stars5/5 (1)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyFrom EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyRating: 3 out of 5 stars3/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- YouTube Marketing: Comprehensive Beginners Guide to Learn YouTube Marketing, Tips & Secrets to Growth Hacking Your Channel and Building Profitable Passive Income Business OnlineFrom EverandYouTube Marketing: Comprehensive Beginners Guide to Learn YouTube Marketing, Tips & Secrets to Growth Hacking Your Channel and Building Profitable Passive Income Business OnlineRating: 4.5 out of 5 stars4.5/5 (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)