Professional Documents

Culture Documents

Assignmnet2 Week2Day1

Assignmnet2 Week2Day1

Uploaded by

Krishna Sai Vootla0 ratings0% found this document useful (0 votes)

11 views3 pagesThe document discusses analyzing option chains for two stocks, HAL and VEDANTA, to implement bearish strategies. For both stocks, it is concluded that a bear put spread, where an at-the-money put is bought and an out-of-the-money put is sold, provides a better risk-reward than a bear call spread due to the limited reward compared to the risk of the call spread. The bear put spread is recommended over the bear call spread for each stock.

Original Description:

Original Title

Assignmnet2_Week2Day1 - Copy

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses analyzing option chains for two stocks, HAL and VEDANTA, to implement bearish strategies. For both stocks, it is concluded that a bear put spread, where an at-the-money put is bought and an out-of-the-money put is sold, provides a better risk-reward than a bear call spread due to the limited reward compared to the risk of the call spread. The bear put spread is recommended over the bear call spread for each stock.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views3 pagesAssignmnet2 Week2Day1

Assignmnet2 Week2Day1

Uploaded by

Krishna Sai VootlaThe document discusses analyzing option chains for two stocks, HAL and VEDANTA, to implement bearish strategies. For both stocks, it is concluded that a bear put spread, where an at-the-money put is bought and an out-of-the-money put is sold, provides a better risk-reward than a bear call spread due to the limited reward compared to the risk of the call spread. The bear put spread is recommended over the bear call spread for each stock.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

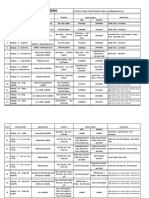

LONG Buildup Stocks on 23rd March

Price Change >= -1%

OI CHange >= 8%

HAL

Option Chain

Bear Call Spread (Sell ATM, Buy OTM)

Bear Put Spread (Buy ATM, Sell OTM)

Conclusions:

The Bear Call spread is too risky for the limited reward. Even when we move the buy leg closer

by 20 or 40 points, the risk is still much higher than the reward.

Bear Put Spread is a better strategy than Bear call spread for manappuram today

VEDANTA

Option Chain

Bear Call Spread (Sell ATM, Buy OTM )

Bear Put Spread (Buy ATM, Sell OTM)

Conclusions:

The Bear Call spread is too risky for the limited reward. Even when we move the buy leg closer

by 20 or 40 points, the risk is still much higher than the reward.

Bear Put Spread is a better strategy than Bear call spread for manappuram today

You might also like

- Options Trading Strategies: Option Spread Strategy Description Reason To Use When To UseDocument6 pagesOptions Trading Strategies: Option Spread Strategy Description Reason To Use When To UseSGNo ratings yet

- Exit Strategies For Stocks and Futures by LeBeauDocument41 pagesExit Strategies For Stocks and Futures by LeBeaucasimeer100% (1)

- Formula Options - Trading - Strategies PDFDocument2 pagesFormula Options - Trading - Strategies PDFSameer Shinde100% (1)

- Option Trading Strategies SummaryDocument6 pagesOption Trading Strategies SummaryRavi Khushalani100% (1)

- TradingDemarkPatterns PDFDocument13 pagesTradingDemarkPatterns PDFbebehui100% (4)

- Bearish: Options Strategies For Bearish ViewDocument10 pagesBearish: Options Strategies For Bearish Viewukumar_657611No ratings yet

- Lesson 4 - Position Sizing Placing OrdersDocument30 pagesLesson 4 - Position Sizing Placing Ordersdaysan100% (2)

- Option Trading Tactics With Oliver VelezDocument62 pagesOption Trading Tactics With Oliver VelezRenato89% (9)

- Put Ratio Spread: Limited Profit PotentialDocument4 pagesPut Ratio Spread: Limited Profit PotentialAbhijit SenguptaNo ratings yet

- Future and Option Hedging StrategyDocument9 pagesFuture and Option Hedging StrategyAshishVenugopal100% (2)

- Online Program StrategyDocument4 pagesOnline Program StrategyHiral PatelNo ratings yet

- Charles LeBeau - Exit Strategies For Stock and FuturesDocument42 pagesCharles LeBeau - Exit Strategies For Stock and Futuresbeli_oblak_1100% (1)

- Options Strategies For A Range Bound ViewDocument11 pagesOptions Strategies For A Range Bound ViewAshutosh ChauhanNo ratings yet

- Systematic Options TradingDocument35 pagesSystematic Options Tradingnayan kumar duttaNo ratings yet

- Lesson 8 Developing A Trading Plan & Resources: by Adam KhooDocument15 pagesLesson 8 Developing A Trading Plan & Resources: by Adam Khoosesilya 14No ratings yet

- Option StrategiesDocument24 pagesOption Strategiesarvi2020100% (1)

- Advancedoptionsspreads 141218174938 Conversion Gate01 PDFDocument4 pagesAdvancedoptionsspreads 141218174938 Conversion Gate01 PDFManoj Kumar SinghNo ratings yet

- Parabolic SARDocument2 pagesParabolic SARprivatelogic100% (2)

- Subtle, But Important Types of Support and Resistance: November 17, 2016Document38 pagesSubtle, But Important Types of Support and Resistance: November 17, 2016Vinicius Freitas100% (1)

- Lesson 03 The Iron CondorDocument14 pagesLesson 03 The Iron CondorMahesh Kumar100% (3)

- Lesson 2 Breakout Trading SystemDocument26 pagesLesson 2 Breakout Trading Systemsesilya 14No ratings yet

- Option Strategies That Can Be Implemented Based On Implied VolatilityDocument8 pagesOption Strategies That Can Be Implemented Based On Implied Volatilitysivasundaram anushanNo ratings yet

- Options Edge - Margin Rule ChangeDocument21 pagesOptions Edge - Margin Rule ChangeAarti GuptaNo ratings yet

- Options Strategies & Payoff ChartsDocument3 pagesOptions Strategies & Payoff ChartsStephen Mathew100% (1)

- From Swing Trading & Momentum Trading - Alpesh Patel PDFDocument76 pagesFrom Swing Trading & Momentum Trading - Alpesh Patel PDFNham LamNo ratings yet

- It JaganDocument108 pagesIt JaganSaiSudheerreddy AnnareddyNo ratings yet

- Option Calculations Mentorship Option Hedge Future HedgearbitrageDocument26 pagesOption Calculations Mentorship Option Hedge Future HedgearbitrageSANJAY PATIDAR100% (1)

- Bullish: Option Strategies For Bullish ViewDocument10 pagesBullish: Option Strategies For Bullish ViewAshutosh ChauhanNo ratings yet

- Assignment On: Marter'S of Business Economics (MBE)Document19 pagesAssignment On: Marter'S of Business Economics (MBE)88chauhanNo ratings yet

- Option Strategies PDFDocument5 pagesOption Strategies PDFdhanabal sNo ratings yet

- Option Buying FinalDocument59 pagesOption Buying Finalhardik Patel100% (3)

- eLearnMarkets OptionsBuying HindiDocument17 pageseLearnMarkets OptionsBuying Hindisrinivas20% (1)

- Live Trading Session With Rishikesh SirDocument6 pagesLive Trading Session With Rishikesh SirYash GangwalNo ratings yet

- 5 Ways To Increase Investing and Trading ProfitsDocument76 pages5 Ways To Increase Investing and Trading ProfitsKoyasanNo ratings yet

- Butterfly + Broken Wing ButterflyDocument4 pagesButterfly + Broken Wing ButterflyMrityunjay KumarNo ratings yet

- Cannon Trading Education: Options 101Document5 pagesCannon Trading Education: Options 101krolldoggNo ratings yet

- Option Strategies - 5nov20Document28 pagesOption Strategies - 5nov20maheshsNo ratings yet

- Single Stock Option's Seminar: Part I Option Trading OverviewDocument28 pagesSingle Stock Option's Seminar: Part I Option Trading Overviewmr25000No ratings yet

- Frm7 Option StrategiesDocument28 pagesFrm7 Option StrategiesDîvýâñshü MâhâwârNo ratings yet

- 6-Options BasicsDocument25 pages6-Options BasicsNine Not Darp EightNo ratings yet

- Suntv: Option ChainDocument4 pagesSuntv: Option ChainKrishna Sai VootlaNo ratings yet

- Understand DerivDocument13 pagesUnderstand DerivDick OpiyoNo ratings yet

- Optoins Basics Simplified: by Vikas Pratap SinghDocument15 pagesOptoins Basics Simplified: by Vikas Pratap SinghIron ManNo ratings yet

- Anima 5th Place Presentation PDFDocument18 pagesAnima 5th Place Presentation PDFJedson VizcaynoNo ratings yet

- Why Sell Options v2 Caa 31 Dec 23Document13 pagesWhy Sell Options v2 Caa 31 Dec 23chong chanyauNo ratings yet

- Advanced Options Spreads: Complex Put and Call TradesDocument4 pagesAdvanced Options Spreads: Complex Put and Call TradesManoj Kumar SinghNo ratings yet

- Short Straddle Option Strategy - The Options PlaybookDocument3 pagesShort Straddle Option Strategy - The Options PlaybookdanNo ratings yet

- Long Combination - Synthetic Long Stock - The Options PlaybookDocument3 pagesLong Combination - Synthetic Long Stock - The Options PlaybookdanNo ratings yet

- نترلااDocument13 pagesنترلااHazemSamirNo ratings yet

- RBC Options Strategies - SeagullsDocument2 pagesRBC Options Strategies - Seagullsalypaty100% (1)

- Volatile: Strategies For Volatile ViewDocument12 pagesVolatile: Strategies For Volatile ViewAshutosh ChauhanNo ratings yet

- Turtle Indicators: by KgyeoDocument74 pagesTurtle Indicators: by KgyeoThắng Trần RolandNo ratings yet

- Option Writing WebinarDocument46 pagesOption Writing WebinarSwastik TiwariNo ratings yet

- Selling Iron Condors and Butterflies: Trading Strategy DeskDocument14 pagesSelling Iron Condors and Butterflies: Trading Strategy DeskTRILOK KUMAR REDDYNo ratings yet

- Index Basic of Derivatives .2 Option .9 Terminology of Option ..14 Moneyness .17Document66 pagesIndex Basic of Derivatives .2 Option .9 Terminology of Option ..14 Moneyness .17nikomaso tesNo ratings yet

- Option ValuationDocument48 pagesOption ValuationMukul JassalNo ratings yet

- Swing Trade Pro 2.0 (068 134)Document67 pagesSwing Trade Pro 2.0 (068 134)Wenceslas wouedjeNo ratings yet

- Potm Video 3 Not-Useful Options Trading StrategiesDocument38 pagesPotm Video 3 Not-Useful Options Trading StrategiesIsIs DroneNo ratings yet

- Manappuram: Short Buildup Stocks On 23Rd March Price Change 1% Oi Change 8%Document3 pagesManappuram: Short Buildup Stocks On 23Rd March Price Change 1% Oi Change 8%Krishna Sai VootlaNo ratings yet

- Suntv: Option ChainDocument4 pagesSuntv: Option ChainKrishna Sai VootlaNo ratings yet

- Pitfalls of Long-Term Online Controlled Experiments: Pavel Dmitriev, Brian Frasca, Somit Gupta, Ron Kohavi, Garnet VazDocument11 pagesPitfalls of Long-Term Online Controlled Experiments: Pavel Dmitriev, Brian Frasca, Somit Gupta, Ron Kohavi, Garnet VazKrishna Sai VootlaNo ratings yet

- Assignment For Week 1 Day 2Document1 pageAssignment For Week 1 Day 2Krishna Sai VootlaNo ratings yet