Professional Documents

Culture Documents

PLE Assignment Chapter 14

PLE Assignment Chapter 14

Uploaded by

indaswarihafidzni0 ratings0% found this document useful (0 votes)

19 views1 pageThis document contains information about constructing an optimal portfolio using the Markowitz model, including the variance-covariance matrix of various asset classes and the optimal allocations and expected returns and variance for a portfolio constructed from those assets. The portfolio allocates 54.81% to bonds, 27.58% to emerging markets, and 17.61% to large cap, with an expected return of 0.19% and variance of 0.000117.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains information about constructing an optimal portfolio using the Markowitz model, including the variance-covariance matrix of various asset classes and the optimal allocations and expected returns and variance for a portfolio constructed from those assets. The portfolio allocates 54.81% to bonds, 27.58% to emerging markets, and 17.61% to large cap, with an expected return of 0.19% and variance of 0.000117.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views1 pagePLE Assignment Chapter 14

PLE Assignment Chapter 14

Uploaded by

indaswarihafidzniThis document contains information about constructing an optimal portfolio using the Markowitz model, including the variance-covariance matrix of various asset classes and the optimal allocations and expected returns and variance for a portfolio constructed from those assets. The portfolio allocates 54.81% to bonds, 27.58% to emerging markets, and 17.61% to large cap, with an expected return of 0.19% and variance of 0.000117.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

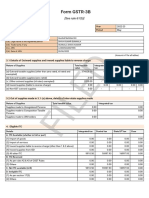

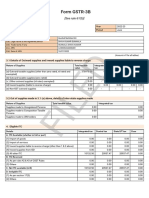

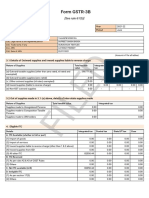

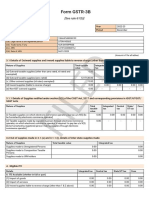

a)

Markowitz Portfolio Model

Data

Variance-Covariance Matrix

Bond S&P 500 Small cap Mid cap Large cap Emerging market Commodity

Bond 0.002%

S&P 500 -0.001% 0.020%

Small cap -0.001% 0.027% 0.047%

Mid cap -0.001% 0.024% 0.039% 0.033%

Large cap -0.001% 0.019% 0.027% 0.023% 0.027%

Emerging market 0.000% 0.032% 0.050% 0.043% 0.041% 0.085%

Commodity 0.000% 0.000% 0.005% 0.005% 0.009% 0.015% 0.054%

Average Weekly Return 0.044% 0.118% 0.256% 0.226% 0.242% 0.447% 0.053%

Model

Allocation Variance and Return Calculations

Bond 54.81%

S&P 500 0.00%

Small cap 0.00% Squared Terms Cross-Products Weighted Expected

Mid cap 0.00%

Large cap 17.61% 0.00000600911 - 0.00024118079

Emerging market 27.58% - - -

Commodity 0.00% - - -

Total 1.0000 - (0.00000193056) -

0.00000837315 - 0.00042616522

0.00006463775 - 0.00123265398

- - -

Variance of Portfolio 0.000117 -

Return 0.19% -

-

-

-

-

-

-

-

-

-

0.00003991794

-

-

You might also like

- TemplatesDocument199 pagesTemplatesJoseMNo ratings yet

- GSTR3B 10cespr1366g1ze 012023Document3 pagesGSTR3B 10cespr1366g1ze 012023Mega GuideNo ratings yet

- Integration GuideDocument672 pagesIntegration Guidedavide543100% (1)

- GSTR3B 36ablfm5302k1z4 022021Document2 pagesGSTR3B 36ablfm5302k1z4 022021venkyNo ratings yet

- 1 - Collected & Compiled by SQN LDR Vikram SavekarDocument31 pages1 - Collected & Compiled by SQN LDR Vikram SavekarDIP50% (2)

- GSTR3B 27avhpk4246l1z8 052022Document2 pagesGSTR3B 27avhpk4246l1z8 052022Rohit GoleNo ratings yet

- GSTR3B 03cuzpr6190r2z9 012024Document3 pagesGSTR3B 03cuzpr6190r2z9 012024kunal3152No ratings yet

- Feb 2019 3BDocument2 pagesFeb 2019 3BNibedita PadhyNo ratings yet

- GSTR3B 36aoupg4539a1zx 052022Document2 pagesGSTR3B 36aoupg4539a1zx 052022abhi ramNo ratings yet

- GSTR3B 19bahph8899e1z2 022023Document3 pagesGSTR3B 19bahph8899e1z2 022023Pawan KanuNo ratings yet

- GSTR3B 18agppi9704c1za 022023Document3 pagesGSTR3B 18agppi9704c1za 022023ABDUL KHALIKNo ratings yet

- GSTR3B 36aoupg4539a1zx 062022Document2 pagesGSTR3B 36aoupg4539a1zx 062022abhi ramNo ratings yet

- GSTR3B 19ahqpb1859d1za 062021Document2 pagesGSTR3B 19ahqpb1859d1za 062021Aditya MitraNo ratings yet

- GSTR3B 10CKPPK6612R1ZP 082022Document3 pagesGSTR3B 10CKPPK6612R1ZP 082022Saurav KumarNo ratings yet

- GSTR3B 32almph4268c1zc 122021Document2 pagesGSTR3B 32almph4268c1zc 122021efile.hco3No ratings yet

- GSTR3B 19bahph8899e1z2 122022Document3 pagesGSTR3B 19bahph8899e1z2 122022Pawan KanuNo ratings yet

- Jan 23-24Document3 pagesJan 23-24crmfinance.tnNo ratings yet

- GSTR3B 08absfa0925d1zk 062021Document2 pagesGSTR3B 08absfa0925d1zk 062021YOGESH JOSHINo ratings yet

- Recordstatement 2Document18 pagesRecordstatement 2SanthoshNo ratings yet

- GSTR3B 29aavpv0973c1z3 092021Document2 pagesGSTR3B 29aavpv0973c1z3 092021Hemanth KumarNo ratings yet

- GSTR3B 19bahph8899e1z2 052022Document3 pagesGSTR3B 19bahph8899e1z2 052022Pawan KanuNo ratings yet

- GSTR3B 27apapd6950p1zj 052022Document2 pagesGSTR3B 27apapd6950p1zj 052022Arun NaikwadeNo ratings yet

- GSTR3B 18actpi6464p1zk 122021Document2 pagesGSTR3B 18actpi6464p1zk 122021IMRADUL HUSSAINNo ratings yet

- GSTR3B 33aespt6851j1zr 072023Document3 pagesGSTR3B 33aespt6851j1zr 072023Vignesh KrishnamoorthyNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Rahul SharmaNo ratings yet

- GSTR3B 09adppu6529c1z2 032024Document3 pagesGSTR3B 09adppu6529c1z2 032024teamlifeeduNo ratings yet

- RecordstatementDocument18 pagesRecordstatementSanthoshNo ratings yet

- GSTR3B 09aocpg6070l1zr 052020Document2 pagesGSTR3B 09aocpg6070l1zr 052020Harshit KumarNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 092022 July To Sep 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 092022 July To Sep 2022Rahul SharmaNo ratings yet

- GSTR3B 21aachs0767c1zm 032023Document3 pagesGSTR3B 21aachs0767c1zm 032023Subrat Kumar RanaNo ratings yet

- 04 July-2022Document3 pages04 July-2022Sunil NNo ratings yet

- GSTR3B 36aoupg4539a1zx 042022Document2 pagesGSTR3B 36aoupg4539a1zx 042022abhi ramNo ratings yet

- GSTR3B 07ahepk2148n1z5 112022Document3 pagesGSTR3B 07ahepk2148n1z5 112022Rishabh Naresh JainNo ratings yet

- GSTR3B 29aavpv0973c1z3 112021Document2 pagesGSTR3B 29aavpv0973c1z3 112021Hemanth KumarNo ratings yet

- GSTR3B 29dxrpb1185a1zj 122020Document2 pagesGSTR3B 29dxrpb1185a1zj 122020Sainath ReddyNo ratings yet

- $RHYXUCEDocument2 pages$RHYXUCEakxerox47No ratings yet

- GSTR3B 36bmypp9150m1zx 072022Document2 pagesGSTR3B 36bmypp9150m1zx 072022RAJESH DNo ratings yet

- GSTR3B 08aerpr6003h1z8 062021Document2 pagesGSTR3B 08aerpr6003h1z8 062021Akash JainNo ratings yet

- GSTR3B 06aapft6555j1zj 022024Document3 pagesGSTR3B 06aapft6555j1zj 022024pakodi pakodiNo ratings yet

- Feb 23-24Document3 pagesFeb 23-24crmfinance.tnNo ratings yet

- GSTR3B 08bgupy2691a1zt 052021Document2 pagesGSTR3B 08bgupy2691a1zt 052021GST COMPLIANCENo ratings yet

- GSTR3B 09humps0863q1zf 072023Document3 pagesGSTR3B 09humps0863q1zf 072023mahtab begNo ratings yet

- GSTR3B 06effpm8326p1zs 102023Document3 pagesGSTR3B 06effpm8326p1zs 102023Prahlad JhaNo ratings yet

- GSTR3B 19anapb5865f2z2 122021Document2 pagesGSTR3B 19anapb5865f2z2 122021Bikram PaulNo ratings yet

- GSTR3B 36ablfm5302k1z4 012021Document2 pagesGSTR3B 36ablfm5302k1z4 012021venkyNo ratings yet

- GSTR3B 02aerps9639a1z9 022023Document3 pagesGSTR3B 02aerps9639a1z9 022023rajender kumarNo ratings yet

- GSTR3B 19anapb5865f2z2 092021Document2 pagesGSTR3B 19anapb5865f2z2 092021Bikram PaulNo ratings yet

- GSTR3B 19azwpd2404n1zx 062023Document3 pagesGSTR3B 19azwpd2404n1zx 062023ho.ubiquityNo ratings yet

- GSTR3B 37adcfs8516j1zp 012018Document2 pagesGSTR3B 37adcfs8516j1zp 012018ravi kiranNo ratings yet

- GSTR3B 33alapv4527e1za 012020Document2 pagesGSTR3B 33alapv4527e1za 012020hakkim satharNo ratings yet

- GSTR3B 07ahepk2148n1z5 052023Document3 pagesGSTR3B 07ahepk2148n1z5 052023PKCL027 Rishabh JainNo ratings yet

- GSTR3B 24bedpj9895q1zi 062022Document2 pagesGSTR3B 24bedpj9895q1zi 062022hetalahir149No ratings yet

- GSTR3B 19bahph8899e1z2 042022Document3 pagesGSTR3B 19bahph8899e1z2 042022Pawan KanuNo ratings yet

- GSTR3B 08bgupy2691a1zt 042021Document2 pagesGSTR3B 08bgupy2691a1zt 042021GST COMPLIANCENo ratings yet

- GSTR3B 19bahph8899e1z2 012022Document3 pagesGSTR3B 19bahph8899e1z2 012022Pawan KanuNo ratings yet

- GSTR3B 19azwpd2404n1zx 072023Document3 pagesGSTR3B 19azwpd2404n1zx 072023ho.ubiquityNo ratings yet

- GSTR3B 33aeqpy3870g1zy 062023Document3 pagesGSTR3B 33aeqpy3870g1zy 062023Durai kannuNo ratings yet

- GSTR3B 29aajcb9687j2zp 122022Document3 pagesGSTR3B 29aajcb9687j2zp 122022nithinganesh174No ratings yet

- GSTR3B 06CXFPS7946R1ZB 082022Document3 pagesGSTR3B 06CXFPS7946R1ZB 082022somesh chandraNo ratings yet

- Dudi JuneDocument3 pagesDudi JuneSukhchain SinghNo ratings yet

- GSTR3B 37adcfs8516j1zp 022019Document2 pagesGSTR3B 37adcfs8516j1zp 022019ravi kiranNo ratings yet

- GSTR3B 10eofpk9217c1zd 042023Document3 pagesGSTR3B 10eofpk9217c1zd 042023Pratik RajNo ratings yet

- Islamic FianceDocument13 pagesIslamic FiancePeer Anees AhmadNo ratings yet

- Grp-3 Case Study 2 Comparative Eco. Devt. Pakistan and BangladeshDocument2 pagesGrp-3 Case Study 2 Comparative Eco. Devt. Pakistan and BangladeshRoisu De KuriNo ratings yet

- Just in Time Manufacturing in The Indian Automobile IndustryDocument7 pagesJust in Time Manufacturing in The Indian Automobile IndustryVinod Kumar Vundela100% (1)

- Bail in NigeriaDocument3 pagesBail in NigeriaCiara OgahNo ratings yet

- The Mooncable: A Profitable Space Transportation System - OriginalDocument7 pagesThe Mooncable: A Profitable Space Transportation System - OriginalJim ClineNo ratings yet

- Wet Tree Dry TreeDocument1 pageWet Tree Dry Treeasparagus1996No ratings yet

- Parag Gacche: Public Transport... The Way ForwardDocument6 pagesParag Gacche: Public Transport... The Way ForwardlokayatNo ratings yet

- Oklahoma Name Change Voter Registration ApplicationDocument1 pageOklahoma Name Change Voter Registration ApplicationJustin CraytonNo ratings yet

- Tute 3Document1 pageTute 3govind_misraaNo ratings yet

- NyDick 1992Document6 pagesNyDick 1992rio ristyawanNo ratings yet

- Marketing Essentials - Chapter 22 - Physical Distribution - 2Document45 pagesMarketing Essentials - Chapter 22 - Physical Distribution - 2Dion PangelinanNo ratings yet

- How To Turn Down A Billion Dollars-Billy GallacherDocument14 pagesHow To Turn Down A Billion Dollars-Billy GallacherChatrine StefanieNo ratings yet

- Bec 225 AssignmentDocument4 pagesBec 225 Assignmentstanely ndlovuNo ratings yet

- How To Delete TR.Document3 pagesHow To Delete TR.nona_rose218No ratings yet

- FMLA Extended Medical LeaveDocument7 pagesFMLA Extended Medical LeavejustmeshayNo ratings yet

- Android Developer CVDocument5 pagesAndroid Developer CVNUN SinghNo ratings yet

- Lotte Chemical Green Promise 2030Document27 pagesLotte Chemical Green Promise 2030Natthaphon ShowchaiyaNo ratings yet

- Sia v. CADocument4 pagesSia v. CAChelsy EliosNo ratings yet

- Assignment 1 Modelling - An200133Document7 pagesAssignment 1 Modelling - An200133Muhammad Haziq AfiqNo ratings yet

- Congenital Glaucoma Epidemiological Clinical and Therapeutic Aspects About 414 EyesDocument5 pagesCongenital Glaucoma Epidemiological Clinical and Therapeutic Aspects About 414 Eyessiti rumaisaNo ratings yet

- E4nb71 - 300ZXDocument99 pagesE4nb71 - 300ZXbricasco100% (1)

- Data AnalyticsDocument11 pagesData AnalyticsSatyam TiwariNo ratings yet

- A Critical Review of Artificial Neural Networks Based Maximum Power Point TrackingDocument13 pagesA Critical Review of Artificial Neural Networks Based Maximum Power Point TrackingmabhatNo ratings yet

- Industrial Internship ReportDocument21 pagesIndustrial Internship ReportKrishna ShahNo ratings yet

- 2024 Jetour t2 BrochureDocument13 pages2024 Jetour t2 Brochuredanilo lekicNo ratings yet

- 09 Inverting Schmitt TriggerDocument6 pages09 Inverting Schmitt TriggerMocanu Vicentiu-AdrianNo ratings yet

- Information System Pitch Deck by SlidesgoDocument40 pagesInformation System Pitch Deck by Slidesgokanhansingh2000No ratings yet