Professional Documents

Culture Documents

Annuity Depreciation

Uploaded by

anisah0 ratings0% found this document useful (0 votes)

6 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesAnnuity Depreciation

Uploaded by

anisahCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

Annuity depreciation - PM

Annuity Depreciation

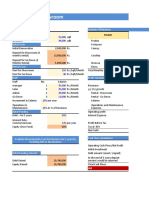

Cost = $634,000

Life = 4 years

Annual cash inflow = $200,000

NPV = $634,000 + $200,000(A4,r) = 0

A4,r = $634,000/$200,000

A4,r = 3.170

R = 10%

Tew You Hoo Page 1

Annuity depreciation - PM

Year Capital Depreciation Profit ROCE Interest RI

employed @ 8%

1 634,000 136,600 63,400 10% 50,720 12,680

2 497,400 150,260 49,740 10% 39,792 9,948

3 347,140 165,286 34,714 10% 27,771.2 6,942.8

4 181,854 181,814.6 18,185.4 10% 14,548.3 3,637.1

33,207.9

NPV

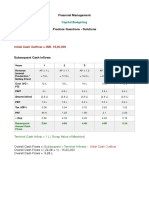

Year Cash flows PV factor @ 8% PV

0 (634,000) 1.000 (634,000)

1-4 200,000 3.312 662,400

28,400

Tew You Hoo Page 2

You might also like

- PC Ch. 11 Techniques of Capital BudgetingDocument22 pagesPC Ch. 11 Techniques of Capital BudgetingVinod Mathews100% (2)

- Assignment Dataset 1Document19 pagesAssignment Dataset 1Chip choiNo ratings yet

- Basic Model-01Document6 pagesBasic Model-01Sambit SarkarNo ratings yet

- Written Assignment Unit 6Document8 pagesWritten Assignment Unit 6rony alexander75% (4)

- Lampiran VDocument23 pagesLampiran VArif Rahman SetiawanNo ratings yet

- Mine Investment AnalysisDocument6 pagesMine Investment AnalysisTriAnggaBayuPutra50% (2)

- EEE Assignment 6Document5 pagesEEE Assignment 6shirleyNo ratings yet

- EEE Assignment 6Document5 pagesEEE Assignment 6shirleyNo ratings yet

- Start-Up Requirements Software Cost: Andriod AppDocument20 pagesStart-Up Requirements Software Cost: Andriod AppRitika SharmaNo ratings yet

- Practice Probelm S6 StudentDocument12 pagesPractice Probelm S6 StudentKartik SharmaNo ratings yet

- Exel Calculation (Version 1)Document10 pagesExel Calculation (Version 1)Timotius AnggaraNo ratings yet

- BizFin ICA2 ReportDocument11 pagesBizFin ICA2 Reporteval_2No ratings yet

- Answer ALL Questions: PHYS 3701 - Advanced Renewable Energy Technologies and Solutions Course Work Assessment IIIDocument6 pagesAnswer ALL Questions: PHYS 3701 - Advanced Renewable Energy Technologies and Solutions Course Work Assessment IIIrahvin harveyNo ratings yet

- Wanda Firdiana Agustin - Paralel ADocument19 pagesWanda Firdiana Agustin - Paralel AintanNo ratings yet

- Software House Project CostDocument8 pagesSoftware House Project Costhymnaduu8250No ratings yet

- Template Worksheet For Capital Budgeting Part 1Document15 pagesTemplate Worksheet For Capital Budgeting Part 1Russiell DanoNo ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Franchise - CarDocument14 pagesFranchise - Carshrish guptaNo ratings yet

- PDF DocumentDocument32 pagesPDF DocumentNasya NapitupuluNo ratings yet

- Fmi S5Document5 pagesFmi S5Aditi RawatNo ratings yet

- Financials of StartupDocument31 pagesFinancials of StartupJanine PadillaNo ratings yet

- Hola-Kola ComputationsDocument7 pagesHola-Kola ComputationsKristine Nitzkie SalazarNo ratings yet

- Lab 9 - What To Invest inDocument16 pagesLab 9 - What To Invest inbegum.ozturkNo ratings yet

- Capital Budgeting - SolutionDocument5 pagesCapital Budgeting - SolutionAnchit JassalNo ratings yet

- Synergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023Document10 pagesSynergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023brook emenikeNo ratings yet

- Kunci Jawaban Pra UasDocument7 pagesKunci Jawaban Pra UasKiki Saskia Marta BelaNo ratings yet

- CF 2Document26 pagesCF 2PUSHKAL AGGARWALNo ratings yet

- Minimum Expected Rate of Return 12% Minimum Pay Back Period 4.5 YearsDocument4 pagesMinimum Expected Rate of Return 12% Minimum Pay Back Period 4.5 Yearsjagan pawanismNo ratings yet

- FM09 CH 10 Im PandeyDocument19 pagesFM09 CH 10 Im PandeyJack mazeNo ratings yet

- Kangaroo Kids Limited: Particulars Amount (RS.) ParticularsDocument6 pagesKangaroo Kids Limited: Particulars Amount (RS.) ParticularsIshaan AgarwalNo ratings yet

- Economic Cost and Profit of BeximcoDocument15 pagesEconomic Cost and Profit of BeximcoMamun RashidNo ratings yet

- Group 1 - Financial Plan For Projectv0.2Document20 pagesGroup 1 - Financial Plan For Projectv0.2ntadbmNo ratings yet

- Trial Integrasi Reporting SystemDocument940 pagesTrial Integrasi Reporting SystemAchmad Syaifullah LubisNo ratings yet

- ENPV - REVISION LECTURE Solution ACTIVITYDocument4 pagesENPV - REVISION LECTURE Solution ACTIVITYRafael StoicanNo ratings yet

- EKOTEKDocument6 pagesEKOTEKDHILA AYUNINGTYASNo ratings yet

- Tahun Jumlah Premi Jumlah Tabarru' Jumlah Tabungan Jumlah Bagi Hasil Dana KematianDocument8 pagesTahun Jumlah Premi Jumlah Tabarru' Jumlah Tabungan Jumlah Bagi Hasil Dana KematianGhoofur NadhiffNo ratings yet

- Capital Investment Break-Up: Marketing and PromotionDocument7 pagesCapital Investment Break-Up: Marketing and PromotionDeepak RamamoorthyNo ratings yet

- Fin Strategy Ass 1Document3 pagesFin Strategy Ass 1mqondisi nkabindeNo ratings yet

- Assignment 2 - Strategic Financial Management - Abdulhakeem MustafaDocument7 pagesAssignment 2 - Strategic Financial Management - Abdulhakeem MustafaHakeem SnrNo ratings yet

- Pinjaman 100,000 R 0 T 5Document16 pagesPinjaman 100,000 R 0 T 5Dinda IdriadhyNo ratings yet

- Financials - Dhobhi BhaiyaDocument9 pagesFinancials - Dhobhi Bhaiyaprince joshiNo ratings yet

- Homework Chapter 8Document2 pagesHomework Chapter 8simonasalNo ratings yet

- REST0001 - Week 5 Sensitivity Analysis Practice Questions - SolutionDocument19 pagesREST0001 - Week 5 Sensitivity Analysis Practice Questions - SolutionVaishnavi HallikarNo ratings yet

- 3.0 Strategic Finance Projections & EvaluationDocument6 pages3.0 Strategic Finance Projections & EvaluationFatin Zafirah Binti Zurila A21A3251No ratings yet

- Trial 1 - DominionDocument17 pagesTrial 1 - Dominionelenasalvazia9No ratings yet

- Indicatori U.M. V1: Date Referitoare La Cele 3 Variante de Investitie Nr. CRTDocument20 pagesIndicatori U.M. V1: Date Referitoare La Cele 3 Variante de Investitie Nr. CRTCristina MiruNo ratings yet

- Excel Bank Income Statement: Particulars YEAR-1 YEAR-2Document6 pagesExcel Bank Income Statement: Particulars YEAR-1 YEAR-2Munir KhanNo ratings yet

- Book 1Document10 pagesBook 1AbRam KNo ratings yet

- Capital Investment Decisions Answers To End of Chapter ExercisesDocument3 pagesCapital Investment Decisions Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Ex1 Sensitivity AnalysisDocument21 pagesEx1 Sensitivity AnalysisP MarpaungNo ratings yet

- Diamond Energy Resources StudentDocument2 pagesDiamond Energy Resources StudentDonny BuiNo ratings yet

- Cumulative Cash Flow Discounted Cash Flow Cum Discounted Cash FlowDocument173 pagesCumulative Cash Flow Discounted Cash Flow Cum Discounted Cash FlowAditi OholNo ratings yet

- Chapter 2 Time Value of MoneyDocument29 pagesChapter 2 Time Value of MoneyVaibhav SrivastavaNo ratings yet

- Apartment Excel AnalysisDocument234 pagesApartment Excel AnalysisCeline TeeNo ratings yet

- Chapter Iv - Data Analysis and Interpretation: Property #1Document12 pagesChapter Iv - Data Analysis and Interpretation: Property #1karthiga312No ratings yet

- Chapter Iv - Data Analysis and Interpretation: Property #1Document32 pagesChapter Iv - Data Analysis and Interpretation: Property #1karthiga312No ratings yet

- How Much Is Next Year's Money Worth Today? Double Checking From Value Today To Next YearDocument7 pagesHow Much Is Next Year's Money Worth Today? Double Checking From Value Today To Next Yearamaresh mahapatraNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Set 12d - ABMDocument20 pagesSet 12d - ABManisahNo ratings yet

- Create & Maximise The Wealth of Shareholders Eva: Tewyouhoo/Vbm 1Document20 pagesCreate & Maximise The Wealth of Shareholders Eva: Tewyouhoo/Vbm 1anisahNo ratings yet

- Equity Strategic Alliance Is An Alliance in Which Two or More Firms Own DifferentDocument1 pageEquity Strategic Alliance Is An Alliance in Which Two or More Firms Own DifferentanisahNo ratings yet

- Types of Strategic Alliances SUPPLY CHAIN (Small)Document1 pageTypes of Strategic Alliances SUPPLY CHAIN (Small)anisahNo ratings yet

- CHAPTER 13 Alternative PerformanceDocument4 pagesCHAPTER 13 Alternative PerformanceanisahNo ratings yet

- Performance Management & ControlDocument13 pagesPerformance Management & ControlanisahNo ratings yet

- Apm Chapter Info Systems 2022Document3 pagesApm Chapter Info Systems 2022anisahNo ratings yet

- Chapter 1 Financial Management and Financial Objectives - SimilarDocument7 pagesChapter 1 Financial Management and Financial Objectives - SimilaranisahNo ratings yet

- Target CostingDocument20 pagesTarget CostinganisahNo ratings yet

- ExAns Ch01Document13 pagesExAns Ch01Anonymous iQuwAQTHNo ratings yet