67% found this document useful (6 votes)

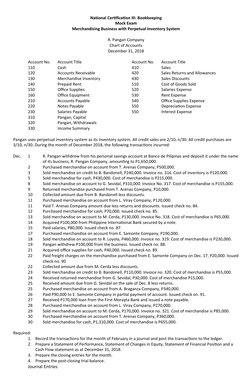

8K views11 pagesNational Certification III: Bookkeeping Mock Exam Merchandising Business With Perpetual Inventory System

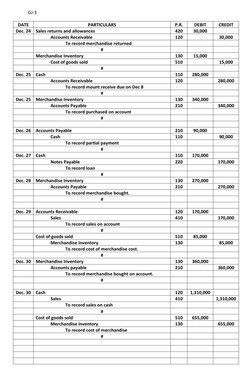

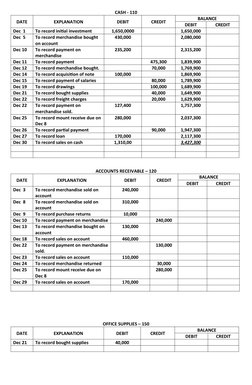

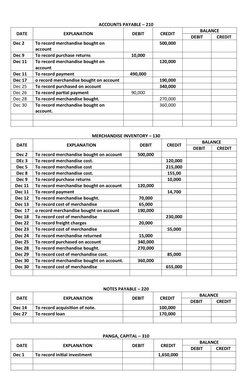

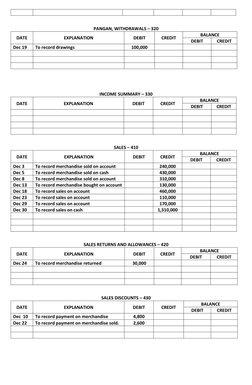

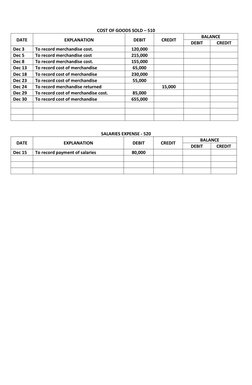

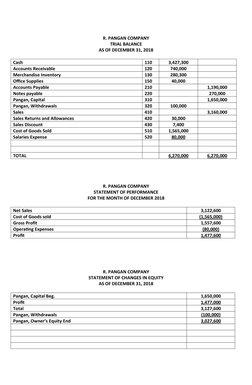

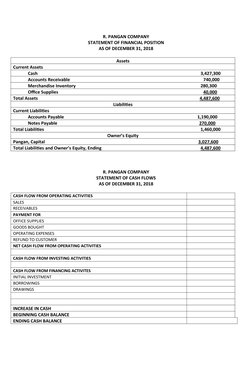

This document provides the chart of accounts and transactions for R. Pangan Company for the month of December 2018. It lists the company's accounts and transactions including purchases and sales of merchandise on account and for cash, payments received and made, withdrawals by the owner, and other expenses. The required tasks are to record the transactions in a journal, post to ledgers, and prepare key financial statements for the period.

Uploaded by

John Rex CapilloCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

67% found this document useful (6 votes)

8K views11 pagesNational Certification III: Bookkeeping Mock Exam Merchandising Business With Perpetual Inventory System

This document provides the chart of accounts and transactions for R. Pangan Company for the month of December 2018. It lists the company's accounts and transactions including purchases and sales of merchandise on account and for cash, payments received and made, withdrawals by the owner, and other expenses. The required tasks are to record the transactions in a journal, post to ledgers, and prepare key financial statements for the period.

Uploaded by

John Rex CapilloCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd