Professional Documents

Culture Documents

CFAS Discussion

Uploaded by

Xiunah Minynne0 ratings0% found this document useful (0 votes)

10 views5 pagesThe document discusses the components and objectives of financial statements. Financial statements communicate key financial information about a company's performance and position, and comprise elements such as the statement of financial position, income statement, statement of cash flows, and notes. They are prepared at minimum annually and provide quantitative data to help decision-makers like owners and investors assess the company's liquidity, solvency, and need for financing. The statements classify assets as current, meant to be realized within a year, and noncurrent, and liabilities as current, due within a year, or noncurrent.

Original Description:

Conceptual Framework in Accounting Standards Discussion Questions and Answers

Original Title

CFAS discussion

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the components and objectives of financial statements. Financial statements communicate key financial information about a company's performance and position, and comprise elements such as the statement of financial position, income statement, statement of cash flows, and notes. They are prepared at minimum annually and provide quantitative data to help decision-makers like owners and investors assess the company's liquidity, solvency, and need for financing. The statements classify assets as current, meant to be realized within a year, and noncurrent, and liabilities as current, due within a year, or noncurrent.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views5 pagesCFAS Discussion

Uploaded by

Xiunah MinynneThe document discusses the components and objectives of financial statements. Financial statements communicate key financial information about a company's performance and position, and comprise elements such as the statement of financial position, income statement, statement of cash flows, and notes. They are prepared at minimum annually and provide quantitative data to help decision-makers like owners and investors assess the company's liquidity, solvency, and need for financing. The statements classify assets as current, meant to be realized within a year, and noncurrent, and liabilities as current, due within a year, or noncurrent.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

CFAS Discussion (page 161)

1. What are financial statements?

Financial statements are like the mouth of the accounting process. It

conveys important quantitative and relative information such as the

financial performance of the company that helps in business decisions

and aids the users of the accounting information. Financial statements

very purpose is to communicate to the proprietor of what happened to

the capital that he put into the business.

2. What are the components of financial statements?

The components of the financial statements contain:

a. Statement of Financial Position

b. Income Statement

c. Statement of Comprehensive Income

d. Statement of Changes in Equity

e. Statement of Cash Flows

f. Notes, comprising a summary of significant accounting

policies and other explanatory notes

3. Explain the objective of financial statements.

The objective of financial statements is to offer information about the

financial position, financial performance and cash flows of an entity

that is valuable to an extensive scope of users in formulating

economic decisions. Moreover, financial statements provide

information about the assets, liabilities, equity, income and expenses,

gains, losses, capital and cash flows of the entity. Thus, financial

statements show the capability, activities, and performances of the

business which can significantly ang critically benefits the decision

makers such as the owners and current or future investors.

4. What is the frequency of reporting of financial statements?

Financial statements shall be prepared and presented at least annually.

Moreover, reporting may be a calendar year or a natural business year.

To define, calendar year is when the accounting period will begin on

January 1 and will end on December 31 of the same year. There are

four (4) quarters in a calendar year and each quarter consists of three

(3) months. On the other hand, fiscal year happens when the

accounting period will begin on the first day of any month of the year

except January and will end on the last day of the twelfth month

completing the one-year period.

5. Define a statement of financial position.

A Statement of Financial Position is a formal statement displaying the

three elements including financial position, specifically assets,

liabilities and equity. Assessment of the factors such as liquidity,

solvency and the need of the entity for additional financing aids the

investors, creditors and other statement users when they scrutinize the

statement of financial position.

6. What are the essential characteristics of an assets?

An asset has a future economic benefit. It is also controlled by a

particular entity. Additionally, assets can be determined by occurrence

of the past transaction or events.

7. What are the classification of assets?

Assets are categorized only into two, explicitly current assets and

noncurrent assets.

8. Define current assets.

Current assets are typically enumerated in the order of liquidity. Also,

current assets are expected that to be realized in a short span of time

or within twelve months after the reporting period. It is also expected

to be consumed within the entity’s normal operating cycle. Its primary

purpose is to trade. Moreover, an asset is said to be current when it is

cash or cash equivalent.

9. What are the line items for current assets?

The line items under current assets are:

a. Cash and cash equivalents

b. Financial assets at fair value such as trading securities and

other investments in quoted equity instruments

c. Trade and other receivables

d. Inventories

e. Prepaid expenses

10.Define noncurrent assets.

Noncurrent assets are those assets not included in the current assets

such as property, plant and equipment, long-term investments,

intangible assets, deferred tax assets and other noncurrent assets.

11.Identify the noncurrent assets.

Noncurrent assets are company's long-term assets that are not easily

converted to cash within a year. Examples include investments,

intellectual property, real estate and equipment.

12.What ere the essential characteristics of a liability?

The essential characteristics of a liability are:

a. it embodies a present duty or responsibility to one or more

other entities that requires settlement by possible future

transfer or usage of assets at a stated or determinable date, on

occurrence of a specified event, or on demand

b. the duty or responsibility necessitates a particular entity,

leaving it little or no discretion to avoid the future sacrifice

c. the transaction or other event obligating the entity has already

happened.

13.What are the classifications of liabilities?

The classifications of liabilities are classified as current liability and

noncurrent liability.

14.Define current liabilities.

Current liabilities are a company's short-term financial obligations

that are due within one year or within a normal operating cycle

15. What are the line items for current liabilities?

The following line items for current liabilities, namely:

a. Trade and other payables

b. Current provision

c. Short term borrowing

d. Current portion of long-term debt

e. Current tax liability

16.Explain the treatment of currently maturing long-term debt.

The treatment of currently maturing long-term debt is the amount of

principal that will be due within one year of the date of the balance

sheet. It is completed on or before the end of the reporting period.

17.Explain the effect of breach of covenants on the classification of liability.

PAS 1, paragraph 74, provides that the liability is classified as current

if the lender has agreed, after the reporting period and before the

statements are authorized for issue.

Paragraph 75, provides that the. liability is classified as noncurrent if

the lender has agreed on or before the end of reporting period.

18.What are the elements comprising the equity of a corporation?

The elements comprising the equity of a corporation are: Capital

stock, subscribed capital stock, preferred stock, Common stock,

Additional paid capital, retained earnings (deficit), Retained earnings

appropriated, Revaluation surplus and Treasury stock.

19.What is the meaning of “notes to financial statements”?

Notes to financial statements are narratives or disaggregation of items

presented in the financial statements and information about items that

do not qualify for recognition.

20.Explain the two forms of statement of financial position.

There are two customary forms in presenting the statement of

financial position:

a. Report form - The report form balance sheet is presented in a

vertical orientation, and is essentially one column that spans

the entire width of a page

b. Account form - The account form refers to a two-column

format for the presentation of the balance sheet. Assets are

listed in the first column, while liabilities and equity accounts

are listed in the second column.

Sources:

Valix, C., Peralta, J., & Valix, C. A. (2020). Conceptual Framework and Accounting

Standards (2020th ed.). GIC Enterprises & Co., INC.

Lopez, Jr., R. (2019). Bookkepping (2018th-2019 ed. ed.). MS Lopez Printing & Publishing.

Nandwani, M. (2016, June 18). Assets: Definition, Characteristics and Objectives. Learn

Accounting: Notes, Procedures, Problems and Solutions.

https://www.accountingnotes.net/assets/assets-definition-characteristics-and-objectives/5341

Jackson, B. (n.d.). The Financial Accounting Standards Board.

https://www.fasb.org/jsp/FASB/CommentLetter_C/ViewCommentLetter&cid=11758033012

43

You might also like

- ACC 3111 - Exercise 1Document5 pagesACC 3111 - Exercise 1Mabelle MangalindanNo ratings yet

- Chapter 8 PRESENTATION OF FS PAS 1Document15 pagesChapter 8 PRESENTATION OF FS PAS 1MicsjadeCastilloNo ratings yet

- Module 1Document32 pagesModule 1Abdulmajed Unda MimbantasNo ratings yet

- Module 007 Week003-Finacct3 Statement of Financial PositionDocument9 pagesModule 007 Week003-Finacct3 Statement of Financial Positionman ibeNo ratings yet

- Ias 1 Presentation of Financial StatementsDocument30 pagesIas 1 Presentation of Financial Statementsesulawyer2001No ratings yet

- Finance 2 - Chapter Review #1Document29 pagesFinance 2 - Chapter Review #1jojie dadorNo ratings yet

- Financial Accounting Libby 7th Edition Solutions ManualDocument5 pagesFinancial Accounting Libby 7th Edition Solutions ManualJennifer Winslow100% (38)

- The Financial Statements PreparationDocument11 pagesThe Financial Statements PreparationanacldnNo ratings yet

- f1.3 Financial Acoounting CpaDocument173 pagesf1.3 Financial Acoounting CpaCyiza Ben RubenNo ratings yet

- CFAS Unit 1 Module 2Document25 pagesCFAS Unit 1 Module 2KC PaulinoNo ratings yet

- C39e54c7 1617599931071Document13 pagesC39e54c7 1617599931071Abby NavarroNo ratings yet

- Libby 10e Ch01 SMDocument32 pagesLibby 10e Ch01 SMJames Matthew LomongoNo ratings yet

- Chapter 3 PAS 1 PRESENTATION OF FINANCIAL STATEMENTSDocument8 pagesChapter 3 PAS 1 PRESENTATION OF FINANCIAL STATEMENTSJeanette LampitocNo ratings yet

- CH 05Document16 pagesCH 05Hanif MusyaffaNo ratings yet

- Government Accounting: Accounting For Non-Profit OrganizationsDocument39 pagesGovernment Accounting: Accounting For Non-Profit OrganizationsmoNo ratings yet

- Balance SheetDocument29 pagesBalance SheetKoo TaehyungNo ratings yet

- L3Document4 pagesL3Emilrose SadiasaNo ratings yet

- Chapter 14 Financial StatementsDocument12 pagesChapter 14 Financial StatementsAngelica Joy ManaoisNo ratings yet

- Chapter 1. Introduction To Accounting: XI / Accountancy / Ch.1/P1Document5 pagesChapter 1. Introduction To Accounting: XI / Accountancy / Ch.1/P1Total Live GamingNo ratings yet

- Financial Statements AnswersDocument6 pagesFinancial Statements AnswersKrizzia Fatima PiodosNo ratings yet

- Ia 3 Pretestchap 1 2Document11 pagesIa 3 Pretestchap 1 2Jarminan Vincent PerolinoNo ratings yet

- Solution Manual For Financial Accounting 11th Edition Robert Libby, Patricia Libby, Frank Hodge Verified Chapter's 1 - 13 CompleteDocument70 pagesSolution Manual For Financial Accounting 11th Edition Robert Libby, Patricia Libby, Frank Hodge Verified Chapter's 1 - 13 Completemarcuskenyatta275No ratings yet

- Conceptual Framework Module 7Document12 pagesConceptual Framework Module 7Jaime LaronaNo ratings yet

- De Leon, Misha Laine - CFAS 03Document3 pagesDe Leon, Misha Laine - CFAS 03Misha Laine de LeonNo ratings yet

- LLH9e Ch01 SolutionsManual FINALDocument32 pagesLLH9e Ch01 SolutionsManual FINALIgnjatNo ratings yet

- Chapter 1 - Solution Manual PDFDocument32 pagesChapter 1 - Solution Manual PDFNatalie ChoiNo ratings yet

- Solution Manual For Financial Accounting 10th by LibbyDocument36 pagesSolution Manual For Financial Accounting 10th by Libbyslugwormarsenic.ci8riNo ratings yet

- Fabm2 PPTG1Document65 pagesFabm2 PPTG1chrisraymund.bermudoNo ratings yet

- Solution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby, Hodge, Verified Chapters 1 - 13, Complete Newest VersioDocument51 pagesSolution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby, Hodge, Verified Chapters 1 - 13, Complete Newest Versiomarcuskenyatta275No ratings yet

- Chapter 8 SummaryDocument5 pagesChapter 8 SummaryXiaoyu KensameNo ratings yet

- Module 3 Conceptual Frameworks and Accounting StandardsDocument10 pagesModule 3 Conceptual Frameworks and Accounting StandardsJonabelle DalesNo ratings yet

- 2 Statement of Financial PositionDocument7 pages2 Statement of Financial Positionreagan blaireNo ratings yet

- ACT100-1 - Partnership Financial ReportingDocument37 pagesACT100-1 - Partnership Financial ReportingHannah TaduranNo ratings yet

- Solution Manual For Financial Accounting 10th by LibbyDocument33 pagesSolution Manual For Financial Accounting 10th by LibbyJenifer Collins100% (38)

- Solution Manual For Financial Accounting 11th Edition Robert Libby Patricia Libby Frank HodgeDocument52 pagesSolution Manual For Financial Accounting 11th Edition Robert Libby Patricia Libby Frank Hodgemarcuskenyatta275No ratings yet

- DocumentDocument8 pagesDocumentDivyansh SinghNo ratings yet

- Revised AccountingDocument46 pagesRevised AccountingAli NasarNo ratings yet

- Elements of Financial Statements & The Recognition Criteria For Assets & LiabilitiesDocument13 pagesElements of Financial Statements & The Recognition Criteria For Assets & LiabilitiesdeepshrmNo ratings yet

- Financial Accounting and Reporting - Week 1 Topic 3 - Conceptual Framework Level 1Document9 pagesFinancial Accounting and Reporting - Week 1 Topic 3 - Conceptual Framework Level 1LuisitoNo ratings yet

- Conceptual Framework and Financial Statements SummaryDocument5 pagesConceptual Framework and Financial Statements SummaryAndrea Mae ManuelNo ratings yet

- Conceptual Framew Ork and Accountin G Standards: Justiniano L. Santos, CPA, MBADocument46 pagesConceptual Framew Ork and Accountin G Standards: Justiniano L. Santos, CPA, MBACarmela BuluranNo ratings yet

- Financial Accounting Libby 7th Edition Solutions ManualDocument36 pagesFinancial Accounting Libby 7th Edition Solutions Manualwalerfluster9egfh3100% (39)

- Chapter 2 - Statement of Financial PositionDocument22 pagesChapter 2 - Statement of Financial PositionKarylle EntinoNo ratings yet

- 03 BSAIS 2 Financial Management Week 5 6Document8 pages03 BSAIS 2 Financial Management Week 5 6Ace San GabrielNo ratings yet

- CFAS Chapter 2 Q&ADocument2 pagesCFAS Chapter 2 Q&ACINDY BALANONNo ratings yet

- Chapter 8 CFASDocument7 pagesChapter 8 CFASVincent QueNo ratings yet

- Conceptual FrameworkDocument5 pagesConceptual FrameworkElla CunananNo ratings yet

- Financial Accounting Libby 7th Edition Solutions ManualDocument5 pagesFinancial Accounting Libby 7th Edition Solutions Manualstephaniehornxsoiceygfp100% (46)

- Template 3: Module Template Module No. & Title Module 6: Financial Reporting and AnalysisDocument17 pagesTemplate 3: Module Template Module No. & Title Module 6: Financial Reporting and AnalysisTrisha Monique VillaNo ratings yet

- Chapter 3 SummaryDocument3 pagesChapter 3 SummaryDarlianne Klyne BayerNo ratings yet

- Sample For Solution Manual For Financial Accounting 11th Edition by Libby and LibbyDocument35 pagesSample For Solution Manual For Financial Accounting 11th Edition by Libby and LibbyAviv Avraham100% (1)

- ACCCOB2 Financial Accounting Discussion PDFDocument5 pagesACCCOB2 Financial Accounting Discussion PDFJose GuerreroNo ratings yet

- Quiz 2 KeyDocument1 pageQuiz 2 KeyMaria DevinaNo ratings yet

- Assignment No. 1 Week 1 ActcomDocument4 pagesAssignment No. 1 Week 1 ActcomLourd jeanille CochingNo ratings yet

- Lesson Proper For Week 1: Statement of Financial PositionDocument7 pagesLesson Proper For Week 1: Statement of Financial PositionCarlo EsbanNo ratings yet

- Modules For Online Learning Management System: Computer Communication Development InstituteDocument26 pagesModules For Online Learning Management System: Computer Communication Development InstituteAngeline AsejoNo ratings yet

- Accounting Concepts and Principles GRADE11 FUNDA1Document30 pagesAccounting Concepts and Principles GRADE11 FUNDA1Jhana Mae BandosaNo ratings yet

- Actg 4 PDFDocument13 pagesActg 4 PDFHo Ming LamNo ratings yet

- Full Download Solution Manual For Financial Accounting Libby Libby Short 8th Edition PDF Full ChapterDocument36 pagesFull Download Solution Manual For Financial Accounting Libby Libby Short 8th Edition PDF Full Chapterunwill.eadishvj8p100% (21)

- Global Financial Crisis-TgDocument4 pagesGlobal Financial Crisis-TgCharlesNo ratings yet

- Export Document Covering LetterDocument4 pagesExport Document Covering Lettertechindia2010No ratings yet

- Trade Confirmation: Trade Date: 11-May-2021 Yordan Herman Alosius DebemDocument2 pagesTrade Confirmation: Trade Date: 11-May-2021 Yordan Herman Alosius DebemYordan H A DebemNo ratings yet

- Case 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTDocument4 pagesCase 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTkunalNo ratings yet

- CV TemplatesDocument3 pagesCV TemplatesMd Shohag AliNo ratings yet

- Lets Talk About MoneyDocument1 pageLets Talk About MoneyMarta RuizNo ratings yet

- 1843 Owner Financing Mortgage ContractDocument3 pages1843 Owner Financing Mortgage ContractRichie Battiest-CollinsNo ratings yet

- Financial Crises: Lessons From The Past, Preparation For The FutureDocument298 pagesFinancial Crises: Lessons From The Past, Preparation For The FutureJayeshNo ratings yet

- Capital Investment Factors7to16Document15 pagesCapital Investment Factors7to16Spencer Tañada100% (1)

- U.S. Hegemony Today - Peter GowanDocument12 pagesU.S. Hegemony Today - Peter GowanpeterVoterNo ratings yet

- London School Ofbusiness and Finance: Lecture Nine Corporate FinanceDocument44 pagesLondon School Ofbusiness and Finance: Lecture Nine Corporate FinanceAayaz TuriNo ratings yet

- Module 1 - Lesson 2 - Taxable Net Gift and Computation of Donor's Tax DueDocument6 pagesModule 1 - Lesson 2 - Taxable Net Gift and Computation of Donor's Tax Dueohmyme sungjaeNo ratings yet

- Indian Securities MarketDocument73 pagesIndian Securities Marketbharti palNo ratings yet

- FRM-I Valuation Models NotesDocument146 pagesFRM-I Valuation Models Notesprincelyprince100% (2)

- Gen Math - Q2 - SLM - WK3Document9 pagesGen Math - Q2 - SLM - WK3Floraville Lamoste-MerencilloNo ratings yet

- AcctgDocument2 pagesAcctgJona FranciscoNo ratings yet

- The Ultimate Guide To Buying and Selling BusinessesDocument35 pagesThe Ultimate Guide To Buying and Selling Businesseselpaisa4711No ratings yet

- Icici: Broad Objectives of The ICICI AreDocument7 pagesIcici: Broad Objectives of The ICICI Aremanya jayasiNo ratings yet

- Test Bank Ques - 5Document4 pagesTest Bank Ques - 5MahfuzulNo ratings yet

- Chapter 3: Product Costing and Cost Accumulation in A Batch Production EnvironmentDocument31 pagesChapter 3: Product Costing and Cost Accumulation in A Batch Production EnvironmentSusan TalaberaNo ratings yet

- Tax 2 T Lecture TranscriptDocument26 pagesTax 2 T Lecture TranscriptEphraimEnriquez100% (1)

- Recent Technology Has Made Possible A Computerized Vending Machine ThatDocument1 pageRecent Technology Has Made Possible A Computerized Vending Machine ThatLet's Talk With HassanNo ratings yet

- Money and Banking: IgcseDocument19 pagesMoney and Banking: IgcseEntertainment IS EntertainmentNo ratings yet

- Exam 1 Learning ObjectivesDocument4 pagesExam 1 Learning ObjectivesYingfanNo ratings yet

- ICICI Project ReportDocument53 pagesICICI Project ReportPawan MeenaNo ratings yet

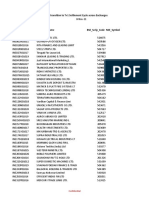

- Schedule of List of Securities To Be Transition To T+1 Settlement Cycle Across ExchangesDocument234 pagesSchedule of List of Securities To Be Transition To T+1 Settlement Cycle Across ExchangesHans RajNo ratings yet

- Fagan V Wells Fargo Et Al - BBB - Burton@gmailDocument1 pageFagan V Wells Fargo Et Al - BBB - Burton@gmailburton1863No ratings yet

- Chapter 18 - Equity Valuation ModelsDocument44 pagesChapter 18 - Equity Valuation ModelsQingXu1986No ratings yet

- Pay&Save Account 112022Document1 pagePay&Save Account 112022maxNo ratings yet

- UCO Bank Might Be Facing Complex Challenges in Capital RestructuringDocument4 pagesUCO Bank Might Be Facing Complex Challenges in Capital RestructuringKakumanu Hemanth KumarNo ratings yet