Professional Documents

Culture Documents

Activity Ratios

Uploaded by

Sannithi YamsawatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity Ratios

Uploaded by

Sannithi YamsawatCopyright:

Available Formats

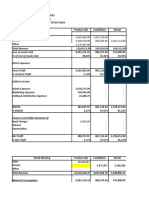

Activity Ratios:

1. Total asset turnover for Magnetronics in 1999 can be calculated by dividing

$48,769 into $22,780. The turnover deteriorated from 2.175 times in 1995 to

2.141 times in 1999.

32,153

1995: 14,949

= 2. 175

48,769

1999: 22,780

= 2. 141

2. Magnetronics had $7,380 invested in accounts receivables at year-end 1999. Its

average sales per day were $133.61 during 1999 and its average collection period

was 55.23 days. This represented an improvement from the average collection

period of 58.68 days in 1995.

5,227

1995: 32,513 = 58. 68

365

7,380

1999: 48,769 = 55. 23

365

3. Magnetronics apparently needed $8,220 of inventory at year-end 1999 to support

its operations during 1999. Its activity during 1999 as measured by the cost of

goods sold was $29,700. It therefore had an inventory turnover of 3.61 times. This

represented a deterioration from 4.76 times in 1995.

19,183

1995: 4,032

= 4. 76

29,700

1999: 8,220

= 3. 61

You might also like

- Assessing A FirmDocument4 pagesAssessing A Firm蔡朝泉No ratings yet

- Margin (B) Return On Invested Capital and (C) Return On Equity. We Have AlsoDocument1 pageMargin (B) Return On Invested Capital and (C) Return On Equity. We Have AlsoSannithi YamsawatNo ratings yet

- Growing Too Fast Compared To Net Income and The Increase in Expenses (COGS and Operating Cost)Document1 pageGrowing Too Fast Compared To Net Income and The Increase in Expenses (COGS and Operating Cost)Sannithi YamsawatNo ratings yet

- Sales On PartnershipDocument10 pagesSales On PartnershipEunice BernalNo ratings yet

- ASTRAL RECORDS - EditedDocument11 pagesASTRAL RECORDS - EditedNarinderNo ratings yet

- Microsoft FY 2000 "What-If?": (In Millions, Except Earnings Per Share)Document4 pagesMicrosoft FY 2000 "What-If?": (In Millions, Except Earnings Per Share)januarNo ratings yet

- PTX - Past Year Set ADocument8 pagesPTX - Past Year Set ANUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Vodafone Bid HBS Case - ExhibitsDocument13 pagesVodafone Bid HBS Case - ExhibitsNaman PorwalNo ratings yet

- PTX - Final ExamDocument7 pagesPTX - Final ExamNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- 01 Activity 1Document2 pages01 Activity 1Emperor SavageNo ratings yet

- PTX - Past Year Set BDocument9 pagesPTX - Past Year Set BNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Sony Annual Report 1994Document58 pagesSony Annual Report 1994Carmencita WeissNo ratings yet

- 21P078 GarimaSingh ET MA-IIDocument12 pages21P078 GarimaSingh ET MA-IIGarimaSinghNo ratings yet

- CASE Solution VyadermDocument8 pagesCASE Solution VyadermIshan Shah100% (2)

- BMA Flashnote LUCK 24042020 PDFDocument2 pagesBMA Flashnote LUCK 24042020 PDFUmer AftabNo ratings yet

- MAXWELL-COMMS-CORP Finance Management Case AnalysisDocument4 pagesMAXWELL-COMMS-CORP Finance Management Case AnalysisRosemarie FranciaNo ratings yet

- Microsoft FY 2000 "What-If?": (In Millions, Except Earnings Per Share)Document5 pagesMicrosoft FY 2000 "What-If?": (In Millions, Except Earnings Per Share)amro_baryNo ratings yet

- BDLB Forecasting ExerciseDocument2 pagesBDLB Forecasting ExerciseBRENT DECHERY LOPEZ BARCONo ratings yet

- Nyse Aan 1998Document18 pagesNyse Aan 1998gaja babaNo ratings yet

- Is and BS For FinalsDocument5 pagesIs and BS For FinalsRehan FarhatNo ratings yet

- Mock Test 3 Online AnswerDocument4 pagesMock Test 3 Online AnswerLucia XIIINo ratings yet

- Accounting - Higherlevel: Leaving Certificate Examination, 2000Document10 pagesAccounting - Higherlevel: Leaving Certificate Examination, 2000meelas123No ratings yet

- Wipro: Company OverviewDocument3 pagesWipro: Company OverviewJeswinNo ratings yet

- Acb21103 Tutorial Business Income 2023Document8 pagesAcb21103 Tutorial Business Income 2023alifarhanah6No ratings yet

- 21P071 - Atul Jhunjhunwala - ET - MA2Document10 pages21P071 - Atul Jhunjhunwala - ET - MA2ATUL JHUNJHUNWALANo ratings yet

- Financial Management 1Document18 pagesFinancial Management 1Ketz NKNo ratings yet

- Assignment: Principles of Accounting: Instructor:Rais AhmedDocument8 pagesAssignment: Principles of Accounting: Instructor:Rais AhmedMr AnonymousNo ratings yet

- SL InstSDocument4 pagesSL InstSMarjorie Kate PagaoaNo ratings yet

- If Finalll 2020Document10 pagesIf Finalll 2020TebashiniNo ratings yet

- Lloyds TSB Group PLC: Results For Half-Year To 30 June 2000Document41 pagesLloyds TSB Group PLC: Results For Half-Year To 30 June 2000saxobobNo ratings yet

- 2010 June Financial Reporting L1Document90 pages2010 June Financial Reporting L1Dixie Cheelo0% (1)

- CHP 9 Plant Assets and Depreciation AccountingDocument15 pagesCHP 9 Plant Assets and Depreciation AccountingRASHONNo ratings yet

- PDFDocument6 pagesPDFjoshua yakubuNo ratings yet

- Presentation 1QFY17Document42 pagesPresentation 1QFY17kimNo ratings yet

- ElectronicDocument11 pagesElectronicannisa lahjieNo ratings yet

- Nokia Profit and Loss Account 2010Document2 pagesNokia Profit and Loss Account 2010Yashwanth VeerNo ratings yet

- Geschaeftsbericht 2000 DataDocument101 pagesGeschaeftsbericht 2000 DataNouveau RienNo ratings yet

- Berkshire QDocument4 pagesBerkshire Qmarco colomboNo ratings yet

- Buy Unitech - Target 51Document7 pagesBuy Unitech - Target 51Sovid GuptaNo ratings yet

- Introduction To Project Management Session 2Document14 pagesIntroduction To Project Management Session 2debojyotiNo ratings yet

- ACC 4041 Tutorial - Business Income and ExpensesDocument5 pagesACC 4041 Tutorial - Business Income and ExpensesAyekurik0% (1)

- Wahyu Gunawan - Mid Exam Financial MGT - ENEMBA7Document15 pagesWahyu Gunawan - Mid Exam Financial MGT - ENEMBA7Rydo PrastariNo ratings yet

- 7 - Frank SpenceDocument8 pages7 - Frank SpenceEdited By MENo ratings yet

- TheSun 2009-06-26 Page16 Airlines Struggle As Flu Adds To Woes IataDocument1 pageTheSun 2009-06-26 Page16 Airlines Struggle As Flu Adds To Woes IataImpulsive collectorNo ratings yet

- Dokumen - Tips - Interco Case KqfjkniwfDocument17 pagesDokumen - Tips - Interco Case KqfjkniwfFabián AlvaradoNo ratings yet

- XLS EngDocument3 pagesXLS EngSalmaNo ratings yet

- XLS EngDocument3 pagesXLS EngmonemNo ratings yet

- 1999 Annual Report: 128th YEARDocument33 pages1999 Annual Report: 128th YEARJonathan OngNo ratings yet

- Palmer Limited Case StudyDocument9 pagesPalmer Limited Case StudyPrashil Raj MehtaNo ratings yet

- OCC's Quarterly Report On Bank Trading and Derivatives Activities Second Quarter 2009Document33 pagesOCC's Quarterly Report On Bank Trading and Derivatives Activities Second Quarter 2009Nathan MartinNo ratings yet

- Affecting Behavior and Achieving: Marcom AccountabilityDocument1 pageAffecting Behavior and Achieving: Marcom AccountabilityAnshul SharmaNo ratings yet

- OCC's Quarterly Report On Bank Trading and Derivatives Activities Second Quarter 2009Document33 pagesOCC's Quarterly Report On Bank Trading and Derivatives Activities Second Quarter 2009qtipxNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Possible AnswersDocument8 pages2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Possible AnswersChantelle IsaksNo ratings yet

- Wacom Annual Report 2009Document42 pagesWacom Annual Report 2009Ric HollandNo ratings yet

- BASF Annual Report 2000Document72 pagesBASF Annual Report 2000邹小胖No ratings yet

- Annual Report 2009Document21 pagesAnnual Report 2009MPIMLACNo ratings yet

- Powerol - Monthly MIS FormatDocument34 pagesPowerol - Monthly MIS Formatdharmender singhNo ratings yet

- Cost-Effective Pension Planning: Work in America Institute Studies in Productivity: Highlights of The LiteratureFrom EverandCost-Effective Pension Planning: Work in America Institute Studies in Productivity: Highlights of The LiteratureNo ratings yet

- The level of protection provided by Chinese labour law compared to German labour lawFrom EverandThe level of protection provided by Chinese labour law compared to German labour lawNo ratings yet

- HBR-investing in A Retirement Plan. Assignment Questions 1. What..Document4 pagesHBR-investing in A Retirement Plan. Assignment Questions 1. What..Sannithi YamsawatNo ratings yet

- Week 2020Document53 pagesWeek 2020Sannithi YamsawatNo ratings yet

- Investment Analysis and Portfolio ManageDocument14 pagesInvestment Analysis and Portfolio ManageSannithi YamsawatNo ratings yet

- Script Investment-2-3Document2 pagesScript Investment-2-3Sannithi YamsawatNo ratings yet

- WalmartDocument5 pagesWalmartSannithi YamsawatNo ratings yet

- Liquidity RatiosDocument1 pageLiquidity RatiosSannithi YamsawatNo ratings yet

- 1Document1 page1Sannithi YamsawatNo ratings yet