Professional Documents

Culture Documents

Camel Analysis-1

Camel Analysis-1

Uploaded by

Syukri Salim0 ratings0% found this document useful (0 votes)

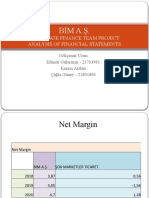

9 views2 pagesMaybank's capital adequacy ratio averaged 19.15% from 2016-2020 indicating its ability to withstand loan losses. Its asset quality was strong, with non-performing loans averaging only 8.18% of total loans. Management efficiency was high, with operating expenses averaging 36.24% of total, lower than the recommended threshold of 60%. Earnings capability was good at an average profit rate of 1.38%, higher than the required 1%. However, liquidity was weak at only 5.76% on average, lower than the recommended 19.9%, indicating low capacity to cover unexpected deposit withdrawals. Overall, Maybank received a composite rating of 2.6, considered a "fair" rating.

Original Description:

Original Title

CAMEL ANALYSIS-1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMaybank's capital adequacy ratio averaged 19.15% from 2016-2020 indicating its ability to withstand loan losses. Its asset quality was strong, with non-performing loans averaging only 8.18% of total loans. Management efficiency was high, with operating expenses averaging 36.24% of total, lower than the recommended threshold of 60%. Earnings capability was good at an average profit rate of 1.38%, higher than the required 1%. However, liquidity was weak at only 5.76% on average, lower than the recommended 19.9%, indicating low capacity to cover unexpected deposit withdrawals. Overall, Maybank received a composite rating of 2.6, considered a "fair" rating.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pagesCamel Analysis-1

Camel Analysis-1

Uploaded by

Syukri SalimMaybank's capital adequacy ratio averaged 19.15% from 2016-2020 indicating its ability to withstand loan losses. Its asset quality was strong, with non-performing loans averaging only 8.18% of total loans. Management efficiency was high, with operating expenses averaging 36.24% of total, lower than the recommended threshold of 60%. Earnings capability was good at an average profit rate of 1.38%, higher than the required 1%. However, liquidity was weak at only 5.76% on average, lower than the recommended 19.9%, indicating low capacity to cover unexpected deposit withdrawals. Overall, Maybank received a composite rating of 2.6, considered a "fair" rating.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

CAMEL ANALYSIS

COMPONENT YEARS AVERAGE RATING

OF FIVE

2016 2017 2018 2019 2020 YEARS

CAPITAL 19.29 19.38 19.02 19.39 18.68 19.15 1

ADEQUACY

RATIO

ASSET 8.79 8.63 7.07 9.21 7.23 8.18 5

QUALITY

MANAGEMENT 36.53 40.85 37.95 32.81 33.10 36.24 1

EFFICIENCY

EARNINGS 1.29 1.20 1.60 1.57 1.25 1.38 1

CAPABILITY

LIQUIDITY 7.73 6.03 5.90 4.10 5.06 5.76 5

AVERAGE COMPOSITE RATING 2.6 (FAIR)

CAPITAL ADEQUACY RATIO

Based on Table 1, 19.15% of Maybank’s assets are financed by its capital. This shows that

Maybank are on par in terms of its resistibility to loan losses.

ASSET QUALITY

Asset quality is determined by one ratio which is non performing loans divide with loans and

advances. The table shows that the total loans of Maybank is in small amount, which is only

8.18% average in five years.

MANAGEMENT EFFICIENCY

Table 1 show that Maybank is efficient in managing its operating expenses as its ratio is

lower than 60%, which is only 36.24% average in five years. Maybank have managed to

maintain their interest expense or profit rate in relation to customers’ deposits.

EARNINGS CAPABILITY

Based on Table 1, Maybank recorded 1.38% profit rate from its business higher than 1% of

the component composite rating. This might be due to the nature of Maybank that offers a

comprehensive range of products and services that includes commercial banking, investment

banking, Islamic banking, offshore banking, leasing and hire purchase, insurance, factoring,

trustee services, asset management, stock broking, nominee services, venture capital and

Internet banking.

LIQUIDITY

The results show that the ratio of liquid for Maybank is only 5.76%. In other words, for

every RM 1 of total asset in Maybank, there is RM 0.0576 of liquid assets, which is lower

than 19.9% from the component composite ratings. From Table 1, we can see that Maybank

has low capacity to cover unanticipated deposit drain as the average liquidity ratio for five

years of Maybank is only 5.76%. This is means that for every RM 1 of customers’ deposits

taken, Maybank only affords to cover RM 0.0576 of withdrawals made by customers.

You might also like

- Canara Bank Statement 1Document11 pagesCanara Bank Statement 1Lingaraj Padhy50% (6)

- OceanLink Partners Q1 2019 LetterDocument14 pagesOceanLink Partners Q1 2019 LetterKan ZhouNo ratings yet

- A151 Tutorial Topic 5 - QuestionDocument3 pagesA151 Tutorial Topic 5 - QuestionNadirah Mohamad Sarif100% (1)

- Capital Struture Analysis Oman CompaniesDocument9 pagesCapital Struture Analysis Oman CompaniesSalman SajidNo ratings yet

- Interest Rate and Currency SwapsDocument143 pagesInterest Rate and Currency Swapscrinix7265100% (1)

- Net Interest Margin% 3% 3% 3%Document4 pagesNet Interest Margin% 3% 3% 3%Rabita QayoomNo ratings yet

- Assignment 2Document12 pagesAssignment 2Nimra SiddiqueNo ratings yet

- Financial Performance AnalysisDocument9 pagesFinancial Performance AnalysisTahmina ChowdhuryNo ratings yet

- Yes Bank MD&A Analysis 2018Document2 pagesYes Bank MD&A Analysis 2018Siddhant KhandelwwalNo ratings yet

- MS7SL800 - Assignment - 1 - McBrideDocument36 pagesMS7SL800 - Assignment - 1 - McBrideDaniel AjanthanNo ratings yet

- Sesssion 5 17-Oct-2020Document44 pagesSesssion 5 17-Oct-2020Uzma UzmaNo ratings yet

- WPR-02 SNDocument11 pagesWPR-02 SNADITYA KUMARNo ratings yet

- Shree Chanakya Education Society's Indira Institute of Management, Pune Master of Business Administration Semester - IIDocument17 pagesShree Chanakya Education Society's Indira Institute of Management, Pune Master of Business Administration Semester - IIbunnyNo ratings yet

- Analyzing Dubai Islamic Bank's Performance Using The CAMEL ApproachDocument8 pagesAnalyzing Dubai Islamic Bank's Performance Using The CAMEL Approachventures.acolyteNo ratings yet

- ACI Limited FMDocument13 pagesACI Limited FMTariqul Islam TanimNo ratings yet

- Fsa-IciciDocument41 pagesFsa-IciciBirddoxyNo ratings yet

- Group Assignment FIN 410 - Group #3Document22 pagesGroup Assignment FIN 410 - Group #3ShahikNo ratings yet

- ACI Limited FMDocument13 pagesACI Limited FMTariqul Islam TanimNo ratings yet

- Paper LC SamsungDocument9 pagesPaper LC SamsungRidho RakhmanNo ratings yet

- Report On Ratio Analysis Titan Company LTDDocument15 pagesReport On Ratio Analysis Titan Company LTDJITENDRA LAMSALNo ratings yet

- Group CDocument27 pagesGroup Canika moniNo ratings yet

- Avinash SinghDocument16 pagesAvinash Singhproject wordNo ratings yet

- 3.0 Financial Analysis 3.1 Gross MarginDocument7 pages3.0 Financial Analysis 3.1 Gross MarginhanisNo ratings yet

- Care Ratings - Q4FY19 - Call Closure - 13062019 - 14-06-2019 - 09Document4 pagesCare Ratings - Q4FY19 - Call Closure - 13062019 - 14-06-2019 - 09Jai SinghNo ratings yet

- Financial Performance AnalysisDocument14 pagesFinancial Performance AnalysisNurul Islam SojibNo ratings yet

- Session19 - MBA - Term I - FA - SNU - 2019Document49 pagesSession19 - MBA - Term I - FA - SNU - 2019ashuuuNo ratings yet

- EFIN 519 ( (Bank Fund Management) : On "Key Performance Indicator (KPI) "Document22 pagesEFIN 519 ( (Bank Fund Management) : On "Key Performance Indicator (KPI) "anika moniNo ratings yet

- FAM Task 1 - Anil Kumar AmbatiDocument20 pagesFAM Task 1 - Anil Kumar AmbatiAnil KumarNo ratings yet

- Ratio AnalysisDocument30 pagesRatio AnalysiskmillatNo ratings yet

- Ratio Analysis Al Anwar Ceramic Tiles SAOG CoDocument16 pagesRatio Analysis Al Anwar Ceramic Tiles SAOG CoDevender SharmaNo ratings yet

- Ratio AnalysisDocument14 pagesRatio AnalysisNurul Islam SojibNo ratings yet

- Chapter - 4 Data Analysis and Interpretation: Current RatioDocument15 pagesChapter - 4 Data Analysis and Interpretation: Current RatioSarva ShivaNo ratings yet

- Meghna Life Insurance Financial Performance AnalysisDocument16 pagesMeghna Life Insurance Financial Performance AnalysisshagorprNo ratings yet

- Kongkaikai 10 Writing Materials#Document7 pagesKongkaikai 10 Writing Materials#abiramieNo ratings yet

- Camel AnalysisDocument12 pagesCamel AnalysisvineethkmenonNo ratings yet

- MERRPDocument11 pagesMERRPSheetal DwevediNo ratings yet

- Comparative Financial Analysis Between 1Document21 pagesComparative Financial Analysis Between 1Russel MehediNo ratings yet

- IJCRT1812572Document5 pagesIJCRT1812572buviaroNo ratings yet

- Applying The CAMELS Performance Evaluation Approach For HDFC Bank Company OverviewDocument9 pagesApplying The CAMELS Performance Evaluation Approach For HDFC Bank Company OverviewDharmesh Goyal100% (1)

- Finance ProjectDocument36 pagesFinance ProjectLokesh ChoudharyNo ratings yet

- Yeni Microsoft Office PowerPoint SunusuDocument9 pagesYeni Microsoft Office PowerPoint SunusukeremNo ratings yet

- Vinita Jain C-40 Amita Pathak C-47 Mayank Dand C-60: Dr.V.N.Bedekar Institute of Management Studies, ThaneDocument30 pagesVinita Jain C-40 Amita Pathak C-47 Mayank Dand C-60: Dr.V.N.Bedekar Institute of Management Studies, ThaneHeena KauserNo ratings yet

- Revised Mba Sheet 2Document14 pagesRevised Mba Sheet 2FINANCIAL LITERACYNo ratings yet

- NRBC - MD Riazul Haque Patwari - 503Document11 pagesNRBC - MD Riazul Haque Patwari - 503riazul haqueNo ratings yet

- New BenishangulDocument8 pagesNew Benishangulteklay asmelashNo ratings yet

- Financial Analysis of Pakistan State Oil For The Period July 2017-June 2020Document9 pagesFinancial Analysis of Pakistan State Oil For The Period July 2017-June 2020Adil IqbalNo ratings yet

- C18Y1101 Sadhurshan Sathyawelu BAIBF10020Document14 pagesC18Y1101 Sadhurshan Sathyawelu BAIBF10020saran.woowNo ratings yet

- FM-1 Risk Return Analysis Project GuidelinesDocument5 pagesFM-1 Risk Return Analysis Project Guidelinesparika khannaNo ratings yet

- The Effect of Financial Ratios On Profitability of Commercial Bank Based On Business Activities (BUKU) IV Banks in IndonesiaDocument7 pagesThe Effect of Financial Ratios On Profitability of Commercial Bank Based On Business Activities (BUKU) IV Banks in IndonesiaaijbmNo ratings yet

- Fund Manager Report November 2019: NBP FundsDocument17 pagesFund Manager Report November 2019: NBP FundsTaha SaleemNo ratings yet

- 2 MBA M - CIA 3B - Group No 6Document16 pages2 MBA M - CIA 3B - Group No 6Akanksha Ranjan 2028039No ratings yet

- SCM Yash BatraDocument5 pagesSCM Yash BatraSurbhi SabharwalNo ratings yet

- FSA Assignment 2Document16 pagesFSA Assignment 2Daniyal ZafarNo ratings yet

- 2018 - Investor - Presentation - Q1-2019 ICICILombard - General - Insurance PDFDocument20 pages2018 - Investor - Presentation - Q1-2019 ICICILombard - General - Insurance PDFRAHUL PANDEYNo ratings yet

- Internship Presentation On: Financial Performance of Social Islami Bank Limited: An AnalysisDocument19 pagesInternship Presentation On: Financial Performance of Social Islami Bank Limited: An AnalysisMS Sojib ChowdhuryNo ratings yet

- Vatsal Changoiwala - Bajaj Auto Ltd.Document12 pagesVatsal Changoiwala - Bajaj Auto Ltd.Vatsal ChangoiwalaNo ratings yet

- Companies Intra Analysis.Document3 pagesCompanies Intra Analysis.Mahir Hussain BangashNo ratings yet

- AXIS BANK - Analysis by Group 4Document28 pagesAXIS BANK - Analysis by Group 4CH NAIRNo ratings yet

- PBB 2017 Annual Report (Page 136 - Proxy Form)Document164 pagesPBB 2017 Annual Report (Page 136 - Proxy Form)celia7172No ratings yet

- ĐỊNH GIÁ SO SÁNHDocument6 pagesĐỊNH GIÁ SO SÁNHAn HoaiNo ratings yet

- Lombard Fy19Document21 pagesLombard Fy19Sriram RajaramNo ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019From EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019No ratings yet

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2015: Joint Initiative of the ASEAN Capital Markets Forum and the Asian Development BankFrom EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2015: Joint Initiative of the ASEAN Capital Markets Forum and the Asian Development BankNo ratings yet

- (Template) ELC501 Test DEC2020 Set - 2Document11 pages(Template) ELC501 Test DEC2020 Set - 2Syukri SalimNo ratings yet

- (Template) ELC501 Test - QP Set 1Document9 pages(Template) ELC501 Test - QP Set 1Syukri SalimNo ratings yet

- FIN533Document4 pagesFIN533Syukri SalimNo ratings yet

- GROUPDocument6 pagesGROUPSyukri SalimNo ratings yet

- FIN542 Group Assignment 1Document5 pagesFIN542 Group Assignment 1Syukri SalimNo ratings yet

- Internship Report On MCB Bank 2013 by Muhammad HijabDocument75 pagesInternship Report On MCB Bank 2013 by Muhammad HijabMuhammad Hijab100% (6)

- FINAL Internship Report of Askari BankDocument126 pagesFINAL Internship Report of Askari Bankatif aslam29% (7)

- HGFJHGDocument121 pagesHGFJHGCaesar Romero DixiNo ratings yet

- Payphi Corporate Overview New v1Document24 pagesPayphi Corporate Overview New v1Ankit BhatiaNo ratings yet

- GACPA, Inc. Convention Payment InstructionDocument3 pagesGACPA, Inc. Convention Payment InstructionCrizziaNo ratings yet

- KY Birth Certificate ApplicationDocument1 pageKY Birth Certificate Applicationwill heiseNo ratings yet

- Seminar On Central Bank of IndiaDocument23 pagesSeminar On Central Bank of IndiaHarshkinder SainiNo ratings yet

- Nigerian - Banks Fitch Mar17Document12 pagesNigerian - Banks Fitch Mar17Funso Ade100% (1)

- Walmart Z-ScoreDocument3 pagesWalmart Z-Scorenasimorabi1981No ratings yet

- Example of Bank Reconciliation StatementDocument1 pageExample of Bank Reconciliation StatementElla Mae TimbangNo ratings yet

- Role of Central BanksDocument16 pagesRole of Central BanksZinat AfrozNo ratings yet

- Case Study On Bear StearnsDocument13 pagesCase Study On Bear StearnsKhushi WadhawanNo ratings yet

- Banking Law B.com - Docx LatestDocument69 pagesBanking Law B.com - Docx LatestViraja Guru100% (1)

- Presentation 1Document15 pagesPresentation 1vanita kunnoNo ratings yet

- Session 19-20 - Accounts OperationDocument16 pagesSession 19-20 - Accounts OperationB VaidehiNo ratings yet

- Banking and Financial Institutions NET-JRFDocument65 pagesBanking and Financial Institutions NET-JRFAakash DebnathNo ratings yet

- Charge Documention For LoanDocument19 pagesCharge Documention For LoanChayan ArdNo ratings yet

- National Bank of Pakistan - WikipediaDocument4 pagesNational Bank of Pakistan - WikipediaAbdul RehmanNo ratings yet

- Lounge List - Axis Bank Priority Debit Card: S.no State City Lounge Terminal LandmarkDocument2 pagesLounge List - Axis Bank Priority Debit Card: S.no State City Lounge Terminal LandmarkDebmalya DuttaNo ratings yet

- Statement of Account: South Bangla Agriculture & Commerce Bank LTDDocument1 pageStatement of Account: South Bangla Agriculture & Commerce Bank LTDjhohan freestyleNo ratings yet

- Register of Cash in Bank and Other Related Financial TransactionsDocument2 pagesRegister of Cash in Bank and Other Related Financial TransactionsCarmel YparraguirreNo ratings yet

- Board Re So For CompanyDocument6 pagesBoard Re So For CompanydebashisdasNo ratings yet

- 78 SMTC-2015 (Honorarium) Approv ListDocument10 pages78 SMTC-2015 (Honorarium) Approv ListNitin PatneNo ratings yet

- RBSDocument90 pagesRBSMediha WaheedNo ratings yet

- WIN SEM (2022-23) FRESHERS STS1007 TH AP2022237000732 Reference Material I 25-Mar-2023 Simple InterestDocument26 pagesWIN SEM (2022-23) FRESHERS STS1007 TH AP2022237000732 Reference Material I 25-Mar-2023 Simple InterestVIMEDHA CHATURVEDI 22BCE7796No ratings yet

- Private Bank Project Funding-1Document4 pagesPrivate Bank Project Funding-1Rama Krishna SaraswatiNo ratings yet

- IBS Objective Type QuestionsDocument4 pagesIBS Objective Type QuestionsShrijiNo ratings yet