Professional Documents

Culture Documents

Example CS - APR2009 - MAF620 Basic Understanding Q

Uploaded by

Zoe McKenzieOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Example CS - APR2009 - MAF620 Basic Understanding Q

Uploaded by

Zoe McKenzieCopyright:

Available Formats

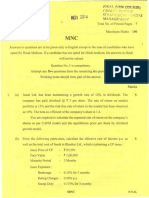

CONFIDENTIAL AC/APR 2009/MAF620/FMC570

Example: Capital Structure for Basic Understanding

QUESTION 3

Aman Sentosa Berhad has 4 million ordinary shares with a market price of RM10 per share. It

also has RM100 million perpetual debt with a pre-tax cost of 6%. The firm’s cost of equity is

18% and the company tax rate is 25%.

Required:

a. Determine the value of Aman Sentosa Berhad.

(1 mark)

b. Determine the rate of return required by the shareholders if the firm were financed

entirely with equity.

(2 marks)

c. Calculate the firm’s earnings before interest and taxes (EBIT).

(3 marks)

d. Suppose the firm plans to issue additional RM10 million debt and use the proceeds to

buy back 1 million units of its ordinary shares, calculate the following after the

restructuring:

i. Value of Aman Sentosa Berhad.

ii. The firm’s cost of equity.

iii. The firm’s overall cost of capital.

iv. The market price of its ordinary shares.

(6 marks)

e. Suppose instead of part (d) above, the firm changes its capital structure by issuing

RM10 million in additional shares and uses the proceeds to redeem its debt, calculate

the following after the restructuring:

i. Value of Aman Sentosa Berhad.

ii. The firm’s cost of equity.

iii. The firm’s overall cost of capital.

iv. The market price of its ordinary shares.

(5 marks)

f. Explain the differences in your answers (if any) in parts, d(i)(ii)(iii) with parts e(i)(ii)(iii).

(3 marks)

g. Suggests three (3) assumptions used in the Modigliani Miller Propositions with corporate

taxes

(3 marks)

(Total: 23 marks)

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Exam Paper 2012 ZAB CommentariesDocument35 pagesExam Paper 2012 ZAB Commentariesamna666No ratings yet

- Buss 203 Business FinanceDocument2 pagesBuss 203 Business FinanceTevin67% (3)

- Test 1 Maf653 April 2018 Latest-SolutionDocument9 pagesTest 1 Maf653 April 2018 Latest-SolutionFakhrul Haziq Md FarisNo ratings yet

- Tutorial Question 1 (December 2018) : "Electrical Speed Rail Project" With The Government of BruneiDocument5 pagesTutorial Question 1 (December 2018) : "Electrical Speed Rail Project" With The Government of Bruneihannacute0% (1)

- New Format Exam Q Maf620 - Oct 2009Document5 pagesNew Format Exam Q Maf620 - Oct 2009kkNo ratings yet

- PST CL 2015 2023Document88 pagesPST CL 2015 2023Benny MwaloziNo ratings yet

- 44956mtpbosicai Final QP p2Document7 pages44956mtpbosicai Final QP p2Shubham SurekaNo ratings yet

- BBMF2093 24octDocument4 pagesBBMF2093 24octyvonneapj-wb22No ratings yet

- 7 Corporate Finance - Prof. Gagan SharmaDocument4 pages7 Corporate Finance - Prof. Gagan SharmaVampireNo ratings yet

- December 2010 Examination: FM12 Financial Management Time: Three Hours Maximum Marks: 100Document5 pagesDecember 2010 Examination: FM12 Financial Management Time: Three Hours Maximum Marks: 100Eashan YadavNo ratings yet

- CF Final Term Paper 1 Spring 2021Document3 pagesCF Final Term Paper 1 Spring 2021Daniyal AsifNo ratings yet

- Test Series: August, 2016 Mock Test Paper - 1 Final Course: Group - I Paper - 2: Strategic Financial ManagementDocument40 pagesTest Series: August, 2016 Mock Test Paper - 1 Final Course: Group - I Paper - 2: Strategic Financial ManagementMuhamed Muhsin PNo ratings yet

- Clinch The Deal QuizDocument6 pagesClinch The Deal QuizNiraj_Murarka_5987No ratings yet

- Tutorial 1 Introduction-Student VersionDocument6 pagesTutorial 1 Introduction-Student VersionSyaimma Syed AliNo ratings yet

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFDocument9 pagesModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitNo ratings yet

- BCM 4206 Corporate Finance PDFDocument4 pagesBCM 4206 Corporate Finance PDFSimon silaNo ratings yet

- MBA183F4: RamaiahDocument3 pagesMBA183F4: Ramaiahvijay shetNo ratings yet

- MTP 1 May 21 QDocument4 pagesMTP 1 May 21 QSampath KumarNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument15 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answerritz meshNo ratings yet

- f9 2018 Marjun QDocument6 pagesf9 2018 Marjun QDilawar HayatNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument8 pagesThis Paper Is Not To Be Removed From The Examination HallsPaul DavisNo ratings yet

- Maf603-Test 2-Jan 2021-QDocument2 pagesMaf603-Test 2-Jan 2021-QPutri Naajihah 4GNo ratings yet

- Financial Management-P III - Nov 08Document4 pagesFinancial Management-P III - Nov 08gundapolaNo ratings yet

- Faculty Business Management 2021 Session 1 - Degree Fin430Document6 pagesFaculty Business Management 2021 Session 1 - Degree Fin430Mimi SaiziatulNo ratings yet

- Faculty Business Management 2021 Session 1 - Degree Fin430Document6 pagesFaculty Business Management 2021 Session 1 - Degree Fin430Mimi SaiziatulNo ratings yet

- Paper 2Document7 pagesPaper 2Suppy PNo ratings yet

- Nov 10Document7 pagesNov 10chandreshNo ratings yet

- An Autonomous Institution, Affiliated To Anna University, ChennaiDocument7 pagesAn Autonomous Institution, Affiliated To Anna University, Chennaisibi chandanNo ratings yet

- SP March 2022Document3 pagesSP March 2022Niranjan JadhavNo ratings yet

- Heriot-Watt University Finance - December 2020 Section I Case StudiesDocument5 pagesHeriot-Watt University Finance - December 2020 Section I Case StudiesSijan PokharelNo ratings yet

- TWO (2) Questions From SECTION B in The Answer Booklet Provided. All Question CarryDocument4 pagesTWO (2) Questions From SECTION B in The Answer Booklet Provided. All Question CarrynatlyhNo ratings yet

- Final Group III Test Papers (Revised July 2009)Document43 pagesFinal Group III Test Papers (Revised July 2009)Kishor SandageNo ratings yet

- Acc202 (Q) - Online Exam (Both Campus) (Mock Exam)Document8 pagesAcc202 (Q) - Online Exam (Both Campus) (Mock Exam)Rishiaendra CoolNo ratings yet

- 00 Assignment 2 QuestionnaireDocument6 pages00 Assignment 2 QuestionnaireBharat KoiralaNo ratings yet

- AL Financial Management May Jun 2014Document2 pagesAL Financial Management May Jun 2014hyp siinNo ratings yet

- Question 1289158Document11 pagesQuestion 1289158groverpankaj04No ratings yet

- Question PaperDocument3 pagesQuestion PaperAmbrishNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswercdNo ratings yet

- AL Financial Management Nov Dec 2013Document4 pagesAL Financial Management Nov Dec 2013hyp siinNo ratings yet

- Corp. AccountingDocument6 pagesCorp. AccountingUtkalika R SahooNo ratings yet

- BFF3351 S1 2020 FinalDocument11 pagesBFF3351 S1 2020 Finalsardar hussainNo ratings yet

- Orientation Phase Emp@Spjimr Finance Management Marks: 100 Time: 90 MinDocument4 pagesOrientation Phase Emp@Spjimr Finance Management Marks: 100 Time: 90 MinPratap singh chundawatNo ratings yet

- Company Accounts and Cost & Management Accounting: Part-ADocument9 pagesCompany Accounts and Cost & Management Accounting: Part-AOm PrakashNo ratings yet

- Paper10 Set1Document8 pagesPaper10 Set13 6 1 4 6 Ganesh Kumaran ANo ratings yet

- Iii Semester Endterm Examination November 2016Document3 pagesIii Semester Endterm Examination November 2016Gautam KumarNo ratings yet

- Fe 202009 BBCF1013Document8 pagesFe 202009 BBCF1013Wan Muhamad ShariffNo ratings yet

- FM 15-16Document3 pagesFM 15-16BrijmohanNo ratings yet

- 090617000053Document5 pages090617000053Shyamsunder SinghNo ratings yet

- Revised APP 814 PROJECT fINANCE EXAM April 2019 PDFDocument4 pagesRevised APP 814 PROJECT fINANCE EXAM April 2019 PDFRays ResearchersNo ratings yet

- MTP 1 May 18 QDocument4 pagesMTP 1 May 18 QSampath KumarNo ratings yet

- Mba Sem 4 Mergers and Acquisitions Sum 2017Document5 pagesMba Sem 4 Mergers and Acquisitions Sum 2017MANSINo ratings yet

- BMMF5103 QuestionDocument7 pagesBMMF5103 QuestionAbdurahman Isse IgalNo ratings yet

- Ac Maf603 Dec16Document6 pagesAc Maf603 Dec16MOHAMMAD NOOR AIMAN AHMADNo ratings yet

- Dividend Model Examples and Review QuestionsDocument1 pageDividend Model Examples and Review QuestionsGadafi FuadNo ratings yet

- Fina 1027 - May 2017 - ExamDocument12 pagesFina 1027 - May 2017 - ExamJiaFengNo ratings yet

- Academic Session 2022 MAY 2022 Semester: AssignmentDocument6 pagesAcademic Session 2022 MAY 2022 Semester: AssignmentChristopher KipsangNo ratings yet

- MTP 17 53 Questions 1710507531Document9 pagesMTP 17 53 Questions 1710507531janasenalogNo ratings yet

- Model Test Papers Accounts Class 12Document171 pagesModel Test Papers Accounts Class 12Ruchi AgarwalNo ratings yet

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItFrom EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItRating: 5 out of 5 stars5/5 (1)

- CH 2 - Return and RiskDocument68 pagesCH 2 - Return and RiskZoe McKenzieNo ratings yet

- Maf603 - Tutorial 1 - EmhDocument1 pageMaf603 - Tutorial 1 - EmhZoe McKenzieNo ratings yet

- Chapter 2: Overview of Business ProcessDocument16 pagesChapter 2: Overview of Business ProcessZoe McKenzieNo ratings yet

- Jan 2018 Solotion To Q5.EMHDocument3 pagesJan 2018 Solotion To Q5.EMHZoe McKenzieNo ratings yet

- Chapter 1 - Introduction To Corporate Finance - NewDocument26 pagesChapter 1 - Introduction To Corporate Finance - NewZoe McKenzieNo ratings yet

- Illustration 1 - COCDocument5 pagesIllustration 1 - COCZoe McKenzieNo ratings yet

- GMS724 Learning ObjectivesDocument59 pagesGMS724 Learning ObjectivesZoe McKenzieNo ratings yet

- Table A-1Document1 pageTable A-1Zoe McKenzieNo ratings yet

- Capm - Class ExerciseDocument1 pageCapm - Class ExerciseZoe McKenzieNo ratings yet

- TOPIC 3d - Audit PlanningDocument29 pagesTOPIC 3d - Audit PlanningLANGITBIRUNo ratings yet

- MAF603 COC - StudentsDocument12 pagesMAF603 COC - StudentsZoe McKenzieNo ratings yet

- A Review of Islamic Management and Conventional ManagementDocument3 pagesA Review of Islamic Management and Conventional ManagementZoe McKenzieNo ratings yet

- Solution Risk and Return JULY 2020Document2 pagesSolution Risk and Return JULY 2020Zoe McKenzieNo ratings yet

- Case Study On BMW PDFDocument1 pageCase Study On BMW PDFZoe McKenzieNo ratings yet

- Revision Notes Notes-Contractlaw PDFDocument32 pagesRevision Notes Notes-Contractlaw PDFshoaibmirza1No ratings yet

- Maf603-Question Test 2 - June 2022Document8 pagesMaf603-Question Test 2 - June 2022Zoe McKenzieNo ratings yet

- Maf603-Question Test 2 - Jan 2022Document9 pagesMaf603-Question Test 2 - Jan 2022Zoe McKenzieNo ratings yet

- Mind Map Seni Sem 1Document12 pagesMind Map Seni Sem 1Ariff AzizNo ratings yet

- A Review of Islamic Management and Conventional ManagementDocument3 pagesA Review of Islamic Management and Conventional ManagementZoe McKenzieNo ratings yet

- GL4102-06-Equivalence and Compound Interest-BaruDocument36 pagesGL4102-06-Equivalence and Compound Interest-BaruVicky Faras Barunson PanggabeanNo ratings yet

- Chapter 01 Overview of Government AccountingDocument7 pagesChapter 01 Overview of Government AccountingMargotte Joy NucumNo ratings yet

- MCQ - BasicDocument22 pagesMCQ - BasicLalitNo ratings yet

- Tutorial Hedge Fund WEEK 12 With SolutionsDocument13 pagesTutorial Hedge Fund WEEK 12 With SolutionsYaonik HimmatramkaNo ratings yet

- Chapter No.1Document41 pagesChapter No.1ffNo ratings yet

- Statement Details: Transaction Date Posting Date Description Debit Credit Posting Amount Posting Currency Auth CodeDocument2 pagesStatement Details: Transaction Date Posting Date Description Debit Credit Posting Amount Posting Currency Auth CodeTarek KareimNo ratings yet

- Kelly Lee WesterlinDocument1 pageKelly Lee WesterlinJim ShortNo ratings yet

- MTH302 All FormulasDocument5 pagesMTH302 All Formulasstudentcare mtnNo ratings yet

- CIMBClicksDocument6 pagesCIMBClicksNurul FalahNo ratings yet

- Doubtful Accounts Expense Using Allowance Method: SolutionDocument2 pagesDoubtful Accounts Expense Using Allowance Method: Solutionmade elleNo ratings yet

- ACH Authorization AgreementDocument2 pagesACH Authorization AgreementAdriana MendozaNo ratings yet

- BSMQ Settlement Funds Declaration FormDocument2 pagesBSMQ Settlement Funds Declaration FormRyanNo ratings yet

- Mudharabah Definition:: Mohd Faris Ikhwan Bin Khalil Mohammad Shafiq Ikmal Bin Nor ShaharimDocument2 pagesMudharabah Definition:: Mohd Faris Ikhwan Bin Khalil Mohammad Shafiq Ikmal Bin Nor ShaharimFareast Ikhwan KhalilNo ratings yet

- Non Performing Assets - Challenges To Public Sector Bank-1Document96 pagesNon Performing Assets - Challenges To Public Sector Bank-1nimittpathak1989No ratings yet

- Statement of Comprehensive Income (SCI) : Fabm IiDocument17 pagesStatement of Comprehensive Income (SCI) : Fabm IiAlyssa Nikki VersozaNo ratings yet

- Portfolio PerformanceDocument30 pagesPortfolio PerformanceSiddhant AggarwalNo ratings yet

- NAVDocument27 pagesNAVSai PrintersNo ratings yet

- Purchasing Process Exercise 3.1, 3.2 & 3.3Document3 pagesPurchasing Process Exercise 3.1, 3.2 & 3.3Kathlyn TajadaNo ratings yet

- An Investigation of Various Interest Rate Models and Their Calibration in The South African MarketDocument221 pagesAn Investigation of Various Interest Rate Models and Their Calibration in The South African Market_oooo_No ratings yet

- Week 6-7 Let's Analyze Acc213Document5 pagesWeek 6-7 Let's Analyze Acc213Swetzi CzeshNo ratings yet

- Asset For A Period of Time in Exchange For Consideration (IFRS #16)Document6 pagesAsset For A Period of Time in Exchange For Consideration (IFRS #16)Its meh SushiNo ratings yet

- CH03 Mish11 EMBFMDocument20 pagesCH03 Mish11 EMBFMARIANNE MICOLE KUANo ratings yet

- Metro Bank PLC ArticleDocument2 pagesMetro Bank PLC ArticleDave LiNo ratings yet

- Chapter Exam - Partnership Operations - 2Document13 pagesChapter Exam - Partnership Operations - 2NarikoNo ratings yet

- Internship Report On PRABHU BankDocument28 pagesInternship Report On PRABHU BankSuraj BhattNo ratings yet

- Minutes of Session MeetingDocument8 pagesMinutes of Session Meetingjohn jamonNo ratings yet

- What Is KitingDocument8 pagesWhat Is KitingWawex DavisNo ratings yet

- Self - Declaration: Anjali Tiwari Mba, I Year ID: (MBMBA19270)Document6 pagesSelf - Declaration: Anjali Tiwari Mba, I Year ID: (MBMBA19270)Anjali TiwariNo ratings yet

- Insurable InterestDocument6 pagesInsurable InterestShash BernardezNo ratings yet

- 04082020185610gubc0l8kevafd56qs2 Estatement 072020 309Document5 pages04082020185610gubc0l8kevafd56qs2 Estatement 072020 309Ankur ChauhanNo ratings yet