Professional Documents

Culture Documents

CFAS Notes Chapter 2 Objectives

Uploaded by

Khey Khey0 ratings0% found this document useful (0 votes)

156 views5 pages1. The objective of financial reporting is to provide useful financial information to existing and potential investors, lenders, and other creditors for decision making.

2. The conceptual framework provides the foundation for accounting standards and guides standard setters, preparers, and users in preparing and presenting financial statements.

3. The conceptual framework covers topics like the objective of financial reporting, qualitative characteristics of useful information, elements of financial statements, and recognition and measurement concepts.

Original Description:

CFAS

Original Title

Conceptual Framework and Accounting Standards - Chapter 2 - Notes.docx

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The objective of financial reporting is to provide useful financial information to existing and potential investors, lenders, and other creditors for decision making.

2. The conceptual framework provides the foundation for accounting standards and guides standard setters, preparers, and users in preparing and presenting financial statements.

3. The conceptual framework covers topics like the objective of financial reporting, qualitative characteristics of useful information, elements of financial statements, and recognition and measurement concepts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

156 views5 pagesCFAS Notes Chapter 2 Objectives

Uploaded by

Khey Khey1. The objective of financial reporting is to provide useful financial information to existing and potential investors, lenders, and other creditors for decision making.

2. The conceptual framework provides the foundation for accounting standards and guides standard setters, preparers, and users in preparing and presenting financial statements.

3. The conceptual framework covers topics like the objective of financial reporting, qualitative characteristics of useful information, elements of financial statements, and recognition and measurement concepts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

CFAS – Notes – Chapter 2 capital and the people to whom they have

entrusted their money

(Valix-Peralta, 2022 Edition) c. Contribute to economic efficiency by

helping investors identify opportunities

CONCEPTUAL FRAMEWORK

and risks across the world.

Objective of financial reporting

Purposes of Revised Conceptual Framework

CONCEPTUAL FRAMEWORK

a. To assist the IASB to develop IFRS

⮚ Conceptual Framework for Financial Standards based on consistent concepts.

Reporting – complete, comprehensive b. To assist preparers of financial statements

and single document promulgated by the to develop consistent accounting policy

IASB. when no Standard applies to a particular

⮚ Conceptual Framework transaction or other event or where an

- summary of the terms and concepts issue is not yet addressed by an IFRS.

that underlie the preparation and c. To assist preparers of financial statements

presentation of financial statements to develop accounting policy when a

for external users. Standard allows a choice of an accounting

- describes the concepts for general policy

purpose financial reporting d. To assist all parties to understand and

- an attempt to provide an overall interpret the IFRS Standards

theoretical foundation for

accounting.

- intended to guide standard setters, Authoritative status of Conceptual

preparers and users of financial Framework

information in the preparation and

⮚ Standard or interpretation overrides the

presentation of statements

Conceptual Framework.

- underlying theory for the

⮚ In the absence of a standard or an

development of accounting standards

interpretation that specifically applies to

and revision of previously issued

a transaction, management shall consider

accounting standards

the applicability of the Conceptual

- will be used in future standard

Framework in developing and applying

setting decision but no changes are

an accounting policy that results in

made to the current IFRS.

information that is relevant and

The Conceptual Framework provides the reliable.

foundation for standards that: ⮚ Conceptual Framework is not an IFRS.

⮚ Nothing in the Conceptual Framework

a. Contribute to transparency by

overrides any specific IFRS.

enhancing international comparability

⮚ In case of conflict, IFRS shall prevail over

and quality of financial information.

the Conceptual Framework.

b. Strengthen accountability by reducing

information gap between the providers of

Users of financial information 1. Employees

⮚ Interested in information about the

a. Primary users – existing and potential

stability and profitability of the entity.

investors, lenders and other creditors

⮚ Interested in information which enables

b. Other users – employees, customers,

them to assess the ability of the entity to

governments and their agencies, and the

provide remuneration, retirement

public

benefits and employment opportunities

2. Customers

⮚ Have an interest in information about the

Primary users

continuance of an entity especially when

⮚ Parties whom general purpose financial they have a long-term involvement with

reports are primarily directed. or are dependent on the entity

⮚ They cannot require reporting entities to 3. Governments and their agencies

provide information directly to them and ⮚ Interested in the allocation of resources

therefore must rely on general purpose and therefore the activities of the entity.

financial reports for how much of ⮚ Require information to regulate the

financial information is needed. activities of the entity, determine taxation

policies and as a basis for national income

and similar statistics

1. Existing and potential investors 4. Public

⮚ Concerned with the risk inherent in ⮚ Entities affect members of the public in a

and return provided by their variety of ways.

investments ⮚ Financial statements may assist the public

2. Lenders and other creditors by providing information about the trend

⮚ Are interested in information which and the range of its activities

enables them to determine whether

their loans, interest thereon and other

amounts owing to them will be paid Scope of Revised Conceptual Framework

when due

1. Objective of financial reporting

2. Qualitative characteristics of useful financial

information

Other Users 3. Financial statements and reporting entity

⮚ Users of financial information other 4. Elements of financial statements

than the existing and potential 5. Recognition and derecognition

investors, lenders and other creditors 6. Measurement

⮚ Parties that may find the general 7. Presentation and disclosure

purpose financial reports useful but 8. Concepts of capital and capital maintenance

the reports are not directed to them

primarily

OBJECTIVE OF FINANCIAL REPORTING ⮚ Management need not rely on general

purpose financial reports because it is

⮚ The overall objective of financial

able to obtain or access additional

reporting is to provide financial

financial information internally.

information about the reporting entity

that is useful to existing and potential

investors, lenders and other creditors

Specific objectives of financial reporting

in making decisions about providing

resources to the entity. ⮚ Overall objective: provide information

⮚ The “why”, purpose or goal of accounting useful for decision making.

⮚ Financial reporting is the provision of

financial information about an entity

to external users that is useful to them Specific objectives of financial reporting:

in making economic decisions and for

assessing the effectiveness of the a. To provide information useful in making

entity’s management. decisions about providing resources to the

⮚ Annual financial statements – principal entity.

way of providing financial information to b. To provide information useful in assessing

external users the cash flow prospects of the entity.

⮚ Financial reporting also encompasses c. To provide information about entity

other information such as financial resources, claims and changes in

highlights, summary of important resources and claims.

financial figures, analysis of financial

statements and significant ratios.

⮚ Financial reports also include Economic decisions

nonfinancial information such as ⮚ Existing and potential investors need

description of major products and a general purpose financial reports in order

listing of corporate officers and directors to enable them in making decisions

whether to buy, sell or hold equity

investments.

Target users ⮚ Existing and potential lenders and

⮚ Financial reporting is directed primarily other creditors need general purpose

to the primary user group. financial reports in order to enable them

⮚ Primary users have the most critical and in making decisions whether to provide

immediate need for information in or settle loans and other forms of credit.

financial reports.

⮚ Primary users provide resources to the

entity. Assessing cash flow prospects

⮚ Information that meets the needs of ⮚ Decisions by existing and potential

the specified primary users is likely to investors about buying, selling or holding

meet the needs of other users equity instruments depend on the

returns that they expect from an users to predict how future cash flows

investment for example, dividends. will be distributed among those with a

⮚ Decisions by existing and potential claim against the reporting entity.

lenders and other creditors about

Changes in economic resources and claims

providing or settling loans and other

forms of credit depend on the principal ⮚ General purpose financial reports provide

and interest payments or other returns information about the effects of

that they expect. transactions and other events that change

⮚ Financial reporting – should provide the economic resources and claims.

information useful in assessing the ⮚ Result from financial performance and

amount, timing and uncertainty of from other events or transactions, such as

prospects for future net cash inflows to issuing debt or equity instruments.

the entity. ⮚ The financial performance of an entity

comprises revenue, expenses and net

income or loss for a period of time.

Economic resources and claims ⮚ Financial performance is the level of

income earned by the entity through the

⮚ General purpose financial reports provide

efficient and effective use of its resources.

information about the financial position

⮚ Financial performance is the results of

of a reporting entity.

operations and is portrayed in the

⮚ Financial position – information about

income statement and statement of

the entity’s economic resources and the

comprehensive income.

claims against the reporting entity.

⮚ Financial position comprises the assets,

liabilities and equity of an entity at a

Usefulness of financial performance

particular moment in time.

⮚ Information about the nature and ⮚ Information about financial performance

amounts of an entity’s economic helps users to understand the return that

resources and claims can help users the entity has produced on the economic

identify the entity’s financial strength and resources.

weakness. ⮚ Information about the return provides an

⮚ Information about financial position can indication of how well management has

help users to assess the entity’s liquidity, discharged its responsibilities to make

solvency and the need for additional efficient and effective use of the entity’s

financing. economic resources.

⮚ Liquidity is the availability of cash in ⮚ Information about past financial

the near future to cover currently performance is usually helpful in

maturing obligations. predicting the future returns on the

⮚ Solvency is the availability of cash over entity’s economic resources.

a long term to meet financial ⮚ Information about financial performance

commitments when they fall due. during a period is useful in assessing the

⮚ Information about priorities and payment entity’s ability to generate future cash

requirements of existing claims can help inflows from operations.

Accrual accounting d. To a large extent, general purpose financial

reports are based on estimate and judgment

⮚ An entity’s financial performance must be

rather than exact depiction.

measured using the accrual basis of

accounting.

⮚ Depicts the effects of transactions and

Management stewardship

other events and circumstances on an

entity’s economic resources and claims in ⮚ Information about how efficiently and

the periods in which those effects occur effectively management has discharged

even if the resulting cash receipts and its responsibility to use the entity’s

payments occur in a different period. economic resources helps users to assess

⮚ Effects of transactions and other events management stewardship of those

are recognized when they occur and not resources.

as cash is received or paid. ⮚ Information is useful for predicting how

⮚ Income is recognized when earned management will use the entity’s

regardless of when received and economic resources in future periods.

expense is recognized when incurred ⮚ Information can be useful for assessing

regardless of when paid. the entity’s prospects for future net cash

⮚ Provides a better basis for assessing past flows.

and future performance than information

For example, management can decide not to

solely about cash receipts and payments

dispose or sell investments when prices are

during a period.

declining in order to avoid realized losses.

Limitations of financial reporting

a. General purpose financial reports do not and

cannot provide all of the information that

primary users need.

Primary users need to consider pertinent

information from other resources, for example,

general economic conditions, political events and

industry outlook.

b. General purpose financial reports are not

designed to show the value of an entity but

the reports provide information to help the

primary users estimate the value of the

entity.

c. General purpose financial reports are

intended to provide common information to

users and cannot accommodate every request

for information.

You might also like

- Chapter 2 Accounting 300 Exam ReviewDocument2 pagesChapter 2 Accounting 300 Exam Reviewagm25No ratings yet

- Quiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsDocument3 pagesQuiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsPaula BautistaNo ratings yet

- Repealed PD 692 Known As Revised Accountancy LawDocument8 pagesRepealed PD 692 Known As Revised Accountancy LawLian RamirezNo ratings yet

- Chapter 5 (Estimation of Doubtful Accounts)Document8 pagesChapter 5 (Estimation of Doubtful Accounts)Joan LeonorNo ratings yet

- Guabna Aldyn Bookkeeping TransactionsDocument40 pagesGuabna Aldyn Bookkeeping TransactionsSHIENNA MAE ALVIS100% (1)

- Accounting Part 2: Problem SolvingDocument10 pagesAccounting Part 2: Problem Solvingnd555No ratings yet

- Current Net Receivables December 2015 Total SEODocument1 pageCurrent Net Receivables December 2015 Total SEOpompomNo ratings yet

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocument12 pagesSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionChristine Jean MajestradoNo ratings yet

- Balance SheetDocument18 pagesBalance SheetAndriaNo ratings yet

- BFAR Qualifying Exam ReviewerDocument18 pagesBFAR Qualifying Exam ReviewerHappy MagdangalNo ratings yet

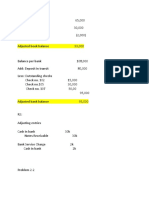

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFEunjina MoNo ratings yet

- Problem 1 ReqDocument5 pagesProblem 1 ReqAgent348No ratings yet

- Chapter 7Document18 pagesChapter 7Raven Vargas DayritNo ratings yet

- Assignment and Quiz 2 Accounting For CashDocument5 pagesAssignment and Quiz 2 Accounting For CashGab BautroNo ratings yet

- Chapter 4 - Accounts ReceivableDocument2 pagesChapter 4 - Accounts ReceivableJerome_JadeNo ratings yet

- Chapter4 IA Midterm BuenaventuraDocument10 pagesChapter4 IA Midterm BuenaventuraAnonnNo ratings yet

- Prob 3Document3 pagesProb 3jikee11No ratings yet

- Midterm Exam Parcor 2020Document1 pageMidterm Exam Parcor 2020John Alfred CastinoNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- CFAS Sample ProblemsDocument5 pagesCFAS Sample ProblemsChristian MartinNo ratings yet

- Final Instruction ACC 111 Competency Assessment 3Document3 pagesFinal Instruction ACC 111 Competency Assessment 3Jennylyn Angela PatarataNo ratings yet

- 03 Cash and Cash Equivalents (Student)Document27 pages03 Cash and Cash Equivalents (Student)Christina Dulay50% (2)

- JD Repair ShopDocument10 pagesJD Repair ShopMYDMIOSYL ALABE100% (1)

- GUINTO - Activity 1 - Loans and Impairment ReceivableDocument4 pagesGUINTO - Activity 1 - Loans and Impairment ReceivableGUINTO, DAN FRANCIS B.No ratings yet

- Exam Questionaire in IntermediateDocument5 pagesExam Questionaire in IntermediateJester IlaganNo ratings yet

- 2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingDocument9 pages2.1 Assessment Test 2.2: Receivables Prelim Exam Intermediate AccountingWinoah HubaldeNo ratings yet

- Inventories (PROBLEM 10-6) : Allyna Rose V. Ojera BSA-2ADocument18 pagesInventories (PROBLEM 10-6) : Allyna Rose V. Ojera BSA-2AOJERA, Allyna Rose V. BSA-1BNo ratings yet

- IAcctg1 Accounts Receivable ActivitiesDocument10 pagesIAcctg1 Accounts Receivable ActivitiesYulrir Alesteyr HiroshiNo ratings yet

- Prefinal Review AcfarDocument8 pagesPrefinal Review AcfarBugoy CabasanNo ratings yet

- Acct-111e - Quiz CompDocument18 pagesAcct-111e - Quiz CompJap Keren LirazanNo ratings yet

- AFAR001 PartnershipDocument11 pagesAFAR001 PartnershipLen Charisse SiocoNo ratings yet

- Sam and Neneng capital contribution and profit sharing calculationsDocument19 pagesSam and Neneng capital contribution and profit sharing calculationsJasmine ActaNo ratings yet

- Chapter6 Matematika BusinessDocument17 pagesChapter6 Matematika BusinessKarlina DewiNo ratings yet

- Las 6Document4 pagesLas 6Venus Abarico Banque-AbenionNo ratings yet

- Accounting For Special TransactionsDocument13 pagesAccounting For Special Transactionsviva nazarenoNo ratings yet

- Problem 2 8Document6 pagesProblem 2 8Carl Jaime Dela CruzNo ratings yet

- IA Activity 1Document13 pagesIA Activity 1Sunghoon SsiNo ratings yet

- ACCBP100 - ULOcdefg Lets Check ActivityDocument2 pagesACCBP100 - ULOcdefg Lets Check ActivityWennonah Vallerie LabeNo ratings yet

- Estimated Value of Merchandise Destroyed by FloodDocument2 pagesEstimated Value of Merchandise Destroyed by FloodLoli WalkerNo ratings yet

- 7 3 BuenaventuraDocument2 pages7 3 BuenaventuraAnonnNo ratings yet

- IntAcc-1 Accounting For ReceivablesDocument13 pagesIntAcc-1 Accounting For ReceivablesShekainah BNo ratings yet

- Vallix QuestionnairesDocument14 pagesVallix QuestionnairesKathleen LucasNo ratings yet

- Accounts Receivable: QuizDocument4 pagesAccounts Receivable: QuizRisa Castillo MiguelNo ratings yet

- CFAS - Chapter 7: Multiple ChoiceDocument1 pageCFAS - Chapter 7: Multiple Choiceagm25No ratings yet

- Bank ReconciliationDocument6 pagesBank Reconciliationclarisse jaramillaNo ratings yet

- SEO-optimized title for accounting exam review documentDocument8 pagesSEO-optimized title for accounting exam review documentWennonah Vallerie LabeNo ratings yet

- Receivables and Allowance for Doubtful Accounts ProblemsDocument3 pagesReceivables and Allowance for Doubtful Accounts ProblemsAdyangNo ratings yet

- Ia-Chap 4&5 SolutionsDocument18 pagesIa-Chap 4&5 SolutionsRoselyn IgartaNo ratings yet

- MachineryDocument4 pagesMachineryDianna DayawonNo ratings yet

- Bank Recon and PCFDocument2 pagesBank Recon and PCFAiza Ordoño0% (1)

- ACC 111 Answer KeyDocument7 pagesACC 111 Answer KeyMAXINE CLAIRE CUTINGNo ratings yet

- CFAS: Chapter 5 & 6Document47 pagesCFAS: Chapter 5 & 6gelgelai29No ratings yet

- CFASDocument61 pagesCFASPrinces Jamela G. AgraNo ratings yet

- Accounts ReceivableDocument34 pagesAccounts ReceivableRose Aubrey A Cordova100% (1)

- Quiz 2 Cost AccountingDocument1 pageQuiz 2 Cost AccountingRocel DomingoNo ratings yet

- Understanding Financial InstrumentsDocument11 pagesUnderstanding Financial InstrumentsMaria G. BernardinoNo ratings yet

- PARCORDocument5 pagesPARCORjelai anselmoNo ratings yet

- Conceptual FrameworkDocument11 pagesConceptual FrameworkAshianna KimNo ratings yet

- FAR 001 Conceptual FrameworkDocument4 pagesFAR 001 Conceptual FrameworkdreianyanmaraNo ratings yet

- Conceptual Framework and Accounting Standards - Chapter 1 - NotesDocument7 pagesConceptual Framework and Accounting Standards - Chapter 1 - NotesKhey KheyNo ratings yet

- Conceptual Framework and Accounting Standards - Chapter 4 - NotesDocument4 pagesConceptual Framework and Accounting Standards - Chapter 4 - NotesKhey KheyNo ratings yet

- Conceptual Framework and Accounting Standards - Chapter 5 - NotesDocument4 pagesConceptual Framework and Accounting Standards - Chapter 5 - NotesKhey KheyNo ratings yet

- Conceptual Framework and Accounting Standards - Chapter 3 - NotesDocument7 pagesConceptual Framework and Accounting Standards - Chapter 3 - NotesKhey KheyNo ratings yet

- PROCESS COSTING REPORTDocument3 pagesPROCESS COSTING REPORTMita PutryanaNo ratings yet

- Ubs Equity Style Investing Growth On SaleDocument10 pagesUbs Equity Style Investing Growth On SaleSusan LaskoNo ratings yet

- CACIB - Research FAST FX Fair Value ModelDocument5 pagesCACIB - Research FAST FX Fair Value ModelforexNo ratings yet

- Australia and New Zealand Banking Group Limited 6.736 Dated 17 Mar 23Document12 pagesAustralia and New Zealand Banking Group Limited 6.736 Dated 17 Mar 23Mister MisterNo ratings yet

- 9MFY18 MylanDocument94 pages9MFY18 MylanRahul GautamNo ratings yet

- Len Company acquires 80% of Lyn Company stock and consolidates financialsDocument14 pagesLen Company acquires 80% of Lyn Company stock and consolidates financialsMerliza JusayanNo ratings yet

- Troso Beauty Salon SampleDocument96 pagesTroso Beauty Salon SampleayeerahcaliNo ratings yet

- f2 AnswersDocument68 pagesf2 AnswersKeotshepile Esrom MputleNo ratings yet

- Hands On Exercise No 2Document4 pagesHands On Exercise No 2HomeoDr Babar AminNo ratings yet

- Buscom Summary NotesDocument14 pagesBuscom Summary Notesaaaaa aaaaaNo ratings yet

- Chapter 8Document3 pagesChapter 8kish MishNo ratings yet

- Capital - Table Excel TemplateDocument5 pagesCapital - Table Excel TemplateGolamMostafaNo ratings yet

- Momentum Investing, An Underused Investment Style. Oct. 2014Document16 pagesMomentum Investing, An Underused Investment Style. Oct. 2014Pierluigi GandolfiNo ratings yet

- Magic Current Affairs - Weekly Current Affairs from 09/01/22 to 15/01/22Document38 pagesMagic Current Affairs - Weekly Current Affairs from 09/01/22 to 15/01/22Kamlesh SuthariyaNo ratings yet

- Ninepoint Alternative Income: Product ComparisonDocument3 pagesNinepoint Alternative Income: Product ComparisonleminhptnkNo ratings yet

- Swap Discounting and OIS CurveDocument6 pagesSwap Discounting and OIS Curvelycancapital100% (2)

- Assignment 1 (Profit Sales-Revenue Maximization)Document2 pagesAssignment 1 (Profit Sales-Revenue Maximization)ayushsapkota907No ratings yet

- Byco Petroleum Pakistan LTD Income Statement: Period Ending: 2019Document22 pagesByco Petroleum Pakistan LTD Income Statement: Period Ending: 2019mohammad bilalNo ratings yet

- Dispute Results 3Document20 pagesDispute Results 3Melvin CandelariaNo ratings yet

- Instant Download Ebook PDF Fundamentals of Corporate Finance 5th Canadian Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Fundamentals of Corporate Finance 5th Canadian Edition PDF Scribdlauryn.corbett387100% (42)

- BlueMar Capital Monthly Snapshot - Mar 2020Document1 pageBlueMar Capital Monthly Snapshot - Mar 2020YehoNo ratings yet

- PT Hero Supermarket TBK.: Summary of Financial StatementDocument2 pagesPT Hero Supermarket TBK.: Summary of Financial StatementMaradewiNo ratings yet

- Top 10 Chart Patterns for Technical Analysis TradersDocument8 pagesTop 10 Chart Patterns for Technical Analysis TradersP.sai.prathyusha100% (2)

- Capital BudgetingDocument6 pagesCapital BudgetingkipovoNo ratings yet

- Joint arrangement profit calculation and settlementDocument3 pagesJoint arrangement profit calculation and settlementMaurice AgbayaniNo ratings yet

- Perrt 8 Debt InvestmentDocument2 pagesPerrt 8 Debt InvestmentVidya IntaniNo ratings yet

- Z 15030000120164005 CH 06Document48 pagesZ 15030000120164005 CH 06Hanna GabriellaNo ratings yet

- Sessions 5 and 6Document69 pagesSessions 5 and 6Priyansh SinghNo ratings yet

- 1 Income From PGBPDocument12 pages1 Income From PGBPAllaretrashNo ratings yet

- IAS 20 Accounting for Government GrantsDocument44 pagesIAS 20 Accounting for Government Grantsontykerls100% (1)