Professional Documents

Culture Documents

Untitled

Untitled

Uploaded by

SUJIT SINGH0 ratings0% found this document useful (0 votes)

6 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesUntitled

Untitled

Uploaded by

SUJIT SINGHCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

SHAH HOSPITALITY

Balance Sheet

as at March 31, 2022

(Al amounts in unless otherwise stated)

Particulars Asat Particulars Asat

March 31, 2022 March 31, 2022

LIABILITIES ASSETS,

Proprietor's Capital Account Fixed Assets

Suraj Kumar 4/621,122.34 _As pe annexure 89,766.00

Unsecured Loan Investment

IMD Electricals '360,002.00_ Nippon Mutual Fund 2,000.00,

‘Ansul Kumar 100,600.00)

‘Shiv Kumar '96,000.00

Current Assets

‘Current Liabilities Bank Balance 186,270.16

Expenses Payable ‘Cashrin-Hand 21,205.28

Electricity Expense Payable 35,888.69 _ Trade Receivables 3,513,433.00

‘Audit Fees Payable 27,500.00 TDS 69,303.00

‘Accounting Charges Payable 24,000.00 _ GST Input 292,982.59

‘Salary Payable 124,468.00__Loan & Advances

Legal Charges Payable 39,500.00 __ Rent Security-Miriva 1,200,000.00,

Housekeeping Charges Payable 193,200.00 O¥O Wallet 10,442.00

Car Booking-Shiv Durga Auto 21,000.00

Others 265,281.00

TOTAL TOTAL 5,671,681.03

This isthe Balance Sheet referred to in our report

1U/s-44A6 of the Income Tax Act, 1962,

For SKMR AND ASSOCIATES. For Shah Hospitality

(Chartered Accountants)

Reg. No.: 0024931N ‘

(CA KAPIL JAIN) Suraj Kumar

Partner Proprietor

M.No.: 524024

Pace: New Delhi

Date: 04.10.2022

voIN:

Trading, Profit and Loss Account

for the year ended March 31, 2022

(At amounts in unless omerwie sated)

Particulars For the year ended Particulars For the year ended

March 31, 2022 March 31, 2022

EXPENSES INCOME

To Premises Rent 354,258.00 By Room Revenue 9,845 309.00

To Commission & Others 981,207.90

To Other Expenses 270,453.00

To Complimantry Water 72,718.06

"To Gras Prof 164,652.04

sepa season ce

Te Accounting Charges 144,000.00 By Gross Profit 4.168 692.08

To Aust Fees 15,000.00

To Bank Charges 17,297.12

To Business Promotion 136,762.00

"To Conveyance 61,684.00

“Te Depreciation 9,299.00

To electricity Bl 972,512.52

To Entertainment Expenses 104,798.00

To Festival Celebration 47,890.00,

To cst 35.68

Te GST Late Fass 70,120.00

To Housekeeping Charges 793,200.00

To Laundry expenses: 262,368.00

“To Legal & Professional 24,000.00.

To Misclenious Expenses 81,746.20

“To Newspaper & Magzine: 12,864.00

To Painting & Stationery 14,456.00

To Repairs & Maintenance 134,897.40.

To Rounded OM 3.04

To Salary 7,252,050.00

To Stat Welfare 72,465.00

“To Telephone and Internet 20,108.00,

To Net Profit ex7iaoaz

Tora ries sa2.08- “ToTAL H169,652.04

“hss te Trading, Profi and Lass refered to in eur report

Us 4448 of he Income Tax Act, 1961

For SKIR AND ASSOCIATES

(Chartered Accountants)

Reg. No: 00249310

(Asean)

to.: s24024

ace: New Deli

Date: 04.10.2022

vow:

For shah Hospitality

pure

‘Suraj Kumar

Propeietor

voyouidoig

seuny fens,

rot

Aayedson weus 204

008768 wees 0090'S = OowST EZ OOSTE RE

TWwior

3ST 00

‘00E92'SE * ounpew BuIUseEM

‘%ST (O08: ‘00°00S'2z =“ cs INIA

‘00°990'8T ‘%®ST — 00°S9P'T ‘o0'res’€ = Aan

FOrSOTE ayy gag suassvon0Te ygIMS,, mvs. was“ auouse =‘ TZ0R'vOT0 wowaniosaa

notsraav

4OV XVL AWOONI Yad SV ZZ07'E0"TE LV SV SLASSV G3XI4 4O 31NGaHOS

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Yes Bank 1 1 March 2023 To 4 April 2023Document4 pagesYes Bank 1 1 March 2023 To 4 April 2023SUJIT SINGHNo ratings yet

- 01 Apr 2023 - 05 Apr 2023Document2 pages01 Apr 2023 - 05 Apr 2023SUJIT SINGHNo ratings yet

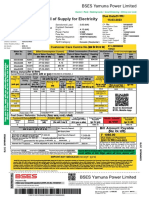

- Bill of Supply For Electricity: BSES Yamuna Power LimitedDocument2 pagesBill of Supply For Electricity: BSES Yamuna Power LimitedSUJIT SINGHNo ratings yet

- Resume: Company: India Bulls Financial Services LTDDocument3 pagesResume: Company: India Bulls Financial Services LTDSUJIT SINGHNo ratings yet

- Career Objective: Address: - Bahlolpur Krishna Colony Sec-65 Noida UP-201301Document2 pagesCareer Objective: Address: - Bahlolpur Krishna Colony Sec-65 Noida UP-201301SUJIT SINGHNo ratings yet

- Manish Aggarwal Residental Electricity Bill-1-2Document2 pagesManish Aggarwal Residental Electricity Bill-1-2SUJIT SINGH0% (1)

- Acct Statement - XX8372 - 30032023Document4 pagesAcct Statement - XX8372 - 30032023SUJIT SINGHNo ratings yet