Professional Documents

Culture Documents

Untitled

Uploaded by

betty KemOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

betty KemCopyright:

Available Formats

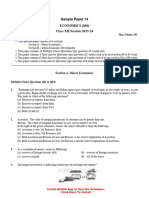

MERU UNIVERSITY OF SCIENCE AND TECHNOLOGY

P.O. Box 972-60200 – Meru-Kenya.

Tel: +254 (0)799529958, +254 (0)799529959, +254 (0)712524293

Website: www.must.ac.ke Email: info@must.ac.ke

University Examinations 2019/2020

FOURTH YEAR, FIRST SEMESTER EXAMINATION FOR THE DEGREE OF BACHELOR

OF COMMERCE

BFC 3430 – PENSION FINANCE

DATE: OCTOBER 2020 TIME: 2 HOURS

INSTRUCTIONS: Answer question one and any other two questions.

QUESTION ONE (30 MARKS)

a) Describe the roles of each of the following parties who may be involved in the provision

of pensions in Kenya.

(i) Employers (3 Marks)

(ii) The regulator ( 3 Marks)

(iii) Trustees (3 Marks)

(iv) Fund manager (3 Marks)

b) Explain the difference between Defined Benefit Scheme and Defined Contribution

scheme. (8 Marks)

c) Discuss three challenges of expanding pension coverage in Kenya. (6 Marks)

d) Explain the two fundamental tenets of the new legislation for pension system in Kenya.

(4 Marks)

QUESTION TWO(20 MARKS)

a) Mr. Muriungi works as a Human Resource Manager in Kenya Railways on a permanent

and pensionable basis. The following were his employment details for the month of

December 2015;

Meru University of Science & Technology is ISO 9001:2015 Certified

Foundation of Innovations Page 1

• He was paid basic salary of sh. 90,000 , house allowance of sh. 30,000 and

commuter allowance of sh. 12,000. He contributed five per cent of his basic salary

to pension scheme and the employer contributed ten per cent. He lives in Nairobi

and is married with two children.

• He had a life assurance policy with ICEA Lions Insurance for which he

contributed sh. 5,000.

• He had mortgage loan from Savings and Loan (National Bank) which he took for

purchase of residential property on which he repaid sh.20,160. The repayment was

inclusive of interest of sh. 10,000.

• Other statutory deduction : NHIF sh. 1,700

Required:

Prepare a well laid out statement (pay-slip) showing Mr. Muriungi’s net pay for the month of

December 2015.

(i) Assuming that the pension scheme is registered

(ii) Assuming that the pension scheme is not registered

RATES OF TAX

Monthly taxable pay(shillings) Rate of tax % in each shilling

1 - 10,164 10%

10,165 - 19,740 15%

19,741 - 29,316 20%

29,317 - 38,892 25%

Excess/over - 38,892 30%

Personal relief Kshs. 1,162 per month

Insurance Relief 15% of the contribution (10 Marks)

Meru University of Science & Technology is ISO 9001:2015 Certified

Foundation of Innovations Page 2

b) Briefly explain the following laws in Kenya that provide for social security:

(i) National Hospital Insurance Fund (5 Marks)

(ii) Retirement Benefit Authority Act (5 Marks)

QUESTION THREE (20 MARKS)

a) Discuss various categories of financial risks faced by a pension scheme. (12 Marks)

b) List and explain the benefits provided under National Social Security Fund Act2013

payable under both pension and provident fund. (8 Marks)

QUESTION FOUR (20 MARKS)

a) The current retirement benefits system in Kenya can be classified into four scheme types;

(i) List the four scheme types (4 Marks)

(ii) Discuss the scheme types in terms of their establishment, coverage, funding and

regulation. (6 Marks)

b) Despite numerous advantages of using corporate trustees, over 90% of Pension Schemes

in Kenya use individual trustees.

Required:

Explain ;

(i) The advantages of using individual trustee (5 Marks)

(ii) The disadvantages of using corporate trustee (5 Marks)

QUESTION FIVE (20 MARKS)

Old age is emerging as a global phenomenon. Number of persons who are old worldwide is

estimated to be around 800 million today. This aging population is posing insurmountable

challenges both for the developed as well as developing countries such as Kenya.

Required:

a) Explain five problems associated with old age in Kenya (10 Marks)

b) Explain five solutions to old age problems. (10 Marks)

Meru University of Science & Technology is ISO 9001:2015 Certified

Foundation of Innovations Page 3

You might also like

- BUCU004 Entreprenuership Lecture Notes From Mount Kenya University BUCU004 Entreprenuership Lecture Notes From Mount Kenya UniversityDocument149 pagesBUCU004 Entreprenuership Lecture Notes From Mount Kenya University BUCU004 Entreprenuership Lecture Notes From Mount Kenya Universitybetty KemNo ratings yet

- Me Assignment 1 Bbce3013Document8 pagesMe Assignment 1 Bbce3013Murugan RS100% (1)

- Bright Day School, Vadodara CBSE Unit - Vasna Academic Year: 2021 - 22 Term Test - I Subject: Economics (030) Date: 18/09/2021 STD: XII Time: 3 Hours Marks: 80Document4 pagesBright Day School, Vadodara CBSE Unit - Vasna Academic Year: 2021 - 22 Term Test - I Subject: Economics (030) Date: 18/09/2021 STD: XII Time: 3 Hours Marks: 80ADITYA SINGHNo ratings yet

- Microsoft Word Sta 2190 Introduction To Actuarial ScienceDocument3 pagesMicrosoft Word Sta 2190 Introduction To Actuarial ScienceAnuoluwapo PalmerNo ratings yet

- Upisa Que Uace p220 2 - 042616Document4 pagesUpisa Que Uace p220 2 - 042616kinene richardNo ratings yet

- Pre Board Class Xii Term 2Document5 pagesPre Board Class Xii Term 2NupurNo ratings yet

- Contribution of Life Insurance Sector in The Economy: Presentation by S B Mathur Delhi, Sept. 26th, 2005Document16 pagesContribution of Life Insurance Sector in The Economy: Presentation by S B Mathur Delhi, Sept. 26th, 2005hiten_bhandariNo ratings yet

- SRI JAYEWARDENEPURA EDUCATIONAL ZONE - IIDocument4 pagesSRI JAYEWARDENEPURA EDUCATIONAL ZONE - IIAshley GazeNo ratings yet

- EC Sample Paper 3 UnsolvedDocument8 pagesEC Sample Paper 3 Unsolvedsubasree803No ratings yet

- Fca Psaf Ican Nov 2023 Mock QuestionsDocument7 pagesFca Psaf Ican Nov 2023 Mock QuestionsArogundade kamaldeenNo ratings yet

- SLS 3231 - Financial Services Law - March 2016Document2 pagesSLS 3231 - Financial Services Law - March 2016Brad WafffNo ratings yet

- 0455 - m18 - 2 - 2 - QP IGCSEDocument8 pages0455 - m18 - 2 - 2 - QP IGCSEloveupdownNo ratings yet

- Package 1Document11 pagesPackage 1aNo ratings yet

- Financial Awareness Top 500 QuestionsDocument104 pagesFinancial Awareness Top 500 QuestionsRanjeeth KNo ratings yet

- Departmental Exams Himchal PradeshDocument3 pagesDepartmental Exams Himchal PradeshmadhaniasureshNo ratings yet

- Analytical Review of The Pension System in KenyaDocument34 pagesAnalytical Review of The Pension System in KenyaAndrew TumboNo ratings yet

- XII - Economics - MOCK PAPERDocument7 pagesXII - Economics - MOCK PAPERRiyanshi MauryaNo ratings yet

- Crescent - AuditingDocument2 pagesCrescent - AuditingMuhammad Uzair AbbasiNo ratings yet

- Eco Set B XiiDocument7 pagesEco Set B XiicarefulamitNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument4 pagesInstitute of Actuaries of India: ExaminationsNikhilGuptaNo ratings yet

- BST QP-29072023 - Xi DT 3Document4 pagesBST QP-29072023 - Xi DT 3kartik deshwalNo ratings yet

- Bec 3100 Introduction To EconomicsDocument2 pagesBec 3100 Introduction To EconomicsKelvin MagiriNo ratings yet

- 12 Economics Sp08Document18 pages12 Economics Sp08devilssksokoNo ratings yet

- Byjus Indian EconomyDocument35 pagesByjus Indian EconomyArnav MishraNo ratings yet

- CP12 121 ExamDocument5 pagesCP12 121 Examjohn.lee2022.8No ratings yet

- Cbse Class 12 Economics - PQDocument21 pagesCbse Class 12 Economics - PQMurtaza JamaliNo ratings yet

- ECO-12 CBSE Additional Practice Questions 2023-24Document20 pagesECO-12 CBSE Additional Practice Questions 2023-24Sadjaap SinghNo ratings yet

- Economics PQDocument9 pagesEconomics PQash kathumNo ratings yet

- Subject Title: C2A: Life InsuranceDocument9 pagesSubject Title: C2A: Life InsuranceJeff GundyNo ratings yet

- 12th Eco Rrs QuarterlyDocument6 pages12th Eco Rrs QuarterlyAditya ShrivastavaNo ratings yet

- BFM 3404 Forensic AccountingDocument3 pagesBFM 3404 Forensic AccountingStephen KamauNo ratings yet

- 2014 Ibe 2014Document1 page2014 Ibe 2014Ninad JuyalNo ratings yet

- BBE 3404 Health EconomicsDocument2 pagesBBE 3404 Health EconomicsKelvin MagiriNo ratings yet

- Eco Set A XiiDocument6 pagesEco Set A XiicarefulamitNo ratings yet

- Economics SQP Term2Document4 pagesEconomics SQP Term2Shivam ShuklaNo ratings yet

- Public Sector Accounting & FinanceDocument21 pagesPublic Sector Accounting & Financeappiah ernestNo ratings yet

- Icse 2024 Specimen 631 CSTDocument7 pagesIcse 2024 Specimen 631 CSTShweta SamantNo ratings yet

- KVS Agra XI BST Annual Exam QP & MS 2019Document10 pagesKVS Agra XI BST Annual Exam QP & MS 2019Dhruv KaushikNo ratings yet

- MergedDocument9 pagesMergedJot EkamNo ratings yet

- CBF 311 OdelDocument2 pagesCBF 311 OdelRay RoseNo ratings yet

- HBC 2109 Insurance and Risk ManagementDocument2 pagesHBC 2109 Insurance and Risk Managementcollostero6No ratings yet

- BF PP 2016Document5 pagesBF PP 2016Revatee HurilNo ratings yet

- CorporateS18 PDFDocument30 pagesCorporateS18 PDFMohammad FaisalNo ratings yet

- 12 Economics MS PB-I Dec-2022Document2 pages12 Economics MS PB-I Dec-2022shreyaNo ratings yet

- BSF 4230 - Advanced Portfolio Management - April 2022Document8 pagesBSF 4230 - Advanced Portfolio Management - April 2022Maryam YusufNo ratings yet

- EC Sample Paper 14 UnsolvedDocument7 pagesEC Sample Paper 14 Unsolvedmanjotsingh.000941No ratings yet

- 12 EcofinalDocument4 pages12 EcofinalRubi ChoudharyNo ratings yet

- Indian Economy and Indian Financial SystemDocument32 pagesIndian Economy and Indian Financial SystemgplkumharNo ratings yet

- Eco Mock Test 02 SPCCDocument3 pagesEco Mock Test 02 SPCCsattwikd77No ratings yet

- Ecovisionnaire Must Do QuestionsDocument6 pagesEcovisionnaire Must Do QuestionsAastha VermaNo ratings yet

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) Subject: Economics Class: Xii TIME: 1hr. 30min Max Marks:40Document3 pagesFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) Subject: Economics Class: Xii TIME: 1hr. 30min Max Marks:40fffffNo ratings yet

- Positive Effects Of: GlobalizationDocument9 pagesPositive Effects Of: Globalizationharshul_777880No ratings yet

- Cbleecpu 12Document8 pagesCbleecpu 12Pubg GokrNo ratings yet

- Cambridge Ordinary LevelDocument4 pagesCambridge Ordinary LevelSanjeewani WedamullaNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument4 pagesInstitute of Actuaries of India: ExaminationsNikhilGuptaNo ratings yet

- QP 3Document8 pagesQP 3Varshitha Vardhini PatchaNo ratings yet

- Red Rose School Lambakheda Bhopal First Term Examination, 2019 Class Xii Subject: EconomicsDocument5 pagesRed Rose School Lambakheda Bhopal First Term Examination, 2019 Class Xii Subject: EconomicsAditya ShrivastavaNo ratings yet

- Set 1 Economics Paper 2Document3 pagesSet 1 Economics Paper 2Brone AramsNo ratings yet

- Nonfinancial Defined Contribution Pension Schemes in a Changing Pension World: Volume 1, Progress, Lessons, and ImplementationFrom EverandNonfinancial Defined Contribution Pension Schemes in a Changing Pension World: Volume 1, Progress, Lessons, and ImplementationNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Credit M. AssDocument12 pagesCredit M. Assbetty KemNo ratings yet

- UntitledDocument18 pagesUntitledbetty KemNo ratings yet

- UntitledDocument5 pagesUntitledbetty KemNo ratings yet