Professional Documents

Culture Documents

Unit 14 Retail Banks or Commercial Banks

Uploaded by

リンOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit 14 Retail Banks or Commercial Banks

Uploaded by

リンCopyright:

Available Formats

Unit 14 Retail banks or commercial banks (often called High Street banks in Britain)

receive deposits from, and make loans to, individuals and small companies. Investment

banks work with big companies, giving financial advice, raising capital by issuing stocks

or shares and bonds, arranging mergers and takeover bids, and so on. They also generally

offer stockbroking and portfolio management services to rich corporate and individual

clients. Wealthy individuals can also use private banks, which provide them with banking

and investment services, and hedge funds, which are private investment funds for wealthy

investors (both individuals and institutions) that use a wider variety of (risky) investing

strategies than traditional investment funds, in order to achieve higher returns. In the

USA, where many banks went bankrupt following the Wall Street Crash in 1929, a law

was passed in 1934 (the Glass-Steagall Act) that separated commercial banks and

investment banks or stockbroking firms. For the rest of the 20th century, there were

regulations in the US, Britain and Japan that prevented commercial banks from doing

investment banking business. In other countries, including Germany and Switzerland,

large banks did all kinds of financial business. But starting in the 1980s, many rules were

ended by financial deregulation, and Glass Steagall was repealed in 1999. Large banks

became international conglomerates offering a complete range of financial services that

were previously provided by banks, stockbrokers and insurance companies. Islamic

banks, in Islamic countries and major financial centres, offer interest-free banking. They

do not pay interest to depositors or charge interest to borrowers, but invest in companies

and share the profits (or losses) with their depositors. Some car manufacturers, food

retailers and department stores now offer products like personal loans, credit cards and

insurance. Technically these are not banks but non-bank financial intermediaries

You might also like

- 1 637304139596797833 Stockholders Equity Section AccountingDocument7 pages1 637304139596797833 Stockholders Equity Section AccountingShandaNo ratings yet

- Soal-Soal LatihanDocument5 pagesSoal-Soal LatihanAldoNo ratings yet

- Materi 8 - New - Market - Leader - Elementary - Course - Book-52-63 - CH 6Document12 pagesMateri 8 - New - Market - Leader - Elementary - Course - Book-52-63 - CH 6Immanuel PaternuNo ratings yet

- 2009-10-28 225356 SouthcoastDocument17 pages2009-10-28 225356 Southcoastjas02h1100% (1)

- Fitzgeraldhyne Rappan - A031221038Document2 pagesFitzgeraldhyne Rappan - A031221038Fitzgeraldhyne RappanNo ratings yet

- Surya Toto Indonesia - Lap Keu - 31 - Des - 2018 - ReleasedDocument99 pagesSurya Toto Indonesia - Lap Keu - 31 - Des - 2018 - ReleasedAyu SeptiasariNo ratings yet

- Instructions: Bad Debt Expense Allowance For Doubtful AccountsDocument2 pagesInstructions: Bad Debt Expense Allowance For Doubtful AccountsWisanggeni RatuNo ratings yet

- The Bar Chart Illustrates The Percentage of Businesses in The UK Who Had A Social Media Presence From 2012 To 2016Document2 pagesThe Bar Chart Illustrates The Percentage of Businesses in The UK Who Had A Social Media Presence From 2012 To 2016Alvin NguyễnNo ratings yet

- Chapter 14 SolutionsDocument11 pagesChapter 14 Solutionssalsabilla rpNo ratings yet

- Amira Berdikari - Jurnal Khusus - Hanifah Hilyah SyahDocument10 pagesAmira Berdikari - Jurnal Khusus - Hanifah Hilyah Syahreza hariansyahNo ratings yet

- Chapter 19 Managerial AccountingDocument36 pagesChapter 19 Managerial AccountingTien TienNo ratings yet

- The Respective Normal Account Balances of Sales RevenueDocument12 pagesThe Respective Normal Account Balances of Sales RevenueRBNo ratings yet

- Soal Asistensi AK1 Pertemuan 7Document3 pagesSoal Asistensi AK1 Pertemuan 7Afrizal WildanNo ratings yet

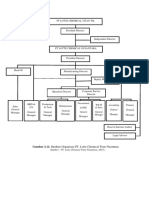

- Diagram Struktur Organisasi PT LotteDocument1 pageDiagram Struktur Organisasi PT LottesabrinaNo ratings yet

- Output: Nama: Shalsa Darma Aulia NPM: C0C019003Document3 pagesOutput: Nama: Shalsa Darma Aulia NPM: C0C019003shalsa darma auliaNo ratings yet

- FIN604 - HW03 - Farhan Zubair - 18164052Document9 pagesFIN604 - HW03 - Farhan Zubair - 18164052ZNo ratings yet

- Tugas InggDocument2 pagesTugas Inggfyou77615No ratings yet

- Ch8 AR Test 9902Document7 pagesCh8 AR Test 9902ايهاب غزالةNo ratings yet

- Latihan 3Document3 pagesLatihan 3Radit Ramdan NopriantoNo ratings yet

- Chapter 15 JawabanDocument24 pagesChapter 15 JawabanDamelinaNo ratings yet

- Bengkalis MuriaDocument10 pagesBengkalis Muriareza hariansyahNo ratings yet

- Long-Term Financial Planning and Growth: Mcgraw-Hill/IrwinDocument25 pagesLong-Term Financial Planning and Growth: Mcgraw-Hill/Irwinkota lainNo ratings yet

- Gamalama Desain - Jurnal Khusus - Hanifah Hilyah SyahDocument3 pagesGamalama Desain - Jurnal Khusus - Hanifah Hilyah Syahreza hariansyahNo ratings yet

- Solution:: Step: 1 of 14: Job Costing, Normal and Actual Costing. Anderson Construction Assembles ResidentialDocument6 pagesSolution:: Step: 1 of 14: Job Costing, Normal and Actual Costing. Anderson Construction Assembles ResidentialHerry SugiantoNo ratings yet

- Assignment 2Document4 pagesAssignment 2Sultan LimitNo ratings yet

- AnswerDocument2 pagesAnswertouya hibikiNo ratings yet

- Tugas CompletingDocument6 pagesTugas CompletingWidad NadiaNo ratings yet

- Pertemuan 14 - Investasi Saham (20% - 50%) PDFDocument17 pagesPertemuan 14 - Investasi Saham (20% - 50%) PDFayu utamiNo ratings yet

- Akdas Brief Dan SelfDocument18 pagesAkdas Brief Dan SelfAwun Sukma100% (1)

- Nordic CompanyDocument6 pagesNordic CompanySally ZansNo ratings yet

- Akuntansi DagangDocument13 pagesAkuntansi DagangAsmarani SiregarNo ratings yet

- Lecture 10 - LiabilitiesDocument50 pagesLecture 10 - LiabilitiesIsyraf Hatim Mohd TamizamNo ratings yet

- MODULE 6 English For Communication IDocument26 pagesMODULE 6 English For Communication IAngga ServiamNo ratings yet

- Kumpulan Latihan IntermediateDocument27 pagesKumpulan Latihan IntermediateRina KusumaNo ratings yet

- 3 March - Group 1Document2 pages3 March - Group 1Lydia limNo ratings yet

- Unit 4 Personal AccountsDocument12 pagesUnit 4 Personal Accountsprisca pebriyaniNo ratings yet

- Cash in Bank Per Books Per Bank: InstructionsDocument9 pagesCash in Bank Per Books Per Bank: InstructionsDetha Prasetio KumaraNo ratings yet

- Alpha Graphics CompanyDocument2 pagesAlpha Graphics CompanyMira FebriasariNo ratings yet

- Financial Management - Quiz 02Document2 pagesFinancial Management - Quiz 02Muhammad AdilNo ratings yet

- On January 1 2010 Kloppenberg Company Had Accounts Receivable PDFDocument1 pageOn January 1 2010 Kloppenberg Company Had Accounts Receivable PDFAnbu jaromiaNo ratings yet

- UNIT 2 (Financial Statements and Ratios) Class DDocument17 pagesUNIT 2 (Financial Statements and Ratios) Class DDinda Yuniar A.No ratings yet

- Assignment Intermediate Financial Accounting I - Rifky Mahendra - 1900012264.Document4 pagesAssignment Intermediate Financial Accounting I - Rifky Mahendra - 1900012264.Rahmat AlamsyahNo ratings yet

- Modul Session 12 Akuntasi FebDocument26 pagesModul Session 12 Akuntasi FebZahraNo ratings yet

- Accounting Problem 5 5ADocument8 pagesAccounting Problem 5 5AParbon Acharjee100% (1)

- Account Titiles Trial Balance Adjustment Adjusted Trial BalanceDocument2 pagesAccount Titiles Trial Balance Adjustment Adjusted Trial BalanceBambang HasmaraningtyasNo ratings yet

- Wey Ifrs 2e CCCDocument19 pagesWey Ifrs 2e CCCAnonymous 1SUDEbgFNo ratings yet

- P4 5BDocument15 pagesP4 5BAngel JNo ratings yet

- Tugas Latihan Chapter 10 Dan 11Document2 pagesTugas Latihan Chapter 10 Dan 11Arnalistan EkaNo ratings yet

- Health CommunicationDocument17 pagesHealth CommunicationshuvoNo ratings yet

- Foundations of Control: Stephen P. Robbins Mary CoulterDocument48 pagesFoundations of Control: Stephen P. Robbins Mary CoulterRatul HasanNo ratings yet

- Worksheet Akuntansi DahliaDocument4 pagesWorksheet Akuntansi DahliaDahliaNo ratings yet

- 1 Intermediate Accounting IFRS 3rd Edition-554-569Document16 pages1 Intermediate Accounting IFRS 3rd Edition-554-569Khofifah SalmahNo ratings yet

- The Statement of Financial Position of Stancia Sa at DecemberDocument1 pageThe Statement of Financial Position of Stancia Sa at DecemberCharlotte100% (1)

- CH 10Document47 pagesCH 10Ismadth2918388100% (1)

- Tugas: English For Accounting (SESSION 12)Document4 pagesTugas: English For Accounting (SESSION 12)Muh Insanul KamilNo ratings yet

- ForumDocument5 pagesForumMariana Hb0% (1)

- Tugas CashFlow - Aura Anggun Permatasari - 21812141027 - A'21Document4 pagesTugas CashFlow - Aura Anggun Permatasari - 21812141027 - A'21Aura Anggun Permatasari auraanggun.2021No ratings yet

- Worksheet Assigned Problem 7-17, 7-35 (Chapter 7)Document4 pagesWorksheet Assigned Problem 7-17, 7-35 (Chapter 7)Vu NguyenNo ratings yet

- Retail Banks or Commercial BankDocument1 pageRetail Banks or Commercial BankNinutsa DolidzeNo ratings yet

- Quiz KTQTDocument15 pagesQuiz KTQTリンNo ratings yet

- Figure 17Document1 pageFigure 17リンNo ratings yet

- Speaking - MidtermDocument8 pagesSpeaking - MidtermリンNo ratings yet

- KTGK CT6Document2 pagesKTGK CT6リンNo ratings yet

- M3 SpeakingDocument1 pageM3 SpeakingリンNo ratings yet