Professional Documents

Culture Documents

Week 67 and 9 Absorption Costing Vs Marginal Costing Costing Method

Uploaded by

Mai LyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 67 and 9 Absorption Costing Vs Marginal Costing Costing Method

Uploaded by

Mai LyCopyright:

Available Formats

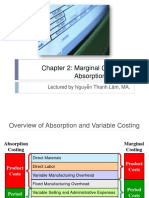

CHAPTER 8: MARGINAL & ABSORPTION COSTING

1. CHAPTER OBJECTIVES

Explain the importance of, and apply, the concept of contribution.[S]

Demonstrate and discuss the effect of absorption and marginal costing on

inventory valuation and profit determination.[S]

Calculate profit or loss under absorption and marginal costing.[S]

Reconcile the profits or losses calculated under absorption and marginal

costing.[S]

Describe the advantages and disadvantages of absorption and marginal

costing.[K]

2. CONTENTS

In this chapter, marginal costing and absorption costing are defined and compared

with each other. In general terms, these two are costing methods that are used to

value inventory and cost of goods sold.

The basic difference between the two methods lies in the way we treat fixed

production overheads. Under marginal costing, fixed production overheads are

treated as period costs. Meanwhile, under absorption costing, fixed production

overheads are allocated into the cost of making each unit of output.

Marginal costing is usually applied in making short-term decisions such as one-off

contracts.

2.1 Marginal Costing and contribution

The word “marginal" in marginal costing comes from Latin margo, which means

"edge, brink, border, margin". This etymology highlights the incremental nature of

marginal costing.

The marginal cost of production is the incremental costs required to produce an

extra unit, which equals the total variable cost of the unit. This includes direct

materials, direct labour, direct expenses and variable production overheads.

For inventory valuation, it is important to distinguish the marginal cost of production

and the marginal cost of sale. The marginal cost of sale is the incremental costs

required to produce and sell an extra unit, which equals the marginal cost of

production plus variable selling and distributing cost.

Part C| Chapter 9: Job, Batch, Service and Process Costing 99

The contribution is the sales revenue after marginal/variable product costs have

been paid.

Key formula

Selling price less variable cost = contribution.

The contribution information has a major advantage over profit information in the

decision-making process, that is, from contribution information we can calculate the

potential changes in profit or loss with a change in sales.

EXAMPLE 1

OZONE is a manufacturer supplying Thermometer for hospitals. Given below is the

information about this single product:

$

Sales price 160

Direct materials 60

Direct labour 35

Prime cost 95

Variable production overheads 25

Fixed production overheads 10

Total cost 130

Based on a budgeted normal output of 6,000 units, it has been estimated that fixed

costs would be $60,000. Predicted costs and revenues generated in scenarios of

different sales volumes are as below.

Previous month Current month

Sales of 2,000 Sales of 2,500

thermometers thermometers

$ $

Sales revenue 320,000 400,000

Direct materials 120,000 150,000

Direct labour 70,000 87,500

Prime cost 190,000 235,500

Variable production overheads 50,000 62,500

Marginal cost of production 240,000 300,000

CONTRIBUTION 80,000 100,000

Fixed production overheads 60,000 60,000

Total profit 20,000 40,000

Contribution per unit 40 40

Profit per unit 10 16

Part C| Chapter 9: Job, Batch, Service and Process Costing 100

From the above information, it can be seen that there is an increase in the profit per

unit from $10 when 2000 units are sold to $16 when 2,500 units are sold. This is

due to the increase in all the variable costs (direct materials, direct labour, direct

expenses and variable overheads), while fixed costs are kept stable at $60,000.

Accordingly, we can see that the figure of profit per unit is not particularly insightful

in this case, since it is directly influenced by the number of units being sold. As a

result, the concept of contribution is introduced and widely adopted by management

accountants.

When the number of units produced and the number of units sold changes, profit

per unit changes, while contribution remains constant.

Key formulas

Total contribution = Contribution per unit × Sales volume.

Profit = Total contribution – Fixed overheads.

2.2 Absorption costing

In absorption costing, all production cost should be absorbed into cost units.

Accordingly, the total cost of a unit includes two elements: variable cost per unit

and the proportion of overhead costs that are absorbed into each unit.

Variable cost per unit can be calculated at the start of the period. With overhead

costs, we use the term predetermined overhead absorption rate, which equals

budgeted overhead divided by budgeted activity.

2.3 Standard cost under Marginal Costing (“MC”) and Absorption

Costing (“AC”)

Key terms

Standard cost is the estimated amount of the costs that typically incur in the

process of producing a unit of product.

Part C| Chapter 9: Job, Batch, Service and Process Costing 101

2.3.1 Standard cost under MC

Direct material xx

Direct labour xx

Direct overhead xx

Total variable production cost per unit xx

As a result, the Statement of Profit and Loss (“SOPL”) under MC will be

Sales xx

Less Cost of sales

Opening inventory (*) xx

Variable cost of production xx

Less: Closing inventory (*) xx

xx

Less: variable selling cost, admin cost… xx

Contribution xx

Less: Fixed cost (**) xx

Profit/Loss xx

(*) - valued at marginal cost per unit

(**) - Total fixed cost = fixed production overheads + fixed non-production

overheads

2.3.1 Standard cost under MC

Direct material xx

Direct labour xx

Direct overhead xx

Fixed production overhead xx

Total production cost per unit xx

As a result, the SOPL under AC will be

Sales xx

Less Cost of sales

Opening inventory (*) xx

Variable cost of production xx

Fixed overhead absorbed xx

Less: Closing inventory (*) xx

xx

(under)/over absorption xx

Gross profit

Less: non-production cost xx

Profit/Loss xx

(*) - valued at marginal cost per unit

(**) - Total fixed cost = fixed production overheads + fixed non-production

overheads

Part C| Chapter 9: Job, Batch, Service and Process Costing 102

EXAMPLE 2

HAGL started as a manufacturing business on 1 Jan 2021, with a single product

being made. The cost card of this product is written below:

$

Sales price 15

Direct materials 2

Direct labour 4

Variable production overheads 1

Fixed production overheads 3

Standard cost 5

Based on a monthly budgeted normal output of 12,000 units, it has been calculated

that the fixed production overhead incurred in January was $36,000.

Selling and administrative expenses are as below:

Fixed $3,000 per month

Variable 10% of the sales value

The number of units produced and sold in Jan 2021 was:

- Production 10,000 units

- Sales 9,000 units

The management accounting has been asked to prepare the absorption costing

and marginal costing income statements for Jan 2021.

Solution:

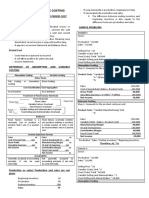

Absorption costing statement of profit or loss – Jan 2021

$ $

Sales revenue 135,000

Less: cost of sales

Opening inventory

Variable cost of production (10,000 x $7) 70,000

Fixed overhead absorbed (10,000 x $3) 30,000

Less closing inventory (1,000 x $10) (10,000) (90,000)

Under absorption (6,000)

Gross profit 39,000

Less: Selling and administration expenses

- Fixed cost 3,000

- Variable cost (10% of sales value) 13,500 (16,500)

Profit 22,500

Marginal costing statement of profit or loss – Jan 2021

Part C| Chapter 9: Job, Batch, Service and Process Costing 103

$ $

Sales revenue 135,000

Less: cost of sales

Opening inventory

Variable cost of production (10,000 x $7) 70,000

Less closing inventory (1,000 x $7) (7,000) (63,000)

Other variable costs (13,500)

Gross profit 58,500

Less: Fixed cost

- Fixed production cost 36,000

- Fixed selling and administration cost 3,000 (39,000)

Profit 19,500

2.4 Profit under MC and AC

As we can see from the previous section, the standard cost per unit calculated

using marginal costing would always be lower than the one calculated using

absorption costing. The inventory value is sometimes different under each method.

But what is the implication of these differences on the difference between profit

calculations using the two methods?

An interesting point to note when explaining this is the way fixed production costs

are treated under each method. Under marginal costing, we treat fixed production

costs as period costs, which are expensed (as cost of goods sold) immediately as

they are incurred. Under absorption costing, fixed production costs are absorbed

into unit production cost at a predetermined overhead absorption rate. These costs

are expensed later when the units are sold. This point helps explain why the

difference in inventory value leads to the difference in profits under different

valuation methods, which is discussed below.

▪ When there is no change in inventory level: All produced products in the

period were sold, therefore all the fixed overheads are expensed, regardless

of the valuation method. As a result, both methods give the same profit.

▪ When there is an increase in inventory levels: The number of products

produced is bigger than the number of products sold. As a result, under

absorption costing, an amount of fixed overheads are not expensed at the

same period and thus carried forward to the next accounting period.

Meanwhile, under marginal costing, all fixed overheads are expensed in the

Part C| Chapter 9: Job, Batch, Service and Process Costing 104

period. Therefore, absorption costing gives the lower cost of goods sold and

higher profit.

▪ When there is a decrease in inventory levels: The number of products

produced is smaller than the number of products sold. As a result, under

absorption costing, an extra amount of fixed overheads are expensed as

costs of goods sold in the same period. Meanwhile, under marginal costing,

only the predetermined amount of fixed overheads are expensed in the

period. Therefore, absorption costing gives a higher cost of goods sold and

lower profit.

EXAMPLE 3

Closing inventory at the end of Jan 2021 shows the difference between the level of

outputs and the level of sales, i.e. 1,000 units (10,000 – 9,000)

According to example 2, the profit for Jan 2021 would be:

Under absorption costing: $22,500

Under marginal costing: $19,500

Difference in profits = $3,000

It can be interpreted that this difference is caused by the fixed overhead held in

inventory, i.e. 1,000 units of inventory ‘holding’ $3 fixed overhead per unit

(or 1,000 × $3 = $3,000 which is the difference between the profit in the profit

statements under the different costing methods for Jan 2021 mentioned above).

In an examinable question, the information of the profit under either marginal or

absorption costing might be provided, and you would be required to estimate the

alternative profit.

There is a quicker approach to profit reconciliation:

Absorption costing profit 22,500

(Opening inventory – Closing inventory) × OAR (0–1,000) × 3 –3,000

Marginal costing profit 19,500

Part C| Chapter 9: Job, Batch, Service and Process Costing 105

EXAMPLE 4

MINH NGUYEN has been launching a product called Lizzy for 1 year. Below are

the recorded accounting information relating to Lizzy

Sales volume 40,000

$

Selling price per unit 10.00

Variable cost per unit

Production 5.50

Selling and administration 1.10

Fixed costs per unit

Production overhead 1.20

The fixed production overhead cost was based on a budget of $60,000.

There are no difference between budgeted and actual fixed production overheads

and production volume. MINH NGUYEN adopts absorption costing

If MINH NGUYEN used marginal rather than absorption costing

The profit will be higher/lower at $_____?

Solution:

If MINH NGUYEN uses marginal rather than absorption costing, the profit will be

$12,000 lower.

Budgeted production = budgeted fixed production overhead / fixed overhead

absorption rate = $60,000/$1.20 = 50,000 units

Opening inventory = 0 (just finished first year of trading)

Closing inventory = opening inventory + production – sales

= 0 + 50,000 – 40,000 = 10,000

Difference between marginal costing and absorption costing =

Change in inventory × fixed overhead absorption rate =

(0 – 10,000) × $1.20 = $12,000

Inventory is increasing therefore marginal profit will be lower

Part C| Chapter 9: Job, Batch, Service and Process Costing 106

2.5 Compare Marginal costing and Absorption costing

Marginal costing Absorption costing

Fixed costs are treated as period Fixed costs are absorbed into the cost of

cost and are charged in full to the products at a predetermined rate and

period under consideration. expensed when the units are sold. In small

organisations, this is the best way of

estimating job costs and profits on jobs.

The valuation of closing inventory is Absorption costing includes an element of

not in compliance with IAS 2. fixed

production overheads in inventory values (in

compliance with IAS 2).

There is no under or over Analysing under/over absorption of overheads

absorption of overheads (and is a useful cost controlling practice in an

therefore there is no requirement for organisation.

adjustment in the statement of profit

or loss).

Marginal costing is more useful in Absorption costing is not as useful in the

the decision-making process. Its decision-making process, especially the short-

contribution information provides term one, because the fixed costs do not

more insights for planning costs and change in the short term.

other tactical decisions. Instead, absorption costing is more useful for

financial accounting purposes, for routine profit

reporting application.

The method is simple and easy to The method is more complex, requires

use. advanced skills.

Absorption costing is useful in circumstances

where it is difficult to classify all costs as fixed

or variable, or when variable costs only

contribute a low proportion in total costs.

Part C| Chapter 9: Job, Batch, Service and Process Costing 107

CHAPTER SUMMARY

- The marginal cost of production is the incremental costs required to produce

an extra unit, which equals the total variable cost of the unit

- The contribution is the sales revenue after marginal/variable product costs

have been paid.

- Selling price less variable cost = contribution.

- The contribution information has a major advantage over profit information in

the decision-making process, that is, from contribution information we can

calculate the potential changes in profit or loss with a change in sales..

- In absorption costing, all production cost should be absorbed into cost units.

Accordingly, the total cost of a unit includes two elements: variable cost per

unit and the proportion of overhead costs that are absorbed into each unit.

- Under marginal costing, we treat fixed production costs as period costs, which

are expensed (as cost of goods sold) immediately as they are incurred. Under

absorption costing, fixed production costs are absorbed into unit production

cost at a predetermined overhead absorption rate. These costs are expensed

later when the units are sold

• When there is no change in inventory level, both methods give the same

profit.

• Different methods would give differ profit if there is any change in the level

of inventories in the period.

- Absorption costing is not as useful in the decision-making process as marginal

costing, especially the short-term one, because the fixed costs do not change

in the short term. Instead, absorption costing is more useful for financial

accounting purposes, for routine profit reporting application

Part C| Chapter 9: Job, Batch, Service and Process Costing 108

PRACTICE QUESTION

1. The overhead absorption rate for product Y is $2 per direct labour hour. Required

direct labour hours per unit is 5 hours/ unit. Beginning Inventory of product Y was 200

units and closing inventory was 500 units.

Required: Determine the difference between the profit for the month under absorption

costing and under marginal costing?

A The marginal costing profit would be $3000 less.

B The marginal costing profit would be $3000 greater.

C The marginal costing profit would be $600 greater.

D The marginal costing profit would be $600 greater

2. ZING Co manufactures a single product. The fixed production overheads for the

period are budgeted to be$50,000. The budgeted output for the period amounts to

10000 units. Opening inventory at the start of the period equals 8500 units, closing

inventory at the end of the period equals 6300 units.

ZING Co adopts marginal costing, in which the profit was $500,000.

Required: Calculated the profit for the period under absorption costing:

A $925,000

B $675,000

C $920,000

D $680,000

Part C| Chapter 9: Job, Batch, Service and Process Costing 109

ANSWER

1. The correct answer is: The marginal costing profit would be $3000 less

Difference in profit = change in inventory level x fixed overhead per unit

= (200 – 500) × ($2 x 5)

= $3000

The absorption costing profit will be greater because inventories have increased

2.

The correct answer is: $680,000

Units

Opening inventory 8500

Closing inventory 6300

Decrease 2200 × ($50,000/10,000) = $11,000 lower

Profit under absorption costing = $500,000 – $11,000 = $489,000

Part C| Chapter 9: Job, Batch, Service and Process Costing 110

CHAPTER 9: JOB, BATCH, SERVICE AND PROCESS

COSTING

1. CHAPTER OBJECTIVES

Job and batch costing:

▪ Describe the characteristics of job and batch costing.[K]

▪ Describe the situations where the use of job or batch costing would be

appropriate.[K]

▪ Prepare cost records and accounts in job and batch costing situations.[S]

▪ Establish job and batch costs from given information.[S]

Process costing

▪ Describe the characteristics of process costing.[K]

▪ Describe the situations where the use of process costing would be

appropriate.[S]

▪ Explain the concepts of normal and abnormal losses and abnormal gains.[K]

▪ Calculate the cost per unit of process outputs.[S]

▪ Prepare process accounts involving normal and abnormal losses and

abnormal gains.[S]

▪ Calculate and explain the concept of equivalent units.[S]

▪ Apportion process costs between work remaining in-process and transfers

out of a process using the weighted average and FIFO methods.[S]

▪ Prepare process accounts in situations where work remains incomplete.[S]

▪ Prepare process accounts where losses and gains are identified at different

stages of the process.[S]

▪ Distinguish between by-products and joint products.[K]

▪ Value by-products and joint products at the point of separation.[S]

▪ Prepare process accounts in situations where by-products and/or joint

products occur.[S] (Situations involving work-in-process and losses in the

same process are excluded).

Service/operation costing

▪ Identify situations where the use of service/operation costing is

appropriate.[K]

Illustrate suitable unit cost measures that may be used in different

service/operation situations.[S]

▪ Carry out service cost analysis in simple service industry situations.[S]

Part C| Chapter 9: Job, Batch, Service and Process Costing 111

2. CONTENTS

2.1. Job and batch costing

2.1.1 Job costing

Job costing is a costing method used to determine the cost of specific jobs, which

are performed according to the customer's order. Accordingly, each job has its

unique price and unique requirements in terms of different amounts and types of

labour (e.g. skilled and unskilled); materials; overheads).

Job costing is appropriate and likely to be used in custom-made industries for the

production of specialized outputs. For example, custom-designed furniture, party

invitations, auditing services, maintenance and repair services and any

goods/services produced one at a time/in small quantity and that is unique to each

need.

Like any other costing method, the objectives of job costing is to identify, assign

and accurately record relevant costs to complete each distinctive order.

▪ Each distinctive order is given a unique job code.

▪ When the total cost is determined, the good/service provider would add a

certain amount of profit to the total cost to form the selling price.

Cost records

Until the job is complete, all costs arising are recorded on a job card (or job cost

sheet).

Direct costs:

▪ Direct materials (from goods received notes (GRNs)/ suppliers' invoices,

from stores requisitions);

▪ Direct labour (wages from timesheets);

▪ Direct expenses from invoices.

Indirect cost:

▪ manufacturing overhead (predetermined)

Abnormal costs: costs arise due to a change in the production process, usually

when re-working is needed.

Treatments:

▪ Charged to a job (if the change come from the customer’ side e.g. customer

changed their requirements);

▪ Written off (e.g. company policy stated abnormal costs to be written off to a

specific account).

Part C| Chapter 9: Job, Batch, Service and Process Costing 112

EXAMPLE 1

Product Sao Ta's unit cost is $240. A selling price is set based on a margin of 20%.

What is the selling price?

Solution

Margin = Selling price – unit cost

Margin = 20% selling price, then the unit cost = 100% - 20% = 80% selling price

Therefore selling price = $240 ÷ 80% = $300

EXAMPLE 2

Product MH's unit cost is $240. The mark-up is 20%.

What is the selling price?

Solution

Profit per unit = 20% unit cost, the selling price = 120% unit cost

Therefore selling price = $240 × 120% = $288

2.1.2 Batch costing

Batch costing is also a form of specific order costing, however, there are a few

differences:

Basis for Job costing Batch costing

comparison

Definition Job costing, a specific costing Batch costing, a specific

method, used when the costing method, used when the

good/service is produced per good/service is produced in

specific requirements. batches or mass-produced

following specific requirements.

Production The product is produced as per The product is produced in

quantity customer specification. batches or at a large scale

(mass production).

Product identity Product has a unique identity, Even when mass-produced,

as each job is different from products can keep their identity

others. intact, as they are produced in

the continuum.

Cost unit The cost unit in job costing is The cost unit in batch costing is

Executed Job. the Batch of goods produced.

Cost The cost is ascertained on the The cost is ascertained for the

ascertainment completion of each job. whole batch and then the unit

cost is determined.

Part C| Chapter 9: Job, Batch, Service and Process Costing 113

2.2. Process costing

Key terms

Process costing is a costing system that assigns all production costs to

processes or departments and averages them across all units produced.

(Management Accounting Information for Creating and Managing Value by

Langfield Smith).

Process costing is used for businesses with a sequence of repetitive production

processes.

2.2.1 Equivalent unit

If units, completed at a certain degree (work in process inventories), exist at the

beginning or the end of the accounting period, they need to be converted into

equivalent units (“EU”) for the convenience of measuring costs. In other words,

work in process inventories can be expressed as a part of the completed inventory.

For example, if there are 100 30% finished units at the end of the period, for the

convenience of the accounting process, the aforementioned items can be recorded

as 30 fully completed units. Therefore, the 100 in-process units are equivalent to 30

fully completed units or 30 EUs.

The main assumption of process costing is that material costs incurred at the

beginning of the process. Labour costs and overheads are incurred throughout the

production process. (Labour costs and overheads are also known as conversion

costs.)

The 4 major steps when dealing with process costing

Step 1: Analyse the physical flow of units

Step 2: Calculate the equivalent units (for direct material, Labour and

overheads).

Step 3: Calculate the unit costs (the cost per equivalent unit for direct material,

Labour and overheads).

Step 4: Analyse the total amount of costs (to determine and remove work in

process and/or transfer that amount to the following production department or

finished goods).

Part C| Chapter 9: Job, Batch, Service and Process Costing 114

EXAMPLE 3

The following information is recorded at company A for Process 1:

Period costs $2,400

Input: 300 units

Output: 200 fully completed units and 100 units only 40% complete

There were no process losses.

Required:

Produce the process account

Solution:

Physical units Degree of completion Equivalent units

Fully completed units 200 100% 200

Work in progress 100 40% 40

Total 300 240

Therefore, cost per EU = $2,400/240 units = $10 per equivalent unit

Process 1 account

Units $ Units $

Input 300 2,400 Transfer to the 200 2,000

following process

Work in progress 100 400

300 2,400 300 2,400

2.2.2 Different degrees of completion

For most processes, the material is fully provided at the beginning of the process,

so the amount to be added for these inputs to become finished goods are labour

and overheads, which means that if there are to be WIPs at the end of the period,

these costs, labour and overheads, are to be allocated over the equivalent units.

The material cost should be allocated overall units, but conversion costs should be

allocated over the EUs.

Note: Conversion costs = labour costs +overheads costs

EXAMPLE 4

The following information is recorded at company T for Process no.1:

Part C| Chapter 9: Job, Batch, Service and Process Costing 115

Material costs: 200 units at $6 per unit. Labour costs: $1,800. Overheads costs:

$2,400

Output:

150 fully completed units, transferred to Process 2.

50 three-fifth complete for direct labour, one-fifth complete for overheads, but

fully complete for materials.

There were no process losses.

Required: Produce the process account.

Solution:

Physical Material Labour Overheads

units

% EU % EU % EU

Fully worked units 150 100% 150 100% 150 100% 150

Work in progress 50 100% 50 60% 30 20% 10

Total 200 200 180 160

Costs incurred $1,200 $1,800 $2,400

Cost per EU $6 $10 $15

Cost per finished product = $6 + $10 + $15 = $31

Cost of 150 finished products = $31 × 150 = $4,650

Cost of closing work in progress:

- Material: $6 × 50 = $300

- Labour: $10 × 30 = $300

- Overheads: $15 × 10 = $150

Total: $750

Part C| Chapter 9: Job, Batch, Service and Process Costing 116

Process 1 account

Units $ Units $

Input 200 1,200 Transfer to next 150 4,650

process

Labour and 4,200 Work in progress 50 750

overhead

200 5,400 200 5,400

2.2.3 Opening work in progress

The 2 primary accounting methodologies to record the inventory used in process

costing: Weighted average and FIFO (First in first out).

a. Weighted average method:

In the weighted average method, no distinction is made between units in the

process at the start of a period and those added during the period.

Step 1:

Opening WIP (physical unit) + Physical units started - Physical units completed

and transferred out = Closing WIP (physical unit)

Step 2: Calculate Equivalent units

Equivalent units completed and transferred out + Equivalent units in closing work

in progress = Total Equivalent units

Step 3: Calculate cost per Equivalent Unit

Calculate cost per EU for direct material, added material and conversion costs

Note that under the Weighted average method, total costs include the cost of

opening WIP (which are finished in this period). That is because when

calculating EU, we have included the opening WIP into the calculation

Step 4: Calculate cost of finished goods and cost of WIP

EXAMPLE 5

Details of process 1 in PAN Co for Jan 20X1 are as follows:

- Opening WIP: 400 units, with degree of completion as:

+ Materials: 100% with the value of $1,800

+ Conversions: 30% with the value of $780

- Units input for the period: 1,400 units

Part C| Chapter 9: Job, Batch, Service and Process Costing 117

- Closing WIP 300 units, with degree of completion as:

+ Materials: 100%

+ Conversions: 40%

- Costs incurred in the period:

+ Material costs: $6,300

+ Conversion costs: $5,700

There were no process losses.

Required: Using the weighted average method, prepare the process account for

Jan 20X1.

Solution:

Step 1: Opening WIP (physical unit) + Physical units started - Physical units

completed and transferred out = Closing WIP (physical unit)

=> Physical units completed and transferred out = Opening WIP + Physical units

started - Closing WIP = 400 + 1,400 – 300 = 1,500

Step 2 & 3: Calculate EU and cost per EU

Physical Material Conversion

units

% EU % EU

Finished goods (transferred to 1,500 100% 1,500 100% 1,500

Process 2)

Closing WIP 300 100% 300 40% 120

Total 200 1,800 1,620

Costs $8,100 $6,480

- Opening WIP $1,800 $780

- Costs incurred in the period $6,300 $5,700

Cost per EU $4.5 $4

Step 4: Calculate cost of finished goods and cost of WIP

- Finished goods: ($4.5 + $4) × 1,500 = $12,750

- Closing WIP:

+ Material: $4.5 × 300 = $1,350

+ Conversion: $4 × 120 = $480

Value of closing WIP = $1,830

Part C| Chapter 9: Job, Batch, Service and Process Costing 118

Process 1 account

Units $ Units $

Opening WIP 400 2,580 Transfer to the 1,500 12,750

following process

Input 1,400 6,300 Work in progress 300 1,830

Labour and 5,700

overheads

1,800 14,580 1,800 14,580

b. FIFO:

The FIFO method assumes that the existing units in the process (WIP) at the

beginning of the period need to be completed first before any production process

for new units begins.

Step 1:

Opening WIP (physical unit) + Physical units started - Physical units completed and

transferred out = Closing WIP (physical unit)

Step 2: Calculate Equivalent units

1. Equivalent units needed to complete opening WIP

2. Newly introduced and completed and transferred out

3. Equivalent units in closing work in progress

(1) + (2) + (3) = Total Equivalent units

Step 3: Calculate cost per Equivalent Units

Calculate cost per EU for direct material, added material and conversion costs

Note that under the FIFO method, only use costs incurred in the period. That is

because when calculating EU, we have included the opening WIP in the calculation

Step 4: Calculate cost of finished goods and cost of WIP

EXAMPLE 6

Details of process 1 in PAN Co for Jan 20X2 are as follows:

- Opening WIP: 400 units, with degree of completion as:

+ Materials: 100% with the value of $1,800

+ Conversion: 30% with the value of $780

Part C| Chapter 9: Job, Batch, Service and Process Costing 119

- Units input for the period: 1,400 units

- Closing WIP 300 units, with degree of completion as:

+ Materials: 100%

+ Conversions: 40%

- Costs incurred in the period:

+ Material costs: $6,300

+ Conversion costs: $5,700

There were no process losses.

Required: Using the weighted average method. prepare the process account for

Jan 20X1.

Solution:

Step 1: Opening WIP (physical unit) + Physical units started - Physical units

completed and transferred out = Closing WIP (physical unit)

=> Physical units completed and transferred out = Opening WIP + Physical units

started - Closing WIP = 400 + 1,400 – 300 = 1,500

In which:

- Opening WIP that is finished in period: 400

- Introduced and completed in period: 1,500 – 400 = 1,100

Step 2 & 3: Calculate EU and cost per EU

Physical Material Conversion

units

% EU % EU

Opening WIP finished in period 400 - - 70% 280

Introduced and completed in 1,100 100% 1,100 100% 1,100

period

Closing work in progress 300 100% 300 40% 120

Total 200 1,400 1,500

Costs incurred in the period $6,300 $5,700

Cost per EU $4.5 $3.8

Step 4: Calculate cost of finished goods and cost of WIP

Finished goods:

▪ Opening WIP that is finished in period = opening value from last period +

works completed in this period = 2,580 + $3.8 × 280 = $3,644

Part C| Chapter 9: Job, Batch, Service and Process Costing 120

▪ Introduced and completed in period = cost per unit * number of units = ($4.5

+ $3.8) * 1,100 = 9,130

Closing WIP:

▪ Material: $4.5 × 300 = $1,350

▪ Conversion: $3.8 × 120 = $456

Value of closing WIP = $1,806

Process 1 account

Units $ Units $

Opening WIP 400 2,580 Transfer to next 1,500 12,774

process

Input 1,400 6,300 Work in progress 300 1,806

Labour and 5,700

overhead

1,800 14,580 1,800 14,580

COMPARISON OF WEIGHTED AVERAGE AND FIFO METHODS

The most significant feature to highlight the difference between the weighted

average and FIFO method is how each method treats the beginning work in

process inventory.

For the weighted average method, the costs of beginning work in process and

the equivalent units of work done on it are included as the cost per equivalent

unit is calculated. The resulting figure of this method is a weighted average of

costs coming from both the previous and the current calculating period.

For the FIFO method, the costs of beginning work in process is not included,

only the equivalent units of work done in the current calculating period is

counted.

The difference in value between the two methods, therefore, lays in the amount of

beginning work in process, without it, there is no difference.

2.3. Loss in process costing

Loss is due to the nature of the process, defective material or a mistake made by

workers. In a process, the expected loss is the normal loss. The loss in materials or

the loss in the form of finished goods can still be sold and the amount gained from

Part C| Chapter 9: Job, Batch, Service and Process Costing 121

this is the scrap value, which is also included in the process account. In the exam, if

the scrap value is not mentioned, its value is 0 in the process account.

Cost per unit formula:

Expected output = Input - expected loss = Input × (1 - % of normal loss)

Total cost of inputs - Scrap value of the normal loss

Average cost per unit =

Expected output

EXAMPLE 7

The following data relates to Process 1 at a manufacturing company:

Materials input: $3,000 for 200 units

Labour costs: $1,000.

Overheads costs: $800

Normal loss is 5% of input and is sold at $5 per unit.

Actual output = 190 units

Required: Calculate the average cost per unit in Process 1 and complete the

process account.

Solution:

Process 1 account

Units $ Units $

Material 200 3,000 Transfer to 190 4,750

next process

Labour 1,000 Normal loss 10 50

Overhead 800

200 4,800 200 4,800

Workings

(W1) Normal loss = 5% × 200 = 10 units. Expected output = 200 – 10 = 190 units

Scrap value of normal loss = 10 × $5 = $50

(W2)

Total cost of inputs - Scrap value of normal loss

Average cost per unit =

Expected output

= $4,800 – $50

Part C| Chapter 9: Job, Batch, Service and Process Costing 122

190

= $ 25 per unit

Value of goods transferred = 190 × $25 = $4,750

2.3.1 Abnormal loss and abnormal gains

In reality, the actual loss may be different from the expected loss.

- Abnormal loss is the amount of actual loss that exceeds expected loss by

- Abnormal gain is the amount expected loss exceeds actual loss by.

In the case there is an abnormal loss or abnormal gain, the cost of a unit gained or

loss is the same as the cost of a unit of normal output. The abnormal losses or

gains may have a scrap value. In this case, the scrap value should be

reduced/increased to the abnormal gain/loss account.

EXAMPLE 8

The following data relates to Process 2 at a manufacturing company:

Materials input: $2,800 for 300 units

Labour costs: $630.

Overheads costs: $260

Normal loss is 4% of input and is sold at $7.5 per unit. Actual output = 280 units

Required: Calculate the average cost per unit in Process 1 and complete the

process account.

Solution:

Process 2 account

Units $ Units $

Material 300 2,800 Transfer to next 280 3,500

process

Labour 630 Abnormal loss 8 100

Overhead 260 Normal loss 12 90

300 3,690 300 3,690

Part C| Chapter 9: Job, Batch, Service and Process Costing 123

Abnormal gains and losses account

$ $

Process 2 100 Scrap 60

Statement of profit 40

and loss

100 100

Scrap value

$ $

Process 2 (normal 90 Cash received (20 150

loss) units * $7.5)

Abnormal loss 60

150 150

Workings

(W1) Normal loss = 4% × 300 = 12 units. Expected output = 300 – 12 = 288 units

Scrap value of normal loss = 12 × $7.5 = $90

(W2)

Total cost of inputs - Scrap value of normal

loss

Average cost per unit =

Expected output

$3,660 – $60

288

= $ 12.5 per unit

Value of goods transferred = 280 × $12.5 = $3,500

Actual loss = 300 – 280 = 20 => Abnormal loss: 20 – 12 = 8 units.

Value of abnormal loss = 8 × $12.5 = $100

Value of abnormal loss transferred to the scrap account = 8 × $7.5 = $60

Part C| Chapter 9: Job, Batch, Service and Process Costing 124

2.4. Joint product and by-product

Process costing is created for businesses with multi-operational processes for an

end-product, so they often produce products at different stages. These products

may either fall into the category of joint products or by-products.

Joint products are two or more products produced along the process, each

having a sufficiently high value for sale. Joint product is intendedly produced

and is among the main products.

By-products are incidentally produced outputs in the process of making

something else (main products). By-products have a relatively low sales value

compared to joint products.

Accounting for joint products

If joint process costs occur before the split-off point then these can be categorized

as common costs.

The remaining costs incurred from the split-off point and the joint product

completion point need to be apportioned to determine the value of closing inventory

and cost of sales.

The apportionment of joint costs to products is usually based on one of the

following:

▪ market value

▪ production units

▪ net realizable value.

Part C| Chapter 9: Job, Batch, Service and Process Costing 125

When preparing process accounts, joint products should be treated as main

products while by-products in process accounts are treated similar to that of normal

loss.

Income from by-product is credited to the process account and debited to the by-

product account.

EXAMPLE 9

T&T is a manufacturing company. It combines the manufacturing processes of two

products called M and A in a single joint process. Last month, the total costs of the

joint process amounted to $120,000, with the relating information about the two

products are as follows:

Product M Product A

Output (units) 12,000 15,000

Additional processing costs ($) 30,000 18,000

Selling price $20 $16

1. If the physical units method was used, the joint cost allocations to Products M

and A would be:

M: $120,000 ÷ 27,000 units × 12,000 units = $53,333

A: $120,000 ÷ 27,000 units × 15,000 units = $66,667

2. If the sales value method was used, the joint cost allocations to Products M and

A would be:

Calculate the total sales value:

M: 12,000 × $20 = $240,000

A: 15,000 × $16 = $240,000

Total sales value = $480,000

Calculate the joint cost allocation:

M: $120,000 ÷ 480,000 × $100,000 = $60,000

A: $120,000 ÷ 480,000 × $100,000 = $60,000

3. The joint cost allocations to Products M and A using the net realisable value

method would be:

Calculate the total net realisable value:

M: (12,000 units × $20) – $30,000 = $210,000

A: (15,000 units × $18) – $18,000 = $222,000

Part C| Chapter 9: Job, Batch, Service and Process Costing 126

Total net realisable value = $432,000

Calculate the joint cost allocation:

M: $120,000 ÷ $432,000 × $210,000 = $58,333

A: $120,000 ÷ $432,000 × $222,000 = $61,667

2.5 Service costing

Service businesses offer help, care, utility, or provide an experience, information or

other intellectual content. The products of these businesses, as mentioned above,

are usually intangible rather than physical, which are harder to determine

production costs, so service costing is used to establish the costs of services

performed.

DIFFERENCES BETWEEN SERVICE AND MANUFACTURING

BUSINESSES:

Four major features differentiate between manufacturing and most service

businesses:

Basis for Service businesses Manufacturing businesses

comparison

Form of The majority of the outputs The majority of outputs

products service businesses produce manufacturers produce are

are intangible. physical.

Production Service products are usually Manufacturers usually produce

quantity heterogeneous. Each product a range of repetitive products.

is different or is tailor-made The product portfolio (collection

per the customer’s of all the products or services

requirements. offered by a company) of a

manufacturer is limited, these

products tend to involve

common features or processes.

Consumption Services are consumed Goods can be stored in

point immediately as they are warehouses and consumed

produced. later when they are sold.

Product Services cannot be stored, Goods can be stored in

perishability saved for future sale, and warehouses for sale in the

cannot be returned or resold future.

once they have been

consumed.

Part C| Chapter 9: Job, Batch, Service and Process Costing 127

Unit cost measures for service costing:

Since services are intangible products, one of the major difficulties in service

costing is the establishment of an appropriate cost unit. Service businesses,

depending on the kinds of service they provide, can use a variety of cost units

Examples for a hotel might include:

▪ Meals served in the hotel’s restaurant

▪ Room-service-hour worked by the cleaning staff

▪ Hours worked for the reception staff.

▪ A composite cost unit is more appropriate if a service is based on two

variables (or more). For example room-night.

Part C| Chapter 9: Job, Batch, Service and Process Costing 128

CHAPTER SUMMARY

Job costing is a costing method used to determine the cost of specific jobs,

which are performed according to the customer's order.

Batch costing, a specific costing method, used when the good/service is

produced in batches or mass-produced following specific requirements

For each individual order costing situations, different accounts are kept for each

job or batch.

Direct costs are debited to each account. Overheads are charged (debited)

using overhead absorption rates (Chapter 7).

Service businesses offer help, care, utility, or provide an experience,

information or other intellectual content. The products of these businesses are

usually intangible rather than physical, which are harder to determine

production costs, so service costing is used to establish the costs of services

performed.

Process costing is a costing system that assigns all production costs to

processes or departments and averages them across all units produced.

Process costing is used for businesses with a sequence of repetitive production

processes.

For losses, the key points are:

• Normal losses are a cost of manufacture;

• Abnormal losses are an overhead cost;

• Cost per unit is based on expected good output.

In processes involving losses, the value per unit of output is equal to total costs

of inputs less scrap value of normal loss (if any), spread over the expected

number of units of good output.

Normal losses are valued at scrap value per unit.

Abnormal gains and losses are costed at the same amount per unit as good

output.

In some processes, there may be WIP at the beginning and/or end of a period.

In this case, it is necessary to calculate the equivalent units (EU) of production

during the period.

In calculating EUs, two methods are used. For the weighted average method,

the costs of beginning work in process and the equivalent units of work done

on it are included as the cost per equivalent unit is calculated. For the FIFO

method, the costs of beginning work in process is not included, only the

equivalent units of work done in the current calculating period is counted.

Process costing is created for businesses with multi-operational processes for

an end-product, so they often produce products at different stages. These

products may either fall into the category of joint products or by-products.

Joint products are significant, whereas by-products have little (if any) value. The

apportionment of joint costs to products is usually based on one of the following:

market value, production units, net realizable value, etc.

Part C| Chapter 9: Job, Batch, Service and Process Costing 129

You might also like

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Information For Decision MakingDocument33 pagesInformation For Decision Makingwambualucas74No ratings yet

- Activity Based CostingDocument28 pagesActivity Based CostingApril TorresNo ratings yet

- Calculating full product cost and profit under absorption and variable costingDocument49 pagesCalculating full product cost and profit under absorption and variable costingrajeshaisdu009No ratings yet

- Marginal vs Absorption Costing ComparisonDocument12 pagesMarginal vs Absorption Costing Comparisonhamza khanNo ratings yet

- 4.basics of Marginal Costing-SN FoundationDocument22 pages4.basics of Marginal Costing-SN FoundationHasim SaiyedNo ratings yet

- 9Document16 pages9Asal IslamNo ratings yet

- 006 Camist Ch04 Amndd Hs PP 79-102 Branded BW RP SecDocument25 pages006 Camist Ch04 Amndd Hs PP 79-102 Branded BW RP SecMd Salahuddin HowladerNo ratings yet

- Absorption and Marginal CostingDocument25 pagesAbsorption and Marginal CostingMehwish ziadNo ratings yet

- Cost-Volume-Profit Analysis and Direct vs Absorption CostingDocument15 pagesCost-Volume-Profit Analysis and Direct vs Absorption CostingOROM VINE100% (4)

- Chapter 7Document4 pagesChapter 7Mixx MineNo ratings yet

- T10 - NoteDocument7 pagesT10 - NoterbnbalachandranNo ratings yet

- Lecture 7Document14 pagesLecture 7marwanfathy002No ratings yet

- Chapter Four: Supply I: Managerial Economics Lecturer: Chu-Bin Lin Southwest Jiaotong UniversityDocument27 pagesChapter Four: Supply I: Managerial Economics Lecturer: Chu-Bin Lin Southwest Jiaotong Universitymaria rafiqNo ratings yet

- Variable & Absorption Costing LectureDocument11 pagesVariable & Absorption Costing LectureElisha Dhowry PascualNo ratings yet

- Variable Costing Tool for ManagementDocument33 pagesVariable Costing Tool for Management1793 Taherul IslamNo ratings yet

- C.A-I Chapter-5Document4 pagesC.A-I Chapter-5Tariku KolchaNo ratings yet

- Marginal and Absorption CostingDocument8 pagesMarginal and Absorption CostingEniola OgunmonaNo ratings yet

- Cost & Mgt II CH 1Document13 pagesCost & Mgt II CH 1fikruhope533No ratings yet

- Module_2_Practice_ProblemsDocument21 pagesModule_2_Practice_ProblemsLiza Mae MirandaNo ratings yet

- Taller Costeo VariablesDocument10 pagesTaller Costeo VariablesKaroll Joseph Sanchez AlmaralesNo ratings yet

- ACT202 - Chapter 6Document38 pagesACT202 - Chapter 6arafkhan1623No ratings yet

- Marginal & Absorption Costing ST Academy With SolutionDocument14 pagesMarginal & Absorption Costing ST Academy With SolutionFaisal KhanNo ratings yet

- Marginal Absorption Costing Week 6Document9 pagesMarginal Absorption Costing Week 6Susan MberiaNo ratings yet

- Variable Cost Tools: As A DecisionDocument17 pagesVariable Cost Tools: As A DecisionTusif Islam RomelNo ratings yet

- Cost Classification: Total Product/ ServiceDocument21 pagesCost Classification: Total Product/ ServiceThureinNo ratings yet

- Absorption and Variable Costing ReviewDocument13 pagesAbsorption and Variable Costing ReviewRodelLabor100% (1)

- Bca 423-Marginal Vs Absoption Costing.Document8 pagesBca 423-Marginal Vs Absoption Costing.James GathaiyaNo ratings yet

- Contribution Approach To Decision Making: Learning ObjectivesDocument21 pagesContribution Approach To Decision Making: Learning ObjectivesmoonbohoraNo ratings yet

- Absorption Costing & Variable CostingDocument20 pagesAbsorption Costing & Variable Costingsaidkhatib368No ratings yet

- Absorption and Variable Costing Income Statement: Reporter: Sharmaine Laye M. PascualDocument20 pagesAbsorption and Variable Costing Income Statement: Reporter: Sharmaine Laye M. PascualPatrick LanceNo ratings yet

- MA & CA-Merginal & Absorption Costing PDFDocument8 pagesMA & CA-Merginal & Absorption Costing PDFRashfi RussellNo ratings yet

- Marginal Costing and Absorption Costing ComparedDocument32 pagesMarginal Costing and Absorption Costing Compareddunks metaNo ratings yet

- Chapter 7 Variable Costing A Tool For ManagementDocument34 pagesChapter 7 Variable Costing A Tool For ManagementMulugeta GirmaNo ratings yet

- Absorption CostingDocument34 pagesAbsorption Costinggaurav pandeyNo ratings yet

- Inventory Costing & Capacity AnalysisDocument18 pagesInventory Costing & Capacity AnalysisReshu BediaNo ratings yet

- ABSORPTION VS VARIABLE COSTINGDocument3 pagesABSORPTION VS VARIABLE COSTINGDhona Mae FidelNo ratings yet

- CVP ANALYSIS BREAK-EVEN POINT MULTI-PRODUCTDocument40 pagesCVP ANALYSIS BREAK-EVEN POINT MULTI-PRODUCTRajguru JavalagaddiNo ratings yet

- Tasks - Set 3Document4 pagesTasks - Set 3Ramiz OruceliyevNo ratings yet

- 2 CVP and Break-Even AnalysisDocument7 pages2 CVP and Break-Even AnalysisXyril MañagoNo ratings yet

- Variable costing key conceptsDocument21 pagesVariable costing key conceptsMary Rose GonzalesNo ratings yet

- Variable Costing: A Tool For Management: Chapter SixDocument40 pagesVariable Costing: A Tool For Management: Chapter SixFahim RezaNo ratings yet

- Lecture 5Document39 pagesLecture 5Shixi ZhuNo ratings yet

- Absorption and Marginal CostingDocument6 pagesAbsorption and Marginal CostingLarryNo ratings yet

- BBA211 Vol5 Marginal&AbsortptionCostingDocument15 pagesBBA211 Vol5 Marginal&AbsortptionCostingAnisha SarahNo ratings yet

- Exercise 2Document3 pagesExercise 2Kathy LaiNo ratings yet

- Acct602 Managerial AccountingDocument8 pagesAcct602 Managerial AccountingHaroon KhurshidNo ratings yet

- Ca51014 AssignmentDocument9 pagesCa51014 AssignmentRhn SbdNo ratings yet

- DAC 5013-Week 03Document60 pagesDAC 5013-Week 03Dilshan J. NiranjanNo ratings yet

- Job Order Costing 16112021 123409pmDocument8 pagesJob Order Costing 16112021 123409pmHassan AliNo ratings yet

- Session Objectives:: Methods of Costing?Document15 pagesSession Objectives:: Methods of Costing?Sachin YadavNo ratings yet

- Chapter 2 Marginal CostingDocument21 pagesChapter 2 Marginal CostingLan Nhi NguyenNo ratings yet

- Level 3 Costing & MA Text Update June 2021pdfDocument125 pagesLevel 3 Costing & MA Text Update June 2021pdfAmi KayNo ratings yet

- Tutorial 4 SolutionsDocument14 pagesTutorial 4 Solutionss11186706No ratings yet

- Group IV - Variable and Absorption 1Document43 pagesGroup IV - Variable and Absorption 1Mary Ann Ortega AchurraNo ratings yet

- Management Accounting Final ExamDocument21 pagesManagement Accounting Final ExamJoan RecasensNo ratings yet

- Methods of CostingDocument5 pagesMethods of Costingmuhammad qasimNo ratings yet

- Absorption Marginal CostingDocument36 pagesAbsorption Marginal CostingsamiNo ratings yet

- Problem 8 25Document2 pagesProblem 8 25anon_590039258100% (1)

- STAFF IDsDocument106 pagesSTAFF IDsNiyomahoro Jean HusNo ratings yet

- Final Assessment Test optimizationDocument3 pagesFinal Assessment Test optimizationak164746No ratings yet

- Acc 16Document28 pagesAcc 16Erin MalfoyNo ratings yet

- Sumathi Organiser SPFDocument27 pagesSumathi Organiser SPFPalani AppanNo ratings yet

- Prescribed Format of Cost Sheet (For Imfl and Beer Only)Document3 pagesPrescribed Format of Cost Sheet (For Imfl and Beer Only)sujal_shr21No ratings yet

- Dissertation Transfer PricingDocument7 pagesDissertation Transfer PricingHelpMeWithMyPaperAnchorage100% (1)

- Retail Math Part1 MarkupDocument3 pagesRetail Math Part1 Markupapi-513411115No ratings yet

- Resume Looking For OpportunitiesDocument1 pageResume Looking For OpportunitiesAnil Kumar MalladiNo ratings yet

- Pikkol Happy MovingDocument16 pagesPikkol Happy MovingSiddharth GulatiNo ratings yet

- nf077 NF Certification Reference System Sanitary Tapware 020419Document46 pagesnf077 NF Certification Reference System Sanitary Tapware 020419Suman YadavNo ratings yet

- Facility Layout of Bank Final..... Present2Document22 pagesFacility Layout of Bank Final..... Present2Rahul PambharNo ratings yet

- PCITAL Gardeny - Edifici H2 Planta 2 25003 Lleida - Spain Telf: +34 973 100 801 URD Code: 24/10/2023 24/10/2023Document1 pagePCITAL Gardeny - Edifici H2 Planta 2 25003 Lleida - Spain Telf: +34 973 100 801 URD Code: 24/10/2023 24/10/2023GERMANNo ratings yet

- Chapter 5 Scheduling & Tracking Edited 03042014Document40 pagesChapter 5 Scheduling & Tracking Edited 03042014Shafiq KadirNo ratings yet

- Classification of ServicesDocument22 pagesClassification of ServicesdigganthNo ratings yet

- VAL 010 Revalidation Procedure SampleDocument2 pagesVAL 010 Revalidation Procedure SampleSameh MostafaNo ratings yet

- Company ProfileDocument15 pagesCompany ProfileMichael DavidNo ratings yet

- Period Expected Net Cash Flows Cumulative Net Cash FlowsDocument51 pagesPeriod Expected Net Cash Flows Cumulative Net Cash Flowsgio nefoNo ratings yet

- Identifying Major Channel AlternativesDocument19 pagesIdentifying Major Channel AlternativesCarl Joshua TorresNo ratings yet

- Arena Assignment 1Document7 pagesArena Assignment 1Ofojebe SalemNo ratings yet

- Project Control QuestionDocument2 pagesProject Control Questionann94bNo ratings yet

- Ajay Kumar Dubey April 2023Document2 pagesAjay Kumar Dubey April 2023Ajay DubeyNo ratings yet

- C-Tpat Administration: Roles and ResponsibilitiesDocument1 pageC-Tpat Administration: Roles and ResponsibilitiesCarlos Moreno100% (1)

- MANUFACTURING AND NON-MANUFACTURING ENTITIES FINAL ACCOUNTSDocument13 pagesMANUFACTURING AND NON-MANUFACTURING ENTITIES FINAL ACCOUNTSRahul NegiNo ratings yet

- Brand awareness and usage analysis of Surf Excel and Ariel detergentsDocument18 pagesBrand awareness and usage analysis of Surf Excel and Ariel detergentsMuhammad Hassaan BhagatNo ratings yet

- EMERGENCY MANAGEMENT LEXICON - Eng-FrDocument29 pagesEMERGENCY MANAGEMENT LEXICON - Eng-Frbienfait bienfaitNo ratings yet

- J&K Possesses Vast Potential For Entrepreneurship, Innovation, Incubation, Startups: Advisor BhatnagarDocument1 pageJ&K Possesses Vast Potential For Entrepreneurship, Innovation, Incubation, Startups: Advisor BhatnagarShalin NairNo ratings yet

- OSCM MCQ Questions on Operations and Supply Chain ManagementDocument12 pagesOSCM MCQ Questions on Operations and Supply Chain ManagementSAURABH PATIL100% (4)

- Exercises and Problems - Merchandising BusinessDocument4 pagesExercises and Problems - Merchandising BusinessNems PsycheNo ratings yet

- Chapter 5Document10 pagesChapter 5yosef mechalNo ratings yet

- Audit of Inventory - Illustrative ProblemsDocument3 pagesAudit of Inventory - Illustrative ProblemsTEOPE, EMERLIZA DE CASTRONo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)

- Business Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsFrom EverandBusiness Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsNo ratings yet

- Emprender un Negocio: Paso a Paso Para PrincipiantesFrom EverandEmprender un Negocio: Paso a Paso Para PrincipiantesRating: 3 out of 5 stars3/5 (1)

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Full Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperFrom EverandFull Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperRating: 5 out of 5 stars5/5 (3)

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungFrom EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungRating: 4 out of 5 stars4/5 (1)