Professional Documents

Culture Documents

3 Liabilities of Trustee

Uploaded by

deepak sethi0 ratings0% found this document useful (0 votes)

14 views10 pagesnotes on the liabilities of the trustee

Original Title

3 Liabilities of Trustee-converted

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentnotes on the liabilities of the trustee

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views10 pages3 Liabilities of Trustee

Uploaded by

deepak sethinotes on the liabilities of the trustee

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 10

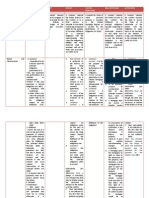

Liabilities of Trustee

Section 3- Indian Trust Act, 1882-

a breach of any duty imposed on a trustee, as such, by

any law for the time being in force, is called a "breach

of trust“.

Liabilities of Trustee are embodied in Section 23 to 30 of

Indian Trust Act, 1882.

A trustee is liable to the trust's beneficiaries for

injuries caused by negligent and intentional breaches

of trust and breaches of the fiduciary duties.

A trustee is absolutely liable, even when acting in

good faith,

for injuries to the beneficiaries' equitable interests

occasioned

by misdelivery or

by the trustee's misconstruing the nature and extent

of the trustee's powers.

Section 23- Liability for breach of trust

Where the trustee commits a breach of trust, he is

liable to make good the loss which the trust property

or the beneficiary has thereby sustained,

unless the beneficiary has by fraud induced the

trustee to commit the breach, or

the beneficiary, being competent to contract, has

himself, without coercion or undue influence having

been brought to bear on him, concurred in the

breach, or subsequently acquiesced therein, with full

knowledge of the facts of the case and of his rights as

against the trustee.

Liability to pay interest

A trustee committing a breach of trust is not liable to pay

interest except in the following cases:-

(a) where he has actually received interest:

(b) where the breach consists in unreasonable delay in

paying trust-money to the beneficiary:

(c) where the trustee ought to have received interest, but

has not done so:

(d) where he may be fairly presumed to have received

interest.

He is liable, in case (a), to account for the interest actually

received, and, in cases (b), (c) and (d), to account for

simple interest at the rate of six per cent. per annum,

unless the Court otherwise directs.

(e) where the breach consists in failure to invest trust

money and to accumulate the interest or dividends

thereon, he is liable to account for compound

interest (with half yearly rests) at the same rate:

(f) where the breach consists in the employment of

trust property or the proceeds thereof in trade or

business, he is liable to account, at the option of the

beneficiary, either for compound interest (with half-

yearly rests) at the same rate, or for the net profits

made by such employment.

Illustrations

(a) A trustee improperly leaves trust-property

outstanding, and it is consequently lost: he is liable to

make good the property lost, but he is not liable to pay

interest thereon.

(b) A bequeaths a house to B in trust to sell it and pay the

proceeds to C. B neglects to sell the house for a great

length of time, whereby the house is deteriorated and its

market price falls. B is answerable to C for the loss.

(c) A trustee is guilty of unreasonable delay in investing

trust money in accordance with section 20, or in paying it

to the beneficiary. The trustee is liable to pay interest

thereon for the period of the delay.

(d) The duty of the trustee is to invest trust-money in any

of the securities mentioned in section 20, clause (a), (b),

(c) or (d). Instead of so doing, he retains the money in his

hands.

He is liable, at the option of the beneficiary, to be charged

either with the amount of the principal money and

interest, or with the amount of such securities as he

might have purchased with the trust-money when the

investment should have been made, and the intermediate

dividends and interest thereon.

(e) The instrument of trust directs the trustee to invest

trust money either in any of such securities or on

mortgage of immoveable property. The trustee does

neither. He is liable for the principal money and interest.

(f) The instrument of trust directs the trustee to

invest trust money in any of such securities and to

accumulate the dividends thereon. The trustee

disregards the direction.

He is liable, at the option of the beneficiary, to be

charged either with the amount of the principal

money and compound interest, or with the amount

of such securities as he might have purchased with

the trust-money when the investment should have

been made, together with the amount of the

accumulation which would have arisen from a proper

investment of the intermediate dividends.

(g) Trust-property is invested in one of the securities

mentioned in section 20, clause (a), (b), (c) or (d). The

trustee sells such security for some purpose not

authorized by the terms of the instrument of trust.

He is liable, at the option of the beneficiary,

either to replace the security with the intermediate

dividends and interest thereon, or

to account for the proceeds of the sale with interest

thereon.

(h) The trust-property consists of land.

The trustee sells the land to a purchaser for a

consideration without notice of the trust.

The trustee is liable, at the option of the beneficiary,

to purchase other land of equal value to be settled

upon the like trust, or

to be charged with the proceeds of the sale with

interest.

You might also like

- Liabilities of TrusteeDocument9 pagesLiabilities of Trusteejay1singheeNo ratings yet

- Liabilities of Trustee. Liabilities of Trustee Is Defied in The Chapter Iiird of Indian Trust Act 1882Document7 pagesLiabilities of Trustee. Liabilities of Trustee Is Defied in The Chapter Iiird of Indian Trust Act 1882Abhineet JhaNo ratings yet

- The Trusts Act in Sn.3 Defines A TrustDocument34 pagesThe Trusts Act in Sn.3 Defines A TrustR100% (1)

- Study Guide Law On Credit TransactionsDocument5 pagesStudy Guide Law On Credit TransactionsCamille ArominNo ratings yet

- Assignment On Trust Equity and Fiduciary RelationshipDocument7 pagesAssignment On Trust Equity and Fiduciary RelationshipDeepak Kumar100% (1)

- Breach of TrustDocument18 pagesBreach of TrustNitsNo ratings yet

- GuarantyDocument9 pagesGuarantyCresteynTeyngNo ratings yet

- B5 Suggested Answer of 2012 Fukd UpDocument6 pagesB5 Suggested Answer of 2012 Fukd UpSyed Mobin NaqviNo ratings yet

- Truste & EquityDocument14 pagesTruste & EquityYash KediaNo ratings yet

- Duties and Liabilities of A TrusteeDocument11 pagesDuties and Liabilities of A TrusteeAdv Sohail BhattiNo ratings yet

- Law 311Document4 pagesLaw 311Reialyn CompuestoNo ratings yet

- Guaranty and PledgeDocument7 pagesGuaranty and PledgeJhannes Gwendholyne Gorre OdalNo ratings yet

- Constructive TrustsDocument9 pagesConstructive TrustsAdv Sohail BhattiNo ratings yet

- Part 10 - Aleatory Contracts, Compromise, and Arbitration PDFDocument7 pagesPart 10 - Aleatory Contracts, Compromise, and Arbitration PDFalex_ang_6No ratings yet

- LAB Assignment 1Document7 pagesLAB Assignment 1khushiNo ratings yet

- UTC - Sept2016 - Restat 2d of Trusts - 203Document2 pagesUTC - Sept2016 - Restat 2d of Trusts - 203OneNationNo ratings yet

- The Indian Trusts ActDocument49 pagesThe Indian Trusts ActAaayushi jainNo ratings yet

- Most Important Provisions To MemorizeDocument7 pagesMost Important Provisions To Memorizeecyor03No ratings yet

- Wraparound Rider To Deed of TrustDocument3 pagesWraparound Rider To Deed of TrustEthan Barnes100% (1)

- Credit Transaction2Document13 pagesCredit Transaction2shai shaiNo ratings yet

- Money Banking Consumer Protection Personal Property For CanadaDocument21 pagesMoney Banking Consumer Protection Personal Property For CanadaTheLite WithinNo ratings yet

- Claims Settlement: Title 11Document33 pagesClaims Settlement: Title 11Eunice SerneoNo ratings yet

- Combinepdf 1Document42 pagesCombinepdf 1DISEREE AMOR ATIENZANo ratings yet

- RFB AgencymortgageantichresisDocument22 pagesRFB AgencymortgageantichresisFlorenz Nicole PalisocNo ratings yet

- Guaranty and SuretyhipDocument6 pagesGuaranty and SuretyhipMic UdanNo ratings yet

- Mercantile Law: Page 1 of 6Document6 pagesMercantile Law: Page 1 of 6Mirza ShujaatNo ratings yet

- Notes in Credit Transactions PDFDocument14 pagesNotes in Credit Transactions PDFLyka Nicole DoradoNo ratings yet

- Trust ActDocument21 pagesTrust Actks136No ratings yet

- Mortgage DeedDocument8 pagesMortgage DeedArslan Haider100% (1)

- Insurance NotesDocument9 pagesInsurance Notespaul_jurado18No ratings yet

- LawDocument7 pagesLawumaima aliNo ratings yet

- GUARANTY - An Agreement by Which One Person: ReportersDocument3 pagesGUARANTY - An Agreement by Which One Person: ReportersRey DumpitNo ratings yet

- Real Estate Mortgage AgreementDocument6 pagesReal Estate Mortgage Agreementm.vangielimpangugNo ratings yet

- Credit Transaction NotesDocument13 pagesCredit Transaction NotesLyra Osorio VillaruelNo ratings yet

- GUARANTY Surety Mortgages Pledge AntichresisDocument35 pagesGUARANTY Surety Mortgages Pledge AntichresisJennilyn TugelidaNo ratings yet

- Credit Transactions Final ReviewerDocument5 pagesCredit Transactions Final ReviewerJumen Gamaru Tamayo100% (1)

- INSURANCEDocument14 pagesINSURANCEEm-em Maguen100% (1)

- Lesson 3 - Provisions On Pledge and MortgageDocument20 pagesLesson 3 - Provisions On Pledge and MortgageHNo ratings yet

- IBBI Discussion PaperDocument11 pagesIBBI Discussion PaperRitesh kumarNo ratings yet

- Antichresis (ARTICLES 2132-2139) : Writing OtherwiseDocument4 pagesAntichresis (ARTICLES 2132-2139) : Writing OtherwiseLisa Bautista100% (1)

- Contracts of Indemnity and GuaranteeDocument19 pagesContracts of Indemnity and GuaranteeKazia Shamoon AhmedNo ratings yet

- Pledge: Coverage of Discussion: Kinds of Pledge Conventional Pledge Legal PledgeDocument26 pagesPledge: Coverage of Discussion: Kinds of Pledge Conventional Pledge Legal PledgeAmie Jane MirandaNo ratings yet

- Summary On Credits - Pledge OnwardsDocument9 pagesSummary On Credits - Pledge OnwardsCarmen FrenNo ratings yet

- LawDocument4 pagesLawMaricar Salvador PenaNo ratings yet

- Trust Act AssaignmenrDocument12 pagesTrust Act AssaignmenrNusrat JahanNo ratings yet

- Guaranty Oct. 9 2020Document5 pagesGuaranty Oct. 9 2020HK FreeNo ratings yet

- Reviewer For Credit TransactionDocument22 pagesReviewer For Credit TransactionMaristela Mark JezrelNo ratings yet

- Real Estate Mortgage AgreementDocument7 pagesReal Estate Mortgage AgreementErikka Shanely LimpangugNo ratings yet

- Investor Escrow AgreementDocument6 pagesInvestor Escrow AgreementStacey LandrumNo ratings yet

- Assignment On RFTBDocument7 pagesAssignment On RFTBMica Ella San DiegoNo ratings yet

- Credit RevDocument3 pagesCredit RevCARLO JOSE BACTOLNo ratings yet

- Insurance Reviewer Midterm ExamsDocument9 pagesInsurance Reviewer Midterm ExamsSantoy CartallaNo ratings yet

- Canon 20 Reasonable CompensationDocument21 pagesCanon 20 Reasonable CompensationElyka RamosNo ratings yet

- Insurance LawDocument3 pagesInsurance LawJoe BuenoNo ratings yet

- Security AgreementDocument2 pagesSecurity Agreementibenhanna100% (1)

- PlayDocument6 pagesPlaylance zoletaNo ratings yet

- Rrevocable Trust Agreement: (For The Benefit of The Grantor'S Adult Children, Designating Two Trustees)Document3 pagesRrevocable Trust Agreement: (For The Benefit of The Grantor'S Adult Children, Designating Two Trustees)JennyMariedeLeon100% (4)

- Disabilities of TrusteesDocument4 pagesDisabilities of TrusteesAdv Sohail Bhatti0% (2)

- B5 Spring2010Document6 pagesB5 Spring2010Aimon JahangirNo ratings yet

- Uniform Civil Code - MergedDocument10 pagesUniform Civil Code - Mergeddeepak sethiNo ratings yet

- ADR Assignment 1Document9 pagesADR Assignment 1deepak sethiNo ratings yet

- ADR Assignment 2Document9 pagesADR Assignment 2deepak sethiNo ratings yet

- 5 Rights of TrusteeDocument9 pages5 Rights of Trusteedeepak sethiNo ratings yet

- "RIGHT TO PRIVACY AND SOCIAL MEDIA PLATFORMS"-final Article-EditedDocument16 pages"RIGHT TO PRIVACY AND SOCIAL MEDIA PLATFORMS"-final Article-Editeddeepak sethiNo ratings yet

- Minor's ContractDocument1 pageMinor's Contractdeepak sethiNo ratings yet

- Hindu Marriage ActDocument4 pagesHindu Marriage Actdeepak sethiNo ratings yet

- Law of Contract Sessional 1Document35 pagesLaw of Contract Sessional 1deepak sethiNo ratings yet

- Constitutional Law 2 Sessional 1Document14 pagesConstitutional Law 2 Sessional 1deepak sethiNo ratings yet

- Legal NoticeDocument3 pagesLegal NoticeMOHIT SAMANIANo ratings yet

- Mobile Device Agreement TemplateDocument3 pagesMobile Device Agreement Templatekim austriaNo ratings yet

- Sas#5-Gen 010Document5 pagesSas#5-Gen 010conandetic123No ratings yet

- 33 - de Guzman V Perez - MendozaDocument2 pages33 - de Guzman V Perez - MendozaJohn YeungNo ratings yet

- Amendment of PleadingsDocument17 pagesAmendment of PleadingsPunam ChauhanNo ratings yet

- 'Free SHS Can Become Another GYEEDA Scandal' - Ayariga Sues Akufo-Addo GovernmentDocument8 pages'Free SHS Can Become Another GYEEDA Scandal' - Ayariga Sues Akufo-Addo GovernmentGhanaWeb EditorialNo ratings yet

- 2009024-Gpg Pre Employment ScreeningDocument79 pages2009024-Gpg Pre Employment ScreeningXeel ShaNo ratings yet

- AIRBNB-MOA Lim TangpuzDocument3 pagesAIRBNB-MOA Lim TangpuzAnneDala アナリザNo ratings yet

- Ambot Sa KinabuhiDocument55 pagesAmbot Sa Kinabuhiadonis.orillaNo ratings yet

- Cruelty in Marriage: Analysis of Supreme Court Cases On Section 498A IPC by Divyansh HanuDocument11 pagesCruelty in Marriage: Analysis of Supreme Court Cases On Section 498A IPC by Divyansh HanuLatest Laws Team100% (2)

- Your Application For Visa Is Registered Online: WWW - Udi.no/checklistsDocument2 pagesYour Application For Visa Is Registered Online: WWW - Udi.no/checklistsw8ndblidNo ratings yet

- Du LLB 2003Document28 pagesDu LLB 2003mittal_udit07No ratings yet

- Cases Torts Go Vii. Civil Liability Arising From CrimeDocument327 pagesCases Torts Go Vii. Civil Liability Arising From CrimeToniNarcisoNo ratings yet

- LeasedeedformatDocument5 pagesLeasedeedformatAnurag JenaNo ratings yet

- Criminal Law and Jurisprudence QuestionnaireDocument6 pagesCriminal Law and Jurisprudence QuestionnaireJOHN FLORENTINO MARIANONo ratings yet

- Resignation of Compelled Social Security Trustee Form InstructionsDocument124 pagesResignation of Compelled Social Security Trustee Form InstructionsMaryUmbrello-Dressler100% (1)

- AZUELA v. CA Case DigestDocument2 pagesAZUELA v. CA Case DigestNOLLIE CALISING100% (2)

- Fue Leung v. IACDocument2 pagesFue Leung v. IAClealdeosaNo ratings yet

- Reflection Paper - On The Basis of SexDocument1 pageReflection Paper - On The Basis of SexAnna VeluzNo ratings yet

- Contract Law - Legal Capacity of PersonsDocument3 pagesContract Law - Legal Capacity of Personstheea53No ratings yet

- BIGAMYDocument25 pagesBIGAMYKherry LoNo ratings yet

- MODULE - Tittle 6 of RPC Book IIDocument2 pagesMODULE - Tittle 6 of RPC Book IIChan Gileo Billy ENo ratings yet

- Filipino Parents of LGBT in The Lens of Global Sustainability and Climate Justice Dissecting Filipino Values As Engage in Environmental EthicsDocument2 pagesFilipino Parents of LGBT in The Lens of Global Sustainability and Climate Justice Dissecting Filipino Values As Engage in Environmental EthicsKay Santos FernandezNo ratings yet

- Ergonomic Systems Vs EnajeDocument1 pageErgonomic Systems Vs EnajeRobertNo ratings yet

- HHP - Indonesia Now Has A Specific E-Commerce RegulationDocument8 pagesHHP - Indonesia Now Has A Specific E-Commerce RegulationOsc GerhatNo ratings yet

- Summary Guide For Chapter 11 Foundations of Australian Law: Fourth EditionDocument7 pagesSummary Guide For Chapter 11 Foundations of Australian Law: Fourth EditionRishabhMishraNo ratings yet

- Of The Estate of The Late TITUS ARON MOLLEL) .................. 1st RESPONDENTDocument9 pagesOf The Estate of The Late TITUS ARON MOLLEL) .................. 1st RESPONDENTjaulanetworkNo ratings yet

- Ipr AssignmentDocument23 pagesIpr AssignmentGaurav PandeyNo ratings yet

- Calendar of CasesDocument3 pagesCalendar of CasesRtc Forty Eight BacolodNo ratings yet

- Pantaleon v. MMDADocument2 pagesPantaleon v. MMDAArly MicayabasNo ratings yet