Professional Documents

Culture Documents

Chapter 6 Shipping Terms FAS FOB CF CIF 20220331 Final

Uploaded by

Debora Gracia saragihOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 6 Shipping Terms FAS FOB CF CIF 20220331 Final

Uploaded by

Debora Gracia saragihCopyright:

Available Formats

Chapter 6

Shipping Terms

FAS, FOB, C&F, CIF

Many of the key terms of trade used in international grain contracts are

standardized to communicate clearly and help ensure transactions proceed

smoothly. These terms provide consistency, minimize confusion, and clarify

the obligations of buyers and sellers. A small misunderstanding of contract or

shipping terms can easily lead to a dispute including, the allocation of risk, or

which party is responsible for certain costs, such as freight, insurance or other

expenses involved in the delivery of goods.

In order to facilitate international trade, the International Chamber of

Commerce (ICC) publishes and regularly updates a set of globally recognized

terms that help to create a standard for trade terms commonly used in the sale

of goods.i These terms are commonly referred to as “Incoterms®,” which is

the abbreviation for International Commercial Terms. ii

Incoterms® rules are a globally recognized set of standards, used worldwide in

international and domestic contracts. These rules have been developed and

maintained by experts and practitioners brought together by ICC. The trade

terms help traders avoid costly misunderstandings by clarifying the tasks, costs

and risks involved in the delivery of goods from sellers to buyers.

The latest Incoterms® are referred to as Incoterms® 2020. They were

launched in September 2019 and came into effect on the 1st of January 2020.

Please note that all contracts made under Incoterms® 2010 and any other

previous editions remain valid and parties to a contract for the sale of goods

can agree to choose any version of the Incoterms® rules. However, we

recommend using the most current version of the rules, which today is

Incoterms® 2020. It is important to clearly specify the chosen version.

For more information on the International Chamber of Commerce and

Incoterms, please see: https://iccwbo.org/about-us/who-we-are/

For bulk commodities transported internationally over inland waterways or by

U.S. Grains Council – Importer Manual, Chapter 6 6-1

sea, there are four other Incoterms that are closely related to cost and freight

and that are frequently used in contracts for the bulk grain trade. Each of the

following terms must also state a place of delivery. These are:

Free Alongside Ship (FAS) requires the seller to deliver grain, cleared for

export, alongside the buyer’s vessel at a named port, at which point risk of

loss or damage to the grain transfers to the buyer.

Free On Board (FOB) requires the seller to deliver grain, cleared for

export, loaded on board the buyer’s vessel at a named port, at which point

risk of loss or damage to the grain transfers to the buyer.

Cost and Freight (CFR) requires the seller to load grain onto a vessel and

to arrange and pay for transport of the grain to a named port; however, the

risk of loss or damage to the grain passes to the buyer as the grain is loaded

onto the vessel, and the buyer can decide whether or not to insure against

Incoterms® this risk.

Note –The term C&F is frequently used in the bulk grain trade, although it

is not a recognized Incoterm®. It has the same meaning as CFR.

Cost, Insurance and Freight (CIF) is the same as C&F, but requires the

seller to obtain and pay for cargo insurance meeting certain minimum

standards. The buyer can claim under the cargo insurance if the grain is

lost or damaged during the voyage.

These four terms as defined by Incoterms® are primarily used in contracts for

international trade in bulk commodities where transportation is entirely

conducted by water. They are generally not suitable for shipments in shipping

containers. Other Incoterms® are better suited to the sale of goods in

containers, such as FCA (Free Carrier), CPT (Carriage Paid To) or CIP

(Carriage Insurance Paid To).

Note that buyer and sellers are not required to use Incoterms ® in the contracts

for the sale of goods. Some standard contract forms, such as those developed

by the Grain and Feed Trade Association (GAFTA) or the North American

Export Grain Association (NAEGA), refer to their contracts as being “cost and

freight” or “free on board” contracts. Their contract forms, however, spell out

the obligations of the buyer and seller and when the risk of loss or damage to

the goods passes in detail so that they do not need to refer to or incorporate the

Incoterms®. Buyers and sellers are free to use these form contracts, or to

incorporate the appropriate Incoterm, as they see fit and as they may agree.

Let’s take a more detailed look at these four Incoterms ® that are intended to

cover the sale of goods by sea or inland waterway.

U.S. Grains Council – Importer Manual, Chapter 6 6-2

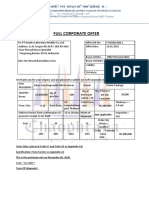

Source: ICC International Chamber of Commerce, Incoterms® 2020 Resources, “Chart -

Transportation Obligations, Costs and Risks”, This chart is not intended to be used alone, and

should always be used in conjunction with the Incoterms® 2020 rule book. iii

“Free Along Side” (FAS): This contract term states the seller only has to

deliver the cargo alongside the vessel nominated by the buyer at the stated

port, at which point the risk in and responsibility for the goods shifts to the

buyer.

This term is not as commonly used for sales of goods exported from the

United States as it may be in some other countries.

Cost of Transportation: Under FAS terms, the seller bears the costs of

transporting the grain to the port for loading. The buyer then bears the cost of

loading the vessel, marine freight transportation, cargo insurance, and finally

the unloading and transportation costs from the discharge port to ultimate

destination of the goods.

If an importer buys grain FAS, the importer must bear the cost of chartering a

vessel, loading the goods onto the vessel at the loading port, appointing agents

to oversee loading of the vessel and securing related documentation,

monitoring the vessel's progress as it sails, arranging and paying for discharge

of the goods at the discharge port, and settling any claims related to the

carriage of the goods with the vessel owner. As you can see, in an FAS sale

the buyer bears significantly more responsibilities and costs than the seller.

Risk of Loss or Damage to the Goods: Under a FAS sale, the liability for

risk of loss or damage to the goods is transferred from the seller to the buyer as

the grain is delivered by the seller alongside the vessel at the agreed load port.

It is at that point that the seller’s responsibility and risk ends.

U.S. Grains Council – Importer Manual, Chapter 6 6-3

The FAS terms do require the seller to clear the goods for export, which is a

change from previous Incoterms. If the parties, however, wish the buyer or its

agent to clear the goods for export, this should be clearly stated in the contract.

iv, v

Cost of Insurance: Under FAS terms the buyer may, at its own cost, purchase

cargo insurance covering the goods against the risk of loss or damage from the

moment the seller delivers the goods alongside the buyer’s vessel. The seller

has no obligation to arrange or pay for this cargo insurance. The buyer can

elect to not insure the goods against the risks of the voyage, though that

decision could end up being penny wise and pound foolish.

FAS

In practice FAS terms are used only for sea transport, and, only for certain

commodities and materials that are not packed and cannot be individualized,

such as grain, feed, meal, timber, minerals, steel products, etc.

Export Clearance: The seller is responsible for clearing the goods for export,

including paying any export fees, duties or taxes. Usually the buyer will clear

the goods for export before placing them alongside the ship.

Other Considerations: In addition, in nearly all FAS (and FOB, CFR and

CIF) sales in the grain and oilseeds trade, the seller must obtain a quality grade

certificate. This is normally generated by the Federal Grain Inspection Service,

satisfying one of the seller’s contractual obligations of quality delivered to the

buyer.

FAS should be used for situations where the buyer has direct access to the

vessel for loading, e.g. bulk cargos or non-containerized goods. When using

FAS, the buyer is responsible for arranging and paying for the cost of loading

the goods on the ship. For this reason, the buyer or their load port agent must

know the practices in the port of shipment.

Finally, FAS is a term generally used only for sea and inland waterway

transport and usually for general cargo. When the goods are transported in

containers, Incoterms 2020 rules recommends the use “Free Carrier”, FCA.vi

U.S. Grains Council – Importer Manual, Chapter 6 6-4

Source: ICC International Chamber of Commerce, Incoterms® 2020 Resources, “Chart -

Transportation Obligations, Costs and Risks”, This chart is not intended to be used alone, and

should always be used in conjunction with the Incoterms® 2020 rule book. vii

“Free on Board” (FOB): This Incoterm ® states the seller deliverers the

commodity to the buyer "at the discharge end of the loading spout, into the

buyer's presented vessel in condition of readiness to load” (Incoterms ® 2010).

The seller must also arrange for export clearance and/or any export permits

and pay any export taxes. The primary difference between a FOB sale and a

FAS sale is that in a FOB sale the seller must not only bring the goods

alongside the buyer’s vessel, but also arrange for and pay the cost of loading

the goods onto the vessel. These loading costs are referred to in the grain trade

as “elevation” costs, or “fobbing” costs. The seller’s risk of loss or damage to

the goods also carries through the loading process until the goods exit the

loading spout in the vessel.

Cost of Transportation: The buyer is responsible for arranging and paying

all costs of the marine freight transportation, any cargo insurance, and the

costs for unloading from the goods at the arrival port.

In the case of a cargo moving by sea, this means the buyer charters the vessel.

The buyer then presents (or nominates) the vessel to the seller as the vessel to

load the cargo and may appoint agents at the load port to monitor the loading

and the creation of the load documents.

Risk of Loss or Damage to the Goods: The risk of loss or damage to the

goods is transferred from a seller to a buyer as the grain is loaded into the

vessel’s holds. This is why it is sometimes said that the risk of loss or damage

to the goods passes from the seller to the buyer as the goods pass from the

shore over the vessel’s “rail,” i.e. the side of the vessel. It is at that point that

the seller’s responsibility for the goods, and risk of loss or damage to the

goods, ends. The risk of loss or damage to the goods then shifts to the buyer.

U.S. Grains Council – Importer Manual, Chapter 6 6-5

Cost of Insurance: A FOB seller has no obligation to obtain or pay for cargo

insurance covering the goods. As mentioned above, the risk of loss or damage

to the goods passes from seller to buyer as the goods are loaded onto the

vessel. It is up to the buyer then to obtain cargo insurance coverage for the

risks of the voyage.

Export Clearance: As with FCA sales, the seller is responsible for clearing

the goods for export, including paying any export fees, duties or taxes.

Other Considerations: Historically, FOB sale terms were used primarily on

the sale of goods transported by ship. However, in the U.S., the term has

expanded to include all types of transportation, including barges, rail and road.

Incoterms®, however, recommends that for non-water borne transport the

parties use instead the free carrier (FCA) term.

FOB

In a typical FOB sale of grain, the buyer will present at the load port an

appropriate vessel of a type typically used for the carriage of the goods sold,

which is inspected and cleared for readiness to load the grain. This

presentation must occur within the contracted delivery period, at a port or

ports stated in the contract. The seller and buyer may even agree in the

contract to a specified loading facility or berth.

The seller then must deliver onto the vessel the quality and quantity of grain

required by the contract. For grain exports from the USA the Federal Grain

Inspection Service (FGIS) normally issues these certificates to the exporter..

The Seller may also be required to deliver to the buyer a number of other

documents as agreed to in the contract, for example a phytosanitary certificate,

non-gmo certificate, or a certificate of origin, etc.

In a typical FOB sale, once the seller has loaded contractual goods on the

buyer’s vessel within the agreed delivery period, and has presented to the

buyer the documents required by the contract to evidence this delivery, the

seller has completed its obligations and is entitled to be paid for the goods.

U.S. Grains Council – Importer Manual, Chapter 6 6-6

Source: ICC International Chamber of Commerce, Incoterms® 2020 Resources, “Chart -

Transportation Obligations, Costs and Risks”, This chart is not intended to be used alone, and

should always be used in conjunction with the Incoterms® 2020 rule book. viii

Cost and Freight (CFR) (though sometimes shortened as C&F or CNF):

Deciding whether to buy or sell on an “F” term (e.g. FAS or FOB) or a “C”

term (e.g. CFR or CIF) is significant. This is because “C” terms shift all the

responsibility and cost of obtaining and paying for the ocean freight from the

buyer to the seller. As a result, the seller must not just arrange and pay for

transporting the cargo to a specified load port, cleared for export, and the

loading of the goods onto an appropriate vessel (as required of an FOB seller).

In addition, the seller must also arrange and pay for the vessel which will carry

the goods to their contractual destination. The term cost and freight means that

the seller must provide to the buyer two things;

(1) the goods themselves, loaded on the vessel (the “cost”), and

(2) the transportation of the goods to the discharge port (the “freight”).

An important element of a CFR sale contract is the shipment period,

sometimes referred to as the delivery period. Remember that in a CFR sale the

seller is responsible not only for getting contractual goods onto the vessel, but

also charter in the vessel to take the goods to the discharge port. The buyer

therefore often has very little insight into the arrival of the goods at the load

port or progress of loading, or when the vessel sails from the load port. The

buyer can, though, agree on a shipment period. The shipment period is the

range of days during which the seller must complete loading the vessel with

the contractual cargo. The bill of lading will show the date on which loading

was complete (or if the vessel issues several bills of lading for the goods, the

latest date shows the day on which loading was complete). The buyer can

therefore easily determine if the vessel was loaded within the agreed shipment

period.

U.S. Grains Council – Importer Manual, Chapter 6 6-7

Use of this term is generally restricted to goods transported by sea or inland

waterway.

Cost of Transportation: As stated above, CFR terms state that, in addition to

loading the vessel with the cargo, the Seller is responsible for the cost of

marine transportation from the load port to the discharge port. This cost is

therefore included in the sales price for the goods.

Risk of Loss or Damage to the Goods: Just as with grain that is sold on FOB

terms, the risk of loss or damage to the goods transfers from the seller to the

buyer when the goods are loaded onto the vessel at the load port. The seller is

responsible for finding and paying for the vessel to carry the goods to the

discharge port, but the buyer still has all of the risk of loss or damage to the

goods during the voyage.

Cost of Insurance: Under CFR terms the buyer not only has the risk of loss or

damage to the goods from the moment the goods are loaded onto the vessel,

but the buyer also must decide whether to purchase cargo insurance to cover

these risks, and if so how much insurance.

CFR

Other Considerations: In a CFR sale the seller’s obligations are complete

when they have loaded contractual goods on a contractual vessel within the

agreed shipment period. The seller is then entitled to be paid for the goods.

Payment typically occurs when the seller presents the buyer with a set of

documents showing that goods meeting the contract requirements were loaded

on a vessel destined for the discharge port. Typical documents include a bill

of lading, the seller’s invoice, and certificates of quality and quantity. English

courts are fond of saying that CFR (and CIF) sales are not sales of goods, but

sales of documents. Once the seller presents the documents required by the

contract the buyer must pay.

Though the seller has the direct contract (known as a charter party) with the

vessel for the carriage of the goods, once the bill of lading has been transferred

from the seller to the buyer the buyer has rights against the vessel under the

bill of lading and has the right to take possession of the goods at the discharge

port.

CFR is a sea transport Incoterm used mainly for general cargo and large

volumes of goods, including grain and oilseeds. When the goods are

transported in containers and the seller is arranging and paying for the ocean

transportation, Incoterms® 2020 rules advise to use CPT instead of CFR, as

containers are usually delivered at the terminals of the load port, before being

placed on board ships.ix

U.S. Grains Council – Importer Manual, Chapter 6 6-8

Source: ICC International Chamber of Commerce, Incoterms® 2020 Resources, “Chart -

Transportation Obligations, Costs and Risks”, This chart is not intended to be used alone, and

should always be used in conjunction with the Incoterms® 2020 rule book. x

Cost, Insurance, and Freight (CIF): This contract term used when freight is

shipped via sea or waterway. Under CIF terms, the seller is responsible for

everything a seller is responsible under a CFR sale (including arranging and

paying for the vessel carrying the goods), plus the responsibility for obtaining

and the cost of paying for the cargo insurance covering the risk of loss or

damage to the goods during the voyage. As with a CFR sale, the buyer is

responsible for all costs of unloading the goods at the destination port.

CIF is similar to carriage and insurance paid to (CIP), but CIF is used for

goods transported by sea or inland waterway shipments, while CIP can be used

for any mode of transport, such as by truck.

Cost of Transportation: This is the same as in a CFR sale. The Seller is

responsible for the cost of the marine transportation from the load port to the

discharge port. The seller therefore includes this cost in the sales price for the

goods.

Risk of Loss of Damage to the Goods: This is also the same as in a CFR (and

FOB) sale. The risk of loss or damage to the goods transfers from the seller to

the buyer when the goods are loaded onto the vessel at the load port. The

seller is responsible for finding and paying for the vessel to carry the goods to

the discharge port, but the buyer still has all of the risk of loss or damage to the

goods during the voyage.

Cost of Insurance: This is the difference between a CFR and CIF sale. Under

both terms the risk of loss transfers to the buyer as the goods are loaded into

the vessel. In a CFR sale the seller has no responsibility for obtaining or

U.S. Grains Council – Importer Manual, Chapter 6 6-9

paying for cargo insurance to cover the risks of the voyage. Under a CIF sale,

however, the seller must obtain and pay for marine cargo insurance to cover

the goods against loss or damage during the voyage. This cost, like the cost of

the vessel, is included in the CIF sales price.

The CIF sale contract should state the minimum marine cargo insurance

coverage that the seller must buy, and the minimum qualifications of the

insurer or underwriter. The sale contract will also normally require that the

seller, in order to be paid, must provide the buyer with a certificate of

insurance showing that these requirements are met. Often the cargo must be

insured for the value of the commercial invoice, including the value of the

cargo plus freight costs from the port of shipping to the port of destination,

plus 10%; (i.e., 110% of CIF value). The policy should be in the same

currency as the contract. The beneficiary of this insurance and, therefore, the

one that must apply to the insurer for compensation in case of loss or damage

to the goods, is the buyer.

Incoterms 2020® made changes to the insurance coverage requirements under

CIF agreements. Sellers are now required to obtain a higher level or more

comprehensive insurance than what was required under Incoterms 2010. xi, xii

CIF

Other Considerations: In practice, CFR and CIF terms should be used for

situations where the seller has direct access to the vessel for loading, e.g. bulk

cargos or non-containerized goods. The goods are shipped to the buyer's port

nominated in the contract. Further, if the product requires additional customs

duties levied by the country to export, export paperwork, or inspections, the

seller must cover these expenses.

Once the cargo has arrived at the CFR or CIF destination port, the buyer

assumes responsibility for the port conditions (draft, available berth, and so

forth), discharging the vessel, and all costs of importing the goods.

As with CFR sale, an important element within CIF sale terms is the shipment

period. This is the range of dates during which the goods must be fully loaded

on the vessel. The date of loading stated on the bill of lading for the goods

clearly shows if the seller has completed loading within the shipment period.

CIF is a widely used term. In addition to delivering the goods to the

destination port of the buyer's country, the CIF value on the commercial

invoice is most likely used by customs to apply tariffs and import taxes,

facilitating the clearance of for import.

Occasionally, an exporter may load a cargo unsure of which sale the shipment

may be applied to or without a sale, hoping to find a buyer once the grain is

afloat. On these occasions, the seller will be self-insuring the cargo value and

deliver it CIF once a sale has been arranged.

U.S. Grains Council – Importer Manual, Chapter 6 6 - 10

CIF is a term generally used only for sea and inland waterway transport and

usually for general cargo of high value. When the goods are transported in

CIF

containers, Incoterms 2020 rules recommends the use ‘Carriage and Insurance

Paid’, CIP instead.xiii

As you can see, small changes in these incoterms can have significant

implications for the responsivities, risks and costs of the seller and buyer.

Every buyer and seller therefore should have a solid working understanding of

contract terms and conditions. They should consult a lawyer well versed in

international trade and maritime law, as well as local statutes, and have the

proposed contracts reviewed before agreeing to the purchase or sale of grain

or oilseeds.

U.S. Grains Council – Importer Manual, Chapter 6 6 - 11

Chapter Author: Guy H. Allen

Senior Economist – International Grains Program

Kansas State University

Chapter Reviewer: Todd Erickson

Senior Advisor with NAEGA and a NAEGA Special Grain Arbitrator

B.A. Carleton College 1981, J.D. Washington University in St. Louis 1985.

Minnesota Bar 1985

i

International Chamber of Commerce. "Incoterms® Rules." https://iccwbo.org/resources-for-

business/incoterms-rules/ Accessed 5 November 2021

ii

International Chamber of Commerce. "Incoterms® Rules." https://iccwbo.org/resources-for-

business/incoterms-rules/ Accessed 5 November 2021

iii

ICC International Chamber of Commerce, Incoterms® 2020 Resources, Chart – “Transportation

Obligations, Costs and Risks” , This chart is not intended to be used alone, and should always be

used in conjunction with the Incoterms® 2020 rule book. https://iccwbo.org/publication/incoterms-

2020-practical-free-wallchart/ Accessed 25 February 2022

iv

Trade Finance Global. "Incoterms® 2020 – 7 key changes you need to know [update]."

https://www.tradefinanceglobal.com/posts/incoterms-2020-7-key-changes-you-need-to-know/

Accessed 9 November 2021

v

ICC. "Incoterms 2020." https://iccwbo.org/resources-for-business/incoterms-rules/incoterms-

2020/ Accessed 9 November 2021

vi

International Chamber of Commerce. "Incoterms® Rules." https://iccwbo.org/resources-for-

business/incoterms-rules/ Accessed 5 November 2021

vii

ICC International Chamber of Commerce, Incoterms® 2020 Resources, Chart –

“Transportation Obligations, Costs and Risks” , This chart is not intended to be used alone, and

should always be used in conjunction with the Incoterms® 2020 rule book.

https://iccwbo.org/publication/incoterms-2020-practical-free-wallchart/ Accessed 25 February

2022

viii

ICC International Chamber of Commerce, Incoterms® 2020 Resources, Chart –

“Transportation Obligations, Costs and Risks” , This chart is not intended to be used alone, and

should always be used in conjunction with the Incoterms® 2020 rule book.

https://iccwbo.org/publication/incoterms-2020-practical-free-wallchart/ Accessed 25 February

2022

ix

International Chamber of Commerce. "Incoterms® Rules." https://iccwbo.org/resources-for-

business/incoterms-rules/ Accessed 5 November 2021

x

ICC International Chamber of Commerce, Incoterms® 2020 Resources, Chart – “Transportation

Obligations, Costs and Risks” , This chart is not intended to be used alone, and should always be

used in conjunction with the Incoterms® 2020 rule book. https://iccwbo.org/publication/incoterms-

U.S. Grains Council – Importer Manual, Chapter 6 6 - 12

2020-practical-free-wallchart/ Accessed 25 February 2022

xi

Trade Finance Global. "Incoterms® 2020 – 7 key changes you need to know [update]."

https://www.tradefinanceglobal.com/posts/incoterms-2020-7-key-changes-you-need-to-know/

Accessed 9 November 2021

xii

ICC. "Incoterms 2020." https://iccwbo.org/resources-for-business/incoterms-rules/incoterms-

2020/ Accessed 9 November 2021

xiii

International Chamber of Commerce. "Incoterms® Rules." https://iccwbo.org/resources-for-

business/incoterms-rules/ Accessed 5 November 2021

U.S. Grains Council – Importer Manual, Chapter 6 6 - 13

You might also like

- Chapter 6 Ibt ReviwerDocument6 pagesChapter 6 Ibt Reviwerseguerrarachel54No ratings yet

- Marine Cargo HandbookDocument14 pagesMarine Cargo HandbookManoj SolankarNo ratings yet

- IncotermsDocument6 pagesIncotermsHarsimran SinghNo ratings yet

- Module 3. Incoterms (Workbook)Document10 pagesModule 3. Incoterms (Workbook)Настя КнутоваNo ratings yet

- Incoterms DefinitionDocument9 pagesIncoterms DefinitionDishank AgrawalNo ratings yet

- Cost, Insurance, and Freight - CIF Definition byDocument5 pagesCost, Insurance, and Freight - CIF Definition byDanica BalinasNo ratings yet

- F.O.B. Sales: Introduction To ANDDocument2 pagesF.O.B. Sales: Introduction To ANDHegde2626No ratings yet

- Manda Topic 22Document5 pagesManda Topic 22HOPENo ratings yet

- Explicate The Cost and Risks To Buyer and Seller Involved Under Various Delivery Terms INCOTERMS in An International Trade TransactionDocument25 pagesExplicate The Cost and Risks To Buyer and Seller Involved Under Various Delivery Terms INCOTERMS in An International Trade TransactionMegha MalhotraNo ratings yet

- ICOTERMSDocument6 pagesICOTERMSalex agredaNo ratings yet

- Incoterms: Incoterms, Promulgated by The International Chamber of Commerce, Is An Acronym For "InternationalDocument4 pagesIncoterms: Incoterms, Promulgated by The International Chamber of Commerce, Is An Acronym For "InternationalTeshaleNo ratings yet

- Incoterms Unit 6 - Trade Terms in International Sale of Goods or International Commercial TermsDocument12 pagesIncoterms Unit 6 - Trade Terms in International Sale of Goods or International Commercial Termsrenatus APOLINARYNo ratings yet

- IncotermDocument3 pagesIncotermMayur KhamitkarNo ratings yet

- IBLaw Weekly Assignment 1Document4 pagesIBLaw Weekly Assignment 1FeiyezNo ratings yet

- March IncotermsDocument2 pagesMarch IncotermsNanu JijeshNo ratings yet

- Incoterm: INCOTERMS Also Deal With The Documentation Required For Global Trade, SpecifyingDocument3 pagesIncoterm: INCOTERMS Also Deal With The Documentation Required For Global Trade, SpecifyingMayur KhamitkarNo ratings yet

- Incoterms For International TradeDocument4 pagesIncoterms For International TradeMohammad Shahjahan SiddiquiNo ratings yet

- Commercial 1.PdfxDocument189 pagesCommercial 1.PdfxwaihtetNo ratings yet

- Incoterms: Search Exhibitions Showcase Join Free Services Reference Resources Forums News Download About Us LoginDocument3 pagesIncoterms: Search Exhibitions Showcase Join Free Services Reference Resources Forums News Download About Us Loginvimal_prajapatiNo ratings yet

- Law NotesDocument31 pagesLaw NotesTumusiime NicholasNo ratings yet

- Faculty of Business Management and Professional StudiesDocument6 pagesFaculty of Business Management and Professional StudieswafiqNo ratings yet

- INCOTERMSDocument3 pagesINCOTERMSAdarsh VarmaNo ratings yet

- Chapter 11 TransportationDocument15 pagesChapter 11 TransportationThích Chơi DạiNo ratings yet

- Incoterms® 2010, Will Be Launched in September and Come Into Effect On 1 January 2011Document3 pagesIncoterms® 2010, Will Be Launched in September and Come Into Effect On 1 January 2011Neha SinghNo ratings yet

- IncotermsDocument11 pagesIncotermsSky509No ratings yet

- INCOTERMSDocument3 pagesINCOTERMSanoop116No ratings yet

- FOB MeaningDocument3 pagesFOB Meaningronald bosNo ratings yet

- Inco TermsDocument20 pagesInco TermsHarmanjit DhillonNo ratings yet

- INCOTERMSDocument6 pagesINCOTERMSCathleen Drew TuazonNo ratings yet

- International Commercial ContractsDocument9 pagesInternational Commercial Contractsalfredo_07No ratings yet

- Incoterms 2010 Why Are They Required?Document8 pagesIncoterms 2010 Why Are They Required?SanktifierNo ratings yet

- Incoterms 2010Document16 pagesIncoterms 2010dkhana243No ratings yet

- INCOTERMS 2020 Handouts PartialDocument5 pagesINCOTERMS 2020 Handouts PartialKc BaniagaNo ratings yet

- ComGI 6th Ed Ver 1.2 - Chapter 5Document28 pagesComGI 6th Ed Ver 1.2 - Chapter 5AndyNo ratings yet

- Paper On IncotermsDocument5 pagesPaper On IncotermsIsagani DionelaNo ratings yet

- Incoterms® 2020 Contains The ICC Rules For Use of The 11 Incoterms® Trade Terms. ItDocument4 pagesIncoterms® 2020 Contains The ICC Rules For Use of The 11 Incoterms® Trade Terms. ItNadia IshmaNo ratings yet

- Celada Crizel Anne KDocument4 pagesCelada Crizel Anne KAnnê CeladaNo ratings yet

- Lesson 2:: Incoterms 2010 & 2020Document33 pagesLesson 2:: Incoterms 2010 & 2020Cathleen Drew TuazonNo ratings yet

- Terms Used in Shipping (INCO Terms) : Nitesh Shelly 09MBA095 Kanda Kumar 09MBA Abhijit 09MBADocument38 pagesTerms Used in Shipping (INCO Terms) : Nitesh Shelly 09MBA095 Kanda Kumar 09MBA Abhijit 09MBAMukund BalasubramanianNo ratings yet

- Incoterms 2000Document6 pagesIncoterms 2000jonh286No ratings yet

- Fas PDFDocument2 pagesFas PDFErolNo ratings yet

- Incoterms: "Incoterms" Is A Registered Trademark of The International Chamber of Commerce. IncotermsDocument7 pagesIncoterms: "Incoterms" Is A Registered Trademark of The International Chamber of Commerce. IncotermsNagaraj SusurlaNo ratings yet

- Discuss The Four Categories of Trade Term Under The Incoterm 2010Document8 pagesDiscuss The Four Categories of Trade Term Under The Incoterm 2010Farhana ShahiraNo ratings yet

- Incoterms 2021 - EnglishDocument23 pagesIncoterms 2021 - Englishgcfs9zh5tbNo ratings yet

- INCOTERMSDocument11 pagesINCOTERMSRomero Mary JaneNo ratings yet

- Assignment IncotermsDocument6 pagesAssignment IncotermsBaba NasheNo ratings yet

- Who Uses Incoterms?: What Are They?Document3 pagesWho Uses Incoterms?: What Are They?FueNo ratings yet

- Chapter 2 (GDTMQT) - SVDocument92 pagesChapter 2 (GDTMQT) - SV18 Nguyễn Khánh LinhNo ratings yet

- Incoterms - Wikipedia, The Free EncyclopediaDocument5 pagesIncoterms - Wikipedia, The Free EncyclopedianayanghimireNo ratings yet

- The Use of Incoterms 2020Document8 pagesThe Use of Incoterms 2020david dearingNo ratings yet

- 43090972540Document2 pages43090972540saeed.work92No ratings yet

- Ibl KKDocument5 pagesIbl KKebs19-kkatengezaNo ratings yet

- Special Terms in International TradeDocument55 pagesSpecial Terms in International TradeDaniel BoatengNo ratings yet

- Incoterms 2020Document3 pagesIncoterms 2020Loulica Danielle Gangoue mathosNo ratings yet

- Incoterms 2010Document13 pagesIncoterms 2010Nico BelloNo ratings yet

- Chapter 2Document58 pagesChapter 2ngonh.nguyenhuyNo ratings yet

- International Payment: Edward G. HinkelmanDocument34 pagesInternational Payment: Edward G. HinkelmanNguyen Van KhanhNo ratings yet

- The Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeFrom EverandThe Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeRating: 5 out of 5 stars5/5 (1)

- Basics of Chartering: Negotiation - Compatibility - Decision MakingFrom EverandBasics of Chartering: Negotiation - Compatibility - Decision MakingNo ratings yet

- The Forwarder´s Concern: An introduction into the marine liability of forwarders, carriers and warehousemen, the claims handling and the related insuranceFrom EverandThe Forwarder´s Concern: An introduction into the marine liability of forwarders, carriers and warehousemen, the claims handling and the related insuranceNo ratings yet

- Material Handling & Storage SystemsDocument22 pagesMaterial Handling & Storage SystemsShikha KathuriaNo ratings yet

- Ax 2009 Functionality OverviewDocument18 pagesAx 2009 Functionality Overviewvinay_axaptaNo ratings yet

- Air TransportationDocument89 pagesAir TransportationFTU-ERNo ratings yet

- E CommerceDocument18 pagesE Commercemabdullah_asad9813No ratings yet

- E Freight Handbook PDFDocument110 pagesE Freight Handbook PDFharikrishnanNo ratings yet

- Omv - Minimum Selecting CriteriaDocument6 pagesOmv - Minimum Selecting CriteriaerdemNo ratings yet

- (g18) Litonjua Shipping Company Inc vs. National Seamen BoardDocument3 pages(g18) Litonjua Shipping Company Inc vs. National Seamen BoardMhaliNo ratings yet

- UPS Marketing StrategyDocument5 pagesUPS Marketing StrategyTrần Thị Hồng NgọcNo ratings yet

- United Airlines v. CIRDocument2 pagesUnited Airlines v. CIRedrixcNo ratings yet

- FAIM 3.1 Standard Edition 1 FINALDocument36 pagesFAIM 3.1 Standard Edition 1 FINALAnonymous T1MgbFNo ratings yet

- DHL Express Domestic PDFDocument4 pagesDHL Express Domestic PDFPaola Bereníce LimónNo ratings yet

- Iata-Fiata Air Cargo Program: Handbook - 1 EditionDocument53 pagesIata-Fiata Air Cargo Program: Handbook - 1 EditionexpairtiseNo ratings yet

- Consignment: Dr. Rini Indahwati, SE, Ak, M.Si, CA, CBV, CERADocument12 pagesConsignment: Dr. Rini Indahwati, SE, Ak, M.Si, CA, CBV, CERARicky FernandooNo ratings yet

- Signing of BLDocument2 pagesSigning of BLRachana ChandraNo ratings yet

- Awb PT Dream 7 Okt 2022Document45 pagesAwb PT Dream 7 Okt 2022Kapten Sultan SparrowNo ratings yet

- MLC Presentation 2016 MAttardDocument25 pagesMLC Presentation 2016 MAttardNgurah Buana100% (1)

- Coastal ShippingDocument1 pageCoastal Shippingpunya.trivedi2003No ratings yet

- VM ChinajoyDocument17 pagesVM ChinajoyCeslhee AngelesNo ratings yet

- ABDA Airfreight SDN BHD V Sistem Penerbangan M'Sia BHD (2001) 3 MLJ 641Document74 pagesABDA Airfreight SDN BHD V Sistem Penerbangan M'Sia BHD (2001) 3 MLJ 641SukeMuneNo ratings yet

- Pak Elektron Limited: Purchase OrderDocument2 pagesPak Elektron Limited: Purchase OrderAbdul GhaffarNo ratings yet

- Masood Textile Mills LTD.: Supply Chain ManagementDocument11 pagesMasood Textile Mills LTD.: Supply Chain ManagementTàlhà Bïn TàrïqNo ratings yet

- Logistical CompetencyDocument6 pagesLogistical CompetencySafijo Alphons100% (1)

- Charter Insurance Vs MV National HonorDocument2 pagesCharter Insurance Vs MV National Honorpja_14100% (1)

- Mormugao Port Trust: Summer Placeme NTDocument166 pagesMormugao Port Trust: Summer Placeme NTmegrahulNo ratings yet

- Fco PT Damha Laboratory Medika From Chaophraya Development Group Company LimitedDocument6 pagesFco PT Damha Laboratory Medika From Chaophraya Development Group Company LimitedAndi RespatiNo ratings yet

- CasualtyInformation 1995 03Document2 pagesCasualtyInformation 1995 03Lai QuocNo ratings yet

- Cargo Record BookDocument7 pagesCargo Record BookTusharsorte100% (1)

- 10.14.2017 Quiz 1 (Audit of Inventory)Document5 pages10.14.2017 Quiz 1 (Audit of Inventory)PatOcampoNo ratings yet

- The Proforma InvoiceDocument8 pagesThe Proforma InvoiceAmit AgrawalNo ratings yet

- Airport Cities - The Evolution-1Document17 pagesAirport Cities - The Evolution-1IswatunHasanahSyatiriNo ratings yet