Professional Documents

Culture Documents

20238-2000-Implementing Section 34 B of The Tax Code Of20211213-11-1kbooi9

Uploaded by

Ramos Claude VinzonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

20238-2000-Implementing Section 34 B of The Tax Code Of20211213-11-1kbooi9

Uploaded by

Ramos Claude VinzonCopyright:

Available Formats

November 20, 2000

REVENUE REGULATIONS NO. 13-00

SUBJECT : Implementing Section 34(B) of the Tax Code of 1997 on the

Requirements for Deductibility of Interest Expense from the

Gross Income of a Taxpayer

TO : All Internal Revenue Officers and Others Concerned

SECTION 1. Scope. — Pursuant to the provisions of Section 244 of the

Tax Code of 1997, these Regulations are hereby promulgated to implement

the provisions of Section 34(B) of the same Code on the requirements for

deductibility of interest expense from the gross income of a corporation or

an individual engaged in trade, business or in the practice of profession.

SECTION 2. Definition of Terms . — For purposes of these Regulations,

the following words and phrases shall have the following meanings, viz:

(a) Interest — shall refer to the payment for the use or forbearance

or detention of money, regardless of the name it is called or

denominated. It includes the amount paid for the borrower's

use of money during the term of the loan, as well as for his

detention of money after the due date for its repayment. cAaETS

(b) Taxpayer — shall refer to a person, whether natural or juridical,

engaged in trade, business or in the exercise of profession,

except one earning compensation income arising from

personal services rendered under an employer-employee

relationship.

SECTION 3. Requisites for Deductibility of Interest Expense. — In

general, subject to certain limitations, the following are the requisites for the

deductibility of interest expense from gross income, viz:

(a) There must be an indebtedness;

(b) There should be an interest expense paid or incurred upon such

indebtedness;

(c) The indebtedness must be that of the taxpayer,

(d) The indebtedness must be connected with the taxpayer's trade,

business or exercise of profession;

(e) The interest expense must have been paid or incurred during

the taxable year;

(f) The interest must have been stipulated in writing;

(g) The interest must be legally due;

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

(h) The interest payment arrangement must not be between

related taxpayers as mandated in Sec. 34(B)(2)(b), in relation

to Sec. 36(B), both of the Tax Code of 1997;

(i) The interest must not be incurred to finance petroleum

operations; and

(j) In case of interest incurred to acquire property used in trade,

business or exercise of profession, the same was not treated

as a capital expenditure.

SECTION 4. Rules on the Deductibility of Interest Expense. —

(a) General Rule . — In general, the amount of interest expense

paid or incurred within a taxable year on indebtedness in

connection with the taxpayer's trade, business or exercise of

profession shall be allowed as a deduction from the

taxpayer's gross income.

(b) Limitation. — The amount of interest expense paid or incurred

by a taxpayer in connection with his trade, business or

exercise of a profession from an existing indebtedness shall

be reduced by an amount equal to the following percentages

of the interest income earned which had been subjected to

final withholding tax depending on the year when the interest

income was earned, viz:

Forty-one percent (41%) beginning January 1, 1998;

Thirty-nine percent (39%) beginning January 1, 1999; and

Thirty-eight percent (38%).beginning January 1, 2000 and thereafter.

This limitation shall apply regardless of whether or not a tax

arbitrage scheme was entered into by the taxpayer or regardless

of the date when the interest bearing loan and the date when the

investment was made for as long as, during the taxable year,

there is an interest expense incurred on one side and an interest

income earned on the other side, which interest income had been

subjected to final withholding tax. This rule shall be observed

irrespective of the currency the loan was contracted and/or in

whatever currency the investments or deposits were made. DTAIaH

Illustration: Supposing on January 15, 1998, Company A,

who has a deposit account with BCD Bank, obtained a loan from

XYZ Financing Corporation in connection with the operation of its

business. Assume that Company A's net income for the year 1998

before the deduction of the interest expense amounted to

P1,000,000. For the year 1998, the interest income it derived

from the said deposit with BCD Bank amounted to P180,000 on

which a final tax of P36,000 had been withheld. Its interest

expense on the loan obtained from XYZ Financing Corporation

during the same year amounted to P150,000.

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

Under this illustration, the deductible interest expense, the

taxable income and the income tax due of Company A shall be

computed as follows:

1998

Net income before interest expense P1,000,000

Less: Interest expense P150,000

Less: 41% of interest income from

deposit (41% x P180,000) 73,800

————

Deductible interest expense 76,200

————

Taxable income P923,800

————

Income tax due for taxable year 1998 (34%) P314,092

========

(c) Interest on Unpaid Taxes . — Provisions of Sec. 4(b) hereof to

the contrary notwithstanding, interest incurred or paid by the

taxpayer on all unpaid business-related taxes shall be fully

deductible from gross income and shall not be subject to the

limitation on deduction heretofore mentioned. Thus, such

interest expense incurred or paid shall not be diminished by

the percentage of interest income earned which had been

subjected to final withholding tax.

(d) Other cases where interest expense is not deductible from

gross income. — No interest expense shall be allowed as

deduction from gross income in any of the following cases:

(1) If within the taxable year, an individual taxpayer reporting

income on the cash basis incurs an indebtedness on

which an interest is paid in advance through discount

or otherwise: Provided, That such interest shall be

allowed as a deduction in the year the indebtedness is

p a i d : Provided, further, That if the indebtedness is

payable in periodic amortization, the amount of interest

which corresponds to the amount of the principal

amortized or paid during the year shall be allowed as

deduction in such taxable year.

Illustration: Mr. Cruz, a self-employed individual,

consistently employs the cash-basis accounting method

in keeping his books of accounts. Assuming that on

January 1, 1998, he contracted a loan of P1,000,000

from XYZ Bank for use in his business operations.

Terms: Payable in two (2) years at 15% interest per

annum, payable in advance. On January 1, 1998, he

received from the bank the proceeds of his loan in the

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

sum of P700,000, net of interest paid in advance in the

amount of P300,000.

In general, the interest expense shall be taken for

the taxable year in which "paid or incurred" or "paid or

accrued" depending upon the method of accounting

upon the basis of which the net income is computed,

unless in order to clearly reflect the income, the

deduction should be taken as of a different period.

Thus, a self-employed individual is allowed to deduct

from his gross income the entire amount of interest

expense actually paid during the taxable year.

However, if the interest expense is paid in advance and

the accounting method used by the self-employed

individual is the cash-basis accounting method, such

interest expense paid in advance shall only be allowed

as deduction in the year when he has fully paid his

liability. So that if the said debtor has fully paid his loan

as of the end of the taxable year 1999, his interest

expense paid in advance on January 1, 1998 in the

amount of P300,000 shall only be allowed as deduction

from his gross income in the taxable year 1999.

On the other hand, even if the interest expense is

paid in advance but the indebtedness is payable in

periodic amortization, the amount of interest expense

which corresponds to the amount of the principal

amortized or paid during the respective years 1998 and

1999 shall be allowed as deduction in such respective

taxable years. EATcHD

(2) If both the taxpayer and the person to whom the payment

has been made or is to be made are persons specified

under Sec. 36(B) of the Tax Code of 1997, viz:

(i) Between members of a family. For purposes of this

paragraph, the family of an individual shall

include only his brothers and sisters (whether by

the whole or half-blood), spouse, ancestors and

lineal descendants; or

(ii) Between an individual and a corporation more than

fifty percent (50%) in value of the outstanding

stock of which is owned, directly and indirectly, by

or for such individual; or

(iii) Between two corporations more than fifty percent

(50%) in value of the outstanding stock of each of

which is owned, directly or indirectly, by or for the

same individual; or

(iv) Between the grantor and a fiduciary of any trust; or

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

aCTHEA

(v) Between the fiduciary of a trust and the fiduciary of

another trust if the same person is a grantor with

respect to each trust; or

(vi) Between a fiduciary of a trust and a beneficiary of

such trust.

(3) If the indebtedness on which the interest expense is paid

is incurred to finance petroleum exploration in the

Philippines. The non-deductible interest expense herein

referred to pertains to interest or other consideration

paid or incurred by a Service Contractor engaged in the

discovery and production of indigenous petroleum in

the Philippines in respect of the financing of its

petroleum operations, pursuant to Section 23 of P.D.

No. 8, as amended by P.D. No. 87, otherwise known as

"The Oil Exploration and Development Act of 1972."

(e) Optional treatment of interest expense on capital expenditure.

— At the option of the taxpayer, interest expense on a capital

expenditure incurred to acquire property used in trade,

business or exercise of a profession may be allowed as a

deduction in full in the year when incurred, the provisions of

Sec. 36 (A)(2) and (3) of the Tax Code of 1997 to the contrary

notwithstanding, or may be treated as a capital expenditure

for which the taxpayer may claim only as a deduction the

periodic amortization of such expenditure.

SECTION 5. Repealing Clause . — The provisions of any revenue

regulations or any revenue issuance or ruling inconsistent with these

Regulations are hereby repealed, amended, or modified accordingly.

SECTION 6. Effectivity Clause. — These Regulations shall take effect

immediately.

(SGD.) JOSE T. PARDO

Secretary of Finance

Recommending Approval:

(SGD.) DAKILA B. FONACIER

Commissioner of Internal Revenue

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- RR No. 13-2000 - Interest RegulationsDocument7 pagesRR No. 13-2000 - Interest RegulationsHershey GabiNo ratings yet

- Interest Expense - RR No. 13-00Document8 pagesInterest Expense - RR No. 13-00美流No ratings yet

- RR 13-2000Document4 pagesRR 13-2000doraemoan100% (1)

- RR 13-00Document2 pagesRR 13-00saintkarri100% (2)

- Final DraftDocument11 pagesFinal Draftne0n_99No ratings yet

- TAXATIONDocument83 pagesTAXATIONKofo IswatNo ratings yet

- RR 13-2000 BIR Ruling 6-00Document1 pageRR 13-2000 BIR Ruling 6-00Angeli Soabas0% (1)

- 1 Income From PGBPDocument20 pages1 Income From PGBPHarsiddhi KotilaNo ratings yet

- Unit I: Income From Profits and Gains of Business or Profession'Document20 pagesUnit I: Income From Profits and Gains of Business or Profession'anuNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPdeepajagadishgowda532003No ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPalex v.m.No ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPDhandu RanjithNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPAchut GoreNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPJuhi MarmatNo ratings yet

- Public Finance & Taxation - Chapter 4, PT IIIDocument32 pagesPublic Finance & Taxation - Chapter 4, PT IIIbekelesolomon828No ratings yet

- M6 - Deductions P2 Students'Document53 pagesM6 - Deductions P2 Students'micaella pasionNo ratings yet

- Income Tax TdsDocument147 pagesIncome Tax TdsRohit SinghNo ratings yet

- Sec. 34 IRC-DeductionsDocument8 pagesSec. 34 IRC-DeductionsMav ZamoraNo ratings yet

- 18-Winter 2018 - BT - SADocument7 pages18-Winter 2018 - BT - SApabloescobar11yNo ratings yet

- Allowable Deductions From Gross Income - ReviewerDocument4 pagesAllowable Deductions From Gross Income - RevieweryzaNo ratings yet

- TAXABLE INCOME ReportDocument6 pagesTAXABLE INCOME ReportTrudgeOnNo ratings yet

- Deductions From Gross IncomeDocument23 pagesDeductions From Gross IncomeAidyl PerezNo ratings yet

- Tds N Adv TaxDocument133 pagesTds N Adv TaxanuNo ratings yet

- Ch-9 Advance Tax, TDS, TCSDocument122 pagesCh-9 Advance Tax, TDS, TCSrinkal jethiNo ratings yet

- Chapter 12 v2Document18 pagesChapter 12 v2Sheilamae Sernadilla GregorioNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPIshani MukherjeeNo ratings yet

- Mat and Amt: Objective of Levying MATDocument17 pagesMat and Amt: Objective of Levying MATNitin ChoudharyNo ratings yet

- 74802bos60498-Cp7 (1) - UnlockedDocument136 pages74802bos60498-Cp7 (1) - Unlockedsinghalrachit27No ratings yet

- 71147bos57143 cp9Document147 pages71147bos57143 cp9shivani singhNo ratings yet

- CP 9 Advanced Tax, Tax Deduction at Source and Introduction of Tax Collection at SourceDocument108 pagesCP 9 Advanced Tax, Tax Deduction at Source and Introduction of Tax Collection at Sourcesaravana pandianNo ratings yet

- Mr. Zulfiqar Computation of Taxable Income For Tax Year 2009 RupeesDocument5 pagesMr. Zulfiqar Computation of Taxable Income For Tax Year 2009 Rupeesmeelas123No ratings yet

- 3108 Deductions From Gross IncomeDocument17 pages3108 Deductions From Gross IncomeMae Angiela TansecoNo ratings yet

- Session 8 - Gross Income - Inclusions and ExclusionsDocument12 pagesSession 8 - Gross Income - Inclusions and ExclusionsMitzi WamarNo ratings yet

- 10.mat and AmtDocument17 pages10.mat and AmtShailendra SainwalNo ratings yet

- Uganda Tax Amendment Bills For 2018Document10 pagesUganda Tax Amendment Bills For 2018jadwongscribdNo ratings yet

- L314 FPD 6 2020 2Document6 pagesL314 FPD 6 2020 2OBERT CHIBUYENo ratings yet

- Gross Incom TaxationDocument32 pagesGross Incom TaxationSummer ClaronNo ratings yet

- TRAIN (Changes) ???? Pages 6 - 8Document3 pagesTRAIN (Changes) ???? Pages 6 - 8blackmail1No ratings yet

- Mat and Amt: Objective of Levying MATDocument17 pagesMat and Amt: Objective of Levying MATSamuel AnthrayoseNo ratings yet

- U I T U: Module 33 Taxes I Divi UALDocument1 pageU I T U: Module 33 Taxes I Divi UALAnonymous JqimV1ENo ratings yet

- BAM031 P3 Q1 Answer FBT DeductionsDocument12 pagesBAM031 P3 Q1 Answer FBT DeductionsMary Lyn DatuinNo ratings yet

- Deductibility of Interest ExpenseDocument2 pagesDeductibility of Interest ExpenseFerjeanie BernandinoNo ratings yet

- TRAIN (Changes) ???? Pages 2, 5 - 7Document4 pagesTRAIN (Changes) ???? Pages 2, 5 - 7blackmail1No ratings yet

- Taxation I ReviewerDocument19 pagesTaxation I ReviewerJay Ryan Sy BaylonNo ratings yet

- 5 Income Tax On Estates Trusts Partnerships Joint Ventures and CoDocument4 pages5 Income Tax On Estates Trusts Partnerships Joint Ventures and CoConcerned CitizenNo ratings yet

- US Internal Revenue Service: f8860 - 2000Document2 pagesUS Internal Revenue Service: f8860 - 2000IRSNo ratings yet

- It Goi Note On Mat and AmtDocument17 pagesIt Goi Note On Mat and AmtKapil AroraNo ratings yet

- Session 2 - Deductions From Gross Income, Part 1Document10 pagesSession 2 - Deductions From Gross Income, Part 1ABBIE GRACE DELA CRUZNo ratings yet

- Revenue Regulation No 13-2000Document1 pageRevenue Regulation No 13-2000Bal Nikko Joville - RocamoraNo ratings yet

- Week 7: Taxation of Individuals (Non Residents and Aliens) and General Professional PartnershipsDocument6 pagesWeek 7: Taxation of Individuals (Non Residents and Aliens) and General Professional PartnershipsEddie Mar JagunapNo ratings yet

- Amended Bsa Handout For Gross Income Part 1Document40 pagesAmended Bsa Handout For Gross Income Part 1Dianne Lontac100% (1)

- Lecture 6-Investment Income-With Answer1 PDFDocument90 pagesLecture 6-Investment Income-With Answer1 PDFScott NickNo ratings yet

- Withholding Tax: Taxation LawDocument21 pagesWithholding Tax: Taxation LawB-an JavelosaNo ratings yet

- Income Compilation Tax ReviewDocument13 pagesIncome Compilation Tax ReviewJosiebethAzueloNo ratings yet

- WHT New 2020Document7 pagesWHT New 2020MadurikaNo ratings yet

- This Study Resource Was: Revenue Regulations No. 9-98Document6 pagesThis Study Resource Was: Revenue Regulations No. 9-98Cyruss Xavier Maronilla NepomucenoNo ratings yet

- LaMitipsJDY - INCOME TAXT, DST, ESTATE TAX, VATDocument5 pagesLaMitipsJDY - INCOME TAXT, DST, ESTATE TAX, VATJohn Dy FlautaNo ratings yet

- Commissioner - of - Internal - Revenue - v. - Citytrust20190606-5466-Rq5hc6 PDFDocument11 pagesCommissioner - of - Internal - Revenue - v. - Citytrust20190606-5466-Rq5hc6 PDFClarence ProtacioNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Spells For Teenage Witches by Marina BakerDocument100 pagesSpells For Teenage Witches by Marina BakerRamos Claude VinzonNo ratings yet

- Chinese Black Magic: An ExposeDocument284 pagesChinese Black Magic: An Exposepermindex1984100% (6)

- The Validity of Industrial Design Registrations and Design Patents As A Measurement of "Good" Product Design - A Comparative Empirical AnalysisDocument10 pagesThe Validity of Industrial Design Registrations and Design Patents As A Measurement of "Good" Product Design - A Comparative Empirical AnalysisRamos Claude VinzonNo ratings yet

- Somaya, D. (2012) - Patent Strategy and Management - An Integrative Review and Research Agenda. Journal of Management 38 (4) 1084-1114Document31 pagesSomaya, D. (2012) - Patent Strategy and Management - An Integrative Review and Research Agenda. Journal of Management 38 (4) 1084-1114Ramos Claude VinzonNo ratings yet

- Codebeautify - HTML 2Document95 pagesCodebeautify - HTML 2Ramos Claude VinzonNo ratings yet

- 26057-2009-Metro. Inc. vs. Commissioner of Internal20210618-12-93cv58Document29 pages26057-2009-Metro. Inc. vs. Commissioner of Internal20210618-12-93cv58Ramos Claude VinzonNo ratings yet

- 20250-2001-Implementing Section 34 D 3 of The National20220711-12-W9h5keDocument9 pages20250-2001-Implementing Section 34 D 3 of The National20220711-12-W9h5keRamos Claude VinzonNo ratings yet

- 20191-1998-Implementing Republic Act No. 8424 An Act20210505-12-Vmgyc3Document8 pages20191-1998-Implementing Republic Act No. 8424 An Act20210505-12-Vmgyc3Ramos Claude VinzonNo ratings yet

- Eliscupidez v. EliscupidezDocument2 pagesEliscupidez v. EliscupidezRamos Claude VinzonNo ratings yet

- John Marshall Law Review 1051, Available at Philippine Law Journal 796, Available atDocument15 pagesJohn Marshall Law Review 1051, Available at Philippine Law Journal 796, Available atRamos Claude VinzonNo ratings yet

- Dokumen - Tips Fortun and Angeles Vs Gloria Macapagal ArroyoDocument2 pagesDokumen - Tips Fortun and Angeles Vs Gloria Macapagal ArroyoRamos Claude VinzonNo ratings yet

- Salalima V GuingonaDocument1 pageSalalima V GuingonaRamos Claude VinzonNo ratings yet

- LRT V BIRDocument9 pagesLRT V BIRJN CENo ratings yet

- Borkenstick Makes A Very Popular Undyed Cloth Sandal inDocument2 pagesBorkenstick Makes A Very Popular Undyed Cloth Sandal intrilocksp SinghNo ratings yet

- What Is Health System, William Hsiao, 2003Document33 pagesWhat Is Health System, William Hsiao, 2003dsshhkNo ratings yet

- 6.3 7Document26 pages6.3 7Revy CumahigNo ratings yet

- PreviewpdfDocument38 pagesPreviewpdfBurak Cengo tvNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPDhandu RanjithNo ratings yet

- Accounting Cycle ProblemDocument2 pagesAccounting Cycle ProblemShaira Mica SanitaNo ratings yet

- Roth IRADocument2 pagesRoth IRAanon_757121No ratings yet

- A Synopsis of Affordable Housing Issues in Riverside County: July 2003Document7 pagesA Synopsis of Affordable Housing Issues in Riverside County: July 2003shubhamNo ratings yet

- Rac Bidco Limited: Interim Report and Financial StatementsDocument27 pagesRac Bidco Limited: Interim Report and Financial StatementsMus ChrifiNo ratings yet

- Barangay Micro Business Enterprise (Bmbe) Act: 13284-TOPIC 3Document16 pagesBarangay Micro Business Enterprise (Bmbe) Act: 13284-TOPIC 3kim cheNo ratings yet

- Active With Latin America and The CaribbeanDocument56 pagesActive With Latin America and The CaribbeanOECD Global RelationsNo ratings yet

- Different Branches of LawDocument3 pagesDifferent Branches of Lawgo foreducationNo ratings yet

- Mock Bar in Taxation Law - 2020Document4 pagesMock Bar in Taxation Law - 2020Juliefer Ann GonzalesNo ratings yet

- NATURALIZATION2Document5 pagesNATURALIZATION2Sean ArcillaNo ratings yet

- Export ARMY CoffeeDocument73 pagesExport ARMY CoffeePhương TrangNo ratings yet

- Adam Smith's Analysis of Bounties As An Early Example ofDocument10 pagesAdam Smith's Analysis of Bounties As An Early Example ofFreddie SinginiNo ratings yet

- BAFE-Training Economic-Analysis DDB AVO-3Document50 pagesBAFE-Training Economic-Analysis DDB AVO-3aldrinmgalangNo ratings yet

- PAL Holdings, Inc.: CertificationDocument53 pagesPAL Holdings, Inc.: CertificationJerryJoshuaDiaz100% (1)

- Improperly Accumulated Earnings Tax Return: Mac Arthur Highway, Brgy. Dolores, City of San Fernando, PampangaDocument3 pagesImproperly Accumulated Earnings Tax Return: Mac Arthur Highway, Brgy. Dolores, City of San Fernando, PampangaTrisha Mae Mendoza MacalinoNo ratings yet

- LGC Sec. 17-22,48-59 CasesDocument49 pagesLGC Sec. 17-22,48-59 CasesMark Jason Crece AnteNo ratings yet

- Shop Sign Tax Ate PaluDocument6 pagesShop Sign Tax Ate PaluAnggie DiemitrieNo ratings yet

- AllowancesDocument19 pagesAllowanceshanumanthaiahgowdaNo ratings yet

- Readings in Philippine History: Activity 1 Pre-FinalsDocument2 pagesReadings in Philippine History: Activity 1 Pre-FinalsStefh GonzalesNo ratings yet

- Income Tax Payment Procedures in TanzaniaDocument3 pagesIncome Tax Payment Procedures in Tanzaniashadakilambo100% (1)

- Best Practised ThroughputDocument1 pageBest Practised ThroughputBinu Kumar SNo ratings yet

- 36 - PILIPINAS TOTAL GAS vs. CIRDocument2 pages36 - PILIPINAS TOTAL GAS vs. CIRLEIGH TARITZ GANANCIALNo ratings yet

- REM1 Hand OutDocument42 pagesREM1 Hand OutFrancis LNo ratings yet

- Internship Report Bank of Punjab: Submitted byDocument28 pagesInternship Report Bank of Punjab: Submitted byLucifer Morning starNo ratings yet

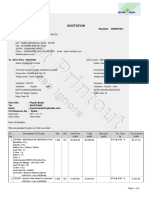

- Quote 1Document6 pagesQuote 1Gunwant VarmaNo ratings yet