Professional Documents

Culture Documents

14569

14569

Uploaded by

downrajaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

14569

14569

Uploaded by

downrajaCopyright:

Available Formats

NLC TAMILNADU POWER LIMITED

Ratings Assigned Facilities Term Loans Amount (Rs. crore) 3437 Ratings CARE AAA(SO) [Triple A (Structured Obligation)] Remarks Re-affirmed

Total Facilities@

3437

@ backed by letter of comfort given by Neyveli Lignite Corporation Ltd (NLC) Rating Rationale The rating is based on the credit enhancement in the form of Letter of Comfort given by Neyveli Lignite Corporation Ltd (NLC) to the term loan of NLC Tamilnadu Power Limited (NTPL). The credit profile of NLC draws comfort from the company(NLC) being a Public Sector enterprise and a Navratna operating under the administrative control of Ministry of Coal with Government of India (GoI) holding 93.56% stake, long operational track record of NLC in power generation for over four decades, assured offtake of power given that NLC is one of the lowest cost producers largely due to the operational efficiencies and depreciated nature of the plants, presence of own lignite mines with adequate reserves resulting in guaranteed fuel supply linkages and strong financial position of NLC characterised by consistently healthy cash accruals, high level of networth, low gearing and net debt position consistently remaining nil due to the high level of cash balances. The rating also takes note of the various projects being undertaken by NLC and decline in reported profits during 9mFY11 after a strong operational and financial performance in FY10. Background: NLC Tamilnadu Power Limited (NTPL) is a joint venture company between NLC and Tamilnadu Electricity Board (TNEB) to implement the 1000 MW thermal power project in Tuticorin, Tamilnadu. The company was set up consequent to a MoU entered into by NLC with Government of Tamilnadu in 2003 and a joint venture agreement inked between NLC and TNEB in June 2005. The shareholding of NLC in NTPL is 89% and the balance stake is held by TNEB. The project is classified as a mega power project and GoI accorded sanction for the project in May 2008. The project implementation is carried out by NLC itself and is assisted by project consultants M/s.Mecon Ltd. Project: The project is a conventional thermal power plant comprising two units of Pulverised Coal Fired Steam boilers with two units of steam turbine generators of 500 MW capacity each. The power plant will be located just South and West of the existing Tuticorin Thermal Power station (TTPS) of TNEB. The total land area required is about 133 hectares and the same has been taken on long term lease (35 years) from Tuticorin Port Trust (TPT). The approved cost of the project is Rs.4909.54cr. Some of the key risks associated with the project and status of the same are given below: Project implementation risks The long gestation period and complex nature of the project results in various risks during project implementation. Unit I of the project is scheduled to be completed by 46 months from the date of sanction ie March 2012 and Unit II by August 2012. The Letter of Award(LOA) for the Main Plant Package has been given to M/s.Bharat Heavy Electricals Limited(BHEL) at a price of Rs.3196cr in January 2009. Erection works in respect of electrostatic precipitator, boilers are in progress. Other major contracts such as coal handling, circulating water system, bi-flue chimney, transformer package and natural gas cooling tower package have also been awarded. Cumulative physical progress till Dec 2010 was 27.2%. Delays in achievement of certain milestones were reported and accordingly NTPL has revised the commissioning date by a month. Funding Risks The sanctioned cost of the project is Rs.4909.5cr and would be funded by debt of Rs.3437cr and equity of Rs.1473cr. NTPL had tied up the entire debt funding for the project from M/s.Rural Electrification Corporation in October 2008 and had drawn Rs.272cr till Feb 28, 2010. With a view to reducing the cost of debt, NTPL has replaced the REC loan with bank debt. Company has received sanctions for a term loan of Rs.2500 cr from consortium of bankers and the balance debt requirement has been proposed to be partially met through external commercial borrowing and through issue of bonds etc. The total equity infusion as

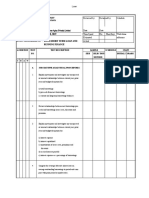

on December 31, 2010 is about Rs.500cr by both NLC and TNEB of the total estimated requirement of Rs.1473cr. Given the robust financial position of NLC, the remaining equity funding is likely to be infused as and when required. NTPL has now estimated the completion cost of the project at about Rs.5713.9cr and would tie-up the requisite funds in due course of time. Details of spending upto Dec 2010 is as below: Particulars Land EPC Contract Non-EPC works Pre-operative Overheads Insurance IDC and Finance charge Total Funding Equity Debt Total Offtake Risk The power generated by NTPL has been tentatively allocated to Tamilnadu, Andhra Pradesh, Karnataka, Kerala and Pondicherry in the ratio 39%, 25%, 16%, 7% and 1% respectively. The remaining 12% power is unallocated. NTPL has already signed Power Purchase Agreement for 25 years with all the states to whom power has been allocated. The terms and conditions of the tariff shall be determined by Central Electricity Regulatory Commission (CERC) as per tariff regulations in force from time to time. Fuel supply risks The coal requirement of the power project would be primarily met through the domestic coal from Mahanadi Coalfield Ltd.s (MCL) Talcher Coal Fields located in Orissa. Annual requirement of coal for the project at around 80% PLF would work out to be 4.5 million tonnes. MCL has already issued a Letter of Assurance for supplying coal to the tune of 4.624 MTPA. NTPL is in the process of revalidating the same as it has expired. Operation & Maintenance risk On completion, the day to day operations of NTPL are likely to be handled by NLC. Given the long operational track record of NLC spanning over 40 years in operating thermal power plants and the efficient operational parameters observed in the plants operated by NLC, the O&M risks for this project are low. Industry Outlook India has been sustaining healthy economic growth over a large part of the previous decade. With the surge in economic activities, the demand for power has gone up sharply. The planned power capacity additions have been lagging behind the targets set by Government of India (GoI) in the previous and current five-year plans. Consequently, the demand for power has been outstripping its availability. Substantial peak and energy shortages prevail in the country. The all-India energy demand stood at 830,300 MU in FY10 as against supply of 746,493 MU, leading to a deficit of 83,807 MU (10.1%). The peak demand in FY10 was 118,472 MW against supply of 102,725 MW, leading to a deficit of 15,748 MW (13.3%). The GoI has initiated several reform measures to create a favourable environment for addition of new generating capacities in the country. The Electricity Act 2003 has put in place a highly-liberal framework for generation of power. There is no requirement NLC TNEB 1310.8 162.0 3437.7 4909.5 445.0 55.0 828.5 1328.5 Sanctioned 63.0 2925.4 862.3 1.1 327.1 133.2 597.3 4909.5 61.7 1318.8 Actual Infusion Rs.cr Actual spent upto Dec 2010 51.7 1134.2 56.8 0.9 13.4

of licensing for generation. The requirement of techno-economic clearance of Central Electricity Authority (CEA) for thermal generation project has been removed. Given the significant power supply deficit in the country, low per capita consumption of power in India compared to the world average, growing industrialisation and urbanisation and GoI recognizing the power sector as a key infrastructure sector to be developed to sustain the Indian economic growth, the overall growth potential for companies in the power sector is favourable. Prospects The parentage of NLC is expected to bring in significant benefits to NTPL during implementation as well as operation phase of the project. The strong financial position of NLC significantly reduces the funding risk for NTPL. The offtake risk is also low given the power shortage in the Southern region and credit risk arising out of supply to state government utilities is also minimal as NTPL will be a central power generating unit. In this context, ability of NTPL to implement the project on time will be critical to its prospects. About NLC NLC Ltd, a Public Sector enterprise and a Navratna is engaged in mining of lignite and generation of electricity. The company, established in 1956 by Government of India(GoI) following the discovery of lignite deposits in Neyveli, Tamilnadu, is one of the major power generating source in South India. The company operates under the administrative control of Ministry of Coal with a 93.56% GoI stake by the end of Mar10. NLC presently operates four open cast lignite mines with an aggregate capacity of 30.6 MTPA of lignite production (Mine I-10.5 MTPA, Mine I A- 3.0 MTPA, Mine II- 15.0 MTPA and Barsingsar Mine 2.1 MTPA) and three thermal power stations with aggregate capacity of 2490 MW (Thermal Power Station [TPS] I- 600 MW, TPS I Extension-420 MW and TPS II- 1470 MW). Unit I of TPS II Expansion (500 MW) and Unit I of Barsingsar Thermal (250 MW) are nearing completion. The fuel requirements of the power generation plants of NLC are completely met by the lignite excavated from the mines operated by the company. The generated power is mainly used by the southern states of Tamil Nadu, Andhra Pradesh, Karnataka, Kerala and Union Territory of Puducherry. A brief snapshot of the operational & financial performance of NLC is given below: Particulars Total Power Generation (MU) PLF(%) Lignite production (Lakh tonnes) Income from Operations PBILDT PAT Gross Cash Accruals Net Worth Cash Balance Total Debt Overall Gearing(times) Interest coverage (times) FY08 17457 80 215 3505 1754 1102 1477 9615 4750 2791 0.29 199.37 FY09 15768 72 213 3920 1386 821 1311 10084 5452 4058 0.40 170.06 Rs.cr FY10 17656 81 223 4615 1784 1247 1400 10796 4824 4077 0.38 53.13

The financial position of NLC is characterised by healthy cash accruals, high level of networth, low level of gearing and net debt position consistently remaining nil due to the high level of cash balances. Led by higher power generation and higher power tariff as per the tariff petition filed before CERC, total income grew by 17.7% in FY10. Power generation and power export during FY10 was 17656 MU and 14828 MU respectively registering a growth of 11.97% and 12.3% over last year. Better operational performance coupled with absence of one time exceptional items like wage arrears and mine closure expenses helped NLC register 51.9% PAT growth in FY10. Pending finalisation of tariff orders by CERC (approval received for only one unit), debtors have accumulated. Debtors stood at Rs.1612cr as on Mar10 against Rs.781cr as on Mar09. The same has increased further to Rs.2400cr as on Dec10.

During the nine month period ended December 2010, NLC recorded PAT of Rs.712 cr on a total income of Rs.3488 cr. During 9MFY11, the companys PAT declined (by 24% on an annualised basis) mainly attributable to commissioning of two mines while corresponding power generation had not happened. During 9MFY11, heavy rainfall has also caused marginally lower power generation. NLC is in advanced stage of completing two power plants (TPS II Expansion (500 MW) and Barsingsar Thermal (250 MW)). NLC has proposed several other projects including a new power plant of 1000 MW capacity as a replacement to the existing TPS I at Neyveli but these projects are yet to get GoI approval.

DISCLAIMER CAREs ratings are opinions on credit quality and are not recommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or hold any security. CARE has based its ratings on information obtained from sources believed by it to be accurate and reliable. CARE does not, however, guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE have paid a credit rating fee, based on the amount and type of bank facilities/instruments.

CARE is headquartered in Mumbai, with Offices all over India. The office addresses and contact numbers are given below:

HEAD OFFICE: MUMBAI

Mr. D.R. Dogra Managing Director Cell : +91-98204 16002 E-mail : dr.dogra@careratings.com Mr. P N Sathees Kumar Executive Vice President Marketing Mobile: +91-9820416004 mail:sathees.kumar@careratings.com Mr. Rajesh Mokashi Dy. Managing Director Cell : +91-98204 16001 E-mail: rajesh.mokashi@careratings.com Mr. Ankur Sachdeva Vice President Marketing (SME) Mobile: +91-9819698985 E-mail: ankur.sachdeva@careratings.com

4th Floor, Godrej Coliseum, Somaiya Hospital Road, Off Eastern Express Highway, Sion (East), Mumbai 400 022 Tel.: (022) 67543456 Fax: (022) 67543457 Website: www.careratings.com

OFFICES

Mr.Mehul Pandya Regional Manager 32 TITANIUM Prahaladnagar Corporate Road, Satellite, Ahmedabad - 380 015. Tel: 079 4026 5656 Mobile: 98242 56265 E-mail: mehul.pandya@careratings.com Mr. Pradeep Kumar Regional Manager Unit No. O-509/C, Spencer Plaza, 5th Floor, No. 769, Anna Salai, Chennai - 600 002. Tel: 044 2849 7812/2849 0811 Mobile: 98407 54521 E-mail: Pradeep.kumar@careratings.com Mr. Sukanta Nag Regional Manager 3rd Floor, Prasad Chambers (Shagun Mall Building) 10A, Shakespeare Sarani Kolkata - 700 071. Tel: 033 2283 1800/1803 Mobile: 98311 70075 E-mail: sukanta.nag@careratings.com Mr.Sundara Vathanan Regional Manager Unit No. 8, I floor, Commander's Place No. 6, Raja Ram Mohan Roy Road, Richmond Circle, Bangalore - 560 025. Tel: 080 2211 7140 Mobile: 98803 60878 E-mail: sundara.vathanan@careratings.com Mr. Ashwini Jani Regional Manager 401, Ashoka Scintilla 3-6-520, Himayat Nagar Hyderabad - 500 029. Tel: 040 40102030 Mobile: 91600 74789 E-mail: ashwini.jani@careratings.com Ms.Swati Agrawal Regional Manager 3rd floor, B-47, Inner Circle Near Plaza Cinema Connaught Place New Delhi 110 001. Tel: 011 2331 8701/2371 6199 Mobile: 98117 45677 E-mail: swati.agrawal@careratings.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Trading Forex The Forex Profit SystemDocument10 pagesTrading Forex The Forex Profit Systemapi-3732851100% (1)

- Memorandum of UnderstandingDocument2 pagesMemorandum of UnderstandingAnmolNo ratings yet

- Ubs Case StudyDocument9 pagesUbs Case StudyIlavarasan NeeraruNo ratings yet

- Visa Gold Low Rates Statement: Account Name MR John DoeDocument3 pagesVisa Gold Low Rates Statement: Account Name MR John DoeWenjie65No ratings yet

- The Role of Financial System in DevelopmentDocument5 pagesThe Role of Financial System in DevelopmentCritical ThinkerNo ratings yet

- Cherat Cement Company (Managing Financial Resources)Document10 pagesCherat Cement Company (Managing Financial Resources)prosmaticNo ratings yet

- Sample Paper State Bank of Pakistan: Building Standards in Educational and Professional TestingDocument10 pagesSample Paper State Bank of Pakistan: Building Standards in Educational and Professional TestingAsad RehmanNo ratings yet

- Credit Transactions Course Outline: I. Review of Contract Law (1) Elements - Art. 1305, 1318, CCDocument3 pagesCredit Transactions Course Outline: I. Review of Contract Law (1) Elements - Art. 1305, 1318, CCRomnick De los ReyesNo ratings yet

- List of Accounts Team 1Document9 pagesList of Accounts Team 1Tintin LorenzoNo ratings yet

- Assignment 3 - Bottom of The PyramidDocument14 pagesAssignment 3 - Bottom of The Pyramidディクソン KohNo ratings yet

- Case Digest GuarantyDocument23 pagesCase Digest GuarantyRachel AndreleeNo ratings yet

- Consumer Finance at Bank AlfalahDocument29 pagesConsumer Finance at Bank AlfalahSana Khan100% (2)

- GauravDocument10 pagesGauravBbly AngelNo ratings yet

- Abhinav Mansingh KaDocument18 pagesAbhinav Mansingh Kaarif420_999No ratings yet

- 5farmer Producer Operational FPO GuidelinesDocument9 pages5farmer Producer Operational FPO GuidelinesArun KurtakotiNo ratings yet

- Sbi 051112Document11 pagesSbi 051112PADMA JOELNo ratings yet

- SwotDocument8 pagesSwotManank DaveNo ratings yet

- Paytm PDFDocument5 pagesPaytm PDFAdalbert P ShaNo ratings yet

- Responsive Document - CREW: FDLE: Request For Records in Investigation of Rep. David Rivera: 5/14/2012 - FDLE Report (Combined)Document172 pagesResponsive Document - CREW: FDLE: Request For Records in Investigation of Rep. David Rivera: 5/14/2012 - FDLE Report (Combined)CREWNo ratings yet

- OpTransactionHistory02 12 2019Document4 pagesOpTransactionHistory02 12 2019Vijay KumarNo ratings yet

- Procedure of Letter of Credit (LC), ImportDocument84 pagesProcedure of Letter of Credit (LC), ImportRayhan AhmedNo ratings yet

- Administrative Assistant Office Assistant in Colorado Springs CO Resume Jeri BakerDocument1 pageAdministrative Assistant Office Assistant in Colorado Springs CO Resume Jeri BakerJeri BakerNo ratings yet

- Effectiveness Implementation of Ecommerce in The Developing Countries Empirical Study On JordanDocument11 pagesEffectiveness Implementation of Ecommerce in The Developing Countries Empirical Study On JordanAlexander DeckerNo ratings yet

- 017517-Proforma Invoices FY 2019-20 PDFDocument1 page017517-Proforma Invoices FY 2019-20 PDFMEDICAL SUPERINTENDENTNo ratings yet

- Audit Programme Long Term LoanDocument5 pagesAudit Programme Long Term LoanfaheemNo ratings yet

- Report and Recommendation of The PresidentDocument18 pagesReport and Recommendation of The PresidentTú NguyễnNo ratings yet

- 14 Harshdeep PandeDocument61 pages14 Harshdeep PandepopliyogeshanilNo ratings yet

- Class DirDocument12 pagesClass DirUpdatest newsNo ratings yet

- Fundamentals of Corporate Finance Canadian Canadian 8th Edition Ross Test Bank 1Document77 pagesFundamentals of Corporate Finance Canadian Canadian 8th Edition Ross Test Bank 1robert100% (41)

- Ogone Alias enDocument17 pagesOgone Alias enCatalin CiupituNo ratings yet