Professional Documents

Culture Documents

1.5 & 1.6 Land Use History & Ownership History

1.5 & 1.6 Land Use History & Ownership History

Uploaded by

kevinlow30 ratings0% found this document useful (0 votes)

17 views23 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views23 pages1.5 & 1.6 Land Use History & Ownership History

1.5 & 1.6 Land Use History & Ownership History

Uploaded by

kevinlow3Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 23

REPORT AND VALUATION

on

Mom ER CPEA)

LOT NOS. PT 73478 AND PT 73479

MUKIM AND DISTRICT OF KLANG

‘STATE OF SELANGOR DARUL EHSAN

PREPARED FOR

BCB BERHAD

@ &@

Mow AZM AR

epee W001

S.GOPALA KRISHNAN SMSPIK

Reged aero

NAGALINGAMT

eater Oss)

Our Ref VSAN0162/11/SEL

46 March 2011

The Board

AZM. CO (SHAH ALAM) SDN BID.

(624945-5)

No.8, 34 Floor

Jnl Tengku Ampun Zabel D 91D

40100 Shah Alam, Selangor Darul Ehsan

Malaysia

‘Telephone: 03-5310 1990

Facsimile: 03-5510 2900

erste: soo amine com ny

ligature cm ny

PRIVATE & CONFIDENTIAL,

BCB Berhad

No. 4B, 2nd and 3rd Floor

South Wing Kluang Parade

Jalan Sentol

86000 Kiuang

Dear Sirs,

In compliance with your request, the undersigned has completed a valuation of the property, namely, two

parcels of leasehold development lands with a combined land area of 151.2787 acres located along Persiaran

‘Anggerik Renantanda adjoining Kota Kemuning, off Kesas Highway, Shah Alam, Selangor Darul Ehsan held

under qualified titles bearing HSD No. 69603 for Lot No. PT 73478 and HSD No. 69604 for Lot No. PT 73479

in the Mukim and District of Kiang, State of Selangor Darul Ehsan. These properties are located as shown in

the altached location plan and are more fully desoribed in the body of this report.

Please be informed that a careful and detailed inspection was made of these sites and their improvements,

Due consideration was given to all factors and forces that influence property value at the subject location.

The attached report contains an analysis of general and specific data which were deemed essential to support

the estimate of value as reported herein.

‘As a result of our investigations and detailed findings, it is our considered and professional opinion that the

value of the Leasehold interest of about 90 years remain unexpired in the property described herein in its

existing conditions, free from encumbrances, and with good registrable titles is, for the purpose of securing

credit facilities, as of the material date of this valuation (3 March 2011), in the amounts as follows:

MARKET VALUE - M108,000,000.00

(RINGGIT MALAYSIA: ONE HUNDRED AND EIGHT MILLION ONLY)

FORCED SALE VALUE ~ M86,400,000.00

(RINGGIT MALAYSIA: EIGHTY SIX MILLION AND FOUR HUNDRED

THOUSAND ONLY)

We do hereby confirm that we have exercised due care in carrying out the said valuation and are aware that

this Report and Valuation is required for purposes of securing credit facilities from a financial institution in

reliance thereof,

Please feel free to let us know if you desire additional information concerning this report or if we may be of

further assistance in this matter.

Registered Valuer (V-461)

Designation: Director

A meshes A2.GROUPOF COMPASS

AZM Ear)

TABLE OF CONTENTS

TITLE PAGE

LETTER OF TRANSMITTAL

TABLE OF CONTENTS

EXECUTIVE SUMMARY

LIMITING CONDITION

Part

1 GENERAL INFORMATION

1.0 Purpose of the Valuation

2.0 Basis of Valuation

3.0 Inspection

4.0 Particulars of Property

GENERAL, SOCIAL, ECONOMIC AND OTHER

DATA INFLUENCING VALUE

Location Data

Site Data

Property Data

Services Data

Planning Data

10.0 Property Market Condition

VALUE CONCLUSIONS

14.0 Valuation

12.0 Factors Affecting Valuation

13.0 Opinion of Value

APPENDICES

1 Copy of Catatan Carian Persendirian

ll, Location Plan

ll, Site Plan

IV. Photographs

V. Schedule of sale Comparisons

EXECUTIVE SUMMARY

(ur Reference ‘VSA/O162/11/SEL

‘Your Reference NMA,

Client BCB Berhad

Purpose of Valuation Financing

Date of Valuation ‘3 March 2014

Property Type Development land

Legal Description Title No. HSD No. 69603 for Lot No. PT 73478 and HSD No, 69604 for Lot

No. PT 73479 in the Mukim and District of Klang, State of Selangor Darul

Ehsan

Location Adjoining the East side of Kota Kemuning, off Kesas Highway, Selangor

Darul Ehsen|

Tenure Leasohold interest expiring on 18 April 2101 (Le. with an unexpired term

fof about £0 years)

Category of Land Use : Bangunan

Express Conditions Bangunan Kediaman

Restriction-innterest ‘Tanah yang diberi milk ini tidak boleh dipindahmilk, dipajak alau digadai

melainkan dengan kebenaran Pihak Berkuasa Negeri

Land Area 151.2787 acres (61.2203 hectares)

Floor Area NIA

Encumbrance NIA

Caveat Nit

Registered Proprietors): TPPT Sdn Bhd

In Title

Market Value + RM108,000,000.00

(Ringgit Malaysia: ONE HUNDRED AND EIGHT MILLION ONLY)

Forced Sale Value + RM@6,400,000.00

(Ringgit Malaysia: EIGHTY SIX MILLION AND FOUR HUNDRED

THOUSAND ONLY

UMMARY IS TO BE READ IN THE CONTEXT OF THE WHOLE REPORT & VALUATION,

AR ATTENTION TO THE VALUATION ASSUMPTIONS, IF ANY, AS ADOPTED

Registered Valuer (V-461)

[TAZ Ss

LIMITING CONDITIONS.

The market value set forth in this Report and Valuation is subject to the following

limiting conditions :

1. This Report is confidential to the Client for the specific purpose to which it refers.

it may be disclosed to other professional advisers assisting the Client in respect

of that purpose, but the Client shall not disclose the Report to any other person.

2. The opinion of value expressed in this Report applies strictly upon the terms of a

for the purpose of this Report only. The Valuer is therefore not responsible for it if

quoted out of context.

3. Neither the whole nor any part of this Report or any reference there to may be

included in any published document, circular or statement nor published in any

way without the Valuer’s written approval of the form and context in which it may

appear,

4. While due care Is taken to note bullding defects in the course of inspection no

structural survey Is made nor any inspection of woodwork or other parts of the

structure which are covered or in accessible and we are therefore unable to report

that such part of the property are free of hidden defects or concealed infestation.

5.* Though the property was inspected, we are not able to state that the crops are

free of vermin, soil diseases, etc. We have not carried out a chemical analysis of

the soil nor either investigations to ascertain the soil suitability for the present or

other cultivation. Therefore, we are not able to accept any responsibility with

regard to latent infestation, and defects of the soil and any disease which affect

crops,

6 While we have inspected the title of the property as recorded by the Land

Registry, we cannot accept any responsibility for its legal validity or for any

liabilities against the property which we were unrecorded at the time of our

inspection.

7. The instruction and the valuation assignment does not automatically bind the

Valuer to attendance in court or to appear in enquiry before any government or

statutory bodies in connection with the valuation. Prior arrangement and

agreement shall be made between the Client and Valuer if such attendance or

appearance is required.

* As applicable, to AGRICULTURAL PROPERTY only.

PARTI

GENERAL INFORMATION

AZM! EET)

PURPOSE OF THE VALUATION

The purpose of this valuation is to establish an estimate of market value of the property described

herein as of the material date of this valuation.

This report is prepared to furnish a guide as to the value that the subject property should command

as at the date of this valuation for purposes of securing credit facilites from a financial institution

BASIS OF VALUATION

The basis of valuation, for the purpose of this report, is on market value.

By market value is meant the estimated amount for which an asset should exchange on the date of

valuation between 2 willing buyer and a willing seller in an arm’s-length transaction after proper

marketing wherein the parties had each acted knowledgeably, prudently and without compulsion.

(STANDARD 4 - Market Value Basis of Valuation of the Malaysian Valuation Standards issued by

the Board of Valuers, Appraisers and Estate Agents, Malaysia).

INSPECTION

An inspection of the subject property was made on 3 March 2011 by Mr. JOE CHAN, Senior

Valuation Executive.

For the purpose of this report, we have, therefore, taken the date of inspection as the material date

of valuation.

VENDIO VSEL ICH Page 1 of 8

4.0 PARTICULARS OF PROPERTY

The subject property comprises two parcels of Leasehold development lands having a combined

land area of 151.2787 acres (612,203 square metres or 61.2203 hectares) located along Persiaran

Anggerik Renantanda adjoining the East side of Kota Kemuning, off Kesas Highway, Selangor

Darul Ehsan presently held under Qualified Title bearing HSD No. 69603 for Lot No. PT 73478 and

HSD No, 69604 for Lot No. PT 73479 in the Mukim and District of Klang, State of Selangor Darul

Ehsan.

The subject property is presently held under 2 separate documents of titles. We have made a

search of the Register of Qualified Titles at the Registry of Titles, Selangor Darul Ehsan and we

confirm that the subject property is described in the register documents of titles as shown by the

copy of CATATAN CARIAN PERSENDIRIAN dated 8 March 2014 which is enclosed, herein, as

APPENDIX |.

NOTE:

While due care is taken to obtain the above CATATAN CARIAN PERSENDIRIAN, we would

advise that the Client seeks the services of its own solicitors to conduct a further search at

the Land Registry to confirm the same and/or to ascertain the true nature of the registered

proprietor’s interest in the land and also to determine the existence of any further

‘encumbrances on the land.

VENDIO TISEL ICH Page 20f6

PART II

GENERAL, SOCIAL, ECONOMIC AND OTHER

DATA INFLUENCING VALUE

AZM! Et)

6.0 LOCATION DATA

The subject property is located in a desirable mixed-development area within the locality popularly

known as KOTA KEMUNING lying off the South side of the Kuala Lumpur - Pulau Indah Highway

(KESAS) at about 10 kilometres South of Shah Alam, Selangor Darul Ehsan. This location is shown

on the plan in APPENDIX Il

The area is well located within the administrative area of the Majlis Bandaraya Shah Alam and is

within a few minutes’ drive, by bus or car, of other notable housing developments (Bukit Rimau,

Kemuning Utama, Taman Alam Megah, Taman Bunga Negara, Putra Heights, Taman Sri Muda,

Bandar Putera, Alam Impian and Bandar Puteri)

Communications within the area are excellent. There is easy access to Kesas Highway end

Lebuhraya Kemuning Shah Alam (LKSA) via well-planned service roads and interchanges. In

addition, there are good linkages to Federal Highway and New Klang Valley Expressway, which

form part of the State’s aim to create the best network of roads in the region.

Shah Alam city centre is within comfortable commuting distance some 10 kilometres on the north,

while Kuala Lumpur City Centre is located 25 kilometres on the northeast.

In view of the favourable location, the area is expected to maintain its appeal for mixed development

in the foreseeable future.

Vewie2/nset Joa Page 3 0f8

6.0 SITE DATA

The subject sites are, geographically located on the East side of Persiaran Anggerik Renantanda.

They have a combined net land area of 151.2787 acres (612,203 square metres or 61.2203

hectares) after the compulsory government land acquisition in 2007.

PT 73478. PTTS479 Total

inSq.Metres | infers | Sq Metres [ inAcres | in Sq. Metres | in Acres

Origitallandarea | 44,180 | 10.9171 | 624,223 | 1642489 | 668.403 | 165.1660,

‘Land area

| acquired in 2007 | 18,780 | 4.6406 | __ 37,420 9.2467 $6,200 | 13.8873

Net land area 25,400 | 6.2765 |"586,803 | 145.0023 |~_612,203 | 161.2767

The lots are reguler in shape, having frontage onto Persiaran Anggerik Rennianda: see APPENDIX

for site plan.

The subject property is approachable from the Kuala Lumpur city centre via the Kuala Lumpur-

Seremban Highway, Kesas Highway, Persiaran Anggerik Mokara, Persiaran Anggerik Vanilla and

finally via Persiaran Anggerik Renantanda.

‘As of date of inspection, the lot boundaries of the subject property are not demarcated by any form

of fencing

The area around the subject sites is improved as follows:

To the North bounded by other parcels of development lands and further north are

Kemuning Utama and Taman Sri Muda.

To the East bounded by Klang River and further East is Putra Heights.

To the South bounded by Kota Kemuning Industrial Area.

To the West bounded by Kota Kemuning and further east is Bukit Rimau and Taman

Perindustrian Berjaya.

Venranseruset.scue Page 4 of 8

7.0 PROPERTY DATA

The subject property is, as at date of inspection, unimproved of any building structures. The site is

flat in terrain and is presently overgrown with thick bushes and wild trees.

The Klang River runs along the eastern boundary of the property.

Photographs showing the subject property and the neighbourhood scene are presented in

APPENDIX IV.

SERVICES DATA

All public and quasi-public utilities such as water, telephones and electricity are available in the

vicinity but are not connected to the subject site.

Public transportation in the form of buses and taxis is also available along Persiaran Anggerik

Renantanda.

PLANNING DATA

The subject property is located in an area zoned for Residential land use.

The subject property was approved for development by Majlis Bandaraya Shah Alam vide an

approved site layout plan prepared by DZJ & Associates bearing reference No. DZJ/2040/95/LP in

2006. The said approved site layout plan has however lapsed due to the effluxion of time,

During our enquiries at the Town Planning Department in Shah Alam we are informed that the

client will be required to submit a new layout plan for approval prior to any development works.

Veninse2HSEL.J0%8 Page 6 of8

10.0 PROPERTY MARKET CONDITION

The Malaysia economy registered a strong growth of 9.5% in the first half of 2010, led by sustained

expansion in domestic demand and continued robust growth in external demand, The stronger

domestic demand was supported by the expansion in both the private consumption and public

sector spending. Domestic demand expanded by 7.2% (H1 momentum tom grow at 8.5% (H12009:

-0.2%) supported by continued improvement in labour market conditions amidst an environment of

low inflation, a steady increase in income levels and improved consumer sentiment.

In tandem with the promising 9.5% growth of the Malaysia economy, the properly market recorded

an improved performance in the first half of 2010. A total of 184,666 transactions worth RMS0.58

billion were registered. The volume and value of transactions recorded double-digit growths of

19.0% and 48.0% respectively from h! 2008. Likewise, the volume and of transactions increased

from h@ 2009 but at a moderate rate of 1.1% and 7.95 respectively.

The Selangor state's property market made appositive turn around in H1 2010 as indicated by the

buoyant market activity, improved sales performance of new launches and shrinking numbers of

residential and shop overhang. There were 43,221 transactions worth RM17.04 billion recorded in

the review period, an increase of 8.3% in volume and 35.5% in value from H1 2009 (39,896

transactions worth RM12.57 billion). Against H2 2009 (41,983 transactions worth RM15.46 billion),

the volume and value of transaction increased by 2.9% and 10.2% respectively, Residential sub-

sector propelled the market, accounting for 77.0% of the state’s property market volume. This was

followed by commercial (9.5%), agricultural (6.9%), development land (3/3%) and industrial (3.2%)

sub-sectors. Market activity charted positive movements across the board against both halves of

2009 with one exception. Against H1 2009, commercial sub0sector led the volume growth at 29.2%,

followed by development land (19.1%), industrial (15.0%), agricultural (10.0%), and residential

(6.3%), sub-sectors, Against H2 2008, all sub-sectors recorded positive growths ranging from 0.3%

{0 27.6% with the exception of industrial sub-sector (-5.7%). Value of transactions in all sub-sectors

depicted similar positive trend from both halves of 2009.

‘Source: Property Market Report First Hall 2010

Venez VSEL-ICIA Page 6 of 8

PART II

VALUE CONCLUSIONS

AZM) EET)

41.0 VALUATION

In this instance, we have only adopted the Comparison Method of Valuation to ascertain the market

value of the subject property. This is due to the property being vacant development land where

Comparison Method is sufficient and appropriate to determine the market value. Under this

Method, an estimate of value is derived by comparing the property under valuation with other

properties of similar size, quality and location that have been sold in recent times.

In the determination of value by this method, a survey was made of property sales which have

occurred in the subject locality and other comparable areas within the past few years. From our

investigations, we are aware of sale prices as shown in the schedule enclosed herein as

APPENDIX V. The analysis of the sale evidence and the adjusted values are also shown in the said

appendix.

FACTORS AFFECTING VALUATION

‘The following are the principal factors which have influenced our opi

12.1. The subject property is held under two documents of Qualified Titles held under a 99-year

Leasehold interest, with about 90 years unexpired term.

‘The subject property is heldin title under the Category of Land Use of “Bangunan’, subjectto

the Express Condition and Restriction-in-Interest:

Express Condition

“Bangunan kediaman’.

Restriction in Interest

“Tanah yang diberi mit ini tidak boleh dipindahmilik, dipajak atau digadai melainkan dengan

kebenaran Pihak Berkuasa Negon”.

‘Subject property is ideally located off Persiaran Anggerik Renantanda 1 and is within

comfortable commuting distance of Shah Alam, Petaling Jaya and Kuala Lumpur City Centre.

The immediate neighbourhood is rapidly developed with residential, commercial and

industrial-type developments.

12.6 The scarcity of such large sized development lands in Klang Valley.

Von 1earSEL Ie Page 7 of 8

[AZM 1 Ee)

13.0 OPINION OF VALUE

‘As based on the above approach to value, we are of the opinion that the value of the Leasehold

interest in the property of about 90 years remain unexpired described above, in its existing

condition, free from encumbrances, and with good registrable titles is, for the purpose of securing

credit facilities as of the material date of this valuation (3 March 2011), in the amounts as follows:

MARKET VALUE - _ RINGGIT MALAYSIA:ONE HUNDRED AND EIGHT MILLION

ONLY

(RIM108,000,000.00)

FORCED SALE VALUE - _RINGGIT MALAYSIA:EIGHTY SIX MILLION AND FOUR

HUNDRED THOUSAND ONLY

(RM86,400,000.00)

‘The FORCED SALE VALUE is the amount that may reasonably be received from the sale of a

property under forced sale conditions that do not met all the criteria of a normal market

transaction.

SAI N6zr WSEL-ICI Page 8 of 8

PART IV

APPENDICES

PRIABAT TANAH DAN GALIAN SELANGOR

Selengor

CATATAN CARIAN PERSENDIRIAN

Adalah ‘diperakui bahawa suatu carian persendirian telah dibuat

mengikut Seksyen 384, Kanun Tanah Negara berkenaan tanah berikut :

Jenis dan No, Hakmilikt ; HSD 69604 Nombor Lot + PT73479

andar/Pekan/Nukim —:-Mukim Klang Tempat

Kehiasan + 624223 Meter Porsegt Daerah : Klang

Nombor SyitPhawal + 100-AsB,C & D Nomibor Pelan Akai: ‘Tiada

‘Tarat Pegangen + Pajakan 99 tahun ‘Tarikh Luput Pajakan: 18 Apri 2201

(Gelawa-lananya eve Palakan) (ka Berkenoan)

Kawasan Rizab : Tiada

(Mika Berkenaan)

‘Tarikh Daftar + 19 April 2002 Cukai Tanah + RM 90,013.00

Bahawa pada tarikh dan waktu perakuan ini dikeluarkan,

butir-butir tanah iersebut adalah seperti berikut :

Kategori Kegunaan Tanah: Bangunan

Syarat Nyata + Bangunan kediaman

Sckatan Kepentingan : ‘Tanah yang diberi milik int tidak boleh dipindah milik,

+ dipajak atau digadal melainkan dengan kebenaran Pihak

2” Berkuasa Negeri,

Poniilikan dan Alamat +

'TPPT SDN BHD , No. Syarikat : 208360-D

1/1 bahagian

TING 6 BLOK C BANK NEGARA MALAYSIA JLN DATO ONN 50480 Wilayah Persekutuan KL,

‘Tanggungan dan endosan-endosan lain +

Nombor Perserahan : 33734/2005 Pindaan Cukal Tanah

didaftarkan pada 15 Ogos 2005 jam 07:18:42 petang,

Nombor Perserahan : 884/2007 Pengambllan Sebahaglan Tanah

idaftarkan pada 20 Julai 2007 jam 03:14:35 petang.

Urusan-urusan dalam Perserahan yang belum didaftarkan +

Hikmitik + s90t02HSDO0NG04

Moiasat 11 12)

‘Tarith 1 0870372011

‘PIJABAT TAVAH DAN GALIAN SELANGOR

Selangor

CATATAN CARIAN PERSENDIRIAN

Adalah diperakui bahawa suatu carian persendirian telah dibuat

mengikut Seksyen 384, Kann Tanah Negara berkenaan tanah berikut :

Jenis dan No, Hakmilik + HSD 69603 Nombor Lot 2 PY73478

Bandar/Peken/Mukim — ‘Mukim Klang ‘Tempat :

Keluasen + 44180 Meter Persegi Daerah : Klang

Nombor Syit Piawal — ; 100- A,B,C & D Nombor Pelan Akui : Tiada

Taraf Pegangan + Pajakan 99 tahun ‘Tarikh Luput Pajakan: 18 April 2101

(Selaia-lamanya atau Patan) (ka Berkeraan)

Kawasan Rizab + Tiada

(ka Bertenaan)

‘Tarlkh Dafiar 19 April 2002 Cukei Tanah RM 6371.00

Bahawa pada tarikh dan waktu perakuan ini dikeluarkan,

butir-butir tanah tersebut adalah seperti berikut :

Kategori Kegunaan Tanah : Bangunen

Syarat Nyata + Bangunan kediaman

Sckatan Kepentingan Tanah yang.diberi milik ini tidak boleh dipindah mili,

+ “dipajak atau digadai melainkan dengan kebenaran Pihak

+ Berkuasa Negeri.

Pemilikan dan Alamat

TPT SDN BHD , No, Syarikat : 208360-D

1/1 bahagian

‘TING 6 BLOK C BANK NEGARA MALAYSIA JLN DATO ONN 50480 Wilayah Persekutuan KL,

‘Tanggungan dan endosan-endosan lati :

Nombor Perserahan : 3734/2005 Pindaan Cukai ‘Tanah

didafarkan pada 15 Ogos 2005 Jam 07:18:42 peteng

Nombor Perserahan : 406/2007 Pengambilan Sebahagian Tanah - Borang K

seluas lebih kurang_ 1,878 Hektar dan cukai dipinda kepada -RM2,525.00

didaftarkan pada 15 Mei 2007 jam 08:47:05 pagh

No Warta : 1297 bertarikh 15 Julai 2004

(No, Rujukan Fail : (21)DLM,PTG.SEL,3/K,PERTIOL/94)

slot + 190.02H4sDo006608,

Moke + 1 020

ark +08 03/2011

LOCATION PLAN

ee

Guusierestusaasetee

peer

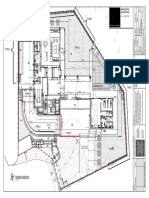

TE PLAN APPENDIX [it

(SA /0162/11/SEL Scale : Not To Scale

General view of the subject property from Persiaran Anggerik Renantanda

swore2M tet -

‘The site is presently overgrown with thick bushes and wild trees

Page 1 of 1

Burunusy ING

UUerer yo "auID4 UEIer ye p=}e00,

ue] weudojanep pjousess

“uesya neq so8uej0g

so0z oz | soe © coarse" © cod; | “SuepHo RIO UE WEIN e6zEI- | “9

-eietuny sepueg

ZJa 4a UeIer ¥e paieoo} puEy esya meg 108ue9g “BuyeIog

quawdojsnsp jenuapisai PjOussi4 — G00Z LOZ 000 OFL‘Lee' LE LLL 40 OUISIG pue WaPANyY 'ES399 107 s

‘vebuequiey tag ueBuebepsag

shy BuLroipe paren} ‘vosys rueq 106u2}9§ "Bureyod

uel weudojenap prouseis | gooz'bi'oe | e'6s =» con'oou'eL | Ley soroinsia pue wiynyy ZzeE 11)

veung

Supinuey ueressiog ye peIeoo| uesyg jeg s08uE}ag

pur] jusudojanap pjoysai4 | 600ZZL'SO dove oz0'0re's Lore “BUPD 40 JOURSIG PUB WHINY) 'L%GL 307 €

“wey Gueqns were Ye paye20) cuesy3 jueg s06ue;g ‘Buyeteg jo

pug wuowdojanap ploysei4 | OL0Z 20°60 06'89 ObO'vae'LE | FLL'OL | PUISIC) "BYESUeWEQ Jo WRYNIY ‘SELL 107 z

eure] feweg uewe | j

“9 eiewuny ueier 18 p2}200] ‘ueayg seq oBuE}9g “Suysjed Jo

‘Puel wausdojenap pjouse4 | OLOZ'6O'L0 sz GEL'96E'SL1 | O0De'SZL — PHMISIG puE WUNINWY “si0) PaPIAIPATS 406 be

eer TS

‘Bevewy uno

(my) on

opm sea 5g aS wo cay ssa wai

‘SNOSIMvdiNOD JIS 40 FINGaHOS

A XIONAddv

EEE AZT

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Plans and ElevsDocument8 pagesPlans and Elevskevinlow3No ratings yet

- RJP Sdn. BHDDocument1 pageRJP Sdn. BHDkevinlow3No ratings yet

- 1.4 Land TitleDocument6 pages1.4 Land Titlekevinlow3No ratings yet

- E楼屋顶钢结构图纸Document6 pagesE楼屋顶钢结构图纸kevinlow3No ratings yet

- RCBeamOpening v061601Document1 pageRCBeamOpening v061601kevinlow3No ratings yet

- 5) PlanDocument1 page5) Plankevinlow3No ratings yet

- Tender Notice - Sedusun Tech ValleyDocument4 pagesTender Notice - Sedusun Tech Valleykevinlow3No ratings yet

- Skywalk Notice of Meeting 16 & 17 Oct 2022Document2 pagesSkywalk Notice of Meeting 16 & 17 Oct 2022kevinlow3No ratings yet

- AIS Tan Sri TTDocument9 pagesAIS Tan Sri TTkevinlow3No ratings yet

- Borang Pengemukaan Permohonan Kemajuan Ke OSC DBKLDocument4 pagesBorang Pengemukaan Permohonan Kemajuan Ke OSC DBKLkevinlow3No ratings yet

- CLQDocument1 pageCLQkevinlow3No ratings yet

- Crab Meet Menu 2020 CompressedDocument28 pagesCrab Meet Menu 2020 Compressedkevinlow3No ratings yet

- Concrete Scanning - SoniconDocument3 pagesConcrete Scanning - Soniconkevinlow3No ratings yet

- Evolution of Geologic Time ScaleDocument10 pagesEvolution of Geologic Time Scalekevinlow3No ratings yet

- EDI 174 - Construction - Drain DetailDocument5 pagesEDI 174 - Construction - Drain Detailkevinlow3No ratings yet