Professional Documents

Culture Documents

2ND Quiz Cost Accounting

Uploaded by

Dexter G. SalcedoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2ND Quiz Cost Accounting

Uploaded by

Dexter G. SalcedoCopyright:

Available Formats

Activity in ABC

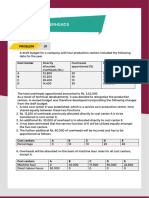

Problem 4-2-1

SuperSonic Company considering to drop one of its product lines due to its poor financial

performance in the last 5 years, and that there is no indication that the product has brighter

prospects in the coming years. Before making decisions, he requested you to once more look

into the annual budgeted data as presented below and present a report in 6 hours.

SURI SKYGOODBYE

Unit sales price P3500 P4600

Direct cost (Materials & 2800 2500

Labor)

Production in units 75,00 25,000

0

Machine hours 46,00 4,000

0

Inspection hours 45,50 3,000

0

Set-up hours 21 279

You have identified the indirect costs and their corresponding cost drivers as follows:

Budgeted Budgeted

Costs Costs Drivers Amount Activity

Utilities Machine hours P350,000 50,500 hrs

Inspections Inspection hours 450,000 5,000 hrs

Set-up costs No. of set-ups 5,500,000 300 set-ups

P5,700,000

The actual cost-driver levels are tabulated as follows:

Machine hours Inspection hours No. of set-ups

SURI 45,000 1,2500 21

SKYGOODBYE 5,500 3,850 279

The B Company has been traditionally allocating its indirect costs (e.g overhead) based on the

machine hours.

Required: Compute the unit cost for each product using the:

1. Activity Based Costing method

You might also like

- Codification of Statements on Auditing Standards: Numbers 122 to 133, January 2018From EverandCodification of Statements on Auditing Standards: Numbers 122 to 133, January 2018No ratings yet

- Activity in ABC - 044305Document1 pageActivity in ABC - 044305Dexter G. SalcedoNo ratings yet

- Activity in ABC 2 - 044307Document1 pageActivity in ABC 2 - 044307Dexter G. SalcedoNo ratings yet

- Activity in ABCDocument1 pageActivity in ABCDexter G. SalcedoNo ratings yet

- Activity in ABC 3 - 044307Document1 pageActivity in ABC 3 - 044307Dexter G. SalcedoNo ratings yet

- Activity in Cost Accounting 2 - 045053Document1 pageActivity in Cost Accounting 2 - 045053Dexter G. SalcedoNo ratings yet

- Activity BASED CostingDocument1 pageActivity BASED CostingDexter G. SalcedoNo ratings yet

- Activity in ABC 5 - 044307Document1 pageActivity in ABC 5 - 044307Dexter G. SalcedoNo ratings yet

- Activity Based Costing PractiseDocument23 pagesActivity Based Costing PractiseAR KuvadiyaNo ratings yet

- Activity Based Costing Review QuestionsDocument3 pagesActivity Based Costing Review Questionshome labNo ratings yet

- Problem in Activity Based CostingDocument3 pagesProblem in Activity Based CostingLee Thomas Arvey FernandoNo ratings yet

- Chapter 10 Activity Based CostingDocument10 pagesChapter 10 Activity Based CostingRuby P. MadejaNo ratings yet

- ABC QuestionDocument4 pagesABC QuestionOnaderu Oluwagbenga EnochNo ratings yet

- Sample Questions - ABC and JIT PDFDocument4 pagesSample Questions - ABC and JIT PDFRedNo ratings yet

- Managerial Accounting Review Problems - Activity Based Costing Name: Problem 1 ScoreDocument3 pagesManagerial Accounting Review Problems - Activity Based Costing Name: Problem 1 ScoreVivienne Rozenn LaytoNo ratings yet

- Asian Academy For Excellence Foundation, Inc.: Practical Accounting 2-Cost CPA Review O2017Document6 pagesAsian Academy For Excellence Foundation, Inc.: Practical Accounting 2-Cost CPA Review O2017didi chenNo ratings yet

- AC411 Practice QuestionsDocument44 pagesAC411 Practice QuestionsTiya AmuNo ratings yet

- Online LQDocument8 pagesOnline LQIsabella GimaoNo ratings yet

- Tutorial Topic 3 Overhead CostingDocument5 pagesTutorial Topic 3 Overhead CostingPuneetNo ratings yet

- COST ALLOCATION and ACTIVITY-BASED COSTINGDocument5 pagesCOST ALLOCATION and ACTIVITY-BASED COSTINGBeverly Claire Lescano-MacagalingNo ratings yet

- 3 Process and Job Order Costing System 2019Document8 pages3 Process and Job Order Costing System 2019Abdallah SadikiNo ratings yet

- IPCC Cost - Kol73cck4annhfcjovu6Document17 pagesIPCC Cost - Kol73cck4annhfcjovu6aryanraghuvanshi758No ratings yet

- May 18 Ama PDFDocument33 pagesMay 18 Ama PDFShubham vhoraNo ratings yet

- Activity Based Costing 1st Sem 2023 24Document38 pagesActivity Based Costing 1st Sem 2023 24Jessy Mae FlorentinoNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument6 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerRahul AgrawalNo ratings yet

- Additional Problems in ABCDocument3 pagesAdditional Problems in ABCMaviel SuaverdezNo ratings yet

- Home Work ABCDocument2 pagesHome Work ABCLiamNo ratings yet

- Pricing Decisions and Cost ManagementDocument18 pagesPricing Decisions and Cost ManagementAmrit PrasadNo ratings yet

- AFAR - 11.1-Cost Accounting (Job Order and Process Costing)Document3 pagesAFAR - 11.1-Cost Accounting (Job Order and Process Costing)Daniela AubreyNo ratings yet

- Activity Based Costing Notes and ExerciseDocument6 pagesActivity Based Costing Notes and Exercisefrancis MagobaNo ratings yet

- Topic 4 Extra QuestionsDocument2 pagesTopic 4 Extra QuestionsThirusha balamuraliNo ratings yet

- Tutorial 3 Activity Based Costing QDocument6 pagesTutorial 3 Activity Based Costing QnurathirahNo ratings yet

- Overheads & ABC - Questions Test 1Document4 pagesOverheads & ABC - Questions Test 1jj4223062003No ratings yet

- 3 Classroom-ExercisesDocument4 pages3 Classroom-ExercisesNikko Bowie PascualNo ratings yet

- ABC and CashFlow QuestionDocument11 pagesABC and CashFlow QuestionTerryDemetrioCesarNo ratings yet

- 12914sugg Pe2 gp2 1Document33 pages12914sugg Pe2 gp2 1harshrathore17579No ratings yet

- Activity Base Costing (ABC Costing)Document12 pagesActivity Base Costing (ABC Costing)SantNo ratings yet

- OH AllocationDocument1 pageOH AllocationAngelo JavierNo ratings yet

- ABC Costing 2Document4 pagesABC Costing 2محمد شہبازNo ratings yet

- Unit4 ActivityDocument11 pagesUnit4 ActivityJasper John NacuaNo ratings yet

- May 2021 G1 Test2Document4 pagesMay 2021 G1 Test2Dipak UgaleNo ratings yet

- 15 Activity Based Management and Costing IM May 2014Document10 pages15 Activity Based Management and Costing IM May 2014erjan nina bombayNo ratings yet

- ABC CostingDocument17 pagesABC CostingHameed Ullah KhanNo ratings yet

- Publishing Company Question: Service Department Operating Department A B C 1 2 TotalDocument3 pagesPublishing Company Question: Service Department Operating Department A B C 1 2 Totalisrael adesanyaNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument33 pagesPaper - 3: Cost and Management Accounting Questions Material CostEFRETNo ratings yet

- Brocher Solution Problem 5-51Document5 pagesBrocher Solution Problem 5-51Alif ArmadanaNo ratings yet

- ABC - Sem-IV - 10 MarksDocument5 pagesABC - Sem-IV - 10 MarksTechboy RahulNo ratings yet

- 2.2 PM - Activity Based Costing - 250622Document26 pages2.2 PM - Activity Based Costing - 250622abhijit tikekarNo ratings yet

- Module 2 - Activity Based CostingDocument3 pagesModule 2 - Activity Based CostingFrancis Ryan PorquezNo ratings yet

- ACC 2112 Final Exam SEM 2 2021 - 22 PDFDocument6 pagesACC 2112 Final Exam SEM 2 2021 - 22 PDFMukmin ShukriNo ratings yet

- Handout 4: Cost ManagementDocument15 pagesHandout 4: Cost ManagementNikki San GabrielNo ratings yet

- 602 Assignment 1Document8 pages602 Assignment 1Irina ShamaievaNo ratings yet

- ABC Costing Assignment Problems 209Document3 pagesABC Costing Assignment Problems 209DenNo ratings yet

- Intervention ManDocument47 pagesIntervention ManFrederick GbliNo ratings yet

- 17272pe2 Sugg June09 4Document25 pages17272pe2 Sugg June09 4harshrathore17579No ratings yet

- 3 - CostDocument27 pages3 - CostSONALI DHARNo ratings yet

- Acctg6 ABCDocument1 pageAcctg6 ABCPanda ErarNo ratings yet

- 66088bos53351inter p3Document34 pages66088bos53351inter p3Asfarin ShaikhNo ratings yet

- ABC Exercises #2 To #4Document3 pagesABC Exercises #2 To #4padayonmhieNo ratings yet

- ManAcc Quiz 2Document13 pagesManAcc Quiz 2Deepannita ChakrabortyNo ratings yet

- 1st Quiz Assignments in Financial MarketingDocument1 page1st Quiz Assignments in Financial MarketingDexter G. SalcedoNo ratings yet

- Activity in ABC 5 - 044307Document1 pageActivity in ABC 5 - 044307Dexter G. SalcedoNo ratings yet

- Name: Subject: PE 3 Course/YearDocument1 pageName: Subject: PE 3 Course/YearDexter G. SalcedoNo ratings yet

- Activity BASED CostingDocument1 pageActivity BASED CostingDexter G. SalcedoNo ratings yet

- Actg 400 Final QuizDocument1 pageActg 400 Final QuizDexter G. SalcedoNo ratings yet

- Arnis NotesDocument4 pagesArnis NotesuuuuulanNo ratings yet

- Introduction To Macroeconomics: SustainabilityDocument3 pagesIntroduction To Macroeconomics: SustainabilityDexter G. SalcedoNo ratings yet

- Ge2 m10 QuizDocument1 pageGe2 m10 QuizDexter G. SalcedoNo ratings yet

- Market Mechanisms Relative Prices Market Failure EfficientDocument3 pagesMarket Mechanisms Relative Prices Market Failure EfficientDexter G. SalcedoNo ratings yet

- By The Country. Available Resources of The EconomyDocument3 pagesBy The Country. Available Resources of The EconomyDexter G. SalcedoNo ratings yet