0% found this document useful (0 votes)

2K views7 pagesTax Return Transcript - MORA - 103921412180

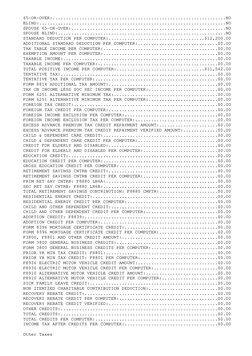

This document is a tax return transcript for Nico S Mora for the 2019 tax year that ends on December 31, 2019. It shows their income, adjustments, deductions, credits and tax details such as filing status of single, $11,542 of business income, $816 self-employment tax deduction, no taxable income, and $4,760 in refundable credits. It includes details of their dependents but no other tax payments or amounts owed.

Uploaded by

Nicole MoralesCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views7 pagesTax Return Transcript - MORA - 103921412180

This document is a tax return transcript for Nico S Mora for the 2019 tax year that ends on December 31, 2019. It shows their income, adjustments, deductions, credits and tax details such as filing status of single, $11,542 of business income, $816 self-employment tax deduction, no taxable income, and $4,760 in refundable credits. It includes details of their dependents but no other tax payments or amounts owed.

Uploaded by

Nicole MoralesCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd