Professional Documents

Culture Documents

A Study On The Role and Importance of Treasury Management System

Uploaded by

PAVAN KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On The Role and Importance of Treasury Management System

Uploaded by

PAVAN KumarCopyright:

Available Formats

Special Issue for International Conference on Business Research,

Dept of Commerce, Faculty of Science and Humanities

SRM Institute of Science & Technology, Kattankulathur, Tamilnadu.

A STUDY ON THE ROLE AND IMPORTANCE OF TREASURY MANAGEMENT

SYSTEM

Dr. S.TAMILARASI1,Mrs. V. RENUKA2

1

Associate Professor, department of Commerce, FSH,SRMIST

2

Research Scholar, Department of Commerce, FSH, SRMIST

-

INTRODUCTION management of interest-rate and exchange-rate risks

and, finally, banking management (Charro& Ortiz,

Treasury management is the creation and governance 1996; López, 2003).

of policies and procedures that ensure the company

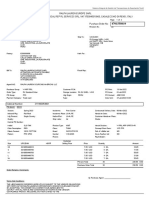

Table 1

manages financial risk successfully. It is the process of

administering the financial assets and holdings of a Centralized Treasury Management (CTM) vs. Decentralized

business. The main goal is to optimize the company’s Treasury Management (DTM)

liquidity, take right financial decisions for future, and

handle financial risks wisely. It is simply referred to as S Centralized Treasury Decentralized Treasury

cash management. A treasury management system No Management Management

(TMS) is a software application or enterprise resource

1 Under CTM, the Existence of diversified

planning (ERP) software component that automates the treasury management is sources of finance

repetitive steps required to manage a company’s cash set in the head office

flow. A TMS can be managed in-house or purchased as

a service from a third-party provider. It consists of 2 Avoids mix of cash More confusion with

surpluses and overdrafts surpluses and overdrafts

hardware, software and real-time data for cash

at various locations

positions, interest rates, payables, receivables and with

provision for foreign exchange rate 3 Negotiate with banks No scope for negotiation

for lower rate of interest with banks

Less money circulation, increasing interest rates and

economic volatility have paved way for specialized 4 Surplus cash is invested Very less chance of

skills called ‘treasury management’. Though nothing in short-term and investment in short-term

marketable securities securities

has been done till today, the competitive business

environment has created a pressure to manage cash. It 5 Borrow foreign funds at Maximum utilization of

deals with both working capital management (cash cheaper rates of interest borrowed local funds

management) and financial risk management (forex and

6 Efficient management Greater autonomy is

interest rate management, along with equity and of foreign currency given to subsidiaries and

commodity prices). The key objective of treasury risks divisions

management is to plan, organize and control cash assets

to meet future financial objectives of the company. 7 Efficient utilization of More responsive to the

business funds needs of individual

Treasury managers try to minimize losses by adopting

operating units

risk transfer and hedging techniques that suit the

internal policies of the organization.In short, treasury 8 Maintenance of a There is a shift of

management is based on payment and collection favourable balance of favourable and

management, liquidity management and banking funds unfavourable balance of

funds

management which has now taken on a broader

perspective that includes the planning of disposable

treasury assets and their subsequent monitoring, a The treasury operations of any company can be divided

strategy for investing surpluses to obtain maximum into:

profitability and finance deficits with minimum costs,

International Journal of Research in Engineering, IT and Social Sciences Page 238

A Study On The Role And Importance Of Treasury Management System Dr. S.Tamilarasi & Mrs. V. Renuka

(a) Short-term investment of surplus funds to maximize global Financial Messaging Standards has the option to

their benefits. switch bank providers, without affecting the daily

(b) Short-term borrowings from banks or market for productivity or the workflow.

working capital requirements and temporary shortage of

funds at the lowest possible rate of interest. Compliance and System Standardization

By adopting a Treasury Management System one

Benefits of Treasury Management System

canstandardize processes and systems. The team can be

Time Efficiency trained in a single system meaning quicker on-boarding

times.

Using a treasury management system will streamline

your payment process, minimizing the time spent on Issues of Treasury Management

authorization and the initiation of payments.A Treasury management in India has become an

Streamlined and distributed authorization process increasingly specialized function due to regulatory

further minimize the time spent and eradicates relaxation and increasing scale of treasury operations.

organizational bottlenecks.

In today’s context, treasuries are expected to perform

Economical two critical functions:

The clarity and complete information offered by a Financial risk management

treasury management system, allowsindetecting the cost

Financial supply chain management

of expensive cross bank transactions.

Financial risk managementincludes currency risk

Reduce Errors management, commodity price risk management and

interest rate risk management.

By mapping corporate processes and digitizing

workflow processes helps to reduce arbitrary and The financial supply chainmanagementis focused on

haphazard work and directly minimize the potential for reducing the borrowing costs, redeploying business cash

human errors. The existence of multiple authorization flows efficiently and optimizing the risk-return profile

points helps to automate the routing rules. of investible surplus.

Accurate Audit Control Statement of the problem

The digitization, enforcement and logging of Capital adequacy, liquidity management, receivable

authorization process generate a complete, detailed management and payable management have significant

andaccurate audit trail within a single system. There's and positive effect on financial performance on

always a complete register of all actions pertaining to a commercial banks in Mogadishu, Somalia. The goals of

specific payment. the cash management function bring out the basic

responsibilities of the cash manager, which, broadly

Detailed andExecutable Insights speaking, take up planning, monitoring and controlling

of the cash flows and the cash position of a company,

The system serves as an Aggregated and Consolidated

while maintaining its liquidity (Coyle, 2010, p. 6).

Analysis & Reporting platform. Thus it provides

Depending on how many responsibilities it consists of,

executable insights to discover inefficiencies and

cash management can be divided into: treasury

optimization opportunities.

management (or basic cash management) and advanced

cash management. A study of cash management

Bank provider flexibility

practices in a sample of Spanish firms done by San José

It acts as a single interface to multiple banks and et al. (2008, p. 192) confirm that treasury management

accounts. This in conjunction with the emergence of in a narrow sense or basic cash management, which

International Journal of Research in Engineering, IT and Social Sciences Page 239

A Study On The Role And Importance Of Treasury Management System Dr. S.Tamilarasi & Mrs. V. Renuka

encompasses the fundamental functions of cash In this study the target population is 75executives of

management, has evolved into treasury management in various non-banking financial companies. A total of 75

a broad sense, or advanced cash management. out of 80 executives included in the sample responded

According to San José et al. (2008, p. 193) basic cash to the questionnaire. This represents a response rate of

management involves developing and undertaking 93.75%. 5 out of the 80 executives were not included in

administrative measures aimed at establishing the the analysis as 3 were incomplete and 2 failed to return

optimal level of cash, that would allow the company to back the questionnaire.

make IJRDO-Journal of Business Management ISSN:

2455-6661 V Limitations of the Study

Objectives of the Study This study assumed a favorable environment for the

The primary objective of this study is to companies following treasury management system and

conduct an in-depth analysis of the need and managing working capital requirements effectively. The

importance of treasury management in non- researcher felt that it might be difficult to get sufficient

banking financial companies. and reliable documents and details about the company

To study the role of treasury management and their financial records. However, the treasury

system in planning, organizing and controlling management system can be maintained with the

cash assets of the company. assistance of professional experts who can render expert

To understand the procedure followed in an and reliable information. The time limit was also a

effective treasury management system. constraint for better and detailed study. Future studies

To be familiar with the means to satisfy the may use this indicator as a mediating / moderating

future financial objectives of the company variable to see whether the results will be different.

through active cash management and financial

management techniques. Data Analysis

RESEARCH METHODOLOGY Data analysis is done on the collected data to give

somemeaning from the gathered raw data. The data is

Treasury management plays an important role in the analyzed using simple statistical tools and

cash management of a company. It adds value to the questionnaires were distributed to the respondents. The

financial decisions of the company and contributes duly filled in form was later received and consequently

significantly in forecasting the cash requirements and edited, coded and then entered on to the computer. As

monitors the liquidity position of the company. The data is entered it ischecked for inconsistencies and

number of companies is increasing day by day and has errors to produce the right decision.

high exposure to the investment world. The present

study is based on both primary data and secondary data. (i) Role of Treasury Management Systemand its

Personal interviews with 75 executives of various non- Importance

banking financial companies were conducted to know The researcher formulated a hypothesis that the

about the economic profile as well as the role of relationship between treasury management system and

treasury management system in the growth and its importance in achieving the financial goals is

development of the company. The secondary data essential for the financial stability of the company and

included books, journals, magazines and websites. This the overall economic growth of the country. It is vital to

is purely a descriptive study and therefore no manage cash wisely and take effective decisions for the

complicated models and tools were used. financial future of the company.

Target Population Ho: There is a significant relationship between treasury

The target population in the research is made up of all management system and its importance in achieving the

potential participants that form the group to be studied. financial goals of the company.

International Journal of Research in Engineering, IT and Social Sciences Page 240

A Study On The Role And Importance Of Treasury Management System Dr. S.Tamilarasi & Mrs. V. Renuka

H1: There is no significant relationship between (iv) Respondent’s feedback on treasury management

treasury management system and its importance in system

achieving the financial goals of the company. Response No. of Respondents

From the computations it was found that the null User-friendly 57

hypothesis is accepted and concluded that there is a Costly 24

positive relationship between treasury management Helpful in decisions 41

system and its importance to achieve financial goals of Meet financial goals 46

the company. Accurate and reliable 38

Majority of the respondents (57) have said that the

Table 2 treasury management system is user-friendly, followed

The respondent’s age group and experience in by 46 respondents who conveyed that they are able to

treasury management system meet the financial goals of the company. 41 respondents

find it helpful in managing cash assets and take

Years No. of Percentage effective financial decisions. Other feedbacks were

Respondents

costly, accurate and reliable.

Less than 25 10 13

25 – 35 31 41

35 – 45 25 34 (v)The respondent’s hardship in managing the

More than 45 9 12 treasury management system

Total 75 100 Response No. of Percentage

Respondents

The above table shows that around 41% (31 Yes 22 29

respondents) are between 25-35 years and they have No 53 71

been into treasury management system for quite a few Total 75 100

years. The middle aged persons in the age group of 35-

45 years represent 34% (25 respondents). Followed by About 71% of the respondents have told that they do not

10 respondents in the age group of less than 25 years encounter hardship in managing the treasury system and

and 9 respondents in the age group of above 45 years. 29% (22 respondents) of the respondents are not

efficient with the system and find it difficult to cope

(iii) The respondent’s company size with the technological advancements. Today many

companies are capable to manage machines and man

Response No. of Percentage power efficiently.

Respondents

Big 33 44 (vi) Respondentsview to have professionals to operate

Medium 26 35 the system

Small 16 21 Response No. of Percentage

Total 75 100 Respondents

Yes 28 37

It is clear from the above table that most of the No 47 63

respondents (44%) are working in big company and Total 75 100

their company has an effective treasury management

system to manage their cash management. 35% It is revealed from the above table that 63% respondents

respondents work in medium-size company and 21% consider that there is no need of professional to operate

respondents are in small size company. Nowadays, even the system and that they can handle them with their

the small companies are ready to invest in treasury company accountants. 37% respondents find it difficult

management system for the growth of the company. to manage on their own and prefer to seek the assistance

of professionals.

International Journal of Research in Engineering, IT and Social Sciences Page 241

A Study On The Role And Importance Of Treasury Management System Dr. S.Tamilarasi & Mrs. V. Renuka

(vii) Respondent company’s cash flow pattern

(revenue) Using a treasury management system will

No. of streamline company’s payment process,

Response Percentage

Respondents minimizing the time spent on authorization and

Weekly 32 43 initiation of payments.

Random 27 36 The clarity in complete information and

Fixed billing date 16 21 insights offered by treasury management

Total 75 100 system, allows the company to detect the cost

of expensive cross bank transactions.

Nearly 43% of the respondents conveyed that their The company can minimize float across the

revenue is mostly on a weekly basis. 36% respondents business value chain and thereby reduce the

do not have any fixed time period and that their receipts cost of borrowings from external sources.

are on a random basis. 16 respondents (21%) work for The Treasury department has to prepare

companies in which they have a fixed billing date. various plans to ensure that cash outflows are

(viii) Disbursement ofpayments compatible with cash inflows, and just in case

borrowings are needed, to ensure that

Response No. of Percentage borrowing plans are in place.

Respondents As a result of implementing treasury

Batch-wise 17 23 management system, the companies are able to

As bills are received 12 16 obtain financial resources in an economical

On availability of 21 28 manner for the purpose of actualizing the set

funds goals.

Late payments 10 13 There is effective control over cash inflows and

Total 75 100 cash outflows like disbursements of various

expenses.

The above table reveals that 28% of the respondents The study shows that there is a positive

agree that they make payments only if there are funds relationship between treasury management

available. 23% respondents said that they make system and its importance to achieve financial

payments on a batch-wise basis so as to keep track of goals of the company.

payments. 16% respondents ensure they have adequate 63% of the respondents are confident to handle

funds to make payments and settle their bills as and the treasury system on their own and feel that

when they receive the same. 13% respondents do not there is no need of professionals to assist them

manage their funds properly and always make late to maintain the system.

payments. The respondents in the age group of 25-35

years are better equipped with the treasury

FINDINGS AND SUGGESTIONS management system as a result of their years of

experience in the field.

The study focused on the importance of treasury Nearly 44% of the respondents are working

management system in managing cash assets and with big companies which are capable to invest

making wise financial decisions. The practical issues are in the system and ensure timely cash

studied to enhance the use of treasury system. management and wise financial decisions for

Technological progress has paved way for better the growth of the company.

working capital management and financial decisions for While introducing a treasury management

the future of company. system is difficult, regular monitoring and

The study shows the existence of several internal and maintaining is even more difficult as it

external constraints in maintaining the treasury involves a lot of time and energy to keep pace

management system.

International Journal of Research in Engineering, IT and Social Sciences Page 242

A Study On The Role And Importance Of Treasury Management System Dr. S.Tamilarasi & Mrs. V. Renuka

with the changing internal and external REFERENCES

conditions.

CONCLUSION https://searcherp.techtarget.com/definition/treasury-

management

https://www.youtube.com/watch?v=AOIm117KVx0

To accomplish the primary objective of effective cash

http://www.accountingnotes.net/financial-

management, the companies put in place an effective management/treasury-management-meaning-and-

and an efficient treasury management system and role/11070

relevant policiesare framed accordingly. This would https://www.paymentcomponents.com/the-7-benefits-of-

result in optimal generation of revenue and efficient using-a-treasury-management-system/

https://www.ey.com/in/en/industries/financial-

utilization of the revenue raised. A modern treasury

services/banking---capital-markets/treasury-management

management system offers the ability to enforce https://ctmfile.com/story/future-evolution-of-treasury-

multiple authorization points and automate the routing management

rules, thereby eliminating errors, in payments https://www2.deloitte.com/be/en/pages/.../future-bank-

processing.An optimal treasury function can reduce treasury-management.html

https://youtu.be/AOIm117KVx0

financial risks and financial costs of a company. The https://www.finyear.com/attachment/600503

scope of treasury management function is likely to

extend to other areas of the business such as

procurement and commodity risks. Automation may

increase substantially and result in additional benefits to

the company.

The operating model of the treasury management

system will evolve to more matured state influencing

other decisions of future corporates in the relevant field.

There is going to be a huge increase in investment on

technologies for the betterment of the company.

International Journal of Research in Engineering, IT and Social Sciences Page 243

You might also like

- MJM0S200758Document12 pagesMJM0S200758meditation channelNo ratings yet

- 1 Treasury Management by LCLEJARDEDocument23 pages1 Treasury Management by LCLEJARDEJholan Hazel TabanceNo ratings yet

- TM Chapter 1 and 2Document27 pagesTM Chapter 1 and 2bsrem.deguzmanarvinmNo ratings yet

- Week 1 Treasury Management by LCLEJARDEDocument23 pagesWeek 1 Treasury Management by LCLEJARDEErica CadagoNo ratings yet

- Cash Flow Management as a Financial Risk FactorDocument8 pagesCash Flow Management as a Financial Risk Factordickens omondiNo ratings yet

- Treasury Management in BankingDocument6 pagesTreasury Management in BankingSolve AssignmentNo ratings yet

- WEEK 2 - Treasury ManagementDocument9 pagesWEEK 2 - Treasury ManagementJerwin LomibaoNo ratings yet

- TM ReviewerDocument9 pagesTM ReviewerkyliebellecNo ratings yet

- Cash ManagementDocument14 pagesCash Managementnkewasamanta27No ratings yet

- Role of Treasury FunctionDocument4 pagesRole of Treasury Functionadnan040% (1)

- Treasury Management - Benefits: Liquidity (I.e. Working Capital)Document52 pagesTreasury Management - Benefits: Liquidity (I.e. Working Capital)CISA PwCNo ratings yet

- Best Practices in Cash ManagementDocument5 pagesBest Practices in Cash Managementadi2005No ratings yet

- Financial Management Chapter 10.2Document30 pagesFinancial Management Chapter 10.2CA Uma KrishnaNo ratings yet

- 10.7 Treasury Management: MeaningDocument30 pages10.7 Treasury Management: MeaningGAURAV KHERANo ratings yet

- Working Capital Management Notes PDFDocument40 pagesWorking Capital Management Notes PDFBarakaNo ratings yet

- Chapter 1 - Introduction To Treasury ManagementDocument17 pagesChapter 1 - Introduction To Treasury ManagementCarlos Reid89% (9)

- Sesi 1 Treasury MGTDocument9 pagesSesi 1 Treasury MGTNanda NovitaNo ratings yet

- Management of CashDocument6 pagesManagement of CashVIVEKNo ratings yet

- DTaa SDocument7 pagesDTaa SArun ShekarNo ratings yet

- Inbound 2395138260823252972Document13 pagesInbound 2395138260823252972Aprilyn Montilla LaynoNo ratings yet

- Treasury Management EssentialsDocument12 pagesTreasury Management EssentialsErica LargozaNo ratings yet

- Detail of Treasury FunctionsDocument4 pagesDetail of Treasury Functionsgabutac aivlysNo ratings yet

- Pinky Finance ProjectDocument22 pagesPinky Finance ProjectPinky VishnaniNo ratings yet

- Cash ManagementDocument30 pagesCash ManagementankitaNo ratings yet

- Group 1 Chapter 1 - Treasury DepartmentCBET 22 701ADocument19 pagesGroup 1 Chapter 1 - Treasury DepartmentCBET 22 701ACiocon JewelynNo ratings yet

- Cash Management: Sub By: Maricris J. PascuaDocument11 pagesCash Management: Sub By: Maricris J. PascuaRaishlle Aaliyah OcampoNo ratings yet

- Introduction to Treasury Management in 40 CharactersDocument25 pagesIntroduction to Treasury Management in 40 CharactersAngelie AnilloNo ratings yet

- Cash ManagementDocument58 pagesCash ManagementPranav ChandraNo ratings yet

- Basics of Cash Management: For Financial Management and ReportingDocument42 pagesBasics of Cash Management: For Financial Management and ReportingCanMelah EmmyNo ratings yet

- CalALTs WhitePaper FINALDocument12 pagesCalALTs WhitePaper FINALBobby QuantNo ratings yet

- UNIT 1 Introduction To Treasury ManagementDocument7 pagesUNIT 1 Introduction To Treasury ManagementCarl BautistaNo ratings yet

- Chapter 1 - Treasury DepartmentDocument11 pagesChapter 1 - Treasury DepartmentespartinalNo ratings yet

- Cash Forecasting GuideDocument6 pagesCash Forecasting GuideGlorian DaplinNo ratings yet

- Cash Forecasting: Tony de Caux, Chief ExecutiveDocument6 pagesCash Forecasting: Tony de Caux, Chief ExecutiveAshutosh PandeyNo ratings yet

- EY Treasury Management Services PDFDocument16 pagesEY Treasury Management Services PDFKathir KNo ratings yet

- An Investigation of Cash Management Practices and Their Effects On The Demand For MoneyDocument10 pagesAn Investigation of Cash Management Practices and Their Effects On The Demand For MoneySumesh KurupNo ratings yet

- Functions of Treasury MGTDocument5 pagesFunctions of Treasury MGTk-911No ratings yet

- Ey Collateral OptimizationDocument15 pagesEy Collateral OptimizationpromckingzscribdNo ratings yet

- Liquidity Management and Corporate Profitability: Case Study of Selected Manufacturing Companies Listed On The Nigerian Stock ExchangeDocument16 pagesLiquidity Management and Corporate Profitability: Case Study of Selected Manufacturing Companies Listed On The Nigerian Stock ExchangeAta Ullah MukhlisNo ratings yet

- Management?-: SupplyDocument4 pagesManagement?-: SupplyKavya MuraliNo ratings yet

- Role of The TreasurerDocument39 pagesRole of The TreasurerWasifAhmadNo ratings yet

- Digital Transformation in Treasury ServicesDocument20 pagesDigital Transformation in Treasury Servicesakash100% (1)

- Bank TreasuryDocument61 pagesBank Treasurymip_123100% (1)

- Chapter 1: Treasury DepartmentDocument2 pagesChapter 1: Treasury DepartmentGem. SalvadorNo ratings yet

- Treasury Management Systems-PreDocument2 pagesTreasury Management Systems-PreMckenzie PalaganasNo ratings yet

- Management of CashDocument4 pagesManagement of Cashvicky241989No ratings yet

- Treasury ManagementDocument70 pagesTreasury ManagementSoumik Banerjee50% (2)

- Accounting Research Topics and TitlesDocument4 pagesAccounting Research Topics and TitlesMitch Tokong MinglanaNo ratings yet

- Mats Institute of Management & Entreprenuership: An Assignment On "Intrnational Finance"Document7 pagesMats Institute of Management & Entreprenuership: An Assignment On "Intrnational Finance"saiko6No ratings yet

- Cash ManagementDocument32 pagesCash ManagementVijeshNo ratings yet

- Swift Liquidity Risk White PaperDocument8 pagesSwift Liquidity Risk White Paperpsc00No ratings yet

- EY Treasury FunctionsDocument24 pagesEY Treasury FunctionsAsbNo ratings yet

- Treasury ManagementDocument64 pagesTreasury ManagementLalit MakwanaNo ratings yet

- Advanced Introduction 1Document13 pagesAdvanced Introduction 1Nabatanzi HeatherNo ratings yet

- Treasury Management OperationsDocument112 pagesTreasury Management OperationsNamrata JerajaniNo ratings yet

- Treasury ManagementDocument70 pagesTreasury ManagementmohamedNo ratings yet

- Alternative Investment Operations: Hedge Funds, Private Equity, and Fund of FundsFrom EverandAlternative Investment Operations: Hedge Funds, Private Equity, and Fund of FundsNo ratings yet

- SAP Collateral Management System (CMS): Configuration Guide & User ManualFrom EverandSAP Collateral Management System (CMS): Configuration Guide & User ManualRating: 4 out of 5 stars4/5 (1)

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceFrom EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNo ratings yet

- Business LawDocument103 pagesBusiness Law፩ne LoveNo ratings yet

- Chapter 1 - Review of Accounting ProcessDocument13 pagesChapter 1 - Review of Accounting ProcessJam100% (1)

- A Complete Guide To Credit Risk Modelling PDFDocument30 pagesA Complete Guide To Credit Risk Modelling PDFAvanish KumarNo ratings yet

- Merchandising - Journal EntriesDocument3 pagesMerchandising - Journal EntriesBhea Ballesteros CabasanNo ratings yet

- Cost of DebtDocument6 pagesCost of DebtrajisumaNo ratings yet

- Business Ethics - An Oxymoron or NotDocument4 pagesBusiness Ethics - An Oxymoron or NotDong West100% (1)

- TaxReturn2022 1040Document10 pagesTaxReturn2022 1040Trish Hit100% (3)

- ElementDocument3 pagesElementMaiko Gil HiwatigNo ratings yet

- Amazon SAP ERP Case ProjectDocument5 pagesAmazon SAP ERP Case Projectjem heartNo ratings yet

- Application For Exemption of Customs DutyDocument10 pagesApplication For Exemption of Customs DutyFahad BataviaNo ratings yet

- Cibi Job Readiness Program: Confidential and ProprietaryDocument6 pagesCibi Job Readiness Program: Confidential and Proprietaryhpp academicmaterialsNo ratings yet

- Storage and Ware Housing of Agricultural ProductsDocument14 pagesStorage and Ware Housing of Agricultural ProductsPragyan SarangiNo ratings yet

- The 4 Types of InnovationDocument8 pagesThe 4 Types of InnovationMoncheNo ratings yet

- Week 4 Operations ManagementDocument28 pagesWeek 4 Operations ManagementTrishia RoseroNo ratings yet

- Cadbury Schweppes Edition 9 WorksheetDocument3 pagesCadbury Schweppes Edition 9 WorksheetLong Dong Mido0% (1)

- Wa0004.Document16 pagesWa0004.DEBASHISHCHATTERJE78No ratings yet

- Case 7B FRC M. Gerry Naufal 29123123Document7 pagesCase 7B FRC M. Gerry Naufal 29123123m.gerryNo ratings yet

- IMC Plan - Nhóm 5 - PowerpointDocument25 pagesIMC Plan - Nhóm 5 - PowerpointQuỳnh Lai PhươngNo ratings yet

- Case Analysis of Infosys 1326776317Document5 pagesCase Analysis of Infosys 1326776317Shweta P PaiNo ratings yet

- Walmart - Market Leader StrategiesDocument4 pagesWalmart - Market Leader Strategiesmurtaza mannanNo ratings yet

- Po 4701558619Document2 pagesPo 4701558619Roger Sebastian Rosas AlzamoraNo ratings yet

- Depreciation. PART 1 (Straight Line Variable Method) - 021728Document60 pagesDepreciation. PART 1 (Straight Line Variable Method) - 021728UnoNo ratings yet

- Flattening of Copper and Copper-Alloy Pipe and Tube: Standard Test Method ForDocument3 pagesFlattening of Copper and Copper-Alloy Pipe and Tube: Standard Test Method ForErick VargasNo ratings yet

- Etech11 Q1 Mod6 JDRiveroDocument24 pagesEtech11 Q1 Mod6 JDRiveroReyvelyn Salon0% (1)

- Matching TypeDocument2 pagesMatching Type채문길No ratings yet

- The corridor of customer satisfaction and loyalty in B2B marketsDocument16 pagesThe corridor of customer satisfaction and loyalty in B2B marketsJohn SmithNo ratings yet

- Reflection on Experiences and Organizational Behavior Concepts Learned this SemesterDocument6 pagesReflection on Experiences and Organizational Behavior Concepts Learned this SemesterVaneet SinglaNo ratings yet

- Dagnachew GetachewDocument91 pagesDagnachew GetachewAhsan HumayunNo ratings yet

- Starfinder v3 2008 Full DownloadDocument17 pagesStarfinder v3 2008 Full Downloadericamiller081294azp100% (122)

- Technology Based Project: Special Track 1)Document14 pagesTechnology Based Project: Special Track 1)Kim ChiquilloNo ratings yet