Professional Documents

Culture Documents

Reserve Bank of Australia - The-Transmission-Of-Monetary-Policy

Uploaded by

Nthabiseng MunyaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reserve Bank of Australia - The-Transmission-Of-Monetary-Policy

Uploaded by

Nthabiseng MunyaiCopyright:

Available Formats

rba.gov.

au/education

twitter.com/RBAInfo

The Transmission

facebook.com/

ReserveBankAU/

youtube.com

/user/RBAinfo

of Monetary Policy

The transmission of monetary policy describes how

changes made by the Reserve Bank to its monetary

policy settings flow through to economic activity

and inflation. This process is complex and there is a

large degree of uncertainty about the timing and

size of the impact on the economy. In simple terms,

the transmission can be summarised in two stages.

11. Changes to monetary policy affect interest

rates in the economy.

22. Changes to interest rates affect economic

activity and inflation.

This explainer outlines these two stages and

highlights some of the main channels through which

monetary policy affects the Australian economy.

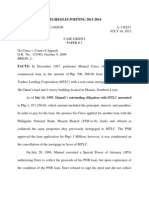

Interest rates Economic activity and inflation

GDP

Saving and

investment

channel

Domestic

Wealth Consumption prices

Interest rates channel and

Cash rate

and other for investment

monetary households

and Balance sheet

policy and cash flow Inflation

tools businesses

channel

Exchange rate Net exports Import prices

channel

Inflation expectations

RESERVE BANK OF AUSTRALIA | Education The Transmission of Monetary Policy 1

First Stage

Monetary policy in Australia is determined over other interest rates, such as deposit and

by the Reserve Bank Board. The primary and lending rates for households and businesses. The

conventional tool for monetary policy is the Reserve Bank’s other monetary policy tools work

target for the cash rate, but other tools have primarily by affecting longer-term interest rates in

included forward guidance, price and quantity the economy.

targets for the purchase of government bonds,

While monetary policy acts as a benchmark for

and the provision of low-cost fixed term funding

interest rates in the economy, it is not the only

to financial institutions.

determinant. Other factors, such as conditions in

The first stage of transmission is about how financial markets, changes in competition, and

changes to settings for these tools influence the risk associated with different types of loans,

interest rates in the economy. The cash rate is the can also impact interest rates. As a result, the

market interest rate for overnight loans between spread (or difference) between the cash rate and

financial institutions, and it has a strong influence other interest rates varies over time.

Second Stage

The second stage of transmission is about how However, there is a large degree of uncertainty

changes to monetary policy influence economic about these estimates because the structure of

activity and inflation. To highlight this, we can the economy changes over time, and economic

use a simple example of how lower interest rates conditions vary. Because of this, the overall effects

for households and businesses affect aggregate of monetary policy and the length of time it takes

demand and inflation. (Higher interest rates have to affect the economy can vary.

the opposite effect on demand and inflation).

Inflation Expectations

Aggregate Demand Inflation expectations also matter for the

Lower interest rates increases aggregate demand transmission of monetary policy. For example, if

by stimulating spending. But it can take a workers expect inflation to increase, they might

while for the supply of goods and services to ask for larger wage increases to keep up with the

respond because more workers, equipment changes in inflation. Higher wage growth would

and infrastructure may be required to produce then contribute to higher inflation.

them. Because of this, aggregate demand is

By having an inflation target, the central bank can

initially greater than aggregate supply, putting

anchor inflation expectations. This should increase

upward pressure on prices. As businesses increase

the confidence of households and businesses in

their prices more rapidly in response to higher

making decisions about saving and investment

demand, this leads to higher inflation.

because uncertainty about the economy is

There is a lag between changes to monetary reduced.

policy and its effect on economic activity and

inflation because households and businesses take

time to adjust their behaviour. Some estimates

suggest that it takes between one and two years

for monetary policy to have its maximum effect.

2 RESERVE BANK OF AUSTRALIA | Education The Transmission of Monetary Policy

Channels of Monetary • A reduction in lending rates reduces interest

repayments on debt, increasing the amount of

Policy Transmission cash available for households and businesses

to spend on goods and services. For example,

Saving and Investment Channel a reduction in interest rates lowers repayments

Monetary policy influences economic activity for households with variable-rate mortgages,

by changing the incentives for saving and leaving them with more disposable income.

investment. This channel typically affects

• At the same time, a reduction in interest

consumption, housing investment and business

rates reduces the amount of income that

investment.

households and businesses get from deposits,

• Lower interest rates on bank deposits reduce and some may choose to restrict their

the incentives households have to save their spending.

money. Instead, there is an increased incentive

• These two effects work in opposite

for households to spend their money on

directions, but a reduction in interest rates

goods and services.

can be expected to increase spending in the

• Lower interest rates for loans can encourage Australian economy through this channel (with

households to borrow more as they face lower the first effect larger than the second).

repayments. Because of this, lower lending

rates support higher demand for assets, such Asset Prices and Wealth Channel

as housing. Asset prices and people's wealth influence how

much they can borrow and how much they

• Lower lending rates can increase investment

spend in the economy. The asset prices and

spending by businesses (on capital goods like

wealth channel typically affects consumption and

new equipment or buildings). This is because

investment.

the cost of borrowing is lower, and because of

increased demand for the goods and services • Lower interest rates support asset prices (such

they supply. This means that returns on these as housing and equities) by encouraging

projects are now more likely to be higher than demand for assets. One reason for this is

the cost of borrowing, helping to justify going because the present discounted value of

ahead with the projects. This will have a more future income is higher when interest rates are

direct effect on businesses that borrow to fund lower.

their projects with debt rather than those that

use the business owners’ funds. • Higher asset prices also increases the equity

(collateral) of an asset that is available for banks

Cash-flow Channel to lend against. This can make it easier for

households and businesses to borrow.

Monetary policy influences interest rates,

which affects the decisions of households and • An increase in asset prices increases people's

businesses by changing the amount of cash they wealth. This can lead to higher consumption

have available to spend on goods and services. and housing investment as households

This is an important channel for those that are generally spend some share of any increase in

liquidity constrained (for example, those who their wealth.

have already borrowed up to the maximum that

banks will provide).

RESERVE BANK OF AUSTRALIA | Education The Transmission of Monetary Policy 3

Exchange Rate Channel • A reduction in interest rates (compared with

the rest of the world) typically results in a lower

The exchange rate can have an important

exchange rate, making foreign goods and

influence on economic activity and inflation

services more expensive compared with those

in a small open economy such as Australia. It

produced in Australia. This leads to an increase

is typically more important for sectors that are

in exports and domestic activity. A lower

export oriented or exposed to competition from

exchange rate also adds to inflation because

imported goods and services.

imports become more expensive in Australian

• If the Reserve Bank lowers the cash rate it dollars.

means that interest rates in Australia have

fallen compared with interest rates in the rest

of the world (all else being equal).

• Lower interest rates reduce the returns

investors earn from assets in Australia (relative

to other countries). Lower returns reduce

demand for assets in Australia (as well as

for Australian dollars) with investors shifting

their funds to foreign assets (and currencies)

instead.

4 RESERVE BANK OF AUSTRALIA | Education The Transmission of Monetary Policy

You might also like

- Promissory Note TemplateDocument1 pagePromissory Note TemplatejamesrockhardNo ratings yet

- World Trade Center RFQDocument27 pagesWorld Trade Center RFQKatherine SayreNo ratings yet

- The Transmission of Monetary PolicyDocument4 pagesThe Transmission of Monetary PolicyPan Thet NaingNo ratings yet

- Interest Rates and Economic GrowthDocument7 pagesInterest Rates and Economic GrowthTufail MallickNo ratings yet

- Chapter 8 Unit 3 - UnlockedDocument16 pagesChapter 8 Unit 3 - UnlockedSanay ShahNo ratings yet

- Monetary Theories and PoliciesDocument9 pagesMonetary Theories and PoliciesCHRISTIAN DE VERANo ratings yet

- Why Monetary Policy MattersDocument2 pagesWhy Monetary Policy MattersKatieYoungNo ratings yet

- Policies To Reduce InflationDocument3 pagesPolicies To Reduce InflationBobbie LittleNo ratings yet

- Investors ConfidenceDocument4 pagesInvestors ConfidenceShame MukokaNo ratings yet

- Lesson 2 - The Financial Management EnvironmentDocument24 pagesLesson 2 - The Financial Management EnvironmentHafiz HishamNo ratings yet

- Counter-Cyclical Economic Policy: Economics Department Policy Note No. 1Document9 pagesCounter-Cyclical Economic Policy: Economics Department Policy Note No. 1Adnan KamalNo ratings yet

- Government and Legal Environment (Part-2)Document14 pagesGovernment and Legal Environment (Part-2)Darshan MNo ratings yet

- Monetary Policy in IndiaDocument9 pagesMonetary Policy in IndiaShubhakeerti RaoNo ratings yet

- Monetary Policy in India PDFDocument9 pagesMonetary Policy in India PDFNo NoNo ratings yet

- 2033314, Macro CIA-3Document8 pages2033314, Macro CIA-3Rohan GargNo ratings yet

- 3.4 Managing The Economy - Monetary PolicyDocument16 pages3.4 Managing The Economy - Monetary PolicyDharm GajjarNo ratings yet

- Kristine Jewel S. Pacursa 1nonbsa2Document2 pagesKristine Jewel S. Pacursa 1nonbsa2Kristine Jewel PacursaNo ratings yet

- Ijmt ISSN: 2249-1058: Effect of Interest Rate Deregulations On Banks Deposit Mobilization in NigeriaDocument13 pagesIjmt ISSN: 2249-1058: Effect of Interest Rate Deregulations On Banks Deposit Mobilization in NigeriaShyqri KrasniqiNo ratings yet

- MACC 224 Narrative ReportDocument3 pagesMACC 224 Narrative ReportaceNo ratings yet

- ch11 Lecture and Textbook NotesDocument11 pagesch11 Lecture and Textbook Notes47fwhvhc6kNo ratings yet

- Laggui 3bsaccty-A Chap 2 Essay Acc311Document1 pageLaggui 3bsaccty-A Chap 2 Essay Acc311hsjhsNo ratings yet

- Chapter 2: Introducing Money EssayDocument1 pageChapter 2: Introducing Money EssayhsjhsNo ratings yet

- Monetary Transmission MechanismDocument12 pagesMonetary Transmission MechanismFarhat ImteyazNo ratings yet

- 1 - Monetary - Fiscal PolicyDocument41 pages1 - Monetary - Fiscal PolicyAditya NugrohoNo ratings yet

- 3.2 Real Estate FinanceDocument14 pages3.2 Real Estate Financegore.solivenNo ratings yet

- Monetary Policy NotesDocument2 pagesMonetary Policy NotesjyotsnatrathodNo ratings yet

- 201910880Document4 pages201910880Chelsea Irish MedranoNo ratings yet

- Impact of MacroeconomicsDocument5 pagesImpact of MacroeconomicsChetan ChanneNo ratings yet

- Fiscal ImpDocument5 pagesFiscal ImpabdulsamadNo ratings yet

- Solution Manual For Financial Markets and Institutions 12th Edition by Madura ISBN 1337099740 9781337099745Document36 pagesSolution Manual For Financial Markets and Institutions 12th Edition by Madura ISBN 1337099740 9781337099745caseywestfmjcgodkzr100% (18)

- Central BankDocument2 pagesCentral BankbeppowalcottNo ratings yet

- 2.6. Macroeconomic Objectives and PoliciesDocument19 pages2.6. Macroeconomic Objectives and Policiesclaire zhouNo ratings yet

- Eco Dev MidtermDocument6 pagesEco Dev MidtermGlenn VeluzNo ratings yet

- Economics Essay HWDocument3 pagesEconomics Essay HWJunhua LeeNo ratings yet

- Monetary PolicyDocument4 pagesMonetary PolicySadia R ChowdhuryNo ratings yet

- Effect of Monetory PolicyDocument3 pagesEffect of Monetory PolicyAshish SinhaNo ratings yet

- Economics ProjectDocument21 pagesEconomics ProjectMalvika SoodNo ratings yet

- Monetary Policy in Pakistan: BackgroundDocument6 pagesMonetary Policy in Pakistan: BackgroundChoudhery Saleh MohammadNo ratings yet

- Thesis Monetary PolicyDocument6 pagesThesis Monetary Policycgvmxrief100% (2)

- Chairman Ben S. BernankeDocument10 pagesChairman Ben S. BernankeZim VicomNo ratings yet

- List of ContentsDocument17 pagesList of ContentsSneha JainNo ratings yet

- Research Paper On Impact of Monetary Policy On GDPDocument5 pagesResearch Paper On Impact of Monetary Policy On GDPafnhceivhbpbdwNo ratings yet

- Basan C061 Prelims CasestudyDocument5 pagesBasan C061 Prelims Casestudyliberace cabreraNo ratings yet

- 2020 11economics IDocument16 pages2020 11economics IUdwipt VermaNo ratings yet

- Monetary & Fiscal PolicyDocument42 pagesMonetary & Fiscal PolicySk Imran IslamNo ratings yet

- Government Saving Has Not Grown Much in The Developing Countries and Corporate Saving Is Relatively SmallDocument6 pagesGovernment Saving Has Not Grown Much in The Developing Countries and Corporate Saving Is Relatively SmalljoooNo ratings yet

- R O M P I C I Submitted By:: OLE F Onetary Olicy N Ontrolling NflationDocument17 pagesR O M P I C I Submitted By:: OLE F Onetary Olicy N Ontrolling NflationSanjeevNo ratings yet

- The Transmission Mechanism of Monetary Policy: Introduction and SummaryDocument10 pagesThe Transmission Mechanism of Monetary Policy: Introduction and SummaryVanessa RagoneNo ratings yet

- Monetary Transmission MechanismDocument12 pagesMonetary Transmission MechanismTarun SethiNo ratings yet

- UNIT 2 Tutorial Questions and AnswersDocument6 pagesUNIT 2 Tutorial Questions and AnswersAlicia AbsolamNo ratings yet

- Pakistan's Monetary Policy of 2022Document14 pagesPakistan's Monetary Policy of 2022Gohar KhalidNo ratings yet

- Fundamentals of Financial Markets and Institutions in Australia 1St Edition Valentine Solutions Manual Full Chapter PDFDocument44 pagesFundamentals of Financial Markets and Institutions in Australia 1St Edition Valentine Solutions Manual Full Chapter PDFequally.ungown.q5sgg100% (11)

- Part II Interest Rates and TVM (Revised For 2e)Document68 pagesPart II Interest Rates and TVM (Revised For 2e)Harun MusaNo ratings yet

- R03 Capital Market Expectations, Part 1 - Framework and Macro Considerations HY NotesDocument7 pagesR03 Capital Market Expectations, Part 1 - Framework and Macro Considerations HY NotesArcadioNo ratings yet

- Monetary PolicyDocument13 pagesMonetary PolicyAishath Aala AhmedNo ratings yet

- Lesson 7 Monetray and Fiscal PolicyDocument5 pagesLesson 7 Monetray and Fiscal PolicyJamNo ratings yet

- IGCSE Economics Self Assessment Chapter 27 AnswersDocument3 pagesIGCSE Economics Self Assessment Chapter 27 AnswersDesreNo ratings yet

- Monetary and Fiscal PolicyDocument26 pagesMonetary and Fiscal PolicyTisha GabaNo ratings yet

- EconomicsDocument13 pagesEconomicsMark HughesNo ratings yet

- Navigating the Global Storm: A Policy Brief on the Global Financial CrisisFrom EverandNavigating the Global Storm: A Policy Brief on the Global Financial CrisisNo ratings yet

- Quantum Strategy II: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy II: Winning Strategies of Professional InvestmentNo ratings yet

- MIM BrochureDocument25 pagesMIM BrochureSaurabh BajpeyeeNo ratings yet

- CaseStudy ExerciseDocument20 pagesCaseStudy ExerciseLinh NguyễnNo ratings yet

- $20 To Acquire PT Sumber Tbk. The Fair Value of The Stock at The Time Was $40 Per Share. PTDocument4 pages$20 To Acquire PT Sumber Tbk. The Fair Value of The Stock at The Time Was $40 Per Share. PTBryan LukeNo ratings yet

- End of Unit Test.U6.M3: ServicesDocument4 pagesEnd of Unit Test.U6.M3: ServicesPiHung DoNo ratings yet

- IDN Times - Taskforce - Media & HomelessDocument1 pageIDN Times - Taskforce - Media & HomelessHanan Rananta ArbiNo ratings yet

- Professional Code For The Financial Services IndustryDocument21 pagesProfessional Code For The Financial Services IndustryMubarakNo ratings yet

- Pag-Ibig PAMP - NegoSale - Batch - 3 - 102819Document15 pagesPag-Ibig PAMP - NegoSale - Batch - 3 - 102819Patricia Marie ManaliliNo ratings yet

- Hang Gliders Product InformationDocument20 pagesHang Gliders Product InformationJanardhan S IyerNo ratings yet

- Accounting MCQDocument15 pagesAccounting MCQFahad RazaNo ratings yet

- A Critique of The Anglo-American Model of Corporate GovernanceDocument3 pagesA Critique of The Anglo-American Model of Corporate GovernanceSabrina MilaNo ratings yet

- QChartist Highly Profitable Trading SystemsDocument23 pagesQChartist Highly Profitable Trading SystemsJulien MoogNo ratings yet

- 2 - Project Structure and Financing Sources For Wind FarmsDocument28 pages2 - Project Structure and Financing Sources For Wind Farmsviethoa_uehNo ratings yet

- Knowledge Is Power, So Be As Powerful As You Can!Document27 pagesKnowledge Is Power, So Be As Powerful As You Can!Ahemad ShamimNo ratings yet

- 48 - Insular Life Assurance Co., Ltd. Vs Toyota Bel-Air, Inc. (550 SCRA 70)Document9 pages48 - Insular Life Assurance Co., Ltd. Vs Toyota Bel-Air, Inc. (550 SCRA 70)Jessie Marie dela PeñaNo ratings yet

- Dwnload Full Accounting For Corporate Combinations and Associations Australian 7th Edition Arthur Test Bank PDFDocument36 pagesDwnload Full Accounting For Corporate Combinations and Associations Australian 7th Edition Arthur Test Bank PDFdietzbysshevip813100% (16)

- Poland 2005Document315 pagesPoland 2005MarianNo ratings yet

- Prospects OF Venturecapital in India: Presented By: Shweta Gupta 10MBA 32Document21 pagesProspects OF Venturecapital in India: Presented By: Shweta Gupta 10MBA 32shwetajiiNo ratings yet

- NLKTDocument8 pagesNLKTMy Nguyễn HàNo ratings yet

- Shriram City Finance-NewDocument62 pagesShriram City Finance-NewSamira D'souza67% (3)

- Assignment of Financial ManagementDocument7 pagesAssignment of Financial ManagementPRACHI DASNo ratings yet

- Leg Res 3Document4 pagesLeg Res 3Aj GuanzonNo ratings yet

- Policy On Accounts ReceivableDocument8 pagesPolicy On Accounts ReceivableMazhar Hussain Ch.No ratings yet

- Mutual Funds in IndiaDocument8 pagesMutual Funds in IndiaSimardeep SinghNo ratings yet

- Chapter NineDocument10 pagesChapter NineAsif HossainNo ratings yet

- Hotel AccountsDocument52 pagesHotel AccountsAbinavam Subramanian Mohan95% (22)

- GL R12Document93 pagesGL R12b_rakes2005100% (1)

- 5 Strategic Capacity Planning For Products and ServicesDocument39 pages5 Strategic Capacity Planning For Products and ServicesRubaet HossainNo ratings yet

- CalPERS Portfolio DataDocument34 pagesCalPERS Portfolio DataFortuneNo ratings yet