Professional Documents

Culture Documents

Life Insurance: Mahdzan & Boey 2015

Life Insurance: Mahdzan & Boey 2015

Uploaded by

Jerrine KohOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Life Insurance: Mahdzan & Boey 2015

Life Insurance: Mahdzan & Boey 2015

Uploaded by

Jerrine KohCopyright:

Available Formats

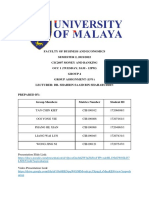

CHAPTER 5

LIFE INSURANCE

Mahdzan & Boey 2015

Learning Outcomes

Explain the basics of life insurance.

Distinguish the different types of life insurance.

Calculate the amount of life insurance to own.

List the general exclusions under life insurance

policies.

Mahdzan & Boey 2015

1.0 Basics of life insurance

1.1 Definition

Upon the death or any other contingency dependent on

human life, company will pay a lump sum amount (the face

amount of the policy) which is guaranteed at inception of

the contract to the insured’s beneficiary(ies).

Mahdzan & Boey 2015

1.0 Basics of life insurance

1.2 Perils covered under Life Insurance

Types: death, disability and critical illnesses.

A basic life insurance policy only covers death of the Insured.

Disability and critical illness benefits are usually purchased as

riders.

A rider - supplementary benefits that are attached together

to a basic policy.

The cost of insurance (COI) or premiums- depend upon the

features of the rider that is offered by the insurance company

and the sum assured that is purchased for that rider by the

Insured.

Mahdzan & Boey 2015

1.0 Basics of life insurance

1) Death

Basically covers premature death.

Premature death: dying too soon

with outstanding liabilities and

financial commitments.

Primary breadwinner: spouse who

has most of the earning capability

to support the household of

growing children and elderly

parents.

Mahdzan & Boey 2015

1.0 Basics of life insurance

2) Total and Permanent Disability (TPD)

One is unable to perform the daily living activities and

never be expected to ever work again.

A totally and permanently disabled person has to fulfill

the following conditions:

1. Total and irrecoverable loss of sight of BOTH eyes.

2. Severance of TWO (2) limbs at or above wrist or

ankle

3. Total and irrecoverable of loss of sight of ONE (1)

eye and loss by severance of ONE (1) limb at or

above the wrist or ankle.

Mahdzan & Boey 2015

Visualisation of losses under TPD

Mahdzan & Boey 2015

1.0 Basics of life insurance

3) Critical illness

To cover an insured from loss of income upon the diagnosis one of the

36 debilitating critical illness.

AIA Malaysia was the first to cover 39 critical illnesses in July 2018.

Prudential Malaysia started to offer 43 critical illness cover in Jan 2019.

Mahdzan & Boey 2015

The basic 36 critical illnesses

Alzheimer’s Disease / Encephalitis Medullary Cystic Disease

Irreversible Organic End Stage Kidney Motor Neuron Disease

Degenerative Brain Disorders Failure Multiple Sclerosis

Angioplasty and Other Invasive End Stage Liver Failure Muscular Dystrophy

Treatments for Major Coronary End Stage Lung Disease Other Serious Coronary

Artery Disease Fulminant Viral Hepatitis Artery Disease

Bacterial Meningitis Heart Attack Paralysis / Paraplegia

Benign Brain Tumor Heart Valve Surgery Parkinson’s Disease

Blindness / Total Loss of Sight HIV due to Blood Primary Pulmonary

Brain Surgery Transfusion Arterial Hypertension

Cancer Loss of Independent Severe Cardiomyopathy

Chronic Aplastic Anemia Existence

Stroke

Coma Loss of Speech

Coronary Artery By-pass Major Burns

Surgery to Aorta

Surgery Major Head Trauma

Terminal Illness

Deafness / Total Loss of Major Organ / Bone

Hearing Marrow Transplant

Table 1: Listing of 36 Critical Illness commonly covered in Malaysia

Mahdzan & Boey 2015

Additional critical illness cover

Occupationally Systemic Lupus

Acquired Human Erythematosus with

Full Blown AIDS

Immunodeficiency Severe Kidney

Virus (HIV) Infection Complications

Mahdzan & Boey 2015

1.0 Basics of life insurance

1.2 Identifying the Primary Breadwinner

Single Adults

Many adults are single either by choice or

through circumstance.

As long as they have provided for all their

outstanding liabilities and medical needs,

this group does not need a huge amount

of life insurance as they do not have any

dependents.

Mahdzan & Boey 2015

1.0 Basics of life insurance

Single Breadwinner/Traditional Families

A traditional family - only one breadwinner in the family.

Conventional wisdom recommends that the income-

generating breadwinner purchase an adequate amount of

life insurance.

Mahdzan & Boey 2015

1.0 Basics of life insurance

Double-income Families

In modern times double income

families are normal where both

spouses are working to jointly pay the

bills and raise the children.

Each spouse will need to buy an

equivalent amount of life insurance for

their financial contribution towards

the family.

Mahdzan & Boey 2015

1.0 Basics of life insurance

Single-Parent Families

Single-parent families may be the result when

one of the spouses passes away or through a

divorce.

Divorce - the parent who is the primary care-

giver will be financially dependent on the

estranged spouse’s monthly financial

contribution upon a separation or a divorce.

Some single mothers are not so lucky to receive

such financial support as their ex-spouses have

gone astray and are no longer bother to provide

any financial or emotional support.

Mahdzan & Boey 2015

1.0 Basics of life insurance

Sandwich Families

The working generation is

sandwiched in between the older

retired generation and the

younger still school-going

generation.

A substantial amount of life

insurance is needed to cover the

working generation who have to

provide for the needs of two

generations with differing needs.

Mahdzan & Boey 2015

1.0 Basics of life insurance

Blended Families

The parents have children from

previous relationships but all the

members come together as one

unit.

The breadwinners from both

families need to buy sufficient

amount of life insurance to ensure

that the needs of the children

from two different families are

well taken care of.

Mahdzan & Boey 2015

Basic definitions in a life insurance contract:

Premiums:

The regular amount of premiums payable to the life

insurance company which is based on the Insured’s

attained/future age, smoker or non-smoker status and

health condition at the time of policy application.

Mahdzan & Boey 2015

Basic definitions in a life insurance contract:

Insured Person:

The Named Person whose life is covered in the

insurance policy contract.

Mahdzan & Boey 2015

Basic definitions in a life insurance contract:

Death Benefit:

The amount of insurance money that the

beneficiary(ies) receive from the insurance company

upon the death of the Insured.

Mahdzan & Boey 2015

Basic definitions in a life insurance contract:

Face Amount:

The Sum Assured which is the amount of insurance cover

that the Insurer will pay the Insured beneficiary(ies) at the

point of insured’s death.

Mahdzan & Boey 2015

Basic definitions in a life insurance contract:

Beneficiary(ies):

The person(s) who will receive Death Benefit proceeds

from the insurance company upon the death of the

Insured.

Mahdzan & Boey 2015

Basic definitions in a life insurance contract:

Lapsed policy:

A life insurance policy may lapse upon non-payment of

premiums.

The unpaid premiums will be initially deducted from any

available Account Value. Over a prolonged period of non-

payment (>1year) of premiums, the policy will be

converted to an Extended Term Insurance (ETI) where the

Insured will only be covered for Death/TPD.

The Sum Assured and all the accrued benefits on a policy

will be terminated by the insurer due to prolonged non-

payment of premiums by the Payor.

Mahdzan & Boey 2015

Basic definitions in a life insurance contract:

Extended Term Insurance (ETI):

Insured is only covered for Death/TPD like a basic Term

policy. This is non-forfeiture option to extend the life of

the policy when the policyholder is unable to pay

premiums on time.

Mahdzan & Boey 2015

Basic definitions in a life insurance contract:

Account Value:

Actual accumulated

cash value (either from

dividends or capital

appreciation of the

units for ILP) in the

policy at time of death

of the Insured, upon

surrender of policy or

at any given time.

Mahdzan & Boey 2015

Basic definitions in a life insurance contract:

Surrender policy:

Early termination policy

contract before Maturity by

the policyholder.

Mahdzan & Boey 2015

2.0 Types of life insurance

Term

insurance

Investment- Whole life

linked plans Insurance

Types of

life

insurance

Endownment

Annuities

insurance

Mahdzan & Boey 2015

2.0 Types of life insurance

2.1 Term Insurance

Temporary insurance or a fixed term insurance- the Insured is

covered for a fixed level amount of Face Amount for a specified

period.

Term insurance

Death Benefit = Face Amount

Usually includes a guaranteed convertible - the insured can

convert this policy to a permanent plan without any further

evidence of insurability at the time of conversion.

Mahdzan & Boey 2015

2.0 Types of life insurance

2.2 Whole life Insurance

A plan that provides protection for the entire lifetime of the

insured, usually until he/she is 100 years.

No clear separation between the protection and savings

element as it is bundled together in the cost of insurance

(the premiums).

Whole Life Insurance

Death Benefit = Face Amount + Account Value

Mahdzan & Boey 2015

2.0 Types of life insurance

2.2 Whole life Insurance

Participating (Par) policy: dividends are accrued to this

policy from the life fund of the insurance company.

Non-Participating (Non-Par) policy: it does not participate

in the dividends accrued in the life fund of the insurance

company.

Limited Payment Whole Life policy: premiums are payable

for a limited number of years (a much shorter period

compared to paying premiums for the Insured’s lifetime)

after which the policy becomes fully paid-up.

Mahdzan & Boey 2015

Mahdzan & Boey 2015

2.0 Types of life insurance

2.3 Endowment Insurance

Term insurance of a relatively long period (e.g. 10, 15 or 20

years) that incorporates a savings element together with

insurance.

E.g.: child’s education savings plan or a personal savings plan.

Endowment Insurance

Death Benefit = Face Amount

(payable to the beneficiaries if the insured dies before maturity of the

policy)

Death Benefit = Face Amount + Account Value

(payable to the insured if the insured survives till the maturity of the policy)

Mahdzan & Boey 2015

2.0 Types of life insurance

2.4 Annuities

The payer deposits regular premiums for a specific period and will later

receive guaranteed regular coupon payments from the insurance

company upon maturity of the policy.

Mahdzan & Boey 2015

2.0 Types of life insurance

2.5 Investment linked plan

A relatively new type of insurance that combines

insurance (protection) with investments (savings).

The flexibility benefits of investment linked plan:

The insured may choose the level of protection

and investment desired

The amount of premiums can be varied from

time to time

The type of funds chosen should be according to

the risk profile of the insured

Investment Linked Plan

Death Benefit = Face Amount + Actual

Accumulated Cash Value

Mahdzan & Boey 2015

2.5 Investment linked plan

Mahdzan & Boey 2015

2.5 Investment linked plan

Computation of Cash Value under Single Pricing

Premiums = RM3,600, Initial Sales Charge = 5%, Unit Price of fund = RM0.50

Initial Sales Charge 5% = RM3,600 x 5%= RM180

Balance premium to be invested = RM3,600 – RM180 = RM3,420

Number of units purchased = RM3,420 / RM0.50 = 6,840units

Assume Mortality charge to be 1% and Policy fee = RM50

Cash Value under Single Pricing

= (Number of units x Unit Price) – (Mortality charge + Policy fee)

= (6,840units x RM0.50) – [(6,840units x RM0.50 x 1%) + RM50]

= RM3,335.80

Mahdzan & Boey 2015

3.0 The amount of life insurance

to own

3.1 Human Life Value Method

A simple method to quantify the amount of insurance

needed on a person’s life.

Three steps:

1. Estimate the breadwinner’s average annual income

till he/she retires.

2. Determine the remaining number of years till

retirement.

3. Assume a reasonable discount rate (Fixed Deposit

rates can be used)

Mahdzan & Boey 2015

3.1 Human Life Value Method

Example:

Assume that Aishah, age 35, takes home a salary of RM60,000 per

annum (after deducting EPF and income taxes). She plans to retire at 60

years old. Assuming a discount rate of 4% per annum and that income is

received at the end of the period, compute Aishah’s human life value

today.

Mahdzan & Boey 2015

3.1 Human Life Value Method

Using a financial calculator:

Mode: END; PMT=60,000; n=25; i=4%; compute PV.

PV = 937,325

Using a Present Value of Annuities (PVA) Table:

Human Life Value = RM60,000 x 15.62208

= RM937,324.80

Hence, Aishah’s human live value today is RM937,325 and should be

protected by insurance by this amount.

Mahdzan & Boey 2015

3.1 Human Life Value Method

Disadvantages of the Human Life Value method :

It assumes the breadwinner’s earnings are constant throughout

his entire career.

It doesn’t provide for variations in income or expenses

throughout life, or consider for life’s major events (e.g. the birth

of a child, home upgrading home, divorce, etc).

Variations in the assumed discount rate will lead to different

results. Lastly, inflation on future earnings and expenses are not

taken into account.

Mahdzan & Boey 2015

3.0 The amount of life insurance

to own

3.2 Needs Based Approach

Allows for a more comprehensive method of determining

an individual’s life insurance needs based on his or her

unique needs and priorities.

Important family needs could be: regular income needs and

lump sum capital needs

Method:

Capital Liquidation Method

Capital Preservation Method

Mahdzan & Boey 2015

a) Capital Liquidation Method

Creates a capital sum of money for the breadwinner’s dependents to meet

a particular family need for a specific time period (n).

Five steps:

1. Net Worth - Total Assets minus Total Liabilities

2. Capital to generate regular income needs - Present value of

regular income required (PMT) at a specific Interest rate (i) * for a

specific number of years (n)

3. Lump sum capital needs – total sum of liabilities and other needs

to be settled upon the breadwinner’s death

4. Income Producing Assets – sum of liquid assets which can be

invested to produce income.

5. Capital Shortfall required - additional insurance that is required

for the family’s needs: Total Capital Needed from 2) plus Total

Liabilities that need to be settled upon breadwinner’s death from

3) minus Available Income from Net Income-Producing Assets from

4)

Mahdzan & Boey 2015

b) Capital Preservation Method

Creates an amount of capital required to provide for the breadwinner’s

family or beneficiaries for an infinite time period.

Five steps:

1. Net Worth - Total Assets minus Total Liabilities

2. Capital to cater for regular income needs - an indefinite time

period: Total Income requirement (PMT) divide by a specific

Interest rate*

3. Lump sum capital needs – total sum of liabilities and other needs

to be settled upon the breadwinner’s death

4. Income Producing Assets – sum of liquid assets which can be

invested to produce income.

5. Capital Shortfall required - additional insurance that is required

for the family’s needs: Total Capital Needed from 2) plus Total

Liabilities that need to be settled upon breadwinner’s death from

3) minus Available Income from Net Income-Producing Assets from

4)

Mahdzan & Boey 2015

4.0 Basic Exclusions in a life

insurance policy

Exclusion clauses : to limit their liability and to discourage

anti-selection

Do not cover the listed perils and not payable

Types:

Exclusion on Death Benefit

Exclusions on Disability Benefit

Exclusions on Critical Illness Benefit

Mahdzan & Boey 2015

4.0 Basic Exclusions in a life

insurance policy

Exclusion on Death Benefit

Death caused by suicide within the first year from the issue date or

commencement date, whichever is later.

Mahdzan & Boey 2015

4.0 Basic Exclusions in a life

insurance policy

Exclusions on Disability Benefit

Any disability resulting from attempted self destruction or self-inflicted

injuries while sane or insane:

Services in any armed forces or public order restoration

Activities connected to any aerial device or conveyance except as fare-

paying passenger or crew member on a commercial airline on an

established passenger route

Any congenital defect which has manifested or was diagnosed before the

insured attains 17 years of age

Pre-existing disability resulting from a physical or mental condition

Mahdzan & Boey 2015

Exclusions on Critical Illness Benefit

The signs and symptoms of the critical illness are manifested prior to or within 60 days

of the date of the rider begins or last reinstatement date for Cancer, Heart Attack,

Coronary Artery By-Pass Surgery, Other Serious Coronary Artery Disease and

Angioplasty and Other Invasive Treatments for Major Coronary Artery Disease

The critical illness arises from a pre-existing condition which existed prior to the date

of purchase of the rider

Cancer from the following conditions:

All cancers which are histologically classified as pre-malignant, non-invasive,

carcinoma-in-situ, having either borderline malignancy, or having low malignant

potential

All tumours of the prostate, thyroid and urinary bladder histologically classified as

T1N0M0 (TNM classification)

All cancers in the presence of HIV

Any skin cancer other than malignant melanoma

The critical illness or surgery is caused a self-inflicted injury

The critical illness is caused directly or indirectly by AIDS or HIV infection except for HIV

due to blood transfusion

This list is non-exhaustive. Kindly refer to the policy contract for full list of exclusions

under the policy.

Mahdzan & Boey 2015

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Group 4 CIC2007 MONEY AND BANKING-GROUP ASSIGNMENTDocument11 pagesGroup 4 CIC2007 MONEY AND BANKING-GROUP ASSIGNMENTJerrine KohNo ratings yet

- Money and Banking Presentation (Chapter 5-Question10)Document10 pagesMoney and Banking Presentation (Chapter 5-Question10)Jerrine KohNo ratings yet

- CHAPTER 1 - Fundamentals of RiskDocument28 pagesCHAPTER 1 - Fundamentals of RiskJerrine KohNo ratings yet

- Quantifying Risks: Mahdzan & Boey 2015Document28 pagesQuantifying Risks: Mahdzan & Boey 2015Jerrine KohNo ratings yet

- CHAPTER 2-Fundamentals of Risk ManagementDocument22 pagesCHAPTER 2-Fundamentals of Risk ManagementJerrine Koh0% (1)