Professional Documents

Culture Documents

Untitled

Uploaded by

fxn fnd0 ratings0% found this document useful (0 votes)

9 views1 pageA company's share is currently trading at Rs. 240. In 6 months, there is an 80% chance the price will be Rs. 250 and a 20% chance the price will be Rs. 220. There is a European call option on the share with an exercise price of Rs. 230. To calculate the expected value of the call option on maturity, the expected share price, exercise price, potential call value (expected price - exercise price), probability of each potential price, and call option value (potential call value x probability) are listed in a table. The expected value is the sum of the call option values, which is Rs. 16.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA company's share is currently trading at Rs. 240. In 6 months, there is an 80% chance the price will be Rs. 250 and a 20% chance the price will be Rs. 220. There is a European call option on the share with an exercise price of Rs. 230. To calculate the expected value of the call option on maturity, the expected share price, exercise price, potential call value (expected price - exercise price), probability of each potential price, and call option value (potential call value x probability) are listed in a table. The expected value is the sum of the call option values, which is Rs. 16.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageUntitled

Uploaded by

fxn fndA company's share is currently trading at Rs. 240. In 6 months, there is an 80% chance the price will be Rs. 250 and a 20% chance the price will be Rs. 220. There is a European call option on the share with an exercise price of Rs. 230. To calculate the expected value of the call option on maturity, the expected share price, exercise price, potential call value (expected price - exercise price), probability of each potential price, and call option value (potential call value x probability) are listed in a table. The expected value is the sum of the call option values, which is Rs. 16.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

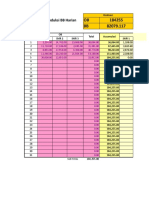

Example: A company’s share is currently trading at `240.

After 6 months, the price will be either `250 with probability

of 0.80 or `220 with probability of 0.20. A European call option exists with an exercise price of `230. What will be the

expected value of call option on maturity date?

Solution:

Expected Share Price (`) Exercise Call Value Probability Call Option

(1) Price (`) (`) Value (`)

(2) (3) = (1) − (2) (4) (5) = (3) × (4)

250 230 20 0.80 16

220 230 0 0.20 0

16

You might also like

- Red Tomato Tools SolutionDocument7 pagesRed Tomato Tools SolutionSumit GuptaNo ratings yet

- Aggregate Demand BADocument10 pagesAggregate Demand BAshaktiveer singhNo ratings yet

- Calculo Custos Por EmpregadoDocument3 pagesCalculo Custos Por EmpregadoFabio.soares RhNo ratings yet

- Paak OutDocument2 pagesPaak OutVisobraNo ratings yet

- Ch07 Red Tomato ToolsDocument8 pagesCh07 Red Tomato ToolsReisya NurriantiNo ratings yet

- Report Weekly MedanDocument17 pagesReport Weekly Medanganiawizasiregar25No ratings yet

- Kusen T 75 MetDocument2 pagesKusen T 75 MetUsodo ArchNo ratings yet

- 2da Investigacion de OperacionesDocument5 pages2da Investigacion de OperacionesEmilio PadronNo ratings yet

- UltraDish TP 400 Datasheet 3D BeamDocument3 pagesUltraDish TP 400 Datasheet 3D BeamAlejandro ChirinosNo ratings yet

- Viscosity Converting ChartDocument3 pagesViscosity Converting ChartMaria Victoria Morales GalindezNo ratings yet

- Rekapitulasi Produksi BB HarianDocument8 pagesRekapitulasi Produksi BB HarianAndri Nurul RamdanNo ratings yet

- Payal Pharma SolutionDocument1 pagePayal Pharma SolutionAkhil NarangNo ratings yet

- Stock Management With Sell PurchaseDocument5 pagesStock Management With Sell PurchaseRaufur RahmanNo ratings yet

- Template NilaiDocument3 pagesTemplate NilaiFikri Farikhin RebornNo ratings yet

- Plan de Trading Acciones Plantilla (v.2)Document32 pagesPlan de Trading Acciones Plantilla (v.2)JUAN LOPEZNo ratings yet

- ABM 221-Examples (ALL UNITS)Document10 pagesABM 221-Examples (ALL UNITS)Bonface NsapatoNo ratings yet

- Ra 2023 08Document1 pageRa 2023 08IcemellowNo ratings yet

- Procurement ManagementDocument10 pagesProcurement ManagementRishabh AgarwalNo ratings yet

- National Highways Authority of India: Oven Calibration ReportDocument2 pagesNational Highways Authority of India: Oven Calibration ReportDeepakNo ratings yet

- Chapter 8 - 9 - TTT ExamplesDocument7 pagesChapter 8 - 9 - TTT Examplesaaha10No ratings yet

- Chapter 8 - 9 - ExamplesDocument7 pagesChapter 8 - 9 - Examplesaaha10No ratings yet

- IPAQ TOTALDocument76 pagesIPAQ TOTALnorayusNo ratings yet

- Ipaq TotalDocument76 pagesIpaq TotalnorayusNo ratings yet

- Fpi Raw DataDocument44 pagesFpi Raw DataMeditate Your LifeNo ratings yet

- Chapter 9 Mintendo Game GirlDocument5 pagesChapter 9 Mintendo Game GirlANANG DWI CAHYADINo ratings yet

- PDF Ajustes Ejercicio No 30 - CompressDocument1 pagePDF Ajustes Ejercicio No 30 - CompressJefry VenturaNo ratings yet

- Workbook and Lab ManualDocument62 pagesWorkbook and Lab ManualMadavan Raj100% (1)

- Operation Hourly Output 202209280824Document34 pagesOperation Hourly Output 202209280824Novia Indriani PutriNo ratings yet

- Kandang 1Document134 pagesKandang 1LuqmanNo ratings yet

- Ultradish™ TP 27: Product DatasheetDocument2 pagesUltradish™ TP 27: Product DatasheetAbdallaNo ratings yet

- UG pipeline-REV01Document7 pagesUG pipeline-REV01Yousef SalahNo ratings yet

- Aggregate Planning in SCDocument13 pagesAggregate Planning in SCmartain maxNo ratings yet

- Costo Hora MaquinasDocument3 pagesCosto Hora MaquinasJulio César Jauregui TolentinoNo ratings yet

- Windowlux - Case SolutionDocument2 pagesWindowlux - Case SolutionanisaNo ratings yet

- Energy Revenue Summary - 01-08-2022Document3 pagesEnergy Revenue Summary - 01-08-2022prabhakaranNo ratings yet

- Lecture # 40: Creation of A File On NTFSDocument6 pagesLecture # 40: Creation of A File On NTFSapi-3812413No ratings yet

- Comparing Temperatures - Thermometer: A B A B A BDocument2 pagesComparing Temperatures - Thermometer: A B A B A BIdriis AslamNo ratings yet

- 13 Sept Comparison Thermometer1 4Document2 pages13 Sept Comparison Thermometer1 4Idriis AslamNo ratings yet

- Comparing Temperatures - Thermometer: A B A B A BDocument2 pagesComparing Temperatures - Thermometer: A B A B A BIdriis AslamNo ratings yet

- Single Period Model - Full Marginal Cost Analysis Approach: Number PurchasedDocument18 pagesSingle Period Model - Full Marginal Cost Analysis Approach: Number PurchasedHernan Pumasupa SolanoNo ratings yet

- JSW Steel Intraday Nov 2020Document4 pagesJSW Steel Intraday Nov 2020khairnarsayali257No ratings yet

- Cash Flow 1Document1 pageCash Flow 1Michelle QuadrosNo ratings yet

- MA 205 - 424-Intro - MatlabDocument19 pagesMA 205 - 424-Intro - MatlabSAKSHAM SETIANo ratings yet

- Filling Grade of Tube MillsDocument4 pagesFilling Grade of Tube MillsIrfan AhmedNo ratings yet

- 23-00 Feb - Subnetting ResueltoDocument9 pages23-00 Feb - Subnetting ResueltoRENSO EVELIO RAMIREZ GARCIANo ratings yet

- Relevant Costs For DecisionsDocument9 pagesRelevant Costs For DecisionskhengmaiNo ratings yet

- Ic 12 2018 enDocument60 pagesIc 12 2018 enIonescu RaduNo ratings yet

- Bar Bending Schedule BBSDocument8 pagesBar Bending Schedule BBSsandip santpalNo ratings yet

- Kertas Kerja PPH 21 TER 2024 PahampajakDocument194 pagesKertas Kerja PPH 21 TER 2024 PahampajakpurdayaniNo ratings yet

- BD20022 OprDocument12 pagesBD20022 OprDeepNo ratings yet

- O Fortuna by Carl Orff PDFDocument7 pagesO Fortuna by Carl Orff PDFIktmgdtksthwNo ratings yet

- 001 Dav RuanasDocument2 pages001 Dav RuanasIngenieria ComarNo ratings yet

- Brief For Motorcycle (Quota)Document8 pagesBrief For Motorcycle (Quota)Minh Tấn NguyễnNo ratings yet

- Bitcoin (BTC) Price Prediction 2022 - 2030 According To The Crypto ExpertsDocument1 pageBitcoin (BTC) Price Prediction 2022 - 2030 According To The Crypto Expertssanyshah0No ratings yet

- ITT-116 Subnetting Worksheet: Use The Following Tables As References For The Remainder of The DocumentDocument7 pagesITT-116 Subnetting Worksheet: Use The Following Tables As References For The Remainder of The DocumentBilguun lusNo ratings yet

- Quality Loss FunctionDocument9 pagesQuality Loss FunctionUmesh AroraNo ratings yet

- Accounting Equation: Under The Guidance ofDocument7 pagesAccounting Equation: Under The Guidance ofAcademic BunnyNo ratings yet

- Combinación 3-1/16" 10,000 Psi X Conexión de Golpe 4" Fig. 1502Document2 pagesCombinación 3-1/16" 10,000 Psi X Conexión de Golpe 4" Fig. 1502Akaalj InspeccionNo ratings yet

- Plan Famatel BG 2020Document46 pagesPlan Famatel BG 2020Ivan TimarevNo ratings yet

- Organizational Plantilla As of April 2006: Date Date of Date SalaryDocument2 pagesOrganizational Plantilla As of April 2006: Date Date of Date SalaryJoe WickNo ratings yet

- Future ContractDocument2 pagesFuture Contractfxn fndNo ratings yet

- Black and ScholesDocument1 pageBlack and Scholesfxn fndNo ratings yet

- BinomialDocument1 pageBinomialfxn fndNo ratings yet

- StraddleDocument1 pageStraddlefxn fndNo ratings yet

- Futures HedgingDocument1 pageFutures Hedgingfxn fndNo ratings yet

- Butterfly SpreadDocument1 pageButterfly Spreadfxn fndNo ratings yet

- Transaction and Economic Risk ExampleDocument1 pageTransaction and Economic Risk Examplefxn fndNo ratings yet

- Replacement Decision ExampleDocument1 pageReplacement Decision Examplefxn fndNo ratings yet

- Average Rate of Return ExampleDocument1 pageAverage Rate of Return Examplefxn fndNo ratings yet

- Facility LocationDocument1 pageFacility Locationfxn fndNo ratings yet

- Foreign Exchange RiskDocument2 pagesForeign Exchange Riskfxn fndNo ratings yet

- Working CapitalDocument3 pagesWorking Capitalfxn fndNo ratings yet

- MQP For MBA I Semester Students of SPPUDocument2 pagesMQP For MBA I Semester Students of SPPUfxn fndNo ratings yet