Professional Documents

Culture Documents

FAR.2936 - Non-Financial Liabilities Summary (DIY) .

Uploaded by

Edmark LuspeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAR.2936 - Non-Financial Liabilities Summary (DIY) .

Uploaded by

Edmark LuspeCopyright:

Available Formats

Since 1977

FAR OCAMPO/SOLIMAN/OCAMPO

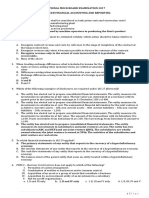

FAR.2936 – Non-financial Liabilities Summary (DIY) OCTOBER 2020

1. Which of the following is not a characteristic of a c. There is always "accounting symmetry" for

liability? recording and reporting leases between the lessor

a. It represents a probable, future sacrifice of and lessee.

economic benefits. d. A finance lease does not transfer substantially all

b. It arises from present obligations to other entities. of the risks and rewards of ownership from the

c. It results from past transactions or events. lessor to the lessee, whereas an operating lease

d. It must be payable in cash. does.

2. The most common type of liability is: 6. Which statement is correct?

a. One that comes into existence due to a loss a. The distinction between a direct-financing lease

contingency. and a sales-type lease is the presence or absence

b. One that must be estimated. of a transfer of title.

c. One that comes into existence due to a gain b. Lessors classify and account for all leases that

contingency. don’t qualify as sales-type leases as operating

d. One to be paid in cash and for which the amount leases.

and timing are known. c. Only the lessee makes the distinction of classifying

leases as operating or finance leases.

3. An entity made an unusually high profit for the current d. Lessors classify and account for all leases that do

year because it negotiated a significantly lower cost not qualify as direct-financing or sales-type leases

price for its main raw material at a time when the as operating leases.

selling price of its products was rising sharply.

Management does not want to make public the 7. Inrelation to leases, initial direct costs exclude

unusually high profit because they believe that a. Commissions

knowledge of the entity’s profitability would result in b. Legal fees

their customers seeking to negotiate lower selling c. Internal costs that are incremental and directly

prices when purchasing goods from the entity. attributable to negotiating and arranging a lease

Consequently, management would like to decrease d. General overheads such as those incurred by a

profit for the year by recognizing a provision for sales and marketing team

unforeseen possible expenses.

a. Because creation of the provision is prudent, it is 8. Which is the correct accounting treatment for a finance

acceptable accounting. lease in the accounts of a lessor?

b. Because creation of the provision is common a. Treat as a noncurrent asset equal to net

practice in the jurisdiction in which the entity investment in lease. Recognize all finance

operates, it is acceptable accounting. payments in statement of comprehensive income.

c. Because they do not satisfy the definition of a b. Treat as a receivable equal to gross amount

liability, the entity cannot create a provision for receivable on lease. Recognize finance payments in

unforeseen possible expenses. cash and by reducing debtor.

d. Provided the reason for creating the provision is c. Treat as a receivable equal to net investment in

explained in the notes, it is acceptable accounting. the lease. Recognize finance payment by reducing

debtor and taking interest to statement of

4. Which of the following is a situation that would comprehensive income.

normally lead to a lease being classified as a finance d. Treat as a receivable equal to net investment in

lease? the lease. Recognize finance payments in cash and

a. The lease assets are of a specialized nature such by reduction of debtor.

that only the lessee can use them without major

modifications being made. 9. Lessors should show assets that are out on operating

b. If the lessee is entitled to cancel the lease, the leases and income from there as follows:

lessor's losses associated with the cancellation are a. The asset should be shown in the statement of

borne by the lessee. financial position according to its nature with the

c. Gains or losses from fluctuations in the fair value lease income going to the statement of

of the residual fall to the lessee (for example, by comprehensive income.

means of a rebate of lease payments). b. The asset should be kept off the statement of

d. The lessee has the ability to continue to lease for a financial position and the lease income should go

secondary period at a rent that is substantially to reserves.

lower than market rent. c. The asset should be kept off the statement of

financial position and the lease income should go

5. Which of the following statements is true? to the statement of comprehensive income.

a. In a finance lease, the lessee, but not the lessor, d. The asset should be shown in the statement of

should use present value computations in financial position according to its nature and the

recording and reporting the lease results. lease income should go to reserves.

b. Accounting symmetry is said to exist in accounting

for leases when the lessor and lessee record the

same amounts but the accounts and the

debits/credits are reciprocal.

Page 1 of 5 www.facebook.com/excel.prtc FAR.2936

EXCEL PROFESSIONAL SERVICES, INC.

10. Which statement is incorrect regarding measurement d. The change during the period in the net defined

of lease liabilities in accordance with PFRS 16? benefit liability (asset) that arises from the

a. A company measures lease liabilities at the present passage of time.

value of future lease payments.

b. Lease liabilities include only economically 17. Which of these events will cause a change in a defined

unavoidable payments. benefit obligation?

c. Lease liabilities include fixed payments (including I. Changes in mortality rates or the proportion of

inflation-linked payments) and only those optional employees taking early retirement.

payments that the company is reasonably certain II. Changes in the estimated salaries or benefits that

to make. will occur in the future.

d. Lease liabilities include variable lease payments III. Changes in the estimate employee turnover.

linked to future use or sales. IV. Changes on the discounted rate used to calculate

defined benefit liabilities and the value of assets.

11. Lease liabilities do not include a. I, II, III and IV c. I, II and IV

a. Fixed payments b. II and III d. II, III and IV

b. Inflation-linked payments

c. Optional payments that the company is reasonably 18. Which of these elements are taken into account when

certain to make determining the discount rate to be used?

d. Variable lease payments linked to future use or a. Markets yields at the balance sheets dates on high-

sales quality corporate bonds

b. Investment or actuarial risk

12. Which of the following is most likely an effect of PFRS c. Specific risk associated with the entity's business

16 on lessor’s financial statements? d. Risk that future experiences may differ from

a. Increase in finance lease receivables. actuarial assumptions

b. Increase in finance income

c. Increase in asset turnover. 19. In accordance with PAS 19, the discount rate used to

d. None of the above. determine defined benefit cost reflects

a. Time value of money

13. An entity contributes to an industrial pension plan that b. Actuarial risk

provides a pension arrangement for its employees. A c. Investment risk.

large number of other employers also contribute to the d. All of the above

pension plan, and the entity makes contributions in

respect of each employee. These contributions are kept 20. The return on plan assets is interest, dividends and

separate from corporate assets and are used together other income derived from the plan assets, together

with any investment income to purchase annuities for with realized and unrealized gains or losses on the plan

retired employees. The only obligation of the entity is assets, less:

to pay the annual contributions. This pension scheme a. Any costs of managing plan assets.

is a b. Any tax payable by the plan itself, other than tax

a. Multiemployer plan and a defined contribution included in the actuarial assumptions used to

scheme measure the present value of the defined benefit

b. Multiemployer plan and a defined benefit scheme obligation.

c. Defined contribution plan only c. Both a and b.

d. Defined benefit plan only d. Neither a nor b.

14. Visor Co. maintains a defined benefit pension plan for 21. In accordance with the revised PAS 19, which of the

its employees. The service cost component of Visor’s following can be deferred?

net periodic pension cost is measured using the a. Actuarial gains and losses

a. Unfunded accumulated benefit obligation. b. Past service cost if not yet vested

b. Unfunded vested benefit obligation. c. Both a and b

c. Projected benefit obligation. d. Neither a nor b

d. Expected return on plan assets.

22. In determining the present value of the prospective

15. Service cost excludes benefits (often referred to as the defined benefit

a. Current service cost obligation), the following are considered by the

b. Past service cost actuary:

c. Gain or loss on settlement a. Retirement and mortality rate.

d. Actuarial gains and losses b. Interest rates.

c. Benefit provisions of the plan.

16. Current service cost is d. All of these factors.

a. The increase in the present value of the defined

benefit obligation resulting from employee service 23. An entity has decided to improve its defined benefit

in the current period. pension scheme. The benefit payable will be

b. The change in the present value of the defined determined by reference to 60 years service rather

benefit obligation for employee service in prior than 80 years service. As a result, the defined benefit

periods. pension liability will increase by P10 million. The

c. The difference between the present value of the average remaining service lives of the employees is 10

defined benefit obligation being settled, as years. How should the increase in the pension liability

determined on the date of settlement and the by P10 million be treated in the financial statements?

settlement price, including any plan assets a. The past service cost should be charged against

transferred and any payments made directly by the retained profit

entity in connection with the settlement. b. The past service cost should be charged against

profit or loss for the year

Page 2 of 5 www.facebook.com/excel.prtc FAR.2936

EXCEL PROFESSIONAL SERVICES, INC.

c. The past service cost should be spread over the 30. Under PFRS2 Share-based payment, in which ONE of the

remaining working lives of the employees following will a cash-settled share-based payment give

d. The past service cost should not be recognized rise to an increase?

a. A current asset c. Equity

24. An entity changes its defined benefit pension plan to a b. A non-current asset d. A liability

defined contribution plan. The entity agrees with the

employees to pay them P9 million in total on the 31. In accordance with PFRS2 Share-based payment, how,

introduction of a defined contribution plan. The if at all, should an entity recognize the change in the fair

employees forfeit any pension entitlement for the value of the liability in respect of a cash-settled share-

defined benefit plan. The pension liability recognized in based payment transaction?

the balance sheet was P10 million. How should this a. Should not recognize in the financial statements but

curtailment be accounted? disclose in the notes thereto

a. A settlement gain of P1 million should be shown b. Should recognize in the statement of changes in

b. The pension liability should be credited to reserves equity

and a cash payment of P9 million should be shown c. Should recognize in other comprehensive income

in expense in the income statement d. Should recognize in profit or loss

c. The cash payment should go to reserves and the

pension liability should be shown as a credit to the 32. In relation to provisions, for a present obligation to

income statement exist, which one of the following factors must be

d. A credit to reserves should be made of P1 million present?

a. The obligation must be capable of being reliably

25. When an employee has rendered service to an entity measured.

during an accounting period, the entity shall recognize b. The entity must have a legal obligation that can be

the undiscounted amount of short-term employee enforced by law.

benefits expected to be paid in exchange for that c. The entity must have no realistic alternative to

service: settling the obligation.

a. As a liability, after deducting any amount already d. It must be more likely than less likely that there

paid. will be a future flow of economic benefits.

b. As an expense, unless another PFRS requires or

permits the inclusion of the benefits in the cost of 33. In accordance with the requirements of PAS 37

an asset. Provisions, Contingent Liabilities and Contingent

c. Both a and b Assets, where measurement uncertainty exists, which

d. Neither a nor b one of the following methods is not an appropriate

valuation for a provision based on accounting

26. Which one of the following factors will be reflected in standards?

the amount of a short-term employee benefit a. The mid-point of a range of equally likely outcomes

obligation measured in accordance with PAS 19 of expenditure.

Employee Benefits? b. No provision should be recognized where

a. The risk-free interest rate measurement uncertainty exists.

b. Salary rates current at reporting date c. The minimum amount expected to represent a best

c. Salary rates that reflect the future sacrifice estimate, where the other option is omission.

d. Interest rates on high-quality corporate bonds d. The most likely amount expected to represent a

best estimate, where there is a single obligation.

27. On June 1, 20X4, an entity offered its employees share

options subject to the award being ratified in a general 34. Which statement is incorrect regarding distinction

meeting of the shareholders. The award was approved between provisions and accruals?

by a meeting on September 5, 20X4. The entity's year- a. Provisions can be distinguished from accruals

end is June 30. The employees were to receive the because there is uncertainty about the timing or

share options on June 30, 20X6. At which date should amount of the future expenditure required in

the fair value of the share options be valued for the settlement.

purposes of PFRS 2? b. Accruals are liabilities to pay for goods or services

a. June 1, 20X4. c. September 5, 20X4. that have been received or supplied but have not

b. June 30,20X4. d. June 30, 20X6. been paid, invoiced or formally agreed with the

supplier, including amounts due to employees.

28. The entity has issued a range of share options to c. Although it is sometimes necessary to estimate the

employees. What type of share-based payment does amount or timing of accruals, the uncertainty is

this represent? generally much less than for provisions.

a. Asset settled share-based payment. d. Accruals and provisions are often reported as part

b. Cash settled share-based payment. of trade and other payables.

c. Equity settled share-based payment.

d. Liability settled share-based payment. 35. A contingent liability

a. Definitely exists as a liability but its amount and

29. In accounting for share-based compensation under due date are indeterminable.

PFRS 2, what interest rate is used to discount both the b. Is accrued even though not reasonably estimated.

exercise price of the option and the future dividend c. Is the result of a loss contingency.

stream? d. Is not recognized in the financial statements.

a. The risk-free interest rate.

b. The firm’s known incremental borrowing rate. 36. Which of the following is the proper way to report a

c. Any rate that firms can justify as being reasonable. probable contingent asset?

d. The current market rate that firms in that a. As an accrued amount.

particular industry use to discount cash flows. b. As deferred revenue.

Page 3 of 5 www.facebook.com/excel.prtc FAR.2936

EXCEL PROFESSIONAL SERVICES, INC.

c. As an account receivable with additional disclosure 42. A company is legally obligated for the costs associated

explaining the nature of the contingency. with the retirement of a long-lived asset

d. As a disclosure only. a. Only when it hires another party to perform the

retirement activities.

37. Ortiz Corporation, a manufacturer of household paints, b. Only if it performs the activities with its own

is preparing annual financial statements at December workforce and equipment.

31. Because of a recently proven health hazard in one c. Whether it hires another party to perform the

of its paints, the government has clearly indicated its retirement activities or performs the activities

intention of having Ortiz recall all cans of this paint itself.

sold in the last six months. The management of Ortiz d. When it is probable the asset will be retired.

estimates that this recall would cost P800,000. What

accounting recognition, if any, should be accorded this 43. To record an environmental liability, the cost

situation? associated with the liability is:

a. No recognition a. Included in the carrying amount of the related

b. Note disclosure only long-lived asset

c. Operating expense of P800,000 and liability of b. Expressed

P800,000 c. Included in a separate account

d. Appropriation of retained earnings of P800,000 d. None of these answer choices are correct

38. Information available prior to the issuance of the 44. Which of the following is a contingency that should be

financial statements indicates that it is probable that, at accrued?

the date of the financial statements, a company has a a. The company is being sued and a loss is

present obligation related to product warranties. The reasonably possible and reasonably estimable.

amount of the expense involved can be reasonably b. The company deducts life insurance premiums

estimated. Based on the above facts, the estimated from employees' paychecks.

warranty expense should be c. The company offers a two-year warranty and the

a. Accrued. expenses can be reasonably estimated.

b. Disclosed but not accrued. d. It is probable that the company will receive

c. Neither accrued nor disclosed. P1,000,000 in settlement of a lawsuit.

d. Classified as an appropriation of retained earnings.

45. All of the following are examples of provision, EXCEPT

39. Which of the following is not considered when a. Advanced receipt of subscription

evaluating whether or not to record a liability for b. Environmental contamination

pending litigation? c. Warranty and guarantee

a. Time period in which the underlying cause of action d. Pending court case

occurred.

b. The type of litigation involved. 46. A restructuring is a programme that is planned and

c. The probability of an unfavorable outcome. controlled by management, and materially changes:

d. The ability to make a reasonable estimate of the a. The scope of a business undertaken by an entity

amount of the loss. b. The manner in which that business is conducted

c. Either a or b

40. A competitor has sued an entity for unauthorized use d. Neither a nor b

of its patented technology. The amount that the entity

may be required to pay to the competitor if the 47. The board of directors of ABC Inc. decided on

competitor succeeds in the lawsuit is determinable with December 15, to wind up international operations in

reliability, and according to the legal counsel it is less the Middle East and move them to China. The decision

than probable (but more than remote) that an outflow was based on a detailed formal plan of restructuring.

of the resources would be needed to meet the This decision was conveyed to all workers and

obligation. The entity that was sued should at year- management personnel at the headquarters in Manila.

ended: How should ABC Inc. treat this restructuring in its

a. Recognize a provision for this possible obligation. financial statements for the year-end December 31?

b. Make a disclosure of the possible obligation in a. Because ABC Inc. has not announced the

footnotes to the financial statements. restructuring to those affected by the decision and

c. Make no provision or disclosure and wait until the thus has not raised an expectation that ABC Inc.

lawsuit is finally decided and then expense the will actually carry out the restructuring (and as no

amount paid on settlement, if any. constructive obligation has arisen) only disclose

d. Set aside, as an appropriation, a contingency the restructuring decision and the cost of

reserve, an amount based on the best estimate of restructuring in footnotes to the financial

the possible liability. statements.

b. Recognize a provision for restructuring since the

41. What condition is necessary to recognize an board of directors has approved it and it has been

environmental liability? announced in the headquarters of ABC Inc. in

a. Company has an existing legal obligation and can Manila.

reasonably estimate the amount of the liability c. Mention the decision to restructure and the cost

b. Company can reasonably estimate the amount of involved in the chairman's statement in the annual

the liability report since it is a decision of the board of

c. Company has an existing legal obligation directors.

d. Obligation event has occurred d. Do nothing in this year's financial statements.

Page 4 of 5 www.facebook.com/excel.prtc FAR.2936

EXCEL PROFESSIONAL SERVICES, INC.

48. The rationale for inter-period income tax allocation is 52. Under PAS 12, deferred tax assets and liabilities are

to measured at the tax rates that:

a. Recognize a tax asset or liability for the tax a. Are expected to apply when the asset is recovered

consequences of temporary differences that exist or the liability is settled.

at the balance sheet date. b. Applied at the beginning of the reporting period.

b. Recognize a distribution of earnings to the taxing c. At the end of the reporting period.

agency. d. At the rates that prevail at the reporting date.

c. Reconcile the tax consequences of permanent and

temporary differences appearing on the current 53. Which statement is correct regarding recovery of

year's financial statements. underlying asset in PAS 12?

d. Adjust income tax expense on the income a. PAS 12 requires an entity to measure deferred tax

statement to be in agreement with income taxes relating to an asset on a sale basis.

payable on the balance sheet. b. Deferred tax on investment property measured at

fair value is always required to be determined

49. Which of the following examples would not give rise to using the presumption that the carrying amount of

a temporary difference? the underlying asset will be recovered through sale

a. Revenue from installment sales recognized under c. Deferred tax on non-depreciable assets measured

the installment method for taxation. using the revaluation model in PAS 16 will always

b. Straight-line depreciation used for accounting be determined on a sale basis.

purposes while an accelerated method is used for d. All of the above.

tax purposes.

c. Warranty costs recognized for accounting purposes 54. At the December 31, 20X1 statement of financial

but not recognized for tax purposes until paid. position date, Unruh Corporation reports an accrued

d. Recognition of goodwill in a business combination. receivable for financial reporting purposes but not for

tax purposes. When this asset is recovered in 20X2, a

50. Which of the following differences would result in future taxable amount will occur and

future taxable amounts? a. Pretax financial income will exceed taxable income

a. Expenses or losses that are tax deductible after in 20X2.

they are recognized in financial income. b. Total income tax expense for 20X2 will exceed

b. Revenues or gains that are taxable before they are current tax expense for 20X2.

recognized in financial income. c. Unruh will record an increase in a deferred tax

c. Revenues or gains that are recognized in financial asset in 20X2.

income but are never included in taxable income. d. Unruh will record a decrease in a deferred tax

d. Expenses or losses that are tax deductible before liability in 20X2.

they are recognized in financial income.

55. The tax expense related to profit or loss of the period

51. The deferred tax expense is the is required to be presented:

a. Increase in balance of deferred tax asset minus the a. On the face of the statement of financial position

increase in balance of deferred tax liability. b. On the face of the statement of profit or loss

b. Increase in balance of deferred tax liability minus c. In the statement of cash flows

the increase in balance of deferred tax asset. d. In the statement of changes in equity

c. Increase in balance of deferred tax asset plus the

increase in balance of deferred tax liability.

d. Decrease in balance of deferred tax asset minus

the increase in balance of deferred tax liability. J - end of FAR.2936 - J

SUGGESTED ANSWERS

1. D 11. D 21. D 31. D 41. A 51. B

2. D 12. D 22. D 32. C 42. C 52. A

3. C 13. A 23. B 33. B 43. A 53. C

4. A 14. C 24. A 34. D 44. C 54. D

5. B 15. D 25. C 35. D 45. A 55. B

6. D 16. A 26. C 36. D 46. C

7. D 17. A 27. C 37. C 47. A

8. C 18. A 28. C 38. A 48. A

9. A 19. A 29. A 39. B 49. D

10. D 20. C 30. D 40. B 50. D

1.

Page 5 of 5 www.facebook.com/excel.prtc FAR.2936

You might also like

- Non-financial Liabilities SummaryDocument5 pagesNon-financial Liabilities SummaryNah HamzaNo ratings yet

- Discussion Problems: FAR.2831-Leases MAY 2020Document13 pagesDiscussion Problems: FAR.2831-Leases MAY 2020Eira ShaneNo ratings yet

- IFRS 3 Business Combination EssentialsDocument1 pageIFRS 3 Business Combination EssentialsSweet EmmeNo ratings yet

- ACCOUNTING 3B HomeworkDocument11 pagesACCOUNTING 3B HomeworkRheu Reyes75% (4)

- 9 - Liabilities Theory of Accounts 9 - Liabilities Theory of AccountsDocument8 pages9 - Liabilities Theory of Accounts 9 - Liabilities Theory of AccountsandreamrieNo ratings yet

- Group of 5: Key Accounting Rules for LeasesDocument3 pagesGroup of 5: Key Accounting Rules for LeasesGarp BarrocaNo ratings yet

- DYSAS QuestionairesDocument5 pagesDYSAS QuestionairesAngelica Manaois100% (1)

- PFRS 16 Lease Accounting Group of 5 QuestionsDocument3 pagesPFRS 16 Lease Accounting Group of 5 QuestionsRichard Sarra Mantilla88% (8)

- AFAR Answer-KeyDocument8 pagesAFAR Answer-KeyShirliz Jane Benitez100% (1)

- Act 6J03 - Comp2 - 1stsem05-06Document12 pagesAct 6J03 - Comp2 - 1stsem05-06ROMAR A. PIGANo ratings yet

- Which of The Following Is Not An Essential Characteristic of A LiabilityDocument31 pagesWhich of The Following Is Not An Essential Characteristic of A LiabilityJam PotutanNo ratings yet

- 6840 - PAS 37 Provisions Contingent Liabilities and Contingent AssetsDocument6 pages6840 - PAS 37 Provisions Contingent Liabilities and Contingent AssetsAhmad Noainy AntapNo ratings yet

- MSU CBA Final Exam QuestionsDocument10 pagesMSU CBA Final Exam QuestionsBashayer M. Sultan100% (1)

- AFAR Answer KeyDocument9 pagesAFAR Answer KeyKim Fernandez50% (2)

- AFAR Answer KeyDocument9 pagesAFAR Answer KeyFery AnnNo ratings yet

- Financial Accounting and Reporting: Multiple ChoiceDocument54 pagesFinancial Accounting and Reporting: Multiple ChoiceLouiseNo ratings yet

- Review 105 - Day 20 TOADocument7 pagesReview 105 - Day 20 TOABriccioNo ratings yet

- Case 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Document14 pagesCase 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Santiago BuladacoNo ratings yet

- Advanced financial accounting and reporting exam questionsDocument9 pagesAdvanced financial accounting and reporting exam questionsnavie VNo ratings yet

- 29 - Liabilities - TheoryDocument5 pages29 - Liabilities - Theoryjaymark canayaNo ratings yet

- 7208 - PAS 37 - Provisions, Contingent Liabilities and Contingent AssetsDocument6 pages7208 - PAS 37 - Provisions, Contingent Liabilities and Contingent Assetsjsmozol3434qcNo ratings yet

- Nfjpia Nmbe Afar 2017 AnsDocument12 pagesNfjpia Nmbe Afar 2017 AnsSamiee0% (1)

- Nfjpia Mock Board 2016 - AfarDocument8 pagesNfjpia Mock Board 2016 - AfarLeisleiRago50% (2)

- Investments Test BankDocument36 pagesInvestments Test BankKristel Joyce LaurenoNo ratings yet

- Lease PART 1 and 2Document6 pagesLease PART 1 and 2shadowlord468No ratings yet

- FAR EASTERN UNIVERSITY FINANCIAL ACCOUNTING PART 2 QUIZ 5 ON LEASESDocument8 pagesFAR EASTERN UNIVERSITY FINANCIAL ACCOUNTING PART 2 QUIZ 5 ON LEASESZairah Francisco100% (1)

- Select The Best Answer From The Choices Given.: TheoryDocument14 pagesSelect The Best Answer From The Choices Given.: TheoryROMAR A. PIGANo ratings yet

- Income Tax - Reviewer PDFDocument5 pagesIncome Tax - Reviewer PDFalabwalaNo ratings yet

- Act-6j03 Comp2 1stsem05-06Document12 pagesAct-6j03 Comp2 1stsem05-06RegenLudeveseNo ratings yet

- Toa-Current Labilities and ContingenciesDocument19 pagesToa-Current Labilities and ContingenciesZaira PangesfanNo ratings yet

- Multiple Choice: Nama: Isdawati Talib NIM: 36119034 Kelas: 2B-D3Document4 pagesMultiple Choice: Nama: Isdawati Talib NIM: 36119034 Kelas: 2B-D3Den OfficialNo ratings yet

- ACCTGDocument13 pagesACCTGCabardo Maria RegilynNo ratings yet

- BA 114.1 - Module2 - Receivables - Handout PDFDocument4 pagesBA 114.1 - Module2 - Receivables - Handout PDFKurt OrfanelNo ratings yet

- Finals Conceptual Framework and Accounting Standards AnswerkeyDocument7 pagesFinals Conceptual Framework and Accounting Standards AnswerkeyMay Anne MenesesNo ratings yet

- Debt Securities ReviewerDocument30 pagesDebt Securities Reviewerjhie boterNo ratings yet

- Test Bank 3Document1 pageTest Bank 3GabyVionidyaNo ratings yet

- Review 105 - Day 20 TOADocument6 pagesReview 105 - Day 20 TOAChronos ChronosNo ratings yet

- Mock Cpa Board Exams - Rfjpia r-12 - W.ansDocument17 pagesMock Cpa Board Exams - Rfjpia r-12 - W.anssamson jobNo ratings yet

- Quizzer #10 LiabilitiesDocument19 pagesQuizzer #10 LiabilitiesKimmy ShawwyNo ratings yet

- FAR 6.3MC - Provisions, Contingent Liabilities and Contingent AssetsDocument5 pagesFAR 6.3MC - Provisions, Contingent Liabilities and Contingent Assetskateangel ellesoNo ratings yet

- Practice Quiz NonFinlLiabDocument15 pagesPractice Quiz NonFinlLiabIsabelle GuillenaNo ratings yet

- Trade and Other Receivables Discussion ProblemsDocument3 pagesTrade and Other Receivables Discussion ProblemsJim IsmaelNo ratings yet

- Since 1977Document7 pagesSince 1977Lynssej BarbonNo ratings yet

- Ia2 Compre ToaDocument11 pagesIa2 Compre ToaMagic KentNo ratings yet

- 7.30.22 Am Investments-In-Debt-InstrumentsDocument6 pages7.30.22 Am Investments-In-Debt-InstrumentsAether SkywardNo ratings yet

- National Mock Board Examination 2017 Advanced Financial Accounting and ReportingDocument11 pagesNational Mock Board Examination 2017 Advanced Financial Accounting and ReportingTzaddi Ann DeluteNo ratings yet

- Latihan Asdos APDocument8 pagesLatihan Asdos APKevin Fico SaverioNo ratings yet

- 2009 F-5 Class NotesDocument3 pages2009 F-5 Class NotesChris Tian FlorendoNo ratings yet

- Final Exam CDocument12 pagesFinal Exam Cnhorelajne03No ratings yet

- ACCO 20103 Intermediate Accounting 3 MidtermsDocument12 pagesACCO 20103 Intermediate Accounting 3 Midtermsaj dumpNo ratings yet

- LeasingDocument6 pagesLeasingSamar MalikNo ratings yet

- Toa Drill 2 (She, SFP, Sme, Lease, Govt GrantsDocument15 pagesToa Drill 2 (She, SFP, Sme, Lease, Govt GrantsROMAR A. PIGANo ratings yet

- Theory of AccountsDocument8 pagesTheory of AccountsMoira C. VilogNo ratings yet

- Investments: Pas 32 Financial Instruments - PresentationDocument11 pagesInvestments: Pas 32 Financial Instruments - PresentationBromanine100% (1)

- Mock BoardsDocument11 pagesMock BoardsRaenessa FranciscoNo ratings yet

- Review 105 Day 3 Theory of AccountsDocument13 pagesReview 105 Day 3 Theory of Accountschristine anglaNo ratings yet

- Colegio de San Juan de Letran: NAME - SECTIONDocument9 pagesColegio de San Juan de Letran: NAME - SECTIONmaria evangelistaNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- FAR.2956 - Simulated ExaminationDocument9 pagesFAR.2956 - Simulated ExaminationEdmark LuspeNo ratings yet

- Discussion Problems: FAR.2925-Derivatives and Hedge Accounting OCTOBER 2020Document12 pagesDiscussion Problems: FAR.2925-Derivatives and Hedge Accounting OCTOBER 2020Edmark LuspeNo ratings yet

- FAR.2932 - Employee Benefits.Document6 pagesFAR.2932 - Employee Benefits.Edmark LuspeNo ratings yet

- FAR.2829 Bonds Payable PDFDocument3 pagesFAR.2829 Bonds Payable PDFNah HamzaNo ratings yet

- FAR.2948 - Related Party DisclosuresDocument3 pagesFAR.2948 - Related Party DisclosuresEdmark LuspeNo ratings yet

- Discussion Problems: FAR.2949-Financial Reporting and Changing Prices OCTOBER 2020Document4 pagesDiscussion Problems: FAR.2949-Financial Reporting and Changing Prices OCTOBER 2020Edmark LuspeNo ratings yet

- Discussion Problems: FAR.2955-Accounting Process OCTOBER 2020Document3 pagesDiscussion Problems: FAR.2955-Accounting Process OCTOBER 2020Edmark LuspeNo ratings yet

- FAR.2954 - Cash To AccrualDocument3 pagesFAR.2954 - Cash To AccrualEdmark LuspeNo ratings yet

- FAR.2950 - Interim Financial ReportingDocument3 pagesFAR.2950 - Interim Financial ReportingEdmark LuspeNo ratings yet

- FAR.2907 PPE-Revaluation.Document3 pagesFAR.2907 PPE-Revaluation.Edmark LuspeNo ratings yet

- Excel - Professional Services Inc.: Management Firm of Professional Review and Training Center (PRTC)Document7 pagesExcel - Professional Services Inc.: Management Firm of Professional Review and Training Center (PRTC)Phoeza Espinosa VillanuevaNo ratings yet

- FAR.2933 - Share-Based Payment.Document9 pagesFAR.2933 - Share-Based Payment.Edmark LuspeNo ratings yet

- FAR.2910 - Wasting Assets.Document4 pagesFAR.2910 - Wasting Assets.Edmark LuspeNo ratings yet

- Far.2912 - Nca Hfs.Document4 pagesFar.2912 - Nca Hfs.Edmark LuspeNo ratings yet

- FAR.2913 - Government Grants.Document4 pagesFAR.2913 - Government Grants.Edmark LuspeNo ratings yet

- Since 1977Document4 pagesSince 1977Edmark LuspeNo ratings yet

- Understanding Becoming Member of The Society - v3Document25 pagesUnderstanding Becoming Member of The Society - v3szcha cha60% (5)

- Mail MergeDocument1 pageMail MergeEdmark LuspeNo ratings yet

- Physical Education 11: Fitness Enhancement Through Physical ActivitiesDocument15 pagesPhysical Education 11: Fitness Enhancement Through Physical ActivitiesEdmark Luspe82% (11)

- Here are the answers to the questions in "What I Know":1. a2. d 3. cDocument28 pagesHere are the answers to the questions in "What I Know":1. a2. d 3. cMary Ann Isanan91% (92)

- General Chemistry I: Final Exams Review PacketDocument20 pagesGeneral Chemistry I: Final Exams Review PacketEdmark LuspeNo ratings yet

- Types of HazardsDocument29 pagesTypes of HazardsEdmark LuspeNo ratings yet

- Recycled Miniature Car Equipped With CD Tape Wheels and Rubber BandDocument6 pagesRecycled Miniature Car Equipped With CD Tape Wheels and Rubber BandEdmark LuspeNo ratings yet

- Empowerment Technologies Final Summarazation PaperDocument15 pagesEmpowerment Technologies Final Summarazation PaperEdmark LuspeNo ratings yet

- Fina LLLLLDocument14 pagesFina LLLLLEdmark LuspeNo ratings yet

- Revised PAS 19R Employee Benefits Technical SummaryDocument4 pagesRevised PAS 19R Employee Benefits Technical SummaryJBNo ratings yet

- Ratio Analysis GuideDocument43 pagesRatio Analysis Guideraghavendra_20835414No ratings yet

- Corporate Finance FundamentalsDocument171 pagesCorporate Finance FundamentalsMai Nữ Song NgânNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961NirajNo ratings yet

- Consolidated Financial Statements Subsequent to AcquisitionDocument5 pagesConsolidated Financial Statements Subsequent to AcquisitionMixx MineNo ratings yet

- A Research Report On Inventory Valuation and ISA 2 Consistence in Bangladeshi Assembling EnterprisesDocument11 pagesA Research Report On Inventory Valuation and ISA 2 Consistence in Bangladeshi Assembling EnterprisesMD Hafizul Islam HafizNo ratings yet

- Correction of Errors (Aug 31)Document2 pagesCorrection of Errors (Aug 31)Claire BarbaNo ratings yet

- Corporate Governance at Tata Sons Did They Walk The Talk CaseDocument12 pagesCorporate Governance at Tata Sons Did They Walk The Talk CaseAyush KapoorNo ratings yet

- C Ons TR Uc Ted Res Ponse Questions - Section C: S E Cti On 3Document2 pagesC Ons TR Uc Ted Res Ponse Questions - Section C: S E Cti On 3Mazni Hanisah100% (1)

- Accounting Entries Related To MM TransactionsDocument16 pagesAccounting Entries Related To MM TransactionsPallavi Chawla100% (3)

- Each Autumn As A Hobby Pauline Spahr Weaves Cotton PlacematsDocument1 pageEach Autumn As A Hobby Pauline Spahr Weaves Cotton PlacematsAmit PandeyNo ratings yet

- Detailed Analysis of Profit MarginDocument11 pagesDetailed Analysis of Profit MarginJeet SinghNo ratings yet

- MSQ 03 Standard Costs and Variance Analysis BrylDocument13 pagesMSQ 03 Standard Costs and Variance Analysis BrylDavid DavidNo ratings yet

- MCTE Ch07 PDFDocument12 pagesMCTE Ch07 PDFJulie-Ann Salinas20% (10)

- Quiz 1: Introduction To Accounting and BookkeepingDocument37 pagesQuiz 1: Introduction To Accounting and BookkeepingDiana Rose BassigNo ratings yet

- Calculate Taxable Income from various sourcesDocument1 pageCalculate Taxable Income from various sourcesKrizel rochaNo ratings yet

- Translated - OBAŞ 2018 KURUMLAR BYNMDocument11 pagesTranslated - OBAŞ 2018 KURUMLAR BYNMIndranil MandalNo ratings yet

- Lecture Aid Dol and CapmDocument8 pagesLecture Aid Dol and CapmrnNo ratings yet

- ICICI ReceiptDocument1 pageICICI ReceiptShivam GuptaNo ratings yet

- Patisserie Haya (PP) FinalDocument10 pagesPatisserie Haya (PP) FinalWolfManNo ratings yet

- Sample Assumption For Strategic Management PaperDocument2 pagesSample Assumption For Strategic Management PaperDaniela AubreyNo ratings yet

- Relevant Costing Exercises - KingDocument7 pagesRelevant Costing Exercises - KingAlexis KingNo ratings yet

- ParallelAccounting SAP ERPDocument48 pagesParallelAccounting SAP ERPradmilhfNo ratings yet

- Case 44CDocument17 pagesCase 44CChris DiazNo ratings yet

- Far Test Bank PDFDocument128 pagesFar Test Bank PDFCix SorcheNo ratings yet

- Finance For Decision MakingDocument12 pagesFinance For Decision MakingDr.Martin WhiteNo ratings yet

- MMZ ACCOUNTANCY SCHOOL: 15 Mark Questions on Preparing Simple Consolidated Financial StatementsDocument7 pagesMMZ ACCOUNTANCY SCHOOL: 15 Mark Questions on Preparing Simple Consolidated Financial StatementsSerena100% (1)

- Feasibility Study On A Street Food SellerDocument24 pagesFeasibility Study On A Street Food SellerMarie WrightNo ratings yet

- Formulae and Key Data: Number FormulaDocument3 pagesFormulae and Key Data: Number FormulaTrinh LinhNo ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementRich1781No ratings yet