Professional Documents

Culture Documents

State Payment Plan

Uploaded by

Mary Grace Sastrillo MonicaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

State Payment Plan

Uploaded by

Mary Grace Sastrillo MonicaCopyright:

Available Formats

State of [INSERT STATE]

PAYMENT PLAN

Background

This payment plan (the “Payment Plan”) is created and effective as of the [INSERT DATE] (the

“Commencement Date”).

The Payment Plan is between:

a. [INSERT LENDER DETAILS] (the “Lender”)

b. [INSERT BORROWER DETAILS] (the “Borrower”)

Collectively the “Parties”.

By signing this agreement, for the reasons outlined below, and in consideration of the mutual

covenants and obligations outlined hereto, with the intention to be legally bound, the Lender and

Borrower agree to the following terms:

Purpose

1. This Payment Plan is between the Lender and the Borrower.

2. The Borrower is liable to the Lender for the amount of $[INSERT BORROWED AMOUNT] (the

“Debt”).

3. The Borrowers is obtaining this Debt [for [INSERT REASON FOR THE BORROW] OR [for the

reasons outlined within schedule 1.]

4. All terms referred to within this agreement shall be interpreted in accordance with the

original documents and agreements.

5. Unless expressly stated, the original agreement shall remain unamended and in full force

and effect.

[Deferral

6. The Deferral will apply for the duration of [INSERT DATE] until [INSERT DATE] covering the

Debt.]

Payment

7. [Payment shall be paid as a lump sum. The Borrower will make payments in the sum of $

[INSERT AMOUNT] [as outlined within schedule 1]. OR

8. [Payment shall be paid in instalments. The Borrower will pay $[INSERT AMOUNT]

commencing on the [INSERT DATE] until the [INSERT DATE] on the [INSERT DATE] every

[INSERT DURATION].

9. Interest will not accrue on any of the instalments.

Payment Method:

10. The Lender accepts the following payment methods:

a. [Cash]

b. [Bank transfer]

c. [Personal cheque]

d. [Money order]

e. [Credit card and debit cards]

[Paypal]

f. [INSERT OTHER]

11. The Lender shall [deliver payment by hand] OR [mailed to [INSERT ADDRESSS]]

12. [The Lender will be entitled to a discount of $[INSERT AMOUNT] on the condition that

[INSERT CONDITION]. The discount will be applied [once] OR [every payment period] OR

[every other payment period] OR [INSERT OTHER]].

Indemnity

13. The Lender shall release the Borrower of any penalties and fees relating to a claim resulting

from damage of deficiencies that occurred prior to this agreement.

Acceleration

14. The Lender is entitled to damages for late payment.

15. The Borrowers payment is considered to be late if it is made [INSERT DAYS] days after it was

due.

Representations and Warranties

16. Each party warrants that they have the full authority to enter into this agreement and that

doing so will not be an infringement or violation of any other parties’ rights.

No Variation and Waiver

17. No variation of this Agreement shall be effective unless it is in writing and signed by or on

behalf of each party for the time being. A waiver of any right or remedy under this

Agreement or by law is only effective if it is given in writing and is signed by the party

waiving such right or remedy. Any such waiver shall apply only to the circumstances for

which it is given and shall not be deemed a waiver of any subsequent breach or default.

Survival

18. If any provision or part-provision of this agreement is or becomes invalid, illegal or

unenforceable, it shall be deemed modified to the minimum extent necessary to make it

valid, legal and enforceable. If such modification is not possible, the relevant provision or

part-provision shall be deemed deleted. Any modification to or deletion of a provision or

part-provision under this clause 18 shall not affect the validity and enforceability of the rest

of this agreement.

Entire Agreement

19. This Agreement (together with the documents referred to in it) constitutes the entire

Agreement between the parties and supersedes and extinguishes all previous discussions,

correspondence, negotiations, drafts, agreements, promises, assurances, warranties,

representations, arrangements, and understandings between them, whether written or oral,

relating to its subject matter. Each party acknowledges that in entering into this Agreement

(and any documents referred to in it), he does not rely on, and shall have no remedies in

respect of, any statement, representation, assurance or warranty (whether made innocently

or negligently) that is not set out in this Agreement or those documents. Nothing in this

clause 19 shall limit or exclude any liability for fraud.

Assignment and Other Dealings

20. No party shall assign, transfer, mortgage, charge, subcontract, declare a trust over a deal in

any other manner with any or all of his rights and obligations under this Agreement (or any

other document referred to in it) without the prior written consent of the other party (such

consent not to be unreasonably withheld or delayed). Each party confirms that he is acting

on his own behalf and not for the benefit of any other person.

Third Parties

21. Except as expressly provided elsewhere in this Agreement, no one other than a party to this

Agreement, its successors and permitted assignees, shall have any right to enforce any of its

terms.

Joint and Several Liability

22. The Indemnitors obligations are joint and severally liable.

Governing Law and Jurisdiction

23. This agreement and any dispute or claim arising out of or in connection with it or its subject

matter or formation (including non-contractual disputes or claims) shall be governed by and

construed in accordance with the law of [INSERT STATE]. Each party irrevocably agrees that

the courts of [INSERT STATE] have exclusive jurisdiction to settle any dispute or claim that

arises out of or in connection with this agreement or its subject matter or formation

(including non-contractual disputes or claims).

Disputes

24. If a dispute arises under or in connection with this agreement (“Dispute”), including any

Dispute arising out of any amount due to a party, then before bringing any legal proceedings

or commencing any other alternative dispute resolution procedure in connection with such

Dispute, a party must first give written notice (“Dispute Notice”) of the Dispute to the other

party describing the Dispute and requesting that it is resolved under the dispute resolution

procedure described in this clause 24. Disputes arising under this agreement shall be

resolved by: (Insert those that apply)

a. [Bringing proceedings in the courts of [INSERT STATE].]

b. [Arbitration in accordance with the American Arbitration Association.]

c. [Mediation. If the parties fail to come to an agreement by mediation, then it shall be

resolved through arbitration.]

25. If a dispute arises resulting in legal action, the unsuccessful party shall indemnify the

successful party for the legal fees that have incurred as a result.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Commencement Date.

Borrower Name Borrower Signature

Lender Name Lender Signature

You might also like

- Payment PlanDocument4 pagesPayment PlanJasperNo ratings yet

- Debt Assignment and Assumption With ReleaseDocument2 pagesDebt Assignment and Assumption With ReleaseJOSE FRANCIANo ratings yet

- Small Business Loan DetailsDocument4 pagesSmall Business Loan DetailsJean Paul VillanNo ratings yet

- General Release of Liability FormDocument3 pagesGeneral Release of Liability FormJosh “OMJ” SanPascualNo ratings yet

- Loan Assignment Agreement: Page 1 of 2Document2 pagesLoan Assignment Agreement: Page 1 of 2Panki1No ratings yet

- Law Insider Loan-Assignment-Agreement Filed 05-10-2021 ContractDocument3 pagesLaw Insider Loan-Assignment-Agreement Filed 05-10-2021 ContractPanki1No ratings yet

- Loan AgreementDocument5 pagesLoan AgreementUmang BansalNo ratings yet

- Loan Agreement TemplateDocument4 pagesLoan Agreement TemplateElisa DahotoyNo ratings yet

- Settlement Agreement TemplateDocument3 pagesSettlement Agreement TemplateGeramer Vere DuratoNo ratings yet

- Loan Agreement TemplateDocument4 pagesLoan Agreement TemplateMj Ong Pierson GarboNo ratings yet

- Settlement AgreementDocument3 pagesSettlement AgreementBetsy Maria ZalsosNo ratings yet

- Mortgage DeedDocument6 pagesMortgage Deedleomagbanua916No ratings yet

- Payment Installment AgreementDocument5 pagesPayment Installment AgreementRia KudoNo ratings yet

- Docs 5Document5 pagesDocs 5Henry Ihedughinuka100% (1)

- Bloche Settlementagreementandrelease Ausexample 2 503 1929Document8 pagesBloche Settlementagreementandrelease Ausexample 2 503 1929ghilphilNo ratings yet

- Jay IndemnityDocument4 pagesJay IndemnityS ArunNo ratings yet

- Template Settlement Agreement 2018Document4 pagesTemplate Settlement Agreement 2018MeeraTharaMaayaNo ratings yet

- aarush ji assignment agreementDocument5 pagesaarush ji assignment agreementAdv Tarun PantNo ratings yet

- Payment Agreement TemplateDocument4 pagesPayment Agreement TemplateojasNo ratings yet

- Debt Settlement AgreementDocument3 pagesDebt Settlement AgreementKal LamigoNo ratings yet

- Payoff Letter Template for Debt SettlementDocument3 pagesPayoff Letter Template for Debt Settlementslubin100% (1)

- Personal Loan Agreement TemplateDocument3 pagesPersonal Loan Agreement TemplateChalliz OmorogNo ratings yet

- Joint Venture AgreementDocument3 pagesJoint Venture AgreementchikondifbNo ratings yet

- Commercial Transactions Release AgreementDocument6 pagesCommercial Transactions Release AgreementAmr MouradNo ratings yet

- Service Agreement SummaryDocument5 pagesService Agreement Summaryana zNo ratings yet

- SettlementAgreementForm FAA DisputesDocument3 pagesSettlementAgreementForm FAA DisputesJayhze DizonNo ratings yet

- Guarantor FormDocument2 pagesGuarantor FormRich GarrNo ratings yet

- Assignment of Partnership InterestDocument5 pagesAssignment of Partnership InterestIrin200No ratings yet

- Assignment of Partnership InterestDocument4 pagesAssignment of Partnership InterestJoebell VillanuevaNo ratings yet

- Acknowledgement of DebtDocument7 pagesAcknowledgement of Debtyawizzy bNo ratings yet

- Pre Negotiation AgreementDocument7 pagesPre Negotiation AgreementMaria VangelosNo ratings yet

- Loan Agreement TemplateDocument3 pagesLoan Agreement TemplateZayne DiputadoNo ratings yet

- Family Loan AgreementDocument3 pagesFamily Loan AgreementshamuzanyiNo ratings yet

- Termination Agreement SummaryDocument5 pagesTermination Agreement SummarySheilaNo ratings yet

- Promissory Note: Page 1 of 4Document4 pagesPromissory Note: Page 1 of 4Famela ElmedorialNo ratings yet

- Equity Commitment LTRDocument6 pagesEquity Commitment LTRColin TanNo ratings yet

- Prepared ForDocument2 pagesPrepared ForxyrahonorNo ratings yet

- Independent Contractor Agreement Philippines TemplateDocument4 pagesIndependent Contractor Agreement Philippines TemplatePaige JavierNo ratings yet

- Texas Secured Promissory Note TemplateDocument4 pagesTexas Secured Promissory Note Templatedale100% (1)

- Assignment Agreement Download - FriendlyDocument4 pagesAssignment Agreement Download - FriendlyJOSE FRANCIANo ratings yet

- Joint Venture Agreement TemplateDocument5 pagesJoint Venture Agreement TemplateMilly Kay ItsKgotlyNo ratings yet

- Standard PNDocument4 pagesStandard PNDoctrine ChurchNo ratings yet

- Personal Loan Agreement DetailsDocument3 pagesPersonal Loan Agreement DetailsVina Mae AtaldeNo ratings yet

- Cleaning Subcontractor Agreement: Page 1 of 4Document4 pagesCleaning Subcontractor Agreement: Page 1 of 4Ronnie JerezaNo ratings yet

- Standard Promissory Note TemplateDocument4 pagesStandard Promissory Note TemplateBelle LagumbayNo ratings yet

- Mutual Compromise Agreement and Mutual ReleaseDocument4 pagesMutual Compromise Agreement and Mutual ReleaseG Boy DongNo ratings yet

- Loan Agreement - With InterestDocument5 pagesLoan Agreement - With InterestAntonie CollantesNo ratings yet

- Pla C.-C PDFDocument3 pagesPla C.-C PDFKim Orven KhoNo ratings yet

- Standard Secured Promissory Note TemplateDocument4 pagesStandard Secured Promissory Note TemplateJsda Bayad CentreNo ratings yet

- SAMPLE Debt Assignment and Assumption With ReleaseDocument2 pagesSAMPLE Debt Assignment and Assumption With ReleaserOSENo ratings yet

- Sales AgreementDocument5 pagesSales AgreementE-25 Siddhesh BNo ratings yet

- Personal-loan-Agreement Vengco, Erwin ChesterDocument4 pagesPersonal-loan-Agreement Vengco, Erwin ChesterTerenz World IIINo ratings yet

- Loan Agreement TemplateDocument3 pagesLoan Agreement TemplateSheila Liezel SantosNo ratings yet

- Referral AgreementDocument3 pagesReferral AgreementPaul100% (1)

- Commercial Security AgreementDocument11 pagesCommercial Security AgreementGee Penn98% (46)

- LoanDocument9 pagesLoanM YusronNo ratings yet

- CHP 10 - Refund - Guarantees - 10 - Guarantees - Issued - On - Behalf - of - The - BuyerDocument3 pagesCHP 10 - Refund - Guarantees - 10 - Guarantees - Issued - On - Behalf - of - The - BuyerBikram ReflectionsNo ratings yet

- Loan-Agreement TemplateDocument4 pagesLoan-Agreement TemplateAlan Taylor100% (1)

- Payment PlanDocument2 pagesPayment PlanTruth Ways Law FirmNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- RBI - Gold Card SchemeDocument9 pagesRBI - Gold Card Schemenitin.dokaniaNo ratings yet

- Errors and Irregularities in The Transaction CyclesDocument39 pagesErrors and Irregularities in The Transaction CyclesE.D.J83% (6)

- Acupuncture Needles and TCM ProductsDocument21 pagesAcupuncture Needles and TCM Productsluke3No ratings yet

- Piba User Manual V1.5 13 Dec 20Document60 pagesPiba User Manual V1.5 13 Dec 20Shamnoor Arefin Ratul100% (1)

- Project BamulDocument74 pagesProject Bamulಜಯಂತ್ ಗೌಡNo ratings yet

- USAA Home Equity Line of Credit Statement SummaryDocument3 pagesUSAA Home Equity Line of Credit Statement SummaryЮлия ПNo ratings yet

- Loan and Security AgreementDocument20 pagesLoan and Security AgreementtradukegNo ratings yet

- Supreme Court: Vicente P. Leus For Petitioners. The Government Corporate Counsel For GSISDocument5 pagesSupreme Court: Vicente P. Leus For Petitioners. The Government Corporate Counsel For GSISMark Catabijan CarriedoNo ratings yet

- Dorma HardwaresDocument48 pagesDorma HardwarescharibackupNo ratings yet

- DHS AuditDocument100 pagesDHS Auditthe kingfish100% (1)

- Florentina Bautista-Spille v. Nicorp Management and International Exchange Bank, GR No. 214057, Octoberr 19, 2015Document9 pagesFlorentina Bautista-Spille v. Nicorp Management and International Exchange Bank, GR No. 214057, Octoberr 19, 2015Cza PeñaNo ratings yet

- SAP Cash ManagementDocument13 pagesSAP Cash ManagementBülent Değirmencioğlu100% (1)

- Presentation By: Finance Department Government of MaharashtraDocument37 pagesPresentation By: Finance Department Government of MaharashtraenjoypiyushNo ratings yet

- Basics of Negotiable InstrumentsDocument46 pagesBasics of Negotiable Instrumentsgox350% (2)

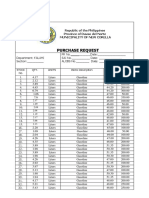

- Purchase Request: Republic of The Philippines Province of Davao Del Norte Municipality of New CorellaDocument9 pagesPurchase Request: Republic of The Philippines Province of Davao Del Norte Municipality of New CorellaIan LapingNo ratings yet

- RBC Credit Card AgreementDocument2 pagesRBC Credit Card AgreementKendra MangioneNo ratings yet

- (NIL) 014 Phil. Commercial Bank vs. Antonio B. BalmacedaDocument3 pages(NIL) 014 Phil. Commercial Bank vs. Antonio B. BalmacedaJacob DalisayNo ratings yet

- Winebrenner-Inigo-Insurance-Brokers-Inc-v-CIRDocument24 pagesWinebrenner-Inigo-Insurance-Brokers-Inc-v-CIRDarrel John SombilonNo ratings yet

- Chapter 4-Cash & Cash EquivalentDocument14 pagesChapter 4-Cash & Cash EquivalentEmma Mariz Garcia75% (4)

- Funds Management Budget Planning and ExecutionDocument4 pagesFunds Management Budget Planning and ExecutionAkashNo ratings yet

- Payment Proof - SarjanaSeni FilmDocument1 pagePayment Proof - SarjanaSeni FilmPrabowo SubiantoNo ratings yet

- RR HousngDocument24 pagesRR HousngSyed MudhassirNo ratings yet

- Dealership Agreement FinalDocument9 pagesDealership Agreement Finalkapishsharma100% (1)

- TEMENOS Reference Processes Inventory R18Document269 pagesTEMENOS Reference Processes Inventory R18AJ Amine100% (1)

- Apply Advance Airfare Rules Procedures - 291015Document63 pagesApply Advance Airfare Rules Procedures - 291015Hershell ContaNo ratings yet

- Business Accounting With PastelDocument2 pagesBusiness Accounting With PastelBoogy GrimNo ratings yet

- Les Roches Tuition 2010.2Document4 pagesLes Roches Tuition 2010.2Arsim NeziriNo ratings yet

- Cash Against DocumentsDocument4 pagesCash Against DocumentsKureshi Sana100% (2)

- Internship Report For Bank Alfalah LimitedDocument51 pagesInternship Report For Bank Alfalah Limitednaveedsmfood100% (2)

- MOI Foods Internship ReportDocument100 pagesMOI Foods Internship ReportAin Jeb100% (1)