Professional Documents

Culture Documents

Assignment 3 Consolidation. Subsequent To The Date of Acquisition

Uploaded by

Aivan De LeonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 3 Consolidation. Subsequent To The Date of Acquisition

Uploaded by

Aivan De LeonCopyright:

Available Formats

CONSOLIDATION SUBSEQUENT TO THE DATE OF ACQUISITION

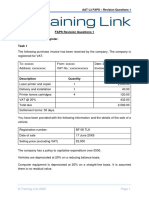

PROBLEM 1

On January 1, 2022, Pink Panther acquired 70% of the outstanding shares of stocks of

Pink Sweats for P1,500,000. The book value of the net assets of Pink Panther at the date

of acquisition was P3,000,000 of which the retained earnings amounted to P1,800,000.

On the other hand, the book value of the net assets of Pink Sweats at the date of

acquisition was P2,800,000. The non-controlling interest is measured at the minimum.

The book value of the assets and liabilities of Pink Sweats equal the fair values except:

an inventory which had an excess of fair over book value in the amount of P60,000; an

equipment which had an excess of book over fair value in the amount of P80,000; and a

note payable bearing an interest of 5% which was understated by P10,000.

30% of the above inventory was sold in the current year and the rest was sold in 2023.

The equipment had a remaining life of 2 years. The note payable was issued on January

1, 2020 and it had a remaining term of 5 years. The following data were also ascertained:

2022 2023

Net income P. Panther P500,000 P600,000

Net income P. Sweats P320,000 P280,000

Dividend declared P. P110,000 P150,000

Panther

Dividend declared P. P70,000 P60,000

Sweats

1. What is the consolidated net income attributable to Pink Panther on December 31,

2022?

A. 1,143,050

B. 1,098,250

C. 1,129,050

D. 1,092,500

E. 1,095,250

2. What is the non-controlling interest net income on December 31, 2022?

A. 96,000

B. 102,450

C. 89,550

D. 102,750

E. 89,750

3. What is the non-controlling interest net asset on December 31, 2022?

A. 918,450

B. 912,450

C. 933,450

D. 912,750

E. 920,450

4. What is the consolidated retained earnings on December 31, 2022?

A. 2,819,050

B. 2,833,050

C. 2,782,500

D. 2,788,250

E. 2,785,500

5. What is the non-controlling interest net asset on December 31, 2023?

A. 983,700

B. 978,450

C. 979,200

D. 977,700

E. 967,450

6. What is the consolidated retained earnings on December 31, 2023?

A. 3,421,300

B. 3,860,300

C. 3,424,800

D. 3,463,300

E. 3,555,300

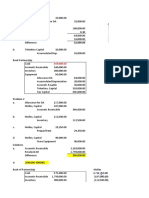

PROBLEM 2

On January 1, 2022, Human Alarm Co acquired 60% of the outstanding shares of stocks

of Sleeper BB Co for P3,000,000. The book value of the net assets of Human Alarm Co

at the date of acquisition consisted of Ordinary shares in the amount of P1,000,000;

Additional paid in capital in the amount of P2,500,000; retained earnings in the amount of

P2,400,000. On the other hand, the book value of the net assets of Sleeper BB Co at the

date of acquisition was P2,200,000 including a goodwill in the amount of P250,000. The

non-controlling interest is measured at fair value in the amount of P1,300,000.

The book value of the assets and liabilities of Sleeper BB Co equal the fair values except:

an inventory which was overstated in the amount of P45,000 and a machine which was

understated by P200,000.

The machine had a remaining life of 8 years. If the result of the business combination was

goodwill, it was impaired in the amount of P75,000 in the current year. The net income of

Human Alarm Co was P700,000 and the net income of Sleeper BB Co was P430,000 at

the end of the year. Dividends declared by Human Alarm Co was P220,000, but only

P200,000 was paid. On the other hand, dividends declared by Sleeper BB Co was

P130,000, but only P100,000 was paid.

1. What is the consolidated net income attributable to Human Alarm Co on December

31, 2022?

A. 832,649

B. 808,649

C. 847,000

D. 910,649

E. 850,449

2. What is the non-controlling interest net income on December 31, 2022?

A. 150,000

B. 148,351

C. 164,351

D. 134,000

E. 154,351

3. What is the non-controlling interest net asset on December 31, 2022?

A. 1,398,000

B. 1,464,351

C. 1,395,351

D. 1,412,351

E. 1,495,351

4. What is the consolidated retained earnings on December 31, 2022?

A. 3,027,000

B. 3,012,649

C. 3,032,649

D. 2,988,649

E. 3,089,649

You might also like

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Consolidation Subsequent To The Date of AcquisitionDocument3 pagesConsolidation Subsequent To The Date of AcquisitionJoseph FelipeNo ratings yet

- Audit Pre TestDocument13 pagesAudit Pre Testpwcpresident.nfjpia2324No ratings yet

- Consolidation Intercompany Sale of Fixed AssetsDocument4 pagesConsolidation Intercompany Sale of Fixed AssetsEdma Glory MacadaagNo ratings yet

- Intermediate Accounting Chapters 6,7,8Document63 pagesIntermediate Accounting Chapters 6,7,8Jonathan NavalloNo ratings yet

- Changes in Equity, Cash Flows, NotesDocument3 pagesChanges in Equity, Cash Flows, NotesLucas BantilingNo ratings yet

- RESA FAR PreWeek (B43)Document10 pagesRESA FAR PreWeek (B43)MellaniNo ratings yet

- Consolidated Financial Statements - IntercomapnyDocument6 pagesConsolidated Financial Statements - IntercomapnyCORNADO, MERIJOY G.No ratings yet

- FAR Problem Quiz 1Document6 pagesFAR Problem Quiz 1Ednalyn CruzNo ratings yet

- Philippine School of Business Administration Financial Accounting and Reporting Problems Final ExamDocument11 pagesPhilippine School of Business Administration Financial Accounting and Reporting Problems Final ExamNicole Aragon0% (1)

- 8919 - Consolidation Subsequent To The Date of AcquisitionDocument4 pages8919 - Consolidation Subsequent To The Date of AcquisitionFayehAmantilloBingcangNo ratings yet

- Practice Actp 4 SubsDocument4 pagesPractice Actp 4 SubsWisley GamuzaNo ratings yet

- SM09 4thExamReview-2 054657Document4 pagesSM09 4thExamReview-2 054657Hilarie JeanNo ratings yet

- Audit of Liabilities QuizDocument13 pagesAudit of Liabilities QuizAldrin DagamiNo ratings yet

- Accounting for Investments in AssociatesDocument2 pagesAccounting for Investments in AssociatesMina ChouNo ratings yet

- Ilovepdf Merged 1Document14 pagesIlovepdf Merged 1BATISATIC, EDCADIO JOSE E.No ratings yet

- 02 FAR02 Accounting-for-ReceivablesDocument3 pages02 FAR02 Accounting-for-ReceivablesBea GarciaNo ratings yet

- SYZ Mining Audit Problem AnalysisDocument26 pagesSYZ Mining Audit Problem AnalysisKate NuevaNo ratings yet

- 2022 Accele4 M5 AssignmentDocument6 pages2022 Accele4 M5 AssignmentPYM MataasnakahoyNo ratings yet

- Assets Maam MaconDocument6 pagesAssets Maam Maconchristinemariet.ramirezNo ratings yet

- 8922 - Self TestDocument6 pages8922 - Self TestEmily CamilleNo ratings yet

- Audit of investments and equity securitiesDocument6 pagesAudit of investments and equity securitiesMark Lord Morales Bumagat43% (7)

- ABC FinalsDocument10 pagesABC Finalsnena cabañesNo ratings yet

- Final Exam Fin 2Document3 pagesFinal Exam Fin 2ma. veronica guisihanNo ratings yet

- Substantive Audit of Investments CHAPTER 15 16Document8 pagesSubstantive Audit of Investments CHAPTER 15 16Nexxus BaladadNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaEsse ValdezNo ratings yet

- FTME Reviewer Part 2Document7 pagesFTME Reviewer Part 2Mel BoqueNo ratings yet

- Gen008 P1 ExamDocument11 pagesGen008 P1 ExamMary Lyn DatuinNo ratings yet

- (ACC124) Investment QuizDocument6 pages(ACC124) Investment QuizKloie SanoriaNo ratings yet

- Pre-Quali Examination - Level II - Cluster C AccountingDocument12 pagesPre-Quali Examination - Level II - Cluster C AccountingRobert CastilloNo ratings yet

- Far Drill2Document4 pagesFar Drill2Jung Hwan SoNo ratings yet

- National University- Manila Audit of Shareholders' Equity ProblemsDocument12 pagesNational University- Manila Audit of Shareholders' Equity ProblemsxjammerNo ratings yet

- 8 Audit of LiabilitiesDocument4 pages8 Audit of LiabilitiesCarieza CardenasNo ratings yet

- Accounting ReviewDocument76 pagesAccounting Reviewjoyce KimNo ratings yet

- AFAR Self Test - 9005Document6 pagesAFAR Self Test - 9005King MercadoNo ratings yet

- Denji Company balance sheet cash amountDocument9 pagesDenji Company balance sheet cash amountlil mixNo ratings yet

- Lesson 2-ACCOUNTS RECEIVABLES-2021NADocument5 pagesLesson 2-ACCOUNTS RECEIVABLES-2021NAandreaNo ratings yet

- Aud 1 and Aud 2 ProblemsDocument6 pagesAud 1 and Aud 2 ProblemsRomelie M. NopreNo ratings yet

- AUDProb TEST BANKDocument28 pagesAUDProb TEST BANKFrancine HollerNo ratings yet

- Cpa Review School of The Philipines Manila Financial Accounting and Reporting JULY 2021 First Preboard Examination SITUATION 1 - Three Unrelated EntitiesDocument15 pagesCpa Review School of The Philipines Manila Financial Accounting and Reporting JULY 2021 First Preboard Examination SITUATION 1 - Three Unrelated EntitiesSophia PerezNo ratings yet

- Test AfarDocument24 pagesTest AfarZyrelle Delgado100% (3)

- FAR PreBoard (1) CPAR BATCH90Document18 pagesFAR PreBoard (1) CPAR BATCH90Bella ChoiNo ratings yet

- Audit of Liabilities for SendingDocument35 pagesAudit of Liabilities for SendingNye NyeNo ratings yet

- Seatwork-Liabilities1st2023 StudentDocument5 pagesSeatwork-Liabilities1st2023 StudentpadayonmhieNo ratings yet

- Aud Sample UpdatedDocument36 pagesAud Sample Updatedreynald john dela cruzNo ratings yet

- Audit Problem Receivables Part 2Document4 pagesAudit Problem Receivables Part 2Rio Cyrel CelleroNo ratings yet

- Audit Problem Investments Part 1Document3 pagesAudit Problem Investments Part 1Rio Cyrel CelleroNo ratings yet

- 7210 - Retained EarningsDocument2 pages7210 - Retained Earningsjsmozol3434qcNo ratings yet

- Pre-Quali Examination - Level III - Cluster C, PDF FSUU AccountingDocument13 pagesPre-Quali Examination - Level III - Cluster C, PDF FSUU AccountingRobert CastilloNo ratings yet

- TCC Auditing Concepts and Apps 2 Problem SolvingDocument4 pagesTCC Auditing Concepts and Apps 2 Problem SolvingCristal CristobalNo ratings yet

- 7169 - Noncurrent Asset Held For Sale and Discountinued OperationDocument2 pages7169 - Noncurrent Asset Held For Sale and Discountinued Operationjsmozol3434qcNo ratings yet

- Test2 AfarDocument24 pagesTest2 AfarZyrelle DelgadoNo ratings yet

- Audit Working Papers SummaryDocument15 pagesAudit Working Papers SummaryMarielle GonzalvoNo ratings yet

- Acctg 205A Quiz NOV. 6,2020Document3 pagesAcctg 205A Quiz NOV. 6,2020Rheu ReyesNo ratings yet

- Second PreboardDocument6 pagesSecond PreboardBella AyabNo ratings yet

- FAR Final PreboardDocument13 pagesFAR Final PreboardMarvin ClementeNo ratings yet

- Notes ReceivableDocument3 pagesNotes Receivablepcdesktop.brarNo ratings yet

- Audit Problem Investments Part 2Document6 pagesAudit Problem Investments Part 2Rio Cyrel CelleroNo ratings yet

- 3 Revaluation SurplusDocument1 page3 Revaluation SurplusNeighvestNo ratings yet

- 6898 - Equity InvestmentsDocument2 pages6898 - Equity InvestmentsAljur SalamedaNo ratings yet

- Assignment No. 2 Business Combination Stock Acquisition Part 1.2Document4 pagesAssignment No. 2 Business Combination Stock Acquisition Part 1.2Aivan De LeonNo ratings yet

- Assignment 4 Intercompany Sale of PPEDocument2 pagesAssignment 4 Intercompany Sale of PPEAivan De LeonNo ratings yet

- Assignment 5 Consolidation Intercompany Sale of MerchandiseDocument3 pagesAssignment 5 Consolidation Intercompany Sale of MerchandiseAivan De LeonNo ratings yet

- Assignment 7 Financial Statements Translation..Document2 pagesAssignment 7 Financial Statements Translation..Aivan De LeonNo ratings yet

- AAT L3 FAPS Revision Questions 1Document7 pagesAAT L3 FAPS Revision Questions 1uzytkownik2207No ratings yet

- Financial Accounting and ReportingDocument30 pagesFinancial Accounting and ReportingRegine VegaNo ratings yet

- Final Exam Cheat-SheetDocument1 pageFinal Exam Cheat-SheetPaolo TipoNo ratings yet

- Kumari Bank Limited: Damauli BranchDocument28 pagesKumari Bank Limited: Damauli BranchBijaya DhakalNo ratings yet

- 1 What Implications Do You Draw From The Graph ForDocument2 pages1 What Implications Do You Draw From The Graph ForAmit PandeyNo ratings yet

- Business Finance: Projected Statement of Income, Financial Position, and Cash FlowDocument16 pagesBusiness Finance: Projected Statement of Income, Financial Position, and Cash FlowAngelica Paras0% (1)

- ACT312 Quiz1 Online-1 PDFDocument6 pagesACT312 Quiz1 Online-1 PDFCharlie Harris0% (1)

- Ohada Accounting Plan by Nchendeh Christian 674101690Document35 pagesOhada Accounting Plan by Nchendeh Christian 674101690Unamor Madeira NguemaNo ratings yet

- Revised Conceptual Framework: Rainiel C. Soriano, CPA, MBADocument60 pagesRevised Conceptual Framework: Rainiel C. Soriano, CPA, MBAMila VeranoNo ratings yet

- Management of Financial Services MCQ'SDocument4 pagesManagement of Financial Services MCQ'SGuruKPO96% (23)

- Project On Indian Financial MarketDocument44 pagesProject On Indian Financial MarketParag More85% (13)

- Understanding Intangible AssetsDocument8 pagesUnderstanding Intangible AssetsMya B. Walker100% (1)

- Annual Report 2022Document72 pagesAnnual Report 2022Sandesh ShettyNo ratings yet

- Chapter 7 ReceivablesDocument87 pagesChapter 7 ReceivablesLEE WEI LONGNo ratings yet

- Audit Notes (Nikhil Gupta Sir)Document193 pagesAudit Notes (Nikhil Gupta Sir)rajuNo ratings yet

- Demo Teaching - Accrual AccountingDocument17 pagesDemo Teaching - Accrual AccountingEugene DayanNo ratings yet

- Business Transformation Towards SustainabilityDocument200 pagesBusiness Transformation Towards SustainabilitySamanthameidelinNo ratings yet

- Partnership Formation - SolutionsDocument5 pagesPartnership Formation - SolutionsMohammadNo ratings yet

- Artikel Corporate Governance, Internal Control and The Role of Internal Auditors - ZhangDocument22 pagesArtikel Corporate Governance, Internal Control and The Role of Internal Auditors - ZhangBudi MahendNo ratings yet

- FRA Auditors' ReportDocument16 pagesFRA Auditors' ReportRafiullah MangalNo ratings yet

- Ch05 Quiz Solution 052416Document5 pagesCh05 Quiz Solution 052416sum pradhanNo ratings yet

- Apollo Food Credit Analysis 2010-2012 FinancialsDocument21 pagesApollo Food Credit Analysis 2010-2012 FinancialsAzilah UsmanNo ratings yet

- BUS 505.assignmentDocument16 pagesBUS 505.assignmentRashìd RanaNo ratings yet

- BSRM Steels Annual Report 2018 19 Final - 14.11.19 - Small SizeDocument176 pagesBSRM Steels Annual Report 2018 19 Final - 14.11.19 - Small SizeMohaiminul Islam MominNo ratings yet

- Maynilad 2016 Financial StatementsDocument75 pagesMaynilad 2016 Financial StatementsRaquion, Jeanalyn R.No ratings yet

- PGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1Document26 pagesPGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1nidhidNo ratings yet

- Assignment 2023 For BPOI-102 (002) (DBPOFA Prog)Document2 pagesAssignment 2023 For BPOI-102 (002) (DBPOFA Prog)Pawar ComputerNo ratings yet

- Számlatükör AngolulDocument15 pagesSzámlatükör AngolulV.K.No ratings yet

- SXXXZDocument5 pagesSXXXZKane Francis VeranoNo ratings yet

- Chapter 3 Journalizing and PostingDocument40 pagesChapter 3 Journalizing and PostingDahlia Fernandez Bt Mohd Farid FernandezNo ratings yet