Professional Documents

Culture Documents

ES M303 ProdAssist

Uploaded by

LAURAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ES M303 ProdAssist

Uploaded by

LAURACopyright:

Available Formats

PUBLIC

2021-02-16

Documentation for SAP Note 3006595

VAT Return Model 303 (ES_VAT_DCL_M303_NATIONAL)

© 2021 SAP SE or an SAP affiliate company. All rights reserved.

THE BEST RUN

Content

1 VAT Return - Form 303. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

1.1 Correction Run for VAT Return - Form 303. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

1.2 Configuration for VAT Return - Form 303. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7

Documentation for SAP Note 3006595

2 PUBLIC Content

1 VAT Return - Form 303

Companies in Spain with a monthly and quarterly settlement period must submit a VAT declaration grouped by

tax rate and type of transaction. For this, they must use the official form 303 (Modelo 303).

You can use the Run Compliance Reports app to generate a TXT file with the necessary data for the VAT Return

- Form 303 for Spain.

Prerequisites

The key user responsible for configuration has made the necessary settings for generating the VAT Return -

Form 303 as described in Configuration for VAT Return - Form 303 [page 7].

Processing the Activities for the VAT Return - Form 303

1. To get a list of the reports that require actions, enter selection parameters that define the reporting period

and choose the ES_VAT_DCL_M303_NATIONAL (Spain VAT Return : Model 303) report in the search help of

the Report Name field.

2. Choose one or more reporting statuses depending on how close the deadline of the report is to the actual

calendar day.

You can also enter additional filtering options, such as the submission due date, the reporting year, or the

country/region.

3. Choose Go.

The app displays a list of activities that you need to process one by one.

4. Choose the Manage Tax Items activity.

The app navigates to another app called Manage Tax Items for Legal Reporting. Follow the instructions as

described in .

Note

You need to run this activity only if you want to include or exclude any tax items from your reporting

period.

5. After you are done, choose Set Completed to manually set the status of the activity as complete.

6. Go back to the main screen of the app and choose the row of the second activity you want to process.

7. Choose the Prepare VAT Return Form 303 (Spain) activity.

8. Choose New Run.

The Company Code and Reporting Period parameters are mandatory.

Note that the report selects journal entries based on the tax reporting date. If the tax reporting date is not

activated for your company code, it uses the posting date.

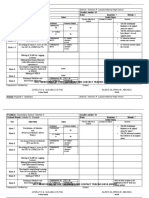

If necessary, modify or enter values in the following parameters, depending on the type of run:

Documentation for SAP Note 3006595

VAT Return - Form 303 PUBLIC 3

Selection Parameter Use Tax Box on Official Form Valid for Run

Percentage of VAT for State Percentage of VAT that 65 All runs

Admin. [65] should be collected by the

Spanish central tax admin

istration.

Amount from Previous VAT amount to compensate 67 All runs up to the end of

Periods [67] from previous periods. 2020

Pending Amount from Prev. Pending VAT amount to 110 All runs as of January 2021

Periods [110] compensate from previous

periods.

Applied Amount from Prev. VAT amount to compensate 78

Periods [78] from previous periods ap

plied in this period.

Amount art. 80.five.5ªLIVA Correction of VAT amount 76 All runs

[76] according to art. 80. five.5ª

LIVA.

Deductible Amount due to When a company has oper 44 All runs for last period

Pro rata [44] ations with VAT and opera

tions with no VAT (0%), the

company cannot deduct all

input VAT. Deductible input

VAT is calculated according

to specific rules based on

previous year amounts. At

the end of the year, this rule

must be recalculated ac

cording to the actual year

amount. This calculation

generates a correction of

the deductible VAT.

Adjustment Amount State & Only for taxes payable to 68

Province [68] State and provincial (Foral)

administration. Annual ad

justment result. If you en

tered 100% in the

Percentage of VAT for State

Admin. [65] field above, you

must enter <blank> in this

field.

Note

For the selection parameters shown during a correction run, refer to .

You can choose to generate the report run immediately or schedule the runs for a later point in time. For

report runs that may take a long time to process, you can choose to run the reports in the background.

9. Choose Run.

The app generates the run and displays it in the Generated section on the screen. You can do the following:

Documentation for SAP Note 3006595

4 PUBLIC VAT Return - Form 303

○ Display the generated data by clicking the row of the generated run.

○ Review the data for successful runs. You do this in the TXT file on the Legal Reporting tab by clicking

the link in the Document Name column.

If pro rata is relevant for your company and it is the year-end run, enter the pro rata information in the

data preview of the report output in record 30305 under Pro rata. Note that the section Activities with

differentiated deduction regimes is display only.

○ Download the generated document to your local computer and submit it to the tax authorities as

required.

○ Display the analytical view by clicking Analyze Data on the right-hand side of your screen. You can then

check the data and dynamically change the analytical view for the displayed fields. For more

information, see .

If the data displayed is complete and correct, change the status of the reporting run by choosing the row of

the run and then click the Update Submission Status button. Change the status manually to Accepted by

Government.

Note

After you have done so, you will no longer be able to run this activity again.

10. When you are done, go back to the previous screen and choose the Post Tax Payable activity.

The app navigates you to another app called Post Tax Payables. Follow the instructions as described in .

Note

Run this activity after the report generation when you want to post the balances of tax accounts

directly to a tax payable account, without any manual entry.

11. After you are done, choose Set Completed to manually set the status of the activity as complete.

1.1 Correction Run for VAT Return - Form 303

If you need to correct Form 303 after you have submitted it to the tax authorities, you can start a correction

run.

When you generate VAT Return - Form 303 using the Run Compliance Reports app, you can repeat the steps in

the standard phase as many times as required until you set the status of the activity to Completed. You can

then no longer run this activity again. If you need to make changes, you trigger a correction run, which belongs

to a new phase called a correction phase.

Note

We recommend that you set an activity to Completed only when you are sure your .TXT file and related

activities are correct and finished.

Documentation for SAP Note 3006595

VAT Return - Form 303 PUBLIC 5

Prerequisites

Before generating a correction run you must set the status of the Prepare VAT Return Form 303 (Spain) to

Completed. To do so:

1. After you run your report and check the results, click Update Submission Status on the lower right-hand

corner of your screen.

2. Confirm that you want to change the status of the report run to Accepted by Government by clicking Yes on

the pop-up.

3. The status of the report run changes to Completed.

Triggering a Correction Run

1. Click the Prepare VAT Return Form 303 (Spain) activity that has been set to Completed to open it.

2. Click Start New Phase on the lower right-hand corner of your screen.

3. The correction phase is shown on the upper left-hand corner of your screen. Select the Prepare VAT Return

Form 303 (Spain) activity and click Start New Run on the lower right-hand corner of your screen to trigger

the correction run.

4. On the following screen, the Company Code and Reporting Period parameters have already a default value

that corresponds to the run you want to correct.

Additionally, click and/or enter a value for the following selection parameters. Consider the following:

Selection Parameter Use Tax Box on Official Form Valid for Run

Percentage of VAT for State Percentage of VAT that 65 All runs

Admin. [65] should be collected by the

Spanish central tax admin

istration.

Pending Amount from Prev. Pending VAT amount to 110

Periods [110] compensate from previous

periods.

Applied Amount from Prev. VAT amount to compensate 78

Periods [78] from previous periods ap

plied in this period.

Amount art. 80.five.5ªLIVA Correction of VAT amount 76

[76] according to art. 80. five.5ª

LIVA.

Documentation for SAP Note 3006595

6 PUBLIC VAT Return - Form 303

Selection Parameter Use Tax Box on Official Form Valid for Run

Deductible Amount due to When a company has oper 44 All runs for last period

Pro rata [44] ations with VAT and opera

tions with no VAT (0%), the

company cannot deduct all

input VAT. Deductible input

VAT is calculated according

to specific rules based on

previous year amounts. At

the end of the year, this rule

must be recalculated ac

cording to the actual year

amount. This calculation

generates a correction of

the deductible VAT.

Adjustment Amount State & Only for taxes payable to 68

Province [68] State and provincial (Foral)

administration. Annual ad

justment result. If you en

tered 100% in the

Percentage of VAT for State

Admin. [65] field above, you

must enter <blank> in this

field.

Result Amount from VAT amount of the previous 70 All correction runs

Previous Return [70] VAT return that should be

deducted from the current

amount.

ID Number of Previous ID number of the VAT return Not applicable (form field

Return you want to correct with this and not a tax box)

run.

5. On the same screen, select a run option.

6. Click Run.

1.2 Configuration for VAT Return - Form 303

To configure the VAT Return - Form 303 report, proceed as follows:

1. Make the required settings in Customizing for Financial Accounting under Advanced Compliance

Reporting Setting Up Your Compliance Reporting . For detailed information about the steps involved in

setting up your compliance reports, see .

Find below the details of the sample settings provided for the report. You may change the settings based

on your requirements:

○ Reporting Entity: ES_RPG_ENT

Documentation for SAP Note 3006595

VAT Return - Form 303 PUBLIC 7

○ Report Category: ES_VAT_DCL_M303_NATIONAL

○ Periodicity of the report category:

○ Offset: 25

○ Fiscal Year Variant: K0 or any other variant for monthly or quarterly reporting.

○ Notification Period: 20

○ Parameters specific to the report category: none

○ Parameters specific to reporting entity:

Parameter Explanation of the Parameter

ES_IAE_MAIN_ACTIVITY_KEY Key of the main activity of the company code. Allowed

values are 0 to 6 as determined by law.

ES_IAE_MAIN_EPIGRAPH Key section of the main activity. Values are determined

by law.

ES_IAE_OTHER_1_ACTIVITY_KEY Key of other activity of the company code. See values

above for ES_IAE_MAIN_ACTIVITY_KEY above.

ES_IAE_OTHER_1_EPIGRAPH Key section of other activity. Values are determined by

law.

ES_IAE_OTHER_2_ACTIVITY_KEY Key of other activity of the company code. See values

above for ES_IAE_MAIN_ACTIVITY_KEY above.

ES_IAE_OTHER_2_EPIGRAPH Key section of other activity. Values are determined by

law.

ES_IAE_OTHER_3_ACTIVITY_KEY Key of other activity of the company code. See values

above for ES_IAE_MAIN_ACTIVITY_KEY above.

ES_IAE_OTHER_3_EPIGRAPH Key section of other activity. Values are determined by

law.

ES_IAE_OTHER_4_ACTIVITY_KEY Key of other activity of the company code. See values

above for ES_IAE_MAIN_ACTIVITY_KEY above.

ES_IAE_OTHER_4_EPIGRAPH Key section of other activity. Values are determined by

law.

ES_IAE_OTHER_5_ACTIVITY_KEY Key of other activity of the company code. See values

above for ES_IAE_MAIN_ACTIVITY_KEY above.

ES_IAE_OTHER_5_EPIGRAPH Key section of other activity. Values are determined by

law.

Documentation for SAP Note 3006595

8 PUBLIC VAT Return - Form 303

Parameter Explanation of the Parameter

ES_VAT_3PARTY_DECL_REQUIRED Flag to identify if your company must report transac

tions in the annual operations report with 3rd parties.

Allowed values are:

○ X: Yes

○ <blank>: No (Default)

ES_VAT_ANNUAL_OPERATIONS Is there any annual volume of operations (article 121

LIVA)? Allowed values are:

○ 0: For periods other than the last period of the year

○ 1: Yes for last period of the year (Default)

○ 2: No for last period of the year

ES_VAT_EXEMPTED_M390 Are you exempted from the annual VAT summary decla

ration, form 390? Only for last period of the year. Al

lowed values are:

○ 1: Yes

○ 2: No (Default)

Note that to report pro rata VAT in the year-end run in

record 30305, you must enter the value 1. In addition,

you must enter at least one CNAE code in the parame

ter ES_VAT_PRORATA_CNAE_CODE, which is descri

bed below.

ES_VAT_INSOLVENCY Have you been declared in bankruptcy in the current pe

riod? Allowed values are:

○ 1: Yes

○ 2: No (Default)

ES_VAT_INSOLVENCY_DATE Date on which the declaration of bankruptcy was is

sued, in format dd/mm/yy

ES_VAT_INSOLVENCY_TYPE If a declaration of bankruptcy has been issued in this

period, indicate the type of self-assessment (Pre-bank

ruptcy/Post-bankruptcy). Allowed values are:

○ <blank>: No

○ 1: Pre-bankruptcy

○ 2: Post-bankruptcy

ES_VAT_ON_CASH_RECIPIENT Are you recipient of VAT on Cash transactions? Allowed

values are:

○ 1: Yes (Default)

○ 2: No

Documentation for SAP Note 3006595

VAT Return - Form 303 PUBLIC 9

Parameter Explanation of the Parameter

ES_VAT_PRORATA_CNAE_CODE CNAE codes for pro rata VAT. If more than one code is

required, use a semicolon as the separator.

Note the following:

○ To report pro rata VAT in the year-end run in record

30305, you must enter at least one CNAE code in

this parameter. If you do not enter a code, record

30305 is not included in the output.

○ The user enters the pro rata amounts manually in

the data preview for the report output.

ES_VAT_PRORATA_REVOCATION Revocation of the option for the application of the spe

cial pro rata (article 103 Two 1st LIVA). Allowed values

are:

○ 1: Yes

○ 2: No (Default)

ES_VAT_REDEME Are you in REDEME - Monthly VAT Reimbursement

Schema (Article 30 RIVA)? Allowed values are:

○ 1: Yes

○ 2: No (Default)

ES_VAT_REGISTER_SII_OPTIONAL Have you voluntarily submitted the VAT books/VAT re

cords through the electronic website of the AEAT during

the year - SII? Allowed values are:

○ 1: Yes

○ 2: No (Default)

ES_VAT_RETURN_IBAN IBAN code

ES_VAT_RETURN_SWIFT_BIC SWIFT/BIC code

ES_VAT_SPECIAL_PRORATA Option for the application of the special pro rata (Article

103 Two 1st LIVA). Allowed values are:

○ 1: Yes

○ 2: No (Default)

2. Assign a tax group version.

In Customizing for Financial Accounting choose General Ledger Accounting Periodic Processing

Report Sales/Purchases Tax Returns Assign Tax Group Version Time-Dependent (view V_T007Z).

Define a tax group version and the starting date. The From Date defines the date from which the

appropriate periodic VAT return can be generated by the system.

3. Define the mapping between VAT codes and the VAT boxes on your periodic VAT return for the tax base

amounts.

In Customizing for Financial Accounting choose General Ledger Accounting Periodic Processing

Report Sales/Purchases Tax Returns Group Tax Base Balances (view V_T007K).

Documentation for SAP Note 3006595

10 PUBLIC VAT Return - Form 303

You must enter the combination of all relevant tax codes, account keys (Trs) and credit/debit indicator to

group (GrpNo.). See the table below:

Description Trs Bal. GrpNo.

Input tax 10% VST 28

Input tax 10% VST 40

Acquisition of goods Input ESA 10

tax EU 4%

Acquisition of goods Input ESA 14

tax EU 4%

Acquisition of goods Input ESE 36

tax EU 4%

Acquisition of goods Input ESE 40

tax EU 4%

Output tax 4% MWS 1

Output tax 4% MWS 14

Output tax 4% MWS 80

Output tax 21% + sales MWS 7

equalization tax 5,2%

Output tax 21% + sales MWS 14

equalization tax 5,2%

Output tax 21% + sales MWS 80

equalization tax 5,2%

Output tax 21% + sales ASB 16

equalization tax 5,2%

Output tax 21% + sales ASB 25

equalization tax 5,2%

Note

GrpNo 80 is a box on the year-end section of the VAT return. If your company needs to fill this part, you

need to include the corresponding box customizing here.

4. Define the mapping between your document types and the VAT boxes on your Form 303 for tax base

amounts.

In Customizing for Financial Accounting choose General Ledger Accounting Periodic Processing

Report Sales/Purchases Tax Returns Assign Base Amount Group Number to Document Type (view

FIVATGENV_T007K).

In this step, you need to define the document types used for corrections (credit/debit memos) and their

corresponding tax base amount boxes on the VAT return. See the following table:

Type Group GrpNo.

Customer credit memo 14

Documentation for SAP Note 3006595

VAT Return - Form 303 PUBLIC 11

Type Group GrpNo.

Customer credit memo 25

Customer debit memo 14

Vendor credit memo 40

According to this configuration, the base amount of a customer invoice with 4% output tax (MWS) will be

reported in box 1 (V_T007K) and the tax amount of a customer credit/debit memo will be reported in box

14 (as there is an entry in V_T007K and in FIVATGENV_T007K for the same Grp.No 14).

Note that in the year-end section, that is, box 80, both the invoice and the credit memo will go to the same

box.

5. Define the mapping between VAT codes and the VAT boxes on your periodic VAT return for the tax

amounts.

In Customizing for Financial Accounting choose General Ledger Accounting Periodic Processing

Report Sales/Purchases Tax Returns Group Tax Balances (view V_T007L).

You must enter the combination of all relevant tax codes, account keys and credit/debit indicator (Trs) to

group (GrpNo). See the following table:

Description Trs Bal. GrpNo.

Input tax 10% VST 29

Input tax 10% VST 41

Acquisition of goods Input ESA 11

tax EU 4%

Acquisition of goods Input ESA 15

tax EU 4%

Acquisition of goods Input ESE 37

tax EU 4%

Acquisition of goods Input ESE 41

tax EU 4%

Output tax 4% MWS 3

Output tax 4% MWS 15

Output tax 21% + sales MWS 9

equalization tax 5,2%

Output tax 21% + sales MWS 15

equalization tax 5,2%

Output tax 21% + sales ASB 18

equalization tax 5,2%

Output tax 21% + sales ASB 26

equalization tax 5,2%

6. Define the mapping between your document types and the VAT boxes on your Form 303 for tax amounts.

In Customizing for Financial Accounting choose General Ledger Accounting Periodic Processing

Report Sales/Purchases Tax Returns Assign Tax Group Number to Document Type (view

FIVATGENV_T007L).

Documentation for SAP Note 3006595

12 PUBLIC VAT Return - Form 303

In this step, you need to define the document types used for corrections (credit/debit memos) and their

corresponding tax amount boxes on the VAT return. See the following table:

Type Group GrpNo.

Customer credit memo 15

Customer credit memo 26

Vendor credit memo 41

Vendor debit memo 41

According to this configuration, the tax amount of a vendor invoice with 10% input tax (VST) will be

reported in box 29 (V_T007L) and the tax amount of a vendor credit memo will be reported in box 41 (as

there is an entry in V_T007L and in FIVATGENV_T007L for the same Grp.No 41).

Predefined Reporting Activities

As the Manage Tax Items activity is relevant for the VAT Return - Form 303 report, consider the following:

● Please check if any other setting or configuration shall be completed for using this activity in .

As the Post Tax Payable activity is relevant for the VAT Return - Form 303 report, please check if any other

setting or configuration shall be completed for using this activity in .

Documentation for SAP Note 3006595

VAT Return - Form 303 PUBLIC 13

Important Disclaimers and Legal Information

Hyperlinks

Some links are classified by an icon and/or a mouseover text. These links provide additional information.

About the icons:

● Links with the icon : You are entering a Web site that is not hosted by SAP. By using such links, you agree (unless expressly stated otherwise in your

agreements with SAP) to this:

● The content of the linked-to site is not SAP documentation. You may not infer any product claims against SAP based on this information.

● SAP does not agree or disagree with the content on the linked-to site, nor does SAP warrant the availability and correctness. SAP shall not be liable for any

damages caused by the use of such content unless damages have been caused by SAP's gross negligence or willful misconduct.

● Links with the icon : You are leaving the documentation for that particular SAP product or service and are entering a SAP-hosted Web site. By using such

links, you agree that (unless expressly stated otherwise in your agreements with SAP) you may not infer any product claims against SAP based on this

information.

Videos Hosted on External Platforms

Some videos may point to third-party video hosting platforms. SAP cannot guarantee the future availability of videos stored on these platforms. Furthermore, any

advertisements or other content hosted on these platforms (for example, suggested videos or by navigating to other videos hosted on the same site), are not within

the control or responsibility of SAP.

Beta and Other Experimental Features

Experimental features are not part of the officially delivered scope that SAP guarantees for future releases. This means that experimental features may be changed by

SAP at any time for any reason without notice. Experimental features are not for productive use. You may not demonstrate, test, examine, evaluate or otherwise use

the experimental features in a live operating environment or with data that has not been sufficiently backed up.

The purpose of experimental features is to get feedback early on, allowing customers and partners to influence the future product accordingly. By providing your

feedback (e.g. in the SAP Community), you accept that intellectual property rights of the contributions or derivative works shall remain the exclusive property of SAP.

Example Code

Any software coding and/or code snippets are examples. They are not for productive use. The example code is only intended to better explain and visualize the syntax

and phrasing rules. SAP does not warrant the correctness and completeness of the example code. SAP shall not be liable for errors or damages caused by the use of

example code unless damages have been caused by SAP's gross negligence or willful misconduct.

Gender-Related Language

We try not to use gender-specific word forms and formulations. As appropriate for context and readability, SAP may use masculine word forms to refer to all genders.

Documentation for SAP Note 3006595

14 PUBLIC Important Disclaimers and Legal Information

Documentation for SAP Note 3006595

Important Disclaimers and Legal Information PUBLIC 15

www.sap.com/contactsap

© 2021 SAP SE or an SAP affiliate company. All rights reserved.

No part of this publication may be reproduced or transmitted in any form

or for any purpose without the express permission of SAP SE or an SAP

affiliate company. The information contained herein may be changed

without prior notice.

Some software products marketed by SAP SE and its distributors

contain proprietary software components of other software vendors.

National product specifications may vary.

These materials are provided by SAP SE or an SAP affiliate company for

informational purposes only, without representation or warranty of any

kind, and SAP or its affiliated companies shall not be liable for errors or

omissions with respect to the materials. The only warranties for SAP or

SAP affiliate company products and services are those that are set forth

in the express warranty statements accompanying such products and

services, if any. Nothing herein should be construed as constituting an

additional warranty.

SAP and other SAP products and services mentioned herein as well as

their respective logos are trademarks or registered trademarks of SAP

SE (or an SAP affiliate company) in Germany and other countries. All

other product and service names mentioned are the trademarks of their

respective companies.

Please see https://www.sap.com/about/legal/trademark.html for

additional trademark information and notices.

THE BEST RUN

You might also like

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- VAT Return - Form 303: SAP S/4HANA 1909 FPS01 - Preliminary DocumentationDocument14 pagesVAT Return - Form 303: SAP S/4HANA 1909 FPS01 - Preliminary DocumentationLAURANo ratings yet

- SAP - VAT ConfgireDocument11 pagesSAP - VAT ConfgireTop NgôNo ratings yet

- Sage UBS - Guide On Transitioning From GST To SST and Non-SST - V1.0Document27 pagesSage UBS - Guide On Transitioning From GST To SST and Non-SST - V1.0CTLNo ratings yet

- RealSoft VAT Module - User ManualDocument26 pagesRealSoft VAT Module - User ManualKhaleel Abdul GaffarNo ratings yet

- VAT Return 2015 SAP LibraryDocument17 pagesVAT Return 2015 SAP LibraryTatyana KosarevaNo ratings yet

- Activate Country Version India For Specific Fiscal Years: ActivitiesDocument32 pagesActivate Country Version India For Specific Fiscal Years: ActivitiesSiva KumarrNo ratings yet

- ReportDoc UpdateTaxDatesDocument3 pagesReportDoc UpdateTaxDatesbenhzbNo ratings yet

- SAP Month End Closing ProcessDocument30 pagesSAP Month End Closing ProcesssurendraNo ratings yet

- CIN Step by StepDocument32 pagesCIN Step by StepBalakrishna GovinduNo ratings yet

- VAT Return - HANADocument3 pagesVAT Return - HANAZORRONo ratings yet

- Year End STP Finalisation: Process ManualDocument5 pagesYear End STP Finalisation: Process ManualJaycee RamonesNo ratings yet

- Sage ERP X3 Fiscal Year End ClosingDocument8 pagesSage ERP X3 Fiscal Year End ClosingruzhaNo ratings yet

- Whats New Vat Framework EnhancementsDocument58 pagesWhats New Vat Framework EnhancementsDinesh PandianNo ratings yet

- Tally ERP 9 - TAX AUDITDocument15 pagesTally ERP 9 - TAX AUDITLakshmi811No ratings yet

- SAP US Payroll Tax - Well ExplainedDocument45 pagesSAP US Payroll Tax - Well ExplainedSuren Reddy67% (15)

- SAP Funds Management - Integration With FIDocument27 pagesSAP Funds Management - Integration With FIKathiresan NagarajanNo ratings yet

- SD - Tax Determination in Sales and DistributionDocument15 pagesSD - Tax Determination in Sales and DistributionNarendra BodhisatvaNo ratings yet

- User Manual - Argentina Tax ReportingDocument9 pagesUser Manual - Argentina Tax ReportingIrina Castro100% (1)

- Sap Payroll Taxes ScribdDocument41 pagesSap Payroll Taxes ScribdChakrapani Dusetti100% (3)

- Month End ActivitiesDocument30 pagesMonth End ActivitiesRaju BothraNo ratings yet

- Vat Guide EngDocument10 pagesVat Guide EngMohit GaurNo ratings yet

- Sage X3 - User Guide - HTG-Fiscal Year End Closing PDFDocument5 pagesSage X3 - User Guide - HTG-Fiscal Year End Closing PDFcaplusincNo ratings yet

- Statement of Business or Professional Activities: Part 1 - IdentificationDocument6 pagesStatement of Business or Professional Activities: Part 1 - IdentificationHimanshu MohtaNo ratings yet

- GST ConfigurationDocument15 pagesGST ConfigurationSahitee BasaniNo ratings yet

- SAP End-to-End System Configuration - Financial Accounting Global SettingsDocument76 pagesSAP End-to-End System Configuration - Financial Accounting Global SettingsUmaNo ratings yet

- HTG-V6 Fiscal Year End ClosingDocument8 pagesHTG-V6 Fiscal Year End ClosingAriel SpallettiNo ratings yet

- VariantDocument60 pagesVariantSourav KumarNo ratings yet

- Screenshots Remarks Creating Tax Codes: o o o oDocument11 pagesScreenshots Remarks Creating Tax Codes: o o o oSiber CKNo ratings yet

- SAP CO ConfigurationDocument171 pagesSAP CO ConfigurationAditya PakalaNo ratings yet

- AJRW Asset Fiscal Year ChangeDocument10 pagesAJRW Asset Fiscal Year ChangeVenkata AraveetiNo ratings yet

- Fi-Co: NotesDocument247 pagesFi-Co: NotesanumandlayamuneshNo ratings yet

- Guide On GSTR 1 Filing On GST PortalDocument53 pagesGuide On GSTR 1 Filing On GST PortalCA Naveen Kumar BalanNo ratings yet

- ACCOUNTING TUTORIALS (Income Statement)Document1 pageACCOUNTING TUTORIALS (Income Statement)Rizza Christine Thereza UsbalNo ratings yet

- Sap Fico MaterialDocument241 pagesSap Fico MaterialManoj Kumar50% (2)

- Step-1:-Login and Navigate To Gstr-1 PageDocument2 pagesStep-1:-Login and Navigate To Gstr-1 PageHarsh DixitNo ratings yet

- Tax Calculation Process in SDDocument4 pagesTax Calculation Process in SDVinayNo ratings yet

- TDS Config in SAPDocument31 pagesTDS Config in SAPvaishaliak2008No ratings yet

- CO FI Ledger ReconciliationDocument10 pagesCO FI Ledger ReconciliationUnoShankarNo ratings yet

- Documentation - AR RedesignDocument9 pagesDocumentation - AR RedesignIrina CastroNo ratings yet

- Year Closing 2010 FSIBLDocument5 pagesYear Closing 2010 FSIBLHasanul HoqueNo ratings yet

- S - ALR - 87012357 Advance Tax Reporting (RFUMSV00)Document11 pagesS - ALR - 87012357 Advance Tax Reporting (RFUMSV00)Sridhar Muthekepalli50% (4)

- Reversal and Refund of CENVAT Credit (Excise For Manufacturer) in Tally - ERP 9Document32 pagesReversal and Refund of CENVAT Credit (Excise For Manufacturer) in Tally - ERP 9vishalsolsheNo ratings yet

- How To Setup INSSDocument11 pagesHow To Setup INSSRodrigo Oliveira FurtadoNo ratings yet

- SAP GST Configuration 1627828736Document31 pagesSAP GST Configuration 1627828736Parvati sbNo ratings yet

- GST ConfigurationDocument31 pagesGST Configurationamarnathreddyl100% (1)

- SAP GST ConfigurationDocument31 pagesSAP GST ConfigurationRULER KINGS100% (1)

- Vat Reporting For France Topical EssayDocument17 pagesVat Reporting For France Topical EssayMiguel FelicioNo ratings yet

- E Tax PDFDocument43 pagesE Tax PDFzanyoneNo ratings yet

- Using Tally Ies 7Document112 pagesUsing Tally Ies 7Ramesh100% (2)

- Guide On Furnishing of ReturnsDocument28 pagesGuide On Furnishing of ReturnsKiMi MooeNaNo ratings yet

- SAP FICO Interview QuestionsDocument6 pagesSAP FICO Interview Questionskamal rajNo ratings yet

- Goods and Services TaxDocument79 pagesGoods and Services TaxhatimNo ratings yet

- Sap Controlling ConfigurationDocument58 pagesSap Controlling ConfigurationFaychal Ahmed100% (3)

- Co DocumentDocument240 pagesCo DocumentRock SylvNo ratings yet

- New GL SegmentDocument9 pagesNew GL SegmentDiego PazinNo ratings yet

- Trigonometric Ratios PresentationDocument15 pagesTrigonometric Ratios PresentationArchie ConagNo ratings yet

- Gen Math Lesson SummaryDocument4 pagesGen Math Lesson SummaryZsayne Jasmine SallanNo ratings yet

- School: Solomon P. Lozada National High SchoolDocument4 pagesSchool: Solomon P. Lozada National High SchoolRutchelNo ratings yet

- PENGARUH STRUKTUR KULIT TERHADAP KEAWETAN BAWANG MERAH (Allium Cepa L.)Document14 pagesPENGARUH STRUKTUR KULIT TERHADAP KEAWETAN BAWANG MERAH (Allium Cepa L.)midukarthaNo ratings yet

- T Intro ScratchDocument22 pagesT Intro Scratch3eativityNo ratings yet

- Red Flags A3Document1 pageRed Flags A3ShamNo ratings yet

- Samba Vscan 0.3.6b 84, Clamav 0.88.7 1.1 (Anti Virus For Samba)Document3 pagesSamba Vscan 0.3.6b 84, Clamav 0.88.7 1.1 (Anti Virus For Samba)djsusantoNo ratings yet

- Tourism Information Management System With QR Code and Guest LocatorDocument40 pagesTourism Information Management System With QR Code and Guest LocatorMaydhel BalinoNo ratings yet

- NesasmDocument26 pagesNesasmcarlo_asd1No ratings yet

- Book Trailer PlannerDocument3 pagesBook Trailer Plannerapi-544265557No ratings yet

- Didactic ADocument1 pageDidactic AAlina DubencoNo ratings yet

- Git & Github: Basic Resources To Follow StatusDocument8 pagesGit & Github: Basic Resources To Follow StatusAsad UllahNo ratings yet

- Native Tribes of Britain The CeltsDocument3 pagesNative Tribes of Britain The Celtsmaría joséNo ratings yet

- Ccan ATDocument21 pagesCcan ATradyghezNo ratings yet

- MINI PROJECT Report FormatDocument6 pagesMINI PROJECT Report Formatharsha sidNo ratings yet

- DCOM Configuration Guide - OPCInt PDFDocument25 pagesDCOM Configuration Guide - OPCInt PDFPablo Andres Jara GonzalezNo ratings yet

- Bruner, Frederick Dale. 2001. A Theology of The Holy Spirit. The Trinity FoundationDocument1 pageBruner, Frederick Dale. 2001. A Theology of The Holy Spirit. The Trinity FoundationJesús E Rincón TNo ratings yet

- Interview/ Steps in Conducting Interview: Senior High School Practical Research 2 Prepared By: Ryan Jay C. VerboDocument1 pageInterview/ Steps in Conducting Interview: Senior High School Practical Research 2 Prepared By: Ryan Jay C. VerboEmelyn Hubo100% (1)

- Plagiarism GuidelinesDocument28 pagesPlagiarism GuidelinesDr. Rajni GargNo ratings yet

- NTS Verbal ReasoningDocument4 pagesNTS Verbal Reasoningaftab awanNo ratings yet

- New! JavaScript I18n Support in WordPress 5.0 - Make WordPress CoreDocument11 pagesNew! JavaScript I18n Support in WordPress 5.0 - Make WordPress CoreZhihao WangNo ratings yet

- Et200s Im151 8 PN DP Cpu Operating Instructions en-US en-USDocument300 pagesEt200s Im151 8 PN DP Cpu Operating Instructions en-US en-USMichael AkpanNo ratings yet

- Chapter 1: Introduction To Computers and Programming: Starting Out With C++ Early Objects Ninth Edition, Global EditionDocument34 pagesChapter 1: Introduction To Computers and Programming: Starting Out With C++ Early Objects Ninth Edition, Global Editioncys96No ratings yet

- An Apology For The Study of Northern Antiquities by Elstob, Elizabeth, 1683-1756Document35 pagesAn Apology For The Study of Northern Antiquities by Elstob, Elizabeth, 1683-1756Gutenberg.orgNo ratings yet

- IntroductionDocument2 pagesIntroductionDiana Golea BobeicoNo ratings yet

- Analysis of Paradox in Rupi Kaur's HungerDocument2 pagesAnalysis of Paradox in Rupi Kaur's HungerHarumingga OgustariaNo ratings yet

- Stephane BraunschweigDocument20 pagesStephane BraunschweigCeci N'est Pas ParisNo ratings yet

- Leccion 1 Consonante Con Todas Las Vocales Leccion 2 Silabas, Diptongos Y Triptongos Leccion 3 Los Tiempos Verbales Verb Tense Overview With ExamplesDocument10 pagesLeccion 1 Consonante Con Todas Las Vocales Leccion 2 Silabas, Diptongos Y Triptongos Leccion 3 Los Tiempos Verbales Verb Tense Overview With ExamplesSandra PerezNo ratings yet

- Culture and Heritage of PunjabDocument14 pagesCulture and Heritage of PunjabMiso100% (1)

- EDUPHARMA Komunikasi Efektif Praktik Apoteker Umi AthiyahDocument29 pagesEDUPHARMA Komunikasi Efektif Praktik Apoteker Umi AthiyahAyu WijiNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingFrom EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingRating: 4.5 out of 5 stars4.5/5 (760)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Excel 2019: The Best 10 Tricks To Use In Excel 2019, A Set Of Advanced Methods, Formulas And Functions For Beginners, To Use In Your SpreadsheetsFrom EverandExcel 2019: The Best 10 Tricks To Use In Excel 2019, A Set Of Advanced Methods, Formulas And Functions For Beginners, To Use In Your SpreadsheetsNo ratings yet

- Beyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!From EverandBeyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!Rating: 4.5 out of 5 stars4.5/5 (8)

- Radically Simple Accounting: A Way Out of the Dark and Into the ProfitFrom EverandRadically Simple Accounting: A Way Out of the Dark and Into the ProfitRating: 4.5 out of 5 stars4.5/5 (9)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackFrom EverandThe Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackRating: 1 out of 5 stars1/5 (1)

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityFrom EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityNo ratings yet

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessFrom EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo ratings yet

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceFrom EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceRating: 4 out of 5 stars4/5 (1)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Bookkeeping: Advance Accounting Principles to Build a Successful Business (Accounting Made Simple for Non Accountants)From EverandBookkeeping: Advance Accounting Principles to Build a Successful Business (Accounting Made Simple for Non Accountants)No ratings yet

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsFrom EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsRating: 4.5 out of 5 stars4.5/5 (2)

- Accounting All-in-One For Dummies, with Online PracticeFrom EverandAccounting All-in-One For Dummies, with Online PracticeRating: 3 out of 5 stars3/5 (1)