Professional Documents

Culture Documents

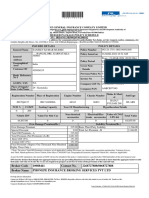

Agent/Broker/Producer Name: Agent/Broker License Code: POSPACHPA7032M Agent/Broker Contact No.

Uploaded by

Shubham GargOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agent/Broker/Producer Name: Agent/Broker License Code: POSPACHPA7032M Agent/Broker Contact No.

Uploaded by

Shubham GargCopyright:

Available Formats

11/24/22, 5:48 PM Policy Schedule

Certificate Of Insurance and Policy Schedule Form 51 of the Central Motor Vehicle Rules, 1989

Agent/Broker/Producer Name:

Agent/Broker License Code: POSPACHPA7032M; Agent/Broker Contact No.:

Certificate & Policy No.: 3192779770/000000/00 Policy Type:

Auto Secure - Two Wheeler Package Policy

Insured Name & Address: Premium (Incl. of all tax/cess) 4,113.00

MR RAM KUMAR S/O

JAIKARAN Insured Business/Profession: OTHER

SURAJPUR - 497231

Geographical Area: India

CHHATTISGARH Registration Authority:

INDIA Ambikapur

Place of supply -CHHATTISGARH HPA / Hyp / Lease to: N/A

State code -22

Seating

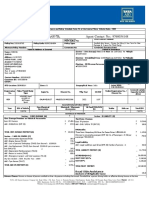

Registration No. Make & Model Engine No. Chassis No. CC/KW Mfg. Year Body Type

Capacity

CG29 HF DELUX HA11ESLGK05628 MBLHAW146LGK05872 100 2020 SCOOTER 2

AD35

25

IDV of Vehicle IDV of Side Bi-Fuel/CNG/LPG IDV of non-built-in Accessories( ) Total Insured Declared

() Car Kit( ) Values(IDV) - ( )

() Electrical Non-Electrical

46333 0 0 0 0 46333

SCHEDULE OF PREMIUM

A. OWN DAMAGE B. LIABILITY

Own Damage Period of From 14:10 Own Damage Date of Liability Period of From 14:10

To Midnight of 12/11/2021 Liability Date of Expiry: To Midnight of 12/11/2025

Insurance: Hrs on 13/11/2020 Expiry: Insurance: Hrs on 13/11/2020

Premium on Vehicle and non electrical accessories 702.88 Basic 3,485.00

A. TOTAL OWN DAMAGE PREMIUM 702.88 One Year Compulsory PA Cover for Owner-Driver 1500000 00.00

Add: Depreciation Reimbursement (TA16) 132.80 Less : Reduction in liability of Third Party Property Damage 00.00

C. TOTAL ADD ON PREMIUM 132.80 B. TOTAL LIABILITY PREMIUM 00.00

COMPREHENSIVE PREMIUM(A+B+C) 00.00

NET PREMIUM 3,485.00

UGST/SGST @9 % 314.00

CGST @9 % 314.00

TOTAL PREMIUM 4,113.00

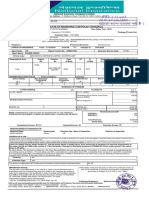

Drivers Clause: Persons or classes of persons entitled to drive: Any person including the insured. Provided that a person driving holds an effective driving

license at the time of the accident and is not disqualified from holding or obtaining such a license. Provided also that the person holding an effective Learner's

License may also drive the vehicle and that such a person satisfies the requirements of Rule 3 of the Central Motor Vehicles Rules, 1989.

Limitations as to Use: The Policy covers use of the vehicle for any purpose other than : a) Hire or Reward b) Carriage of goods (other than samples or

personal luggage) c) Organized racing d) Pace Making e) Speed testing f) Reliability Trials g) Any purpose in connection with Motor Trade

Limits of Liability: Under Section II-1 (i) of policy (Death of or bodily injury): Such amount as is necessary to meet the requirements of the Motor Vehicles Act,

1988. I/we hereby certify that the Policy to which this Certificate

Under Section II-1 (ii) of policy (Third Party Property Damage): 6,000.00 relates as well as this Certificate of Insurance are issued in

accordance with provisions of Chapter X and XI of Motor

Under Section III : One Year Compulsory PA Cover for Owner-Driver : 1500000 /- Vehicles Act,1988.

Nominee:BASH DEV Relationship:Father

Number of claims covered under Depreciation Reimbursement Cover :2 In witness whereof this Policy has been signed at BILASPUR

on 13/11/2020

Receipt No.(s): 108111032737084 13/11/2020

This policy does not cover pre-existing damages as per Inspection photographs and Report

The stamp duty Of Rs 0.50/ -paid In cash Or demand draft Or

Deductible Under Section - I : 100.00 - (Compulsory Deductible : 100.00, Voluntary Deductible: 0.00, Imposed Excess: 0.00) Franchisee: 0.00 by pay order,vide Receipt/ Challan no:

Depriciation Allowance: 0.00

LOA/CSD/403/2022/3025dated the13/11/2020.

For Tata AIG General Insurance Company LTD.

No Claim Bonus : The insured is entitled for a No Claim Bonus (NCB) on the own damage section of the policy, if no claimis made or pending during the

preceding year(s), as follows: The preceding year - 20%,, preceding two consecutive years -25%, preceding three consecutive years - 35%, preceding four

consecutive years - 45%, preceding five consecutive years -50% of NCB on OD Premium. NCB will only be allowed provided the policy is renewed within 90

days of the expiry date ofthe previous policy.

Subject to: A) IMT Endorsement No.: 20,22

B) TATA AIG Auto Secure endorsement No.(TA): 16

Authorized Signatory

GSTIN : 22AABCT3518Q1Z6 - CHHATTISGARH Service Accounting Code : 997134

Policy Servicing Office : OFFICE NO. T-8, 4TH FLOOR,, GWALANI CHAMBER, BAPER BIHAR,BILASPUR,CHHATTISGARH,BILASPUR-495001, Tel No:--

Warranted that the insured named herein/owner of the vehicle holds a valid Pollution Under Control (PUC) Certificate and/or valid fitness certificate, as

applicable, on the date of commencement of the Policy and undertakes to renew and maintain a valid and effective PUC and/or fitness Certificate, as

applicable, during the subsistence of the Policy. Further, the Company reserves the right to take appropriate action in case of any discrepancy in the PUC or

fitness certificate.

IMPORTANT NOTICE

The Insured is not indemnified if the vehicle is used or driven otherwise than in accordance with this Schedule. Any payment made by the Company by reason of wider terms appearing in the Certificate in order to comply with the Motor

Vehicles Act, 1988 is recoverable from the Insured. See the clause headed 'AVOIDANCE OF CERTAIN TERMS AND RIGHT OF RECOVERY'.

Note :This Schedule, Policy terms and conditions available on company website and Endorsements mentioned herein above shall read together and word or expression to which a specific meaning has been attached in any part of this Policy or of the Schedule shall bear the same meaning wherever it may appear. Any

amendments/modifications/alterations made on this system generated policy document is not valid and Company shall not be liable for any liability whatsoever arising from such changes. Any changes required to be made in the policy once issued, would be valid and effective, only after written request is made to the Company and

Company accepts the requested amendments/modifications/alterations and records the same through separate endorsement to be issued by the Company. You are advised to go through the policy schedule cum certificate of insurance which is issued based on your declaration and if any error/ discrepancy is found in respect of vehicle

details, No Claim Bonus or any other material information, it should be brought to our notice within 15 days of receipt of this policy for necessary correction along with the supporting documents, otherwise it will be deemed correct. You may visit company website at www.tataaiginsuarance.in for detailed benefits, terms & conditions &

exclusions of the policy. You may also reach us at our 24*7 helpline 1800 266 7780 in case you desire to have a printed copy of policy wording. Our grievance redressal procedure and details about ombudsman is also available in our policy wording. Please note that any misrepresentation, non disclosure or withholding of material facts will

lead to cancellation of policy ab initio with forfeiture of premium and non consideration of claim, if any. We will specifically seek confirmation on No Claim Bonus availed by you from your previous insurer. In case we receive confirmation that you had lodged claim with them then we will forfeit all the benefits under section I i.e. own damage

section of the policy.

POS PAN No: ACHPA7032M POS Aadhar No:

TATA AIG General Insurance Company Ltd. Regd. Office: 15th floor, Tower A, Peninsula Business Park,Ganpatrao Kadam Marg, Off Senapati Bapat Marg, Lower Parel, Mumbai- 400 013.

IRDA Registration No.108, CIN No : U85110MH2000PLC128425, PAN : AABCT3518Q, UIN No.: IRDAN108RP0007V01201819

Website: www.tataaig.com 24X7 Tollfree Helpline 1800-266-7780 E-mail: customersupport@tataaig.com

file:///C:/Users/nchinch3/Desktop/sarwan.htm 2/4

You might also like

- Performance-Based Road Maintenance Contracts in the CAREC RegionFrom EverandPerformance-Based Road Maintenance Contracts in the CAREC RegionNo ratings yet

- Electric Motorcycle Charging Infrastructure Road Map for IndonesiaFrom EverandElectric Motorcycle Charging Infrastructure Road Map for IndonesiaNo ratings yet

- Commercial Vehicle Policy ScheduleDocument1 pageCommercial Vehicle Policy ScheduleBhavesh RavalNo ratings yet

- Duster Insurance 2022Document6 pagesDuster Insurance 2022Roy ZachariahNo ratings yet

- Bajaj Allianz General Insurance Company002Document2 pagesBajaj Allianz General Insurance Company002sarath potnuriNo ratings yet

- Bajaj Allianz General Insurance CompanyDocument3 pagesBajaj Allianz General Insurance Companysarath potnuriNo ratings yet

- Iffco - Tokio General Insurance Co. LTD: Regd. Office: IFFCO SADAN, C1 Distt Centre, Saket, New Delhi-110017Document1 pageIffco - Tokio General Insurance Co. LTD: Regd. Office: IFFCO SADAN, C1 Distt Centre, Saket, New Delhi-110017Gireesh Kumar AllaNo ratings yet

- Auto Secure Private Car Package PolicyDocument6 pagesAuto Secure Private Car Package Policyniren4u1567No ratings yet

- AP39TS5226Bajaj Allianz General Insurance Company Ltd.Document2 pagesAP39TS5226Bajaj Allianz General Insurance Company Ltd.sarath potnuriNo ratings yet

- AP39TQ1723Bajaj Allianz General Insurance CompanyDocument2 pagesAP39TQ1723Bajaj Allianz General Insurance Companysarath potnuriNo ratings yet

- Quote (33)Document2 pagesQuote (33)Himanshu KamaneNo ratings yet

- Auto Secure - Two Wheeler Package Policy: Authorized SignatoryDocument5 pagesAuto Secure - Two Wheeler Package Policy: Authorized Signatoryrajabharath12No ratings yet

- Bajaj Allianz General Insurance CompanyDocument3 pagesBajaj Allianz General Insurance Companysarath potnuri0% (1)

- Prem Narayan Soni 14.12.2020Document2 pagesPrem Narayan Soni 14.12.2020Subhash Chandra MalviNo ratings yet

- 4064 Tata Magic InsuranceDocument4 pages4064 Tata Magic InsuranceAnil aachryaNo ratings yet

- Bajaj Allianz General Insurance CompanyDocument2 pagesBajaj Allianz General Insurance Companysarath potnuri0% (1)

- MR Palutla Subba Rao Your Policy Details: Tata AIG General Insurance Company LimitedDocument3 pagesMR Palutla Subba Rao Your Policy Details: Tata AIG General Insurance Company LimitedParshu NagNo ratings yet

- Bajaj Allianz General Insurance CompanyDocument2 pagesBajaj Allianz General Insurance Companysarath potnuriNo ratings yet

- Auto Secure Private Car Package PolicyDocument6 pagesAuto Secure Private Car Package PolicyVipin KumarNo ratings yet

- Page From OG-24-1701-1802-00492400Document1 pagePage From OG-24-1701-1802-00492400sanjeevmurmu81No ratings yet

- Yamaha R15 Insurance Policy PDFDocument1 pageYamaha R15 Insurance Policy PDFRohit Kumar SrivastavaNo ratings yet

- Your Policy DetailsDocument5 pagesYour Policy DetailsARUN JYOTHI A SNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument2 pagesBajaj Allianz General Insurance Company LTDrajvansh katiyarNo ratings yet

- HR98J5334 With All Cover BajajDocument2 pagesHR98J5334 With All Cover Bajajpankaj_97No ratings yet

- 6816 IcDocument2 pages6816 Icsuresh makalaNo ratings yet

- Your Policy DetailsDocument3 pagesYour Policy DetailsMaddur LavanyaNo ratings yet

- 6028 InsDocument3 pages6028 InsMuni RajuNo ratings yet

- Policy Bajaj Mahindra AlfaDocument4 pagesPolicy Bajaj Mahindra AlfaAnonymous GoeJBoNo ratings yet

- Shikha Sharma InsDocument2 pagesShikha Sharma InsSAMNo ratings yet

- Auto Secure - Two Wheeler Package Policy: Authorized SignatoryDocument5 pagesAuto Secure - Two Wheeler Package Policy: Authorized SignatoryR.k GamingNo ratings yet

- Certificate Cum Policy Schedule: MOTOR 2 WHEELER (PACKAGE POLICY) - UIN NO. IRDAN137P0017V01200809 - SAC Code. 997134Document1 pageCertificate Cum Policy Schedule: MOTOR 2 WHEELER (PACKAGE POLICY) - UIN NO. IRDAN137P0017V01200809 - SAC Code. 997134nagendra reddy panyamNo ratings yet

- POS - Motor Insurance - Miscellaneous Carrying ComprehensiveDocument3 pagesPOS - Motor Insurance - Miscellaneous Carrying ComprehensiveSwagatom SadangiNo ratings yet

- Bajaj Allianz General Insurance Company LTD.: Certificate Cum Policy ScheduleDocument2 pagesBajaj Allianz General Insurance Company LTD.: Certificate Cum Policy Schedulesarath potnuriNo ratings yet

- Motor Insurance - Motorcycle / Scooter Standalone Own Damage (Uin: Irdan545Rp0001V02201920) Policy ScheduleDocument2 pagesMotor Insurance - Motorcycle / Scooter Standalone Own Damage (Uin: Irdan545Rp0001V02201920) Policy ScheduleHemalalitha mNo ratings yet

- Rohit Thapliyal InsDocument2 pagesRohit Thapliyal InsSAMNo ratings yet

- PolicyDocument6 pagesPolicyMohit PandeyNo ratings yet

- Bajaj Allianz General Insurance Company LTD.: Certificate Cum Policy ScheduleDocument2 pagesBajaj Allianz General Insurance Company LTD.: Certificate Cum Policy Schedulesarath potnuriNo ratings yet

- Deepak Kumar Raw SWM Zakir Ali CCDocument4 pagesDeepak Kumar Raw SWM Zakir Ali CCBamnawat JasramNo ratings yet

- Auto Secure Private Car Package Policy: Your Policy Details: Akshay BhardwajDocument5 pagesAuto Secure Private Car Package Policy: Your Policy Details: Akshay BhardwajyashNo ratings yet

- Motor Insurance - Motorcycle / Scooter Standalone Own Damage (Uin: Irdan545Rp0001V02201920) Policy ScheduleDocument2 pagesMotor Insurance - Motorcycle / Scooter Standalone Own Damage (Uin: Irdan545Rp0001V02201920) Policy Schedulebalajimr758No ratings yet

- Birendra Cg12ac13172702003123p105284710Document2 pagesBirendra Cg12ac13172702003123p105284710abcdmoyeNo ratings yet

- KA14ER2268.PDF-Shkti PRVSNDocument2 pagesKA14ER2268.PDF-Shkti PRVSNImran KhanNo ratings yet

- Swarna Latha PolicyDocument3 pagesSwarna Latha PolicyShaik Chand BashaNo ratings yet

- Schedule of Premium (Amount in RS.)Document4 pagesSchedule of Premium (Amount in RS.)Nagaiah MadipeddiNo ratings yet

- Auto Secure Two Wheeler Package Policy: MR Abhijeet PatilDocument4 pagesAuto Secure Two Wheeler Package Policy: MR Abhijeet PatiltanmaystarNo ratings yet

- Ap02y4777 Ar Ic BajajDocument1 pageAp02y4777 Ar Ic BajajPrince AnjiNo ratings yet

- MOP6594797Document4 pagesMOP6594797Ådârsh DûßêyNo ratings yet

- Bike Insurance PolicyDocument2 pagesBike Insurance PolicyAnaruzzaman Sheikh0% (1)

- Orange FinDocument1 pageOrange Finisha selvamNo ratings yet

- Krosdok Supply Car Insurance Renewal 6Document6 pagesKrosdok Supply Car Insurance Renewal 6PiyaliNo ratings yet

- Mahinra Alfa Chi - RemovedDocument1 pageMahinra Alfa Chi - Removedsarath potnuriNo ratings yet

- Bajaj Allianz General Insurance CompanyDocument2 pagesBajaj Allianz General Insurance Companysarath potnuriNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument2 pagesBajaj Allianz General Insurance Company LTDsarath potnuri0% (2)

- Hardik Trilokbhai PatelDocument4 pagesHardik Trilokbhai PatelSaumil tevarNo ratings yet

- Policy Type-Product Name-: Policy & Owner Details Renew Auto Secure - Standalone Own Damage Two Wheeler PolicyDocument1 pagePolicy Type-Product Name-: Policy & Owner Details Renew Auto Secure - Standalone Own Damage Two Wheeler PolicyApurba MandalNo ratings yet

- Shaikh Abbasshaikh KasimDocument6 pagesShaikh Abbasshaikh KasimShaikh AbbasNo ratings yet

- RwservletDocument1 pageRwservletRajveer SinghNo ratings yet

- Auto Secure Private Car Package PolicyDocument5 pagesAuto Secure Private Car Package PolicyLalit SharmaNo ratings yet

- A H M Yariswamy PolicyDocument2 pagesA H M Yariswamy Policyasif qureshiNo ratings yet

- DL7CK7894 - Acko Insurance PolicyDocument1 pageDL7CK7894 - Acko Insurance PolicyTAUSEEF HASSANNo ratings yet

- Insurance Presentation - ClassDocument69 pagesInsurance Presentation - ClassSanbi AhmedNo ratings yet

- Digit Private Car Package Policy Schedule: (AKA The Paper You Pull Out When You Get Pulled Over)Document7 pagesDigit Private Car Package Policy Schedule: (AKA The Paper You Pull Out When You Get Pulled Over)Sahil ManeNo ratings yet

- AAMI Car Certificate of Insurance MPA101242740Document2 pagesAAMI Car Certificate of Insurance MPA101242740acftravel23No ratings yet

- Commercial Vehicle Policy WordingDocument13 pagesCommercial Vehicle Policy WordingHemant TyagiNo ratings yet

- STRONGHOLD INSURANCE COMPANY, INC. v. INTERPACIFIC CONTAINER SERVICES and GLORIA DEE CHONGDocument2 pagesSTRONGHOLD INSURANCE COMPANY, INC. v. INTERPACIFIC CONTAINER SERVICES and GLORIA DEE CHONGRoms RoldanNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document3 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)kalair motorsNo ratings yet

- YADU NATH MANDAL JH05BZ2512 HERO MOTOCORP GLAMOUR FI 2021-08-28 2022-08-27 Digit Two-Wheeler Liabilty Only PolicyDocument2 pagesYADU NATH MANDAL JH05BZ2512 HERO MOTOCORP GLAMOUR FI 2021-08-28 2022-08-27 Digit Two-Wheeler Liabilty Only PolicyAkash KumarNo ratings yet

- Jaswant Singh Policy #: 1-2457U0F6 P400 Policy # MM669182: Signature Not VerifiedDocument3 pagesJaswant Singh Policy #: 1-2457U0F6 P400 Policy # MM669182: Signature Not VerifiedyogeshNo ratings yet

- Company Profile IndosuranceDocument27 pagesCompany Profile Indosurancetheofiluz yolanNo ratings yet

- Aa-Plc 2021Document103 pagesAa-Plc 2021gaja babaNo ratings yet

- CorrespondenceDocument23 pagesCorrespondenceMihaela IleanaNo ratings yet

- Ap 37 TC 3646Document2 pagesAp 37 TC 3646sarath potnuriNo ratings yet

- Krunal PatelDocument4 pagesKrunal Patelpkrunal643No ratings yet

- 2024 Auto Show Vehicle Giveaway RulesDocument3 pages2024 Auto Show Vehicle Giveaway RulesWKYC.comNo ratings yet

- NTH Month: Three Party Agreement Template - Docx Page 1 of 6Document6 pagesNTH Month: Three Party Agreement Template - Docx Page 1 of 6Marvy QuijalvoNo ratings yet

- Lynn Cantwell An Architect Organized Cantwell Architects On July 1Document1 pageLynn Cantwell An Architect Organized Cantwell Architects On July 1trilocksp SinghNo ratings yet

- I20 InsuranceDocument6 pagesI20 Insurancesain idiishNo ratings yet

- Airen B. Ramirez PDFDocument5 pagesAiren B. Ramirez PDFBenjonit CapulongNo ratings yet

- Schedule Cum Certificate of Insurance: Chola Standalone Own Damage Policy For Two Wheeler - UIN: IRDAN123RP0003V01201920Document3 pagesSchedule Cum Certificate of Insurance: Chola Standalone Own Damage Policy For Two Wheeler - UIN: IRDAN123RP0003V01201920psakhareNo ratings yet

- Policy DocumentDocument26 pagesPolicy DocumentZak BradleyNo ratings yet

- Vehicle Rental Agreement PDF 2Document4 pagesVehicle Rental Agreement PDF 2Liz BethNo ratings yet

- ISHRAT AFZA National Insurance Certificate of Insurance Cum Policy Shedule Ok TestedDocument1 pageISHRAT AFZA National Insurance Certificate of Insurance Cum Policy Shedule Ok TestedAnil SharmaNo ratings yet

- Agent Name Policybazaar Insurance Wa PVT LTD Agent Code Imd1046412 Agent Contact No 1800208878Document1 pageAgent Name Policybazaar Insurance Wa PVT LTD Agent Code Imd1046412 Agent Contact No 1800208878Mohit YaduvanshiNo ratings yet

- Eastern Shipping v. PrudentialDocument5 pagesEastern Shipping v. PrudentialKara SolidumNo ratings yet

- Auto Secure Private Car Package PolicyDocument8 pagesAuto Secure Private Car Package PolicyYOGI NANDESARINo ratings yet

- Claim Underwriting Guide LineDocument7 pagesClaim Underwriting Guide LineDhin Mohammed MorshedNo ratings yet

- Welcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Document4 pagesWelcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Loan LoanNo ratings yet

- RO/07/R7/YD: Valabilitate - V A L I DDocument2 pagesRO/07/R7/YD: Valabilitate - V A L I DLily MeryNo ratings yet

- Insurance Against Third Party RisksDocument10 pagesInsurance Against Third Party RisksDeeptangshu Kar100% (1)