Professional Documents

Culture Documents

Tax Invoice: Customer GSTIN No.: Place of Supply: Document Type

Uploaded by

Prince Pandey0 ratings0% found this document useful (0 votes)

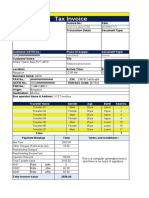

15 views1 pageThis tax invoice summarizes the details of a bus travel transaction from Bangalore to Mumbai. It lists 7 travelers with details like name, gender, age, berth and seat number. It provides the payment breakdown showing a total bus fare of Rs. 2500, other charges of Rs. 15.50 and an operator discount of Rs. 100 for a total taxable value of Rs. 2415.50. The invoice further specifies the CGST at 2.5% of Rs. 60.39, SGST at 2.5% of Rs. 60.39 and a total invoice value of Rs. 2536.28.

Original Description:

Original Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis tax invoice summarizes the details of a bus travel transaction from Bangalore to Mumbai. It lists 7 travelers with details like name, gender, age, berth and seat number. It provides the payment breakdown showing a total bus fare of Rs. 2500, other charges of Rs. 15.50 and an operator discount of Rs. 100 for a total taxable value of Rs. 2415.50. The invoice further specifies the CGST at 2.5% of Rs. 60.39, SGST at 2.5% of Rs. 60.39 and a total invoice value of Rs. 2536.28.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views1 pageTax Invoice: Customer GSTIN No.: Place of Supply: Document Type

Uploaded by

Prince PandeyThis tax invoice summarizes the details of a bus travel transaction from Bangalore to Mumbai. It lists 7 travelers with details like name, gender, age, berth and seat number. It provides the payment breakdown showing a total bus fare of Rs. 2500, other charges of Rs. 15.50 and an operator discount of Rs. 100 for a total taxable value of Rs. 2415.50. The invoice further specifies the CGST at 2.5% of Rs. 60.39, SGST at 2.5% of Rs. 60.39 and a total invoice value of Rs. 2536.28.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

Tax Invoice

Invoice No.: Date:

2022-012-abcd-0789 DD/MM/YYYY

Transaction Detail: Document Type:

LOGO

Customer GSTIN No.: Place Of Supply: Document Type:

29AZ############### Karnataka Invoice

Customer Name: TIN:

Simply Vyapar Apps PVT LMTD.

TINXXXXXXXXXXXX

Location: Arrival Time : Departure Time:

Bangalore 12:00 AM 12:00 PM

Business Name: ABCD

PAN No.: ################ CIN: 987812rw5rtvsjh9

GSTIN No.: 29AZ############# HSN/SAC Code: 977822

PNR No.: XX##XX##XX

Origin: Bangalore

Destination: Mumbai

Bus operator Name & Address: XYZ Travellers

Traveller Name Gender Age Berth Seat No.

Traveller 01 Male 25yrs Upper 1

Traveller 02 Female 25yrs Upper 2

Traveller 03 Male 25yrs Upper 3

Traveller 04 Female 25yrs Upper 4

Traveller 05 Male 25yrs Lower 15

Traveller 06 Female 25yrs Lower 16

Traveller 07 Male 25yrs Lower 17

Total 7

Payment Breakup Total Terms and Conditions :

Bus Fare 2500.00

Other Charges (Toll+Levies etc) 15.50

Resheduling Charges

Rescheduling Excess Fare

Operator Discount 100.00

This is a computer generated invoice

Total Taxable Value 2415.50 and there is no need of signature.

IGST Rate 0.0% 0

CGST Rate 2.5% 60.39

SGST Rate 2.5% 60.39

Total Invoice Value 2536.28

You might also like

- Bus Ticket Format 04Document1 pageBus Ticket Format 04nightbuzzerNo ratings yet

- Bus Ticket Format 01Document1 pageBus Ticket Format 01nightbuzzerNo ratings yet

- Tax Invoice: Customer GSTIN No.: Place of Supply: Document TypeDocument2 pagesTax Invoice: Customer GSTIN No.: Place of Supply: Document TypeBaskaran RNo ratings yet

- Bus Ticket Format 01Document2 pagesBus Ticket Format 01Rajan TiwariNo ratings yet

- Bus Ticket Format 04Document1 pageBus Ticket Format 04Anshu SharmaNo ratings yet

- ShowreportDocument1 pageShowreportUtpal PalNo ratings yet

- Ticket 11056138 180321104456Document1 pageTicket 11056138 180321104456Binod Kumar PadhiNo ratings yet

- ShowreportDocument1 pageShowreportUtpal PalNo ratings yet

- Ticket Duplicate10736293 180224093338Document1 pageTicket Duplicate10736293 180224093338NatarajNo ratings yet

- ShowreportDocument1 pageShowreportAMALESH DEYNo ratings yet

- ShowreportDocument1 pageShowreportSuman duttaNo ratings yet

- E-Ticket/Reservation Voucher: Seat No/s: Passenger InformationDocument1 pageE-Ticket/Reservation Voucher: Seat No/s: Passenger InformationSANURASAGARNo ratings yet

- GOBUSAND7351F0D440Document2 pagesGOBUSAND7351F0D440YashNo ratings yet

- E-Ticket/Reservation Voucher: Seat No/s: Passenger InformationDocument1 pageE-Ticket/Reservation Voucher: Seat No/s: Passenger InformationSANURASAGARNo ratings yet

- E Way Bill Format1Document1 pageE Way Bill Format1SherinNo ratings yet

- AC GST Tax InvoiceDocument1 pageAC GST Tax Invoiceanbu.jerome01No ratings yet

- CRB25021903199Document2 pagesCRB25021903199amresh gokulNo ratings yet

- Qrcode: Electronic Reservation Slip Irctc E Ticketing Service (Agent)Document2 pagesQrcode: Electronic Reservation Slip Irctc E Ticketing Service (Agent)Kiran PradhanNo ratings yet

- Pritam KhanDocument1 pagePritam KhanpritamkharoyNo ratings yet

- Convocation Fee-1Document2 pagesConvocation Fee-1Rakshitha K MNo ratings yet

- Rahul 24 12 Pryj STDocument1 pageRahul 24 12 Pryj STMohit LahotiNo ratings yet

- AC GST Tax InvoiceDocument3 pagesAC GST Tax InvoiceVijay KumarNo ratings yet

- Invoice No.59 Durga Stone (Sedum)Document2 pagesInvoice No.59 Durga Stone (Sedum)sales.saimedhaNo ratings yet

- GSRTC PDFDocument1 pageGSRTC PDFamitNo ratings yet

- Thank You For E-Ticketing. Wishes You A Pleasant Journey and Hopes To Serve You Again in FutureDocument1 pageThank You For E-Ticketing. Wishes You A Pleasant Journey and Hopes To Serve You Again in FutureSujan MajiNo ratings yet

- Ticket Duplicate10528006 180221112540Document1 pageTicket Duplicate10528006 180221112540NatarajNo ratings yet

- Invoice No.62 BBM (Foundation Bolts)Document2 pagesInvoice No.62 BBM (Foundation Bolts)sales.saimedhaNo ratings yet

- Tax Invoice: Dehradun DelhiDocument1 pageTax Invoice: Dehradun DelhiViraz DobiyalNo ratings yet

- PNR NO: 2718953001 Transaction ID: 100003296918225Document1 pagePNR NO: 2718953001 Transaction ID: 100003296918225Ritika SharmaNo ratings yet

- TR3P93640730Document2 pagesTR3P93640730Vijay KasinadhuniNo ratings yet

- 141 Flydubai: Only Unused Taxes Refund OnlyDocument2 pages141 Flydubai: Only Unused Taxes Refund OnlyAli KhanNo ratings yet

- Satish Krishna (PDR Mumbai)Document1 pageSatish Krishna (PDR Mumbai)Supri DhumalNo ratings yet

- Onward Journey Ticket Details E-Ticket Advance Reservation: ID Proof NoteDocument2 pagesOnward Journey Ticket Details E-Ticket Advance Reservation: ID Proof NoteDileep KumarNo ratings yet

- Sharma JiDocument1 pageSharma JiAjay GuptaNo ratings yet

- AC GST Tax InvoiceDocument1 pageAC GST Tax InvoiceArnab AdhikariNo ratings yet

- GAURAVDocument1 pageGAURAVMOHAN ChandNo ratings yet

- Ahmedabad ReturnDocument1 pageAhmedabad Returnketandabhi777No ratings yet

- GSRTCDocument1 pageGSRTCimurjasoniNo ratings yet

- FASTag - 24.01.2024Document2 pagesFASTag - 24.01.2024aman04patNo ratings yet

- TN02S3987 FASTag Statement 1701397321963Document2 pagesTN02S3987 FASTag Statement 1701397321963ST COMMNICATIONNo ratings yet

- Acronyms: RLWL: Remote Location Waitlist PQWL: Pooled Quota Waitlist RSWL: Road-Side WaitlistDocument3 pagesAcronyms: RLWL: Remote Location Waitlist PQWL: Pooled Quota Waitlist RSWL: Road-Side WaitlistMd Toufique AhmedNo ratings yet

- Gmail - Redbus Ticket - TP2N23214654Document1 pageGmail - Redbus Ticket - TP2N23214654Praful ThakreNo ratings yet

- WL WL: Irctcs E-Ticketing Service Electronic Reservation Slip (Agent)Document1 pageWL WL: Irctcs E-Ticketing Service Electronic Reservation Slip (Agent)Omkar SawantNo ratings yet

- Buses List ONLINE BUS TICKET BOOKINGS Raj Rat PDFDocument1 pageBuses List ONLINE BUS TICKET BOOKINGS Raj Rat PDFshubh chourasiaNo ratings yet

- Https WWW - Irctc.co - in Eticketing Printticket - JSF PNR 2253304869 B 17-Dec-2018 0 PDFDocument1 pageHttps WWW - Irctc.co - in Eticketing Printticket - JSF PNR 2253304869 B 17-Dec-2018 0 PDFसद्दाम हुसैनNo ratings yet

- Current Booking Current Booking: Irctcs E-Ticketing Service Electronic Reservation Slip (Agent)Document2 pagesCurrent Booking Current Booking: Irctcs E-Ticketing Service Electronic Reservation Slip (Agent)Aman KarlupiaNo ratings yet

- Pnbe To BeDocument1 pagePnbe To BeKhushi GuptaNo ratings yet

- AP02AJ0294Document1 pageAP02AJ0294SWAMYNo ratings yet

- NR7625459356207507 ETicketDocument4 pagesNR7625459356207507 ETicketTanushree BiswasNo ratings yet

- GOBUSANDD9E0AD89B2Document1 pageGOBUSANDD9E0AD89B2Kishan GhetiaNo ratings yet

- GSRTCDocument1 pageGSRTCnoptary567No ratings yet

- Wa0001.Document2 pagesWa0001.reality171200No ratings yet

- Electronic Reservation Slip IRCTC E Ticketing Service (Agent)Document2 pagesElectronic Reservation Slip IRCTC E Ticketing Service (Agent)atul shahareNo ratings yet

- Caf DeliveryDocument4 pagesCaf Deliveryprem.sNo ratings yet

- Electronic Reservation Slip IRCTC E-Ticketing Service (Agent)Document1 pageElectronic Reservation Slip IRCTC E-Ticketing Service (Agent)Anurag SinghNo ratings yet

- TR6C53707024Document1 pageTR6C53707024Radha MuraliNo ratings yet

- AP02AB4172Document1 pageAP02AB4172SWAMYNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip (Agent)Document1 pageIrctcs E-Ticketing Service Electronic Reservation Slip (Agent)9990400390 9990400390No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet