Professional Documents

Culture Documents

CBDT Instructions 12032021

Uploaded by

Vedaprakash Manavalan0 ratings0% found this document useful (0 votes)

10 views1 pagecbdt instructions

Original Title

CBDT-Instructions-12032021

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcbdt instructions

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageCBDT Instructions 12032021

Uploaded by

Vedaprakash Manavalancbdt instructions

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

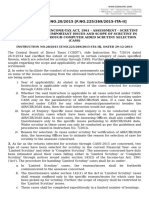

F.No.225/40/2021/1TA-L

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

ew Delhi, the — March,2021

To

All Principal Chief Commissioners of Income-tax

Madam/Sir,

Subject: Instruetions regarding selection of cases for issue of notice u/s 148 of the Income-tax Act, 1961-

clarification to CBDT’s letter dated 04.03.2021-reg

1. With reference to CBDT’s Instruction dated 04.03.2021 on the above-mentioned subject, it has been

decided to clarify as under:

(@) The ‘potential cases’ at Point no.1(iii) mean the cases flagged by the Directorate of Tncome-tax

(Systems) subsequent to 04.03.2021. It is further clarified that the NMS cases flagged earlier will get

subsumed in the new list.

(b) With respect to criterion at Point no.1(v), it is clarified that ‘any other Income-tax Authority’ includes

the Assessing Officer (A.O.) herself/himself. Purther, the information received as per Point no.1(v) shall not

include information received from Directorate of Income-tax (Investigation), Central Charges and

Directorate of Income-tax (Intelligence and Criminal Investigation) after 01,04.2019.

() With respect to the condition at Point no. 1(v), that cases are to be considered as potential cases for issue

of notice w/s,148 of the Act ‘with the approval of CCIT concerned’. it is clarified that the CIT shall call for

the list of the potential cases along with details and evidences from the Subordinate Authorities and shall,

after careful examination, suggest to the A.O., the potential cases to be taken for consideration for action w/s

148 of the Act.

2. Subsequent to the issuance of notice u/s 148 of the Act, the A.O, shall upload all the underlying documents,

relied upon and satisfaction recorded, in the ITBA Module for all category of cases in Para no.1 of CBDT's

Instruction dated 04.03.2021.

3. This issues with the approval of Chairman, CBDT.

X rven

“13103|221

(Ravinder Maini)

Director (ITA-ID, CBDT.

Copy to:

i, PS to FM/PS to MoS(F)

PS to Revenue Secretary

iii, Chairman, CBDT & Ali Members, CBDT

iv. All Pr.DGsIT/DGsIT

v. All Joint Secretaries/CsIT, CBDT

vi. _JCIT, Data-Base Cell for uploading on irsofficersonline website

TN piox)p024

(Ravinder Maini)

Director (ITA-II), CBDT

You might also like

- Commentary For Fin Act 21-Sec9bDocument13 pagesCommentary For Fin Act 21-Sec9bVedaprakash ManavalanNo ratings yet

- Article 2Document7 pagesArticle 2Vedaprakash ManavalanNo ratings yet

- Sec 149Document2 pagesSec 149Vedaprakash ManavalanNo ratings yet

- Sec 149 ClarificationDocument6 pagesSec 149 ClarificationVedaprakash ManavalanNo ratings yet

- Section 153C Income Tax Act 1961 FA 2022Document3 pagesSection 153C Income Tax Act 1961 FA 2022Vedaprakash ManavalanNo ratings yet

- 148A ArticleDocument17 pages148A ArticleVedaprakash ManavalanNo ratings yet

- FitnessDocument9 pagesFitnessVedaprakash ManavalanNo ratings yet

- Cass 2014Document2 pagesCass 2014Vedaprakash ManavalanNo ratings yet

- (1968) 67 ITR 213 (Gujarat) (27-07-1967) Lalji Haridas vs. Commissioner of Income-TaxDocument3 pages(1968) 67 ITR 213 (Gujarat) (27-07-1967) Lalji Haridas vs. Commissioner of Income-TaxVedaprakash ManavalanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)