Professional Documents

Culture Documents

CM121.COAIL I Question CMA September 2022 Exam.

Uploaded by

newazOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CM121.COAIL I Question CMA September 2022 Exam.

Uploaded by

newazCopyright:

Available Formats

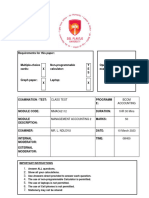

CMA SEPTEMBER-2022 EXAMINATION

INTERMEDIATE LEVEL I

COST ACCOUNTING

Course Code : CM121 Total Marks : 100

Reading Time : 15 minutes Writing Time : 180 minutes

Instructions to Candidates

You MUST NOT write anything during the reading time.

You should attempt ALL questions.

Answers should be properly structured and relevant.

Carefully read ALL the requirements and sub-questions before attempting a specific

question.

ALL answers must be written in the answer book.

AVOID WRITING/MARKING on the question paper at any time which may cause

disciplinary action.

Start answering each question from a fresh sheet.

Answers should be clearly numbered with the sub-question number.

Allowable Materials

Writing Stationaries

Non-programmable Calculator

Assessment Structure

Sub- Expected Time

Marks

question Required

Question 1 Multiple Choice Questions 10 10 20 minutes

Section

Question 2 Modified True/False 5 5 10 minutes

A

Question 3 Matching 5 5 10 minutes

Question 4 Essay/Computational/Case 3 20 32.50 minutes

Section Question 5 Essay/Computational/Case 3 20 32.50 minutes

B Question 6 Essay/Computational/Case 3 20 32.50 minutes

Question 7 Essay/Computational/Case 3 20 32.50 minutes

Revision 10 minutes

Total 100 180 minutes

RESTRICTED USE

This paper MUST NOT BE REMOVED from the examination venue

Do not turn the page until instructed

SECTION A [20 MARKS]

THERE ARE 3 (THREE) QUESTIONS IN THIS SECTION. ANSWER ALL THE QUESTIONS IN

THE ANSWER SCRIPT FOLLOWING THE EXAMPLE PROVIDED FOR THE SPECIFIC

QUESTION.

QUESTION 1 [10 × 1 = 10 Marks]

There are ten (10) multiple-choice questions with five options. Pick the option that best explains

the given question. Write your answer on the answer script [DO NOT PUT ANY MARK ON THE

QUESTION PAPER]. Follow the example given below in providing your answer.

Example:

(i) ICMAB stands for the –

(a) Institute of Cost Management Accounting of Bangladesh

(b) Institute of Cost and Management Accountants of Bangladesh

(c) Institute for Cost Managers and Accounting of Bangladesh

(d) Institute of Cost Management Accountants of Bangladesh

(e) Industrial Cost Management Accountants of Bangladesh

Answer: (i) (b)

(i) All of the following are the characteristics of early centuries’ manufacturing environment

and information requirement EXCEPT:

(a) Mass production of few standardized products

(b) Widely accepted concept of ‘economies of scale’

(c) Activity-based management

(d) Narrow product focus

(e) Focused on directly measured cost

(ii) Cost and expense differ in that:

(a) Cost is a part of expense

(b) Expense is a part of cost

(c) Cost is short-term and expense is long-term

(d) Cost is small and expense is large

(e) There is no connection between them

(iii) Job-order costing deals with:

(a) Customized goods

(b) Non-customized goods

(c) Similar goods and mass production

(d) Dissimilar goods and mass production

(e) All goods that are available in the market

(iv) Which of following is not an example of process costing?

(a) Brick field

(b) Tailors shop

(c) Shoe company

(d) Electric organization

(e) Food company

CMA September 2022 Examination, CM121 [Page 2 of 8]

(v) Contract costing is a part of:

(a) Process costing

(b) Activity-based costing

(c) Marginal costing

(d) Job-order costing

(e) Target costing

(vi) Variance analysis is discussed in:

(a) Relevant costing

(b) Traditional costing

(c) Absorption costing

(d) Contract costing

(e) Standard costing

(vii) Which of the following is not a method of joint cost allocation?

(a) Physical measure

(b) Sales at split-off

(c) Equal distribution

(d) Net realizable value

(e) Constant gross margin NRV

(viii) Relevant costs usually refer to:

(a) Indirect costs

(b) Direct and indirect costs

(c) Fixed costs

(d) Variable costs

(e) Variable and fixed costs

(ix) Which of the following is prevention cost?

(a) Quality training

(b) Inspection of materials

(c) Field testing

(d) Scrap

(e) Lost sales

(x) Service costing is suitable for:

(a) Construction company

(b) Furniture company

(c) Food company

(d) Fabric company

(e) Transportation company

CMA September 2022 Examination, CM121 [Page 3 of 8]

QUESTION 2 [5 × 1 = 5 Marks]

There are five (5) statements given under the question. Identify the statements as True or

False. If the statement is false, rewrite the statement on the answer script to make it ‘True’.

Reasoning is NOT required. Follow the example given below in providing your answer.

Example:

(a) ICMAB stands for the Industrial Cost Management and Accounting of Bangladesh.

Answer:

(a) False. ICMAB stands for the Institute of Cost and Management Accountants of

Bangladesh.

Note:

You will not get any mark if you simply rewrite as ICMAB does not stand for the

Industrial Cost Management Accountants of Bangladesh.

If the statement is true, you need NOT to rewrite the statement rather only mention

that the statement is True.

(a) All overhead costs are indirect costs.

(b) Conversion cost is equal to prime cost plus manufacturing overhead.

(c) External failure cost occurs before the sales of products.

(d) Opportunity cost is the cost of next best alternative.

(e) Contribution margin is synonymous to gross margin.

QUESTION 3 [5 × 1 = 5 Marks]

Match the items of column A with the most suitable items of column B. Match only one item of

column A with one item of column B. Write your answer on the answer script. Follow the

example given below in providing your answer.

Example:

Column A Column B

(i) ICMAB (a) Professional accountancy body

(b) University

Answer: (i) (a)

Column A Column B

(i) Inter process profit (a) Material mix variance

(ii) Material usage sub variance (b) Valued at cost.

(iii) Work uncertified (c) Assessing the performance of the process

operations.

(iv) Life cycle costing (d) Production of standardized goods.

(v) Job Ticket (e) Not useful for controlling cost.

(f) No profit should be taken into account.

(g) A method of Time Booking

(h) A Technique of Inventory Control

(i) Design costs

(j) Cost driver

END OF SECTION A

CMA September 2022 Examination, CM121 [Page 4 of 8]

SECTION B [80 MARKS]

THERE ARE 4 (FOUR) QUESTIONS IN THIS SECTION. ANSWER ALL THE QUESTIONS IN

THE ANSWER SCRIPT. SHOW ALL RELEVANT COMPUTATION.

QUESTION 4 [4+6+10 = 20 Marks]

(a) What do you mean by economic order quantity? How does it help an organization to

minimize the inventory cost?

(b) Calculate the total monthly remuneration of three workers: A, B, and C from the following

data:

(i) Standard production per month per worker 2,000 units. Actual production during the

month:

A: 1,800 units

B: 1,600 ”

C: 1,900 ”

(ii) Piece work rate is 40 paisa per unit of actual production.

(iii) Additional production bonus is Tk. 10 for each percentage of actual production

exceeding 80% of standard production.

(c) Barilgaon Company has three production departments and two service departments. For

the month of April 2021, the departmental expenses were as follows:

Production departments: Tk.

A 50,000

B 30,000

C 40,000

Service departments:

X 10,000

Y 8,000

Total 138,000

The overhead costs of service departments are apportioned on the following basis:

Department A B C X Y

X 20% 40% 30% - 10%

Y 40% 20% 20% 20% -

Required:

Show the distribution of service departments’ overhead costs to production departments

under the following methods:

(i) Repeated distribution method;

(ii) Simultaneous equation method.

QUESTION 5 [8+4+8 = 20 Marks]

(a) Seedy manufactures one product, and the entire product is sold as soon as it is produced.

There is no opening or closing inventories and work in progress is negligible. The

company operates a standard costing system and analysis of variances is made every

month. The standard cost card for the product, a boomerang, is as follows.

STANDARD COST CARD Tk.

Direct materials 0.5 kilos at Tk. 4 per kilo 2.00

Direct wages 2 hours at Tk. 2.00 per hour 4.00

Variable overheads 2 hours at Tk. 0.30 per hour 0.60

Fixed overhead 2 hours at Tk. 3.70 per hour 7.40

Standard cost 14.00

Standard profit 6.00

Standing selling price 20.00

CMA September 2022 Examination, CM121 [Page 5 of 8]

Selling and administration expenses are not included in the standard cost, and are deducted

from profit as a period charge. Budgeted (planned) output for the month of June 2022 was

5,100 units. Actual results for June 2022 were as follows:

Production of 4,850 units was sold for Tk. 95,600.

Materials consumed in production amounted to 2,300 kgs at a total cost of Tk. 9,800. Labor

hours paid for amounted to 8,500 hours at a cost of Tk.16,800.

Actual operating hours amounted to 8,000 hours. Variable overheads amounted to Tk. 2,600.

Fixed overheads amounted to Tk. 42,300.

Selling and administration expenses amounted to Tk.18,000.

Required:

Calculate all variances and prepare an operating statement for the month ended 30 June 2022.

(b) Alpha Inc. makes one main product, AZ-3, and a by-product, PA-5. The estimated sales

value of the units of PA-5 produced during the month is Tk. 5,000. Assuming that the

value of the by-product is treated as a reduction in cost of the main product, prepare the

journal entries to record the placing of PA-5 in stock and the subsequent sale of it for Tk.

4,000, on account.

(c) Kalatia Company manufactures only one product that is available in both a Deluxe model

and a Regular model. The company has manufactured the Regular model for years and

the Deluxe model was recently introduced. The company is concerned about the accuracy

of its costing system because profits are declining since the Deluxe model was

introduced.

Indirect production costs are assigned to the products using direct labor hours. For the

current year, the company estimates Tk. 2,000,000 of indirect production costs and

40,000 direct labor hours. They expect to produce 5,000 units of the Deluxe model and

40,000 units of the Regular model. The Deluxe model requires 1.6 hours of direct labor

time per unit and the Regular model requires 0.8 hours. Other costs are as follows:

Costs Deluxe Model Regular Model

Direct materials Tk. 150 Tk. 112

Direct labor Tk. 16 Tk. 8

Assume the company's indirect production costs can be traced to four activities with the

following cost drivers:

Activity (Cost Driver) Costs

Purchase orders (number of purchase orders) Tk. 84,000

Rework orders (number of rework orders) Tk. 216,000

Product testing (number of tests) Tk. 450,000

Machining (number of machine hours) Tk. 1,250,000

Cost Drivers Deluxe Model Regular Model

Number of purchase orders 400 600

Number of rework orders 200 600

Number of tests 4,000 6,000

Number of machine hours 20,000 30,000

Required:

(i) Assume direct labor hours are the only cost-allocation base. What is the cost to

manufacture one unit of each model?

(ii) Assume the activity-based costing method is used. What is the cost to manufacture

one unit of each model?

CMA September 2022 Examination, CM121 [Page 6 of 8]

QUESTION 6 [3+9+8 = 20 Marks]

(a) Discuss briefly the salient features of service costing.

(b) The following data relate to a process of a single product in a manufacturing

company for the month of April 2021:

% Units Tk.

(a) Opening work-in-process 10,000

Degree of completion:

Raw materials 100 60,000

Labour 60 36,000

Overheads 60 18,000

(b) Receipts from previous process 100,000 427,500

(c) Expenses incurred during the month:

Raw materials 197,500

Labour 345,575

Overheads 172,800

(d) Closing work-in-process 7,500

Degree of completion:

Raw materials 100

Labour & overheads 50

(e) Scrapped units 10,000

Degree of completion:

Raw materials 100

Labour & overheads 80

(f) Normal loss 5% of current input

(g) Spoiled units sold @ Tk. 1.50 each

Units completed are transferred to warehouse. The company uses the FIFO

method of valuation.

Required: Prepare:

(i) Statement of equivalent units.

(ii) Statement of cost per equivalent unit and total cost.

(iii) Process account.

(c) New Construction Ltd. is engaged in a contract during the year. Following information is

available at the year end.

Particulars Amount (Tk.)

Contract price 6,00,000

Material delivered direct to site 1,20,000

Materials issued from stores 40,000

Materials returned to stores 4,000

Materials at site at the end of year 22,000

Direct labor payments 1,40,000

Direct expenses 60,000

Architect's fees 2,500

Establishment charges 24,500

Plant installed at cost 80,000

Value of plant at the end of year 65,000

Accrued wages at the end of year 10,000

Accrued expenses at the end of year 6,000

Cost of contract not certified by architect 23,000

Value of contract certified by architect 4,20,000

Cash received from contractor 3,78,000

During the period, materials amounting to Tk. 9,000 have been transferred to another

contract to another place. You are required to show the Contract Account.

CMA September 2022 Examination, CM121 [Page 7 of 8]

QUESTION 7 [4+4+12 = 20 Marks]

(a) Cost associated with the quality of conformance can be broken down into four broad

groups. What are these four groups and how do they differ?

(b) Given the strong cost orientation in a target costing environment, there is obviously a

considerable role for the cost accountant on a design team. What are the specific

activities and required skills of this person?

(c) The marketing department at Taranagar Manufacturing has an idea for a new product that

is expected to have a life cycle of 5 years. After conducting market research, the company

has determined that the product could sell for Tk. 250 per unit in the first 3 years of life

and Tk. 175 per unit for the last 2 years. Units expected to sell are as follows:

Year 1 3,000 units

Year 2 4,500 units

Year 3 4,800 units

Year 4 5,000 units

Year 5 1,500 units

Per unit variable selling costs are estimated at Tk. 30 through the product’s life; annual

fixed selling and administrative costs are expected to be Tk. 350,000. Taranagar

Manufacturing desires a profit margin of 20% of selling price per unit.

Required:

(i) Compute the life cycle target cost to manufacture the product.

(ii) If the company expects the product to cost Tk. 65 to manufacture in the first year

what can the maximum manufacturing cost be in the following 4 years.

(iii) Assume Taranagar Manufacturing engineers conclude that the expected

manufacturing cost per unit is Tk. 70. What action might the company take to reduce

this cost?

END OF SECTION B

CMA September 2022 Examination, CM121 [Page 8 of 8]

You might also like

- Production Management ExamDocument4 pagesProduction Management ExamKhalid Abedrabo100% (3)

- Study of Cost Accounting and AnalysisDocument410 pagesStudy of Cost Accounting and AnalysisloknathNo ratings yet

- 151 0106Document37 pages151 0106api-27548664No ratings yet

- ICAEW MI - Question BankDocument350 pagesICAEW MI - Question BankDương NgọcNo ratings yet

- Battle of Five Armies - GW PDFDocument34 pagesBattle of Five Armies - GW PDFJustin Larson88% (17)

- CM121.COA (IL-I) Question CMA May-2023 Exam.Document7 pagesCM121.COA (IL-I) Question CMA May-2023 Exam.Md FahadNo ratings yet

- CM121.COAIL I Question CMA May 2022 ExaminationDocument8 pagesCM121.COAIL I Question CMA May 2022 ExaminationnewazNo ratings yet

- CM121.COAIL I Question CMA Janauary 2022 ExaminationDocument7 pagesCM121.COAIL I Question CMA Janauary 2022 ExaminationnewazNo ratings yet

- CM121.Question September-2023 Exam.Document8 pagesCM121.Question September-2023 Exam.Arif HossainNo ratings yet

- CM231.MAC (IL-II) Question CMA May-2023 Exam.Document7 pagesCM231.MAC (IL-II) Question CMA May-2023 Exam.Md FahadNo ratings yet

- 4.EF232.FIM (IL-II) Question CMA January-2023 Exam.Document7 pages4.EF232.FIM (IL-II) Question CMA January-2023 Exam.nobiNo ratings yet

- EF113.EIBF .L Question CMA September 2022 Exam.Document9 pagesEF113.EIBF .L Question CMA September 2022 Exam.MD Mahmudul HasanNo ratings yet

- 3.EF232.FIMIL II Question CMA September 2022 Exam.Document8 pages3.EF232.FIMIL II Question CMA September 2022 Exam.nobiNo ratings yet

- FR111.FFAF - .L Question CMA May 2022 Examination PDFDocument8 pagesFR111.FFAF - .L Question CMA May 2022 Examination PDFMohammed Javed UddinNo ratings yet

- Fr111.Ffa (F.L) Question Cma May-2023 Exam.Document7 pagesFr111.Ffa (F.L) Question Cma May-2023 Exam.sshahed007No ratings yet

- Paper8 Set1 AnsDocument19 pagesPaper8 Set1 AnsMd sarfarajNo ratings yet

- FR111.FFAF - .L Question CMA September 2022 Exam.Document9 pagesFR111.FFAF - .L Question CMA September 2022 Exam.Mohammed Javed UddinNo ratings yet

- MCQ Chapter 6 & 7Document5 pagesMCQ Chapter 6 & 7Menu GargNo ratings yet

- AA133.AUDIL II Question CMA May 2022 ExaminationDocument7 pagesAA133.AUDIL II Question CMA May 2022 Examinationkm nafizNo ratings yet

- Question Paper ModelDocument20 pagesQuestion Paper Modelahlaam sameerNo ratings yet

- TA112.BQAF - .L Question CMA September 2022 Exam.Document9 pagesTA112.BQAF - .L Question CMA September 2022 Exam.Mohammed Javed UddinNo ratings yet

- FR 222.IFAIL I Question CMA May 2022 ExaminationDocument9 pagesFR 222.IFAIL I Question CMA May 2022 Examinationrumelrashid_seuNo ratings yet

- TA112.BQAF - .L Question CMA May 2022 ExaminationDocument8 pagesTA112.BQAF - .L Question CMA May 2022 ExaminationMohammed Javed UddinNo ratings yet

- CMFM June 19Document23 pagesCMFM June 19Sannu VijayeendraNo ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument14 pagesIntermediate Examination: Suggested Answers To QuestionsSuhani JainNo ratings yet

- P8 PDFDocument18 pagesP8 PDFA22BBD65No ratings yet

- Lt234.Tvp (Il-II) Question Cma May-2023 Exam.Document7 pagesLt234.Tvp (Il-II) Question Cma May-2023 Exam.Arif HossainNo ratings yet

- MTP - Intermediate - Syllabus 2016 - December 2017 - Set 2: Paper 8-Cost AccountingDocument12 pagesMTP - Intermediate - Syllabus 2016 - December 2017 - Set 2: Paper 8-Cost AccountingPranali ThombeNo ratings yet

- P8 Syl2012 InterDocument23 pagesP8 Syl2012 Internivedita_h42404No ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument16 pagesIntermediate Examination: Suggested Answers To QuestionsDINESH K SADAYAKUMARNo ratings yet

- TA112 .BQAF - .L Question CMA January 2022 Examination PDFDocument7 pagesTA112 .BQAF - .L Question CMA January 2022 Examination PDFMohammed Javed UddinNo ratings yet

- CH 14Document4 pagesCH 14Hoàng HuyNo ratings yet

- Advanced Cost AccountingDocument5 pagesAdvanced Cost AccountingPrathamesh ChawanNo ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument23 pagesIntermediate Examination: Suggested Answers To QuestionsKUNAL KUMARNo ratings yet

- Midterm Set ADocument9 pagesMidterm Set Afiseco4756No ratings yet

- P1.PROO - .L Question CMA September 2022 ExaminationDocument7 pagesP1.PROO - .L Question CMA September 2022 ExaminationS.M.A AwalNo ratings yet

- FIA MA2 Course Exam 1 QuestionsDocument12 pagesFIA MA2 Course Exam 1 QuestionsChar CharmaineNo ratings yet

- P1 Question January 2022Document6 pagesP1 Question January 2022S.M.A AwalNo ratings yet

- 4 Cost Acconting Class XII CommerceDocument60 pages4 Cost Acconting Class XII Commercegangadharp497No ratings yet

- Bchcr410 CIADocument4 pagesBchcr410 CIA15Nabil ImtiazNo ratings yet

- Paper8 Set1 SolutionDocument12 pagesPaper8 Set1 Solutionmamun khanNo ratings yet

- Mock Exam: Operations and Supply Chain ManagementDocument24 pagesMock Exam: Operations and Supply Chain ManagementShrey ThakkarNo ratings yet

- CAPE Accounting 2013 U2 P1Document10 pagesCAPE Accounting 2013 U2 P1Lauren EstwickNo ratings yet

- 2009 EE enDocument80 pages2009 EE enTara GorurNo ratings yet

- Management Accounting I 0105Document29 pagesManagement Accounting I 0105api-26541915100% (1)

- Screenshot 2023-12-17 at 7.11.13 PMDocument3 pagesScreenshot 2023-12-17 at 7.11.13 PMsinghmanthan2004No ratings yet

- 2022 - 12 - 11 - 147 - CL3 Advanced Management Accounting-December 2022 - EnglishDocument14 pages2022 - 12 - 11 - 147 - CL3 Advanced Management Accounting-December 2022 - EnglishfcNo ratings yet

- Suggested Answer - Syl08 - Dec13 - Paper 8 Intermediate ExaminationDocument13 pagesSuggested Answer - Syl08 - Dec13 - Paper 8 Intermediate ExaminationBalaji RajagopalNo ratings yet

- LT 125.CBLIL I Question CMA January 2022 ExaminationDocument5 pagesLT 125.CBLIL I Question CMA January 2022 Examinationrumelrashid_seuNo ratings yet

- Cma & Cs Costing McqsDocument35 pagesCma & Cs Costing Mcqskumar udayNo ratings yet

- MA Final Exam Prep Sample 4 PDFDocument18 pagesMA Final Exam Prep Sample 4 PDFbooks_sumiNo ratings yet

- Sample Mid Term ExamDocument12 pagesSample Mid Term ExamDevanshi ShahNo ratings yet

- Btech Cse 8 Sem Industrial Management 2013Document7 pagesBtech Cse 8 Sem Industrial Management 2013AmanNo ratings yet

- TA 223.ICTIL I Question CMA January 2022Document4 pagesTA 223.ICTIL I Question CMA January 2022Riad FaisalNo ratings yet

- Paper8 SolutionDocument14 pagesPaper8 SolutionHarsh TanejaNo ratings yet

- Paper8 Syl22 Dec23 Set2 SolDocument13 pagesPaper8 Syl22 Dec23 Set2 Solwaranbhuvanesh81No ratings yet

- Cost Acc V Sem QB - 2nd InternalDocument4 pagesCost Acc V Sem QB - 2nd InternalTanyaNo ratings yet

- Instructions:: Question Paper Booklet NoDocument16 pagesInstructions:: Question Paper Booklet NoArpita ChawlaNo ratings yet

- Mmac62112 Test 1 - March 2023Document5 pagesMmac62112 Test 1 - March 2023Evelyn MaileNo ratings yet

- Legacy - Wasteland AlmanacDocument33 pagesLegacy - Wasteland AlmanacВлад «Befly» Мирошниченко100% (3)

- Topic 5 - Market Forces - SupplyDocument5 pagesTopic 5 - Market Forces - Supplysherryl caoNo ratings yet

- Benzathine Penicillin, Metronidazole and Benzyl PenicillinDocument5 pagesBenzathine Penicillin, Metronidazole and Benzyl PenicillinJorge Eduardo Espinoza RíosNo ratings yet

- Lab 2 (Methods, Classes)Document23 pagesLab 2 (Methods, Classes)Skizzo PereñaNo ratings yet

- Judicial & Bar CouncilDocument3 pagesJudicial & Bar Councilmitch galaxNo ratings yet

- LESSON PLAN World Religion Week 6Document3 pagesLESSON PLAN World Religion Week 6VIRGILIO JR FABINo ratings yet

- Mitchell - Heidegger and Terrorism (2005)Document38 pagesMitchell - Heidegger and Terrorism (2005)William Cheung100% (2)

- 4 Measurement of AirspeedDocument23 pages4 Measurement of AirspeedNagamani ArumugamNo ratings yet

- For Larger Pictures and More Information, Please VisitDocument4 pagesFor Larger Pictures and More Information, Please VisitArun kumarNo ratings yet

- Spectra of ComplexesDocument41 pagesSpectra of ComplexesSheena GagarinNo ratings yet

- Dependent PrepositionDocument4 pagesDependent PrepositionSolange RiveraNo ratings yet

- Plan B ModuleDocument220 pagesPlan B ModuledamarwtunggadewiNo ratings yet

- Week 2 Reflection Sept 6 To Sept 10Document2 pagesWeek 2 Reflection Sept 6 To Sept 10api-534401949No ratings yet

- Swaps: Options, Futures, and Other Derivatives, 9th Edition, 1Document34 pagesSwaps: Options, Futures, and Other Derivatives, 9th Edition, 1胡丹阳No ratings yet

- Introduction To Agriculturemodule Week OneDocument7 pagesIntroduction To Agriculturemodule Week OneJeric BorjaNo ratings yet

- 2112 Filipino Thinkers PDFDocument4 pages2112 Filipino Thinkers PDFHermie Rose AlvarezNo ratings yet

- Agricultural FinanceDocument8 pagesAgricultural FinanceYayah Koroma100% (1)

- Jimmy Lim 2Document33 pagesJimmy Lim 2Ramsraj100% (1)

- 1991 Indianapolis 500 - WikipediaDocument48 pages1991 Indianapolis 500 - WikipediabNo ratings yet

- Photovoltaic For Buildings and GreenhiusesDocument14 pagesPhotovoltaic For Buildings and GreenhiusessriNo ratings yet

- Crossed Roller DesignGuideDocument17 pagesCrossed Roller DesignGuidenaruto256No ratings yet

- LG Neon2Document4 pagesLG Neon2LorenzoNo ratings yet

- Mechanic of Solid and Shells PDFDocument521 pagesMechanic of Solid and Shells PDFKomarudinNo ratings yet

- Guide in The Preparation of Manual of OperationDocument3 pagesGuide in The Preparation of Manual of Operationerickson_villeta50% (2)

- International Arbitration ReviewDocument28 pagesInternational Arbitration ReviewOsagyefo Oliver Barker-VormaworNo ratings yet

- Why Should We Cast Vote in IndiaDocument3 pagesWhy Should We Cast Vote in IndiaKrishna Prince M MNo ratings yet

- Cloning Quiz: Name: Date: ClassDocument1 pageCloning Quiz: Name: Date: ClassPhuong Lien LaiNo ratings yet

- L3 - Lesson PlanDocument6 pagesL3 - Lesson PlanPaola PinedaNo ratings yet

- Assignment Two CartoonsDocument3 pagesAssignment Two CartoonsAbraham Kang100% (1)