Professional Documents

Culture Documents

The Delta Project Financial Analysis

Uploaded by

Phú Tài LêOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Delta Project Financial Analysis

Uploaded by

Phú Tài LêCopyright:

Available Formats

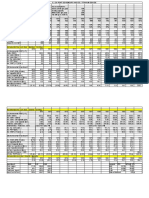

EX 3: THE DELTA PROJECT

Year 0 1 2 3 4

Capital outlay ($1000) -1000 -500

Savage value ($1000)

Depcritiation of innitial investment -125 -125 -125 -125

Depcritiation of upgrade -100

Quantity (unit) 720000 740000 760000 780000 1280000

Price ($) 0.5 0.5 0.5 0.5 0.5

Sales ($1000) 360 370 380 390 640

Production cost ($1000) -72 -74 -76 -78 -128

Operating cost ($1000) -50 -50 -50 -50 -50

Changes in working capital ($1000) -2 -0.5 -0.6 -0.5 -0.4

Profits($1000) 238 121 129 137 237

Income tax -71.4 -36.3 -38.7 -41.1 -71.1

Net Inflow -835.4 209.2 214.7 -279.6 390.5

Working capital 2000 2500 3100 3600 4000

0.5 0.6 0.5 0.4

5 6 7 8

dvi: $

16

-125 -125 -125 -125

-100 -100 -100 -100

1780000 2280000 2780000

0.75 0.75 0.75

1335 1710 2085

-178 -228 -278

-55 -55 -55

-0.3 -0.2 1.5 3

877 1202 1527 -225

-263.1 -360.6 -458.1 0

838.6 1066.2 1295.4 19

4300 4500 3000 0

0.3 0.2 -1.5 -3

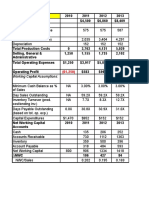

Ex 11

Year 1 Year 2 Year 3 Year 4

0 1 2 3

Sales volume ( units/year) 520000 624000 717000 788000

Selling price ($/unit) 30 30 30 30

Inflation adjusted price 30 31.2 32.448 33.74592

Variable cost ($/unit) 10 10.2 10.61 10.93

Inflation adjusted VC 10 10.506 11.256149 11.943506

Fixed costs ($) 700000 735000 779000 841000

Sale ($1000) 15600 19468.8 23265.216 26591.785

VC ($1000) -5200 -6555.744 -8070.659 -9411.4828

FC ($1000) -700 -735 -779 -841

Invesment cost ($1000) -25000

Depreciation -6250 -6250 -6250

-6250

Scrap value 1250

Profit 3450 5928.056 8165.5572 11339.302

Income Tax -1035 -1778.4168 -2449.667 -3401.7906

Net Inflow -16335 10399.6392 11965.89 14187.512

Nominal NPV $11,239.21

You might also like

- Corporate Finance Case Study WorkingDocument11 pagesCorporate Finance Case Study WorkingS.H. Rustam16% (19)

- Group6 - Heritage Doll CaseDocument6 pagesGroup6 - Heritage Doll Casesanket vermaNo ratings yet

- She 110Document24 pagesShe 110You're WelcomeNo ratings yet

- Boston Beer ExcelDocument6 pagesBoston Beer ExcelNarinderNo ratings yet

- Chapter 3 Investment Information and Securities Transactions - 1Document42 pagesChapter 3 Investment Information and Securities Transactions - 1Mya EmberNo ratings yet

- Perhitungan NPV Valuasi TambangDocument3 pagesPerhitungan NPV Valuasi Tambangmuhammad irfan labaNo ratings yet

- Business-Plan-Workbook OfficialDocument7 pagesBusiness-Plan-Workbook OfficialSergei MoshenkovNo ratings yet

- LOD SECOND MODEL STOCK CONTROL DECISIONDocument4 pagesLOD SECOND MODEL STOCK CONTROL DECISIONFranciskus Febry AnggoroNo ratings yet

- Cash Outflows (Beginning of The Project) Amount (In Rs. Lakh)Document3 pagesCash Outflows (Beginning of The Project) Amount (In Rs. Lakh)Twinkle ChoudharyNo ratings yet

- 03 PS9 KB - SolDocument2 pages03 PS9 KB - Soljunaid1626No ratings yet

- PV CalculationDocument4 pagesPV CalculationArun RaiNo ratings yet

- Investment Analysis and ProjectionsDocument214 pagesInvestment Analysis and ProjectionsHunainNo ratings yet

- Cost_BenefitDocument5 pagesCost_Benefitjhoy contrerasNo ratings yet

- New Microsoft Excel WorksheetDocument8 pagesNew Microsoft Excel WorksheetBhavya HandaNo ratings yet

- IS, SOFP, SCE My WorkDocument6 pagesIS, SOFP, SCE My WorkoluwapelumiotunNo ratings yet

- Financial Analysis of 5-Year Cash Flow ProjectionDocument2 pagesFinancial Analysis of 5-Year Cash Flow Projectionসৈকত হাবীবNo ratings yet

- Mercury AthleticDocument9 pagesMercury AthleticfutyNo ratings yet

- Titanium Dioxide and Super Project Prof. Joshy JacobDocument3 pagesTitanium Dioxide and Super Project Prof. Joshy JacobSIDDHARTH SINGHNo ratings yet

- Mirr MMDC (3,020) (5,706) 11% 8.40 940 DYOD (5,331) (9,557) 10% 8.12 940 Initial Capex Add Capex Base Payback Base CaseDocument3 pagesMirr MMDC (3,020) (5,706) 11% 8.40 940 DYOD (5,331) (9,557) 10% 8.12 940 Initial Capex Add Capex Base Payback Base Casesd717No ratings yet

- Analisis Keekonomian Proyek MigasDocument4 pagesAnalisis Keekonomian Proyek MigasAly RasyidNo ratings yet

- Annual Rate 13% Quarterly Rate 0.0325Document4 pagesAnnual Rate 13% Quarterly Rate 0.0325Maithri Vidana KariyakaranageNo ratings yet

- Budgeting SolutionsDocument9 pagesBudgeting SolutionsPavan Kalyan KolaNo ratings yet

- First Name Last Name ABC Analysis EOQ Reorder Point & Safety StockDocument9 pagesFirst Name Last Name ABC Analysis EOQ Reorder Point & Safety StockNATHAN SAMMYNo ratings yet

- FM Study HubDocument71 pagesFM Study HubchimbanguraNo ratings yet

- ES _GROUP 8Document4 pagesES _GROUP 8Papa NketsiahNo ratings yet

- Capital Investment 12-1 To 6 PanisalesDocument8 pagesCapital Investment 12-1 To 6 PanisalesVincent PanisalesNo ratings yet

- Sneakers 2Document2 pagesSneakers 2TalungNo ratings yet

- PET E 411 Work Session Oil Field Development Project Sensitivity AnalysisDocument14 pagesPET E 411 Work Session Oil Field Development Project Sensitivity AnalysistwofortheNo ratings yet

- Valuation Final ExamDocument4 pagesValuation Final ExamJeane Mae Boo100% (1)

- Color ScopeDocument12 pagesColor Scopeprincemech2004100% (1)

- Bethesda & GoodweekDocument8 pagesBethesda & GoodweekDian Pratiwi RusdyNo ratings yet

- Financial AnalysisDocument24 pagesFinancial AnalysisSwathi ShanmuganathanNo ratings yet

- Case 1Document4 pagesCase 1imi.imtenanNo ratings yet

- FM C QuestionsDocument20 pagesFM C QuestionsleylaNo ratings yet

- RoughDocument10 pagesRoughAashish JhaNo ratings yet

- Quiz # 6 Part 1Document5 pagesQuiz # 6 Part 1arslan mumtazNo ratings yet

- Imprimir 17-05-2023Document1 pageImprimir 17-05-2023ANDRES LEONARDO ROMERO MANRIQUENo ratings yet

- New Heritage DollDocument8 pagesNew Heritage DollJITESH GUPTANo ratings yet

- The - Model - Class WorkDocument16 pagesThe - Model - Class WorkZoha KhaliqNo ratings yet

- Cashflow Net Room RevenueDocument4 pagesCashflow Net Room RevenueAshadi CahyadiNo ratings yet

- Ejer 7 EvaDocument17 pagesEjer 7 EvavaleNo ratings yet

- Madison Super Draft Figures '000 Madison Super Year 0 1 2 3 4 5 YearDocument3 pagesMadison Super Draft Figures '000 Madison Super Year 0 1 2 3 4 5 Yearabubakar321No ratings yet

- Accounting Finance Sem. I Choice Base 81403 Financial Management I Q.P.CODE 24578Document3 pagesAccounting Finance Sem. I Choice Base 81403 Financial Management I Q.P.CODE 24578Gaurav ShettigarNo ratings yet

- Akb2 - Tika Putri Maulina - 040Document3 pagesAkb2 - Tika Putri Maulina - 04023 Tika Putri MaulinaNo ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- Diamond Energy Resources StudentDocument2 pagesDiamond Energy Resources StudentDonny BuiNo ratings yet

- Declining BalanceDocument15 pagesDeclining BalanceGigih Adi PambudiNo ratings yet

- CH 9Document6 pagesCH 9K RollsNo ratings yet

- Corprate FinanceDocument14 pagesCorprate Financeramisha tasnuvaNo ratings yet

- Forum Analisa Investasi - Asfianingsih (43118210060)Document1 pageForum Analisa Investasi - Asfianingsih (43118210060)Asfianingsih 28No ratings yet

- MGAC2 Sensitivity AnalysisDocument6 pagesMGAC2 Sensitivity AnalysisJoana TrinidadNo ratings yet

- Investment Analysis ExercisesDocument4 pagesInvestment Analysis ExercisesAnurag SharmaNo ratings yet

- Assignment 2 - 1A12 - DuquezaDocument9 pagesAssignment 2 - 1A12 - DuquezaReniella AllejeNo ratings yet

- Business - Valuation - Modeling - Assessment FileDocument6 pagesBusiness - Valuation - Modeling - Assessment FileGowtham VananNo ratings yet

- F9 AnswersDocument10 pagesF9 AnswersHil ShahNo ratings yet

- Financial Data Analysis of Companies A and BDocument3 pagesFinancial Data Analysis of Companies A and Btrio bimboNo ratings yet

- Exel Calculation (Version 1)Document10 pagesExel Calculation (Version 1)Timotius AnggaraNo ratings yet

- MockDocument5 pagesMockamna noorNo ratings yet

- Acct2015 - 2021 Paper Final SolutionDocument128 pagesAcct2015 - 2021 Paper Final SolutionTan TaylorNo ratings yet

- 15 SC030219115614314 PDFDocument40 pages15 SC030219115614314 PDFArniel PasignaNo ratings yet

- FINC1901 Corporate Finance Mid-Term Revision QuestionsDocument2 pagesFINC1901 Corporate Finance Mid-Term Revision Questionsrosario correiaNo ratings yet

- Basel Disclosure Ashad2080Document4 pagesBasel Disclosure Ashad2080Na Bee NaNo ratings yet

- Bai Tap CF 2018 Solution PDFDocument11 pagesBai Tap CF 2018 Solution PDFXuân Huỳnh100% (2)

- Financial Statement PreparationDocument9 pagesFinancial Statement PreparationDELFIN, LORENA D.No ratings yet

- ExercisesDocument27 pagesExercisesazhar aliNo ratings yet

- WRD FinMan 14e - SM 05Document82 pagesWRD FinMan 14e - SM 05CyyyNo ratings yet

- CA Inter RTP Nov 2018 Small PDFDocument281 pagesCA Inter RTP Nov 2018 Small PDFSANKAR SIVANNo ratings yet

- Lahore School of Economics Financial Management II Working Capital Management - 1 Assignment 9Document2 pagesLahore School of Economics Financial Management II Working Capital Management - 1 Assignment 9AhmedNo ratings yet

- Department of Business Administration Education FM 223 - Course SyllabusDocument7 pagesDepartment of Business Administration Education FM 223 - Course SyllabusMari ParkNo ratings yet

- Qbank 23-24 Npo RemovedDocument135 pagesQbank 23-24 Npo Removedramu gowdaNo ratings yet

- Annual report highlights key financialsDocument244 pagesAnnual report highlights key financialsKshitij SrivastavaNo ratings yet

- F.S. Analysis AssignmentDocument2 pagesF.S. Analysis AssignmentSeiha ChhengNo ratings yet

- Understanding Business and Entrepreneurship - 2024 v2 PDF-1Document37 pagesUnderstanding Business and Entrepreneurship - 2024 v2 PDF-1Nomvuma GubesaNo ratings yet

- Date of Valuation: Default AssumptionsDocument53 pagesDate of Valuation: Default AssumptionsVsjnsnakihbNo ratings yet

- IB Pitchbook Valuation AnalysisDocument3 pagesIB Pitchbook Valuation AnalysisSHIVAM SRIVASTAVANo ratings yet

- Full Download Financial Accounting 17th Edition Williams Test BankDocument35 pagesFull Download Financial Accounting 17th Edition Williams Test Bankmcalljenaevippro100% (43)

- Assessment of Working Capital Requirements Form AnalysisDocument16 pagesAssessment of Working Capital Requirements Form AnalysisRaghavendra Kulkarni40% (5)

- Meaning and Definition of Capital StructureDocument6 pagesMeaning and Definition of Capital Structureveeresh_patil05No ratings yet

- MTP May21 ADocument11 pagesMTP May21 Aomkar sawantNo ratings yet

- MULTIPLE CHOICE: (30 Points) - Select The Best Answer by Choosing The Appropriate Letter. Item Nos. 1 To 3 Are Based On The Following InformationDocument2 pagesMULTIPLE CHOICE: (30 Points) - Select The Best Answer by Choosing The Appropriate Letter. Item Nos. 1 To 3 Are Based On The Following InformationAnne Alag100% (1)

- Scheme Information Documents For Common Equity & Balanced SchemesDocument64 pagesScheme Information Documents For Common Equity & Balanced SchemesprajwalbhatNo ratings yet

- Module 5 (TOPIC 1) - PROPERTY, PLANT AND EQUIPMENTDocument13 pagesModule 5 (TOPIC 1) - PROPERTY, PLANT AND EQUIPMENTKhamil Kaye GajultosNo ratings yet

- Corporate Accounting Exam with Bonus Share CalculationDocument25 pagesCorporate Accounting Exam with Bonus Share Calculationyash nawariyaNo ratings yet

- Group 15 F 405 Working Capital ManagementDocument17 pagesGroup 15 F 405 Working Capital ManagementNowshad AyubNo ratings yet

- SIP Topics For ReferenceDocument44 pagesSIP Topics For ReferenceMahesh KhadeNo ratings yet

- AFAR-11 (Consolidated FS - Intercompany Sales of Fixed Assets)Document7 pagesAFAR-11 (Consolidated FS - Intercompany Sales of Fixed Assets)MABI ESPENIDONo ratings yet

- Strong Tie RatiosDocument2 pagesStrong Tie RatiosHans WeirlNo ratings yet