Professional Documents

Culture Documents

Working Capital Management. Receivable Management PDF

Working Capital Management. Receivable Management PDF

Uploaded by

Alok0 ratings0% found this document useful (0 votes)

14 views10 pagesOriginal Title

Working capital management. receivable management.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views10 pagesWorking Capital Management. Receivable Management PDF

Working Capital Management. Receivable Management PDF

Uploaded by

AlokCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 10

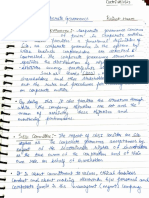

Credit Policy

>Xenient Credit Polic i: 7 Firm tends o sell on credit to

“customers on very liberal terms and standards, credit

01

are granted for longer “even to those

customer whose crei doubt not fully known

or whose financial position is doubtful.

vAtrin ent Credit Policy - Firm sells on credit on a

highly selective basis only to those customer who

roven creditworthiness and who are financially

Credit Policy

Profitability

___ Costs and benefits

~)

bene

———— — oak

vag Zs and)

p+ jomaiaarasanecnd oo Gute 2s) So =

ait Capacity is added- for sales. Fealiting |

rom loosening of credit then incrementa

production & selling cost wi ag ude both-variable &

ixed cost.

_ 2)_Administrations Cost- (i) Credit_investigation &

supervision costs «uy Coll jection co:

» 3) Bad=debt Losses- firm is unable to collect its

ccount receivable.

ptimum Credit Policy

» Incremental Rate. of Return can be calculated as Incremental

Operating Profit divide y Incremental investment Receivable.

CPt le

Frcs, Rane WNL

ad OF RETURN Wwceearenerpy, Ivesicerr Ye Trend

=e ie tee eel

» The Incremental Cost of Funds is the Rate of Return Required by the

suppliers of funds, given the Risk of investment in account

receivable.

Higher the Risk.of investment, Higher the Required Rate of Return.

» As the firm Loosen its Credit Policy, its investment in A/c Receivable

becomes more Risky because. cf Increasing. slowing paving arid

ulting customer. Thus the Required Rate of Return is an Upward

ptimum Credit Policy:

¥1.Credit Standard and Analysis

Credit Standards are the criteria which a_firm follows

in selecting customer for the purpose of credit

extension. ae =

Credit standard influence the quality of _firm’s

customers . there are two aspects of the quality of

customer. -

(i) The Time Taken by customers to repay credit

obligation.(ACP)

ii) Default Rate (Bad Debt Losses Ratio)

.Credit Standard and analysis

Average Fallection_Period- determines the speed of

payment by customer.

soe wade

» It measures the gumber of day’ for which credit sales

remaining outstanding .Longer the ACP , higher the

firm's investment in A/c Receivable.

» Default Rate is.measured in term of Bad-Debt Losses

Ratio-the proportion of uncollected receivable.

» Bad-Debt Losses Ratio indicates default risk.

Default Risk-is the likelihood that a customer will fail

e credit obligation.

1.Credit Standard and Analysis

» To estimate the Probability of Default (FM should consider

ree Se \1 &

Gar arT

ts

EE

Aa) Character-refers to the customer's willingness to pay.

» (b) Capacity -refer to the customer's ability to pay.

» (©) Condition- refer to the prevailing economic & other

conditions which may affect the customer's ability to pay.

» The firm may categorise its customer ,

3 categories :

Account , Bad Account , Marginal Accounts.

at least in following

22 2.Credit Term

» The stipulations under which the firm sell on cr ustomer

are talled Credit Term.(Stipulations include (a) Credit Period (b)

the Cash Discount. CD, RP bey

v€tedit Period-the length of time for which credit is extended to

customer is called the credit period. It is generally stated in

terms of Net Date.

Cash Discount-A cash discount is a reduction in payment

offered to customers to induce them to repay credit obI igation

within specified period of time, which will be less than the

normal credit per period. It is usually expressed as a percentage

of sales.

— Credit term may be expressed as ‘2/10, net 30.’. this means tnata

ustomer pays within 10 days

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Auditing Class Notes Unit1&2Document25 pagesAuditing Class Notes Unit1&2AlokNo ratings yet

- Industrial RelationsDocument26 pagesIndustrial RelationsAlokNo ratings yet

- Profit and Gain From BusinessDocument12 pagesProfit and Gain From BusinessAlokNo ratings yet

- MOS Unit-1 PDFDocument6 pagesMOS Unit-1 PDFAlokNo ratings yet

- House Property - (Tax)Document26 pagesHouse Property - (Tax)AlokNo ratings yet

- Corporate GovernanceDocument23 pagesCorporate GovernanceAlokNo ratings yet

- Direct TaxDocument16 pagesDirect TaxAlokNo ratings yet

- Assignment - MOS (BCH-602) BBAU PDFDocument1 pageAssignment - MOS (BCH-602) BBAU PDFAlokNo ratings yet

- WCMDocument10 pagesWCMAlokNo ratings yet