Professional Documents

Culture Documents

Marion County Ballot

Uploaded by

KTLO News0 ratings0% found this document useful (0 votes)

2K views1 pageMarion County Ballot

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMarion County Ballot

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views1 pageMarion County Ballot

Uploaded by

KTLO NewsMarion County Ballot

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

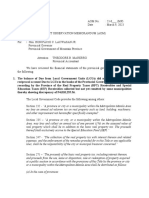

OFFICIAL BALLOT

For Annual School Election in

MOLINTAIN HOME SCHOOL DISTRICTNO.9 OF

BAXTER COUNTY, ARKANSAS

MAY 9,2023

vote bv placing ui,rT'*gyfl?3i1""#: person for whom

BOARD OF DIRECTORS for 2023"year term VOTE FOR I

POSITION

NO.6 scoTT R. BRYANT ........... (

scoTT BooTH..........

STEWART ROGERS

Vote on mea priate mark below the

or against.

34.41 Mill SchoolTax

The total rate proposed above includes the uniform rate of tax (the "Statewide Uniform

Rate") to be collected on all taxable property in the State and remitted to the State Treasurer

pursuant to Amendment No. 74 to the Arkansas Constitution to be used solely for maintenance

and operation of schools in the State. As provided jn Amendment No. 74, the Statewide Uniform

Rate replaces a portion ofthe existing rate oftax levied by this School District and available for

maintenance and operation of schools in this District. The total proposed school tax levy of 34.41

mills includes 25.29 mills specifically voted for general maintenance and operation, 6.87 mills

voted for debt service previously voted as a continuing levy pledged for the retirement ofexisting

bonded indebtedness (the "Existing Indebtedness") and2.25 new debt service mills. The 2.25 new

debt service mills plus the existing 6.87 debt service mills now pledged for the retirement of

existing bonded indebtedness, which debt service mills will continue after retirement of the bonds

to which now pledged, will be a continuing debt service tax until the retirement of proposed bonds

to be issued in the principal amount of $55,530,000, and which will mature over a period of 30

years and will be issued for the purpose of erecting and equipping new school facilities and making

additions and improvements to existing facilities. While the Existing lndebtedness is outstanding,

the surplus revenues produced each year by the existing 6.87 debt service mills may be used by

the District for other school purposes. After the Existing lndebtedness is retired, the surplus

revenues produced each year by the existing 6.87 debt service mills may be used by the District,

first, for the scheduled payment of principal of and interest on the bonds and, second, for the

maintenance of, and improvements to, school facilities. The surplus revenues produced each year

by the new 2.25 debt service mills may be used by the District, first, for the scheduled payment of

principal of and interest on the bonds and, second, for the maintenance of, and improvements to,

school facilities.

The total proposed school tax levy of 34.41 mil1s represents an increase of 2.25 mills from

the rate presently being levied.

LIST OF VOTERS NUMBER

PRECINCT

You might also like

- Kalamazoo County Ballot Proposals May 2023Document2 pagesKalamazoo County Ballot Proposals May 2023WXMINo ratings yet

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet

- Allegan County May ElectionsDocument5 pagesAllegan County May ElectionsWXMINo ratings yet

- Norman Hall's Postal Exam Preparation Book: Everything You Need to Know... All Major Exams Thoroughly Covered in One BookFrom EverandNorman Hall's Postal Exam Preparation Book: Everything You Need to Know... All Major Exams Thoroughly Covered in One BookRating: 3 out of 5 stars3/5 (1)

- Props May23Document6 pagesProps May23WDIV/ClickOnDetroitNo ratings yet

- Cass County May 2023 Ballot ProposalsDocument3 pagesCass County May 2023 Ballot ProposalsWXMINo ratings yet

- Van Buren May Elections - ProposalsDocument4 pagesVan Buren May Elections - ProposalsWXMINo ratings yet

- Nov 7 2023 Official List of Proposals - 202309050814187517Document4 pagesNov 7 2023 Official List of Proposals - 202309050814187517Daniel MichelinNo ratings yet

- Montcalm May Election 2Document2 pagesMontcalm May Election 2WXMINo ratings yet

- Kent County May ElectionsDocument3 pagesKent County May ElectionsWXMINo ratings yet

- Newaygo May ElectionsDocument2 pagesNewaygo May ElectionsWXMINo ratings yet

- St. Joseph County ProposalsDocument1 pageSt. Joseph County ProposalsWXMINo ratings yet

- Official List of Proposals Special Election - February 25, 2014Document2 pagesOfficial List of Proposals Special Election - February 25, 2014pkampeNo ratings yet

- Ottawa County May ElectionDocument7 pagesOttawa County May ElectionWXMINo ratings yet

- Employment Contract Between Albuquerque Public Schools Board of Education and Scott Elder 2021Document7 pagesEmployment Contract Between Albuquerque Public Schools Board of Education and Scott Elder 2021Albuquerque JournalNo ratings yet

- Branch County May ElectionsDocument1 pageBranch County May ElectionsWXMINo ratings yet

- Approps Hb6350 Sdebudget EcsDocument8 pagesApprops Hb6350 Sdebudget EcsrealhartfordNo ratings yet

- Fy10 Budget Summary: TaxesDocument4 pagesFy10 Budget Summary: TaxesRichard100% (1)

- Kalamazoo County August RacesDocument1 pageKalamazoo County August RacesWXMINo ratings yet

- Dec. 20 2022 Duluth Public Schools Truth in Taxation PresentationDocument32 pagesDec. 20 2022 Duluth Public Schools Truth in Taxation PresentationJoe BowenNo ratings yet

- Palo Alto Unified School District (PAUSD) Final Project List For Measure A (2008)Document15 pagesPalo Alto Unified School District (PAUSD) Final Project List For Measure A (2008)wmartin46No ratings yet

- Bridge Pta By-Laws Final September 2020Document16 pagesBridge Pta By-Laws Final September 2020api-316758680No ratings yet

- Buchanan RulingDocument30 pagesBuchanan RulingJonathan KrauseNo ratings yet

- KDE 2023 Legislative Guidance-Emergency BillsDocument9 pagesKDE 2023 Legislative Guidance-Emergency BillsSpectrum NewsNo ratings yet

- Draft AOM No. On Due From LGUsDocument5 pagesDraft AOM No. On Due From LGUsWilliam A. Chakas Jr.No ratings yet

- MI Education Budget Fiscal Year 2024Document171 pagesMI Education Budget Fiscal Year 2024CassidyNo ratings yet

- 2012 SB24 Jacob WerblowDocument8 pages2012 SB24 Jacob WerblowrealhartfordNo ratings yet

- Foil - FL CL 22.504 RedactedDocument97 pagesFoil - FL CL 22.504 RedactedChris BraggNo ratings yet

- Voters' Pamphlet 1922Document31 pagesVoters' Pamphlet 1922Curtis LeonardNo ratings yet

- Van Buren County August ProposalsDocument16 pagesVan Buren County August ProposalsWXMINo ratings yet

- Motoin For TRODocument12 pagesMotoin For TROCBS News ColoradoNo ratings yet

- Senate Bill 227Document7 pagesSenate Bill 227Statesman JournalNo ratings yet

- 7.21.21 Handbook For 2021 MAED ConfDocument232 pages7.21.21 Handbook For 2021 MAED ConfDennis JudsonNo ratings yet

- Community Schools InitiativeDocument11 pagesCommunity Schools InitiativeLas Vegas Review-JournalNo ratings yet

- Brunswick County Recommended Budget For FY 2023 2024Document16 pagesBrunswick County Recommended Budget For FY 2023 2024Nick AzizNo ratings yet

- School Districts' Orig PetitionDocument20 pagesSchool Districts' Orig PetitionCBS Austin WebteamNo ratings yet

- Mansfield 2019 Town Meeting WarrantDocument36 pagesMansfield 2019 Town Meeting WarrantJimmy BentleyNo ratings yet

- Measure J WordingDocument7 pagesMeasure J WordingLivermoreParentsNo ratings yet

- SRS Settlement RecommendationsDocument12 pagesSRS Settlement RecommendationsaugustapressNo ratings yet

- Carlisle Area School District Superintendent ContractDocument18 pagesCarlisle Area School District Superintendent ContractBarbara MillerNo ratings yet

- Term Sheet For Cleveland Indians Lease ExtensionDocument10 pagesTerm Sheet For Cleveland Indians Lease ExtensionHope SloopNo ratings yet

- Benzie County Road Commission Millage ProposalDocument2 pagesBenzie County Road Commission Millage ProposalColin MerryNo ratings yet

- 2016 MIAFLCIO Legislative ScorecardDocument12 pages2016 MIAFLCIO Legislative ScorecardMichigan AFLCIONo ratings yet

- EspLost Special Election NoticeDocument3 pagesEspLost Special Election Noticesavannahnow.comNo ratings yet

- FY14 BRA Draft Print (Final)Document32 pagesFY14 BRA Draft Print (Final)Susie CambriaNo ratings yet

- Maine Citizen's Guide To The Referendum Election: Tuesday, July 14, 2020Document9 pagesMaine Citizen's Guide To The Referendum Election: Tuesday, July 14, 2020NEWS CENTER MaineNo ratings yet

- Bossier City Property Tax Renewal Proposition Fact SheetDocument1 pageBossier City Property Tax Renewal Proposition Fact SheetshreveporttimesNo ratings yet

- FY13 Local Aid ResoDocument22 pagesFY13 Local Aid ResomasshousegopNo ratings yet

- Superintendent ContractDocument8 pagesSuperintendent ContractinforumdocsNo ratings yet

- Whitmer Administration's School Aid RequestDocument5 pagesWhitmer Administration's School Aid RequestMLive.comNo ratings yet

- This Is A Sample Ballot and Cannot Be Used As An Official Ballot Under Any CircumstancesDocument2 pagesThis Is A Sample Ballot and Cannot Be Used As An Official Ballot Under Any CircumstancesKOLD News 13No ratings yet

- Pekel Contract 2021-22Document7 pagesPekel Contract 2021-22inforumdocsNo ratings yet

- Doe V Peyser Memo and Order On Defendants' Motion To DismissDocument22 pagesDoe V Peyser Memo and Order On Defendants' Motion To DismissGintautas DumciusNo ratings yet

- SB1 Amendatory Veto LetterDocument7 pagesSB1 Amendatory Veto LetterCrainsChicagoBusinessNo ratings yet

- Joe Graves' Superintendent ContractDocument3 pagesJoe Graves' Superintendent ContractinforumdocsNo ratings yet

- Illinois Grand Bargain OutlineDocument12 pagesIllinois Grand Bargain OutlineKennethDeneauJr.No ratings yet

- Enc. No. 2, Superintendent's ContractDocument8 pagesEnc. No. 2, Superintendent's ContractBrittany PolitoNo ratings yet

- Menstrual Diginity ActDocument5 pagesMenstrual Diginity ActTiffany OlinNo ratings yet

- Resolution - County AdministratorDocument7 pagesResolution - County AdministratorWZZM NewsNo ratings yet

- Cotter Ballot 3Document1 pageCotter Ballot 3KTLO NewsNo ratings yet

- Marion Co Sample Tax StatementDocument1 pageMarion Co Sample Tax StatementKTLO NewsNo ratings yet

- MHPS June 27, 2023 Personnel ReportDocument4 pagesMHPS June 27, 2023 Personnel ReportKTLO NewsNo ratings yet

- MHSB Personnel Report 031623Document4 pagesMHSB Personnel Report 031623KTLO NewsNo ratings yet

- Calico Rock Sample BallotDocument1 pageCalico Rock Sample BallotKTLO NewsNo ratings yet

- Mountain Home Public Schools Personnel ReportDocument4 pagesMountain Home Public Schools Personnel ReportKTLO NewsNo ratings yet

- Community CenterDocument1 pageCommunity CenterKTLO NewsNo ratings yet

- Flippin School DistrictDocument1 pageFlippin School DistrictKTLO NewsNo ratings yet

- 2023-2024 MHPS School CalendarDocument1 page2023-2024 MHPS School CalendarKTLO NewsNo ratings yet

- Tax Info For CollectorDocument1 pageTax Info For CollectorKTLO NewsNo ratings yet

- Sewer Rate EstimatesDocument1 pageSewer Rate EstimatesKTLO NewsNo ratings yet

- Mountain Home State of The City AddressDocument10 pagesMountain Home State of The City AddressKTLO NewsNo ratings yet

- Yellville Summit Report CardDocument1 pageYellville Summit Report CardKTLO NewsNo ratings yet

- MH Chamber Light CompetitionDocument1 pageMH Chamber Light CompetitionKTLO NewsNo ratings yet

- Yellville Summit School DistrictDocument1 pageYellville Summit School DistrictKTLO NewsNo ratings yet

- Mountain Home School DistrictDocument1 pageMountain Home School DistrictKTLO NewsNo ratings yet

- Norfork School DistrictDocument1 pageNorfork School DistrictKTLO NewsNo ratings yet

- Barney Larry Day ProclamationDocument1 pageBarney Larry Day ProclamationKTLO NewsNo ratings yet

- Cotter School DistrictDocument1 pageCotter School DistrictKTLO NewsNo ratings yet

- MH City Council Noise Ordinance ProposalDocument5 pagesMH City Council Noise Ordinance ProposalKTLO NewsNo ratings yet

- Statewide DistributionDocument1 pageStatewide DistributionKTLO NewsNo ratings yet

- Cotter Report CardDocument1 pageCotter Report CardKTLO NewsNo ratings yet

- Norfork Report CardDocument1 pageNorfork Report CardKTLO NewsNo ratings yet

- Mountain Home Public Schools Certified Staff Recommendations May 2, 2022Document4 pagesMountain Home Public Schools Certified Staff Recommendations May 2, 2022KTLO NewsNo ratings yet

- Mountain Home Report CardDocument1 pageMountain Home Report CardKTLO NewsNo ratings yet

- September Cotter Movie in The ParkDocument1 pageSeptember Cotter Movie in The ParkKTLO NewsNo ratings yet

- Cotter Big Spring Park Movie - CharadeDocument1 pageCotter Big Spring Park Movie - CharadeKTLO NewsNo ratings yet

- Mountain Home Public Schools Certified Staff Recommendations April 21, 2022Document6 pagesMountain Home Public Schools Certified Staff Recommendations April 21, 2022KTLO NewsNo ratings yet

- Mountain Home School Board Personnel Report 5-19-22Document6 pagesMountain Home School Board Personnel Report 5-19-22KTLO NewsNo ratings yet

- MHSB Personnel Report June 2022Document4 pagesMHSB Personnel Report June 2022KTLO NewsNo ratings yet

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteFrom EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteRating: 4.5 out of 5 stars4.5/5 (16)

- The War after the War: A New History of ReconstructionFrom EverandThe War after the War: A New History of ReconstructionRating: 5 out of 5 stars5/5 (2)

- The Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaFrom EverandThe Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaRating: 4.5 out of 5 stars4.5/5 (12)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpFrom EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpRating: 4.5 out of 5 stars4.5/5 (11)

- Modern Warriors: Real Stories from Real HeroesFrom EverandModern Warriors: Real Stories from Real HeroesRating: 3.5 out of 5 stars3.5/5 (3)

- Thomas Jefferson: Author of AmericaFrom EverandThomas Jefferson: Author of AmericaRating: 4 out of 5 stars4/5 (107)

- Crimes and Cover-ups in American Politics: 1776-1963From EverandCrimes and Cover-ups in American Politics: 1776-1963Rating: 4.5 out of 5 stars4.5/5 (26)

- We've Got Issues: How You Can Stand Strong for America's Soul and SanityFrom EverandWe've Got Issues: How You Can Stand Strong for America's Soul and SanityRating: 5 out of 5 stars5/5 (1)

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonFrom EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonRating: 4.5 out of 5 stars4.5/5 (21)

- The Courage to Be Free: Florida's Blueprint for America's RevivalFrom EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalNo ratings yet

- The Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorFrom EverandThe Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorNo ratings yet

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicFrom EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicNo ratings yet

- The Next Civil War: Dispatches from the American FutureFrom EverandThe Next Civil War: Dispatches from the American FutureRating: 3.5 out of 5 stars3.5/5 (49)

- The Great Gasbag: An A–Z Study Guide to Surviving Trump WorldFrom EverandThe Great Gasbag: An A–Z Study Guide to Surviving Trump WorldRating: 3.5 out of 5 stars3.5/5 (9)

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeFrom EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeRating: 4 out of 5 stars4/5 (572)

- Reading the Constitution: Why I Chose Pragmatism, not TextualismFrom EverandReading the Constitution: Why I Chose Pragmatism, not TextualismRating: 4 out of 5 stars4/5 (1)

- The Quiet Man: The Indispensable Presidency of George H.W. BushFrom EverandThe Quiet Man: The Indispensable Presidency of George H.W. BushRating: 4 out of 5 stars4/5 (1)

- The Red and the Blue: The 1990s and the Birth of Political TribalismFrom EverandThe Red and the Blue: The 1990s and the Birth of Political TribalismRating: 4 out of 5 stars4/5 (29)

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaFrom EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaRating: 4.5 out of 5 stars4.5/5 (4)

- Confidence Men: Wall Street, Washington, and the Education of a PresidentFrom EverandConfidence Men: Wall Street, Washington, and the Education of a PresidentRating: 3.5 out of 5 stars3.5/5 (52)

- Second Class: How the Elites Betrayed America's Working Men and WomenFrom EverandSecond Class: How the Elites Betrayed America's Working Men and WomenNo ratings yet

- Camelot's Court: Inside the Kennedy White HouseFrom EverandCamelot's Court: Inside the Kennedy White HouseRating: 4 out of 5 stars4/5 (17)

- An Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordFrom EverandAn Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordRating: 4 out of 5 stars4/5 (5)

- The Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushFrom EverandThe Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushRating: 4 out of 5 stars4/5 (6)

- To Make Men Free: A History of the Republican PartyFrom EverandTo Make Men Free: A History of the Republican PartyRating: 4.5 out of 5 stars4.5/5 (21)

- Socialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismFrom EverandSocialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismRating: 4.5 out of 5 stars4.5/5 (42)

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesFrom EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNo ratings yet