Professional Documents

Culture Documents

Application Pencon Mandatory MSRemittances

Application Pencon Mandatory MSRemittances

Uploaded by

vanessaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application Pencon Mandatory MSRemittances

Application Pencon Mandatory MSRemittances

Uploaded by

vanessaCopyright:

Available Formats

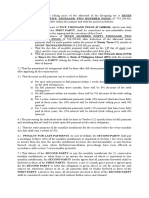

HQP-PFF-397

(V01, 01/2022)

APPLICATION FOR THE NEW PENALTY CONDONATION PROGRAM

ON MANDATORY MONTHLY SAVINGS (MS) REMITTANCES

(Print this form back to back on one single sheet of paper)

EMPLOYER/BUSINESS NAME Pag-IBIG EMPLOYER ID No.

EMPLOYER/BUSINESS ADDRESS DATE FILED

PAYMENT SCHEME EMAIL ADDRESS TELEPHONE NUMBER

FULL PAYMENT PLAN OF PAYMENT

Settlement Term: _______________

APPLICATION AGREEMENT

I hereby certify that I have read and understood the contents hereof, including the guidelines and instructions indicated at the back portion of this

form. I further certify that all information I have indicated herein and statements declared in the documents submitted to the Fund are true and

correct to the best of my knowledge and belief, and that my signature appearing herein is genuine and authentic. Likewise, I hereby authorize

Pag-IBIG Fund to collect, record, organize, update/modify, consult, use, consolidate, block, delete or destroy my personal data as part of my

information. I hereby affirm my right to: (a) be informed; (b) object to processing; (c) access; (d) rectify, suspend or withdraw my personal data;

(e) damages; and (f) data portability, pursuant to the provision of R.A. No. 10173 (Data Privacy Act of 2012).

I shall abide with the applicable Guidelines on penalty condonation, and those that the Pag-IBIG Fund may promulgate from time to time. In case

of non-compliance with said Guidelines, or in case of any misrepresentation or falsification in my application and/or documents submitted,

I understand that the Pag-IBIG Fund shall automatically disapprove my application, forfeit its approval, and/or terminate the Plan of Payment.

Thereupon, I shall be liable to pay the total Membership Savings (MS), deprived dividends, and the penalties. Further, I shall be criminally liable

for violation of Republic Act No. 9679 and other relevant laws.

______________________________________________ ________________________ ________________

HEAD OF OFFICE/AUTHORIZED REPRESENTATIVE Designation/Position Date

(Signature over Printed Name)

THIS PORTION IS FOR Pag-IBIG FUND USE ONLY

RECEIVED BY DATE REMARKS

COMPUTATION OF TOTAL PROVIDENT OBLIGATION

ARREARAGES PRIOR ARREARAGES DURING ARREARAGES AFTER GRAND

PARTICULARS

COVID-19 PANDEMIC COVID-19 PANDEMIC COVID-19 PANDEMIC TOTAL

PERIOD

TOTAL UNREMITTED MS

- Employee Share

- Employer Share

DEPRIVED DIVIDEND

TOTAL ASSESSED PENALTIES

LESS:

CONDONED PENALTIES

DEPRIVED DIVIDEND

TOTAL AMOUNT DUE

COMPUTED BY DATE REVIEWED BY DATE APPROVED BY DATE

THIS FORM MAY BE REPRODUCED. NOT FOR SALE.

GUIDELINES AND INSTRUCTIONS HQP-PFF-397

A. Who May File (V01, 01/2022)

The New Penalty Condonation Program is open to all private and government employers, which may include any of the following:

a. Unregistered b. Did not deduct c. Deducted MS but did not remit d. Delinquent e. With approved plan of payment

B. How to File

The applicant shall:

1. Secure and accomplish the Application for New Penalty Condonation Program on Mandatory Monthly Savings (MS) Remittances (HQP-PFF-397)

from the Pag-IBIG Branch. The application form may be downloaded from the Pag-IBIG Fund website at www.pagibigfund.gov.ph.

2. Submit application and required supporting documents (refer to Checklist of Requirements below) to the Pag-IBIG Fund Branch.

C. Period of Availment for Penalty Condonation

1. Eligible employers may avail this program within the period specified on the applicable guidelines.

2. Only applications with complete documents shall be accepted and processed.

D. Mechanics

1. All penalties on MS of employers whose application for penalty condonation has been approved shall be condoned.

2. All penalties of employers in good standing but found to have gaps, as generated by the report in the newly launched CMS, shall be condoned.

3. Only applications with complete documents shall be accepted and processed.

4. MS Arrearages

4.1 Prior to COVID-19 Pandemic

4.1.1Refers to period prior to March 17, 2020.

4.1.2 For employers who did not deduct MS from their employees, the employer shall pay the employer counterpart and the deprived

dividends to the Fund.

4.1.3 For employers who deducted MS from their employees but did not remit the same to the Fund, the employer shall pay the employee

share, the employer counterpart and the deprived dividends.

4.1.4 For employers with an ongoing plan of payment and/or who shall opt for a plan of payment, interest shall be collected.

4.2 During COVID-19 Pandemic

4.2.1 Refers to the period from the proclamation of the Enhanced Community Quarantine (ECQ) on March 17, 2020 until the State of

Calamity due to COVID-19 is lifted by the President of the Philippines.

4.2.2 MS arrearages shall be collected from employers who continued to be operational despite the COVID-19 pandemic.

4.2.2.1 For employers who did not deduct MS from their employees, the employer shall pay the employer counterpart.

4.2.2.2 For employers who deducted MS from their employees but did not remit the same to the Fund, the employer shall pay the

employees share, and the employer counterpart.

4.2.2.3 For employers who are affected by the pandemic, deprived dividends and interest shall not be collected.

4.3 Upon lifting of State of Calamity due to COVID-19 as may be declared by the President of the Philippines, deprived dividends and interest, if

applicable, shall be collected from the employers.

5. Payment of MS Arrearages

5.1 For employers who opted for Full Payment, the following provisions shall be applied:

5.1.1 Employers shall be required to pay all MS arrearages within thirty (30) days from approval of application for penalty condonation.

Otherwise, the said approval shall be forfeited.

5.1.2 An employer who signified intent to pay in full but later on opted for a plan of payment must submit his plan of payment not later than

the 25th day from the date of approval of application for penalty condonation. Failure to do so renders the approval automatically

revoked and ineffective.

5.1.3 The employer may settle his arrearages through any mode of payment acceptable to the Fund.

5.2 For employers who opted for Plan of Payment, the following provisions shall be applied:

5.2.1 If full remittance cannot be made, an employer may submit a plan of payment upon application for penalty condonation. Said plan of

payment shall be subject to the Fund’s approval in accordance with the approved level of authorities.

5.2.2 Eligible employers with an approved plan of payment shall be granted full condonation of penalties. However, the condonation shall be

automatically revoked, and the penalties shall be re-imposed by the employer’s failure to comply with said plan of payment.

5.2.3 The period of settlement shall not exceed twenty-four (24) months. However, employers may request for longer settlement period,

subject to Management Committee’s approval.

5.2.4 An interest of 6% per annum (0.5% per month) shall be collected from the employer under the following period:

5.2.4.1 Prior to March 17, 2020.

5.2.4.2 During COVID-19 pandemic, only for those employers who failed to prove that they were affected by the Pandemic.

5.2.4.3 Upon lifting of State of Calamity due to COVID-19 as may be declared by the President of the Philippines, and onwards.

5.2.5 Payments shall commence exactly one month from the date of approval of application for penalty condonation.

5.2.6 Appropriate civil and/or criminal actions shall be filed against the delinquent employers who violate their approved plan of payment. In

addition, should the employers fail to collect and/or remit the employee and employer’s contributions due to the current period, the

same shall be charged a penalty of 1/10 of 1% of the amount due per day of delay.

CHECKLIST OF REQUIREMENTS

Basic Requirements Additional Requirements

1. Application for the New Penalty Condonation Program on Mandatory 5. Proposed Plan of Payment if payment scheme is Plan of Payment with

Monthly Savings (MS) Remittances (HQP-PFF-397) notarized Board Resolution/Secretary’s Certificate

2. Photocopy of at least one (1) valid ID with photo and signature of the 6. If filing through an Authorized Representative, submit the following:

employer or authorized representative. a) For Sole Proprietorships and Partnerships,

3. Membership Savings Remittance Form (MSRF, HQP-PFF-053) in - Special Power of Attorney (SPA)

softcopy b) For Corporations:

4. DOLE Establishment Report Form (RKS Form 5 of 2020) or any of its - Notarized Board Resolution/Secretary’s Certificate

equivalent (as applicable) designating the representative to transact/negotiate with the

Fund and to execute/sign documents submitted

You might also like

- Affidavit of Quitclaim 2023Document1 pageAffidavit of Quitclaim 2023Joan Yala SumauangNo ratings yet

- Deed of Grant of Usufructuary RightsDocument3 pagesDeed of Grant of Usufructuary RightsLoi Lang-ayNo ratings yet

- Temporary Room Contract SampleDocument2 pagesTemporary Room Contract SampleEmiliano Vargas CampuzanoNo ratings yet

- Acknowledgement of DebtDocument6 pagesAcknowledgement of DebtRynor Selyob Somar100% (1)

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 16Document34 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 16jasperkennedy076% (17)

- Republic of The Philippines Department of Transportation Land Transportation Franchising and Regulatory Board Regional OfficeDocument3 pagesRepublic of The Philippines Department of Transportation Land Transportation Franchising and Regulatory Board Regional OfficeAtty. Cca MagallanesNo ratings yet

- Ilo Airport Parking ProcedureDocument13 pagesIlo Airport Parking ProcedureArturo Bong Consorte Jr.No ratings yet

- Verified UndertakingDocument2 pagesVerified UndertakingMark Randy Balancio RegaladoNo ratings yet

- BOI - 9G & ACR I-Card Visa Application FormDocument2 pagesBOI - 9G & ACR I-Card Visa Application FormJane Hazel GuiribaNo ratings yet

- Shell Pakistan Limited ReportDocument35 pagesShell Pakistan Limited Reportsohailsajjad0% (1)

- Sabita Report 22Document108 pagesSabita Report 22Divya HalpatiNo ratings yet

- Terms and Conditions For The Rental of Tables and ChairsDocument2 pagesTerms and Conditions For The Rental of Tables and ChairsyuikieeNo ratings yet

- (To Be Obtained On Letter Head Along With Stamp - Proprietary /partnership Firm / Company/ LLP) Wherever ApplicableDocument2 pages(To Be Obtained On Letter Head Along With Stamp - Proprietary /partnership Firm / Company/ LLP) Wherever Applicablevinod financeNo ratings yet

- Unified Application Form For Certificate of Occupancy1Document1 pageUnified Application Form For Certificate of Occupancy1OBO pagadianNo ratings yet

- Tacloban Bir RevenueDocument313 pagesTacloban Bir RevenueCRISS PEDRAITANo ratings yet

- Affidavit of Support and GuaranteeDocument1 pageAffidavit of Support and GuaranteekatjocsonNo ratings yet

- FdggggsDocument1 pageFdggggsCABAGANNo ratings yet

- Affidavit of Consent and SPA AlipoyoDocument3 pagesAffidavit of Consent and SPA AlipoyoJubelee Anne PatanganNo ratings yet

- Joint Affidavit of CohabitationDocument1 pageJoint Affidavit of CohabitationYang Tan100% (1)

- Sample Computation (A & B Lots of 750 SQM.)Document2 pagesSample Computation (A & B Lots of 750 SQM.)iquotientsolutionsNo ratings yet

- Fifth Avenue Property Dev. Corp.: Onett Computation SheetDocument1 pageFifth Avenue Property Dev. Corp.: Onett Computation SheetLaurenNo ratings yet

- Rent To Own Contract-TibonDocument5 pagesRent To Own Contract-TibonChery ValenzuelaNo ratings yet

- Affidavit of Change of VenueDocument1 pageAffidavit of Change of Venueailyn rentaNo ratings yet

- Eastwest Foreclosed Properties For Sale April 14 2023Document16 pagesEastwest Foreclosed Properties For Sale April 14 2023Coleen Navarro-Rasmussen0% (1)

- Affidavit of EmploymentDocument1 pageAffidavit of EmploymentElmer DatuinNo ratings yet

- Affidavit (Sample) : This Is A Sample. Please Prepare Pursuant To The Actual Situation of The CompanyDocument2 pagesAffidavit (Sample) : This Is A Sample. Please Prepare Pursuant To The Actual Situation of The CompanyAlmira SalsabilaNo ratings yet

- Daily Time Record Daily Time RecordDocument2 pagesDaily Time Record Daily Time RecordGapmil Noziuc NylevujNo ratings yet

- Affidavit of Los1Document1 pageAffidavit of Los1Patrio Jr SeñeresNo ratings yet

- Fuel Subsidy Program: Deed of Undertaking For Eligible Puj OperatorsDocument2 pagesFuel Subsidy Program: Deed of Undertaking For Eligible Puj OperatorsCarmelo CequinaNo ratings yet

- Personal Loan Application FormDocument2 pagesPersonal Loan Application FormIde PixelNo ratings yet

- Dar Administrative Order No 8Document74 pagesDar Administrative Order No 8don dehaycoNo ratings yet

- Ccasr DPWH FormDocument11 pagesCcasr DPWH FormWowie MacabantogNo ratings yet

- Deed of SaleDocument2 pagesDeed of SaleJed GurayNo ratings yet

- Affidavit of UnderstandingDocument1 pageAffidavit of UnderstandingNorman CorreaNo ratings yet

- Affidavit of Non - Tenancy STEVE ROGERSDocument1 pageAffidavit of Non - Tenancy STEVE ROGERSNorileisha Ramos AtienzaNo ratings yet

- Log Supply Contract AlmodielDocument3 pagesLog Supply Contract AlmodielDon MaximoNo ratings yet

- Fishpond Lease Contract 11.05.2020Document4 pagesFishpond Lease Contract 11.05.2020Aaron ValdezNo ratings yet

- Affidavit of Loss of Sim GlobeDocument1 pageAffidavit of Loss of Sim Globejv1412No ratings yet

- Contract of Lease SampleDocument7 pagesContract of Lease SampleGigi TicarNo ratings yet

- Lease For LandDocument6 pagesLease For Landmohamed riyasNo ratings yet

- Extra Judicial Settlement of The EstateDocument3 pagesExtra Judicial Settlement of The EstateEnerita AllegoNo ratings yet

- Application Form For ACR I-CARD NEW PDFDocument2 pagesApplication Form For ACR I-CARD NEW PDFButch AmbataliNo ratings yet

- Affidavit of Change of ColorDocument1 pageAffidavit of Change of ColorArden KimNo ratings yet

- Contract To Sell - ELENO G. SANCHEZDocument2 pagesContract To Sell - ELENO G. SANCHEZBarn CabsNo ratings yet

- AFFIDAVIT OF CHANGE OF COLOR OF VEHICLE by Car ShopDocument1 pageAFFIDAVIT OF CHANGE OF COLOR OF VEHICLE by Car ShopChris T NaNo ratings yet

- 2016 Sublicense AgreementDocument1 page2016 Sublicense AgreementnsaoifnasidfnNo ratings yet

- Joint Undertaking To Change NameDocument1 pageJoint Undertaking To Change NameJadeNo ratings yet

- Affidavit of Loss SampleDocument1 pageAffidavit of Loss SampleFrancis Xavier SinonNo ratings yet

- Letter To Officiate The WeddingDocument1 pageLetter To Officiate The WeddingRhealynBalboaLopezNo ratings yet

- Extrajudicial SettlementDocument3 pagesExtrajudicial SettlementArnel Gaballo AwingNo ratings yet

- Affidavit Vacant LotDocument1 pageAffidavit Vacant LotEugene Medina LopezNo ratings yet

- Affidavit of Quitclaim and Waiver of RightsDocument2 pagesAffidavit of Quitclaim and Waiver of RightsMeg Guarin100% (1)

- Affidavit of Heirship With Confirmation of Sale: Macarinas Bongad (Moro)Document2 pagesAffidavit of Heirship With Confirmation of Sale: Macarinas Bongad (Moro)Justice Aurelio YapNo ratings yet

- Affidavit of Consent: Benigno R. AndamonDocument1 pageAffidavit of Consent: Benigno R. AndamonJinJiShinNo ratings yet

- Solidtechnical-Cancellation of Mortgage-Candelaria PropertyDocument1 pageSolidtechnical-Cancellation of Mortgage-Candelaria PropertyJuan CrisostomoNo ratings yet

- Affidavit - Admission of PaternityDocument1 pageAffidavit - Admission of PaternityRomualdo BarlosoNo ratings yet

- SERVICE CONTRACT Leyeco IV DisconnectionDocument5 pagesSERVICE CONTRACT Leyeco IV DisconnectionHazel-mae LabradaNo ratings yet

- Memorandum of Agreement-SampleDocument6 pagesMemorandum of Agreement-SampleIze SpiritNo ratings yet

- PROMISSORY NOTE WITH UNDERTAKING - WilmaDocument1 pagePROMISSORY NOTE WITH UNDERTAKING - WilmaDebz PerezNo ratings yet

- Waiver of Rights Water DistrictDocument2 pagesWaiver of Rights Water DistricthannahleatanosornNo ratings yet

- PFF397 - ApplicationPenconMandatoryMSRemittances - V01 (FORM)Document2 pagesPFF397 - ApplicationPenconMandatoryMSRemittances - V01 (FORM)ey019.aaNo ratings yet

- Application For Penalty Condonation: (For Financially Distressed Employers Due To Covid-19 PandemicDocument2 pagesApplication For Penalty Condonation: (For Financially Distressed Employers Due To Covid-19 PandemicCrizetteTarcenaNo ratings yet

- Cir 299 - Intensified Enforcement and Collection CampaignDocument4 pagesCir 299 - Intensified Enforcement and Collection Campaignmaxx villaNo ratings yet

- PARFI Company Profile 2017Document27 pagesPARFI Company Profile 2017HaZiqHaMidNo ratings yet

- Quiz 1&2 - IiDocument29 pagesQuiz 1&2 - IiJenz Crisha PazNo ratings yet

- Ficha 3 'Applying For A Job' (Enunciado)Document3 pagesFicha 3 'Applying For A Job' (Enunciado)DDC88No ratings yet

- Seafarers: International Shipping, July 27, 2004 and Ravago, March 14, 2005Document51 pagesSeafarers: International Shipping, July 27, 2004 and Ravago, March 14, 2005Ronnie RimandoNo ratings yet

- Internship ReportDocument57 pagesInternship Reportramaa bhat100% (1)

- An Assessment of Bussiness Environment and Its Impact On Organizational GrowthDocument79 pagesAn Assessment of Bussiness Environment and Its Impact On Organizational GrowthMIKE JOSEPHNo ratings yet

- Reading Comprehension Group 2Document6 pagesReading Comprehension Group 2villalba22No ratings yet

- 2017 (G.R. No. 204262, Madridejos v. NYK-Fil Ship Management) PDFDocument19 pages2017 (G.R. No. 204262, Madridejos v. NYK-Fil Ship Management) PDFFrance SanchezNo ratings yet

- Plumbing: Work Experience Verification FormDocument2 pagesPlumbing: Work Experience Verification Formrsinapilo22No ratings yet

- William Uy Construction v. TrinidadDocument3 pagesWilliam Uy Construction v. Trinidadabdullah mauteNo ratings yet

- Department of Migrant Workers Act IRRDocument40 pagesDepartment of Migrant Workers Act IRRLaw MaterialNo ratings yet

- Collective Bargaining and Negotiation - FacultyDocument12 pagesCollective Bargaining and Negotiation - FacultyannpurnakaulNo ratings yet

- Sample CV in English PDFDocument1 pageSample CV in English PDFfikredingil mulugetaNo ratings yet

- Steps Involved in Process of Performance AppraisalDocument6 pagesSteps Involved in Process of Performance AppraisalRakesh MandalNo ratings yet

- GB101 S07 Practice Exam For Students - Posted April 3rdDocument23 pagesGB101 S07 Practice Exam For Students - Posted April 3rdmahendra_dandage10100% (1)

- Understanding Equal Opportunity and The Legal EnvironmentDocument25 pagesUnderstanding Equal Opportunity and The Legal EnvironmentPrimenavigatorNo ratings yet

- Care Ethiopia CoverDocument1 pageCare Ethiopia CoverAli Yimer Ali100% (2)

- Information Security Advisor PDFDocument3 pagesInformation Security Advisor PDFArthur MarcuNo ratings yet

- Factory ActDocument21 pagesFactory ActPrâtèék ShâhNo ratings yet

- D. Production Cost Estimates (1 Yr.)Document6 pagesD. Production Cost Estimates (1 Yr.)Papi Beats-EDMNo ratings yet

- Mou System: SPS Solanki AGM (CP)Document82 pagesMou System: SPS Solanki AGM (CP)SamNo ratings yet

- Impact of Compensation and Promotion Practices On Employees PerformanceDocument39 pagesImpact of Compensation and Promotion Practices On Employees Performancepaulraju_86100% (3)

- 1447 1628760497056 Unit 6 MSCP 2021 and 22 RWDocument56 pages1447 1628760497056 Unit 6 MSCP 2021 and 22 RWrecoveries 1No ratings yet

- Report On Lic of IndiaDocument59 pagesReport On Lic of IndiaRAJESH KUMAR89% (9)

- Internship ReportDocument45 pagesInternship ReportAsif Rajian Khan Apon100% (2)

- UGC NET ManagementDocument58 pagesUGC NET ManagementSatish Varma100% (3)

- Existing DFDDocument2 pagesExisting DFDcarmela ventanillaNo ratings yet