Professional Documents

Culture Documents

Faculty - Accountancy - 2022 - Session 1 - Degree - Tax667 PDF

Uploaded by

Nur Athirah Binti MahdirOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Faculty - Accountancy - 2022 - Session 1 - Degree - Tax667 PDF

Uploaded by

Nur Athirah Binti MahdirCopyright:

Available Formats

CONFIDENTIAL 1 AC/FEB 2022/TAX667/490

UNIVERSITI TEKNOLOGI MARA

FINAL ASSESSMENT

COURSE : ADVANCED TAXATION / ADVANCED MALAYSIAN

TAXATION

COURSE CODE : TAX667/490

ASSESSMENT : FEBRUARY 2022

TIME : 3 HOURS

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of five (5) questions.

2. Answer ALL questions in the Answer Booklet. Start each answer on a new page.

3. Do not bring any material into the examination room unless permission is given by the

invigilator.

4. Please check to make sure that this examination pack consists of:

i) the Question Paper

ii) a two-page Appendix 1

5. Answer ALL questions in English.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 10 printed pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AC/FEB 2022/TAX667/490

QUESTION 1

En Abdussalam, a non-resident businessman from Brunei, come to Malaysia five years ago

and married a local woman from Melaka. They have a daughter who currently studying in

UiTM Jengka. The family lived in Bandar Hilir area. On 1 July 2021, En Abdussalam was

admitted to Melaka Medical Center and passed away due to sudden heart attack. He was

domiciled at the time of his death. Upon En Abdussalam’s death, his uncle En Eusoff a resident

taxpayer was appointed as the executor of his estate.

For the purpose of tax filing, En Eusoff provides information regarding the income and

expenses of the late En Abdusssalam’s for the basis year of 2021.

RM

Business income - Trading

Adjusted income 250,000

Capital allowance 45,000

Business income - Manufacturing

Adjusted loss (25,000)

Business income - Brunei

Adjusted Income (All were donated to an approved institution there). 35,000

Dividend (single tier)

Rasidah Utama Bhd - received on 12 June 2021 5,000

Rental Income

Net rental income - Segamat (received in advanced in June 2021) 15,000

Net rental income - Surabaya (received RM8,000 on 1 September 2021) 13,000

Interest

Maybank, credited on 1 March 2021 7,000

CIMB on RM115,000 saving account, credited on 1 November 2021 11,500

Other income

Honorarium - En Abdussalam was invited as speaker for a seminar series in

Kuala Lumpur, only half of the payment received in May 2021. 20,000

Expenditures incurred during the year of assessment 2021 are as follows:

i. The executor fees of RM20,000 is to be paid to En Eusoff in December 2021, whereas

annuity amounted to RM5,500 per month is to be paid to En Adussalam’s wife (full-time

housewife) every month-end after his death.

ii. En Abdussalam made a cash donation of RM15,000 paid to an approved charitable

institution (Rumah Seri Kenangan, Melaka) on 15 March 2021.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/FEB 2022/TAX667/490

Required:

a. Compute the income tax payable of En Abdussalam and En Eusoff as the executor of

the estate for the year of assessment 2021.

(10 marks)

b. Explain the tax consequences if En Eusoff fails to furnish the tax return and pay income

taxes of the estate.

(2 marks)

(Total: 12 marks)

QUESTION 2

Sunway Berhad (SB) is a company listed on Bursa Malaysia. Its principal activity is holding

an investment. To support its group, SB provides management services to its subsidiaries.

The relevant financial information provided by SB for the preparation of its tax return:

Financial information for the year ended 31 December 2021

Gross Income RM’000

Dividend from Kedah subsidiaries 3,000

Dividend from Singapore subsidiaries 1,400

Interest from loan to Penang subsidiaries 4,600

Fees for management services from subsidiaries 1,000

Other income

Gain from disposal of an investment 5,000

Investments:

Investment in Kedah subsidiaries 80,000

Investment in Singapore subsidiaries 50,000

Loan to Penang subsidiaries 120,000

Additional information:

i. The direct expenses incurred in respect of the provision of the management services

are RM200,000 for staff costs and RM100,000 for office overheads.

ii. The interest expense incurred for the year is RM575,000 and was used to finance those

three investments as above. The interest expense directly attributed to:

Dividend from Kedah subsidiaries RM200,000

Dividend from Singapore subsidiaries RM100,000

Interest from loan to Penang subsidiaries RM275,000

iii. The amount of common expenses after excluding the expenses in items i and ii is RM1

million.

iv. The current year capital allowance relating to the common assets is RM200,000.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/FEB 2022/TAX667/490

v. Based on the tax computation for YA 2020, there was an excess of deductible expenses

over gross income in respect of the management fee and interest income sources of

RM100,000 and RM50,000 respectively.

Required:

a. Discuss, with supporting calculations, why SB will be regarded as an investment holding

company.

(4 marks)

b. Compute SB’s total income for YA 2021.

(11 marks)

c. Compare the tax treatment of the management service fees income if SB is to be

delisted from the Bursa Malaysia.

(5 marks)

(Total: 20 marks)

QUESTION 3

Jihoon, a businessman, was being investigated by the Inland Revenue Board of Malaysia

(IRBM) for suspected tax evasion. An investigation was carried out and the following

information were discovered.

1. The extract of the statement of financial position from Jihoon’s business are shown

below:

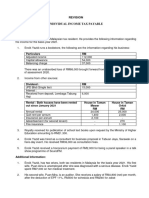

2019 (RM) 2020 (RM) 2021 (RM)

Capital as at 1 January 300,000 350,000 480,000

Profit for the year 150,000 200,000 200,000

Drawings for the year 15,000 40,000 50,000

2. A car was acquired by Jihoon in April 2019 at a cost of RM150,000. The vehicle was

financed by an interest-free loan, provided by his father (RM90,000) and his uncle

(RM30,000) in 2019. Jihoon paid three (3) equal yearly installments and two (2) equal

yearly installments to his father and uncle, respectively. The payment commenced in

November 2019.

Subsequently, the car was traded-in with a Toyota Lexus vehicle at a value of

RM100,000 on 1 July 2021. The cost of the new vehicle was RM240,000. The trade-in

value was used as a down payment for the new vehicle, while the balance was financed

by a 56-month hire purchase loan. Jihoon began paying the monthly installment of

RM2,655 on 1 August 2021.

3. Jihoon acquired 200,000 shares at RM1 per share in Minimalist Bhd for RM200,000 in

2017. In March 2021, 60% of these shares were sold for RM110,000. The broker agent

was given a 1.5% fee from the disposal value. In November 2021, Jihoon acquired

100,000 shares for RM100,000 from Saradise Bhd.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 AC/FEB 2022/TAX667/490

4. Jihoon stayed at an inherited bungalow with his family, since 2012. The market value of

the property at the time was RM300,000. Jihoon incurred RM8,000 being cost in

repairing the roof in February, 2020. Later that year, the bungalow was renovated at a

cost of RM90,000. The property was subsequently sold for RM500,000 in July 2021.

Jihoon and his family moved to a new residential property (RM600,000) at Boulevard

Park in the same year. The proceed from the disposal of the bungalow (RM500,000)

was used to settle a RM200,000 personal loan, while the remaining RM300,000 was

deposited into his personal account in Jakarta, in 2021. Jihoon borrowed the RM200,000

personal loan from his sister in 2019.

5. Jihoon’s personal bank statement in Malaysia showed the following balances at the end

of the year:

As at 31 December 2019 (RM) 2020 (RM) 2021 (RM)

Balances 110,000 (Dr) 250,000 (Cr) 1,500,000 (Cr)

6. Jihoon declared income of RM 105,000, RM180,000 and RM185,000 for the years of

assessment 2019, 2020 and 2021, respectively.

7. The payments extracted from the company’s bank statement are shown below:

2019 (RM) 2020 (RM) 2021 (RM)

Ting Dental - 8,000 (Dr) 12,000 (Dr)

Inland Revenue Board Malaysia 15,000 (Dr) 20,000 (Dr) 20,000 (Dr)

Everise Supermarket Bhd - - 36,000 (Dr)

The following explanations were provided by Jihoon about the above items:

i. The payment for Ting Dental relates to dental bills for his children.

ii. The payment to IRBM pertains to income tax paid.

iii. The payment to Everise Supermarket Bhd pertains to food for his family.

8. Jehan (Jihoon’s brother) made a payment of RM80,000 to Jihoon in September 2020,

being partial payment for the RM150,000 interest-free loan provided by Jihoon earlier

that year. He passed away suddenly in late 2021. Due to financial difficulties, Jehan’s

wife will only be able to settle 50% of the outstanding loan in the year 2022. Jihoon will

not be able to recover the remaining balance in 2021.

Required:

a. Calculate the unreported income (if any) of Jihoon for the years of assessment 2020

and 2021 using the capital statement method.

(20 marks)

b. The revised Tax Investigation Framework 2018 has specified incorrect return as an

offence under Sec 113(1) of the Income Tax Act 1967. Explain the offences of an

incorrect return.

(3 marks)

(Total: 23 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 6 AC/FEB 2022/TAX667/490

QUESTION 4

Saradise Property Trust (SPT) is an approved real estate investment trust (REIT) listed on

Bursa Malaysia. The income statement for the year ended 31 December 2021 is provided

below:

Income Note RM

Rental income 1,480,000

Interest income from debentures 1 200,000

Dividend from Taiwan 50,000

Revaluation surplus 20,700

1,750,700

Expenditure

Trustee’s fee 2 (36,000)

Professional fees for tax appeal (18,000)

Realized loss on sale of quoted shares (3,400)

Contribution of books to National Public Library [sec 34(6)(g)] (12,000)

Interest on loan 3 (40,000)

Profit before tax 1,641,300

Additional information:

1. Debenture was approved by the Securities Commission.

2. The trustee was paid RM20,000 to manage the business.

3. A quarter (¼) of the interest on a loan was related to the purchase of debenture while

the remaining amount was incurred to earn rental income.

4. The total income distributed to unitholders amounted to RM1,200,000.

Required:

a. Calculate the total income of SPT for the year of assessment 2021. Write ‘Nil’ where no

adjustment is required. Start your answer from profit before tax.

(10 marks)

b. Discuss the differences in the tax treatment of the following items under REIT, in

comparison with the normal treatment of a business source.

i. the excess of deductible expenses over income

ii. the excess of capital allowances

(5 marks)

c. Advise the management of SPT on the following:

i. the taxability of its total income for the year of assessment 2021.

ii. the tax implication of distributing another RM200,000 to its unitholders on 15

February 2022.

iii. the deduction of withholding tax to a resident company unit holder, assuming that

the total income of SPT qualifies for exemption.

(5 marks)

(Total: 20 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 7 AC/FEB 2022/TAX667/490

QUESTION 5

A. Gerak Invest Sdn Bhd (GISB) and Mara Invest Sdn Bhd (MISB) are wholly-owned

subsidiaries of Dabeena Investment Holding Bhd (DIHB). Both subsidiaries have an

issued capital of RM7 million each and DIHB has issued a share capital of RM10 million.

Dabeena group of companies were incorporated in Malaysia and have been actively

operating their business in the country for the past five years. These companies end

their accounting period on 31 October annually.

For the year of assessment 2021, DIHB’s aggregate income is RM1,100,000 which

comprises income from rental and business income. MISB recorded a statutory income

of RM2.0 million, meanwhile, GISB suffered an adjusted loss of RM2.5 million

Other information pertaining to the companies are as follows:

1. DIHB and its subsidiaries do not receive any form of tax incentives in the year of

assessment 2021.

2. Donation made by each company to an approved organization is as follows:

i. DIHB RM90,000

ii. GISB RM30,000

iii. MISB RM25,000 and 7 unit computers cost RM5,000 each to a

boarding school in Melaka.

Required:

a. Does Dabeena group of companies eligible for group relief for the year of

assessment 2021? Discuss and highlight criteria that need to be fulfilled before

the tax treatment can be implemented.

(6 marks)

b. Assuming that Dabeena group of companies qualify for group relief, for the year

of assessment 2021, compute the following:

i. The amount of adjusted losses that may be surrendered by GISB.

ii. The amount of unabsorbed losses to be carried forward by GISB.

iii. The defined aggregate income of DIHB and MISB.

(4 marks)

B. Kancil Plantation Sdn Bhd (KPSB), is a Malaysian resident company, which has been in

the business of cocoa plantations since 2000.

In a recent board meeting, KPSB has decided to build a factory in the year 2022 to

process and produce raw cocoa extract for export. The cost estimated for the capital

investment in the factory is RM250 million which plan to be financed from a loan raised

by the company. At the same time, KPSB also anticipates suffering a loss at the

beginning of the new venture.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 8 AC/FEB 2022/TAX667/490

In order to proceed with the plan, KPSB is considering two alternatives:

1. To set up a new wholly-owned subsidiary company with a paid-up capital of RM2.6

million that will take charge of the factory operation, or

2. KPSB will own and operate the factory as an extension of the existing business.

Additional information shows that KPSB incurred the following expenses the year ended

31 December 2021:

RM

Donations 75,000

Training expense 126,000

Leasing expenses 42,000

Bad debts 59,000

Employees’ remuneration 96,000

Notes:

1. The company donate RM20,000 and a van costing RM40,000 to an approved

charity organization.

2. Training expenses for employees.

3. KPSB leased a new Mercedes for its general manager for a period of 5 years at

RM4,200 per month starting March 2021. The cost of the car is RM250,000.

4. Bad debt consists of provision for general doubtful debts of RM30,000 and

provision of specific doubtful debts of RM29,000.

5. The amount includes salaries paid to a disabled employee amounted to RM30,000

per annum.

Required:

a. Based on the expenses incurred, advise five (5) tax planning strategies for KPSB

to minimize its income tax liability.

(10 marks)

b. In regards to KPSB decision to build a new factory, propose comparative tax

impact on each of the two alternatives, with reference to the following aspects:

i. The deductibility of the cost of any feasibility studies and other preparatory

expenses related to the establishment of the mill.

(2 marks)

ii. The treatment of the initial losses incurred.

(3 marks)

(Total: 25 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL APPENDIX 1 (1) AC/FEB 2022/TAX667/490

• The following tax rates and allowances are to be used in answering the questions:

Income Tax Rates

(a) Companies 24%

(b) Small and Medium companies:

Chargeable Income ≤ RM600,000 17%

Chargeable Income > RM600,000 24%

(c) Non-resident individuals 30%

(d) Resident individuals Scaled rate*

(e) Trust Body – Resident or Non-resident 24%

(f) Executor – Domiciled in Malaysia Scaled rate*

(g) Executor – Not domiciled in Malaysia 24%

* Scaled Rate (BUDGET 2021)

*Chargeable Income Rate Cumulative Tax

RM RM

On 5,000 0

Next 5,000 1 50

On 10,000 50

Next 10,000 1 100

On 20,000 150

Next 15,000 3 450

On 35,000 600

Next 15,000 8 1,200

On 50,000 1,800

Next 20,000 13 2,600

On 70,000 4,400

Next 30,000 21 6,300

On 100,000 10,700

Next 150,000 24 36,000

On 250,000 46,700

Next 150,000 24.5 36,750

On 400,000 83,450

Next 200,000 25 50,000

On 600,000 133,450

Next 400,000 26 104,000

On 1,000,000 237,450

Next 1,000,000 28 280,000

On 2,000,000 517,450

Exceeding 2,000,000 30

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL APPENDIX 1 (2) AC/FEB 2022/TAX667/490

Personal reliefs (BUDGET 2021)

RM

Self 9,000

Disabled self, additional 6,000

Spouse relief (normal) - no income/ joint assessment 4,000

Disabled spouse 9,000

Child - basic rate (each) 2,000

Child - more than 18 years old and study at higher institution (each) 8,000

Disabled child (each) 6,000

Disabled child - more than 18 years old and study at higher (each) 14,000

institution

Childcare (below six years old) (maximum) 2,000

Medical expenses expended on parents (maximum) 8,000

Medical expenses expended on self, spouse or child with serious (maximum) 8,000

disease,

including up to RM1,000 medical examination Parental care (each) 1,000

Basic supporting equipment for disabled self, spouse, child or (maximum) 6,000

parent

Study course fees for skills or qualifications (maximum) 7,000

Lifestyle allowance (maximum) 2,500

Rebates

Chargeable income not exceeding RM35,000 RM

Individual - basic rate 400

Individual entitled to a deduction in respect of a spouse or a former wife 800

Rate of Capital Allowances

Initial allowance Annual allowance

(IA) (AA)

Rate % Rate %

Industrial buildings 10 3

Plant and machinery - general 20 14

Motor vehicles and heavy machinery 20 20

Office equipment, furniture and fittings 20 10

Computers 20 20

Agriculture allowance

Buildings for the welfare of or as living

accommodation for farm employees Nil 20

Other buildings used in the business Nil 10

All other qualifying agricultural expenditure Nil 50

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- Mid-Term Test Tax517 June 2022Document8 pagesMid-Term Test Tax517 June 2022FeahRafeah KikiNo ratings yet

- Dec 2021Document83 pagesDec 2021刘宝英No ratings yet

- TAX517 2023 Feb QDocument15 pagesTAX517 2023 Feb QNik Fatehah NajwaNo ratings yet

- Tax267 Jul2022 QQDocument9 pagesTax267 Jul2022 QQLENNY GRACE JOHNNIENo ratings yet

- Tutorial Chapter 1Document5 pagesTutorial Chapter 1Miera FrnhNo ratings yet

- Tax267 February 22 FaDocument13 pagesTax267 February 22 FarumaisyaNo ratings yet

- November 2022 - QSDocument3 pagesNovember 2022 - QSfareen faridNo ratings yet

- Tax 267 Feb21 PyqDocument8 pagesTax 267 Feb21 PyqKenji HiroNo ratings yet

- A201 Mid Assessment QDocument5 pagesA201 Mid Assessment QSanthiya MogenNo ratings yet

- TAX317 TEST Q Dec2021Document10 pagesTAX317 TEST Q Dec2021sharifah nurshahira sakinaNo ratings yet

- Feb2022 Tax267Document9 pagesFeb2022 Tax267Ayu MaisarahNo ratings yet

- A221 MC 9 - StudentDocument4 pagesA221 MC 9 - StudentNajihah RazakNo ratings yet

- A231 Tuto Q Topic 2-4 2023-10-24 05 - 02 - 28Document7 pagesA231 Tuto Q Topic 2-4 2023-10-24 05 - 02 - 28amyNo ratings yet

- Far570 Q Set 1Document8 pagesFar570 Q Set 1NURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- Tax317 Ctmay2022Document10 pagesTax317 Ctmay2022sharifah nurshahira sakinaNo ratings yet

- A211 MC 7 - StudentDocument4 pagesA211 MC 7 - StudentWon HaNo ratings yet

- TAX517 - Feb 2022Document14 pagesTAX517 - Feb 2022IZZAH FAQIHAH AHMAD HARRISNo ratings yet

- Tax517 Test June 2022Document5 pagesTax517 Test June 2022Marlina RashidNo ratings yet

- Tax467 Dec 2019Document13 pagesTax467 Dec 2019Szasza teppeiNo ratings yet

- FAR570 - Q - August 2021Document7 pagesFAR570 - Q - August 2021NURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Degree - Tax467Document9 pagesFaculty - Accountancy - 2022 - Session 1 - Degree - Tax467HAZIQ HASNOLNo ratings yet

- BAC1614 - 2110 - Final ExaminationDocument9 pagesBAC1614 - 2110 - Final ExaminationNABILA HADIFAH BINTI MOHAMAD PATHANNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Tax317Document13 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Tax317Lyana InaniNo ratings yet

- GP Group3 Acc220b2dDocument6 pagesGP Group3 Acc220b2dALIESYA FARHANA ALI HUSSAIN GHAZALINo ratings yet

- FA Dec 2021Document8 pagesFA Dec 2021Shawn LiewNo ratings yet

- Assignment (20%) TRIMESTER 1, 2019/2020 BAC2674 Taxation I: % of Similarity % of Marks DeductionDocument5 pagesAssignment (20%) TRIMESTER 1, 2019/2020 BAC2674 Taxation I: % of Similarity % of Marks DeductionArjun DonNo ratings yet

- Jan22 QQ PDFDocument5 pagesJan22 QQ PDFSYAZWINA SUHAILINo ratings yet

- Malaysian Institute of Information Technology January 2020 SemesterDocument4 pagesMalaysian Institute of Information Technology January 2020 SemesterEiqaa ˘˛˘No ratings yet

- T4Q RCA2 2020 Personal Tax Comp FocusDocument3 pagesT4Q RCA2 2020 Personal Tax Comp FocusHaananth SubramaniamNo ratings yet

- ACC 4041 Tutorial - Investment IncentivesDocument4 pagesACC 4041 Tutorial - Investment IncentivesAyekurikNo ratings yet

- Revision 1Document4 pagesRevision 1carazamanNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Far210Document8 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Far210Bil hutNo ratings yet

- Universiti Teknologi Mara Final Assessment: Confidential 1 AC/FEB 2022/FAR560Document7 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 AC/FEB 2022/FAR560NURUL IRA SHAFINAZ ARMENNo ratings yet

- June 2021Document82 pagesJune 2021刘宝英100% (1)

- Soalan Tugasan Perakaunan BBAW2103Document9 pagesSoalan Tugasan Perakaunan BBAW2103Ina RawaNo ratings yet

- Revision Questions 2020 Part VDocument18 pagesRevision Questions 2020 Part VJeffrey KamNo ratings yet

- CT Far160 Dec2022 QDocument4 pagesCT Far160 Dec2022 QSiti Nurul AtiqahNo ratings yet

- Darshini Mariappan Far 4Document10 pagesDarshini Mariappan Far 4darshini mariappanNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/JUL 2022/FAR320Document7 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/JUL 2022/FAR3202021202082No ratings yet

- Far270 July2022Document8 pagesFar270 July2022Nur Fatin AmirahNo ratings yet

- Far270 February 22 FaDocument8 pagesFar270 February 22 FarumaisyaNo ratings yet

- Tutorial 3: Employment and Personal Taxation: Universiti Tunku Abdul Rahman Faculty of Business and FinanceDocument2 pagesTutorial 3: Employment and Personal Taxation: Universiti Tunku Abdul Rahman Faculty of Business and FinanceKAY PHINE NGNo ratings yet

- Assignment/ TugasanDocument7 pagesAssignment/ TugasanFauziah Mustafa100% (1)

- Q Mar22Document9 pagesQ Mar22user mrmysteryNo ratings yet

- Test 2 Acc117 Q Sem Mar 2022 Am1103bDocument6 pagesTest 2 Acc117 Q Sem Mar 2022 Am1103bHUMAIRA LIYANA FARISHA JAFRINo ratings yet

- Question - Test Acc106 Mac 2021 - 2july2021Document4 pagesQuestion - Test Acc106 Mac 2021 - 2july2021Fara husnaNo ratings yet

- Final Assessment Far210 Feb2021Document8 pagesFinal Assessment Far210 Feb2021Lampard AimanNo ratings yet

- Faculty of Management Studies: Department of Business AdministrationDocument8 pagesFaculty of Management Studies: Department of Business AdministrationEtNo ratings yet

- FAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsDocument5 pagesFAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsAmniNo ratings yet

- Course: Taxation 2 Course Code: TAX517 Date: APRIL 2020 Time: 1 HourDocument5 pagesCourse: Taxation 2 Course Code: TAX517 Date: APRIL 2020 Time: 1 Houranis izzatiNo ratings yet

- Question Far270 Feb2021Document9 pagesQuestion Far270 Feb2021Nur Fatin AmirahNo ratings yet

- Far570 SoalanDocument7 pagesFar570 SoalanNURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- Revision For Test 2Document3 pagesRevision For Test 2Raudhatun Nisa'No ratings yet

- Tax Mac2002Document8 pagesTax Mac2002Insan KerdilNo ratings yet

- Acb21103 Tutorial Business Income 2023Document8 pagesAcb21103 Tutorial Business Income 2023alifarhanah6No ratings yet

- Abfa1513 220518Document6 pagesAbfa1513 220518CRYSTAL NGNo ratings yet

- TUTORIAL Withholding Tax 2023 PDFDocument4 pagesTUTORIAL Withholding Tax 2023 PDFfarhan edhamNo ratings yet

- Bbfa1103 Assigment Question 2023Document13 pagesBbfa1103 Assigment Question 2023Bdq ArrogantNo ratings yet

- 3 Topic 2 Earning Per Share - Tutorial 1Document4 pages3 Topic 2 Earning Per Share - Tutorial 1izwanNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Malaysian University English Test SPEAKING 800/2: Presented By, Mdm. Audrey Koh Speaking Examiner Since 2003Document22 pagesMalaysian University English Test SPEAKING 800/2: Presented By, Mdm. Audrey Koh Speaking Examiner Since 2003Felisca LgNo ratings yet

- Chapter 1 EntrepreneurshipDocument23 pagesChapter 1 EntrepreneurshipMuhamad DzulhazreenNo ratings yet

- 06 - Starting A New Venture - SmsDocument31 pages06 - Starting A New Venture - SmsCAAqilFoziNo ratings yet

- Chapter 2 New Entry & FacebookDocument56 pagesChapter 2 New Entry & FacebookIra SyahirahNo ratings yet

- TaxDocument10 pagesTaxNur Athirah Binti MahdirNo ratings yet

- Ent530 - Case Study Guidelines Mar 2023 PDFDocument10 pagesEnt530 - Case Study Guidelines Mar 2023 PDFNur Athirah Binti MahdirNo ratings yet

- Elc501 - Wa - Pair 7Document4 pagesElc501 - Wa - Pair 7Nur Athirah Binti MahdirNo ratings yet

- Far 510Document11 pagesFar 510Nur Athirah Binti MahdirNo ratings yet

- Genting Malaysia BerhadDocument13 pagesGenting Malaysia BerhadNur Athirah Binti Mahdir100% (1)