Professional Documents

Culture Documents

FM (6th) Dec2016 PDF

FM (6th) Dec2016 PDF

Uploaded by

AxuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM (6th) Dec2016 PDF

FM (6th) Dec2016 PDF

Uploaded by

AxuCopyright:

Available Formats

17425 17425 17425 17425 17425 17425 17425 17425 17425

17425 Roll No.

17425 17425 17425 17425 17425 Total17425

No. of Pages

17425 : 02 17425

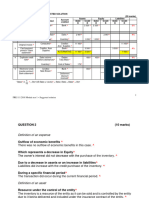

Total No. of Questions : 07

B.Com. (2011 & Onward) (Sem.–6)

17425 17425 17425 FINANCIAL

17425 MANAGEMENT

17425 17425 17425 17425 17425

Subject Code : BCOP-603

Paper ID : [A2260]

17425 Time : 3 Hrs.

17425 17425 17425 17425 17425 Max. Marks

17425 17425 : 60 17425

INSTRUCTIONS TO CANDIDATES :

1. SECTION-A is COMPULSORY consisting of TEN questions carrying T WO marks

17425 17425

each. 17425 17425 17425 17425 17425 17425 17425

2. SECTION-B contains SIX questions carrying TEN marks each and students have

to attempt any FOUR questions.

17425 17425 17425 17425 17425 17425 17425 17425 17425

SECTION-A

17425 1.

17425 Write briefly

17425 : 17425 17425

o m

17425 17425 17425 17425

.r c

1. Financial Plan.

m

17425 17425 17425 17425 17425 17425 17425 17425 17425

e

2. Wealth Maximization

3. Working capital cycle

p o

a .r c

17425 17425 17425 17425 17425 17425 17425 17425 17425

4. Cost of capital

r p

5. Why pay back period method is popular?

e

17425 17425 17425

b

6. Financial Leverage

17425 17425 17425

a p

17425 17425 17425

rp

17425 17425 7. Gordon's

17425 model 17425 17425 17425 17425 17425 17425

17425 17425

8. Present value

17425 17425

9. Optimal capital structure

17425 b 17425 17425 17425 17425

10. Trade credit

17425 17425 17425 17425 17425 17425 17425 17425 17425

17425 17425 17425 17425 17425 17425 17425 17425 17425

17425 1 | M-71028

17425 17425 17425 17425 17425 17425 (S3)-2658

17425 17425

17425 17425 17425 17425 17425 17425 17425 17425 17425

17425 17425 17425 17425 17425 17425 17425 17425 17425

SECTION-B

17425 17425 17425 17425 17425 17425 17425 17425 17425

2 What is Financial Management all about? Describe the principles and objectives of sound

financial planning.

17425 17425 17425 17425 17425 17425 17425 17425 17425

3 Explain the importance of working capital management. Explain and illustrate

the profitability liquidity tradeoffs in working capital management.

17425 17425 17425 17425

4 What are the principles followed 17425

in estimating 17425 17425

the cash flows 17425

in capital budgeting? 17425

Explain the process of capital budgeting.

17425 5

17425 How do you distinguish

17425 17425between the business risk17425

17425 and financial 17425

risk of a firm?17425

How are 17425

they measured by the leverage? Why is increasing leverage indicative of increasing risk?

6 Critically explain the MM approach to capital structure as an extension of NOI approach.

17425 17425 17425 17425 17425

How the arbitrage is done through MM approach? 17425 17425 17425 17425

17425

7

17425 these terms

17425 on the assets

17425and liabilities

17425

o m

What are the various credit terms of receivables management? Illustrate the impact of

of the firm.17425 17425 17425 17425

17425 17425 17425 17425 17425

.r c 17425 17425

m

17425 17425

p e o

a .r c

17425 17425 17425 17425 17425 17425 17425 17425 17425

r p e

17425 17425 17425

b 17425 17425

a

17425

p

17425 17425 17425

rp

17425 17425 17425 17425 17425 17425 17425 17425 17425

17425 17425 17425 17425 17425 b 17425 17425 17425 17425

17425 17425 17425 17425 17425 17425 17425 17425 17425

17425 17425 17425 17425 17425 17425 17425 17425 17425

17425 2 | M-71028

17425 17425 17425 17425 17425 17425 (S3)-2658

17425 17425

17425 17425 17425 17425 17425 17425 17425 17425 17425

You might also like

- S F S P: The Pecial Actor Taking LanDocument7 pagesS F S P: The Pecial Actor Taking LanMG7FILMESNo ratings yet

- Cambridge International As and A Level Business Studies Revision GuideDocument217 pagesCambridge International As and A Level Business Studies Revision GuideAlyan Hanif92% (12)

- Citate Being EricaDocument8 pagesCitate Being EricaCristina Rusu-MarianNo ratings yet

- Atlas Copco Deep Hole Drilling 2015Document132 pagesAtlas Copco Deep Hole Drilling 2015Akshay Yewle100% (1)

- Isuzu Workshop ManualDocument147 pagesIsuzu Workshop ManualJoe Bingham85% (20)

- MSC Structural Geology With Geophysics Test-University of LeedsDocument5 pagesMSC Structural Geology With Geophysics Test-University of Leedsazeem123650% (2)

- Super 75 NotesDocument340 pagesSuper 75 Notesnasiransar26No ratings yet

- Spar PartDocument5 pagesSpar PartMed Lemine Sidi BadiNo ratings yet

- For Proficient Teachers (Ti/Tii/Tiii) Quality: Objective NoDocument2 pagesFor Proficient Teachers (Ti/Tii/Tiii) Quality: Objective NoJoel VillegasNo ratings yet

- Tutorial Letter 202/2/2014: Selected Accounting Standards and Simple Group StructuresDocument11 pagesTutorial Letter 202/2/2014: Selected Accounting Standards and Simple Group StructuresJerome ChettyNo ratings yet

- Cessna SEL-25-03 Secondary Seat StopDocument18 pagesCessna SEL-25-03 Secondary Seat StopPaula Pulido MartínezNo ratings yet

- Phase 4Document1 pagePhase 4ashis maityNo ratings yet

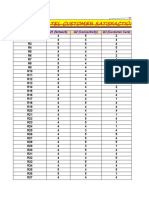

- Airtel Customer Satisfaction in Patna.: No. of Respondent Q1 (Network) Q2 (Connectivity) Q3 (Customer Care)Document6 pagesAirtel Customer Satisfaction in Patna.: No. of Respondent Q1 (Network) Q2 (Connectivity) Q3 (Customer Care)aryansomenNo ratings yet

- DAA (5th) May2016Document2 pagesDAA (5th) May2016Raavi SaamarNo ratings yet

- Kpi-Input 2404012130Document3 pagesKpi-Input 2404012130arunkumar14friendNo ratings yet

- Pilot-Data StudentsDocument7 pagesPilot-Data StudentskrysthelgraceyuNo ratings yet

- Canteen Fs SampleDocument6 pagesCanteen Fs SampleEiuol Nhoj ArraeugseNo ratings yet

- HBL HBL HBL HBL: Bank Copy Finance Copy Student Copy M.I.SDocument1 pageHBL HBL HBL HBL: Bank Copy Finance Copy Student Copy M.I.Skashif aliNo ratings yet

- A2 Book For June 2023 p3 FinalDocument532 pagesA2 Book For June 2023 p3 Finals.alisufyaanNo ratings yet

- A Hybrid MCDM Model For Supplier Selection in Supply ChainDocument8 pagesA Hybrid MCDM Model For Supplier Selection in Supply ChainTJPRC PublicationsNo ratings yet

- Schematic - 10 Channel LED Chaser Using Transistor - 2022-11-24Document1 pageSchematic - 10 Channel LED Chaser Using Transistor - 2022-11-24Bintoro DjatiNo ratings yet

- Tally FinalDocument7 pagesTally FinalVany SyNo ratings yet

- Ca Foundation Accounts TheoryDocument90 pagesCa Foundation Accounts TheoryFREEFIRE IDNo ratings yet

- Fabm1 Grade-11 Qtr4 Module2 Week-2Document6 pagesFabm1 Grade-11 Qtr4 Module2 Week-2Crestina Chu BagsitNo ratings yet

- Closing Entries 2022Document17 pagesClosing Entries 2022Tuyakula ShipadiNo ratings yet

- FRK 111 2018 Module Test 1 - Suggested SolutionDocument6 pagesFRK 111 2018 Module Test 1 - Suggested SolutionSanjana KapoorNo ratings yet

- Assistant (KPK Quota) - 500Document1 pageAssistant (KPK Quota) - 500TahirNo ratings yet

- Practice ProblemsDocument137 pagesPractice Problems司雨鑫No ratings yet

- Blue Riband 2016-17 Aviva MDRT Scheme 2017Document19 pagesBlue Riband 2016-17 Aviva MDRT Scheme 2017Abhinav VermaNo ratings yet

- IPCRF For T1 T3 MARCONDocument13 pagesIPCRF For T1 T3 MARCONMarcon DelgadoNo ratings yet

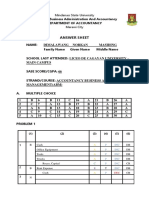

- Answer Sheet: Mindanao State UniversityDocument14 pagesAnswer Sheet: Mindanao State UniversityNermeen C. AlapaNo ratings yet

- Product Design Process: ProblemsDocument12 pagesProduct Design Process: ProblemsSathvik IyerNo ratings yet

- Assignment 1 - QDocument4 pagesAssignment 1 - QSeu4EduNo ratings yet

- Worksheet - Strenghts and WeaknessesDocument2 pagesWorksheet - Strenghts and WeaknessesNunoNo ratings yet

- Tugas KoperasiDocument7 pagesTugas Koperasilike itNo ratings yet

- Book 1Document1 pageBook 1welcomefoodindustries1779No ratings yet

- HO1 Problems and ExercisesDocument2 pagesHO1 Problems and ExercisesGuiana WacasNo ratings yet

- A5 Valuation OutlinesDocument124 pagesA5 Valuation OutlinesThiện Trần ĐứcNo ratings yet

- Act 110 Activity 2 (Answer Sheet - Dimalawang)Document12 pagesAct 110 Activity 2 (Answer Sheet - Dimalawang)Norkan DimalawangNo ratings yet

- The Adjusted Trial Balance of Reid and Campbell LTD atDocument2 pagesThe Adjusted Trial Balance of Reid and Campbell LTD atMuhammad ShahidNo ratings yet

- KPKC KhususDocument2 pagesKPKC KhususElena LieNo ratings yet

- Essential Graphs For AP MacroeconomicsDocument5 pagesEssential Graphs For AP MacroeconomicsDennis100% (1)

- Calculus With Analytical Geometry by SM Yousaf - CompressDocument1 pageCalculus With Analytical Geometry by SM Yousaf - CompressAbdullah HaiderNo ratings yet

- CAF - ACC - Past Exam AnalysisDocument6 pagesCAF - ACC - Past Exam AnalysisTheophras academyNo ratings yet

- Project:1742 - Salt Beach Kite Restaurant@Dubai: S.No Service REV Design DWG NumberDocument6 pagesProject:1742 - Salt Beach Kite Restaurant@Dubai: S.No Service REV Design DWG NumberjeffyNo ratings yet

- Consecutivo Facturas CreditoDocument24 pagesConsecutivo Facturas CreditoDeiry GarciaNo ratings yet

- متابعة إنجازات الموظفينDocument1 pageمتابعة إنجازات الموظفينفہتہى عہدنہNo ratings yet

- Accounting Volume 1 Canadian 9th Edition Horngren Test BankDocument99 pagesAccounting Volume 1 Canadian 9th Edition Horngren Test Bankbacksideanywheremrifn100% (28)

- Chapter12 - AnswerDocument26 pagesChapter12 - AnswerAubreyNo ratings yet

- Tutorial 1: Financial Statements, Taxes and Cash FlowsDocument17 pagesTutorial 1: Financial Statements, Taxes and Cash Flowsmaresa bruinersNo ratings yet

- 9mm Parabellum Bullet - Atarashii Hikari (Bass)Document12 pages9mm Parabellum Bullet - Atarashii Hikari (Bass)Guitar HeroNo ratings yet

- General Journal Dec-19: Date Acc No. Debit Credit Doc. NO. Account Name and DecsriptionDocument4 pagesGeneral Journal Dec-19: Date Acc No. Debit Credit Doc. NO. Account Name and DecsriptionVerren AnggriyaniNo ratings yet

- Physical Targets and Achievements 2016-17 To 2019-2020Document3 pagesPhysical Targets and Achievements 2016-17 To 2019-2020Azhar AliNo ratings yet

- Heineken 2004Document50 pagesHeineken 2004k0yujinNo ratings yet

- Revenue RecognizationDocument7 pagesRevenue RecognizationSajidNo ratings yet

- Real & HCDocument4 pagesReal & HCobed acostaNo ratings yet

- 2.0 Asset EvaluationDocument22 pages2.0 Asset EvaluationPrime ShineNo ratings yet

- Financial Statement Consolidation1 4Document4 pagesFinancial Statement Consolidation1 4crookshanksNo ratings yet

- Soal Dan JWBN Siklus DGGDocument17 pagesSoal Dan JWBN Siklus DGGGhina Risty RihhadatulaisyNo ratings yet

- For The Life Worth Living: Sizwe Hosmed Benefit Guide 2022Document76 pagesFor The Life Worth Living: Sizwe Hosmed Benefit Guide 2022Peter BoonzaierNo ratings yet

- Metals - April 24 2019Document1 pageMetals - April 24 2019Tiso Blackstar GroupNo ratings yet

- XKPI Open 1.31Document28 pagesXKPI Open 1.31Juan K SarmientoNo ratings yet

- Marketing AssignmentDocument27 pagesMarketing AssignmentRohit AnandNo ratings yet

- Make Money With Your Captain's License: How to Get a Job or Run a Business on a BoatFrom EverandMake Money With Your Captain's License: How to Get a Job or Run a Business on a BoatNo ratings yet

- Fate - Lost Continuum - A Fanmade Game Based On D&D 5e - GM BinderDocument70 pagesFate - Lost Continuum - A Fanmade Game Based On D&D 5e - GM BinderJoao PauloNo ratings yet

- Mr. James Bone (The Master Architect of The Body)Document26 pagesMr. James Bone (The Master Architect of The Body)Alfredo T. BakiaoNo ratings yet

- Franciscan Sisters of The Divine MercyDocument2 pagesFranciscan Sisters of The Divine MercyMother of MercyNo ratings yet

- Mabalacat City College Institute of Business Education: 3. Motivation TheoriesDocument3 pagesMabalacat City College Institute of Business Education: 3. Motivation Theoriesrebecca lisingNo ratings yet

- Lecture 3 Quarter Point 2DDocument19 pagesLecture 3 Quarter Point 2DBogdan NedelcuNo ratings yet

- Geometry Formulas 2D 3D Perimeter Area Volume PDFDocument2 pagesGeometry Formulas 2D 3D Perimeter Area Volume PDFSantoshkumar GurmeNo ratings yet

- The Spencer TechniqueDocument11 pagesThe Spencer TechniqueDavidAgelliNo ratings yet

- The Supreme Constitution of The National Health Students Associstion of Ghana (Nahsag)Document27 pagesThe Supreme Constitution of The National Health Students Associstion of Ghana (Nahsag)albert0% (1)

- Mourid Barghoutis I Saw Ramallah The Impossible RDocument14 pagesMourid Barghoutis I Saw Ramallah The Impossible Rrayyanamir59No ratings yet

- Fce WB PDFDocument3 pagesFce WB PDFchuantillyNo ratings yet

- English Let ReviewDocument2 pagesEnglish Let ReviewRamil GofredoNo ratings yet

- подготовки за одговор на астрономија прашањеDocument2 pagesподготовки за одговор на астрономија прашањеChryseisAliceNo ratings yet

- Easement & ArbitrationDocument27 pagesEasement & Arbitrationjanani paulraj100% (1)

- Solid CastDocument55 pagesSolid Castcesar_abddNo ratings yet

- PSAs 210, 300, 310Document4 pagesPSAs 210, 300, 310Kryzzel Anne JonNo ratings yet

- Sy 2022-2023 Technical Assistance Accomplishment Report For The Month of November 2022Document3 pagesSy 2022-2023 Technical Assistance Accomplishment Report For The Month of November 2022JAMES HENSONNo ratings yet

- GT NPNangcaoDocument112 pagesGT NPNangcaoisrealyulsicNo ratings yet

- Harga Kitab Al AnwarDocument3 pagesHarga Kitab Al AnwarSMP AL ANWAR BERBASIS PESANTRENNo ratings yet

- USA v. Keys: Defense Motions in LimineDocument28 pagesUSA v. Keys: Defense Motions in LimineMatthew KeysNo ratings yet

- Transparency and Accountability of Village Fund Financial Management in The Eyes of The PublicDocument11 pagesTransparency and Accountability of Village Fund Financial Management in The Eyes of The PublicInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Rite of Marriage MassDocument8 pagesThe Rite of Marriage MassAnonymous pHooz5aH6VNo ratings yet

- Annotated BibliographyDocument5 pagesAnnotated Bibliographyokapi1245No ratings yet

- Canterbury Cathedral: FoundationDocument2 pagesCanterbury Cathedral: FoundationGianfry7No ratings yet

- Carl Stumpf Tonal FusionDocument1 pageCarl Stumpf Tonal FusionAnonymous J5vpGuNo ratings yet

- Social Psych Paper RubricDocument2 pagesSocial Psych Paper RubricVanessa M. EzzatNo ratings yet