Professional Documents

Culture Documents

Consolidated AFR 31mar2011

Uploaded by

5vipulsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consolidated AFR 31mar2011

Uploaded by

5vipulsCopyright:

Available Formats

REGD.OFFICE : P.O. TILAKNAGAR, TAL. SHRIRAMPUR, DIST. AHMEDNAGAR, MAHARASHTRA - 413 720.

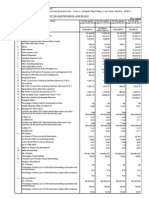

Consolidated Audited Financial Results for the Quarter & Year ended March 31, 2011

(Rs. in Lacs)

Sr. No. 1 2 a b c d e f g 3 4 5 6 7 8 9 10 11 12 13 14 15 16 a a b a b

Particulars

Quarter ended 31.03.2011 Audited 31.03.2010 Unaudited

Year ended 31.03.2011 Audited 31.03.2010 Audited

Net Sales / Income from Operations Other Operating Income Expenditure (Increase) / Decrease in Stock-in-trade & Work-in-progress Consumption of Raw Materials Purchase of Traded Goods Employees Cost Depreciation Other Expenditure Total Profit from Operations before Other Income, Interest & Exceptional Items (1-2) Other Income Profit before Interest & Exceptional items (3 + 4) Interest Profit after Interest but before Exceptional items (5 - 6) Exceptional Items Profit (+) / Loss (-) from ordinary activities before tax (7 + 8) Tax expense Net Profit (+) / Loss (-) from ordinary activities after tax (9 - 10) Extraordinary items (net of Tax expenses Rs..) Net Profit (+) / Loss (-) for the period (11-12) Paid-up Equity Share Capital(Face value of the share Rs.10/- each) Convertible Warrant Reserves excluding Revaluation Reserves as per Balance Sheet of previous accounting year Earnings per Share (EPS)(Rs.) Basic and diluted EPS before extra-ordinary items for the period, for the year to date and for the previous year(not annualized) Basic Diluted

12,962.10 14.63 1,803.81 1,841.92 239.75 361.93 5,857.24 10,104.65 2,872.08 2,872.08 699.44 2,172.64 2,172.64 1,065.58 1,107.07 1,107.07 11,525.67 781.87 -

13,465.96 253.82 (581.88) 5,206.07 373.63 184.68 4,966.25 10,148.74 3,571.04 3,571.04 895.13 2,675.90 2,675.90 1,335.39 1,340.52 1,340.52 3,231.00 -

46,833.09 262.12 959.56 15,068.08 2,124.99 1,311.57 17,320.37 36,784.57 10,310.65 10,310.65 3,877.67 6,432.98 6,432.98 2,475.58 3,957.41 3,957.41 11,525.67 781.87 21,855.26

38,440.30 457.33 (1,894.12) 17,005.55 2,012.97 712.69 13,316.30 31,153.38 7,744.25 7,744.25 2,358.41 5,385.83 5,385.83 1,896.39 3,489.45 3,489.45 3,231.00 9,381.35

0.91 0.87

3.50 3.43

3.76 3.62

5.90 5.76

Basic and diluted EPS after extra-ordinary items for the period, for the year to date and for the previous year(not annualized) Basic Diluted 0.91 0.87 52,917,465 45.91% --3.50 3.43 12,469,675 38.59% --3.76 3.62 52,917,465 45.91% --5.90 5.76 12,469,675 38.59% ---

17

Public Shareholding - Number of shares - Percentage of Shareholding

18

Promoters and promoter group shareholding a) Pledged/ Encumbered - Number of Shares - Percentage of shares ( as a % of the total shareholding of the promoter and promoter group ) - Percentage of shares ( as a % of the total share capital of the Company) b) Non encumbered - Number of Shares - Percentage of shares ( as a % of the total shareholding of the promoter and promoter group ) - Percentage of shares ( as a % of the total share capital of the Company) 54.09% 61.41% 54.09% 61.41% 62,339,239 100% 19,840,325 100% 62,339,239 100% 19,840,325 100%

NOTES:

2 3 4 5 6

The Company in compliance with the provisions of Clause 41 of the Listing Agreement, has opted to publish the consolidated financial results. The standalone financial results will, however, be made available to the Stock Exchanges where the Companys securities are listed and will also be posted on the Companys website i.e. www.tilind.com. The above Audited Financial Results reviewed by the Audit Committee have been approved and taken on record by the Board of Directors at its meeting held on May 26, 2011. The consolidated financial results comprise the financial results of Tilaknagar Industries Ltd. and its 100% subsidiaries viz; Vahni Distilleries Private Limited, Prag Distillery (P) Ltd. and Kesarval Springs Distillers Pvt. Ltd. and have been prepared in accordance with the AS-21 issued by the ICAI. The Board of Directors has recommended a final dividend of Rs. 0.80 per equity share of Rs. 10/- each ( 8% ) for the financial year 2010-11 subject to the approval of shareholders at the ensuing Annual General Meeting. The Company is predominantly engaged in the business of manufacture and sale of Indian Made Foreign Liquor (IMFL) and its related products, which constitute a single business segment. Standalone Information : (Rs. in Lacs)

Particulars

Quarter ended 31.03.2011 Unaudited

Quarter ended 31.03.2010 Unaudited

Year ended 31.03.2011 Audited

Year ended 31.03.2010 Audited

1 2 3 7

Net Sales/ Income from Operations Profit before Tax Profit after Tax

9,885.34 2,464.00 1,343.05

12,377.24 2,891.28 1,687.48

34,939.83 5,668.05 3,490.10

34,993.82 4,996.05 3,312.25

8 9

The Company has franchisee arrangements in some states and in respect of such arrangements the turnover of Rs 22,872.06 lacs (Rs 19,196.87 lacs ) during the quarter ended March 31, 2011 and Rs 83,082.95 lacs ( Rs 55,427.18 lacs) during the financial year ended March 31, 2011 has not been treated as 'Sales'. However the surplus generated out of these arrangements is included in the 'Sales/Income from Operations'. Thus the total sales of the Company's brand is Rs 37,421.39 lacs (Rs 33,436.64 lacs) during the quarter ended March 31, 2011 and Rs 131,539.22 lacs (Rs 1,00,010.14 lacs ) during the financial year ended March 31, 2011. The Company did not have any investor complaints pending on January 01, 2011. During the quarter seven investor complaints were received and the same were resolved. There were no investor complaints pending as on March 31, 2011. Statement of Outstanding Stock Options :

Particulars

1 2 3 4 5 Outstanding Stock Options as on January 01, 2011 Stock Options Granted during the quarter Stock Options Exercised during the quarter Stock Options Cancelled/Lapsed during the quarter Outstanding Stock Options as on March 31, 2011

ESOP Scheme 2,008

ESOP Scheme 2,010

4,709,163 37,640 63,978 4,607,545

1,615,500 11,700 1,603,800

10 During the quarter, the Company has allotted 4,018,264 Equity Shares to Mr. Amit Dahanukar, Promoter of the Company against conversion of warrants and 37640 Equity Shares to option grantees against exercise of vested stock options. (Rs. in Lacs) 11 The Audited statement of assets and liabilities is as under:

Particulars

Year ended 31/03/2011 31/03/2010

Shareholders Funds a) Capital 12,309.53 3,231.00 b) Employee Stock Option Outstanding 190.64 28.30 c) Reserves & Surplus 29,181.54 17,008.43 Loan Funds 43,330.56 44,944.08 Deferred tax liabilities 1,991.05 1,195.47 Total 87,003.32 66,407.29 Fixed Assets 46,318.41 37,449.95 Investments 28.77 28.77 Current Assets, Loans and Advances a) Inventories 8,133.15 8,432.60 b) Sundry debtors 9,663.58 8,199.53 c) Cash and bank balances 1,664.85 2,656.80 d) Other current assets e) Loan and advances 32,010.27 21,513.20 Less : Current liabilities and provisions a) Liabilities 9,569.19 9,276.87 b) Provisions 1,246.54 2,596.70 Miscellaneous Expenses(Not written off or Adjusted) Profit & Loss Account Total 87,003.32 66,407.29 12 During the financial year, the funds amounting to Rs. 134.99 crores raised through allotment of 14,210,500 Equity Shares at issue price of Rs. 95/- per share to Qualified Institutional Buyers have been fully utilized for, amongst other, repayment of unsecured loans raised from Banks/ICDs, capital expenses, Long term working capital expenses/payment to creditors, Investment in subsidiaries and QIP Expenses. Funds amounting to Rs. 22.50 crores raised through allotment of 4,018,264 Equity Shares to Mr. Amit Dahanukar, Promoter of the Company, are towards funding long term working capital requirements and capital expenditure and the same remains unutilized as on March 31, 2011. 13 The previous period figures have been regrouped wherever necessary. For TILAKNAGAR INDUSTRIES LTD. Sd/AMIT DAHANUKAR Place: Mumbai CHAIRMAN & MANAGING DIRECTOR Date : May 26, 2011

You might also like

- ICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Document9 pagesICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Sehrish HumayunNo ratings yet

- AuditedStandaloneFinancialresults 31stmarch, 201111121123230510Document2 pagesAuditedStandaloneFinancialresults 31stmarch, 201111121123230510Kruti PawarNo ratings yet

- Q3 Results 201112Document3 pagesQ3 Results 201112Bishwajeet Pratap SinghNo ratings yet

- Re Ratio AnalysisDocument31 pagesRe Ratio AnalysisManish SharmaNo ratings yet

- Unaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Document1 pageUnaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Amar Mourya MouryaNo ratings yet

- Segment Reporting (Rs. in Crore)Document8 pagesSegment Reporting (Rs. in Crore)Tushar PanhaleNo ratings yet

- Consolidated Balance Sheet As at 31st March, 2012: Particulars (Rs. in Lakhs)Document25 pagesConsolidated Balance Sheet As at 31st March, 2012: Particulars (Rs. in Lakhs)sudhak111No ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- ITC Consolidated FinancialsDocument49 pagesITC Consolidated FinancialsVishal JaiswalNo ratings yet

- Biocon - Ratio Calc & Analysis FULLDocument13 pagesBiocon - Ratio Calc & Analysis FULLPankaj GulatiNo ratings yet

- Audited Results 31.3.2012 TVSMDocument2 pagesAudited Results 31.3.2012 TVSMKrishna KrishnaNo ratings yet

- HCL Technologies LTD 170112Document3 pagesHCL Technologies LTD 170112Raji_r30No ratings yet

- Avt Naturals (Qtly 2011 06 30) PDFDocument1 pageAvt Naturals (Qtly 2011 06 30) PDFKarl_23No ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- Bil Quarter 2 ResultsDocument2 pagesBil Quarter 2 Resultspvenkatesh19779434No ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- 1st Quarter Report 2011Document4 pages1st Quarter Report 2011Smart IftyNo ratings yet

- Balance Sheet of Titan IndustriesDocument24 pagesBalance Sheet of Titan IndustriesAkanksha NandaNo ratings yet

- Q2 Fy2011-12 PDFDocument2 pagesQ2 Fy2011-12 PDFTushar PatelNo ratings yet

- Annual ReportDocument1 pageAnnual ReportAnup KallimathNo ratings yet

- Consolidated Financial Results For March 31, 2016 (Result)Document3 pagesConsolidated Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Rationale of Mergers & Acquisitions: Assignment 1Document6 pagesRationale of Mergers & Acquisitions: Assignment 1mujtabaansariNo ratings yet

- HUL Stand Alone StatementsDocument50 pagesHUL Stand Alone StatementsdilipthosarNo ratings yet

- New Listing For PublicationDocument2 pagesNew Listing For PublicationAathira VenadNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report, Auditors Report For September 30, 2016 (Result)Document16 pagesStandalone & Consolidated Financial Results, Limited Review Report, Auditors Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- NESTLE Financial Report (218KB)Document64 pagesNESTLE Financial Report (218KB)Sivakumar NadarajaNo ratings yet

- GTL Fin Q4 FY 10-11MDocument4 pagesGTL Fin Q4 FY 10-11MAnantmmNo ratings yet

- Analisis Laporan Keuangan PT XL AXIATA TBKDocument9 pagesAnalisis Laporan Keuangan PT XL AXIATA TBKmueltumorang0% (1)

- Summary of Consolidated Financial Results For The Year Ended March 31, 2014 (U.S. GAAP)Document34 pagesSummary of Consolidated Financial Results For The Year Ended March 31, 2014 (U.S. GAAP)pathanfor786No ratings yet

- Annual Report OfRPG Life ScienceDocument8 pagesAnnual Report OfRPG Life ScienceRajesh KumarNo ratings yet

- Avt Naturals (Qtly 2011 03 31) PDFDocument1 pageAvt Naturals (Qtly 2011 03 31) PDFKarl_23No ratings yet

- Consolidated Financial StatementsDocument78 pagesConsolidated Financial StatementsAbid HussainNo ratings yet

- HUL MQ 12 Results Statement - tcm114-286728Document3 pagesHUL MQ 12 Results Statement - tcm114-286728Karunakaran JambunathanNo ratings yet

- Indian Oil Corporation Project 2Document30 pagesIndian Oil Corporation Project 2Rishika GoelNo ratings yet

- EMSCFIN-FARDocument37 pagesEMSCFIN-FARPuwanachandran KaniegahNo ratings yet

- Wipro Financial StatementsDocument37 pagesWipro Financial StatementssumitpankajNo ratings yet

- W16494 XLS EngDocument36 pagesW16494 XLS EngAmanNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- Avt Naturals (Qtly 2010 03 31) PDFDocument1 pageAvt Naturals (Qtly 2010 03 31) PDFKarl_23No ratings yet

- Avt Naturals (Qtly 2011 09 30) PDFDocument1 pageAvt Naturals (Qtly 2011 09 30) PDFKarl_23No ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Tcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Document18 pagesTcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Cipar ClauNo ratings yet

- KFA - Published Unaudited Results - Sep 30, 2011Document3 pagesKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Avt Naturals (Qtly 2012 12 31)Document1 pageAvt Naturals (Qtly 2012 12 31)Karl_23No ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- 1st QTR 30 Sep 11Document18 pages1st QTR 30 Sep 11m__saleemNo ratings yet

- MSSL Results Quarter Ended 31st December 2011Document4 pagesMSSL Results Quarter Ended 31st December 2011kpatil.kp3750No ratings yet

- NFL Results March 2010Document3 pagesNFL Results March 2010Siddharth ReddyNo ratings yet

- Sbi Mutual Funds (Analysis of Financial Stastement)Document4 pagesSbi Mutual Funds (Analysis of Financial Stastement)Krishna Prasad GaddeNo ratings yet

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Document41 pagesInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaNo ratings yet

- Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Document1 pageStandalone Consolidated Audited Financial Results For The Year Ended March 31, 2011Santosh VaishyaNo ratings yet

- Kotak Mahindra 2011Document55 pagesKotak Mahindra 2011Pdr RaooNo ratings yet

- Weida 2011's 4th QTR Return - 31032011Document23 pagesWeida 2011's 4th QTR Return - 31032011Kai Sheng RooraNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Gallup ReportDocument19 pagesGallup Report5vipulsNo ratings yet

- HDFC LTD: Moderating GrowthDocument6 pagesHDFC LTD: Moderating Growth5vipulsNo ratings yet

- JBF Industries (JBFIND) : BOPET Films Deliver A Stellar PerformanceDocument7 pagesJBF Industries (JBFIND) : BOPET Films Deliver A Stellar Performance5vipulsNo ratings yet

- Indias Highest Paid ExecutivesDocument5 pagesIndias Highest Paid ExecutivesbazeerahamedNo ratings yet

- Welspun Corp (WELGUJ) : Volumes To Grow, Margins To ContractDocument6 pagesWelspun Corp (WELGUJ) : Volumes To Grow, Margins To Contract5vipulsNo ratings yet

- December 19, 2013Document10 pagesDecember 19, 2013The Delphos HeraldNo ratings yet

- Preview PDFDocument6 pagesPreview PDFMATHANA SOORIA A/P ADEYAH MoeNo ratings yet

- JPM Kolanovic CommentaryDocument8 pagesJPM Kolanovic CommentaryABAD GERONIMO RAMOS CORDOVANo ratings yet

- Foreign CurrencyDocument7 pagesForeign CurrencyLoraine Garcia GacuanNo ratings yet

- Baird - Option Market Making, 1993Document205 pagesBaird - Option Market Making, 1993ethexman80% (5)

- Capital Markets Institutions, Instruments, and Risk Management Fifth EditionDocument20 pagesCapital Markets Institutions, Instruments, and Risk Management Fifth EditionFrancis0% (2)

- Future Generali Brochure PDFDocument19 pagesFuture Generali Brochure PDFSangeeta LakhoteNo ratings yet

- 9609 s17 QP 32 PDFDocument8 pages9609 s17 QP 32 PDFvictorNo ratings yet

- Vivint Solar 401 (K) Enrollment Workbook - 528946Document62 pagesVivint Solar 401 (K) Enrollment Workbook - 528946KieraNo ratings yet

- #16 DerivativesDocument8 pages#16 DerivativesMakoy BixenmanNo ratings yet

- 5.4-Case Study APA Paper 11-3 and 13-6 - SampleDocument10 pages5.4-Case Study APA Paper 11-3 and 13-6 - SampleSMWNo ratings yet

- Options Trading Plan TemplateDocument2 pagesOptions Trading Plan Templatesangram24No ratings yet

- Finance Electives and Career Choices in Mcmaster UniversityDocument8 pagesFinance Electives and Career Choices in Mcmaster UniversityJamille Tao NiNo ratings yet

- Weekly Option Part 2 PDFDocument9 pagesWeekly Option Part 2 PDFramuNo ratings yet

- Section 1 - Overview and Option Basics: Download This in PDF FormatDocument10 pagesSection 1 - Overview and Option Basics: Download This in PDF FormatKaraokeNo ratings yet

- Cross-Cultural Differences in Risk Perception: A Model-Based ApproachDocument10 pagesCross-Cultural Differences in Risk Perception: A Model-Based ApproachBianca RadutaNo ratings yet

- CH 21 Option Valuation Test BanksDocument72 pagesCH 21 Option Valuation Test BanksAngelica Wira100% (1)

- Szpiro Pricing The Future Finance Finance Physics Black ScholesDocument273 pagesSzpiro Pricing The Future Finance Finance Physics Black ScholesPeterParker1983100% (1)

- Skew Modeling: Bruno Dupire Bloomberg LP Columbia University, New York September 12, 2005Document72 pagesSkew Modeling: Bruno Dupire Bloomberg LP Columbia University, New York September 12, 2005Celine AziziehNo ratings yet

- Mutual Funds E Book v2.5Document50 pagesMutual Funds E Book v2.5Aarna FinNo ratings yet

- Simple Options TradingDocument68 pagesSimple Options Tradingfinnthecelt88% (8)

- Chapter 18. Derivatives and Risk Management: OptionsDocument28 pagesChapter 18. Derivatives and Risk Management: OptionsAshish BhallaNo ratings yet

- Help Doc 1 PDFDocument101 pagesHelp Doc 1 PDFGopal KrishnanNo ratings yet

- Black Scholes DerivativesDocument4 pagesBlack Scholes DerivativesAjay SumalNo ratings yet

- International Financial Management 11 Edition: by Jeff MaduraDocument33 pagesInternational Financial Management 11 Edition: by Jeff MaduraChourp SophalNo ratings yet

- MC0620179935 HDFC SL YoungStar Super Premium - Retail - BrochureDocument8 pagesMC0620179935 HDFC SL YoungStar Super Premium - Retail - BrochuresapmayanNo ratings yet

- Options: Fundamentals of Corporate FinanceDocument23 pagesOptions: Fundamentals of Corporate FinancebutterpuffNo ratings yet

- Advanced Financial Management (AFM) : Syllabus and Study GuideDocument19 pagesAdvanced Financial Management (AFM) : Syllabus and Study GuideMy CaoNo ratings yet

- Derivatives Markets 3rd Edition McDonald Test Bank 1Document26 pagesDerivatives Markets 3rd Edition McDonald Test Bank 1gracegreenegrsqdixozy100% (24)

- Sirius XM Holdings Inc.: Form 4Document2 pagesSirius XM Holdings Inc.: Form 4guneetsahniNo ratings yet