Professional Documents

Culture Documents

Quiz 2 W Notes

Quiz 2 W Notes

Uploaded by

Lolo Lala0 ratings0% found this document useful (0 votes)

6 views2 pagesThe document discusses different types of investments and their associated risks. It notes that younger investors are typically more willing to take on riskier investments like options, while older retired investors prioritize safety and income through investments like bonds and bank accounts. It also provides examples of calculating annual shareholder return, yield to maturity, and earnings per share.

Original Description:

Original Title

Quiz_2_w_notes (1).docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses different types of investments and their associated risks. It notes that younger investors are typically more willing to take on riskier investments like options, while older retired investors prioritize safety and income through investments like bonds and bank accounts. It also provides examples of calculating annual shareholder return, yield to maturity, and earnings per share.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesQuiz 2 W Notes

Quiz 2 W Notes

Uploaded by

Lolo LalaThe document discusses different types of investments and their associated risks. It notes that younger investors are typically more willing to take on riskier investments like options, while older retired investors prioritize safety and income through investments like bonds and bank accounts. It also provides examples of calculating annual shareholder return, yield to maturity, and earnings per share.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

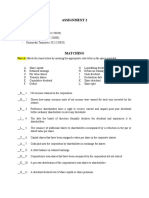

_____2.

Typically, young investors are more willing to take on riskier

investments. T

_____3. There is no relationship between safety and risk when choosing an

investment.F

Which of the following investments would have the greatest potential

for risk?

a. Preferred stock

b. Corporate bonds

c. Options

d. Bank accounts

_____9. Which of the following investment objectives is most likely to be a

priority with older retired investors?

a. growth

b. liquidity

c. income

d. safety

Annual shareholder return

At time of purchase

Market value – $275

Purchase price – $222

Commission paid – $5

Dividend received - $3

Annual shareholder return

Annual s/h return for current year = [(Ann.div. + appreciated value) – starting

price] / starting price

[(3 + 275) – 222] / 222 = 0.25

Market value – $175

Face value - $200

Interest – 10% annually

Purchased Jan 1 2021

Matures Dec 31 2022

Yield to maturity = [$int + [(face value – mkt value) / #of periods]] / [(mkt value +

face value) / 2]

[20 + [(200 - 175) / 2]] / [(175 + 200) / 2]

32.50 / 187.5 = 17.34%

Earning per Share (EPS) = After tax profits / # common shares

If a company earned $5m in profit, has 25% tax rate, and has 1m outstanding

common shares, and 1m outstanding preferred shares, what is it’s Earning [er share

(EPS)?

(5m x 75%)=3750000 / 1m = $3.75

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Investments Bodie Kane Marcus 9th Edition Test BankDocument45 pagesInvestments Bodie Kane Marcus 9th Edition Test BankDouglas Thompson100% (32)

- Summary of Charles B. Carlson's The Little Book of Big DividendsFrom EverandSummary of Charles B. Carlson's The Little Book of Big DividendsRating: 4 out of 5 stars4/5 (1)

- Testbank - Chapter 18Document3 pagesTestbank - Chapter 18naztig_017100% (1)

- 1 - Introduction To Financial Management - AnswersDocument2 pages1 - Introduction To Financial Management - AnswersMadelyn Espiritu50% (2)

- Ceilli EnglishDocument84 pagesCeilli EnglishKanna Nayagam100% (1)

- Mock Exam M9a 2Document16 pagesMock Exam M9a 2Malvin TanNo ratings yet

- Chap 022Document44 pagesChap 022jmsmartinsNo ratings yet

- Answer Key Summative Exam 1 & 2 Business FinanceDocument5 pagesAnswer Key Summative Exam 1 & 2 Business Financejelay agresorNo ratings yet

- MBA Corporate Finance SummariesDocument37 pagesMBA Corporate Finance SummariesOnikaNo ratings yet

- Business Finance LM5Document13 pagesBusiness Finance LM5Joana RoseteNo ratings yet

- Business Finance: Quarter 1 - Module 3 Types of InvestmentDocument11 pagesBusiness Finance: Quarter 1 - Module 3 Types of Investmentalmira calaguioNo ratings yet

- Berkshire Hathaway Balance Sheet Analysis (EXCELLENT)Document38 pagesBerkshire Hathaway Balance Sheet Analysis (EXCELLENT)Michael Cano LombardoNo ratings yet

- Business Finance: First Quarter Learning PacketDocument60 pagesBusiness Finance: First Quarter Learning PacketNikkie Desiongco100% (1)

- Financial Management QuestionsDocument5 pagesFinancial Management QuestionsLYANA NATASHANo ratings yet

- Evaluation (10 Mins) Quiz: Part 1: True/FalseDocument3 pagesEvaluation (10 Mins) Quiz: Part 1: True/Falseclaire juarez100% (1)

- Bonds: Here Are Some Benefits They Can ProvideDocument7 pagesBonds: Here Are Some Benefits They Can ProvidefaqehaNo ratings yet

- Chapter 2 - Capital StructureDocument19 pagesChapter 2 - Capital StructureNguyễn Ngàn NgânNo ratings yet

- Important Investing Information To Consider Before Subscribing With Epic ResearchDocument5 pagesImportant Investing Information To Consider Before Subscribing With Epic ResearchSanket MargajNo ratings yet

- CH 01Document9 pagesCH 01Bilal ImtiazNo ratings yet

- FINRA Investing Knowledge QuizDocument12 pagesFINRA Investing Knowledge QuizCarrotNo ratings yet

- Aifa QBDocument44 pagesAifa QBkrishna chaitanyaNo ratings yet

- BFN 111 Week 9Document15 pagesBFN 111 Week 9Gift AnosiNo ratings yet

- BusFin Q2 Mod5 Type-Of-Investment v2Document20 pagesBusFin Q2 Mod5 Type-Of-Investment v2Romnick SarmientoNo ratings yet

- Assignment 2 - Group 6Document5 pagesAssignment 2 - Group 6Jeremy Michael HariantoNo ratings yet

- Chapter 13 Investing FundamentalsDocument3 pagesChapter 13 Investing Fundamentalsiljuneli3801No ratings yet

- Tutorial 1 Choose ONE Correct Answer ONLYDocument4 pagesTutorial 1 Choose ONE Correct Answer ONLYnhoctracyNo ratings yet

- IPM - Unit-1 - Introduction To InvestmentDocument22 pagesIPM - Unit-1 - Introduction To InvestmentManshi AhirNo ratings yet

- Mid FM IiDocument1 pageMid FM IiMOLALIGNNo ratings yet

- Chapter 5Document9 pagesChapter 5Yasin IsikNo ratings yet

- PDF Storage Business-English-InvestingDocument2 pagesPDF Storage Business-English-Investingmike tanNo ratings yet

- Student Guide Lesson TwelveDocument7 pagesStudent Guide Lesson Twelveapi-344266741No ratings yet

- Section 2 Please Read The Following and Give Your ViewsDocument3 pagesSection 2 Please Read The Following and Give Your ViewsFaisal AnsariNo ratings yet

- w11 3 Investing, Taxation and Debt Part 1 SVDocument26 pagesw11 3 Investing, Taxation and Debt Part 1 SVZhong MattNo ratings yet

- COMR4E Feb 19 Investment Collaborative AssignmentDocument12 pagesCOMR4E Feb 19 Investment Collaborative AssignmentR WattNo ratings yet

- FMSM End Game NotesDocument63 pagesFMSM End Game Notesrnagpal274No ratings yet

- Customer ProfileDocument6 pagesCustomer Profileneha_jaithlya9703No ratings yet

- 3rd Midterm Quiz QuestionnaireDocument9 pages3rd Midterm Quiz QuestionnaireAthena Fatmah AmpuanNo ratings yet

- Accounting - Answer Key Quiz - Financial Assets and Amortized CostDocument3 pagesAccounting - Answer Key Quiz - Financial Assets and Amortized CostNavsNo ratings yet

- CH 06Document9 pagesCH 06Bairah KamilNo ratings yet

- Wealth MaximisationDocument3 pagesWealth MaximisationAmandeep Singh MankuNo ratings yet

- Topic 1 Investments: An IntroductionDocument51 pagesTopic 1 Investments: An Introductionqian liuNo ratings yet

- Exam1 2022fall Answerkey v4Document4 pagesExam1 2022fall Answerkey v4Yeji KimNo ratings yet

- ED213 - INDIVIDUAL PROJECT - Student Completed AnswerDocument6 pagesED213 - INDIVIDUAL PROJECT - Student Completed AnswerAfifi Iskandar MohamadNo ratings yet

- Mock Exam II Midterm WITH SOLUTIONSDocument6 pagesMock Exam II Midterm WITH SOLUTIONSAlessandro FestanteNo ratings yet

- Mock - Exam - II Midterm - WITH SOLUTIONS PDFDocument6 pagesMock - Exam - II Midterm - WITH SOLUTIONS PDFAlessandro FestanteNo ratings yet

- Mutual FundsDocument36 pagesMutual FundsShodasakshari VidyaNo ratings yet

- Solution of InvestmentDocument74 pagesSolution of Investmentahsanmalik2050No ratings yet

- CashCourse Quiz Investing 2Document2 pagesCashCourse Quiz Investing 2Asma RihaneNo ratings yet

- Business FinanceDocument4 pagesBusiness FinanceEduardo Jr. LleveNo ratings yet

- Key - Stocks & Shares (Equities) VocabularyDocument1 pageKey - Stocks & Shares (Equities) VocabularyNguyen HuyenNo ratings yet

- They Either Consume It or Save It.: A Distinction Can Be Made Between Saving and InvestingDocument126 pagesThey Either Consume It or Save It.: A Distinction Can Be Made Between Saving and InvestingAbdela Aman MtechNo ratings yet

- FNCE101 2024 Mid-Term Mock Exam 15Document4 pagesFNCE101 2024 Mid-Term Mock Exam 15samuel.sjhNo ratings yet

- Week 5 and 6 - Module 8 (Basic Concepts of Stocks and Bonds)Document24 pagesWeek 5 and 6 - Module 8 (Basic Concepts of Stocks and Bonds)Nbsb Ni CeiloNo ratings yet

- Presentation 5 - Valuation of Bonds and Shares (Final)Document21 pagesPresentation 5 - Valuation of Bonds and Shares (Final)sanjuladasanNo ratings yet

- Quiz Questions: Student Centre Chapter 2: Review of AccountingDocument4 pagesQuiz Questions: Student Centre Chapter 2: Review of AccountingSandyNo ratings yet

- FIBA 205 NotesDocument7 pagesFIBA 205 NotesGourav GhoshNo ratings yet

- English For Financial MarketsDocument74 pagesEnglish For Financial MarketsTRANNo ratings yet

- Ceilli Sample QuestionsDocument4 pagesCeilli Sample QuestionsPraveena PillaiNo ratings yet

- English For Financial Markets2Document72 pagesEnglish For Financial Markets2Zijian ZHUNo ratings yet