Professional Documents

Culture Documents

Financial Statements Assessment Activities PDF

Uploaded by

Mariz OrasaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statements Assessment Activities PDF

Uploaded by

Mariz OrasaCopyright:

Available Formats

FINANCIAL STATEMENTS

Assessment Activities

MULTIPLE CHOICE THEORIES

1. Which of the following statements are correct concerning fair presentation of financial

statements?

I. In virtually all circumstances, fair presentation is achieved by compliance with applicable

Philippine Financial Reporting Standards.

II. Financial statements shall present fairly the financial position, performance and cash flows of

an enterprise.

III. An enterprise whose financial statements comply with PFRS shall make an explicit and

unreserved statement of such compliance in the notes.

IV. Inappropriate accounting treatments are rectified either by disclosure of the accounting

policies used or by note or explanatory material.

A. I, II, III & IV B. II, III & IV C. I, II & IV D. I, II & III

2. Which basic feature is applied when immaterial amounts of similar nature and function are

grouped or condensed as one line item in the financial statements?

A. aggregation B. accounting policy C. offsetting D. comparability

3. Which of the following is an example of offsetting?

A. the allowance for doubtful accounts is deducted from accounts receivable.

B. the accumulated depreciation is deducted from property, plant and equipment.

C. the total liabilities are deducted from total assets to at net assets.

D. gains and losses from disposal of noncurrent assets are reported by deducting the

proceeds from the carrying amount of the assets and the related selling cost.

4. Which of the following will result to a fair presentation of financial information?

I. Selecting and applying accounting policies in accordance with IFRS.

II. Presenting information including accounting policies, in a manner that provides relevant and

faithfully represented financial information.

III. Providing additional disclosures when specific requirements of IFRS is insufficient to enable

users to understand the impact of transactions on the entity’s financial position and financial

performance.

IV. Disclosing inappropriate accounting policies used either by notes or explanatory material

without rectification.

A. III & IV B. I & II C. I, II & IV D. I, II & III

5. Which statements are correct concerning the general features in the presentation of financial

statements?

I. An entity shall prepare its financial statements except for cash flow information under the accrual

basis of accounting.

II. The presentation and classification of items in the financial statements shall be retained from

on period to the next.

III. Assets and liabilities, income and expenses, shall not be offset unless required or permitted

by another IFRS.

IV. Comparative information need not be disclosed in respect of the previous period for all

numerical information in the financial statements.

A. I, II, III & IV B. II, III & IV C. I & IV D. I, II & III

6. Which is incorrect concerning the concept of materiality and aggregation?

A. Materiality depends on the size and nature of the item judged in the circumstances of

its omission or misstatement.

B. Specific disclosure requirements of an IFRS must be met even if the resulting

information is not material.

C. Items of a dissimilar nature or function shall be presented separately unless they are

immaterial.

D. Information is material if its nondisclosure could influence the economic decisions of

users taken based on the financial statements.

7. Which feature is applied when the effects of transaction and other events are recognized when

they occur and they are recorded in the accounting records and reported in the financial

statements of the periods to which they relate?

A. Going concern B. Entity concept C. Time period D. Accrual basis

Compiled by: Noel A. Bergonia Page 1 of 11

FINANCIAL STATEMENTS

Assessment Activities

8. Which statement is incorrect concerning the “line items” on the face of the statement of financial

position?

A. As a minimum, IAS 1 requires that the face of the statements of financial position shall

include certain line items.

B. Additional line items, heading and subtotals shall be presented on the face of the

statement of financial position when such presentation is relevant to the understanding of

the entity’s financial position.

C. IAS 1 simply provides a list of items that are sufficiently different in nature or function

to warrant separate presentation on the face of the statement of financial position.

D. IAS 1 prescribes the order or format in which items are to be presented on the face of

the statements of financial position.

9. Which of the following is not a component of complete set of financial statements?

A. Statement of financial position

B. Statement of changes in equity

C. Notes, comprising a summary of significant policies and another explanatory

D. Addition statements such as environmental reports and value-added statements.

10. Which of the following is a limitation of the statement of financial position?

I. Many items that are of financial value are omitted.

II. Judgements and estimates are used.

III. Current fair value is not reported.

A. I only B. II only C. I & II D. I, II & III

11. Which statement is correct concerning presentation of information on the face of the statement

of financial position?

I. Additional line items, headings and subtotals shall be presented in the face of the

statement of financial position when such presentation is relevant to an understanding of

the entity’s financial position.

II. The IFRS/PFRS does not prescribe the format in which items are to be prepared.

A. I only B. II only C. Both I & II D. Neither I nor II

12. The statement of financial position is useful for analyzing all of the following except

A. liquidity B. solvency C. profitability D. financial flexibility

13. The operating cycle of an entity

A. is set by the industry’s trade association usually on an average length of time for all

firms which are members of the association

B. is the time between the acquisition of assets for processing and their realization in cash

or cash equivalents.

C. is the period of time that normally elapsed from the time the entity expends cash to the

time it converts trade receivables back into cash.

D. causes the distinction between current and noncurrent items to depend on whether

they will affect cash within one year.

14. Under IAS 1, when an entity’s normal operating cycle is not clearly identifiable, its duration is

assumed to be

A. 12 months B. 6 months C. 3 months D. 24 months

15. Which of the following is not a criterion for classifying an asset as current?

A. it expects to realize the asset, or intends to sell or consume it, in its normal operating

cycle;

B. it holds the asset primarily for the purpose of trading;

C. it expects to realize the asset within twelve months after the reporting period; or

D. the asset is cash or cash equivalents restricted from being exchanged or used to settle

a liability for at least twelve months after the reporting period.

16. Investment securities held for the purpose of retiring long-term bonds payable should be

classified as

A. current assets B. non-current assets C. deferred liability D. intangible assets

Compiled by: Noel A. Bergonia Page 2 of 11

FINANCIAL STATEMENTS

Assessment Activities

17. Which of the following shall not be classified as current asset?

A. A receivable from a customer not collectible within one year.

B. Current tax asset

C. Goodwill arising from business combination accounted for as a purchase

D. Noncurrent assets held for sale

18. Which of the following shall not be classified as a current liability?

A. An obligation expected to be settled in the entity’s normal operating cycle.

B. An obligation held primarily for the purpose of being trading.

C. An obligation due to be settled within 12 months after the reporting period.

D. An obligation for which the entity has an unconditional right to defer settlement for at

least 12 months after the reporting period.

19. Which obligations are classified as current liabilities even if they are due to be settled after

more than 12 months after the end of the reporting period?

A. Payable arising from purchase of goods and consumption of services relating to entity’s

conduct of primary operations.

B. Long term financial liabilities

C. Bank overdrafts

D. Cash dividends payable

20. A long-term debt that is due to be settled within 12 months after the reporting period is

classified as current when

I. an agreement to refinance or rescheduled payment on a long-term basis is completed

after the reporting period and before the financial statements are authorized to issue.

II. the entity has the discretion to refinance or roll over the obligation for at least 12 months

after the reporting period under an existing loan facility.

A. I only B. II only C. Either I or II D. Neither I nor II

21. For an entity that presents current and non-current classification of assets and liabilities,

deferred tax assets and liabilities shall be classified on the statement of financial position as

A. current assets and liabilities

B. noncurrent assets and noncurrent liabilities

C. both current and noncurrent assets and liabilities depending on the period of reversal.

D. both current and noncurrent assets and liabilities depending if related to a current and

noncurrent asset or liability.

22. When an entity breaches an undertaking under a long-term loan agreement on or before the

end of the reporting period with the effect that the liability becomes payable on demand,

I. the liability is classified as current even if the lender has agreed after the reporting period

and before the issuance of the financial statements not to demand payment as a

consequence of the breach.

II. the liability is classified as noncurrent if the lender agreed before the end of the reporting

period within which to rectify the breach.

A. I only B. II only C. Either I or II D. Neither I nor II

23. For purposes SRC Rule 68, large or publicly accountable entities are those that meet any of

the following criteria except:

A. Total assets of more than P350 Million and total liabilities of more than P250 Million.

B. Are required to file financial statements under Part II of SRC Rule 68.

C. Are in the process of filing their financial statements for the purpose of issuing any class

of instruments in a public market.

D. Are holders of secondary licenses issued by regulatory agencies.

24. Which of the following are sources of revenue?

I. sale of goods III. allowing others to use the entity’s resources

II. rendering of services IV. borrowing from banks

A. I, II, III and IV B. I, II and III C. II, III and IV D. I and III

25. Which of the following is not a line item on the face of the income statement using the function

of expense method.

A. revenue B. finance costs C. tax expense D. salaries and wages

Compiled by: Noel A. Bergonia Page 3 of 11

FINANCIAL STATEMENTS

Assessment Activities

26. Which of the following line items is normally shown in income statement presenting expenses

by function but nor in an income statement presenting expenses by nature?

A. gross profit C. income from operations

B. income from associates D. finance cost

27. Which of the following will not appear in the statement of changes in equity?

A. changes in depreciation method C. net loss

B. correction of prior period D. dividends

28. The operating expenses section of a statement of comprehensive income does not include

A. selling expenses C. interest expense

B. admin expense D. loss on sale of securities

29. The best measure of a firm’s ongoing ability to generate cash flows in the future is

A. profit from continuing operations C. discontinued operations

B. profit before tax D. net profit

30. A discontinued operations is a component of an entity that either been disposed of, or is

classified as held for sale and

A. is not part of a single coordinated plan to dispose a major line of business or

geographical area of operations.

B. represents a separate major line of business or geographical area of operations.

C. is discontinuing several products within an ongoing line of business.

D. is a subsidiary whose activities are similar to those of the parents and other subsidiaries

31. The results of a discontinued operation, net of tax shall be presented

A. as a single amount on the face of the income statement with no details disclosed in the

notes.

B. as a single amount on the face of the income statement with appropriate disclosure of

the details in the notes.

C. side by side with continuing operations with details for revenues and expenses

attributable to the discontinued operation shown on the face of the income statement

D. in the notes only

32. What is the primary purpose of the statement of cash flows?

A. to provide information about an entity’s financial position for a point in time.

B. to provide information about an entity’s financial performance for a period of time.

C. to provide information that is useful in assessing the ability of the entity to generate

cash.

D. to provide information about an entity’s financial structure.

33. When preparing a statement of cash flows using the indirect method, the gain on sale of fixed

assets should be reported as a/an

A. cash inflow from investing activities.

B. cash outflow from investing activities.

C. addition to profit to arrive at cash flows from operating activities.

D. deduction from profit to arrive at cash flows from operating activities.

34. In preparing a statement of cash flows, which of the following transactions would be

considered an investing activity?

A. investment by the owner C. proceeds of sale of machinery

B. withdrawal by the owner D. payment to employees

35. Investing activities are

A. that involves the production or purchase and the sale of goods and services to

customers.

B. that involves making and collecting loans, purchasing and selling of fixed assets.

C. with owners or long-term creditors of the business.

D. that involves receipt of interest payments, cash collections from customers.

Compiled by: Noel A. Bergonia Page 4 of 11

FINANCIAL STATEMENTS

Assessment Activities

36. Under the indirect method, which of the following items would be added to the profit to arrive

at cash flows from operating activities.

A. gain on sale of fixed assets. C. decrease in accounts payable

B. increase in prepaid expense D. decrease in accounts receivable

37. Which of the following would appear only in the statement of cash flows using indirect method?

A. cash payment for operating expense C. depreciation expense

B. cash receipts from customers D. cash receipts for money borrowed

from a bank

38. A company’s wages payable decreased from the beginning to the end of the year. In the

company’s statement of cash flows in which operating activities section is prepared under the

direct method, the cash paid for wages would be

A. wages expense plus wages payable at the beginning of the year.

B. wages expense plus the decrease in wages payable from the beginning to the end of

the period.

C. wages expense less the decrease in wages payable from the beginning to the end of

the period.

D. the same as wages expense.

39. The statement of cash flows is

A. another name for statement of financial position.

B. a financial statement showing revenues earned by the business, the expenses incurred

in earning the revenues, and operating profit or loss.

C. a financial report showing the assets, liabilities and equity of an enterprise on a specific

date.

D. a financial statement that reports the cash inflows and outflows for a period.

40. Dividend payments to owners should be classified as cash outflows for

A. operating activities

B. financing activities

C. investing activities

D. operating activities or financing activities provided the classification is consistent from

period to period.

41. Which of the following is not a financing activity?

A. Cash proceeds from issuing shares or other equity instruments

B. Cash payments by a lessee for the reduction of the outstanding liability relating to the

finance lease

C. Cash repayments of amount borrowed.

D. Cash advances and loans made by financial institutions.

42. Which of the following information would be added back to the profit when reporting cash flow

from operating activities using the indirect method?

A. excess treasury share acquisition over sales proceeds.

B. amortization of patents

C. bond premium amortization

D. gain from debt restructuring

43. The analysis of the statement of financial position is useful in assessing the liquidity, which

is the ability to

A. satisfy short-term obligations.

B. maintain profitable operations.

C. maintain past levels of preferred and ordinary dividends.

D. survive major economic downturn.

44. Which of the following is not required to be presented as minimum information on the face of

the financial position?

A. Investment property C. Biological assets

B. Inventories D. Contingent liabilities

Compiled by: Noel A. Bergonia Page 5 of 11

FINANCIAL STATEMENTS

Assessment Activities

45. What is the usual presentation of the balance sheet in the Philippines?

A. Current assets plus noncurrent assets minus current & noncurrent liabilities is equal

to equity.

B. Noncurrent assets before current assets, noncurrent liabilities before current liabilities

and equity after liability.

C. Equity before assets and liabilities, noncurrent liabilities before current liabilities.

D. Current assets before noncurrent assets, current liabilities before noncurrent liabilities

and equity after liabilities.

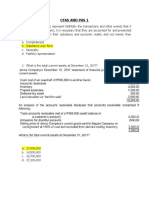

PROBLEMS

46. Fita Company provided the following information on December 31, 2020:

Cash P 300,000

Deferred tax asset 150,000

Bank overdraft 250,000

Inventory 1,000,000

Accounts receivable 1,200,000

Prepaid rent 100,000

Financial assets at FV through P/L 200,000

Financial assets at FV through OCI 800,000

What amount should be reported as current assets on December 31, 2020?

47. Rebisco Corp. provided the following data on December 31, 2020:

Cash (including cash set aside for bond retirement in 2024,

P1,000,000) 5,000,000

Financial assets at fair value (including long-term investment of

P500,000 in ordinary shares of Caramel Corp.) 2,000,000

Inventories (including goods received on consignment of P200,000) 800,000

Prepaid expenses (excluding P50,000 long-term security deposit) 100,000

PPE 10,000,000

Goodwill 1,000,000

Total assets 18,900,000

What is the total amount of current assets on December 31, 2020?

Data for 48 and 49

The accounts and balances shown below were taken from Hiro Co.’s trial balance on December

31, 2020. All adjusting entries have been made. Wages payable – P250,000; Cash – P175,000;

Bonds payable – P600,000; Cash dividends payable – P140,000; Prepaid rent – P136,000;

Inventory – P820,000; Investment in sinking fund- P525,000; Investment at FV through profit or

loss – P153,000; Premium on bonds payable – P48,000; Investment in subsidiary – P1,020,000;

Taxes payable – P228,000; Accounts payable – P248,000; Accounts receivable – P366,000;

Property, Plant and Equipment- P1,200,000; Patents – P150,000; Accumulated depreciation-

PPE- P400,000; Land held for future use – P900,000.

48. How much should be reported as Hiro Co.’s current and non-current assets on

December 31, 2020?

49. How much should be reported as Hiro Co.’s current and non-current liabilities on

December 31, 2020?

50. Cream-O Corp. trial balance contained the following account balances on December 31,

2020:

Equipment and furniture, net P 990,000 Investment to profit or loss securities P150,000

Intangible assets, net 120,000 Prepaid insurance 30,000

Accounts receivable 480,000 Cash and cash equivalents 330,000

Land (held for capital appreciation) 1,200,000 Inventory 900,000

How much is the total current assets in Cream-O’s December 31, 2020 balance sheet?

51. Oreo Company began operations on Jan. 1, 2020 with P1,000,000 from issuance of shares

and borrowed funds of P450,000. Net income for 2020 was P300,000 and Oreo paid a P225,000

cash dividend on Dec. 19, 2020. At Dec. 31, 2020, the liabilities had increased to P597,000. In

Oreo’s balance sheet, how much is to be reported as its total assets?

Compiled by: Noel A. Bergonia Page 6 of 11

FINANCIAL STATEMENTS

Assessment Activities

52. A draft of Skyflakes Company’s 2020 statement of financial position reported a total asset of

P1,083,250 of which includes the following: Treasury shares at cost – P30,000; Unamortized

patents- P14,000 and cash surrender value of life insurance – P17,125. At what amount should

the total assets be correctly reported on the statement of financial position?

53. Coke Company prepared a draft of its 2020 statement of financial position. The draft reported

current liabilities totaling P2,000,000. However, none of the following items were included in this

preliminary total at December 31, 2020:

Accounts payable P300,000

Bonds payable due in 2021 500,000

Unamortized discounts on Bonds payable 80,000

Dividends payable 160,000

Notes payable due in 2022 400,000

At which amount should Coke’ current liabilities be reported correctly reported on

December 31, 2020?

54. Royal Corp. had the following items on December 31, 2020:

Accounts payable P 330,000

Unsecured notes, 9%, due on July 1, 221 800,000

Accrued liabilities 210,000

Provision for litigation 2,700,000

Deferred tax liability 150,000

Bonds payable, 5%, due on March 31, 2021 6,000,000

Royal’s legal counsel expects the suit to be settle in 2021 and estimated that the company is

liable at P2,700,000. The deferred tax liability is expected to be reversed in 2022. What should

be reported as current liabilities as of December 31, 2020?

55. On July 1, 2017, Sprite Inc. acquired machinery worth P2,500,000 from 7-Up Corp. Terms of

the contract calls for a down-payment of P500,000 and signing a 2-year 10% note payable for the

balance. Interest is payable quarterly. The existing loan agreement does not carry a provision to

refinance. During September, Sprite was experiencing financial difficulty and was unable to pay

periodic interest. What amount of current liability should Sprite Inc. report in its December

31, 2017 balance sheet assuming 7-Up Company agreed on Jan. 3, 2018 not to demand

payment as consequence of the breach?

56. Merinda Company adjusted trial balance at Dec. 31, 2020 includes the following account

balances:

Ordinary share capital, P3 par P3,000,000

Subscription receivable due 2021 300,000

Share premium 4,000,000

Treasury share at cost 250,000

Net unrealizable loss on equity securities @ OCI 100,000

Reserve for uninsured earthquake losses 750,000

Accumulated profits 1,000,000

Ordinary share subscribed 500,000

Reserve for treasury share 250,000

What amount should Merinda reported as total shareholders’ equity in its Dec. 31, 2020

balance sheet?

Data for 57 and 58

Pepsi Company provided the following data on December 31, 2020:

Cash P1,800,000 Accounts payable, net of debit balance of P50,000 P2,450,000

Accounts receivable 3,000,000 Interest payable 150,000

Inventory 1,900,000 Income tax payable 300,000

Prepaid expense 100,000 Mortgage payable, due in 4 annual installments 2,000,000

The cash of P1,800,000 included cash in bank of P1,650,000, a customer check of P100,000

marked as NSF and an employee IOU of P50,000. The cash in bank of P1,650,000 is the balance

per bank statement. On Dec. 31, 2020, the outstanding check amounted to P250,000. The

accounts receivable included the ff:

Customer's debit balances P1,600,000

Advances to subsidiary 400,000

Compiled by: Noel A. Bergonia Page 7 of 11

FINANCIAL STATEMENTS

Assessment Activities

Advances to suppliers 200,000

Receivable from officers (due currently) 300,000

Allowance for doubtful accounts (100,000)

Selling price of merchandise invoiced at 120% of costs, undelivered

and excluded from inventory 600,000

57. What amount should be reported as total current assets?

58. What amount should be reported as current liabilities?

59. Root Beer Company provided the following information at year-end:

Machinery P35,000,000 Intangible assets P7,000,000

Land 20,000,000 Accounts payable 8,000,000

Cash 5,000,000 Wages payable 2,000,000

Accounts receivable 20,000,000 Short-term notes payable 3,000,000

Allowance for bad debts 1,000,000 Bonds payable 40,000,000

Inventories 13,000,000 Premium on Bonds Payable 3,000,000

Prepaid insurance 2,500,000

What is the working capital?

60. The Sparkle Inc. is a defendant of a lawsuit in 2020. Based on the lawyer’s estimate, the

company will be found liable and the amount to be settled is at an amount of P400,000 but

somehow would range to P200,000 to P400,000. On February 28, 2017, the company settled an

actual amount of P500,000. If the financial statement was issued on March 31, 2021, how

much should be the liability related to the lawsuit to be reported on its December 31, 2020?

61. Jollibee Company keeps limited records. Its assets and liabilities at the beginning and end of

the current year are as follows:

Beginning End

Cash in bank P30,000 P(5,000)

Accounts receivable 50,000 70,000

Merchandise inventory 100,000 80,000

Accounts payable 40,000 20,000

Notes payable-bank 20,000 25,000

Office equipment (net) 80,000 60,000

During the year, the owner withdraw cash of P12,000 and made additional investments of

P50,000. The profit (loss) of Jollibee Company for the year is

62. The net sales of McDo Mfg. Company in 2020 is P5,800,000. The cost of goods manufactured

is P4,800,000. The beginning inventories of goods in process and finished goods are P820,000

and P650,000, respectively. The ending inventories are: goods in process- P750,000; finished

goods- P550,000. The selling expenses and general administrative expenses are 5% and 2.5%

of cost of sales, respectively. What is McDo’s profit for the year 2020?

63. The following items were reported on KFC Company’s statement of comprehensive income

for the year ended December 31, 2020: Legal and audit fees- P170,000; Rent expense-

P240,000; Interest expense- P210,000; Loss on sale of equipment- P35,000. The office space is

used equally by KFC’s sales and accounting departments. What amount of the above-listed

items should be classified as general and administrative expenses?

64. Chowking Company separates operating expenses in two categories; selling and general and

administrative expenses. The adjusted trial balance at December 31, 2020, included the following

expenses and loss accounts:

Interest P1,400,000

Accounting audit fees 500,000

Advertising 800,000

Freight-out 1,600,000

Product development 350,000

Loss on sale of long-term investment 100,000

Officer’s salaries 900,000

Depreciation on delivery equipment 400,000

Rent for office space 1,200,000

Sales salaries and commissions 750,000

Compiled by: Noel A. Bergonia Page 8 of 11

FINANCIAL STATEMENTS

Assessment Activities

One-half of the rented premises is occupied by the sales department. The entity’s total selling

expenses for 2020 is:

65. The following information is given for Tokyo-Tokyo Company: Freight-in – P8,000; Purchase

returns – P12,000; Selling expenses - P600,000; Ending inventory – P320,000. The cost of

goods sold equal to 800% of selling expenses. What is the cost of goods sold?

Data for 66 and 67

Greenwich Corp. disposed of Segment X, a microchip division during 2017. The segment met the

criteria to be classified as “Held for Sale” on July 1, 2017. Segment X’s revenue from January 1

to June 30 amounted to P2,000,000 and from July 1 to November 30 (the actual disposal date)

amounted P100,000. Selling and administrative expenses from January 1 to June 30 and from

July 1 to November 30 were P1,800,000 and P300,000 respectively. Net proceeds from sale of

the segment on November 30, 2017 were P15,000,000 at which the segment’s carrying value

was P14,000,000. The company’s income tax is 30%. The company presents on the face of the

statement of comprehensive income a single-line item for discontinued operations.

66. How much is the profit (loss) from the operations of the discontinued operations?

67. How much is presented as “Discontinued Operations” on the face of the statement of

comprehensive income?

68. Lemon Company provided the following information on December 31, 2020:

Share capital P6,000,000

Share premium 3,500,000

Cumulative translation adjustment- debit 2,000,000

Changes due to translation adjustment- debit 600,000

Treasury shares (at cost) 700,000

Retained earnings 1,500,000

Cumulative unrealized gain on option contract designated as cash flow hedge 600,000

What is the shareholders’ equity on December 31, 2020?

Data for 69 and 70

The following pre-tax amounts pertain to Zarks Burger Corp. for the year ended Dec. 31, 2020:

Sales P 400,000

Selling and administrative expenses 84,000

Other income 40,000

Interest expense 4,000

Cost of goods sold 280,000

Correction of prior period error- credit 16,000

Discontinued operations- credit 40,000

Cumulative effect of change in accounting policy- debit 24,000

Retained earnings, January 1, 2020 (not restated) 1,600,000

Dividends declared 12,000

Income tax rate 30%

69. What is the company’s profit for the year ended December 31, 2020?

70. How much retained earnings would be shown on December 31, 2020?

71. The following information is available for Shakeys Company for the year ended Dec. 31, 2019.

Cash received from customers P870,000

Cash received for rent 10,000

Cash paid to suppliers and employees 510,000

Taxes paid 110,000

Gain on sale of equipment 30,000

What is the net cash flows from operating activities for 2019?

72. Pizza Hut Inc. has provided the following 2019 account balances for the preparation of the

annual statement of cash flows:

Jan. 1 Dec. 31

Accounts receivable P115,000 P145,000

Allowance of bad debts 4,000 5,000

Prepaid rent expense 62,000 41,000

Accounts payable 97,000 112,000

Pizza Hut’s profit is P750,000. What is the 2019 net cash flows from operations?

Compiled by: Noel A. Bergonia Page 9 of 11

FINANCIAL STATEMENTS

Assessment Activities

73. Max’s Corporation reports:

Cash provided by operating activities P250,000

Cash provided by investing activities 110,000

Cash used by financing activities 140,000

Beginning cash balance 70,000

What is Max’s ending cash balance?

74. The following are the profit or loss accounts of Sunflower Company for the year ended

December 31, 2019:

Sales P4,050,000

Cost of Goods sold (2,340,000)

Gross profit P1,710,000

Gain on sale of equipment 40,000

Total Revenue P1,750,000

Operating expense

Salaries expense P560,000

Depreciation expense 70,000

Rent Expense 160,000

Loss on sale of land 50,000 (840,000)

Profit from operations P910,000

Interest expense (30,000)

Profit before tax P880,000

Income tax expense (264,000)

Profit for the year P616,000

Changes in current assets and current liabilities accounts during 2019 were as follows:

Increase(decrease)

Accounts receivable P 60,000

Merchandise inventory 50,000

Accounts payable (90,000)

Salaries payable 30,000

Interest payable 5,000

Income tax payable (25,000)

How much is the net cash flows from operating activities?

Data for items no. 75 to 77

The following is a list of items to be included in the preparation of the 2019 statement of cash

flows from the Ram Company.

Gain on retirement of bonds P92,000 Net profit P554,000

Increase in inventory 67,000 Ordinary share exchanged for land 140,000

Proceeds from sale of investment 85,000 Payment to retire bonds 370,000

Proceeds from issuance of note 250,000 Payment for purchase of equipment 394,000

Depreciation expense 107,000 Loss on sale of investments 48,000

Decrease in accounts receivable 50,000 Repurchase of treasury shares 120,000

Proceeds from issue of preference

Payment for purchase of patent 198,000 528,000

shares

Decrease in accounts payable 40,000 Amortization of discount on debt 15,000

Payment of dividends 300,000 securities at amortized cost

75. How much is the net cash flow from operating activities during 2019?

76. How much is the net cash flow from investing activities during 2019?

77. How much is the net cash flow from financing activities during 2019?

78. Rosal Inc. prepares the statement of cash flows using direct method for operating activities.

For the year ended December 31, 2019. Rosal reports the following data:

Sales on account and on notes P1,300,000

Cash sales 740,000

Decrease in accounts receivable 610,000

Increase in trade notes receivable 125,000

Increase in accounts payable 72,000

Decrease in notes payable to the bank 75,000

Increase in inventory 48,000

Cost of goods sold 975,000

Compiled by: Noel A. Bergonia Page 10 of 11

FINANCIAL STATEMENTS

Assessment Activities

What is the amount of cash collections from customers?

Data for item nos. 79 to 81

The worksheet below presents the comparative balance sheet (in pesos) of Cherry Company on

December 31, 2021 and 2020.

2021 2020 2021 2020

Cash 4,037,500 3,500,000 Accounts payable 5,075,000 4,775,000

Accounts receivable 5,640,000 5,840,000 Income taxes payable 150,000 250,000

Inventories 9,250,000 8,575,000 Dividends payable 400,000 500,000

PPE 16,535,000 14,835,000 Lease liability 2,000,000 0

Acc. depreciation (5,825,000) (5,200,000) Ordinary shares, P10 par 2,500,000 2,500,000

Investment in associate 1,525,000 1,375,000 Share premium 7,500,000 7,500,000

Loan receivable 1,312,500 0 Retained earnings 14,850,000 13,400,000

Total assets 32,475,000 28,925,000 Total liabilities and equity 32,475,000 28,925,000

Additional information:

❖ On December 31, 2020, Cherry acquired 25% of Cashew Co.’s ordinary shares for

P1,375,000. On that date the book value of Cashew’s assets and liabilities, which

approximates the fair values, was P5,500,000. Cashew reported income of P600,000 for

the year ended December 31, 2021. No dividend was paid on Cashew’s ordinary shares

during the year.

❖ During 2021, Cherry loaned P1,500,000 to Coconut Co., an unrelated company. Cherry

made the first semi-annual principal repayment of P187,500, plus interest at 10%, on

December 31, 2021.

❖ On January 2, 2021, Cherry sold equipment costing P300,000, with carrying amount of

P175,000, for P200,000 cash.

❖ On December 31, 2021, Cherry entered into a lease for an office building. The present value

of the annual rental payments is P2,000,000, which equals the fair value of the building.

Cherry made the first rental payment of P300,000 when due on January 2, 2022.

❖ Net income for 2021 was P1,850,000

❖ Cherry declared and paid cash dividends for 2021 and 2020 as follows:

Declared Paid Amount

2020 Dec. 15, 2020 Feb. 20, 2021 P500,000

2021 Dec. 15, 2021 Feb. 20, 2022 400,000

79. How much is the net cash inflow from operating activities?

80. How much is the net cash outflow from investing activities?

81. How much is the net cash outflow from financing activities?

- END OF ASSESSMENT -

Be blessed! ☺

“Ask and it will be given to you; seek and you will find; knock and the door will be

opened.” - Matthew 7:7

Concentrate === Pray === Achieve

/NABergonia2021

Compiled by: Noel A. Bergonia Page 11 of 11

You might also like

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryROMAR A. PIGANo ratings yet

- Financial Accountinng 3Document10 pagesFinancial Accountinng 3Nami2mititNo ratings yet

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryクロードNo ratings yet

- Toa 1406 Presentation and Preparation of FS and DisclosureDocument25 pagesToa 1406 Presentation and Preparation of FS and DisclosureYani100% (1)

- Pas 1: Presentation of Financial StatementsDocument9 pagesPas 1: Presentation of Financial StatementsJung Jeon0% (1)

- Constructive Accounting ReviewDocument3 pagesConstructive Accounting Reviewlinkin soyNo ratings yet

- Amework & PAS 1 QuizbowlDocument9 pagesAmework & PAS 1 QuizbowlViancaPearlAmores0% (1)

- Besi o Nikki Rose A. Presentation of FSDocument29 pagesBesi o Nikki Rose A. Presentation of FSBrod Lee SantosNo ratings yet

- Homework On Presentation of Financial Statements (Ias 1)Document4 pagesHomework On Presentation of Financial Statements (Ias 1)Jazehl Joy ValdezNo ratings yet

- Cfas - Chapter 4 - Exercise 1Document8 pagesCfas - Chapter 4 - Exercise 1BlueBladeNo ratings yet

- Current AssetsDocument17 pagesCurrent AssetsNhemia ElevencionadoNo ratings yet

- IAS 1 Financial Statement Presentation OverviewDocument12 pagesIAS 1 Financial Statement Presentation OverviewRia GayleNo ratings yet

- Financial statements and accounting concepts explainedDocument5 pagesFinancial statements and accounting concepts explainedMark Domingo MendozaNo ratings yet

- EXERCISES - Chapters 2 and 3: Part I True or FalseDocument4 pagesEXERCISES - Chapters 2 and 3: Part I True or FalseCaroline BagsikNo ratings yet

- q3. Fs QuizzerDocument13 pagesq3. Fs QuizzerClaudine DuhapaNo ratings yet

- Jamolod - Unit 1 - General Features of Financial StatementDocument8 pagesJamolod - Unit 1 - General Features of Financial StatementJatha JamolodNo ratings yet

- 2 Statement of Financial PositionDocument7 pages2 Statement of Financial Positionreagan blaireNo ratings yet

- 1 Cfas - Chapter 4 - Exercise 1Document8 pages1 Cfas - Chapter 4 - Exercise 1Danica CatalanNo ratings yet

- CEL 1 TOA Answer Key 1Document12 pagesCEL 1 TOA Answer Key 1Joel Matthew MozarNo ratings yet

- Quiz - FARDocument12 pagesQuiz - FARJay Abril RondarisNo ratings yet

- Cfas RevDocument18 pagesCfas RevMiriam Ubaldo DanielNo ratings yet

- CPA Review Midterm Exam Conceptual Framework StandardsDocument18 pagesCPA Review Midterm Exam Conceptual Framework Standardslana del rey100% (1)

- Finacc5 LQ1Document6 pagesFinacc5 LQ1Kawaii SevennNo ratings yet

- PAS 1 overview: Key requirements for financial statement presentationDocument16 pagesPAS 1 overview: Key requirements for financial statement presentationKryzzel Anne JonNo ratings yet

- ASS03 Financial StatementsDocument3 pagesASS03 Financial StatementsErine ContranoNo ratings yet

- PAS1 Answer KeyDocument4 pagesPAS1 Answer KeyGalilee Dawn JullezaNo ratings yet

- 6959 - PAS 1 - Presentation of Financial StatementsDocument7 pages6959 - PAS 1 - Presentation of Financial Statementsjohn paulNo ratings yet

- Financial Statement QuestionsDocument3 pagesFinancial Statement QuestionsShane LaguraNo ratings yet

- MidtermsDocument9 pagesMidtermsRae SlaughterNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument6 pagesCpa Review School of The Philippines Mani LaJulius Lester AbieraNo ratings yet

- CFAS Reviewer - Module 3Document8 pagesCFAS Reviewer - Module 3Lizette Janiya SumantingNo ratings yet

- Appraisal DrillsDocument9 pagesAppraisal DrillsLyca Morandante LamaneroNo ratings yet

- Statement of Financial PositionDocument7 pagesStatement of Financial PositionshengNo ratings yet

- De La Salle University Manila TOA Long Quiz 1Document7 pagesDe La Salle University Manila TOA Long Quiz 1abby100% (1)

- Qualifying Reviewer Questions CFASDocument9 pagesQualifying Reviewer Questions CFASReinalyn Larisma MendozaNo ratings yet

- Philippine Financial Reporting Standards for SMEs ReviewDocument12 pagesPhilippine Financial Reporting Standards for SMEs ReviewDennis VelasquezNo ratings yet

- All Subj - Board Exam-Picpa EeDocument9 pagesAll Subj - Board Exam-Picpa EeMJ YaconNo ratings yet

- IFRS Framework ConflictsDocument16 pagesIFRS Framework ConflictsMJ YaconNo ratings yet

- PAS 1: KEY REQUIREMENTS FOR FINANCIAL STATEMENTSDocument55 pagesPAS 1: KEY REQUIREMENTS FOR FINANCIAL STATEMENTSRichard Borja100% (1)

- Presentation of FSDocument9 pagesPresentation of FSrose anneNo ratings yet

- IA3 - MTE - 2020: RequiredDocument15 pagesIA3 - MTE - 2020: RequiredSharjaaahNo ratings yet

- Financial Accounting and Reporting - 399Document37 pagesFinancial Accounting and Reporting - 399Jenny LinNo ratings yet

- Conceptual Framework Purpose Assist Standards Developed IFRSDocument6 pagesConceptual Framework Purpose Assist Standards Developed IFRSKyleZapantaNo ratings yet

- GEN 010 P1 ExamDocument20 pagesGEN 010 P1 ExamJulian Adam PagalNo ratings yet

- Test Bank Reviewer Part 2Document4 pagesTest Bank Reviewer Part 2tres gian de guzmanNo ratings yet

- Conceptual Framework MODFIN1 T1 AY2017 - 2018 Matching - Write The Letter of The Term Under List B That Corresponds To The StatementDocument5 pagesConceptual Framework MODFIN1 T1 AY2017 - 2018 Matching - Write The Letter of The Term Under List B That Corresponds To The StatementAmy SpencerNo ratings yet

- Environment of Financial Accounting and Reporting: FalseDocument6 pagesEnvironment of Financial Accounting and Reporting: Falsekris mNo ratings yet

- BSA 2105 Carandang CFAS Sem ProjectDocument16 pagesBSA 2105 Carandang CFAS Sem Project21-55654No ratings yet

- Conceptual FrameworkDocument13 pagesConceptual FrameworkJoielyn CabiltesNo ratings yet

- 1st PB-TADocument12 pages1st PB-TAGlenn Patrick de LeonNo ratings yet

- IFRS Framework and StandardsDocument63 pagesIFRS Framework and StandardsLoki LukeNo ratings yet

- Chapter 1 5Document76 pagesChapter 1 5John Paulo Samonte59% (29)

- All Subj Board Exam Picpa Ee PDF FreeDocument9 pagesAll Subj Board Exam Picpa Ee PDF FreeannyeongchinguNo ratings yet

- Far 05 - Long Quiz2Document11 pagesFar 05 - Long Quiz2Mark Domingo MendozaNo ratings yet

- Financial Reporting I: Key Accounting ConceptsDocument5 pagesFinancial Reporting I: Key Accounting ConceptsKim Cristian Maaño50% (2)

- CFAs and PAS Financial ReportingDocument19 pagesCFAs and PAS Financial ReportingSoremn PotatoheadNo ratings yet

- Final Exam - Ae14 CfasDocument7 pagesFinal Exam - Ae14 CfasVillanueva RosemarieNo ratings yet

- Theory of Accounts. NewDocument8 pagesTheory of Accounts. NewRubiliza GailoNo ratings yet

- Polytechnic University Accounting ExamDocument10 pagesPolytechnic University Accounting Examyugyeom rojasNo ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- WORKING CAPITAL-WPS OfficeDocument19 pagesWORKING CAPITAL-WPS OfficeChan ChanNo ratings yet

- AI-Powered Innovation and LeadershipDocument28 pagesAI-Powered Innovation and LeadershipSahil MathurNo ratings yet

- SWOT Analysis:: StrengthsDocument5 pagesSWOT Analysis:: Strengthsaq GreaterNo ratings yet

- Industrial Machinery & Tractor TyresDocument2 pagesIndustrial Machinery & Tractor TyresFelipe HernándezNo ratings yet

- Introduction to Retail Management FundamentalsDocument16 pagesIntroduction to Retail Management FundamentalsDavid ShrsthNo ratings yet

- Corporate CultureDocument2 pagesCorporate CultureMae MarinoNo ratings yet

- F 8 BCDCDocument33 pagesF 8 BCDCyenNo ratings yet

- Mercado vs. Espiritu (Digest)Document1 pageMercado vs. Espiritu (Digest)Tini GuanioNo ratings yet

- Court Upholds Foreclosure Despite Family Home Exemption ClaimDocument2 pagesCourt Upholds Foreclosure Despite Family Home Exemption ClaimRey Almon Tolentino Alibuyog100% (1)

- Epic Cards DeliveryDocument15 pagesEpic Cards Deliverybdmails rmyNo ratings yet

- Chapter 1Document21 pagesChapter 1SABBIR AHMEDNo ratings yet

- Internet of Things Iot Advantages On E-LDocument7 pagesInternet of Things Iot Advantages On E-LselmiNo ratings yet

- Pcic VS Central CollegesDocument2 pagesPcic VS Central CollegesannlaurenweillNo ratings yet

- Leading Malaysian Telco DiGi's History and ServicesDocument2 pagesLeading Malaysian Telco DiGi's History and ServicesJy Tan77% (13)

- Full Download Strategic Marketing 1st Edition Mooradian Test BankDocument20 pagesFull Download Strategic Marketing 1st Edition Mooradian Test Banklevidelpnrr100% (26)

- How The CIA Made Google (Google Did Not Start in Susan Wojcicki's Garage)Document9 pagesHow The CIA Made Google (Google Did Not Start in Susan Wojcicki's Garage)karen hudesNo ratings yet

- Ebook PDF Understanding Social Welfare A Search For Social Justice 9th Edition PDFDocument42 pagesEbook PDF Understanding Social Welfare A Search For Social Justice 9th Edition PDFquintin.lane537100% (34)

- Tugas Sesi 5Document5 pagesTugas Sesi 5mutmainnahNo ratings yet

- ENTREPRENEURSHIPDocument3 pagesENTREPRENEURSHIPMikaela FriasNo ratings yet

- WJ-Series WJ-Series: Turbine Meter Instructions Turbine Meter InstructionsDocument8 pagesWJ-Series WJ-Series: Turbine Meter Instructions Turbine Meter InstructionsIndra SUdirmanNo ratings yet

- Mes Advisory Water Electricity TariffDocument12 pagesMes Advisory Water Electricity TariffShailender Singh100% (2)

- Assignment 1 Front SheetDocument12 pagesAssignment 1 Front SheetDinh DoNo ratings yet

- Theory of Consumer BehaviourDocument81 pagesTheory of Consumer Behavioursupriya dasNo ratings yet

- Agile Use CasesDocument80 pagesAgile Use CasesJessica PetersonNo ratings yet

- 2023 ALS Sustainability ReportDocument104 pages2023 ALS Sustainability ReportRichard NegronNo ratings yet

- Case Digest:: Ang Tibay vs. Court of Industrial Relations (Cir) (69 PHIL 635 G.R. NO. 46496 27 FEB 1940)Document2 pagesCase Digest:: Ang Tibay vs. Court of Industrial Relations (Cir) (69 PHIL 635 G.R. NO. 46496 27 FEB 1940)Jeremiah CarlosNo ratings yet

- Case 1Document19 pagesCase 1adil abidNo ratings yet

- Floor Slab Chisling 3rd-5th CertfDocument1 pageFloor Slab Chisling 3rd-5th CertfwendmagegnNo ratings yet

- Roles You Could Play at The RBIDocument1 pageRoles You Could Play at The RBIshelharNo ratings yet

- Corporation and Estate Taxation - Sample ProblemDocument5 pagesCorporation and Estate Taxation - Sample Problemwind snip3r reojaNo ratings yet